Uncategorized

Futures Rebound, Trade Near Session Highs Amid Global UFO Hullaballoon

Futures Rebound, Trade Near Session Highs Amid Global UFO Hullaballoon

US index futures reversed an earlier drop and traded near session highs…

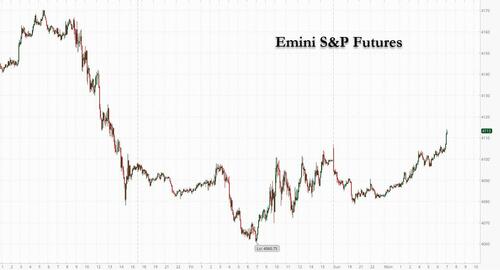

US index futures reversed an earlier drop and traded near session highs as traders braced for inflation data that will may support the Fed’s commitment to further policy tightening (or it may not), and as the world was transfixed by a global UFO hullaballoo(n). S&P 500 futures were up 0.3% at 8:00am ET while Nasdaq 100 futures rose 0.6% after the underlying index suffered its first weekly loss of 2023. European stocks rose to trade near session highs, lifted by construction, industrial goods and consumer stocks while energy and real estate underperformed. The dollar pushed higher, Treasuries were little changed and oil slipped after Friday’s jump; bitcoin slumped.

In premarket trading, Sorrento Therapeutics slumped after the drug developer filed for Chapter 11 bankruptcy protection in Texas. Shares of major US tech and internet companies rose premarket, meanwhile Evercore ISI upgraded Zillow Group to outperform from in line. Here are some other notable premarket movers:

- Advance Auto Parts Inc. is cut to neutral from buy at Roth, with the broker saying it can no longer dismiss the company’s “serial under-performance” against peers, adding its market share is “unwinding quickly.” Shares decline 0.9%.

- BigBear.ai and SoundHound AI (SOUN lead fellow artificial intelligence-related stocks higher. This rebound comes after several stocks faltered on Friday as caution toward AI-related shares set in. Bigbear.ai gains 3.7%. SoundHound AI is up 2.5bbai%.

- Capri Holdings is downgraded to market perform from outperform at Cowen, with the broker saying it has concerns about the company’s wholesale channel and the Michael Kors brand. Shares decline 0.8%.

- Coinbase could ultimately benefit over the long term from the increased scrutiny that the US Securities and Exchange Commission is putting on the staking of digital assets, according to Piper Sandler. Coinbase drops 1.7%.

- Gracell Biotechnologies climbs 1.4% after the company says the Center for Drug Evaluation of China’s National Medical Products Administration has cleared Gracell’s Investigational New Drug application for GC012F, an autologous CAR-T therapeutic candidate, for the treatment of relapsed/refractory multiple myeloma.

- Immunovant Inc. gains 3.1% after Guggenheim upgraded it to buy from neutral, with analyst Yatin Suneja optimistic for its new drug candidate IMVT-1402.

- Microsoft shares are up 1.4% with analysts optimistic about the software company’s long-term growth potential.

- Ocular Therapeutix Inc. rises 14% after the company announced 10-month interim data from an early-stage study of its experimental treatment for wet age-related macular degeneration.

- Proto Labs Inc.shares are up 2.5% after Benchmark Co upgraded the 3D printing company to buy from hold.

- Zillow Group Inc. shares are up 4.4% after Evercore ISI upgraded the online real estate platform to outperform from in line.

- Zim Integrated Shipping Services Ltd. (ZIM) sinks 2.1% after the shipping company was cut to underweight from equal- weight at Barclays, which anticipates a global shipping down- cycle in 2023-2024 due to “significant oversupply” across the industry.

- Shares of China’s cross-border brokerage Futu (FUTU US) falls 0.5% in US premarket trading after Hong Kong-based Bright Smart Securities says it will suspend accounts held by mainland Chinese clients starting Feb. 16.

- Signa Sports United NV (SSU US) is downgraded to hold from buy at Jefferies, with the broker predicting an “uphill climb” for the online sports retailer due to the challenging macroeconomic backdrop.

On Sunday, the US downed yet another flying object, the fourth so far - over Michigan yesterday, following those over northern Canada, Alaska and off the South Carolina coast - after deciding to be more cautious. The Pentagon doesn’t yet know what the most recent objects are and isn’t ruling out anything at this point. Meanwhile, China said US balloons have flown over its airspace more than 10 times since 2022.

The January CPI report on Tuesday is expected to show an increase of 0.5% from a month earlier, spurred in part by higher gasoline costs. That would mark the biggest gain in three months. Excluding fuels and foods, so-called core prices — which better reflect underlying inflation — are seen rising 0.4% for a second month. The BLS changed how CPI is calculated. They changed some weightings which had the effect of showing that less progress was made on inflation than previously thought.

Amid the new data, investors will be reassessing how high US interest rates will rise this year, with inflation and jobs data likely to still come in hot later this week. That has fueled bets for the Fed rate to peak at 5.2% in July, up from less than 5% a month ago.

“We are certainly continuing to be very cautious on equities,” Nannette Hechler-Fayd’Herbe, chief investment officer at Credit Suisse International Wealth Management, said on Bloomberg Television. “We find at the moment there is a disconnect in valuations versus where interest rates by the Fed — but also by other central banks — are going to be for the remainder of the year.”

The rally in US equities lost steam last week over concerns that the Fed will stick to its hawkish resolve amid a strong labor market and relatively elevated inflation. Traders will parse this week’s data for clues on the path of monetary policy and the impact it could have on the US economy.

“We’re looking for a correction over the next few months to take us back down to the lower 3,000s area in the S&P 500,” Saed Abukarsh, chief portfolio manager at Ark Capital Management Dubai Ltd., told Bloomberg Television. “The incentive for the Fed to be hawkish is still there. There is no incentive for them to be less hawkish.”

Meanwhile, Morgan Stanley's downbeat in house permabear argued that US stocks are ripe for a selloff after prematurely pricing in a pause in Fed rate hikes. “While the recent move higher in front-end rates is supportive of the notion that the Fed may remain restrictive for longer than appreciated, the equity market is refusing to accept this reality,” Michael Wilson wrote in a note (more shortly). Wilson — the top-ranked strategist in last year’s Institutional Investor survey — expects deteriorating fundamentals, along with Fed hikes that are coming at the same time as an earnings recession, to drive equities to an ultimate low this spring. “Price is about as disconnected from reality as it’s been during this bear market,” the strategists said.

European stocks rose as the EU Commission lifts its growth forecast for the euro-area in 2023 while lowering estimates for inflation. The Stoxx 600 trade higher by 0.6%, rising to session highs, with outperformance seen in the industrial, construction and consumer product sectors. Here are some of the biggest movers on Monday:

- Kape Technologies shares rise as much as 13%, to 292.5p, and trade above the 285p offer made by majority holder Teddy Sagi to buy the remaining shares in the UK software company

- Smiths shares rise as much as 2.6% in early trading, Weir gains as much as 2.5% and Epiroc rises as much as 3.4%, after Goldman Sachs initiates coverage on 10 European capital goods stocks

- Credit Suisse shares fall as much as 3.2%, resuming their slide following a Friday bounce after Vontobel trims its price target on the Swiss lender and Kepler Chevreux downgraded its recommendation to reduce from hold. The latter also cut its price target to a level implying a 26% fall from the last price

- Castellum falls as much as 11%, the most since March 2020, before paring losses after the Swedish real estate group announced a SEK10 billion ($955 million) rights offering

- Nel shares fall as much as 4%, as Goldman Sachs cut its rating on the electrolyzer firm to neutral following recent outperformance, though the broker remains bullish on the clean hydrogen outlook

- Network International shares fall as much as 4.1% on Monday, after Barclays downgraded the payment firm to equal-weight from overweight, citing the sharp slowdown in the firm’s card issuing business in the fourth quarter

Asian stocks fell, heading to their lowest level in about a month, as investors awaited key inflation data from the world’s largest economy. The MSCI Asia Pacific Index declined as much as 1.2%, extending losses after a two-week rout. Tech stocks led the slump with TSMC and Tokyo Electron dragging the gauge the most. Benchmarks in South Korea, Taiwan and Singapore slid while those in Hong Kong fluctuated. Asian stocks have declined over the past two weeks as strong US jobs data and hawkish comments by Federal Reserve officials dashed hopes of an interest-rate pivot. Investors are reassessing how high US rates will rise this year, with inflation and jobs data likely to still come in hot later this week. “Part of the reason for the overall decline goes to a lack of economic reports to offset the chorus of central bankers chanting ‘higher for longer,’” said Sam Stovall, chief investment strategist at CFRA, adding that investor nervousness may decrease after the release of US inflation figures due Tuesday. China’s defense stocks gained after domestic news outlet The Paper reported that the nation is getting ready to take down an unidentified object flying over waters near the port city of Qingdao. Meanwhile, equities in Japan underperformed amid expectations that Kazuo Ueda, who is expected to be nominated as Japan’s central bank governor, will adopt faster policy normalization

Japanese stocks fell as investors turned cautious ahead of US inflation data due Tuesday. Meanwhile, traders are awaiting the outcome of the official BOJ governor nomination, with the market weighing Kazuo Ueda’s potential policy stance. The Topix Index fell 0.5% to 1,977.67 as of market close Tokyo time, while the Nikkei declined 0.9% to 27,427.32. Sony Group contributed the most to the Topix Index decline, decreasing 1.9%. Out of 2,163 stocks in the index, 702 rose and 1,356 fell, while 105 were unchanged. “Stocks are down partly to reflect the adjustment in US tech stocks last week and the market seems to still be digesting information regarding the potential new BOJ chief,” said Takeru Ogihara, chief strategist at Asset Management One. “Regardless of who the new governor is, BOJ seems to be moving towards monetary policy normalization, which would lead the interest rate and bank stocks to rise.”

Australia's S&P/ASX 200 index fell 0.2% to 7,417.80 as investors assess earnings and brace for a critical US inflation report due this week. Consumer discretionary shares led sector losses, dragged lower by Star Entertainment after the casino operator said its Sydney trading has been hit by operating restrictions and competition from Crown. In New Zealand, the S&P/NZX 50 index fell 0.9% to 12,075.18

India stocks also declined for a second day ahead of the release of consumer-price data later on Monday which came in hotter than expected (6.52% vs exp. 6.50% and up sharply from 5.72% for December). India’s central bank remains watchful of inflation and is open to using monetary policy action to tame price pressures further. The S&P BSE Sensex fell 0.4% to 60,431.84 in Mumbai, while the NSE Nifty 50 Index declined 0.5%. All but three of BSE Ltd.’s 20 sector gauges traded lower, led by service industry stocks. Infosys contributed the most to the Sensex’s decline, decreasing 2.5%. Out of 30 shares in the Sensex index, 11 rose and 18 fell, while 1 was unchanged.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.3% before reversing gains, with the greenback trading mixed against its Group-of-10 peers. The USD/JPY gained 0.9% to 132.60 as the Japanese yen underperforms its G-10 counterparts. The New Zealand dollar is the best performer, adding 0.4% versus the greenback.

- The euro was steady at $1.0677. Bunds and Italian bonds reversed opening losses as money markets pared ECB tightening wagers.

- The New Zealand dollar was the best performer and the yen was the worst. The Treasury curve twist-flattened very modestly. Data on Tuesday are expected to show US consumer price index for January increased 0.5% from a month earlier.

- The pound dipped against the dollar and the euro ahead of a busy week of UK data including jobs and inflation figures for January. Gilts inched lower

- The yen dropped as much as 1.1% 132.77 per dollar ahead of the nomination of a new BOJ governor and before the US inflation print

- Australian sovereign bonds slipped, following Treasuries amid mounting anxiety over how high the Federal Reserve will have to hike rates in its battle with inflation

In rates, Treasuries were narrowly mixed with the curve flatter and long-end slightly richer on the day while front-end trades slightly cheaper vs Friday’s close. In Europe, gilts underperform with busy week of issuance lined-up. US 10-year yields little changed on the day at 3.735% with bunds and gilts underperforming by 1bp and 3bp in the sector; long-end outperformance on Treasury curve flattens 2s10s, 5s30s spreads by 1.7bp and 2.5bp on the day. Bund futures are in the green while Gilts are slightly lower. According to Bloomberg, the dollar issuance slate is empty so far (so no rate lock trades); preliminary estimate suggests $25 billion in new issues this week with bulk of the deals expected Monday before Tuesday’s inflation data. US session light for risk events, with price action relatively calm ahead of Tuesday’s inflation data.

In commodities, crude futures reversed an earlier decline with WTI now flat just shy of $80, after sliding down almost 2% lower. Spot gold falls roughly 0.3% to trade near $1,859.

In cryptos, stablecoin issuer Paxos has been directed to stop minting Binance Coin (BUSD) by the US SEC; following on from WSJ reporting over the weekend that US SEC intends to sue stablecoin issuer Paxos, which is behind the Pax Dollar (USDP) and Binance USD (BUSD) tokens, over the latter stablecoin. India’s Finance Minister said the G20 is exploring collectively regulating cryptocurrencies, according to Reuters.

There is no macro on today's calendar; Bowman is the only Fed speaker at 8am ET this morning

Market Snapshot

- S&P 500 futures little changed at 4,102.50

- MXAP down 0.8% to 165.06

- MXAPJ down 0.4% to 539.31

- Nikkei down 0.9% to 27,427.32

- Topix down 0.5% to 1,977.67

- Hang Seng Index down 0.1% to 21,164.42

- Shanghai Composite up 0.7% to 3,284.16

- Sensex down 0.4% to 60,459.17

- Australia S&P/ASX 200 down 0.2% to 7,417.75

- Kospi down 0.7% to 2,452.70

- STOXX Europe 600 up 0.4% to 459.84

- German 10Y yield little changed at 2.36%

- Euro little changed at $1.0672

- Brent Futures down 1.4% to $85.17/bbl

- Gold spot down 0.5% to $1,857.17

- U.S. Dollar Index up 0.12% to 103.76

Top Overnight News

- The BOJ's expected next governor Kazuo Ueda likely won't rush to overhaul ultra-loose policy and will instead let economic data guide the exit timing, said Tetsuya Inoue, who was Ueda's staff secretary when he was a central bank board member. RTRS

- The euro-zone economy will fare better this year than previously feared as a mild winter and high levels of gas storage help to ease the energy crisis, and the labor market holds up, according to the European Commission. European Union officials in Brussels raised their forecast for growth this year, predicting a 0.9% expansion in the currency bloc, and said it would narrowly avoid a recession. They also cut their projection for consumer price growth, though it remains high at 5.6%. BBG

- Wagner Group founder Yevgeny Prigozhin said it could take Russia up to another two years to capture the entirety of the Donetsk and Luhansk regions, and up to three if Moscow decides to take land east of the Dnipro River. WSJ

- Russia lost 1140 troops on Friday, a new single-day record, bringing the total death toll to nearly 137K (and Russian casualties over the last two weeks are likely the highest of the war). Also, Russia is witnessing an historic exodus of its citizens, with 500K-1M people leaving the country since the Ukraine war began (a departure on par with the 1917 Bolshevik Revolution and the Soviet Union collapse in 1991). Insider / WA Po

- “No landing” scenario gains traction among economists, raising fears the Fed still has more work to do on rates before inflation is sustainably on a path to the 2% target. WSJ

- Americans with college degrees saw a 7.4% inflation-adjusted drop in income last year, the steepest fall since 2004 and one that erases nearly all pandemic-era gains. BBG

- Walmart tells suppliers "no more price hikes" as it begins worrying about the effects of inflation on its customers (Walmart can also see that input costs are falling, which means suppliers have less need for incremental price increases). RTRS

- Meta has delayed finalizing multiple teams’ budgets while it prepares a fresh round of job cuts (11k employees, 13% of workforce) as Mark Zuckerberg’s plan to contain costs in his “year of efficiency” causes disruption at the social media company. Also, AMZN has cut ~20% of the headcount at its Zappos subsidiary. FT / WSJ

- Ford is set to announce as soon as Monday it plans to build a $3.5 billion lithium iron phosphate battery plant in Michigan, sources told Reuters. Ford is expected to own and operate the plant with Chinese battery company China's Contemporary Amperex Technology Co Ltd (CATL) (300750.SZ) as a technology partner to help develop the batteries. RTRS

- Investors have pulled a net $31 billion from U.S. equity mutual funds and exchange-traded funds in the past six weeks, according to Refinitiv Lipper data through Wednesday. That marks the longest streak of weekly net outflows since last summer and the most money pulled in aggregate from domestic equity funds to start a year since 2016. WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week mostly subdued as geopolitical tensions lingered after the US shot down a fourth flying object and with markets bracing for Tuesday's US CPI data, while the region also digested earnings releases and news that Japan's government is likely to nominate academic and former BoJ member Ueda to head the central bank. ASX 200 was lacklustre with earnings in focus and the Consumer Discretionary sector was pressured alongside a more than 20% drop in Star Entertainment shares after it flagged an impairment charge of up to AUD 1.6bln. Nikkei 225 underperformed as participants pondered over the future of the BoJ with the government likely to nominate Ueda as the next central bank chief after dovish continuation candidate and BoJ’s QE policy architect Amamiya was said to turn down the role. Hang Seng and Shanghai Comp. were mixed with Hong Kong pressured early on by weakness in property and tech, while the mainland was kept afloat after China’s recent loans and aggregate financing data topped forecasts with New Yuan Loans at a record high for January.

Top Asian News

- PBoC and CBIRC published rules on the risk classification of banks’ financial assets which will take effect on July 1st, with the tightened management regulations aimed at assessing banks’ credit risks more accurately, reflecting lenders’ real asset quality, according to Reuters.

- Japan's Upper House of Parliament is to hold confirmation hearings on the government's nominations for the BoJ Governor and Deputy Governors on February 27th, according to sources cited by Reuters.

- BoJ's expected next chief Ueda is likely to allow the data to guide the exit timing, according to Tetsuya Inoue who was Ueda's former staff secretary during his time as a BoJ board member, according to Reuters.

- China's Foreign Ministry says senior diplomat Wang Yi will visit France, Italy, Russia and Hungary this month and attend the Munich Security Conference.

European bourses are modestly firmer, Euro Stoxx 50 +0.5%, with fresh developments limited and the schedule relatively sparse ahead of Tuesday's key events. Sectors are predominantly in the green, featuring outperformance in Travel and Construction names while Energy and Real Estate lag on benchmark pricing and broker activity respectively. US futures are incrementally in the green with the NQ leading slightly though overall performance is contained as we look towards Tuesday's CPI with Fed's Bowman due beforehand. Turkey is reportedly considering extending its stock market closure, according to Bloomberg sources.

Top European News

- UK PM Sunak has reportedly asked ministers and officials to draw up plans for rebuilding the UK's relations with the EU, according to Bloomberg.

- UK employers are expected to increase wages by the most since 2012 with median expectations for a 5% pay rise, while 55% of recruiters were planning to lift base or variable pay this year, according to a CIPD survey cited by Reuters.

- Germany’s CDU is set to win in the repeat election in Berlin with 28% of votes, while Chancellor Scholz’s SDP party received just 18% of votes in a blow for the party which has governed the city-state for 22 years, according to ZDF.

- Moody’s affirmed Germany at AAA; Outlook Stable on Friday.

- EU Commission Forecasts: EZ to avoid the prev. expected technical recession, 0.1% QQ growth in Q4-2022 and 0.00% QQ in Q1-2023. Click here for more detail.

- Ship traffic has Turkey's Bosphorus strait has been suspended amid salvage operations of a ship, according to Tribeca shipping agency.

FX

- USD is bid though peers, ex-JPY, are generally fairly contained after Friday's DXY rebound and ahead of US Tier 1 data and Fed speak throughout the week.

- At best, the USD has been up to 103.84 with USD/JPY as high as 132.76 as we await confirmation of Ueda's nomination for the BoJ and after reports indicate he will be data-driven when deciding on the appropriate point to end ultra-accommodation.

- At the other end of the spectrum, NZD is the relative outperformer and holding above 0.6300 as it pares losses vs AUD with data due overnight for the region; AUD/USD holding near 0.6900.

- CHF saw some fleeting strength in wake of hot domestic CPI while both EUR and GBP were unreactive to respective Central Bank speakers; around 0.923, 1.067 and 1.204 vs USD respectively.

- PBoC set USD/CNY mid-point at 6.8151 vs exp. 6.8160 (prev. 6.7884)

Central Banks

- ECB’s Visco said there is no question that the restriction of the euro area monetary stance must continue and reiterated the pace of any further rate hike will continue to be decided based on incoming data and their impact on the inflation outlook, according to Reuters.

- ECB's Centeno says they need to be open minded with data, via Bloomberg TV; inflation surprised the ECB to the downside. Smaller hikes would need mid-term (i.e. 2024/2025) inflation nearing 2%. Labour market is a positive surprise, no signs of second round effects re. wages.

- BoE's Haskel says "it is true that when we raise rates that is not good for investment. I absolutely accept that, and therefore we are potentially contributing to that very poor capital investment", according to an interview with Matthew Klein; would prefer to make policy with much more attention on the data flow over the next few months.

Fixed Income

- EGBs have experienced a firm bounce with Bunds comfortably above 136.00 to a peak circa. 30 ticks above, with technicals and perhaps ECB speak factoring.

- Amidst this, Gilts are more contained as they struggle to convincingly eclipse 104.00 while USTs reside at the top-end of narrow 112.18 to 11224 intra-day parameters.

- As such, EGB yields are modestly softer while the US curve is flat to mixed pre-Bowman.

Commodities

- WTI March and Brent April futures are softer and towards the bottom of intraday ranges as the complex takes a breather from last week’s gains.

- While today's commodity-related schedule is limited, we do have the Olso Energy Conference (14-16th Feb) and the IEA-IEF-OPEC Symposium (15th Feb) in the near term.

- OPEC Secretary General Haitham Al Ghais said OPEC remain committed to stabilising global oil prices and their latest forecast shows oil demand will exceed pandemic levels this year to reach nearly 102mln bpd, while oil demand is expected to reach 110mln bpd by 2025, according to Reuters.

- Azerbaijani oil shipments at Turkey’s Ceyhan terminal resumed after the recent earthquake, according to a (BP/ LN) representative cited by Reuters.

- IEA sees the power sector set for a tipping point on emissions in 2025 and for electricity demand to increase by an average 3% through to 2025 with more than 70% of the global electricity demand increase over the next 3 years to come from China, India and south-east Asia, according to FT.

- Russian Deputy PM Novak says Russia is looking to sell over 80% of its oil exports and 75% of its oil product exports to "friendly" nations in 2023; sees potential for increase of Russian natural gas exports to the APAC region.

- China's CNPC is reportedly close to sealing a long-term agreement to purchase LNG from QatarEnergy's north field expansion, via Reuters citing sources.

- Spot gold is slightly softer with a stronger USD factoring and pressuring the yellow metal to a test of Friday's USD 1852/oz trough at worst, while base metals are softer amid the tentative tone and USD.

Geopolitics

- EU set to propose new Russia sanctions, potentially targeting tech exports used for military purposes, heavy vehicles and rubber, as well as dozens of listings, according to Bloomberg's Nardelli citing sources.

- Russian Deputy Foreign Minister said Russia is ready for negotiations with Ukraine but without preconditions and noted that any negotiations should take into account current realities on the field, according to TASS.

- Russia said it hit energy facilities in Ukraine on Friday, according to RIA. it was also reported that Russian troops took the village of Krasna Hora which is north of Bakhmut in Ukraine’s Donetsk region, according to Reuters.

- Canada’s Defence Minister announced that a fighter jet shot down an object about 100 miles from the US-Canadian border which was a small cylindrical object and had posed a reasonable threat to civilian aviation, while the Defence Minister added it is not prudent to speculate on the origin of the object, according to Reuters.

- US military shot down a fourth flying object over Lake Huron in Michigan which was an octagonal structure with no discernible payload, while the US did not assess the latest object to be a military threat and was shot down due to its potential surveillance capabilities after it flew in proximity to sensitive military sites, according to Reuters.

- China spotted a mystery flying object over the waters near the coastal city of Rizhao in the Shandong province which authorities were preparing to shoot down, according to SCMP.

- China's Foreign Ministry says that since last year US high-altitude balloons flew over Chinese airspace without their permission on over 10 occasions.

- Taiwan has observed dozens of Chinese military balloon flights in its airspace in recent years, according to FT.

- UK is to launch a security review related to China's spy balloons, according to The Telegraph

- China is reportedly contemplating tripling its stockpile of nuclear warheads to 900 by 2035, according to sources cited by Japan Times.

Crypto

- Stablecoin issuer Paxos has been directed to stop minting Binance Coin (BUSD) by the US SEC; following on from WSJ reporting over the weekend that US SEC intends to sue stablecoin issuer Paxos, which is behind the Pax Dollar (USDP) and Binance USD (BUSD) tokens, over the latter stablecoin.

- India’s Finance Minister said the G20 is exploring collectively regulating cryptocurrencies, according to Reuters.

- Binance and TRON reached an agreement in which Binance will reduce transaction fees on the Tron network with withdrawal frees returned to previous levels, according to Reuters.

US Event Calendar

- Nothing major scheduled

Central Bank Speakers

- 08:00: Fed’s Bowman Speaks at Banking Conference

DB's Jim Reid concludes the overnight wrap

I was left alone with Maisie yesterday morning while the twins went to "Ninja Warriors" which is basically a venue aimed at making children as tired as they possibly can be to give their parents a rest later. However my wife came back more tired than the boys as she had to join in! Anyway I used the couple of hours to try to write a surprise Valentine's Day song from Maisie to her mum. However I did it slightly differently. I asked ChatGPT to come up with some song lyrics given a selection of information about the family. The results were fairly spectacular and although I didn't use it all, I used it a starting point and tweaked around it. I'm pretty sure AI will revolutionise the written word in the years ahead. So if you've forgotten a present for your loved one for tomorrow why not ask chatGPT to write a poem for and about them. What could be more romantic than letting a robot and algorithm work out the words to express your love!

On the most romantic day of the year tomorrow, the pheromones in the financial community might be dictated by a pretty important US CPI print. Sadly chatGPT can't give us any guidance there.

It only feels like yesterday that US inflation prints were seen as last year’s news given the recent falls. In addition, forecasts and breakevens suggested we were on a glide path to normality over the next few months and quarters.

However that view has received a bit of a jolt in the last 10 days. First we had payrolls print which raised the prospect that core services ex-shelter could stay stronger for longer. Then we had lots of hawkish central bank speak that the market had previously ignored but was now slowly waking up to. Then Manheim suggested US used cars (+2.5% mom in January) climbed at their fastest rate for 14-months and finally we had US CPI revisions on Friday that have rewritten the last year of history and in turn reduced core inflation by around a tenth each month leading up to June and have increased it by an average of around a tenth in each month since August. As such the trend in core CPI hasn’t fallen as much as expected and we now haven’t seen any month less than +0.3% MoM. In addition 3m annualised core CPI ran at 4.3% in December rather than the 3.1% reported at the January 12th release. So although year on year hasn’t changed the momentum is notably different.

This feeds into work done by our economists over the last few weeks suggesting that inflation is going to be edging up again before it falls. See their chart book “The rise before the fall” (link here) for more on this.

For tomorrow’s reading, higher gas prices should boost headline MoM CPI (+0.42% DB forecast, consensus +0.5%). Last month this printed at -0.1% but got revised up to +0.1% on Friday. Core MoM should be stable (DB +0.36% vs. +0.4% consensus) but only because Friday’s revisions saw it edge up from 0.3% to 0.4% last month. As strong prints from this time last year edge out of the data, the YoY rates should fall around two tenths each to 6.2% and 5.5% (consensus unchanged at 5.7%), respectively. If you want to get more into the weeds see DB’s Justin Weidner’s preview here.

Staying with inflation, US PPI on Thursday is also important as the medical services component feeds directly into the equivalent within the core PCE number (out Feb 24th).

Elsewhere in the US we have leading indicators (LEI) on Friday which are expected to pickup, but stay in negative territory in January after an awful print for December. January retail sales on Wednesday is also expected to bounce back after a poor end to the year. There are also a couple of regional factory surveys (NY on Weds and Philli Thurs) which along with industrial production (Weds) are also all expected to bounce to varying degrees. Thursday will also see the usual jobless claims alongside housing starts and building permits (1.350 vs. 1.337k).

Fed speakers will have plenty of opportunity to address the data throughout the week, with at least ten appearances scheduled so far. There are a number of appearances from ECB officials as well. See the highlights in the day by day week ahead calendar at the end as usual.

Shifting to Europe, UK CPI (Weds) and labour market data (tomorrow) will be in focus following the recent more dovish BoE meeting. This week's CPI will also be calculated with new weights so our UK economists put out a note on the potential impact of the changes here.

Turning to earnings now, with nearly 350 of the S&P 500 members having reported, there will still be a few notable corporates releasing results but the reality is that we are past the biggest potential market movers for the macro world.

Asian equity markets are starting an important week on the back foot. The Nikkei (-0.98%) is leading losses with the KOSPI (-0.91%) and Hang Seng (-0.47%) losing ground. Elsewhere, Chinese stocks are bucking the regional trend with the CSI (+0.62%) and Shanghai Composite (+0.53%) seeing decent gains.

Outside of Asia, US stock futures are indicating a negative start with contracts tied to the S&P 500 (-0.42%) and NASDAQ 100 (-0.49%) trading lower following a disappointing week on Wall Street.

In FX markets, the Japanese yen (-0.57%) continues to remain volatile, trading at 132.11 to the dollar ahead of the Japanese government’s official nomination on the new BOJ Governor scheduled tomorrow. On the oil front, prices are lower this morning with Brent futures (-1.03%) trading at $85.50/bbl and WTI (-1.17%) at $78.79/bbl after a strong past week.

Looking back on that week now, markets moved to price in more aggressive rate hikes from both the Fed and the ECB than had previously been expected. In the US, the fed futures market ended the week pricing a 5.188% rate for July meeting, marking the highest close of this cycle so far. That was an increase of +18.0bps on the week and +4.5bps on Friday. The prospect of more rate hikes reverberated in fixed income markets, with 10yr Treasuries yields up +7.4bps on Friday and +20.7bps over the week, reaching their highest levels since the end of December.

Over in Europe, overnight index swaps similarly moved to price in a higher terminal rate for the ECB at the July meeting, increasing by +18.4bps over the week (+5.8bps on Friday) to 3.501%, the highest level since the end of December. Fixed income markets extended their hawkish shift, with 2yr German bund yields jumping to their highest since 2008, up +7.2bps on Friday. This added to earlier increases, with 2yr bunds up +21.4bps over the week. 10yr bunds also fell back, as yields jumped +17.1bps over the week (+6.1bps on Friday).

Over in equity markets, last week was the worst of 2023 so far following a very strong start to the year. The S&P 500 was down -1.11% over the week (-0.22% on Friday), its largest decline in weekly terms since mid-December. The NASDAQ also saw its largest weekly loss since December, falling back -2.41% (-0.61% on Friday). The STOXX 600 also fell back, down -0.63% (-0.96% on Friday).

In other news from Friday, it was widely reported that Kazuo Ueda was set to be appointed as the BoJ's next governor. Ueda is an academic economist and former policy board member of the BoJ. According to our Japanese economists (link), Ueda is not considered to be hawkish and he would be wary of lifting monetary easing too early. However, foreign exchange markets saw Ueda in a more hawkish light, with the Yen reacting positively to the news, rallying + 1.33% against the US Dollar following the news, before reversing over the course of the day. The Nikkei closed up +0.59% on the week (+0.31% on Friday)

In other data releases on Friday, we had a downward surprise for UK GDP growth for December, which printed at -0.5% month-on-month (vs -0.3% expected). However, a technical recession (2 consecutive quarterly contractions) was just avoided with zero growth in Q4 as a whole, following a -0.2% contraction in Q2. Against this backdrop, the FTSE 100 was down -0.36% on Friday and fell back -0.24% on the week.

Over in commodities, oil prices saw further gains on Friday following the news that Russia would be cutting output from next month. WTI was up +8.63% for the week (+2.13% on Friday) to $79.72/bbl, and Brent crude rose up +8.07% (+2.24% on Friday) to $86.39/bbl. European natural gas futures fell -6.81% over the week (+2.30% on Friday).

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire