Uncategorized

Futures Rise, Yen Craters, Oil Rises As Israeli Troops Press Into Gaza

Futures Rise, Yen Craters, Oil Rises As Israeli Troops Press Into Gaza

Futures were higher and European bourses were solidly in the green…

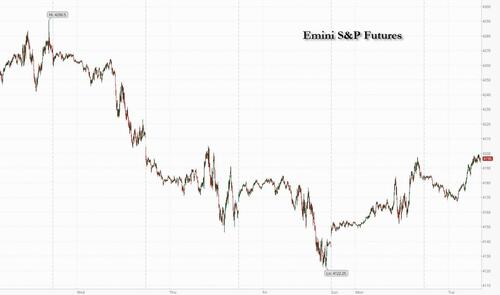

Futures were higher and European bourses were solidly in the green on the last day of the month, extending yesterday's blistering rally which sent the S&P 1.2% higher and which took place after most of the mutual-fund year-end tax loss selling had exhausted itself during last week's rout. As of 7:45am, S&P futures were higher by 0.2%, Nasdaq 100 futs gained 0.1%, while Europe's Estoxx 50 outperforms, higher by around 1% on the day with materials sector outperforming. Treasury yields are lower after the US Treasury reduced its estimate for federal borrowing for the current quarter, citing stronger-than-expected revenue; the dollar was weaker against most major currencies, except the yen. Oil prices are edging higher after dropping in the prior session. Israel stepped up ground operations in Gaza and struck more targets in Lebanon and Syria overnight.

In premarket trading, Samsung Electronics profit beat expectations and it pointed toward a memory chip recovery, AB InBev also outpaced estimates and the performance of its peers, while Vans and North Face owner VFC plunged more than 6% after pulling its full-year guidance. Sarepta Therapeutics cratered 46% after saying results from its Embark Phase 3 study of Elevidys in patients with Duchenne muscular dystrophy between the ages of 4 through 7 years missed its main goal. Here are some other notable premarket movers:

- Amkor Technology drops 13% after the semiconductor packaging company’s net sales forecast for the fourth-quarter missed expectations.

- Arista Networks jumps 10% after the communications-equipment company reported fourth-quarter adjusted earnings per share and revenue that beat estimates.

- Caterpillar Inc. falls 4% after the machinery maker reported a sequential decline in its order backlog.

- Chewy rises about 4% as Morgan Stanley upgrades the pet products company to overweight, saying the 50% year-to-date selloff in the stock is overdone.

- Harmonic shares are down 11% after the communications equipment company cut its full-year forecast.

- JetBlue drops 7% after the low-cost carrier missed Wall Street’s earnings estimates and forecast a worse-than-expected loss this quarter.

- Lattice Semiconductor falls 15% after the chip maker’s 4Q revenue forecast fell short of analyst estimates.

- Lyft drops 3% after MoffettNathanson gives the stock a rare sell rating and set its price target at a Street-low.

- PetMed tumbles 28% after the pet pharmaceutical firm suspended its quarterly dividend and posted 2Q earnings that disappointed.

- Pinterest jumps 16% after the social-networking company reported third-quarter results that beat expectations.

- VF Corp. (VFC) falls about 6% after the apparel and footwear company withdrew guidance for the fiscal year.

European stocks are also higher. The Stoxx 600 gains 0.7% with the real estate subindex the biggest outperformer, fueled by a continued retreat of bond yields. Swiss pharma giant Roche plunges on a disappointing drug study, pulling the sector lower, while fossil fuel giant BP slides after its third-quarter report missed expectations. Here are the most notable movers:

- Wartsila jumps as much as 19%, the most since October 2008, after the Finnish marine and energy equipment manufacturer reported a strong beat to third-quarter figures

- DSM-Firmenich gains as much as 8.8%, the most since its April listing, after the nutrition and chemicals company reported better-than-expected 3Q earnings, as well as reassuring guidances

- Real estate stocks rise for a fourth session on Tuesday, outperforming the broader market, as bond yields decline. The Stoxx Europe 600 Real Estate Index rises as much as 2.4%, the most in about three weeks

- Rolls-Royce gains as much as 6% to be best performer on FTSE 100 as Barclays upgrades the jet-engine maker to overweight, saying a fall over the past month presents a chance to buy

- Anheuser-Busch InBev rises as much as 4% after the brewer reported 3Q earnings ahead of estimates. In what was a challenging period for peers, the performance “stands out,” RBC said

- Spectris advances as much as 4.8% as the electrical engineering company says it expects full-year adjusted operating profit to come in toward the high end of a guided range

- Roche falls as much as 4% to the lowest in five years after a trial of the Swiss drugmaker’s gene therapy for Duchenne muscular dystrophy did not meet the main goal in a study

- BP declines as much as 5.5% after the energy company’s third-quarter profit fell short of estimates. Weak results in gas marketing offset a strong performance in oil trading

- AMS-Osram drops as much as 4.4%, to the lowest intraday since 2009. The chipmaker’s 4Q guidance missed estimates and analysts said 2024 comments were on the cautious side

- SES falls as much as 4.6% after the company said it’s delaying launches of five O3b mPOWER satellites, a move that will cause a mid-single digit percentage hit to 2024 sales and adj. Ebitda

- Carlsberg declines as much as 3.2%, reaching the lowest intraday level since 2022, after the brewer reported third-quarter revenue that missed estimates, driven by weak Asia numbers

- OMV slides as much as 4.3%, the most intraday since June, after Austrian refiner reported “slightly disappointing” 3Q clean CCS operating profit that missed estimates

And while stocks may struggle to keep their early gains, the biggest mover overnight was the Japanese yen which plunged the most in two months after the Bank of Japan made only minor changes to its policy settings, disappointing many who had expected more after the bank had leaked a far more bombastic report to the Nikkei. In its wishy-washy announcement, the BOJ halfheartedly ended YCC, saying the 1% cap on the 10Y would now be a reference rate, inviting bond bears to promptly test out how much higher yields will rise. Meanwhile, the implosion in the yen is sparking even more inflation which as noted below, is already crushing Kishida's approval polling, and ensures that there will very soon be a major scandal between the Japanese government and the BOJ.

“This is the first critical test of whether Japanese officials care about the speed of JPY depreciation or specific levels,” said Simon Harvey, head of fx analysis at Monex Europe. “Thankfully for them lower Treasury yields are delaying any urgency for an answer, but any unexpected hawkish comments from Chair Powell tomorrow or a larger issuance in longer-date Treasuries could force the issue as soon as tomorrow.”

“It looks like loose monetary policy is likely to stay in place for some time to come,” he wrote in a note. “They are now in a corner and cannot afford to allow long-term bond yields to rise much further.”

The prospect of a weaker yen and negative interest rates means Japanese equities are in line for more gains, according to Charles-Henry Monchau, chief investment officer at Bank Syz. The Nikkei 225 added 0.5% on Tuesday, bringing its year-to-date rally to 18%. Japan's gains stood in stark contrast to the rest of the global equity market. The S&P 500 is on track for a 2.8% retreat in October, a third monthly loss.

Elsewhere in Asia, stocks dipped led by Chinese equities, after data showed the nation’s factory activity fell back into contraction in October. The MSCI Asia Pacific Index slipped as much as 0.6%, erasing a small early advance after the China PMI figures, which also showed an expansion of the services sector unexpectedly eased. Consumer discretionary and materials were the worst performers. Earnings remain a big focus in what is the second-busiest week this reporting season for Asia. China’s Ganfeng Lithium and Japan’s Panasonic were among the biggest losers on the regional gauge after their results.

Equities in Japan advanced after the central bank announced its decision to keep its easy monetary policy, making only minor changes to its yield-curve-control settings.

- The Hang Seng and Shanghai Comp were pressured following disappointing PMI data which showed China’s factory activity returned into contractionary territory for October, while there were also plenty of earnings releases including from the likes of Bank of China, BYD and PetroChina.

- Australia's ASX 200 finished flat as strength in real estate, financials and the consumer sectors was offset by underperformance in mining stocks and after the weak factory activity data from Australia’s largest trading partner.

- Japan's Nikkei 225 was initially choppy after Industrial Production and Retail Sales missed estimates although the index was later supported following the BoJ policy announcement in which the central bank announced a less aggressive than anticipated tweak to YCC.

In FX, the Japanese yen tumbled over 1% versus the dollar after the Bank of Japan tweaked its yield curve control policy but disappointed hawks by once again taking a more dovish way out, one which is sure to spark more inflation and lead to a collapse of the already extremely unpopular Kishida government. The euro was is one of the best performing G-10 currencies meanwhile, rising 0.5%, despite euro-area CPI coming in below forecasts and GDP shrinking back into contraction!

In rates, treasuries rallied along with bunds and gilts. US 10-year yields fall 8bps to 4.82%, bull-flattening with futures near top of day’s range into early US session, with yields richer by 3bp to 8bp across the curve. Treasuries were well supported overnight, following the Bank of Japan’s modest policy tweak, saying the 1% level for JGB 10-year yields is now a reference point and adopts a flexible bond-buying stance, disappointing investors who expected a clearer policy signal. Core European rates lag Treasuries, while bunds held gains after Euro-area inflation eased to its lowest level in more than two years. US yields richer by up to 8bp across long-end of the curve, flattening 5s30s spread by 1.8bp on the day — 2s10s spread tightens over 4bp vs. Monday close with front-end underperforming; US 10-year yields around 4.82%, richer by 7.5bp on the day and outperforming bunds and gilts by 3.5bp and 0.5bp in the sector.

In commodities, oil prices rebounded after a steep drop yesterday as investors tracked developments in the Middle East. Israel struck more targets in Lebanon and Syria overnight, while stepping up its ground operations in Gaza. West Texas Intermediate rose 1% to near $83 a barrel. Spot gold climbed 0.1%.

Bitcoin was flatish on the session, holding around the $34.5k mark, with action contained and very much rangebound thus far as we await key US catalysts including the ECI before the week's main Tier 1 events begin from a US perspective.

US economic data includes 3Q employment cost index (8:30am), August FHFA house price index, S&P Case-shiller house prices (9am), October MNI Chicago PMI (9:45am), consumer confidence (10am) and Dallas Fed services index (10:30am)

To the day ahead now, data releases include the Euro Area flash CPI release for October, as well as the Q3 GDP release, both of which came below expectations, with GDP once again contracting. Over in the US, there’s the Employment Cost Index for Q3 (8:30am), August FHFA house price index, S&P Case-shiller house prices (9am), October MNI Chicago PMI (9:45am), consumer confidence (10am) and Dallas Fed services index (10:30am). From central banks, there are several ECB speakers including Vice President de Guindos, and the ECB’s De Cos, Visco, Muller and Nagel. Lastly, today’s earnings releases include BP, Pfizer and Caterpillar.

Market Snapshot

- S&P 500 futures little changed at 4,182.25

- STOXX Europe 600 up 0.3% to 432.21

- MXAP down 0.5% to 151.20

- MXAPJ down 0.7% to 472.75

- Nikkei up 0.5% to 30,858.85

- Topix up 1.0% to 2,253.72

- Hang Seng Index down 1.7% to 17,112.48

- Shanghai Composite little changed at 3,018.77

- Sensex down 0.2% to 63,978.37

- Australia S&P/ASX 200 up 0.1% to 6,780.68

- Kospi down 1.4% to 2,277.99

- German 10Y yield little changed at 2.79%

- Euro up 0.2% to $1.0634

- Brent Futures up 0.9% to $88.25/bbl

- Gold spot up 0.0% to $1,996.79

- U.S. Dollar Index little changed at 106.14

Top Overnight News from Bloomberg

- China’s NBS PMIs fall short of expectations, with manufacturing coming in at 49.5 (down from 50.2 in Sept and below the Street’s 50.2 forecast) and non-manufacturing at 50.6 (down from 51.7 in Sept and below the Street’s 52 forecast). RTRS

- President Xi Jinping underscored his concerns — and more conservative social views — about China’s shrinking population in a speech calling on a key women’s organization to help bolster the nation’s birthrate by promoting a “culture” of childbirth. BBG

- Nvidia’s $5 Billion of China Orders in Limbo After Latest U.S. Curbs. Tech company had been pushing to make chip shipments for next year before new restrictions came into effect. WSJ

- The yen fell below 150 after the BOJ made only minor tweaks to its yield-control strategy. Governor Kazuo Ueda said the 1% cap on 10-year JGB yields is now just a “reference,” but doubts they’ll rise much higher. BBG

- Euro-area inflation eased to its lowest level in more than two years as the bloc’s economy unexpectedly shrank following an unprecedented ramp-up in interest rates. CPI rose 2.9% in October — down from 4.3%. GDP fell 0.1%, missing estimates for stagnation. BBG

- Israel struck more targets in Lebanon and Syria, while stepping up its ground operations in Gaza. The UN warned that the situation in Syria is “at its most dangerous for a long time.” Iran’s foreign minister will visit Qatar today to discuss the situation in Gaza. BBG

- Russia has restricted western companies that sell their Russian assets from withdrawing the proceeds in dollars and euros, imposing additional de facto currency controls in an effort to shore up the weakening rouble. FT

- Central banks have loaded up on more gold than previously thought this year, offering crucial support to prices. Purchases for the first nine months totaled 800 tons, driven mainly by China, Poland and Singapore — more than the same period last year, which ended with record demand. BBG

- VFC pulled its guidance for its current fiscal year, slashed its dividend and said it will replace the president of its Vans brand. VF has come under pressure from activist investors this month. Shares fell nearly 9% premarket. WSJ

- Commercial real-estate lending has slowed sharply, threatening a rise in defaults on expiring debt and a sharp decline in new construction...

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid a deluge of data releases at month-end including disappointing Chinese official PMIs, while participants also digested a slew of earnings releases and the conclusion of the BoJ’s live meeting. ASX 200 finished flat as strength in real estate, financials and the consumer sectors was offset by underperformance in mining stocks and after the weak factory activity data from Australia’s largest trading partner. Nikkei 225 was initially choppy after Industrial Production and Retail Sales missed estimates although the index was later supported following the BoJ policy announcement in which the central bank announced a less aggressive than anticipated tweak to YCC. Hang Seng and Shanghai Comp were pressured following disappointing PMI data which showed China’s factory activity returned into contractionary territory for October, while there were also plenty of earnings releases including from the likes of Bank of China, BYD and PetroChina.

Top Asian News

- China's Foreign Minister Wang met with the French Foreign Affairs Adviser to the President and the sides had friendly, in-depth exchanges regarding China-France and China-EU relations, as well as international and regional issues. Furthermore, Wang said he hopes the EU will adopt a more pragmatic and rational attitude in cooperation with China and avoid external interference, ensure mutual openness and promote stable bilateral relations.

- US is to send its strongest-ever delegation to the China import expo amid improving relations, according to SCMP.

- China interbank overnight repo rate rate jumps to as high as 50%, via official data.

European bourses are in the green, Euro Stoxx 50 +0.8%, following a mixed APAC handover and solid US lead with the region unreactive to the latest CPI & GDP metrics. APAC trade was mixed on account of numerous data points including soft Chinese official PMIs. Sectors are mostly firmer though Energy lagging given benchmark pricing and a poorly received update from BP while Healthcare slips after a disappointing drug update from Roche. At the other end of the spectrum, Chemical names outperform given cost-cutting measures from BASF. Stateside, futures are modestly firmer and have been moving directionally with European peers ahead of US data and a handful of earnings, ES +0.3%. Caterpillar Inc (CAT) Q3 2023 (USD): EPS 5.52 (exp. 4.79), Revenue 16.8bln (exp. 16.59bln), Financial Rev 822mln (exp 766mln), Adj. Operating Income 3.50bln (exp 3.09bln).

Top European News

- UK insolvency service Q3 insolvencies in England and Wales total 6208; after seasonal adjustment, the number of company insolvencies in Q3'23 was 2% lower than in Q2'23, but 10% higher than Q3'22.

- ECB's Visco says ECB needs to be cautious in coming months after hiking rates so much and so quickly; EZ inflation is falling as expected and demand seen further contained in coming months due to delayed impact of rate hikes. A reason for recent rises in Italian bond spreads is probably that investors doubt Italy's economic growth potential and control of public finances. Fears of a wage-spiral in EZ and unanchored inflation expectations have sharply diminished.

FX

- Hawkish sources set Yen up for steep fall as BoJ sticks to dovish guidance after fixing flexible YCT ceiling at 1%, USD/JPY rebounds from 149.03 to 150.75 alongside Yen crosses.

- Euro boosted by breach of 160.00 in EUR/JPY as EUR/USD reclaims 1.0600+ status and and leans on the DXY, Dollar index retreats from 106.45 to 105.89

- Kiwi encouraged by upbeat ANZ business survey, with NZD/USD probing 0.5850 and AUD/USD cross reversing through 1.0900.

- Aussie hampered with Yuan after disappointing Chinese PMIs, AUD/USD capped around 0.6350, USD/CNY above 7.3100 and USD/CNH over 7.3300.

- PBoC set USD/CNY mid-point at 7.1779 vs exp. 7.3024 (prev. 7.1781)

Fixed Income

- Bonds firmly underpinned approaching month end.

- Gilts and T-note pick up the baton from EGBs to hover towards upper end of respective 93.51-09 and 106-19/02 ranges.

- Bunds off best levels between 129.33-128.65 parameters and BTPs regroup within 110.70-15 bounds in relief post-Italian month end supply.

Commodities

- Crude futures consolidated overnight after settling lower by USD 3.23/bbl and USD 2.85/bbl respectively on Monday, paring all of Friday’s gains and more after an unwind of some of the geopolitical risk.

- Currently, WTI Dec resides just under USD 83/bbl (in a USD 82.29-83.17/bbl range) while Brent Jan trades around USD 87/bbl (in a USD 86.30-87.22/bbl parameter).

- Spot gold is flat after seeing a similar unwinding of geopolitical premia while base metals are mixed but with modest gains given the risk tone; Dalian** iron ore** bid on Chinese optimism and as the likes of ING highlight potential strike action in Australia.

BOJ

- BoJ maintained NIRP at -0.10% and the 10yr JGB yield target at 0% but widened the reference range to 100bps up or down from the target from 50bps and made YCC more flexible with the decision on YCC made by 8-1 vote in which board member Nakamura dissented. BoJ said it will regard the upper bound of 1% for the 10yr JGB yield as a reference in market operations and will guide market operations nimbly, while it will flexibly increase JGB buying, fixed-rate operations and collateral fund-supplying operations. Furthermore, it will determine the offer rate for fixed-rate JGB buying operations each time by taking into account market rates and other factors.

- BoJ Governor Ueda says will patiently continue monetary easing with decided new measures; Will not hesitate to take additional easing measures if necessary; Getting gradually closer to achieving price target. Closely working with government and monitoring the situation on FX.** FX could affect policy if it impacts price outlook. Next spring's wage talks will be an important factor**. Click here for more detail.

- Japanese PM Kishida says excessive FX moves are not desirable; weak JPY has various reasons including yield differentials.

Geopolitics

- White House National Security Adviser Sullivan met with the Saudi Defence Minister and confirmed President Biden's commitment to support the defence of US partners against threats from state and non-state actors including those backed by Iran.

- Drone intercepted over the Red Sea reportedly launched from Yemen, according to Walla News' Elster; "drone launched by Yemen's Houthi rebels have been intercepted by the IDF over the Red Sea", according to Faytuks News.

- Yemeni Houthis claim launch of drone towards Israel, according to Sky News Arabia citing AFP.

US Event Calendar

- 08:30: 3Q Employment Cost Index, est. 1.0%, prior 1.0%

- 09:00: Aug. S&P/Case-Shiller US HPI YoY, est. 1.78%, prior 0.98%

- 09:00: Aug. S&P CS Composite-20 YoY, est. 1.75%, prior 0.13%

- 09:00: Aug. S&P/CS 20 City MoM SA, est. 0.80%, prior 0.87%

- 09:45: Oct. MNI Chicago PMI, est. 45.0, prior 44.1

- 10:00: Oct. Conf. Board Consumer Confidence, est. 100.5, prior 103.0

- 10:00: Oct. Conf. Board Expectations, prior 73.7

- 10:00: Oct. Conf. Board Present Situation, prior 147.1

- 10:30: Oct. Dallas Fed Services Activity, prior -8.6

DB's Jim Reid concludes the overnight wrap

On Halloween, the Bank of Japan (BOJ) has decided not to scare markets too much this morning and has only tweaked its yield curve control settings marginally by allowing 10yr Japanese government bond yields to increase above 1% - redefining it as a loose "upper bound" rather than a rigid cap. The central bank’s modest policy shift has led to a decline in the yen, slipping as much as -0.76% to 150.17 per dollar as investors were pricing in the risk of a greater change in the BOJ’s accommodative monetary policy stance. The Nikkei (+0.49%) is seeing gains as weakness in the yen is helping provide an additional boost. Meanwhile, yields on 10yr JGBs reached 0.957% early in Asia trading (from 0.89% at the previous close) before paring back slightly to 0.942% as we type and ahead of the press conference. Inflation forecasts have been increased but it still feels to us that the BoJ are very optimistic about the likelihood of hitting the 2% target so if we're correct the YCC will be abandoned soon.

Moving on to other Asian equities, markets are mostly trading lower this morning after the latest batch of PMI data from China showed economic momentum continuing to wane in the world’s second biggest economy at the beginning of fourth quarter (more on this below). In terms of specific index moves, the Hang Seng (-1.77%) is leading losses across the region with the KOSPI (-1.32%), the CSI (-0.66%) and the Shanghai Composite (-0.38%) also trading in the red. S&P 500 (-0.38%) and NASDAQ 100 (-0.57%) futures are moving lower after a strong day yesterday. Yields on 10yr USTs (-2bps) are slightly lower at 4.87% as I type .

Coming back to China, the official manufacturing PMI unexpectedly contracted to 49.5 (50.2 expected) in October from 50.2, signalling renewed weakness in the sector. At the same time, the non-manufacturing PMI also dropped to 50.6 (52 expected) from 51.7 in September. The disappointing data suggests that the economy is still struggling despite better-than-expected Q3 GDP data reported recently. This might partly explain the stimulus package last week. Elsewhere, retail sales in Japan rose +5.8% y/y in September (v/s +5.9% expected), softening after four straight months of accelerating growth. It follows an expansion of +7.0% in August. Meanwhile, industrial output shrank -4.6% y/y in September and worse than expectations of -2.3% whilst the jobless rate dropped to 2.6% as expected in September from 2.7% previously.

Before the Bank of Japan announcement, risk assets saw a solid rally yesterday as investors grew hopeful that a material escalation in the Middle East would be avoided for now, particularly relative to concerns last Friday. That helped drive a major decline in oil prices, with WTI Crude (-3.78% to $82.31/bbl) erasing its rise since Hamas’ attack on Israel on October 7. Moreover, the Israeli shekel (+1.09%) saw its best daily performance in that time against the US Dollar, whilst gold (-0.42%) also lost ground, having closed above $2,000/oz on Friday for the first time in months. So in terms of the assets most sensitive to an escalation, it was one of the largest moving days since the current conflict began.

That backdrop helped support a recovery in global equities, with the S&P 500 (+1.20%) putting in its strongest session in two months after losing ground in 8 of the 9 previous sessions. However, it was fixed income that saw some of the more interesting moves, since yields on 10yr Treasuries were back up another +5.8bps to 4.89% ahead of the Fed’s decision and the Treasury refunding announcement tomorrow. Yields briefly rallied by c. 3bps after the Treasury reduced its net borrowing estimate for the current quarter to $776bn from the $852bn it had expected back in late July. However, this estimate was close to our rates strategists’ expectations, and bonds more than reversed the move by the close.

The 2s10s Treasury curve steepened another +0.8bps to close at -16.2bps. That’s the steepest that the 2s10s curve has been since July 2022, and means that the curve has steepened by over 60bps in just over a month. Clearly we’ve still got a bit further to go before the curve has a positive slope again, but if we did get back into positive territory, that would end the longest sustained period of inversion for the 2s10s yield curve since 1980. Remember from my CoTD last week here that every recession in the last 70 years has followed an inversion that had steepened up considerably from the most inverted point.

Over in Europe, sovereign bonds outperformed after the flash October CPI prints for Germany and Spain both surprised on the downside. In Germany, CPI fell to 3.0% on the EU-harmonised measure (vs. 3.3% expected), which is the lowest it’s been since June 2021. And in Spain, it came in at 3.5%, which was two-tenths higher than the September figure, but still beneath the 3.8% expected by the consensus. So that was some good news ahead of the Euro Area-wide CPI print today, which our European economists now see tracking at 3.0% for headline and 4.1% for core (vs BBG consensus at 3.1% and 4.2%, respectively). The data helped yields fall across the Euro Area with those on 10yr bunds (-0.9bps), OATs (-1.7bps) and BTPs (-6.9bps) all coming down on the day. The 10yr BTP-Bund has declined by a sizeable 11bps in the three sessions since last week’s ECB meeting.

Alongside the inflation data, we had the latest growth numbers out of Germany, which showed Q3 GDP only contracted by -0.1% (vs. -0.2% expected), and the Q1 and Q2 figures were revised upwards as well. But even with the better-than-expected news, this is hardly showing a booming economy, and our German economists point out that GDP has still stagnated over the last 18 months. They keep their full-year growth forecast for 2023 at -0.5% (link here) with 2024 at +0.3%, expecting growth to remain around stagnation in Q4-23 and Q1-24.

With all that in mind, equities put in an strong performance yesterday, with the S&P 500 (+1.20%) and Europe’s STOXX 600 (+0.36%) both moving higher on the day. The NASDAQ rose by +1.16%. It was broad-based advance for US equities, with 23 of 24 S&P industry groups rising on the day. The one exception was autos (-4.09%), which were weighed down by a -4.79% decline for Tesla on concerns over Chinese competitors, UAW agreements elsewhere in the sector, and production cuts from battery maker Panasonic which hinted at softer EV demand. The small cap Russell 2000 underperformed the broad rally (+0.63%) after hitting its lowest level since November 2020 on Friday. As my CoTD showed here yesterday, the Russell 2000 is now at levels in real price terms that it first surpassed in 2015. So beneath the surface and without the Magnificent Seven, US equities continue to correct from very high valuation with inflation helping in that process.

Elsewhere yesterday, the UK housing market showed little sign of a revival, as mortgage approvals in September fell to an 8-month low of 43.3k (vs. 44.5k expected). Furthermore, the latest M4 money supply data showed a year-on-year contraction of -3.9%, which is the fastest decline since August 2012. The releases come ahead of the Bank of England’s policy decision on Thursday, where they’re widely expected to keep rates on hold at 5.25%.

To the day ahead now, and data releases include the Euro Area flash CPI release for October, as well as the Q3 GDP release. Over in the US, there’s the Employment Cost Index for Q3, the Conference Board’s consumer confidence for October, the MNI Chicago PMI for October, and the FHFA house price index for August. From central banks, there are several ECB speakers including Vice President de Guindos, and the ECB’s De Cos, Visco, Muller and Nagel. Lastly, today’s earnings releases include BP, Pfizer and Caterpillar.

Uncategorized

Default: San Francisco Four Seasons Hotel Investors $3 Million Late On Loan As Foreclosure Looms

Default: San Francisco Four Seasons Hotel Investors $3 Million Late On Loan As Foreclosure Looms

Westbrook Partners, which acquired the San…

Westbrook Partners, which acquired the San Francisco Four Seasons luxury hotel building, has been served a notice of default, as the developer has failed to make its monthly loan payment since December, and is currently behind by more than $3 million, the San Francisco Business Times reports.

Westbrook, which acquired the property at 345 California Center in 2019, has 90 days to bring their account current with its lender or face foreclosure.

Related

- Fed Fears "Notable" Financial System Vulnerability As Renowned CRE Investor Tells Team 'Stop All NYC Underwriting'

- The State Of Commercial Real Estate, In Charts

- "Who Could Be Next": Top Canadian Pension Fund Sells Manhattan Office Tower For $1, Sparking Firesale Panic

- "Heightened Risks": Goldman Points To Leading CRE Indicator That Shows Pain Train Not Over

As SF Gate notes, downtown San Francisco hotel investors have had a terrible few years - with interest rates higher than their pre-pandemic levels, and local tourism continuing to suffer thanks to the city's legendary mismanagement that has resulted in overlapping drug, crime, and homelessness crises (which SF Gate characterizes as "a negative media narrative).

Last summer, the owner of San Francisco’s Hilton Union Square and Parc 55 hotels abandoned its loan in the first major default. Industry insiders speculate that loan defaults like this may become more common given the difficult period for investors.

At a visitor impact summit in August, a senior director of hospitality analytics for the CoStar Group reported that there are 22 active commercial mortgage-backed securities loans for hotels in San Francisco maturing in the next two years. Of these hotel loans, 17 are on CoStar’s “watchlist,” as they are at a higher risk of default, the analyst said. -SF Gate

The 155-room Four Seasons San Francisco at Embarcadero currenly occupies the top 11 floors of the iconic skyscrper. After slow renovations, the hotel officially reopened in the summer of 2021.

"Regarding the landscape of the hotel community in San Francisco, the short term is a challenging situation due to high interest rates, fewer guests compared to pre-pandemic and the relatively high costs attached with doing business here," Alex Bastian, President and CEO of the Hotel Council of San Francisco, told SFGATE.

Heightened Risks

In January, the owner of the Hilton Financial District at 750 Kearny St. - Portsmouth Square's affiliate Justice Operating Company - defaulted on the property, which had a $97 million loan on the 544-room hotel taken out in 2013. The company says it proposed a loan modification agreement which was under review by the servicer, LNR Partners.

Meanwhile last year Park Hotels & Resorts gave up ownership of two properties, Parc 55 and Hilton Union Square - which were transferred to a receiver that assumed management.

In the third quarter of 2023, the most recent data available, the Hilton Financial District reported $11.1 million in revenue, down from $12.3 million from the third quarter of 2022. The hotel had a net operating loss of $1.56 million in the most recent third quarter.

Occupancy fell to 88% with an average daily rate of $218 in the third quarter compared with 94% and $230 in the same period of 2022. -SF Chronicle

According to the Chronicle, San Francisco's 2024 convention calendar is lighter than it was last year - in part due to key events leaving the city for cheaper, less crime-ridden places like Las Vegas.

Uncategorized

Correcting the Washington Post’s 11 Charts That Are Supposed to Tell Us How the Economy Changed Since Covid

The Washington Post made some serious errors or omissions in its 11 charts that are supposed to tell us how Covid changed the economy. Wages Starting with…

The Washington Post made some serious errors or omissions in its 11 charts that are supposed to tell us how Covid changed the economy.

Wages

Starting with its second chart, the article gives us an index of average weekly wages since 2019. The index shows a big jump in 2020, which then falls off in 2021 and 2022, before rising again in 2023.

It tells readers:

“Many Americans got large pay increases after the pandemic, when employers were having to one-up each other to find and keep workers. For a while, those wage gains were wiped out by decade-high inflation: Workers were getting larger paychecks, but it wasn’t enough to keep up with rising prices.”

That actually is not what its chart shows. The big rise in average weekly wages at the start of the pandemic was not the result of workers getting pay increases, it was the result of low-paid workers in sectors like hotels and restaurants losing their jobs.

The number of people employed in the low-paying leisure and hospitality sector fell by more than 8 million at the start of the pandemic. Even at the start of 2021 it was still down by over 4 million.

Laying off low-paid workers raises average wages in the same way that getting the short people to leave raises the average height of the people in the room. The Washington Post might try to tell us that the remaining people grew taller, but that is not what happened.

The other problem with this chart is that it is giving us weekly wages. The length of the average workweek jumped at the start of the pandemic as employers decided to work the workers they had longer hours rather than hire more workers. In January of 2021 the average workweek was 34.9 hours, compared to 34.4 hours in 2019 and 34.3 hours in February.

This increase in hours, by itself, would raise weekly pay by 2.0 percent. As hours returned to normal in 2022, this measure would misleadingly imply that wages were falling.

It is also worth noting that the fastest wage gains since the pandemic have been at the bottom end of the wage distribution and the Black/white wage gap has fallen to its lowest level on record.

Saving Rates

The third chart shows the saving rate since 2019. It shows a big spike at the start of the pandemic, as people stopped spending on things like restaurants and travel and they got pandemic checks from the government. It then falls sharply in 2022 and is lower in the most recent quarters than in 2019.

The piece tells readers:

“But as the world reopened — and people resumed spending on dining out, travel, concerts and other things that were previously off-limits — savings rates have leveled off. Americans are also increasingly dip into rainy-day funds to pay more for necessities, including groceries, housing, education and health care. In fact, Americans are now generally saving less of their incomes than they were before the pandemic.

This is an incomplete picture due to a somewhat technical issue. As I explained in a blogpost a few months ago, there is an unusually large gap between GDP as measured on the output side and GDP measured on the income side. In principle, these two numbers should be the same, but they never come out exactly equal.

In recent quarters, the gap has been 2.5 percent of GDP. This is extraordinarily large, but it also is unusual in that the output side is higher than the income side, the opposite of the standard pattern over the last quarter century.

It is standard for economists to assume that the true number for GDP is somewhere between the two measures. If we make that assumption about the data for 2023, it would imply that income is somewhat higher than the data now show and consumption somewhat lower.

In that story, as I showed in the blogpost, the saving rate for 2023 would be 6.8 percent of disposable income, roughly the same as the average for the three years before the pandemic. This would mean that people are not dipping into their rainy-day funds as the Post tells us. They are spending pretty much as they did before the pandemic.

Credit Card Debt

The next graph shows that credit card debt is rising again, after sinking in the pandemic. The piece tells readers:

“But now, debt loads are swinging higher again as families try to keep up with rising prices. Total household debt reached a record $17.5 trillion at the end of 2023, according to the Federal Reserve Bank of New York. And, in a worrisome sign for the economy, delinquency rates on mortgages, car loans and credit cards are all rising, too.”

There are several points worth noting here. Credit card debt is rising, but measured relative to income it is still below where it was before the pandemic. It was 6.7 percent of disposable income at the end of 2019, compared to 6.5 percent at the end of last year.

The second point is that a major reason for the recent surge in credit card debt is that people are no longer refinancing mortgages. There was a massive surge in mortgage refinancing with the low interest rates in 2020-2021.

Many of the people who refinanced took additional money out, taking advantage of the increased equity in their home. This channel of credit was cut off when mortgage rates jumped in 2022 and virtually ended mortgage refinancing. This means that to a large extent the surge in credit card borrowing is simply a shift from mortgage debt to credit card debt.

The point about total household debt hitting a record can be said in most months. Except in the period immediately following the collapse of the housing bubble, total debt is almost always rising.

And the rise in delinquencies simply reflects the fact that they had been at very low levels in 2021 and 2022. For the most part, delinquency rates are just getting back to their pre-pandemic levels, which were historically low.

Grocery Prices and Gas Prices

The next two charts show the patterns in grocery prices and gas prices since the pandemic. It would have been worth mentioning that every major economy in the world saw similar run-ups in prices in these two areas. In other words, there was nothing specific to U.S. policy that led to a surge in inflation here.

The Missing Charts

There are several areas where it would have been interesting to see charts which the Post did not include. It would have been useful to have a chart on job quitters, the number of people who voluntarily quit their jobs during the pandemic. In the tight labor markets of 2021 and 2022 the number of workers who left jobs they didn’t like soared to record levels, as shown below.

The vast majority of these workers took other jobs that they liked better. This likely explains another item that could appear as a graph, the record level of job satisfaction.

In a similar vein there has been an explosion in the number of people who work from home at least part-time. This has increased by more than 17 million during the pandemic. These workers are saving themselves thousands of dollars a year on commuting costs and related expenses, as well as hundreds of hours spent commuting.

Finally, there has been an explosion in the use of telemedicine since the pandemic. At the peak, nearly one in four visits with a health care professional was a remote consultation. This saved many people with serious health issues the time and inconvenience associated with a trip to a hospital or doctor’s office. The increased use of telemedicine is likely to be a lasting gain from the pandemic.

The World Has Changed

The pandemic will likely have a lasting impact on the economy and society. The Washington Post’s charts captured part of this story, but in some cases misrepr

The post Correcting the Washington Post’s 11 Charts That Are Supposed to Tell Us How the Economy Changed Since Covid appeared first on Center for Economic and Policy Research.

federal reserve pandemic mortgage rates gdp interest ratesUncategorized

Women’s basketball is gaining ground, but is March Madness ready to rival the men’s game?

The hype around Caitlin Clark, NCAA Women’s Basketball is unprecedented — but can its March Madness finally rival the Men’s?

In March 2021, the world was struggling to find its legs amid the ongoing Covid-19 pandemic. Sports leagues were trying their best to keep going.

It started with the NBA creating a bubble in Orlando in late 2020, playing a full postseason in the confines of Disney World in arenas that were converted into gyms devoid of fans. Other leagues eventually allowed for limited capacity seating in stadiums, including the NCAA for its Men’s and Women’s Basketball tournaments.

The two tournaments were confined to two cities that year — instead of games normally played in different regions around the country: Indianapolis for the men and San Antonio for the women.

But a glaring difference between the men’s and women’s facilities was exposed by Oregon’s Sedona Prince on social media. The workout and practice area for the men was significantly larger than the women, whose weight room was just a single stack of dumbbells.

Let me put it on Twitter too cause this needs the attention pic.twitter.com/t0DWKL2YHR

— SEDONA (@sedonaprince_) March 19, 2021

The video drew significant attention to the equity gaps between the Men’s and Women’s divisions, leading to a 114-page report by a civil rights law firm that detailed the inequities between the two and suggested ways to improve the NCAA’s efforts for the Women’s side. One of these suggestions was simply to give the Women’s Tournament the same March Madness moniker as the men, which it finally got in 2022.

But underneath the surface of these institutional changes, women’s basketball’s single-biggest success driver was already emerging out of the shadows.

During the same COVID-marred season, a rookie from Iowa led the league in scoring with 26.6 points per game.

Her name: Caitlin Clark.

As it stands today, Clark is the leading scorer in the history of college basketball — Men’s or Women’s. Her jaw-dropping shooting ability has fueled record viewership and ticket sales for Women’s collegiate games, carrying momentum to the March Madness tournament that has NBA legends like Kevin Garnett and Paul Pierce more excited for the Women’s March Madness than the Men’s this year.

Related: Ticket prices for Caitlin Clark's final college home game are insanely high

But as the NCAA tries to bridge the opportunities given to the two sides, can the hype around Clark be enough for the Women’s March Madness to bring in the same fandom as the Men for the 2024 tournaments?

TheStreet spoke with Jon Lewis of Sports Media Watch, who has been following sports viewership trends for the last two decades; Melissa Isaacson, a veteran sports journalist and longtime advocate of women’s basketball; and Pete Giorgio, Deloitte’s leader for Global and US Sports to dissect the rise Caitlin Clark and women’s collegiate hoops ahead of March Madness.

“Nobody is moving the needle like Caitlin Clark,” Lewis told TheStreet. “Nobody else in sports, period, right now, is fueling record numbers on all these different networks, driving viewership beyond what the norm has been for 20 years."

The Caitlin Clark Effect is real — but there are other reasons for the success of women's basketball

The game in which Clark broke the all-time college scoring record against Ohio State on Sunday, Mar. 3 was seen by an average of 3.4 million viewers on Fox, marking the first time a women’s game broke the two million viewership barrier since 2010. Viewership for that game came in just behind the men’s game between Michigan State vs Arizona game on Thanksgiving, which Lewis said was driven by NFL viewership on the same day.

A week later, Iowa’s Big Ten Championship win over Nebraska breached the three million viewers mark as well, and the team has also seen viewership numbers crack over 1.5 million viewers multiple times throughout the regular season.

The success on television has also translated to higher ticket prices, as tickets to watch Clark at home and on the road have breached hundreds of dollars and drawn long lines outside stadiums. Isaacson, who is a professor at Northwestern, said she went to the game between the Hawkeyes and Northwestern Wildcats — which was the first sellout in school history for the team — and witnessed the effect of Clark in person.

“Standing in line interviewing people at the Northwestern game, seeing men who've never been to a women's game with their little girls watching and so excited, and seeing Caitlin and her engaging with little girls, it’s just been really fun,” Isaacson said.

But while Clark is certainly the biggest success driver, her game isn’t the only thing pulling up the women’s side. The three-point revolution, which started in the NBA with the introduction of deeper analytics as well as the rise of stars like Steph Curry, has been a positive for the Women’s game.

“They backed up to the three-point line and it’s opening up the game,” Isaacson said.

One of the major criticisms from a lot of women’s hoops detractors has been how the game does not compare in terms of quality to the men. However, shooting has become a great equalizer, displayed recently during the 2024 NBA All-Star Weekend last month when the WNBA’s Sabrina Ionescu nearly defeated Curry — who is widely considered the greatest shooter ever — in a three-point contest.

Clark has become the embodiment of the three-point revolution for the women. Her shooting displays have demanded the respect of anyone who has doubted women’s basketball in the past because being a man simply doesn’t grant someone the ability to shoot long-distance bombs the way she can.

Basketball pundit Bill Simmons admitted on a Feb. 28 episode of “The Bill Simmons Podcast” that he used to not want to watch women’s basketball because he didn’t enjoy watching the product, but finds himself following the women’s game this year more than the men’s side in large part due to Clark.

“I think she has the chance to be the most fun basketball player, male or female, when she gets to the pros,” Simmons said. “If she’s going to make the same 30-footers, routinely. It’s basically all the same Curry stuff just with a female … I would like watching her play in any format.”

But while Clark is driving up the numbers at the top, she’s not the only one carrying the greatness of the product. Lewis, Isaacson, Giorgio — and even Simmons, on his podcast — agreed that there are several other names and collegiate programs pulling in fans.

“It’s not just Iowa, it’s not just Caitlin Clark, it’s all of these teams,” Giorgio said. “Part of it is Angel Reese … coaches like Dawn Staley in South Carolina … You’ve got great stories left and right.”

The viewership showed that as well because the SEC Championship game between the LSU Tigers and University of South Carolina Gamecocks on Sunday, Mar. 10 averaged two million viewers.

Bridging the gap between the Men’s and Women’s March Madness viewership

The first reason women are catching up to the men is really star power. While the Women’s division has names like Clark and Reese, there just aren’t any names on the Men’s side this year that carry the same weight.

Garnett said on his show that he can’t name any men’s college basketball players, while on the women’s side, he could easily throw out the likes of Clark, Reese, UConn’s Paige Bueckers, and USC’s JuJu Watkins. Lewis felt the same.

Kevin Garnett energy towards WBB is unmatched. Sorry for the language but that’s how he talks. Just watch. pic.twitter.com/0yGBRGaF3O

— The9450 Podcast Network (@The9450) March 8, 2024

“The stars in the men's game, with one and done, I genuinely couldn't give you a single name of a single men’s player,” Lewis said.

A major reason for this is that the Women’s side has the continuity that the Men’s side does not. The rules of the NBA allow for players to play just one year in college — or even play a year professionally elsewhere — before entering the draft, while the WNBA requires players to be 22-years-old during the year of the draft to be eligible.

“You know the stars in the women's game because they stay longer,” Lewis said. “[In the men’s game], the programs are the stars … In the women's game, it's a lot more like the NBA where the players are the stars.”

Parity is also a massive factor on both sides. The women’s game used to be dominated by a few schools like UConn and Notre Dame. Nowadays, between LSU, Iowa, University of South Carolina, Stanford, and UConn, there are a handful of schools that have a shot to win the entire tournament. While this is more exciting for fans, the talent in the women's game isn’t deep enough, so too many upsets are unlikely. Many of the biggest draws are still expected to make deep runs.

But on the men’s side, there is a bigger shot that the smaller programs make it to the end — which is what was seen last year. UConn eventually won the whole thing, but schools without as big of a national fanbase in San Diego State, Florida Atlantic University, and the University Miami rounded out the Final Four.

“People want to see one Cinderella,” Lewis said. “They don't want to see two and three, they want one team that isn't supposed to be there.”

Is Women's March Madness ready to overtake the Men?

Social media might feel like it’s giving more traction to the Women’s game, but experts don’t necessarily expect that to show up in the viewership numbers just yet.

“There’s certainly a lot more buzz than there used to be,” Giorgio said. “It’s been growing every year for not just the past few years but for 10 years, but it’s hard to compare it versus Men’s.”

But the gap continues to get smaller and smaller between the two sides, and this year's tournament could bridge that gap even further.

One indicator is ticket prices. For the NCAA Tournament Final Four in April, “get-in” ticket prices are currently more expensive for the Women’s game than the Men’s game, according to TickPick. The ticketing site also projects that the Women’s Final Four and Championship game ticket prices will smash any previous records for the Women’s side should Clark and the Hawkeyes make a run to the end.

Getty Images/TheStreet

The caveat is that the Women’s Final Four is played in a stadium that has less than a third of the seating capacity of the Men’s Final Four. That’s why the average ticket prices are still more expensive for the men, although the gap is a lot smaller this year than in previous years.

But that caveat pretty much sums up where the women’s game currently stands versus the men’s: There is still a significant gap between the distribution and availability of the former.

While Iowa’s regular season games have garnered millions of viewers, the majority of the most-viewed games are still Men’s contests.

To illustrate the gap between the men’s and women’s game — last year’s Women’s Championship game that saw the LSU Tigers defeat the Hawkeyes was a record-breaking one for the women, drawing an average of 9.9 million viewers, more than double the viewership from the previous year.

One of the main reasons for that increase, as Lewis pointed out, is that last year’s Championship game was on ABC, which was the first time since 1995 that the Women’s Championship game was on broadcast television. The 1995 contest between UConn and Tennessee drew 7.4 million viewers.

The Men’s Championship actually had a record low in viewership last year garnering only 14.7 million viewers, driven in-part due to a lack of hype surrounding the schools that made it to the Final Four and Championship game. Viewership for the Men’s title game has been trending down in recent years — partly due to the effect the pandemic had on collective sports viewership — but the Men’s side had been easily breaching 20 million viewers for the game as recently as 2017.

Iowa's Big Ten Championship win on Sunday actually only averaged 6,000 fewer viewers than the iconic rivalry game between Duke and University of North Carolina Men’s Basketball the day prior. However, there is also the case that the Iowa game was played on broadcast TV (CBS) versus the Duke-UNC game airing on cable channel (ESPN).

So historical precedence makes it unlikely that we’ll see the women’s game match the men’s in terms of viewership as early as this year barring another massive viewership jump for the women and a lack of recovery for the Men’s side.

But ultimately, this shouldn’t be looked at as a down point for Women’s Basketball, according to Lewis. The Men’s side has built its viewership base for years, and the Women’s side is still growing. Even keeping pace with the Men’s viewership is already a great sign.

“The fact that these games have Caitlin Clark are even in the conversation with men's games, in terms of viewership is a huge deal,” Lewis said.

Related: Angel Reese makes bold statement for avoiding late game scuffle in championship game

recovery pandemic covid-19-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex