International

Futures Sink To Session Lows As Sentiment Sours

Futures Sink To Session Lows As Sentiment Sours

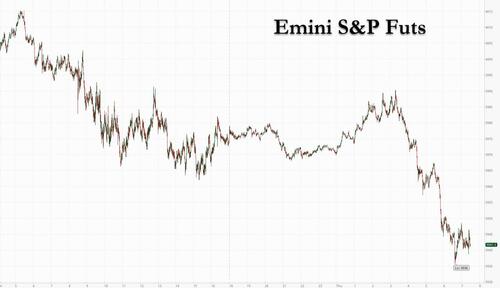

US equity futures dropped to session lows, and surrendered earlier gains of as much as 0.2%,…

US equity futures dropped to session lows, and surrendered earlier gains of as much as 0.2%, setting up Wall Street stocks to extend Wednesday’s weakness, with traders assessing comments from Fed officials about the path of rate hikes amid earnings reports (such as those from Target) confirming that the US consumer is hunkering down for a recession. S&P 500 futures were 0.8% lower and those on the Nasdaq 100 dropped 0.6% at 7:30 a.m. in New York, with treasury yields bouncing after yesterday’s decline. 10-year Treasury yields rose, following indications from Fed officials on Wednesday that policy would tighten further. The dollar rallied half a percent against a basket of currencies.

Traders got mixed signals from policy makers, with Fed hawk Christopher Waller saying recent data have made him more comfortable with a moderate interest-rate increase of 50 basis points next month, but left the door open to a sequence of such increases if needed to curb inflation. Meanwhile, San Francisco Fed President Mary Daly said a pause in rate hikes was “off the table,” and New York Fed President John Williams said the central bank should avoid incorporating financial stability risks into its considerations.

“All this Fed talk in recent weeks starting with Powell’s press conference after the last meeting, they are indicating they are going to slow the pace of hikes,” Patrick Armstrong, CEO at Plurimi Wealth told Bloomberg TV, adding that he expected a 50 basis-point increase at the next meeting.

In premarket trading, Cisco Systems rose after the communications equipment company reported first-quarter results that beat expectations and raised its full-year forecast. Nvidia was also on the rise after topping estimates, lifting semiconductor peers AMD and Marvell. NetEase shares fell as the video game maker plans to end a 14-year partnership with Blizzard Entertainment. Bath & Body Works shares jumped the company boosted its full-year profit forecast. Here are the other notable premarket movers:

- Ardelyx soars ~77% in premarket trading after its kidney disease therapy won the backing of a majority of a panel of FDA advisers. The response from analysts was mostly positive, with Piper Sandler upgrading the stock to overweight, saying it will be hard for the Food and Drug Administration to justify a rejection of the drug based on the advisory committee’s positive feedback.

- Bath & Body Works shares jump ~21% in premarket trading after boosting its full-year profit forecast due to a focus on innovation and cost control. Analysts found the results to be impressive overall, noting the print was “strong” with the company reporting beats across the top line.

- Elevate shares rise ~67% in premarket trading to ~$1.77 after it entered into a definitive agreement to be acquired by an affiliate of Park Cities Asset Management LLC for $1.87/share in cash, implying value of $67m.

- NetEase shares fall in US premarket trading as the video game maker plans to end a 14-year partnership with Blizzard Entertainment after January, suspending services to licensed games that represented low-single-digit percentage of its revenue and net income in 2021.

- Norwegian Cruise Line is double- downgraded to underperform from outperform at Credit Suisse, with the broker seeing downside risk to estimates and preferring the firm’s peers. Norwegian Cruise shares fall ~4% in US premarket trading.

- Principal Financial drops ~2.4% in premarket trading after both Evercore and Morgan Stanley downgrade the stock, citing its high valuation.

- Robinhood Markets shares gain ~1.4% in US premarket trading after the broker gave an operating update for October, with analysts positive on the company’s better performance during the month and early indications of stronger trading volumes for November.

- Sonos jumped in postmarket trading after the speaker company reported fourth-quarter revenue that beat expectations and gave a full-year revenue forecast that is ahead of the analyst consensus.

US equities have marked a pause this week after the S&P 500 rallied 10.5% over the past month, while the Nasdaq 100 rose about 9.4% during the same period, with slowing inflation weighed against stronger-than-expected US economic data. “The market is likely to experience quite a few false bottoms” as seen in the IT sector at the moment, Jefferies strategists led by Sean Darby wrote in a note.

“We are cognizant that each time global markets attempt to rally on the back of speculation that the end of the Fed’s tightening intentions may be in sight, FOMC officials come out with a new paragraph of hawkish narrative, to tamp down any prospect of irrational exuberance,” Simon Ballard, chief economist at First Abu Dhabi Bank, wrote in a note to investors.

In Europe, the Stoxx 600 also erased gains to trade lower 0.4%. Basic resources and utilities underperformed, while food and consumer product stocks rose. The Dax outperformed while the FTSE 100 underperformed regional peers, while gilts 2-year yields rise above 3% and 10-year yields trade around 3.15%, both within Wednesday’s range. Investors braced for the release of the UK budget later in the day, while European Central Bank policy makers were said to consider a slowdown in interest-rate hikes, with only a 50 basis-point increase next month. Here are the biggest European movers"

- Siemens jumps as much as 8.9% on the European engineering giant’s robust order books and outlook, which Jefferies says were well ahead of expectations and mainly driven by its division that makes factory automation software.

- Chipmakers may be in focus after Nvidia posted quarterly sales that topped analysts’ estimates and Micron Technology said it was reducing production of chips due to weakening market conditions. ASML shares rose as much as 1.2%.

- Subsea 7 gains as much as 7.7%, the most since March 7, after the Norwegian offshore energy firm published better-than-expected 3Q results, driven by higher margins and solid performance, Citi says.

- Ocado drops as much as 9.4% after Kintbury Capital chief investment officer Chris Dale said even its bull case is for 50% downside in the stock, on expectations the UK company will struggle to finance itself.

- Alstom declines as much as 6.1% -- paring some of its post-earnings gains -- after Morgan Stanley slashed its price target on worries about the French rail equipment maker’s balance sheet and record-low cash-flow guidance.

- NN Group drops as much as 8.6%, the most since mid-August, after the insurer set new 2025 targets which Citi says may disappoint because of their “conservatism.”

- Bouygues falls as much as 5.2% in Paris trading as a warning on margins at the Colas constructions unit overshadowed nine-month results from the French conglomerate that beat consensus estimates for operating income.

- Embracer slides as much as 21%, the biggest intraday decline on record, after the Swedish video-game maker reduced its fiscal 2023 adjusted Ebit target, citing a delay in its Dead Island 2 game, a more challenging macro environment and a mixed reception to some of its key releases.

Earlier in the session, Asian stocks declined amid fears that Federal Reserve’s tightening still has further go to curb inflation after strong US retail sales print. The MSCI Asia Pacific Index declined as much as 1.3%, its biggest drop in a week before paring losses. Tech drove losses with Meituan, Samsung and Netease leading the gauge lower. Benchmarks in Hong Kong were notable losers in the region, with the Hang Seng Tech Index sliding as much as 5.6% before reducing the loss. They were down for a second day following rapid gains that put the gauges there into bull market territory. Equities in mainland China and South Korea also dropped while those in Japan, Australia and Singapore were slightly higher. Tencent Holdings Ltd.’s plan to pay out $20b of stock in Meituan sparked a broad selloff of Chinese internet stocks on Thursday as investors fear more divestments by the online gaming company are on the cards.

The People’s Bank of China warned inflation may accelerate as overall demand in the economy picks up, suggesting it may refrain from adding more long-term stimulus. It did still doubled short-term cash injection Thursday to ease a selloff in sovereign debt. In the US, San Francisco Fed President Mary Daly said the central bank should keep hiking, while New York Fed President John Williams said it should focus on the economy rather than financial risks as it raises rates. “The hotter-than-expected US retail sales data and hawkish leaning comments from Fed officials weighed on equities,” Saxo Capital Markets strategists including Redmond Wong wrote in a note. US retail sales posted the biggest increase in eight months in October

Japanese stocks traded range-bound as investors worried about further US interest rate hikes after San Francisco Federal Reserve President Mary Daly said that “pausing is off the table.” The Topix Index rose 0.2% to 1,966.28 as of market close Tokyo time, while the Nikkei declined 0.4% to 27,930.57. Sumitomo Mitsui Financial Group Inc. contributed the most to the Topix Index gain, increasing 2.1%. Out of 2,165 stocks in the index, 1,512 rose and 551 fell, while 102 were unchanged. “The US retail sales numbers came out higher than expected, also signaling that inflationary factors remain strong,” said Takeru Ogihara, chief strategist at Asset Management One.

Australian stocks snapped a 3-day losing streak as the S&P/ASX 200 index rose 0.2% to close at 7,135.70, boosted by strength in healthcare shares and banks. Australia’s jobless rate unexpectedly fell in October as a surge in full-time employment underpinned strong hiring, reinforcing the Reserve Bank’s arguments for further interest-rate increases. In New Zealand, the S&P/NZX 50 index rose 0.6% to 11,294.52.

Stocks in India declined, in line with global peers, as investors sought clarity over the Federal Reserve’s future policy moves and their impact on growth. Expiry of weekly derivative contracts also weighed on local shares as investors continued taking profits from recent gainers such as banks after conclusion of quarterly results season. The S&P BSE Sensex fell to close at 0.4%, its biggest drop since Nov. 10, to 61,750.60 in Mumbai, while the NSE Nifty 50 Index declined by an equal measure. For the week, the Sensex and Nifty are little changed. “With the result season now over, we expect the market to track global developments in the near term,” Motilal Oswal Financial Services analyst Siddhartha Khemka said. Mortgage lender HDFC and its banking unit provided the biggest drag to the Sensex. Out of 30 shares in the Sensex index, only eight rose and the rest fell. All but three of BSE Ltd.’s 19 sector sub-gauges closed lower, led by consumer durables stocks.

In rates, 10-year yields TSY yield add 3bps to 3.7%, while bunds 10-year yields drop 2bps to below 2%. Treasuries were cheaper by as much as 2.4bp across 10-year sector, with 3.714% yield vs session high 3.74%, following a more aggressive bear-flattening move in gilts after the UK government released its latest fiscal statement. Bunds outperform by 5bp in the sector while gilts lag by 2bp. UK curve sharply bear- flattens on the day with 2-year yield cheaper by 10bp, back above 3% level.

In commodities, crude benchmarks are under modest pressure given the USD recovery throughout the morning, generally softer APAC tone and a continuing deterioration to the China COVID case count weighing.

Ags. in focus and pressured following a as-expected extension to the Black Sea grain deal.

Currently, the yellow metal is holding around the lower-end of USD 1761-1774/oz parameters, and is thus a similar distance from the WTD peak of USD 1786/oz and the 10-DMA at USD 1738/oz.

WTI falls below $85. Spot gold falls roughly $8 to trade near $1,766/oz

To the day ahead now, and a key highlight will be the UK government’s autumn statement. Otherwise, data releases include US housing starts and building permits for October, the Philadelphia Fed’s business outlook index and the Kansas City Fed manufacturing index for November, and the weekly initial jobless claims. Finally, central bank speakers include the Fed’s Bullard, Bowman, Mester, Jefferson and Kashkari, the ECB’s Villeroy, and the BoE’s Pill and Tenreyro.

Market Snapshot

- S&P 500 futures down 0.2% to 3,960.25

- STOXX Europe 600 down 0.2% to 429.39

- MXAP down 0.7% to 152.94

- MXAPJ down 1.0% to 494.58

- Nikkei down 0.3% to 27,930.57

- Topix up 0.2% to 1,966.28

- Hang Seng Index down 1.2% to 18,045.66

- Shanghai Composite down 0.1% to 3,115.44

- Sensex down 0.1% to 61,897.84

- Australia S&P/ASX 200 up 0.2% to 7,135.65

- Kospi down 1.4% to 2,442.90

- German 10Y yield down 0.5% to 1.99%

- Euro down 0.2% to $1.0378

- Brent Futures down 0.5% to $92.39/bbl

- Gold spot down 0.5% to $1,765.56

- U.S. Dollar Index up 0.27% to 106.57

Top Overnight News from Bloomberg

- Bank customers are the most enthusiastic about using the British pound for global payments since mid-2016, around the same time the UK voted to quit the European Union

- President Joe Biden rejected Ukrainian President Volodymyr Zelenskiy‘s assertion that Russia fired a missile that landed in Poland — continuing efforts by the US and allies to de-escalate the deadly episode

- Chinese regulators asked banks to report on their ability to meet short-term obligations after a rapid selloff in bonds triggered a flood of investor withdrawals from fixed-income products, according to people familiar with the matter

- China will well implement agreements made by Chinese President Xi Jinping and US President Joe Biden at G-20 summit over economic policy and trade negotiations, Ministry of Commerce says

- Turns out Chinese President Xi Jinping’s partnership with Vladimir Putin has limits after all: He doesn’t want to follow the Russian leader into diplomatic isolation

- Brazil President-elect Luiz Inacio Lula da Silva will ask congress to circumvent a key fiscal safeguard by excluding the country’s most important social program from a public spending cap to pay for his campaign pledges

A more detailed look at global market courtesy of Newsquawk

APAC stocks traded mostly lower throughout the session following the downbeat lead from Wall Street. ASX 200 was the relative outperformer with gains lead but the Consumer Staples and IT sector, with no reaction seen in wake of the Aussie jobs data. Nikkei 225 traded on either side of the 28k mark before stabilising under the round figure, with losses modest during the session. KOSPI gave up earlier gains and drifted lower throughout the session with losses led by the chip and IT sectors, whilst sentiment in the region was soured by North Korea firing a short-range ballistic missile. Hang Seng and Shanghai Comp opened with and then extended on losses with the former seeing downside in Meituan, which fell around 6% after Tencent announced a special dividend in the form of Meituan shares, whilst People's Daily also suggested China is able to achieve COVID Zero as mainland cases roses at the fastest pace since April.

Top Asian News

- China reported 2,388 (prev. 1,623) new confirmed coronavirus cases in the mainland on Nov 16th, via Reuters

- China is able to achieve COVID Zero, according to People's Daily.

- China has asked banks to report on liquidity following the sudden bond rout, according to Bloomberg.

- PBoC injected CNY 132bln via 7-day reverse repos with the rate at 2.00% for a CNY 123bln net injection.

- Tokyo to raise COVID alert level by one notch amid the recent rise in COVID cases, according to NTV.

- BoJ Governor Kuroda said it is important to continue monetary easing to support the economy. Kuroda said recent price hikes are due to cost-push factors, according to Reuters. Kuroda said BoJ will closely coordinate with the government to conduct appropriate policy.

- Senior BoJ official Uchida said it is too early to discuss the exit from monetary stimulus, via Reuters.

- Saudi Arabia signed USD 30bln worth of investment agreements with South Korean firms, covering clean energy and medical tech, according to the Saudi Investment Minister

- China's Commerce Ministry, on China-US economic & trade dialogue, says will implement the key consensus reached by leaders, domestic exports/imports will see greater pressure.

Stocks in Europe, Eurostoxx 50 -0.2%, are on a mixed footing after scaling back opening gains with no clear fundamental catalyst driving price action thus far ahead of numerous events. Stateside, futures have similarly pared back initial upside and are near the unchanged mark/marginally lower with the ES back below the 4k figure ahead of data, Fed speak and a few corporate updates.

Top European News

- COP27 Set for Showdown After Draft Leaves Out Fossil Fuel Pledge

- China’s Forgotten Covid Zero Lockdown Has Just Hit 100 Days

- Where European Energy Infrastructure Is Vulnerable to Attack

- Rusal Asks LME to Disclose Origin of All Metal, Not Russian Only

- European Stocks Steady as Investors Assess Policy, Growth Risks

FX

- DXY has seen a intra-day recovery from a 106.08 low to a 106.68 peak, with G10 peers now all pressured vs initial modest upside against the Greenback.

- Fundamental driver(s) behind the move have been limited, with the sessions main events yet to come in the form of the UK budget and Central Bank speak thereafter.

- Cable has, given the USD's recovery, experienced a marked pullback from 1.1950+ best to back below the figure and almost a full point lower.

- Similarly, EUR has moved into the red though this is comparably more contained given its initial upside was capped by EUR/GBP action, action which is now marginally EUR-favourable.

- USD/CNY has reverted back to initial 7.14+ best levels after pulling back towards the figure, with the region focused on fresh COVID commentary.

- PBoC sets USD/CNY mid-point at 7.0655 vs exp. 7.0479 (prev. 7.0363)

Fixed Income

- Gilts unchanged ahead of significant fiscal changes from the UK, USTs await Fed speak post-Waller.

- Currently, the UK benchmark resides at the lower-end of 106.32-107.17 parameters with the associated 10yr yield at 3.15%; a figure that is only 15bp above the current BoE base rate and significantly shy of the 4.632% peak seen in wake of the former PM/Chancellor’s ‘mini-Budget’.

- EGBs and USTs are holding in similarly contained ranges around the unchanged mark; currently, +14 and -9 ticks respectively, with focus on the hefty Central Bank docket.

- Italy maintains the new BTP Italia bond real annual coupon at 1.6%.

Commodities

- Crude benchmarks are under modest pressure given the USD recovery throughout the morning, generally softer APAC tone and a continuing deterioration to the China COVID case count weighing.

- Ags. in focus and pressured following a as-expected extension to the Black Sea grain deal.

- Currently, the yellow metal is holding around the lower-end of USD 1761-1774/oz parameters, and is thus a similar distance from the WTD peak of USD 1786/oz and the 10-DMA at USD 1738/oz.

- TC Energy's Keystone oil pipeline issues were resolved after force majeure, but TC Energy will reduce injections for the rest of November, according to Reuters sources.

- Ukrainian Infrastructure Minister says the Black Sea grain initiative will be extended for 120-days, via Reuters; Russia will not cut off the Black Sea grain deal, via Tass citing the Deputy Foreign Minister.

Geopolitics

- Chinese President Xi may visit Russia in 2023; government heads could have call in December, according to Tass.

- North Korea fired an unspecified ballistic missile toward East Sea, according to the South Korean military cited by Yonhap.

- North Korea said the recent South Korea, US, and Japan summit would lead the Korean peninsula to an even more unpredictable situation, according to KCNA.

- South Korean and US militaries conducted missile defence drills following the North Korean missile launch, according to the South Korean military.

- UK blocked Chinese takeover of Newport chip plant, ordering Chinese-owned Nexperia to sell at least 86% of the factory in order to mitigate risk to national security, according to FT.

- China's President Xi said China is willing to increase imports from Italy, according to CCTV.

- Turkish President Erdogan expects issues around the US F-16 jet purchases to resolve soon, via Reuters.

US Event Calendar

- 08:30: Nov. Initial Jobless Claims, est. 228,000, prior 225,000

- Nov. Continuing Claims, est. 1.51m, prior 1.49m

- 08:30: Oct. Housing Starts, est. 1.41m, prior 1.44m

- Oct. Housing Starts MoM, est. -2.0%, prior -8.1%

- Oct. Building Permits, est. 1.51m, prior 1.56m

- Oct. Building Permits MoM, est. -3.2%, prior 1.4%

- 08:30: Nov. Philadelphia Fed Business Outl, est. -6.0, prior -8.7

- 11:00: Nov. Kansas City Fed Manf. Activity, est. -8, prior -7

Central bank speakers

- 08:00: Fed’s Bullard Discussed the Economy and Monetary Policy

- 09:15: Fed’s Bowman Discusses Financial Literacy and Inclusion

- 09:40: Fed’s Mester Speaks at Financial Stability Conference

- 10:40: Fed’s Jefferson and Kashkari Take Part in Panel Discussion

- 13:45: Fed’s Kashkari Takes Part in Moderated Q&A

- 20:05: Powell, Williams and Daly Honor Chicago Fed’s Evans

DB's Jim Reid concludes the overnight wrap

After a strong rebound over recent days, the momentum behind risk assets started to peter out yesterday thanks to some hawkish comments from Fed officials, weak corporate earnings, as well as strong retail sales numbers that dampened hopes about a dovish pivot from the Fed. To be fair it wasn’t all bad news, and fears of a military escalation subsided after NATO leaders said the missile that hit Polish territory on Tuesday evening wasn’t the result of an intentional Russian attack. However, apart from specific assets like the Polish Zloty, that wasn’t enough to boost sentiment more broadly, and the S&P 500 (-0.83%) ended the day noticeably lower.

Running through those specific factors, a key one behind yesterday’s market moves were some fairly hawkish comments from Fed officials. For instance, Kansas City Fed President George cautioned about prematurely ending rate hikes in a WSJ interview, saying that “the more important question for this committee, looking out over next year, is being careful not to stop too soon”. Later on we then heard from San Francisco Fed President Daly , who said that she thought that “somewhere between 4.75 and 5.25 seems a reasonable place to think about” in terms of how high rates could go. Bear in mind that the peak rate priced in by futures is still at 4.92%, so the bulk of Daly’s range is above where pricing currently is. And finally we heard from Governor Waller, who said he was “more comfortable considering stepping down to a 50 basis-point hike” based on the data of recent weeks, but also said that “we still have a ways to go” and that “policy is barely in restrictive territory today”.

Those comments came against the backdrop of some decent retail sales numbers for October, with headline growth up by +1.3% (vs. +1.0% expected). That was the fastest pace of monthly growth since February, and the details looked pretty strong as well, with the measure excluding autos and gasoline up by +0.9% (vs. +0.2% expected). On one level that’s good news of course, but the report was seen as showcasing the strength of the US consumer amidst the ongoing rate hikes from the Fed, which should give them more space to keep hiking over the next few meetings.

With investors pricing in a slightly more hawkish Fed on the day, the 2yr Treasury yield ticked up +1.7bps to 4.35%. However, the broader risk-off tone meant there was a large decline in longer-dated yields on both sides of the Atlantic. In the US, the 10yr yield came down -8.0bps to 3.69%, and yields on 10yr bunds (-10.9bps), OATs (-12.0bps) and gilts (-14.9bps) all saw sharp declines as well. In turn, those moves pushed several yield curves even deeper into inversion territory, with the 2s10s yield curve closing beneath -60bps for the first time since 1982, which is concerning when you consider its historic accuracy as a leading indicator of recessions. Other yield curves also inverted by even more, with the 3m10yr curve down -6.6bps to -54.2bps. And even the Fed’s preferred yield curve (18m forward 3m yield minus the spot 3m yield) has now spent a full week in inversion territory, closing yesterday at -15.3bps, which is the lowest since March 2020. Overnight in Asia, yields on 10yr USTs (+2.8bps) have slightly retraced their moves yesterday, trading at 3.72% as we go to print.

Growing speculation about a recession proved bad news for equities, and the mood was further hit by a weak earnings release from Target (-13.14%), who cut their outlook and saw earnings miss expectations. By the close, that had seen the S&P 500 shed -0.83%, with the losses driven by the more cyclical sectors. Tech was impacted in particular, with the NASDAQ down -1.54% and the FANG+ index down -2.10%. For Europe it was much the same story, with the STOXX 600 (-0.98%) and the DAX (-1.00%) both losing ground on the day, and after the close we then heard a Bloomberg report that suggested ECB policymakers would slow down their rate hikes to a 50bp move next month.

In more positive news, there were strong signs that a military escalation had been avoided after a missile struck Polish territory on Tuesday evening, after both NATO and Poland’s leaders said that it did not look to have resulted from an intentional Russian attack. Polish President Duda said that “most likely, this was an unfortunate accident”, and NATO Secretary General Stoltenberg said that their view was it resulted from a Ukrainian air defence missile that was fired in defence against Russian attacks. The news helped Poland’s Zloty to regain its position prior to the attack, strengthening +1.14% against the US Dollar yesterday.

Looking forward now, attention will be on the UK today as the government delivers their Autumn Statement. That’s set to outline their fiscal consolidation plans for the years ahead, which is part of their plan to regain market confidence following the turmoil in late September and early October. Our UK economist published an update earlier this week on what to look out for (link here) but a key one will be the overall scale of the package, as well as how that’s distributed between spending cuts and tax rises. Keep an eye out as well on what’s announced on energy prices, since the current Energy Price Guarantee is only confirmed until the end of March. Ahead of the statement, data yesterday showed consumer price inflation surprised on the upside in October, coming in at +11.1%. That’s the highest reading since 1981, and is above the consensus estimate of +10.7%, as well as the Bank of England’s projection at +10.9%. Interestingly, the ONS said that without the government’s Energy Price Guarantee, CPI would have been around +13.8%, rather than +11.1%.

Overnight in Asia, the major equity markets are trading lower this morning, including the Hang Seng (-1.49%), the Shanghai Composite (-0.63%), the CSI (-1.01%), the Nikkei (-0.35%) and the KOSPI (-1.10%). Tech stocks are under pressure again as well, with the Hang Seng Tech index (-3.48%) on track for its biggest decline in a couple of weeks. That follows an announcement from Tencent that they’d be distributing $20bn of shares in Meituan. In the meantime, Bloomberg reported that regulators in China had asked banks about their ability to meet short-term obligations, following a bond selloff that triggered investor withdrawals.

Elsewhere overnight, US equity futures are pointing towards gains at today’s open with contracts on the S&P 500 (+0.21%) and NASDAQ 100 (+0.29%) both higher. And we also had an employment report from Australia showing that the unemployment rate fell to a 48-year low of 3.4% in October (vs. 3.5% expected).

Back in the US, we finally got confirmation overnight that the Republicans had gained control of the House of Representatives following last week’s midterm elections. The Associated Press’ count now puts the Republicans at the 218 mark needed for the majority, whilst the Democrats have 211 seats with only 6 districts now outstanding. So that means from January the Democrats will require at least some Republican support to pass legislation.

When it came to yesterday’s other data from the US, it wasn’t as strong as the retail sales numbers, with industrial production contracting by -0.1% in October (vs. +0.1% expected). We also got the latest NAHB housing market index for November, which fell to 33 (vs. 36 expected). If you exclude the pandemic month of April 2020, that’s the lowest reading for that index in over a decade.

To the day ahead now, and a key highlight will be the UK government’s autumn statement. Otherwise, data releases include US housing starts and building permits for October, the Philadelphia Fed’s business outlook index and the Kansas City Fed manufacturing index for November, and the weekly initial jobless claims. Finally, central bank speakers include the Fed’s Bullard, Bowman, Mester, Jefferson and Kashkari, the ECB’s Villeroy, and the BoE’s Pill and Tenreyro.

Government

Problems After COVID-19 Vaccination More Prevalent Among Naturally Immune: Study

Problems After COVID-19 Vaccination More Prevalent Among Naturally Immune: Study

Authored by Zachary Stieber via The Epoch Times (emphasis…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

People who recovered from COVID-19 and received a COVID-19 shot were more likely to suffer adverse reactions, researchers in Europe are reporting.

Participants in the study were more likely to experience an adverse reaction after vaccination regardless of the type of shot, with one exception, the researchers found.

Across all vaccine brands, people with prior COVID-19 were 2.6 times as likely after dose one to suffer an adverse reaction, according to the new study. Such people are commonly known as having a type of protection known as natural immunity after recovery.

People with previous COVID-19 were also 1.25 times as likely after dose 2 to experience an adverse reaction.

The findings held true across all vaccine types following dose one.

Of the female participants who received the Pfizer-BioNTech vaccine, for instance, 82 percent who had COVID-19 previously experienced an adverse reaction after their first dose, compared to 59 percent of females who did not have prior COVID-19.

The only exception to the trend was among males who received a second AstraZeneca dose. The percentage of males who suffered an adverse reaction was higher, 33 percent to 24 percent, among those without a COVID-19 history.

“Participants who had a prior SARS-CoV-2 infection (confirmed with a positive test) experienced at least one adverse reaction more often after the 1st dose compared to participants who did not have prior COVID-19. This pattern was observed in both men and women and across vaccine brands,” Florence van Hunsel, an epidemiologist with the Netherlands Pharmacovigilance Centre Lareb, and her co-authors wrote.

There were only slightly higher odds of the naturally immune suffering an adverse reaction following receipt of a Pfizer or Moderna booster, the researchers also found.

The researchers performed what’s known as a cohort event monitoring study, following 29,387 participants as they received at least one dose of a COVID-19 vaccine. The participants live in a European country such as Belgium, France, or Slovakia.

Overall, three-quarters of the participants reported at least one adverse reaction, although some were minor such as injection site pain.

Adverse reactions described as serious were reported by 0.24 percent of people who received a first or second dose and 0.26 percent for people who received a booster. Different examples of serious reactions were not listed in the study.

Participants were only specifically asked to record a range of minor adverse reactions (ADRs). They could provide details of other reactions in free text form.

“The unsolicited events were manually assessed and coded, and the seriousness was classified based on international criteria,” researchers said.

The free text answers were not provided by researchers in the paper.

“The authors note, ‘In this manuscript, the focus was not on serious ADRs and adverse events of special interest.’” Yet, in their highlights section they state, “The percentage of serious ADRs in the study is low for 1st and 2nd vaccination and booster.”

Dr. Joel Wallskog, co-chair of the group React19, which advocates for people who were injured by vaccines, told The Epoch Times: “It is intellectually dishonest to set out to study minor adverse events after COVID-19 vaccination then make conclusions about the frequency of serious adverse events. They also fail to provide the free text data.” He added that the paper showed “yet another study that is in my opinion, deficient by design.”

Ms. Hunsel did not respond to a request for comment.

She and other researchers listed limitations in the paper, including how they did not provide data broken down by country.

The paper was published by the journal Vaccine on March 6.

The study was funded by the European Medicines Agency and the Dutch government.

No authors declared conflicts of interest.

Some previous papers have also found that people with prior COVID-19 infection had more adverse events following COVID-19 vaccination, including a 2021 paper from French researchers. A U.S. study identified prior COVID-19 as a predictor of the severity of side effects.

Some other studies have determined COVID-19 vaccines confer little or no benefit to people with a history of infection, including those who had received a primary series.

The U.S. Centers for Disease Control and Prevention still recommends people who recovered from COVID-19 receive a COVID-19 vaccine, although a number of other health authorities have stopped recommending the shot for people who have prior COVID-19.

Another New Study

In another new paper, South Korean researchers outlined how they found people were more likely to report certain adverse reactions after COVID-19 vaccination than after receipt of another vaccine.

The reporting of myocarditis, a form of heart inflammation, or pericarditis, a related condition, was nearly 20 times as high among children as the reporting odds following receipt of all other vaccines, the researchers found.

The reporting odds were also much higher for multisystem inflammatory syndrome or Kawasaki disease among adolescent COVID-19 recipients.

Researchers analyzed reports made to VigiBase, which is run by the World Health Organization.

“Based on our results, close monitoring for these rare but serious inflammatory reactions after COVID-19 vaccination among adolescents until definitive causal relationship can be established,” the researchers wrote.

The study was published by the Journal of Korean Medical Science in its March edition.

Limitations include VigiBase receiving reports of problems, with some reports going unconfirmed.

Funding came from the South Korean government. One author reported receiving grants from pharmaceutical companies, including Pfizer.

International

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

As the global pandemic unfolded, government-funded…

As the global pandemic unfolded, government-funded experimental vaccines were hastily developed for a virus which primarily killed the old and fat (and those with other obvious comorbidities), and an aggressive, global campaign to coerce billions into injecting them ensued.

Then there were the lockdowns - with some countries (New Zealand, for example) building internment camps for those who tested positive for Covid-19, and others such as China welding entire apartment buildings shut to trap people inside.

It was an egregious and unnecessary response to a virus that, while highly virulent, was survivable by the vast majority of the general population.

Oh, and the vaccines, which governments are still pushing, didn't work as advertised to the point where health officials changed the definition of "vaccine" multiple times.

Tucker Carlson recently sat down with Dr. Pierre Kory, a critical care specialist and vocal critic of vaccines. The two had a wide-ranging discussion, which included vaccine safety and efficacy, excess mortality, demographic impacts of the virus, big pharma, and the professional price Kory has paid for speaking out.

Keep reading below, or if you have roughly 50 minutes, watch it in its entirety for free on X:

Ep. 81 They’re still claiming the Covid vax is safe and effective. Yet somehow Dr. Pierre Kory treats hundreds of patients who’ve been badly injured by it. Why is no one in the public health establishment paying attention? pic.twitter.com/IekW4Brhoy

— Tucker Carlson (@TuckerCarlson) March 13, 2024

"Do we have any real sense of what the cost, the physical cost to the country and world has been of those vaccines?" Carlson asked, kicking off the interview.

"I do think we have some understanding of the cost. I mean, I think, you know, you're aware of the work of of Ed Dowd, who's put together a team and looked, analytically at a lot of the epidemiologic data," Kory replied. "I mean, time with that vaccination rollout is when all of the numbers started going sideways, the excess mortality started to skyrocket."

When asked "what kind of death toll are we looking at?", Kory responded "...in 2023 alone, in the first nine months, we had what's called an excess mortality of 158,000 Americans," adding "But this is in 2023. I mean, we've had Omicron now for two years, which is a mild variant. Not that many go to the hospital."

'Safe and Effective'

Tucker also asked Kory why the people who claimed the vaccine were "safe and effective" aren't being held criminally liable for abetting the "killing of all these Americans," to which Kory replied: "It’s my kind of belief, looking back, that [safe and effective] was a predetermined conclusion. There was no data to support that, but it was agreed upon that it would be presented as safe and effective."

Tucker Carlson Asks the Forbidden Question

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

He wants to know why the people who made the claim “safe and effective” aren’t being held to criminal liability for abetting the “killing of all these Americans.”

DR. PIERRE KORY: “It’s my kind of belief, looking back, that [safe and… pic.twitter.com/Icnge18Rtz

Carlson and Kory then discussed the different segments of the population that experienced vaccine side effects, with Kory noting an "explosion in dying in the youngest and healthiest sectors of society," adding "And why did the employed fare far worse than those that weren't? And this particularly white collar, white collar, more than gray collar, more than blue collar."

Kory also said that Big Pharma is 'terrified' of Vitamin D because it "threatens the disease model." As journalist The Vigilant Fox notes on X, "Vitamin D showed about a 60% effectiveness against the incidence of COVID-19 in randomized control trials," and "showed about 40-50% effectiveness in reducing the incidence of COVID-19 in observational studies."

Dr. Pierre Kory: Big Pharma is ‘TERRIFIED’ of Vitamin D

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

Why?

Because “It threatens the DISEASE MODEL.”

A new meta-analysis out of Italy, published in the journal, Nutrients, has unearthed some shocking data about Vitamin D.

Looking at data from 16 different studies and 1.26… pic.twitter.com/q5CsMqgVju

Professional costs

Kory - while risking professional suicide by speaking out, has undoubtedly helped save countless lives by advocating for alternate treatments such as Ivermectin.

Kory shared his own experiences of job loss and censorship, highlighting the challenges of advocating for a more nuanced understanding of vaccine safety in an environment often resistant to dissenting voices.

"I wrote a book called The War on Ivermectin and the the genesis of that book," he said, adding "Not only is my expertise on Ivermectin and my vast clinical experience, but and I tell the story before, but I got an email, during this journey from a guy named William B Grant, who's a professor out in California, and he wrote to me this email just one day, my life was going totally sideways because our protocols focused on Ivermectin. I was using a lot in my practice, as were tens of thousands of doctors around the world, to really good benefits. And I was getting attacked, hit jobs in the media, and he wrote me this email on and he said, Dear Dr. Kory, what they're doing to Ivermectin, they've been doing to vitamin D for decades..."

"And it's got five tactics. And these are the five tactics that all industries employ when science emerges, that's inconvenient to their interests. And so I'm just going to give you an example. Ivermectin science was extremely inconvenient to the interests of the pharmaceutical industrial complex. I mean, it threatened the vaccine campaign. It threatened vaccine hesitancy, which was public enemy number one. We know that, that everything, all the propaganda censorship was literally going after something called vaccine hesitancy."

Money makes the world go 'round

Carlson then hit on perhaps the most devious aspect of the relationship between drug companies and the medical establishment, and how special interests completely taint science to the point where public distrust of institutions has spiked in recent years.

"I think all of it starts at the level the medical journals," said Kory. "Because once you have something established in the medical journals as a, let's say, a proven fact or a generally accepted consensus, consensus comes out of the journals."

"I have dozens of rejection letters from investigators around the world who did good trials on ivermectin, tried to publish it. No thank you, no thank you, no thank you. And then the ones that do get in all purportedly prove that ivermectin didn't work," Kory continued.

"So and then when you look at the ones that actually got in and this is where like probably my biggest estrangement and why I don't recognize science and don't trust it anymore, is the trials that flew to publication in the top journals in the world were so brazenly manipulated and corrupted in the design and conduct in, many of us wrote about it. But they flew to publication, and then every time they were published, you saw these huge PR campaigns in the media. New York Times, Boston Globe, L.A. times, ivermectin doesn't work. Latest high quality, rigorous study says. I'm sitting here in my office watching these lies just ripple throughout the media sphere based on fraudulent studies published in the top journals. And that's that's that has changed. Now that's why I say I'm estranged and I don't know what to trust anymore."

Vaccine Injuries

Carlson asked Kory about his clinical experience with vaccine injuries.

"So how this is how I divide, this is just kind of my perception of vaccine injury is that when I use the term vaccine injury, I'm usually referring to what I call a single organ problem, like pericarditis, myocarditis, stroke, something like that. An autoimmune disease," he replied.

"What I specialize in my practice, is I treat patients with what we call a long Covid long vaxx. It's the same disease, just different triggers, right? One is triggered by Covid, the other one is triggered by the spike protein from the vaccine. Much more common is long vax. The only real differences between the two conditions is that the vaccinated are, on average, sicker and more disabled than the long Covids, with some pretty prominent exceptions to that."

Watch the entire interview above, and you can support Tucker Carlson's endeavors by joining the Tucker Carlson Network here...

International

Shakira’s net worth

After 12 albums, a tax evasion case, and now a towering bronze idol sculpted in her image, how much is Shakira worth more than 4 decades into her care…

Shakira’s considerable net worth is no surprise, given her massive popularity in Latin America, the U.S., and elsewhere.

In fact, the belly-dancing contralto queen is the second-wealthiest Latin-America-born pop singer of all time after Gloria Estefan. (Interestingly, Estefan actually helped a young Shakira translate her breakout album “Laundry Service” into English, hugely propelling her stateside success.)

Since releasing her first record at age 13, Shakira has spent decades recording albums in both Spanish and English and performing all over the world. Over the course of her 40+ year career, she helped thrust Latin pop music into the American mainstream, paving the way for the subsequent success of massively popular modern acts like Karol G and Bad Bunny.

In December 2023, a 21-foot-tall beachside bronze statue of the “Hips Don’t Lie” singer was unveiled in her Colombian hometown of Barranquilla, making her a permanent fixture in the city’s skyline and cementing her legacy as one of Latin America’s most influential entertainers.

After 12 albums, a plethora of film and television appearances, a highly publicized tax evasion case, and now a towering bronze idol sculpted in her image, how much is Shakira worth? What does her income look like? And how does she spend her money?

How much is Shakira worth?

In late 2023, Spanish sports and lifestyle publication Marca reported Shakira’s net worth at $400 million, citing Forbes as the figure’s source (although Forbes’ profile page for Shakira does not list a net worth — and didn’t when that article was published).

Most other sources list the singer’s wealth at an estimated $300 million, and almost all of these point to Celebrity Net Worth — a popular but dubious celebrity wealth estimation site — as the source for the figure.

A $300 million net worth would make Shakira the third-richest Latina pop star after Gloria Estefan ($500 million) and Jennifer Lopez ($400 million), and the second-richest Latin-America-born pop singer after Estefan (JLo is Puerto Rican but was born in New York).

Shakira’s income: How much does she make annually?

Entertainers like Shakira don’t have predictable paychecks like ordinary salaried professionals. Instead, annual take-home earnings vary quite a bit depending on each year’s album sales, royalties, film and television appearances, streaming revenue, and other sources of income. As one might expect, Shakira’s earnings have fluctuated quite a bit over the years.

From June 2018 to June 2019, for instance, Shakira was the 10th highest-earning female musician, grossing $35 million, according to Forbes. This wasn’t her first time gracing the top 10, though — back in 2012, she also landed the #10 spot, bringing in $20 million, according to Billboard.

In 2023, Billboard listed Shakira as the 16th-highest-grossing Latin artist of all time.

How much does Shakira make from her concerts and tours?

A large part of Shakira’s wealth comes from her world tours, during which she sometimes sells out massive stadiums and arenas full of passionate fans eager to see her dance and sing live.

According to a 2020 report by Pollstar, she sold over 2.7 million tickets across 190 shows that grossed over $189 million between 2000 and 2020. This landed her the 19th spot on a list of female musicians ranked by touring revenue during that period. In 2023, Billboard reported a more modest touring revenue figure of $108.1 million across 120 shows.

In 2003, Shakira reportedly generated over $4 million from a single show on Valentine’s Day at Foro Sol in Mexico City. 15 years later, in 2018, Shakira grossed around $76.5 million from her El Dorado World Tour, according to Touring Data.

Related: RuPaul's net worth: Everything to know about the cultural icon and force behind 'Drag Race'

How much has Shakira made from her album sales?

According to a 2023 profile in Variety, Shakira has sold over 100 million records throughout her career. “Laundry Service,” the pop icon’s fifth studio album, was her most successful, selling over 13 million copies worldwide, according to TheRichest.

Exactly how much money Shakira has taken home from her album sales is unclear, but in 2008, it was widely reported that she signed a 10-year contract with LiveNation to the tune of between $70 and $100 million to release her subsequent albums and manage her tours.

How much did Shakira make from her Super Bowl and World Cup performances?

Shakira co-wrote one of her biggest hits, “Waka Waka (This Time for Africa),” after FIFA selected her to create the official anthem for the 2010 World Cup in South Africa. She performed the song, along with several of her existing fan-favorite tracks, during the event’s opening ceremonies. TheThings reported in 2023 that the song generated $1.4 million in revenue, citing Popnable for the figure.

A decade later, 2020’s Superbowl halftime show featured Shakira and Jennifer Lopez as co-headliners with guest performances by Bad Bunny and J Balvin. The 14-minute performance was widely praised as a high-energy celebration of Latin music and dance, but as is typical for Super Bowl shows, neither Shakira nor JLo was compensated beyond expenses and production costs.

The exposure value that comes with performing in the Super Bowl Halftime Show, though, is significant. It is typically the most-watched television event in the U.S. each year, and in 2020, a 30-second Super Bowl ad spot cost between $5 and $6 million.

How much did Shakira make as a coach on “The Voice?”

Shakira served as a team coach on the popular singing competition program “The Voice” during the show’s fourth and sixth seasons. On the show, celebrity musicians coach up-and-coming amateurs in a team-based competition that eventually results in a single winner. In 2012, The Hollywood Reporter wrote that Shakira’s salary as a coach on “The Voice” was $12 million.

Related: John Cena's net worth: The wrestler-turned-actor's investments, businesses, and more

How does Shakira spend her money?

Shakira doesn’t just make a lot of money — she spends it, too. Like many wealthy entertainers, she’s purchased her share of luxuries, but Barranquilla’s barefoot belly dancer is also a prolific philanthropist, having donated tens of millions to charitable causes throughout her career.

Private island

Back in 2006, she teamed up with Roger Waters of Pink Floyd fame and Spanish singer Alejandro Sanz to purchase Bonds Cay, a 550-acre island in the Bahamas, which was listed for $16 million at the time.

Along with her two partners in the purchase, Shakira planned to develop the island to feature housing, hotels, and an artists’ retreat designed to host a revolving cast of artists-in-residence. This plan didn’t come to fruition, though, and as of this article’s last update, the island was once again for sale on Vladi Private Islands.

Real estate and vehicles

Like most wealthy celebs, Shakira’s portfolio of high-end playthings also features an array of luxury properties and vehicles, including a home in Barcelona, a villa in Cyprus, a Miami mansion, and a rotating cast of Mercedes-Benz vehicles.

Philanthropy and charity

Shakira doesn’t just spend her massive wealth on herself; the “Queen of Latin Music” is also a dedicated philanthropist and regularly donates portions of her earnings to the Fundación Pies Descalzos, or “Barefoot Foundation,” a charity she founded in 1997 to “improve the education and social development of children in Colombia, which has suffered decades of conflict.” The foundation focuses on providing meals for children and building and improving educational infrastructure in Shakira’s hometown of Barranquilla as well as four other Colombian communities.

In addition to her efforts with the Fundación Pies Descalzos, Shakira has made a number of other notable donations over the years. In 2007, she diverted a whopping $40 million of her wealth to help rebuild community infrastructure in Peru and Nicaragua in the wake of a devastating 8.0 magnitude earthquake. Later, during the COVID-19 pandemic in 2020, Shakira donated a large supply of N95 masks for healthcare workers and ventilators for hospital patients to her hometown of Barranquilla.

Back in 2010, the UN honored Shakira with a medal to recognize her dedication to social justice, at which time the Director General of the International Labour Organization described her as a “true ambassador for children and young people.”

Shakira’s tax fraud scandal: How much did she pay?

In 2018, prosecutors in Spain initiated a tax evasion case against Shakira, alleging she lived primarily in Spain from 2012 to 2014 and therefore failed to pay around $14.4 million in taxes to the Spanish government. Spanish law requires anyone who is “domiciled” (i.e., living primarily) in Spain for more than half of the year to pay income taxes.

During the period in question, Shakira listed the Bahamas as her primary residence but did spend some time in Spain, as she was dating Gerard Piqué, a professional footballer and Spanish citizen. The couple’s first son, Milan, was also born in Barcelona during this period.

Shakira maintained that she spent far fewer than 183 days per year in Spain during each of the years in question. In an interview with Elle Magazine, the pop star opined that “Spanish tax authorities saw that I was dating a Spanish citizen and started to salivate. It's clear they wanted to go after that money no matter what."

Prosecutors in the case sought a fine of almost $26 million and a possible eight-year prison stint, but in November of 2023, Shakira took a deal to close the case, accepting a fine of around $8 million and a three-year suspended sentence to avoid going to trial. In reference to her decision to take the deal, Shakira stated, "While I was determined to defend my innocence in a trial that my lawyers were confident would have ruled in my favour [had the trial proceeded], I have made the decision to finally resolve this matter with the best interest of my kids at heart who do not want to see their mom sacrifice her personal well-being in this fight."

How much did the Shakira statue in Barranquilla cost?

In late 2023, a 21-foot-tall bronze likeness of Shakira was unveiled on a waterfront promenade in Barranquilla. The city’s then-mayor, Jaime Pumarejo, commissioned Colombian sculptor Yino Márquez to create the statue of the city’s treasured pop icon, along with a sculpture of the city’s coat of arms.

According to the New York Times, the two sculptures cost the city the equivalent of around $180,000. A plaque at the statue’s base reads, “A heart that composes, hips that don’t lie, an unmatched talent, a voice that moves the masses and bare feet that march for the good of children and humanity.”

Related: Taylor Swift net worth: The most successful entertainer joins the billionaire's club

bonds pandemic covid-19 real estate africa mexico spain-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A