Futures Jump, Tech Stocks Rally As Beijing Eases Covid Restrictions

Futures Jump, Tech Stocks Rally As Beijing Eases Covid Restrictions

Global markets and US equity futures pushed sharply higher to start the…

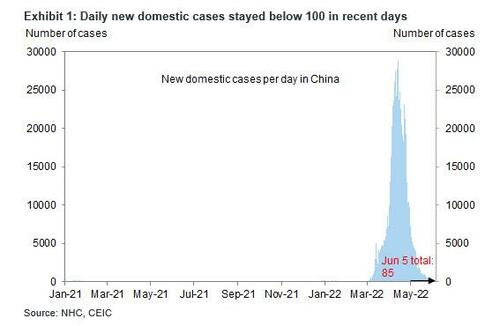

Global markets and US equity futures pushed sharply higher to start the new week (at least until some Fed speakers opens their mouth and threatens a 100bps emergency rate hike) as Beijing’s latest move to ease Covid restrictions injected a note of optimism into markets rattled by inflation and rate-hike concerns. Nasdaq 100 futures climbed 1.4% at 7:15 a.m. in New York after the underlying index erased more than $400 billion in market value on Friday amid renewed concerns about tightening monetary policy, as Beijing rolled back Covid-19 restrictions, boosting global risk appetite after reporting zero local covid cases on Monday while also finding no community cases for three straight days...

... while a Wall Street Journal report that China is preparing to conclude its probe on Didi Global boosted sentiment further, with Didi shares surging 50% and sending the Hang Seng Tech index soaring. S&P 500 futures also climbed, rising about 1% and trading near session highs. Treasuries and the dollar slipped.

Among other notable movers in premarket trading, Apple rose 1.6%, Tesla jumped 3.9% after tumbling over 9% by the close on Friday, while cryptocurrency-tied stocks jumped with Bitcoin. Here are some other notable premarket movers:

- Amazon.com (AMZN US) shares rose as much as 2% following a 20-for-1 stock split.

- Didi Global Inc. (DIDI US) soared after a report that Chinese regulators are about to conclude a probe into the company and restore its apps to mobile stores as soon as this week.

- Cryptocurrency-tied stocks climb with Bitcoin, which rose beyond the $30,000 level after languishing at the weekend. Riot Blockchain (RIOT US) +7.1%; Coinbase (COIN US) +6.6%.

- Crowdstrike (CRWD US) shares rise as much as 3.9% following an upgrade to overweight from equal- weight at Morgan Stanley, with the broker saying that the cyber security firm offers “durable” growth and free cash flow at a discount.

- ON Semi (ON US) shares rise as much as 8.2%. The sensor maker will be added to the S&P 500 Index this month, S&P Dow Jones Indices said late

US stocks slumped in last week’s final session after strong hiring data cleared the way for the Federal Reserve to remain aggressive in its fight against inflation by raising rates, and after repeat warnings by Fed presidents that the central bank was willing to keep hiking. This week, focus will be on the latest US CPI print to assess how much further the Fed will tighten policy.

Inflation is likely to “stall by the end of this year unless the energy or oil prices double again, but a lot of it is already priced in,” Shanti Kelemen, chief investment officer at M&G Wealth, said on Bloomberg Television. While the economy is likely to slow, “I don’t think the US will flip into a recession this year. I think there is still too much of a tailwind from spending and economic activity.”

Goldman economists said the Fed may be able to pull off its aggressive rate-hike plan without tipping the country into recession. The easing of Chinese lockdowns will help abate supply-chain pressures, said Diana Mousina, a senior economist at AMP Capital.

“Positive news around Chinese economic activity and cheaper equity valuations could offer value from a long-term investment perspective, but volatility will remain high in the short-term,” Mousina said in a note.

On the other hand, Morgan Stanley's permagloomish Michael Wilson warned that weakening corporate profit forecasts will provide the latest headwind to US stocks, which are likely to fall further before bottoming during the second-quarter earnings season.

In Europe, the Stoxx 600 was up 0.9% with technology and mining stocks leading gains. Basic resources led an advance in the Stoxx Europe 600 index as copper rose to its highest since April, with sentiment across industrial metals bolstered by China’s gradual reopening. The technology sector also outperformed, following a gain for Asian peers and amid a recovery in Nasdaq 100 futures in the US. The Stoxx 600 Tech index was up as much as 2.1%; Stoxx 600 benchmark up 0.9%. Tencent-shareholder Prosus was among the biggest contributors to the gain amid a rise for Hong Kong’s Hang Seng tech index, driven by Didi Global and Meituan; Tencent shares rose 2.4% while Semiconductor-equipment giant ASML was the biggest contributor to the gain; other chip stocks ASMI, Infineon and STMicro all higher too. Just Eat Takeaway also higher following a report that Grubhub co-founder Matt Maloney had worked with private equity investor General Atlantic to buy back the food delivery company he sold to the Dutch firm last year. Here are some of the other notable European movers today:

- Just Eat Takeaway.com shares rise as much as 12% in the wake of a report saying Grubhub co-founder Matt Maloney had worked with private equity investor General Atlantic to buy back the food delivery company he sold to the Dutch firm last year for $7.3b.

- Semiconductor-equipment giant ASML climbs as much as 3.1% as European tech stocks outperform the broader benchmark, following a gain for Asian peers and amid a recovery in Nasdaq 100 futures.

- LVMH gains as much as 1.7% with luxury stocks active as Beijing continues to roll back Covid-19 restrictions in a bid to return to normality. Kering and Hermes both climb as much as 1.9%.

- Melrose rises as much as 4.7% after the firm said it has entered into an agreement to sell Ergotron to funds managed by Sterling for a total of ~$650m, payable in cash on completion.

- Serica Energy jumps as much as 12%, the most since March 30, after the oil and gas company published a corporate update and said it expects to benefit from investment incentives packaged with the UK’s windfall tax.

- Airbus rises as much as 2.8% after Jefferies reinstated the stock as top pick in European aerospace & defense, replacing BAE Systems, as short-term production challenges should not overshadow the potential to double Ebit by 2025.

- EDF drops as much as 3.3% after HSBC analyst Adam Dickens downgraded to reduce from hold, citing “corroded confidence”

- Accell falls as much as 4.8%, the most intraday since December, after KKR’s tender offer for the bicycle maker failed to meet the 80% acceptance threshold.

Meanwhile, the European Central Bank is set to announce an end to bond purchases this week and formally begin the countdown to an increase in borrowing costs in July, joining global peers tightening monetary policy in the face of hot inflation. The ECB is planniing to strengthen its support of vulnerable euro-area debt markets if they are hit by a selloff, Financial Times reported. Italian and Spanish bonds gained.

Earlier in the session, Asian stocks climbed, supported by a rally in Chinese tech shares and positive sentiment following Beijing’s economic reopening. The MSCI Asia Pacific index rose 0.6% as Hong Kong-listed internet names jumped after a report that authorities are wrapping up their probe into Didi Global. Hong Kong and Chinese shares were among the top gainers in the region, also helped by Beijing moving closer to returning to normal as it rolled back Covid-19 restrictions. “As policymakers continue to deliver on support pledges, the worst is likely behind us,” said Marvin Chen, strategist at Bloomberg Intelligence. “We are seeing the beginning of a recovery into the second half of the year as the growth outlook bottoms out.”

Japanese shares were higher, with transportation and restaurant stocks gaining after the Nikkei reported the government is considering restarting the “Go To” domestic travel subsidy campaign as soon as this month. Japanese equities erased early losses and rose with Chinese stocks as a loosening of Covid-19 restrictions in Beijing increased bets that economic activity will pick up. The Topix rose 0.3% to 1,939.11 as of market close Tokyo time, while the Nikkei advanced 0.6% to 27,915.89. Daiichi Sankyo Co. contributed the most to the Topix gain, increasing 3.7%.

Foreign investors are returning to emerging Asian equities after several weeks of outflows, data compiled by Bloomberg show. Weekly inflows for Asian stock markets excluding Japan and China climbed to almost $2.7 billion last week, the most since February. Asian stocks have been outperforming their US counterparts over the past few weeks, with the MSCI regional benchmark up 5.7% since May 13, more than double the gains in the S&P 500. Stock markets in South Korea, New Zealand and Malaysia were closed on Monday

Stocks in India dropped amid concerns over inflation as the Reserve Bank of India’s interest rate setting panel starts a three-day policy meeting. The S&P BSE Sensex fell 0.2% to 55,675.32 in Mumbai, while the NSE Nifty 50 Index declined 0.1%. Ten of the 19 sector sub-gauges managed by BSE Ltd. slid, led by an index of realty companies. Makers of consumer discretionary goods were also among the worst performers. “The market has been exercising caution ahead of the credit policy announcement this week, and hence investors trimmed their position in rate-sensitive sectors such as realty,” according to Kotak Securities analyst Shrikant Chouhan. The yield on the benchmark 10-year government bond rose to its highest level since 2019 on Monday amid a surge in crude prices and ahead of the RBI’s rate decision on Wednesday. Reliance Industries contributed the most to the Sensex’s decline, decreasing 0.5%. Out of 30 shares in the Sensex index, 9 rose and 21 fell.

In Australia, the S&P/ASX 200 index fell 0.5% to close at 7,206.30 after a strong US jobs report reinforced bets for aggressive Fed tightening. The RBA is also expected to lift rates on Tuesday, with the key debate centering on the size of the move. Read: Australia Set for Back-to-Back Rate Hikes Amid Split on Size Magellan was the worst performer after its funds under management for May declined 5.2% m/m. Tabcorp climbed after settling legal proceedings with Racing Queensland. In New Zealand, the market was closed for a holiday

In FX, the dollar fell against its Group-of-10 peers as hopes for a recovery in China’s economy damped demand for the haven currency. The Bloomberg Dollar Spot Index fell 0.3% after posting a weekly gain on Friday. China’s equity index jumped after Beijing rolled back Covid-19 restrictions and received a further boost after a report that a ban on Didi adding new users may be lifted. “Further lifting of restrictions in Beijing helped Chinese equities, which spilled over into Europe with risk more ‘on’ than ‘off’,” Societe Generale strategist Kit Juckes wrote in a note to clients. “The dollar is once again on the back foot.” USD/JPY dropped 0.1% to 130.73. It touched 130.99 earlier, inching closer to the 131.35 reached last month, which was the highest since April 2002. “Dollar-yen is being sold for profit-taking because we don’t have enough catalysts to break 131.35,” said Juntaro Morimoto, a currency analyst at Sony Financial Group Inc. in Tokyo. But, should US inflation data due this week be higher than estimated, it will see dollar-yen break 131.35.

In rates, Treasuries, though off session lows, remained under pressure as S&P 500 futures recover a portion of Friday’s loss. 10-year TSY yields rose 1bp to 2.95%, extending the streak of advances to five days, the longest in eight weeks; UK 10-year yield underperformed, jumping 6bps to 2.21% after domestic markets were closed Thursday and Friday for a holiday. US auctions resume this week beginning Tuesday, while May CPI report Friday is the main economic event. IG dollar issuance slate includes Tokyo Metropolitan Govt 3Y SOFR; this week’s issuance slate expected to be at least $25b. Three- month dollar Libor +3.90bp to 1.66500%. Bund, Treasury and gilt curves all bear-flatten, gilts underperform by about 2bps at the 10-year mark. Peripheral spreads tighten to Germany.

In commodities, WTI crude futures hover below $120 after Saudis raised oil prices for Asia more than expected. Spot gold is little changed at $1,851/oz. Spot silver gains 1.5% near $22. Most base metals trade in the green; LME nickel rises 5.4%, outperforming peers. LME tin lags, dropping 0.7%.

There is no major economic data on the US calendar.

Market Snapshot

- S&P 500 futures up 1.1% to 4,152.50

- STOXX Europe 600 up 0.9% to 443.90

- MXAP up 0.6% to 169.12

- MXAPJ up 0.8% to 558.02

- Nikkei up 0.6% to 27,915.89

- Topix up 0.3% to 1,939.11

- Hang Seng Index up 2.7% to 21,653.90

- Shanghai Composite up 1.3% to 3,236.37

- Sensex little changed at 55,772.44

- Australia S&P/ASX 200 down 0.4% to 7,206.28

- Kospi up 0.4% to 2,670.65

- German 10Y yield little changed at 1.29%

- Euro up 0.2% to $1.0742

- Brent Futures up 0.5% to $120.28/bbl

- Gold spot up 0.0% to $1,851.93

- U.S. Dollar Index down 0.22% to 101.92

Top Overnight News from Bloomberg

- Boris Johnson will face a leadership vote in his ruling Conservative Party on Monday following a series of scandals, including becoming the first sitting prime minister found to have broken the law.

- Chinese regulators are concluding probes into Didi and two other US-listed tech firms, preparing as early as this week to lift a ban on their adding new users, the Wall Street Journal reported, citing people familiar with the matter.

- The European Central Bank is set to strengthen commitment to support vulnerable euro-area debt markets if they are hit by a selloff, the Financial Times reported, citing unidentified people involved in the discussions.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed following last Friday's post-NFP losses on Wall St and ahead of this week's global risk events - including central bank meetings and US inflation data, while participants also digested the latest Chinese Caixin PMI figures and the North Korean missile launches. ASX 200 was pressured by weakness in tech and mining, with sentiment not helped by frictions with China. Nikkei 225 pared early losses but with upside limited by geopolitical concerns after North Korean provocations. Hang Seng and Shanghai Comp. were encouraged by the easing of COVID restrictions in Beijing, while the Chinese Caixin Services and Composite PMI data improved from the prior month but remained in contraction. Sony Group (6758 JT) said its planned EV JV with Honda Motor (7267 JT) may hold a public share offering, according to Nikkei.

Top Asian News

- China’s Beijing will continue to roll back its COVID-19 restrictions on Monday including allowing indoor dining and public transport to resume in most districts aside from Fengtai and some parts of Changping, according to Reuters and Bloomberg. Furthermore, a China health official called for more targeted COVID control efforts and warned against arbitrary restrictions for COVID, while an official also said that Jilin and Liaoning should stop the spread of COVID at the border.

- Australia accused China of intercepting a surveillance plane and said that a Chinese military jet conducted a dangerous manoeuvre during routine surveillance by an Australian plane over international waters on May 26th, according to FT.

- BoJ Governor Kuroda said Japan is absolutely not in a situation that warrants tightening monetary policy and the BoJ's biggest priority is to support Japan's economy by continuing with powerful monetary easing, while he added Japan does not face a trade-off between economic and price stability, so can continue to stimulate demand with monetary policy, according to Reuters.

European bourses are firmer on the session, Euro Stoxx 50 +1.3%, with newsflow thin and participants reacting to China's incremental COVID/data developments during reduced trade for Pentecost. Stateside, futures are bid to a similar extent in a paring of the post-NFP pressure on Friday, ES +1.0%, with no Tier 1 events for the region scheduled today and attention very much on inflation data due later. Chinese regulators intend to conclude the DiDi (DIDI) cybersecurity probe, and remove the ban on new users, via WSJ citing sources; could occur as soon as this week. DIDI +50% in pre-market trade

Top European News

- Most of the ECB governing council members are expect to back proposals to create a bond-purchase programme to buy stressed government debt, such as Italy, according to sources cited by the FT.

- Confidence vote in UK PM Johnson to occur between 18:00-20:00BST today, results to be immediately counted, announcement time TBC.

- London’s Heathrow Airport ordered carriers to limit ticket sales for flights until July 3rd to maintain safety amid understaffing and overcrowding, according to The Times.

- French Finance Minister Le Maire expects positive economic growth this year although will revise economic forecasts in July, according to Reuters.

- EU Commissioner Gentiloni said he aims to propose reform for the EU stability pact after summer which could envisage a specific debt/GDP target for each country, while he added that Italy should show commitment to keeping public debt under control and needs to avoid increasing current spending in a permanent way, according to Reuters.

FX

- Pound perky on return from long Platinum Jubilee holiday weekend as UK yields gap up in catch up trade and Sterling awaits fate of PM; Cable above 1.2550 to probe 10 DMA, EUR/GBP tests 0.8550 from the high 0.8500 area.

- Dollar eases off post-NFP peaks as broad risk sentiment improves and DXY loses 102.000+ status.

- Kiwi lofty as NZ celebrates Queen’s birthday and Aussie lags ahead of RBA awaiting a hike, but unsure what size; NZD/AUD above 0.6525, AUD/USD sub-0.7125 and AUD/NZD cross closer to 1.1050 than 1.1100.

- Euro firmer amidst further declines in EGBs, bar Italian BTPs, eyeing ECB policy meeting and potential news on a tool to curb bond spreads, EUR/USD nearer 1.0750 than 1.0700.

- Loonie underpinned by rise in WTI after crude price increases from Saudi Arabia, but Lira extends losses irrespective of CBRT lifting collateral requirements for inflation linked securities and Government bonds; USD/CAD under 1.2600, USD/TRY not far from 16.6000.

Fixed income

- Gilts hit hard in catch-up trade, but contain losses to 10 ticks under 115.00 awaiting the outcome of no confidence vote in PM Johnson

- Bunds underperform BTPs ahead of ECB on Thursday amidst reports that a new bond-buying scheme to cap borrowing costs may be forthcoming; 10 year German bond down to 149.59 at worst, Italian peer up to 123.15 at best

- US Treasuries relatively flat in post-NFP aftermath and ahead of low-key Monday agenda comprising just employment trends

Commodities

- Crude benchmarks are bid by just shy of USD 1.00/bbl; though, overall action is contained amid limited developments and two-way factors influencing throughout the morning.

- Saudi Aramco increased its prices to Asia for July with the light crude premium raised to USD 6.50/bbl from USD 4.40/bbl vs Oman/Dubai, while it raised the premium to North West Europe to USD 4.30/bbl from USD 2.10/bbl vs ICE Brent but maintained premiums to the US unchanged from the prior month.

- Oman announced new oil discoveries that will increase output by 50k-100k bpd in the next 2-3 years, while it noted that its crude reserves stand at 5.2bln bbls and gas reserves are at around 24tln cubic feet, according to the state news agency citing the energy and minerals minister.

- Libya's El Sharara oil field resumed production at around 180k bpd after having been shut by protests for more than six weeks, according to Argus.

- French Finance Minister Le Maire said that France is in discussions with the UAE to replace Russian oil supplies, according to Reuters.

- US will permit Italy’s Eni and Spain’s Repsol to begin shipping oil from Venezuela to Europe as early as next month to replace Russian crude, according to Reuters citing sources familiar with the matter.

- Austria released strategic fuel reserves to cover for loss of production at a key refinery due to a mechanical incident, according to Reuters.

- Indonesia will adjust its palm oil export levy with the regulations that will outline the changes expected soon, according to a senior official in the economy ministry cited by Reuters.

- Turkish presidential spokesman Kalin said deliveries of Ukrainian grain via the Black Sea and through the area of the strait could begin in the near future, according to TASS citing an interview with Anadolu news agency.

US Event Calendar

- Nothing major scheduled

DB's Jim Reid concludes the overnight wrap

Later this morning, I will be publishing the 24th Annual Default Study entitled "The end of the ultra-low default world?". Please keep an eye out for it but I won't let you miss it in the EMR and CoTD over the next few days!

For those in the UK, I hope you had a good four-day weekend. We went to two big parties and my digestive system and liver need a rest. Well, until my upcoming birthday this weekend!. One of the parties had a converted VW campervan with 5 or 6 self-service drinks taps on the outside of which one was filled with ice cold Prosecco. Thankfully the Queen doesn't have a 70-year Jubilee very often!

The fun and games in markets this week are heavily back ended as an ECB meeting on Thursday is followed by US CPI on Friday. The rest of the week is scattered with production and trade balance data, while Chinese aggregate financing data is expected at some point. The Fed are now on their pre-FOMC blackout so the attention will be firmly on the ECB this week.

So let's preview the two main events. For the ECB, our European economists believe the ECB will confirm that APP net purchases will cease at the end of the month, paving the way for policy rate lift-off at the July meeting. Our economists believe the ECB will have to hike rates by 50 basis points at either the July or September meeting, with the risks skewed toward the latter, to accelerate the policy hiking cycle in light of growing inflationary pressures. Our economists also believe that hiking cycle will ultimately reach a 2 percent terminal rate next summer, some 50 basis points into restrictive territory. As prelude, next week watch for the staff's forecast to upgrade inflation to 2 percent in 2024, satisfying the criteria for lift-off. With all three lift-off conditions met, expect the statement language to upgrade rate guidance for the path of the hiking cycle. Meanwhile, the June meeting should also bring about the expiration of the TLTRO discount.

There are two interesting things for the ECB to consider at the extreme end of the spectrum at the moment. Firstly German wages seem to be going higher. In a note on Friday, DB's Stefan Schneider (link here) updated earlier work on domestic wage pressures by highlighting that on Thursday night, the 700k professional cleaners in the country achieved a 10.9% pay rise. In addition, with the nationwide minimum wage legalisation voted through on Friday, the lowest paid in this group will get a +12.6% rise from October.

At the other end of the spectrum 10yr Italian BTPs hit 3.40% on Friday, up from 1.12% at the start of the year and as low as 2.85% intra-day the preceding Friday. We're confident that the ECB will create tools to deal with Italy's funding issues, but it is more likely to be reactive than proactive to ensure legal barriers to intervene are not crossed. However, the nightmare scenario we've all been hypothetically thinking about for years, if not decades, is here. Runaway German inflation at the same time as soaring Italian yields. The good news is that this should bring a lot more targeted intervention and a better-balanced policy response than in the last decade where negative rates and blanket QE was a one size fits all policy. High inflation will force the ECB to hike rates while managing the fall out on a more bespoke basis. It won't be easy, but it will likely be better balanced.

Following on from the ECB, the next day brings the US CPI data. Month-over-month CPI is expected to accelerate to 0.7% from last month’s 0.3% reading. The core measure stripping out food and energy is expected to print at 0.5%. Those figures would translate to 8.3% and 5.9% for the year-over-year measures, respectively (from 8.3% and 6.2% last month). The Fed policy path for the next two meetings appears to be locked in to 50 basis point hikes, but Fed officials have highlighted the importance of inflation readings to determine the path of policy thereafter. There is a growing consensus that month-over-month inflation readings will have to decelerate in order to slow hikes to 25 basis points come September. Some Fed officials are still considering ramping the pace up to 75 basis points if inflation doesn’t improve. None appear to be considering zero policy action in September. Elsewhere, data will highlight production figures and the impact of the nascent tightening of financial conditions, with PMI, PPI, and industrial production figures due from a number of jurisdictions.

Asian equity markets have overcame initial weakness this morning and are moving higher as I type. Across the region, the Hang Seng (+1.14%) is leading gains due to a rally in Chinese listed tech stocks. Additionally, the Shanghai Composite (+1.01%) and CSI (+1.06%) are also trading up after markets resumed trading following a holiday on Friday. The easing of Covid-19 restrictions in Beijing is helping to offset a miss in China’s Caixin Services PMI for May. It came in at 41.4 (vs. 46.0 expected), up from 36.2 last month. Elsewhere, the Nikkei (+0.30%) is also up while markets in South Korea are closed for a holiday.

Outside of Asia, US stock futures have been steadily climbing in the last couple of hours before finishing this with contracts on the S&P 500 (+0.55%) and NASDAQ 100 (+0.65%) both in the green. US Treasuries are ever so slightly higher in yield.

Recapping last week now and a renewed sense that global central banks would have to tighten policy more than was priced in given historic inflation drove yields higher and equity markets lower over the past week. This reversed a few weeks where market hike pricing had reversed.

This move was driven by a series of inflationary data but also came right from the source, as Fed and ECB speakers sounded a hawkish tone ahead of their respective meetings in June. Elsewhere, OPEC+ met and agreed to expand daily production, which was followed by reports that President Biden would visit the Crown Prince in Saudi Arabia.

Peeling back the covers. A series of ECB speakers openly considered the merits of +50bp hikes in light of growing inflation prints, as core Euro Area CPI rose to a record high, while German inflation hit figures not seen since the 1950s. In turn, 2yr bund yields climbed +30.9bps (+3.0bps Friday), and the week ended with +122bps of tightening priced in through 2022, the highest to date and implies some hikes of at least +50bps. A reminder that our Europe economists updated their ECB call to at least one +50bp hike in either July or September; full preview of that call and next week’s ECB meeting here.

Yields farther out the curve increased as well, including 10yr bunds (+31.0bps, +3.6bps Friday), OATs (+32.3bps, +4.2bps Friday), and gilts (+23.8bps, +5.4bps Friday) on their holiday-shortened week. Italian BTP 10yr spreads ended the week at their widest spread since the onset of Covid at 212bps. The tighter expected policy weighed on risk sentiment, sending the STOXX 600 -0.87% lower over the week (-0.26% Friday).

It was a similar story in the US, where a march of Fed officials, led by Vice Chair Brainard herself, again signed on for +50bp hikes at the next two meetings, and crucially, ruling out anything less than a +25bp hike in September. It appeared there was growing consensus on the Committee to size the September hike between +25bp and +50bps based on how month-over-month inflation evolves between now and then, with clear evidence of deceleration needed to slow the pace of hikes. The May CPI data will come this Friday but last week had a series of labour market prints that showed the employment picture remained white hot, capped on Friday with nonfarm payrolls increasing +390k and above expectations of +318k. Meanwhile, average hourly earnings maintained its +0.3% month-over-month pace.

Treasury yields thus sold off over the week, with 2yr yields gaining +17.9bps (+2.5bps Friday) and 10yr yields up +20.1bps (+3.1bps Friday). The implied fed funds rate by the end of 2022 ended the week at 2.82%, its highest in two weeks, while the probability of a +50bp September hike ended the week at 66.3%, its highest in a month. The S&P 500 tumbled -1.20% (-1.63% Friday), meaning its run of weekly gains will end at a streak of one. Tech and mega-cap stocks fared better, with the NASDAQ losing -0.98% (-2.47% Friday) and the FANG+ fell -0.30% (-3.76% Friday).

Elsewhere OPEC+ agreed to increase their production to +648k bls/day, after a steady flow of reports leaked that the cartel was considering such a move. Nevertheless, futures prices increased around +1.5% (+3.10% Friday) over the week, as it was not clear whether every member had the spare capacity to increase production to the new putative target, while easing Covid restrictions in China helped increase perceived demand. The OPEC+ announcement was closely followed by reports that President Biden would visit the Crown Prince in Saudi Arabia.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

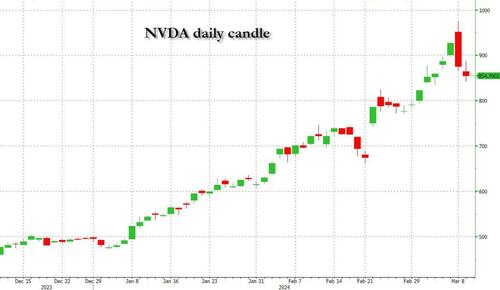

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Government

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19 vaccination was a mistake due to ethical and other concerns, a top government doctor warned Dr. Anthony Fauci after Dr. Fauci promoted mass vaccination.

“Coercing or forcing people to take a vaccine can have negative consequences from a biological, sociological, psychological, economical, and ethical standpoint and is not worth the cost even if the vaccine is 100% safe,” Dr. Matthew Memoli, director of the Laboratory of Infectious Diseases clinical studies unit at the U.S. National Institute of Allergy and Infectious Diseases (NIAID), told Dr. Fauci in an email.

“A more prudent approach that considers these issues would be to focus our efforts on those at high risk of severe disease and death, such as the elderly and obese, and do not push vaccination on the young and healthy any further.”

Employing that strategy would help prevent loss of public trust and political capital, Dr. Memoli said.

The email was sent on July 30, 2021, after Dr. Fauci, director of the NIAID, claimed that communities would be safer if more people received one of the COVID-19 vaccines and that mass vaccination would lead to the end of the COVID-19 pandemic.

“We’re on a really good track now to really crush this outbreak, and the more people we get vaccinated, the more assuredness that we’re going to have that we’re going to be able to do that,” Dr. Fauci said on CNN the month prior.

Dr. Memoli, who has studied influenza vaccination for years, disagreed, telling Dr. Fauci that research in the field has indicated yearly shots sometimes drive the evolution of influenza.

Vaccinating people who have not been infected with COVID-19, he said, could potentially impact the evolution of the virus that causes COVID-19 in unexpected ways.

“At best what we are doing with mandated mass vaccination does nothing and the variants emerge evading immunity anyway as they would have without the vaccine,” Dr. Memoli wrote. “At worst it drives evolution of the virus in a way that is different from nature and possibly detrimental, prolonging the pandemic or causing more morbidity and mortality than it should.”

The vaccination strategy was flawed because it relied on a single antigen, introducing immunity that only lasted for a certain period of time, Dr. Memoli said. When the immunity weakened, the virus was given an opportunity to evolve.

Some other experts, including virologist Geert Vanden Bossche, have offered similar views. Others in the scientific community, such as U.S. Centers for Disease Control and Prevention scientists, say vaccination prevents virus evolution, though the agency has acknowledged it doesn’t have records supporting its position.

Other Messages

Dr. Memoli sent the email to Dr. Fauci and two other top NIAID officials, Drs. Hugh Auchincloss and Clifford Lane. The message was first reported by the Wall Street Journal, though the publication did not publish the message. The Epoch Times obtained the email and 199 other pages of Dr. Memoli’s emails through a Freedom of Information Act request. There were no indications that Dr. Fauci ever responded to Dr. Memoli.

Later in 2021, the NIAID’s parent agency, the U.S. National Institutes of Health (NIH), and all other federal government agencies began requiring COVID-19 vaccination, under direction from President Joe Biden.

In other messages, Dr. Memoli said the mandates were unethical and that he was hopeful legal cases brought against the mandates would ultimately let people “make their own healthcare decisions.”

“I am certainly doing everything in my power to influence that,” he wrote on Nov. 2, 2021, to an unknown recipient. Dr. Memoli also disclosed that both he and his wife had applied for exemptions from the mandates imposed by the NIH and his wife’s employer. While her request had been granted, his had not as of yet, Dr. Memoli said. It’s not clear if it ever was.

According to Dr. Memoli, officials had not gone over the bioethics of the mandates. He wrote to the NIH’s Department of Bioethics, pointing out that the protection from the vaccines waned over time, that the shots can cause serious health issues such as myocarditis, or heart inflammation, and that vaccinated people were just as likely to spread COVID-19 as unvaccinated people.

He cited multiple studies in his emails, including one that found a resurgence of COVID-19 cases in a California health care system despite a high rate of vaccination and another that showed transmission rates were similar among the vaccinated and unvaccinated.

Dr. Memoli said he was “particularly interested in the bioethics of a mandate when the vaccine doesn’t have the ability to stop spread of the disease, which is the purpose of the mandate.”

The message led to Dr. Memoli speaking during an NIH event in December 2021, several weeks after he went public with his concerns about mandating vaccines.

“Vaccine mandates should be rare and considered only with a strong justification,” Dr. Memoli said in the debate. He suggested that the justification was not there for COVID-19 vaccines, given their fleeting effectiveness.

Julie Ledgerwood, another NIAID official who also spoke at the event, said that the vaccines were highly effective and that the side effects that had been detected were not significant. She did acknowledge that vaccinated people needed boosters after a period of time.

The NIH, and many other government agencies, removed their mandates in 2023 with the end of the COVID-19 public health emergency.

A request for comment from Dr. Fauci was not returned. Dr. Memoli told The Epoch Times in an email he was “happy to answer any questions you have” but that he needed clearance from the NIAID’s media office. That office then refused to give clearance.

Dr. Jay Bhattacharya, a professor of health policy at Stanford University, said that Dr. Memoli showed bravery when he warned Dr. Fauci against mandates.

“Those mandates have done more to demolish public trust in public health than any single action by public health officials in my professional career, including diminishing public trust in all vaccines.” Dr. Bhattacharya, a frequent critic of the U.S. response to COVID-19, told The Epoch Times via email. “It was risky for Dr. Memoli to speak publicly since he works at the NIH, and the culture of the NIH punishes those who cross powerful scientific bureaucrats like Dr. Fauci or his former boss, Dr. Francis Collins.”

Government

Trump “Clearly Hasn’t Learned From His COVID-Era Mistakes”, RFK Jr. Says

Trump "Clearly Hasn’t Learned From His COVID-Era Mistakes", RFK Jr. Says

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President…

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President Joe Biden claimed that COVID vaccines are now helping cancer patients during his State of the Union address on March 7, but it was a response on Truth Social from former President Donald Trump that drew the ire of independent presidential candidate Robert F. Kennedy Jr.

During the address, President Biden said: “The pandemic no longer controls our lives. The vaccines that saved us from COVID are now being used to help beat cancer, turning setback into comeback. That’s what America does.”

President Trump wrote: “The Pandemic no longer controls our lives. The VACCINES that saved us from COVID are now being used to help beat cancer—turning setback into comeback. YOU’RE WELCOME JOE. NINE-MONTH APPROVAL TIME VS. 12 YEARS THAT IT WOULD HAVE TAKEN YOU.”

An outspoken critic of President Trump’s COVID response, and the Operation Warp Speed program that escalated the availability of COVID vaccines, Mr. Kennedy said on X, formerly known as Twitter, that “Donald Trump clearly hasn’t learned from his COVID-era mistakes.”

“He fails to recognize how ineffective his warp speed vaccine is as the ninth shot is being recommended to seniors. Even more troubling is the documented harm being caused by the shot to so many innocent children and adults who are suffering myocarditis, pericarditis, and brain inflammation,” Mr. Kennedy remarked.

“This has been confirmed by a CDC-funded study of 99 million people. Instead of bragging about its speedy approval, we should be honestly and transparently debating the abundant evidence that this vaccine may have caused more harm than good.

“I look forward to debating both Trump and Biden on Sept. 16 in San Marcos, Texas.”

Mr. Kennedy announced in April 2023 that he would challenge President Biden for the 2024 Democratic Party presidential nomination before declaring his run as an independent last October, claiming that the Democrat National Committee was “rigging the primary.”

Since the early stages of his campaign, Mr. Kennedy has generated more support than pundits expected from conservatives, moderates, and independents resulting in speculation that he could take votes away from President Trump.

Many Republicans continue to seek a reckoning over the government-imposed pandemic lockdowns and vaccine mandates.

President Trump’s defense of Operation Warp Speed, the program he rolled out in May 2020 to spur the development and distribution of COVID-19 vaccines amid the pandemic, remains a sticking point for some of his supporters.

Operation Warp Speed featured a partnership between the government, the military, and the private sector, with the government paying for millions of vaccine doses to be produced.

President Trump released a statement in March 2021 saying: “I hope everyone remembers when they’re getting the COVID-19 Vaccine, that if I wasn’t President, you wouldn’t be getting that beautiful ‘shot’ for 5 years, at best, and probably wouldn’t be getting it at all. I hope everyone remembers!”

President Trump said about the COVID-19 vaccine in an interview on Fox News in March 2021: “It works incredibly well. Ninety-five percent, maybe even more than that. I would recommend it, and I would recommend it to a lot of people that don’t want to get it and a lot of those people voted for me, frankly.

“But again, we have our freedoms and we have to live by that and I agree with that also. But it’s a great vaccine, it’s a safe vaccine, and it’s something that works.”

On many occasions, President Trump has said that he is not in favor of vaccine mandates.

An environmental attorney, Mr. Kennedy founded Children’s Health Defense, a nonprofit that aims to end childhood health epidemics by promoting vaccine safeguards, among other initiatives.

Last year, Mr. Kennedy told podcaster Joe Rogan that ivermectin was suppressed by the FDA so that the COVID-19 vaccines could be granted emergency use authorization.

He has criticized Big Pharma, vaccine safety, and government mandates for years.

Since launching his presidential campaign, Mr. Kennedy has made his stances on the COVID-19 vaccines, and vaccines in general, a frequent talking point.

“I would argue that the science is very clear right now that they [vaccines] caused a lot more problems than they averted,” Mr. Kennedy said on Piers Morgan Uncensored last April.

“And if you look at the countries that did not vaccinate, they had the lowest death rates, they had the lowest COVID and infection rates.”

Additional data show a “direct correlation” between excess deaths and high vaccination rates in developed countries, he said.

President Trump and Mr. Kennedy have similar views on topics like protecting the U.S.-Mexico border and ending the Russia-Ukraine war.

COVID-19 is the topic where Mr. Kennedy and President Trump seem to differ the most.

Former President Donald Trump intended to “drain the swamp” when he took office in 2017, but he was “intimidated by bureaucrats” at federal agencies and did not accomplish that objective, Mr. Kennedy said on Feb. 5.

Speaking at a voter rally in Tucson, where he collected signatures to get on the Arizona ballot, the independent presidential candidate said President Trump was “earnest” when he vowed to “drain the swamp,” but it was “business as usual” during his term.

John Bolton, who President Trump appointed as a national security adviser, is “the template for a swamp creature,” Mr. Kennedy said.

Scott Gottlieb, who President Trump named to run the FDA, “was Pfizer’s business partner” and eventually returned to Pfizer, Mr. Kennedy said.

Mr. Kennedy said that President Trump had more lobbyists running federal agencies than any president in U.S. history.

“You can’t reform them when you’ve got the swamp creatures running them, and I’m not going to do that. I’m going to do something different,” Mr. Kennedy said.

During the COVID-19 pandemic, President Trump “did not ask the questions that he should have,” he believes.

President Trump “knew that lockdowns were wrong” and then “agreed to lockdowns,” Mr. Kennedy said.

He also “knew that hydroxychloroquine worked, he said it,” Mr. Kennedy explained, adding that he was eventually “rolled over” by Dr. Anthony Fauci and his advisers.

MaryJo Perry, a longtime advocate for vaccine choice and a Trump supporter, thinks votes will be at a premium come Election Day, particularly because the independent and third-party field is becoming more competitive.

Ms. Perry, president of Mississippi Parents for Vaccine Rights, believes advocates for medical freedom could determine who is ultimately president.

She believes that Mr. Kennedy is “pulling votes from Trump” because of the former president’s stance on the vaccines.

“People care about medical freedom. It’s an important issue here in Mississippi, and across the country,” Ms. Perry told The Epoch Times.

“Trump should admit he was wrong about Operation Warp Speed and that COVID vaccines have been dangerous. That would make a difference among people he has offended.”

President Trump won’t lose enough votes to Mr. Kennedy about Operation Warp Speed and COVID vaccines to have a significant impact on the election, Ohio Republican strategist Wes Farno told The Epoch Times.

President Trump won in Ohio by eight percentage points in both 2016 and 2020. The Ohio Republican Party endorsed President Trump for the nomination in 2024.

“The positives of a Trump presidency far outweigh the negatives,” Mr. Farno said. “People are more concerned about their wallet and the economy.

“They are asking themselves if they were better off during President Trump’s term compared to since President Biden took office. The answer to that question is obvious because many Americans are struggling to afford groceries, gas, mortgages, and rent payments.

“America needs President Trump.”

Multiple national polls back Mr. Farno’s view.

As of March 6, the RealClearPolitics average of polls indicates that President Trump has 41.8 percent support in a five-way race that includes President Biden (38.4 percent), Mr. Kennedy (12.7 percent), independent Cornel West (2.6 percent), and Green Party nominee Jill Stein (1.7 percent).

A Pew Research Center study conducted among 10,133 U.S. adults from Feb. 7 to Feb. 11 showed that Democrats and Democrat-leaning independents (42 percent) are more likely than Republicans and GOP-leaning independents (15 percent) to say they have received an updated COVID vaccine.

The poll also reported that just 28 percent of adults say they have received the updated COVID inoculation.

The peer-reviewed multinational study of more than 99 million vaccinated people that Mr. Kennedy referenced in his X post on March 7 was published in the Vaccine journal on Feb. 12.

It aimed to evaluate the risk of 13 adverse events of special interest (AESI) following COVID-19 vaccination. The AESIs spanned three categories—neurological, hematologic (blood), and cardiovascular.

The study reviewed data collected from more than 99 million vaccinated people from eight nations—Argentina, Australia, Canada, Denmark, Finland, France, New Zealand, and Scotland—looking at risks up to 42 days after getting the shots.

Three vaccines—Pfizer and Moderna’s mRNA vaccines as well as AstraZeneca’s viral vector jab—were examined in the study.

Researchers found higher-than-expected cases that they deemed met the threshold to be potential safety signals for multiple AESIs, including for Guillain-Barre syndrome (GBS), cerebral venous sinus thrombosis (CVST), myocarditis, and pericarditis.

A safety signal refers to information that could suggest a potential risk or harm that may be associated with a medical product.

The study identified higher incidences of neurological, cardiovascular, and blood disorder complications than what the researchers expected.

President Trump’s role in Operation Warp Speed, and his continued praise of the COVID vaccine, remains a concern for some voters, including those who still support him.

Krista Cobb is a 40-year-old mother in western Ohio. She voted for President Trump in 2020 and said she would cast her vote for him this November, but she was stunned when she saw his response to President Biden about the COVID-19 vaccine during the State of the Union address.

“I love President Trump and support his policies, but at this point, he has to know they [advisers and health officials] lied about the shot,” Ms. Cobb told The Epoch Times.

“If he continues to promote it, especially after all of the hearings they’ve had about it in Congress, the side effects, and cover-ups on Capitol Hill, at what point does he become the same as the people who have lied?” Ms. Cobb added.

“I think he should distance himself from talk about Operation Warp Speed and even admit that he was wrong—that the vaccines have not had the impact he was told they would have. If he did that, people would respect him even more.”

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges