Futures Recover Losses After Netflix Disaster; 10Y Real Yields Turn Positive

Futures Recover Losses After Netflix Disaster; 10Y Real Yields Turn Positive

US index futures were little changed, trading in a narrow, 20-point…

US index futures were little changed, trading in a narrow, 20-point range, and erasing earlier declines as a selloff in bonds reversed with investors also focusing on the catastrophic Q1 earnings report from Netflix. Nasdaq 100 Index futures slipped 0.2% by 7:15 a.m. in New York, recovering from an earlier drop of as much as 1.2%; the Nasdaq 100 has erased $1.3 trillion in market value since April 4 as bond yields have been surging on fears of rate hikes. S&P 500 futures also recouped losses to trade little changed around 4,460. Treasuries rallied and 10Y yields dropped to 2.86% after hitting 2.98% yesterday. The dollar dropped for the first time in 4 days after hitting the highest level since July 2020, and gold was flat while bitcoin rose again, hitting $42K.

In perhaps the most notable move overnight, US 10-year real yields turned positive for the first time since March 2020, signaling a potential return to the pre-pandemic normal. But that was quickly followed by a global drop in bond yields as investors assessed growth challenges from the Ukraine war and the potential for a peak in inflation.

“Real yields matter for equities,” Esty Dwek, chief investment officer at Flowbank SA, said in an interview with Bloomberg Television. “It’s another aspect for the valuation picture that isn’t helping. It shouldn’t be that much of a surprise to see real yields are back closer to zero again. We’re pricing in so much bad news already between inflation and the hikes and war and supply chains.”

10-year Treasurys yield shed 7 basis points in choppy session after as money managers from Bank of America to Nomura indicated the panic over inflation has gone too far: “Our forecasts point to inflation peaking this quarter and falling steadily into 2023,” BofA analysts including Ralph Axel wrote in a note. “We believe this will reduce the panic level around inflation and allow rates to decline.” Bank of America also said it has turned long on 10-year Treasuries.

Elsewhere, Japan's 10-year yield holds at 0.25%, the top of Bank of Japan’s trading band as the central bank resumes massive intervention. Despite the BOJ's dovish commitment to keep rates low, the Japanese yen rebounded from a 13-day slump and gold extended its decline.

Going back to stocks, Netflix shares which have a 1.2% weighting in the Nasdaq, sank 27% in premarket trading after the streaming service said it lost customers for the first time in a decade and forecast that the decline will continue. The shares were downgraded at many firms including UBS Group AG, KGI Securities and Piper Sandler. Other streaming stocks including Walt Disney and Roku also slipped. IBM, on the other hand, rose 2.5% after reporting revenue that beat the average analyst estimate on demand for its hybrid-cloud offerings. Analysts acknowledged the strong quarter of revenue performance. A dimmer outlook for corporate earnings as well as the rise in yields have dented demand for risk assets, with investors preferring defensive stocks such as healthcare to growth-linked stocks, which come under greater pressure from higher interest rates. Some other notable premarket movers:

- Interactive Brokers (IBKR US) shares fell 1.1% in after-market trading as net income missed analysts’ consensus estimates. Still, analysts at Piper Sandler and Jefferies are positive.

- Omnicom (OMC US) shares jumped 3.7% in postmarket. Its cautious outlook for the rest of the year could bring some positive surprises, according to analysts, after the company’s 1Q revenue beat estimates

In Europe, the Stoxx 600 rose 0.8%, led by banking and technology shares while miners underperformed as metals fell, as investors assessed a mixed bag of corporate results and the outlook for France’s presidential-election runoff on Sunday. There’s a divergence in performance of European stocks; Euro Stoxx 50 rallies 1.2%. FTSE 100 lags, adding 0.4%. Danone SA rose after reporting its fastest sales growth in seven years, and Heineken NV advanced after sales climbed. Here are some of the biggest European movers today:

- ASML shares rise as much as 8% with analysts saying the semiconductor-equipment group’s earnings show demand remains strong, even if a timing issue meant its outlook missed expectations.

- Danone shares gain as much as 9% following a French financial newsletter report that rival Lactalis may be interested in buying its businesses and after the producer of Evian reported a surge in bottled water revenue.

- Just Eat Takeaway shares rise as much as 7.7% after the company gave mixed guidance and said it is considering selling Grubhub. While analysts note the growth looks weak, they highlight the focus on profitability and the strategic review of Grubhub are positives.

- Vopak shares rise as much as 7.2%, most since March 2020, after the tank terminal operator reported higher revenues and Ebitda for the first quarter.

- Heineken shares rise as much as 5% after the Dutch brewer reported 1Q organic beer volume that beat analyst expectations and said net revenue (beia) per hectolitre grew 18.3%. Analysts were impressed by the company’s price-mix during the period.

- Rio Tinto shares fall as much as 3.9%. A production miss for 1Q could prevent the miner’s shares from recovering after recent underperformance, RBC Capital Markets says.

- Credit Suisse declines as much as 2.8% after the bank said it anticipates a first-quarter loss owing to a hit to revenue from Russia invading Ukraine and an increase in legal provisions.

- Oxford Biomedica drops as much as 10% after reporting full-year revenue that was below consensus. RBC Capital said reasons for the revenue miss were “unclear,” adding that there was no new business development news.

Asian stocks rose as Japanese equities rallied on the back of a weaker yen, which will support exports. Shares in China fell as investors were disappointed by the decision among banks to keep borrowing rates there unchanged. The MSCI Asia Pacific Index gained as much as 0.9% and was poised to snap a three-day losing streak. Japanese exporters including Toyota and Sony helped lead the way, with shares also stronger in Singapore, Malaysia and the Philippines. “It looks like the cheap yen may continue for a longer period than originally expected,” said Bloomberg Intelligence auto analyst Tatsuo Yoshida. “The weaker yen is good for all Japanese automakers.” China’s benchmarks bucked the uptrend and dipped more than 1%, as lenders maintained their loan rates for a third month despite the central bank’s call for lower borrowing costs to help an economy hurt by Covid-19 and geopolitical headwinds. China’s rate stall, together with last week’s smaller-than-expected cut in the reserve requirement, has led some investors to believe broad and significant policy easing is unlikely. “Doubts about access to easier funding remain a bugbear despite headline easing,” Vishnu Varathan, head of economics and strategy at Mizuho Bank, wrote in a note. “Inadvertent restraints on actual lending may mute intended stimulus, revealing risks of ‘too little too late’ stimulus.”

In positive news, daily covid cases in Shanghai were in downtrend in recent days and number of communities with more than 100 daily infections fell for three consecutive days, Wu Qianyu, an official with Shanghai’s health commission, says at a briefing.

Financial stocks outside of China gained after U.S. 10-year Treasury real yields turned positive for the first time since 2020 as traders continue to bet on a series of aggressive Federal Reserve rate hikes. This may pose more headwinds for Asian tech stocks, which have dragged the broader market lower this year.

Japanese equities rose for a second day after the yen weakened against the dollar for a record 13 straight days. Automakers were the biggest boost to the Topix, which climbed 1%. Financials advanced as yields gained. Fast Retailing and SoftBank Group were the largest contributors to a 0.9% gain in the Nikkei 225. The yen strengthened slightly after shedding nearly 6% against the dollar since the start of the month. “It looks like the cheap yen may continue for a longer period than originally expected,” said Bloomberg Intelligence auto analyst Tatsuo Yoshida. “The weaker yen is good for all Japaneseautomakers, “no one loses,” he added.

Indian equities snapped their five-day drop as energy companies advanced on expectations of blockbuster earnings, driven by wider refining margins. Software exporters Infosys, Tata Consultancy and lender HDFC Bank bounced back from a slump, triggered by weaker results. The S&P BSE Sensex gained 1% to 57,037.50 in Mumbai, while the NSE Nifty 50 Index rose 1.1%. The two gauges posted their biggest surge since April 4. Thirteen of the 19 sector sub-indexes compiled by BSE Ltd. climbed, led by a gauge of automobile companies. “A series of sharp negative reactions to minor misses in earnings from large caps points to a precarious state of positioning among investors,” according to S. Hariharan, head of sales trading at Emkay Global Financial. He expects corporate commentary on the margin outlook for FY23 to be key to investors’ reaction to other quarterly results, which will be released over the next couple of weeks. The benchmark Sensex lost about 5% in the five sessions through Tuesday, dragged lower by a selloff in software makers, a slump in HDFC Bank and its parent Housing Development Finance Corp. Foreign investors, who have been net sellers of Indian stocks since the start of October, have withdrawn $1.7 billion from local equities this month through April 18. The IMF slashed its world growth forecast by the most since the early months of the Covid-19 pandemic and projected even faster inflation. It expects India’s economy to grow by 8.2% in fiscal 2023 compared with an earlier estimate of 9%. Reliance Industries contributed the most to the Sensex’s gain, increasing 3%. Out of 30 shares in the Sensex index, 20 rose, while 10 fell.

In FX, the Bloomberg Dollar Spot Index fell 0.4%, its first drop in four days, after yesterday reaching its highest level since July 2020, as the greenback weakened against all Group-of-10 peers. Scandinavian and Antipodean currencies led gains followed by the yen, which halted a 13-day rout. The euro advanced a second day and bunds extended gains, underperforming euro-area peers as money markets pared ECB tightening wagers. The yen snapped a historic declining streak amid short covering after the currency approached a key level of 130 per dollar. The Bank of Japan stepped in to cap 10-year yields for the first time since late March as it reiterated its ultra loose monetary policy with four days of unscheduled bond buying. The Australian and New Zealand dollars gained as risk sentiment improved after a selloff in Treasuries paused. The Aussie was supported by offshore funds buying into contracting yield spreads with the U.S. and on demand from exporters for hedging at the week’s low, according to FX traders. The pound edged higher against a broadly weaker dollar, but lagged behind the rest of its Group-of-10 peers, with focus on the risks to the U.K. economy.

In rates, Treasuries advanced, reversing a portion of Tuesday’s sharp selloff which pushed the 10Y as high as 2.98%, with gains led by belly of the curve amid bull-flattening in core Focal points of U.S. session include Fed speakers and $16b 20-year bond reopening. US yields were richer by ~7bp across belly of the curve, 10-year yields around 2.87% keeping pace with gilts while outperforming bunds, Fed-dated OIS contracts price in around 222bp of rate hikes for the December FOMC meeting vs 213bp priced at Monday’s close; 49bp of hikes remain priced in for the May policy meeting. Japan 10-year yields held at 0.25%, the top of Bank of Japan’s trading band as the central bank resumes massive intervention. Australian and New Zealand bonds post back-to-back declines.

Coupon issuance resumes with $16b 20-year bond sale at 1pm New York time; WI yield at around 3.10% sits ~45bp cheaper than March result, which stopped 1.4bp through. IG dollar issuance slate includes Development Bank of Japan 5Y SOFR, Canada 3Y and ADB 3Y/10Y SOFR; six deals priced almost $19b Tuesday, headlined by financials including JPMorgan and Bank.

In commodities, crude futures advance. WTI trades within Tuesday’s range, adding 1.1% to around $103. Brent rises 0.9% to around $108. Most base metals trade in the red; LME lead falls 1.6%, underperforming peers. Spot gold falls roughly $4 to trade near $1,946/oz.

Looking at the day ahead now, and data releases include German PPI for March, Euro Area industrial production for February, US existing home sales for march, and Canadian CPI for March. From central banks, we’ll hear from the Fed’s Bostic, Evans and Daly, as well as the ECB’s Rehn and Nagel, whilst the Federal Reserve will be releasing their Beige Book. Earnings releases include Tesla, Procter & Gamble, and Abbott Laboratories. Finally, French President Macron and Marine Le Pen will debate tonight ahead of Sunday’s presidential election.

Market Snapshot

- S&P 500 futures down 0.4% to 4,443.50

- STOXX Europe 600 up 0.4% to 458.21

- MXAP up 0.5% to 171.88

- MXAPJ up 0.2% to 570.00

- Nikkei up 0.9% to 27,217.85

- Topix up 1.0% to 1,915.15

- Hang Seng Index down 0.4% to 20,944.67

- Shanghai Composite down 1.3% to 3,151.05

- Sensex up 0.9% to 56,945.14

- Australia S&P/ASX 200 little changed at 7,569.23

- Kospi little changed at 2,718.69

- German 10Y yield little changed at 0.88%

- Euro up 0.3% to $1.0823

- Brent Futures up 1.0% to $108.27/bbl

- Brent Futures up 1.0% to $108.27/bbl

- Gold spot down 0.3% to $1,943.30

- U.S. Dollar Index down 0.28% to 100.67

Top Overnight News from Bloomberg

- On the surface the yen looks like the perfect well for carry traders to dip into, under pressure from a Bank of Japan determined to keep local yields anchored to the floor even as interest rates around the world push higher. But despite consensus building for further losses -- peers look like better funding options on certain key metrics

- Almost eight weeks after Vladimir Putin sent troops into Ukraine, with military losses mounting and Russia facing unprecedented international isolation, a small but growing number of senior Kremlin insiders are quietly questioning his decision to go to war

- French President Emmanuel Macron and nationalist leader Marine le Pen are gearing up for their only live TV debate on Wednesday evening, a high-stakes event just days before the final ballot of the presidential election this weekend

- China will continue strengthening strategic ties with Russia, a senior diplomat said, showing the relationship remains solid despite growing concerns over war crimes in Vladimir Putin’s war in Ukraine

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mostly positive after the firm handover from the US despite continued upside in yields. ASX 200 was led by the healthcare sector as shares in Ramsay Health Care surged due to a takeover proposal from a KKR-led consortium, but with gains capped by miners after Rio Tinto's lower quarterly iron ore production and shipments. Nikkei 225 was underpinned by the initial currency depreciation and with the BoJ defending its yield cap. Hang Seng and Shanghai Comp were mixed with the mainland subdued after the PBoC defied expectations for a cut to its benchmark lending rates and instead maintained the 1yr and 5yr Loan Prime Rates at 3.70% and 4.60%, respectively.

Top Asian News

- Fed’s Aggressive Rate Hike Plans Jolt Policy in China and Japan

- BOJ Further Boosts Bond Buying as Yields Advance to Policy Limit

- Sunac Bondholders Say They Haven’t Received Interest Due Tuesday

- Regulators Under Pressure to Ease Loan Curbs: Evergrande Update

- China Buys Cheap Russian Coal as World Shuns Moscow

European bourses and US futures were choppy at the commencement of the European session, but, have since derived impetus in relatively quiet newsflow amid multiple earnings and as yields continue to ease; ES Unch. Currently, Euro Stoxx 50 +1.8%, while US futures are little changed on the session but rapidly approaching positive territory ahead of key earnings incl. TSLA. Netflix Inc (NFLX) - Q1 2022 (USD): EPS 3.53 (exp. 2.89), Revenue 7.87bln (exp. 7.93bln), Net Subscriber Additions: -0.2mln (exp. +2.5mln). Q1 UCAN streaming paid net change -640k (exp.+87.5k). Co. lost 640k subscribers in US/Canada, 300k in EMEA, and 350k in LatAm. Co. Said macro factors, including sluggish economic growth, increasing inflation, geopolitical events such as Russia’s invasion of Ukraine, and some continued disruption from COVID are likely having an impact, via PR Newswire. Click here for the full breakdown. -26% in the pre-market. Chinese Civil Aviation publishes prelim report looking into the China Eastern Airline crash; still recovering and analysing damaged black boxes from the plane: there was no abnormal communication between air crew and air controllers before the aircraft deviated from cruising altitude; no dangerous weather, goods or overdue maintenance.

Top European News

- Le Pen Upset Would Be as Big a Shock to Markets as Brexit

- Macron and Le Pen Set for High Stakes French Debate

- Riksbank Governor Leaves Door Open for String of Rate Hikes

- Danone Gains on Lactalis Takeover Speculation, Evian Rebound

- Heineken Rises; MS Says Results Were Widely Expected

FX:

- Buck concedes ground to recovering Yen as US Treasury yields recede, USD/JPY over 150 pips below new 20 year high circa 129.42.

- Yuan on the rocks after PBoC set a soft onshore reference rate and regardless of unchanged LPRs, USD/CNH eyes 6.4500 after breach of 200 DMA.

- Aussie back in pole position as high betas benefit from Greenback retreat and Kiwi in second spot ahead of NZ CPI data; AUD/USD rebounds through 0.7400 and NZD/USD from under 0.6750.

- Loonie also bouncing before Canadian inflation metrics, with Usd/Cad closer to 1.2550 than 1.2625, while Euro and Pound are both firmer on 1.0800 and 1.3000 handles respectively as DXY dips below 100.500.

- Rand shrugs aside mixed SA CPI prints as correction from bull run continues and Gold slips under Usd 1950/oz, USD/ZAR holds above 15.0000.

- ECB's Kazaks says a rate hike is possible as soon as July this year; ending APP early in Q3 is possible and appropriate; zero is not an a cap for the deposit rate, via Bloomberg. Adds, a gradual approach does not mean a slow approach, do not need to wait for stronger wage growth.

Fixed Income:

- Debt redemption, as futures retrace following tests/probes of cycle lows.

- Lack of concession not really evident at longer-dated German and UK bond sales, but 20 year US supply may be a separate issue.

- BoJ ramps up intervention and aims to anchor rather than cap 10 year JGB yield around zero percent, while BoA suggests contra-trend position in 10 year UST to target 2.25% from current levels close to 3.0%.

Commodities:

- Crude benchmarks are firmer on the session in what is more of a consolidation from yesterday's pressured settlement than a concerted effort to move higher, also benefitting from broader equity action.

- Currently, WTI and Brent reside at the top-end of USD 2/bbl parameters; focus very much on China-COVID, Iran, Libyan supply and Ukraine-Russia developments.

- US Private Energy Inventory Data (bbls): Crude -4.5mln (exp. +2.5mln), Cushing +0.1mln, Gasoline +2.9mln (exp. -1.0mln), Distillate -1.7mln (exp. -0.8mln).

- Spot gold/silver are contained at present but have seen bouts of modest pressure, including the loss of the USD 1946.45/oz 21-DMA at worst.

US Event Calendar

- 07:00: April MBA Mortgage Applications, prior -1.3%

- 10:00: March Existing Home Sales MoM, est. -4.1%, prior -7.2%

- 10:00: March Home Resales with Condos, est. 5.77m, prior 6.02m

- 14:00: U.S. Federal Reserve Releases Beige Book

Central Bank Speakers

- 11:25: Fed’s Daly Discusses the Outlook

- 11:30: Fed’s Evans Discusses the Economic and Policy Outlook

- 13:00: Fed’s Bostic Discusses Equity in Urban Development

DB's Jim Reid concludes the overnight wrap

It took me a while to adjust to being back to the office yesterday after two and a half weeks off. No screaming kids, no stealing half their food as I made their meals, and no stepping on endless lego and screaming myself. My team at work are much better behaved, protect their food, and clear up after playing with their toys. Talking of lego, the first day of the holiday was spent in a snow blizzard at LEGOLAND and the last day in shorts and t-shirt on a family bike ride on the Thames. No I haven't been off for that long just a typical April in the UK. When I left you, I was in constant agony due to sciatica in my back and a knee that was very fragile post surgery. On my last day I had a back injection that I wasn't that hopeful about as three previous ones hadn't done anything. However after a second opinion and a new consultant, this injection hit the spot and my sciatica has completely gone and I'm just back to the long-standing normal wear and tear related back stiffness. The consultant can't tell me how long it'll last so Reformer Pilates starts next week. My knee is slowly getting better via some overuse flare ups. So until the next time, I'm in as good a shape as I have been for quite some time!

It's hard to guage how good a shape the market is in at the moment as there are lots of conflicting forces. Since I've been off global yields have exploded higher, the US yield curve has resteepened notably and risk is a bit softer. As regular readers know I think a late 2023/early 2024 US recession is likely in this first proper boom and bust cycle for over 40 years. However we're still in some kind of boom phase and I've been trying not to get too bearish too early. While I was off, I published our latest credit spread forecasts and having met our earlier year widening targets, we've moved more neutral for the rest of the year. However into year end 2023, we now have a very big widening of spreads in the forecasts to reflect the likely recession. See the report here. Also while I've been off, the House View is now also that we'll get a US recession at a similar point which as far as I can see is the first Wall Street bank to officially predict this. See the World Outlook here for more.

On the steepening I don't have a strong view but ultimately I think 2 year yields will probably have to rise again at some point after a recent pause as the risks are skewed to the Fed having to move faster than the market expects. The long end is complicated by QT but generally I suspect the curve will be fairly flat or inverted for most of the next few months.

Coming back after my holidays and the long Easter weekend, the bond market sell-off resumed yesterday with yields climbing to fresh highs. In fact, the losses for Treasuries so far in April now stand at -2.95% on a total return basis, just outperforming the -3.04% decline in March that itself was the worst monthly performance since January 2009, back when the US economy started emerging from the worst phase of the GFC.

Elsewhere the US yield curve flattened for the first time in six sessions, with 2yr yields climbing +14.4bps to 2.59%, their highest level since early 2019. Yields on 10yr Treasuries rose +8.3bps to 2.94%, a level unseen since late 2018, on another day marked by heightened rates volatility. Meanwhile 30yr yields breached 3.00% intraday for the first time since early 2019, climbing +5.4bps. And what was also noticeable was the continued rise in real yields, with the 10yr real yield closing at -0.009% yesterday, and briefly trading in positive territory for the first time since March 2020 in early trading this morning. Bear in mind that the 10yr real yield has surged roughly 110bps in around 6 weeks, and since we’ve been able to calculate real yields using TIPS, the only faster moves over such a short time period have been during the GFC and a remarkable 2-week period in March 2020 around the initial Covid-19 wave. On the other hand, as I pointed out in my CoTD yesterday (link here), the 10yr real yield based on spot inflation is currently around -5.6%, so still incredibly negative.

The latest moves come ahead of the Fed’s next decision two weeks from now, where futures are placing the odds of a 50bp hike at over 100% now. We’ve been talking about 50bps for some time, and we’d probably have had one last month had it not been for Russia’s invasion of Ukraine, but it would still be a historic moment if it happens, since the last 50bp hike was all the way back in 2000. Nevertheless, we could be about to see a whole run of them, with our economists pencilling in 50bp hikes at the next 3 meetings, whilst St Louis Fed President Bullard (the only dissenting vote at the last meeting who wanted 50bps) said on Monday night that he wouldn’t even rule out a 75bps hike, which probably gave some fuel to the subsequent front end selloff.

The bond selloff also took hold in Europe yesterday, where yields on 10yr bunds (+6.9ps), 10yr OATs (+5.0bps) and BTPs (+6.2bps) all hit fresh multi-year highs. Indeed, those on 10yr bunds (0.91%) were at their highest level since 2015, having staged an astonishing turnaround since they closed in negative territory as recently as March 7. Rising inflation expectations have been a driving theme behind this, and yesterday we saw the 5y5y forward inflation swap for the Euro Area close above 2.4%, which is the first time that’s happened in almost a decade, and just shows how investor confidence in the idea of “transitory” inflation is becoming increasingly subdued given that metric is looking at the 5-10 year horizon. Those moves higher in inflation expectations came in spite of the fact that European natural gas prices fell to their lowest level since Russia’s invasion of Ukraine began yesterday. By the close, they’d fallen -1.94% to €93.77/MWh, whilst Brent crude oil prices were down -5.22% to $107.25/bbl. In Asia, oil prices are a touch higher, with Brent futures +0.82% higher as we go to press.

Whilst bonds sold off significantly on both sides of the Atlantic, equities put in a much more divergent performance, with the US seeing significant advances just as Europe sold off. By the close of trade, the S&P 500 (+1.61%) had posted its best day in more than a month, as part of a broad-based advance that left 446 companies in the index higher on the day, the most gainers in a month. Tech stocks outperformed in spite of the rise in yields, with the NASDAQ (+2.15%) and the FANG+ index (+1.81%) posting solid advances, and the small-cap Russell 2000 (+2.04%) also outperformed. In Europe however, the STOXX 600 shed -0.77%, with others including the DAX (-0.07%), the CAC 40 (-0.83%) and the FTSE 100 (-0.20%) also losing ground.

The S&P was higher despite a day of mixed earnings. Of the ten companies reporting during trading yesterday, only 4 beat both sales and earnings expectations. After hours, Netflix was the main story, losing subscribers for the first quarter in over a decade and forecasting further declines this quarter, which sent the stock as much as -24% lower in after hours trading. It’s 2 bad earnings releases in a row for the world’s largest streaming service, who saw their stock dip -21.79% the day after their fourth quarter earnings in January.

Asian equity markets are mixed this morning as the People’s Bank of China (PBOC) defied market expectations by keeping its benchmark lending rates steady. In mainland China, the Shanghai Composite (-0.21%) and the CSI (-0.43%) are lagging on the news. Bucking the trend is the Nikkei (+0.57%) and the Hang Seng (+0.66%). Outside of Asia, stock futures are indicating a negative start in the US with contracts on the S&P 500 (-0.35%) and Nasdaq (-0.75%) both trading in the red partly due to the Netflix earnings miss.

Separately, the Bank of Japan (BOJ) reiterated its commitment to purchase an unlimited amount of 10-yr Japanese Government Bonds (JGBs) at 0.25% to contain yields, underscoring its desire for ultra-loose monetary settings, in contrast to the global move in a more hawkish direction.

The yen has moved slightly higher (+0.3%) after depreciating for 13 straight days, a streak which hasn’t been matched since the US left the gold standard in the early 70s and effectively brought the global free floating exchange rate regime into being. The pace and magnitude of the depreciation has brought some expressions of consternation from Japanese officials, but no official intervention. The reality is, it would be extraordinarily difficult to credibly support the currency at the same time as maintaining strict control of the yield curve. 10yr JGBs continue to trade just beneath the important 0.25% level.

Over in France, we’re now just 4 days away from the French presidential election run-off on Sunday, and tonight will see President Macron face off against Marine Le Pen in a live TV debate. Whilst that will be an important moment, recent days have seen a slight widening in Macron’s poll lead that has also coincided with signs of an easing in market stress, with the spread of French 10yr yields over bunds coming down to its lowest level since the start of the month yesterday, at 46.7bps. In terms of yesterday’s polls, Macron was ahead of Le Pen by 56-44 (Opinionway), 56.5-43.5 (Ipsos), and 55-54 (Ifop), putting his lead beyond the margin of error in all of them.

Elsewhere, the IMF released their latest World Economic Outlook yesterday, in which they downgraded their estimates for global growth in light of Russia’s invasion of Ukraine. They now see global growth in both 2022 and 2023 at +3.6%, down from estimates in January of +4.4% in 2022 and +3.8% in 2023. Unsurprisingly it was Russia that saw the biggest downgrades, but they were broadly shared across the advanced and emerging market economies, whilst inflation was revised up at the same time.

Otherwise on the data side, US housing starts grew at an annualised rate of 1.793m in March (vs. 1.74m expected), which is their highest level since 2006. Building permits also rose to an annualised rate of 1.873m (vs. 1.82m expected), albeit this was still beneath its post-GFC high reached in January.

To the day ahead now, and data releases include German PPI for March, Euro Area industrial production for February, US existing home sales for march, and Canadian CPI for March. From central banks, we’ll hear from the Fed’s Bostic, Evans and Daly, as well as the ECB’s Rehn and Nagel, whilst the Federal Reserve will be releasing their Beige Book. Earnings releases include Tesla, Procter & Gamble, and Abbott Laboratories. Finally, French President Macron and Marine Le Pen will debate tonight ahead of Sunday’s presidential election.

Government

Four Years Ago This Week, Freedom Was Torched

Four Years Ago This Week, Freedom Was Torched

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare…

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare quotes the soothsayer’s warning Julius Caesar about what turned out to be an impending assassination on March 15. The death of American liberty happened around the same time four years ago, when the orders went out from all levels of government to close all indoor and outdoor venues where people gather.

It was not quite a law and it was never voted on by anyone. Seemingly out of nowhere, people who the public had largely ignored, the public health bureaucrats, all united to tell the executives in charge – mayors, governors, and the president – that the only way to deal with a respiratory virus was to scrap freedom and the Bill of Rights.

And they did, not only in the US but all over the world.

The forced closures in the US began on March 6 when the mayor of Austin, Texas, announced the shutdown of the technology and arts festival South by Southwest. Hundreds of thousands of contracts, of attendees and vendors, were instantly scrapped. The mayor said he was acting on the advice of his health experts and they in turn pointed to the CDC, which in turn pointed to the World Health Organization, which in turn pointed to member states and so on.

There was no record of Covid in Austin, Texas, that day but they were sure they were doing their part to stop the spread. It was the first deployment of the “Zero Covid” strategy that became, for a time, official US policy, just as in China.

It was never clear precisely who to blame or who would take responsibility, legal or otherwise.

This Friday evening press conference in Austin was just the beginning. By the next Thursday evening, the lockdown mania reached a full crescendo. Donald Trump went on nationwide television to announce that everything was under control but that he was stopping all travel in and out of US borders, from Europe, the UK, Australia, and New Zealand. American citizens would need to return by Monday or be stuck.

Americans abroad panicked while spending on tickets home and crowded into international airports with waits up to 8 hours standing shoulder to shoulder. It was the first clear sign: there would be no consistency in the deployment of these edicts.

There is no historical record of any American president ever issuing global travel restrictions like this without a declaration of war. Until then, and since the age of travel began, every American had taken it for granted that he could buy a ticket and board a plane. That was no longer possible. Very quickly it became even difficult to travel state to state, as most states eventually implemented a two-week quarantine rule.

The next day, Friday March 13, Broadway closed and New York City began to empty out as any residents who could went to summer homes or out of state.

On that day, the Trump administration declared the national emergency by invoking the Stafford Act which triggers new powers and resources to the Federal Emergency Management Administration.

In addition, the Department of Health and Human Services issued a classified document, only to be released to the public months later. The document initiated the lockdowns. It still does not exist on any government website.

The White House Coronavirus Response Task Force, led by the Vice President, will coordinate a whole-of-government approach, including governors, state and local officials, and members of Congress, to develop the best options for the safety, well-being, and health of the American people. HHS is the LFA [Lead Federal Agency] for coordinating the federal response to COVID-19.

Closures were guaranteed:

Recommend significantly limiting public gatherings and cancellation of almost all sporting events, performances, and public and private meetings that cannot be convened by phone. Consider school closures. Issue widespread ‘stay at home’ directives for public and private organizations, with nearly 100% telework for some, although critical public services and infrastructure may need to retain skeleton crews. Law enforcement could shift to focus more on crime prevention, as routine monitoring of storefronts could be important.

In this vision of turnkey totalitarian control of society, the vaccine was pre-approved: “Partner with pharmaceutical industry to produce anti-virals and vaccine.”

The National Security Council was put in charge of policy making. The CDC was just the marketing operation. That’s why it felt like martial law. Without using those words, that’s what was being declared. It even urged information management, with censorship strongly implied.

The timing here is fascinating. This document came out on a Friday. But according to every autobiographical account – from Mike Pence and Scott Gottlieb to Deborah Birx and Jared Kushner – the gathered team did not meet with Trump himself until the weekend of the 14th and 15th, Saturday and Sunday.

According to their account, this was his first real encounter with the urge that he lock down the whole country. He reluctantly agreed to 15 days to flatten the curve. He announced this on Monday the 16th with the famous line: “All public and private venues where people gather should be closed.”

This makes no sense. The decision had already been made and all enabling documents were already in circulation.

There are only two possibilities.

One: the Department of Homeland Security issued this March 13 HHS document without Trump’s knowledge or authority. That seems unlikely.

Two: Kushner, Birx, Pence, and Gottlieb are lying. They decided on a story and they are sticking to it.

Trump himself has never explained the timeline or precisely when he decided to greenlight the lockdowns. To this day, he avoids the issue beyond his constant claim that he doesn’t get enough credit for his handling of the pandemic.

With Nixon, the famous question was always what did he know and when did he know it? When it comes to Trump and insofar as concerns Covid lockdowns – unlike the fake allegations of collusion with Russia – we have no investigations. To this day, no one in the corporate media seems even slightly interested in why, how, or when human rights got abolished by bureaucratic edict.

As part of the lockdowns, the Cybersecurity and Infrastructure Security Agency, which was and is part of the Department of Homeland Security, as set up in 2018, broke the entire American labor force into essential and nonessential.

They also set up and enforced censorship protocols, which is why it seemed like so few objected. In addition, CISA was tasked with overseeing mail-in ballots.

Only 8 days into the 15, Trump announced that he wanted to open the country by Easter, which was on April 12. His announcement on March 24 was treated as outrageous and irresponsible by the national press but keep in mind: Easter would already take us beyond the initial two-week lockdown. What seemed to be an opening was an extension of closing.

This announcement by Trump encouraged Birx and Fauci to ask for an additional 30 days of lockdown, which Trump granted. Even on April 23, Trump told Georgia and Florida, which had made noises about reopening, that “It’s too soon.” He publicly fought with the governor of Georgia, who was first to open his state.

Before the 15 days was over, Congress passed and the president signed the 880-page CARES Act, which authorized the distribution of $2 trillion to states, businesses, and individuals, thus guaranteeing that lockdowns would continue for the duration.

There was never a stated exit plan beyond Birx’s public statements that she wanted zero cases of Covid in the country. That was never going to happen. It is very likely that the virus had already been circulating in the US and Canada from October 2019. A famous seroprevalence study by Jay Bhattacharya came out in May 2020 discerning that infections and immunity were already widespread in the California county they examined.

What that implied was two crucial points: there was zero hope for the Zero Covid mission and this pandemic would end as they all did, through endemicity via exposure, not from a vaccine as such. That was certainly not the message that was being broadcast from Washington. The growing sense at the time was that we all had to sit tight and just wait for the inoculation on which pharmaceutical companies were working.

By summer 2020, you recall what happened. A restless generation of kids fed up with this stay-at-home nonsense seized on the opportunity to protest racial injustice in the killing of George Floyd. Public health officials approved of these gatherings – unlike protests against lockdowns – on grounds that racism was a virus even more serious than Covid. Some of these protests got out of hand and became violent and destructive.

Meanwhile, substance abuse rage – the liquor and weed stores never closed – and immune systems were being degraded by lack of normal exposure, exactly as the Bakersfield doctors had predicted. Millions of small businesses had closed. The learning losses from school closures were mounting, as it turned out that Zoom school was near worthless.

It was about this time that Trump seemed to figure out – thanks to the wise council of Dr. Scott Atlas – that he had been played and started urging states to reopen. But it was strange: he seemed to be less in the position of being a president in charge and more of a public pundit, Tweeting out his wishes until his account was banned. He was unable to put the worms back in the can that he had approved opening.

By that time, and by all accounts, Trump was convinced that the whole effort was a mistake, that he had been trolled into wrecking the country he promised to make great. It was too late. Mail-in ballots had been widely approved, the country was in shambles, the media and public health bureaucrats were ruling the airwaves, and his final months of the campaign failed even to come to grips with the reality on the ground.

At the time, many people had predicted that once Biden took office and the vaccine was released, Covid would be declared to have been beaten. But that didn’t happen and mainly for one reason: resistance to the vaccine was more intense than anyone had predicted. The Biden administration attempted to impose mandates on the entire US workforce. Thanks to a Supreme Court ruling, that effort was thwarted but not before HR departments around the country had already implemented them.

As the months rolled on – and four major cities closed all public accommodations to the unvaccinated, who were being demonized for prolonging the pandemic – it became clear that the vaccine could not and would not stop infection or transmission, which means that this shot could not be classified as a public health benefit. Even as a private benefit, the evidence was mixed. Any protection it provided was short-lived and reports of vaccine injury began to mount. Even now, we cannot gain full clarity on the scale of the problem because essential data and documentation remains classified.

After four years, we find ourselves in a strange position. We still do not know precisely what unfolded in mid-March 2020: who made what decisions, when, and why. There has been no serious attempt at any high level to provide a clear accounting much less assign blame.

Not even Tucker Carlson, who reportedly played a crucial role in getting Trump to panic over the virus, will tell us the source of his own information or what his source told him. There have been a series of valuable hearings in the House and Senate but they have received little to no press attention, and none have focus on the lockdown orders themselves.

The prevailing attitude in public life is just to forget the whole thing. And yet we live now in a country very different from the one we inhabited five years ago. Our media is captured. Social media is widely censored in violation of the First Amendment, a problem being taken up by the Supreme Court this month with no certainty of the outcome. The administrative state that seized control has not given up power. Crime has been normalized. Art and music institutions are on the rocks. Public trust in all official institutions is at rock bottom. We don’t even know if we can trust the elections anymore.

In the early days of lockdown, Henry Kissinger warned that if the mitigation plan does not go well, the world will find itself set “on fire.” He died in 2023. Meanwhile, the world is indeed on fire. The essential struggle in every country on earth today concerns the battle between the authority and power of permanent administration apparatus of the state – the very one that took total control in lockdowns – and the enlightenment ideal of a government that is responsible to the will of the people and the moral demand for freedom and rights.

How this struggle turns out is the essential story of our times.

CODA: I’m embedding a copy of PanCAP Adapted, as annotated by Debbie Lerman. You might need to download the whole thing to see the annotations. If you can help with research, please do.

* * *

Jeffrey Tucker is the author of the excellent new book 'Life After Lock-Down'

Government

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A U.S. Centers for Disease Control (CDC) paper released Thursday found that thousands of young children have been taken to the emergency room over the past several years after taking the very common sleep-aid supplement melatonin.

The agency said that melatonin, which can come in gummies that are meant for adults, was implicated in about 7 percent of all emergency room visits for young children and infants “for unsupervised medication ingestions,” adding that many incidents were linked to the ingestion of gummy formulations that were flavored. Those incidents occurred between the years 2019 and 2022.

Melatonin is a hormone produced by the human body to regulate its sleep cycle. Supplements, which are sold in a number of different formulas, are generally taken before falling asleep and are popular among people suffering from insomnia, jet lag, chronic pain, or other problems.

The supplement isn’t regulated by the U.S. Food and Drug Administration and does not require child-resistant packaging. However, a number of supplement companies include caps or lids that are difficult for children to open.

The CDC report said that a significant number of melatonin-ingestion cases among young children were due to the children opening bottles that had not been properly closed or were within their reach. Thursday’s report, the agency said, “highlights the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight,” including melatonin.

The approximately 11,000 emergency department visits for unsupervised melatonin ingestions by infants and young children during 2019–2022 highlight the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight.

The CDC notes that melatonin use among Americans has increased five-fold over the past 25 years or so. That has coincided with a 530 percent increase in poison center calls for melatonin exposures to children between 2012 and 2021, it said, as well as a 420 percent increase in emergency visits for unsupervised melatonin ingestion by young children or infants between 2009 and 2020.

Some health officials advise that children under the age of 3 should avoid taking melatonin unless a doctor says otherwise. Side effects include drowsiness, headaches, agitation, dizziness, and bed wetting.

Other symptoms of too much melatonin include nausea, diarrhea, joint pain, anxiety, and irritability. The supplement can also impact blood pressure.

However, there is no established threshold for a melatonin overdose, officials have said. Most adult melatonin supplements contain a maximum of 10 milligrams of melatonin per serving, and some contain less.

Many people can tolerate even relatively large doses of melatonin without significant harm, officials say. But there is no antidote for an overdose. In cases of a child accidentally ingesting melatonin, doctors often ask a reliable adult to monitor them at home.

Dr. Cora Collette Breuner, with the Seattle Children’s Hospital at the University of Washington, told CNN that parents should speak with a doctor before giving their children the supplement.

“I also tell families, this is not something your child should take forever. Nobody knows what the long-term effects of taking this is on your child’s growth and development,” she told the outlet. “Taking away blue-light-emitting smartphones, tablets, laptops, and television at least two hours before bed will keep melatonin production humming along, as will reading or listening to bedtime stories in a softly lit room, taking a warm bath, or doing light stretches.”

In 2022, researchers found that in 2021, U.S. poison control centers received more than 52,000 calls about children consuming worrisome amounts of the dietary supplement. That’s a six-fold increase from about a decade earlier. Most such calls are about young children who accidentally got into bottles of melatonin, some of which come in the form of gummies for kids, the report said.

Dr. Karima Lelak, an emergency physician at Children’s Hospital of Michigan and the lead author of the study published in 2022 by the CDC, found that in about 83 percent of those calls, the children did not show any symptoms.

However, other children had vomiting, altered breathing, or other symptoms. Over the 10 years studied, more than 4,000 children were hospitalized, five were put on machines to help them breathe, and two children under the age of two died. Most of the hospitalized children were teenagers, and many of those ingestions were thought to be suicide attempts.

Those researchers also suggested that COVID-19 lockdowns and virtual learning forced more children to be at home all day, meaning there were more opportunities for kids to access melatonin. Also, those restrictions may have caused sleep-disrupting stress and anxiety, leading more families to consider melatonin, they suggested.

The Associated Press contributed to this report.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

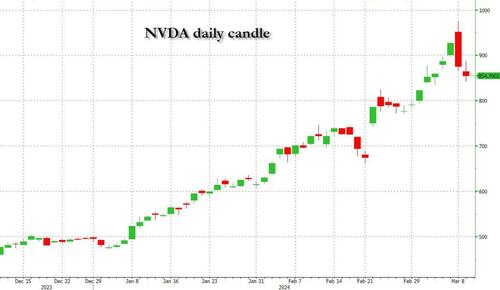

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 days ago

International4 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges