Uncategorized

Futures Grind Higher As Global Yields Slump After Major UK Inflation Miss

Futures Grind Higher As Global Yields Slump After Major UK Inflation Miss

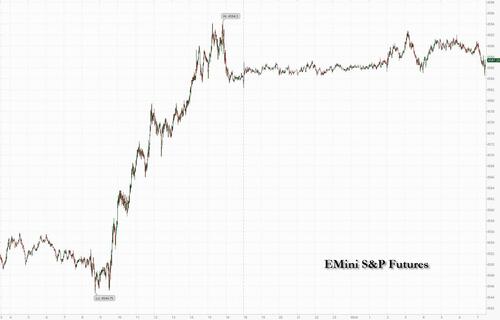

Futures were just barely higher, having erased earlier small gains…

Futures were just barely higher, having erased earlier small gains following yesterday's frenzied meltup that sent spoos just shy of 4600 to a fresh 52-week high. Sentiment was boosted by sliding Treasury yields after UK inflation came in weaker than expected, sending the pound sharply lower and UK bonds led a global fixed income rally, while the USD rose as the Japanese yen resumed its slide as markets reassessed the likelihood of BOJ YCC intervention. At 7:30am ET, S&P futures were up 0.01% at 4588, following mixed results from Goldman Sachs (more details in a follow up post). Bond yields are lower and the USD is higher as pound and yen slide. Commodities are bid in both Energy and Ags; corn and wheat are up more than 3%; oil is also higher while Bitcoin trades just above $30K, erasing much of yesterday's loss.

Today’s macro data focus is on the housing sector, where thanks to the latest Housing Starts and Permits data we may see continued recovery amid a supply shortage and historically low affordability. The XHB has outperformed the SPX by 21% YTD, including by 7% over the last month. Thinking about this Goldilocks market and how far it can go, JPM writes that its Equity Derivatives Trading team tells me that vol markets are pricing in about a 35% - 40% chance of the SPX hitting 5,000 by year-end (via one-touch options).

In premarket trading, AT&T rose after the telecom company reassured investors by saying less than 10% of its nationwide copper-wire telecom network had lead-clad cables. Carvana soared after the used-car retailer reached an agreement to restructure debt and reported second-quarter revenue that beat estimates. Microsoft shares gained as much as 0.9% in US premarket trading, set for their seventh straight day of gains, as Cowen raised its price target on the stock, citing high investor demand for shares. Omnicom Group falls 6.9% in premarket trading after the advertising firm reported second-quarter revenue and organic revenue growth that missed expectations. Citi said the modest organic revenue growth miss could put downward pressure on shares. Here are some other notable premarket movers:

- Western Alliance falls 2.2% after the bank’s second-quarter net interest income and net interest margin missed consensus estimates. Truist Securities note a deterioration in credit quality, with an increase in nonperforming, classified and special-mention loans.

- Joby Aviation drops as much as 5.7% after the maker of electric vertical take-off aircraft is downgraded to underweight from neutral at JPMorgan. The broker says a surge in its shares, as well as in peer Archer Aviation, has decoupled from fundamentals.

- Lilium jumps 13% after the electric commuter aircraft manufacturer announced it had successfully arranged a capital raise of $192 million, which it said would enable it to continue the development of the Lilium Jet at full pace.

The big surprise overnight was news that Britain’s inflation rate cooled more than expected to the lowest level in more than a year, a sign that soaring interest rates may be starting to curtail the worst wage-price spiral in the Group of Seven nations. The Consumer Prices Index was 7.9% higher than a year ago in June, a sharp drop from the 8.7% reading in May, the Office for National Statistics said Wednesday. It was the first downward surprise in five months and the biggest since July 2021, below the 8.2% expected by economists.

The pound slid as much as 0.9% against the dollar, accounting for much of the gain in a gauge of greenback strength, as investors pared back bets on a further sharp surge in interest rates while yields on two-year UK government bonds plunged as traders pared bets on where BOE rates will peak. The yield is down around 50 basis points since last week’s softer-than-expected US inflation reading, the biggest drop among developed-nation bonds. Treasury yields retreated across the curve Wednesday.

“Today’s weaker-than-expected inflation print is arguably a relief, which should lift sentiment on the depressed domestic plays and rates plays. Investors are very bearish on the UK and under-exposed, so short covering may be powerful,” said Barclays strategist Emmanuel Cau.

“It’s clear that the latest inflation data across the globe, like this morning in England or earlier in the US or in Europe show an easing trend and that’s taking pressure off rates,” Bruno Vacossin, a Paris-based senior portfolio manager at Palatine Asset Management, said by phone. “This is providing oxygen to financial markets. So far the earnings season has provided pretty good results. All of this should help maintain markets at decent levels.”

Rate-sensitive real estate stocks led gains in Europe’s Stoxx 600 index; European real estate stocks also jump on the UK inflation figures, triggering a rally in the rate-sensitive sector as the news spurred hopes the rate-hike cycle is reaching an end. UK stocks also benefited, with the FTSE 100 rising 1.6% and outperforming regional peers. UK homebuilders surging the most since 2008 on optimism about less-aggressive hikes and as traders pared bets on further BOE rate hikes following cooler-than-expected UK inflation data. Here are the most notable European movers:

- Kering rises as much as 6.8% after the luxury group announced the departure of Gucci CEO Marco Bizzarri, a move that analysts said constitutes an opportunity to prop up the appeal of the brand

- Severn Trent shares rise as much as 3.8% after it reported an in-line financial performance, which analysts said was a good start to the year, with RBC seeing capital expenditure at guided levels

- Aston Martin Lagonda rises as much as 6.9% after Goldman Sachs upgraded the UK carmaker to buy, noting that the recent strong run in the shares is “clearly factoring in” an upcoming recovery

- Argenx rises as much as 7.4% after raising $1.1 billion in a global share offering, higher than its initially targeted $750 million. The proceeds indicate a high interest in the company, KBC says

- National Grid shares rise as much as 2.5% after the UK utility agreed to sell a further 20% interest in its UK gas transmission business to existing majority owners

- Volvo AB shares fall as much as 3.8% as consensus-beating second-quarter results at the Swedish truck and bus maker were offset by comments on demand environment

- Handelsbanken drops as much as 3.8%, among the worst performers on the Stoxx 600 Banks Index, after reporting results that Citi calls “unimpressive” versus peers as lending arrived revenue in-line

- Antofagasta falls as much as 3.4%, missing out on a broader market rally as the London-listed miner cuts its copper production guidance for the full year

- Wacker Chemie shares drop as much as 4.1%, before paring decline to 0.1%, after the German chemicals company becomes the latest company in the sector to cut its guidance

Earlier in the session, Asian stocks declined again, headed for their third-straight day of losses, amid continued worries over Chinese economic growth. The MSCI Asia Pacific Index declined as much as 0.4%, with Tencent and Alibaba the biggest drags. Key gauges in Hong Kong led declines around the region, with benchmarks in mainland China posting modest losses. A gauge of tech stocks fell as much as 2.6% in Hong Kong as China’s latest measures to boost household spending disappointed the market. Investors still expect further stimulus from Beijing to support growth, including efforts to boost the flagging real estate sector. “Until China’s property industry sees an inflection point, Chinese stock markets are expected tosee sluggish performance and rangebound trading,” said Xuehua Cui, a China equity analyst at Meritz Securities in Seoul. Markets in Malaysia and Indonesia were shut for holidays.

Stocks rose elsewhere in Southeast Asia, while South Korea’s benchmark slipped. Equities in Japan advanced after the nation’s central bank governor indicated a continuation of easy monetary policy. Australia's ASX 200 was positive with gains led by the energy sector after the recent upside in oil prices which facilitated the resilience of Woodside Energy despite its quarterly decline in output and revenue, while the mining sector was choppy amid indecision in Rio Tinto due to a mixed quarterly update.

The daily record juggernaut in India continued as key stock gauges in India closed at another record high Wednesday, boosted by gains in index major Reliance Industries and shares of lenders. The S&P BSE Sensex rose 0.5% to 67,097.44 in Mumbai, while the NSE Nifty 50 Index advanced 0.4% to 19,833.15. The MSCI Asia Pacific Index was little changed for the day. Reliance Industries contributed the most to the Sensex’s gain, increasing 0.6%, ahead of the demerger of its financial services unit on Thursday. Meanwhile, BSE Bankex closed 0.6% higher. Out of 30 shares in the Sensex index, 20 rose and 9 fell, while 1 was unchanged

In FX, the Bloomberg Dollar Spot Index is up 0.2% extending gains into a second day versus all its G-10 rivals except the euro and Canadian dollar. USD/JPY jumped as much as 0.8% to 139.99, extending Tuesday’s 0.1% gain, after BOJ Governor Kazuo Ueda indicated it would take a shift in the bank’s assessment for stably achieving its inflation target to change its stance for persistent monetary easing. The pound fell as much as 0.9% after data showed that inflation in the UK fell more than expected to its lowest level in more than a year. A 25bps hike by the Federal Reserve next week is fully priced in, and traders are betting on roughly a one-in-three possibility of further tightening later in the year; easing US CPI data earlier this month has fueled expectations that the Fed may stop raising rates after its next meeting

In rates, treasuries were off session highs reached amid steep gains for UK government bonds sparked by bigger-than-forecast slowdown in UK inflation. Focal points of US trading day include June housing starts and 20-year bond reopening. Yields are lower by as much as 4bp-5bp at short end vs declines of more than 20bp at UK short end as traders pared bets on how much further BOE will raise rates. In the US, 10Y yields were down 2.5bp at 3.76%, and testing the 50-day moving average which they last closed below in mid-May; 30Y yield at 3.87% is through its 50-DMA, last close below was June 28. Fed swaps continue to fully price in a 25bp rate hike on July 26 and about a third of an additional quarter-point hike this year. Ahead of a $12BN 20Y bond auction (second and final reopening of issue that debuted in May), WI yield is around 4.045%, exceeding 20Y auction results since November.

In commodities, crude futures advanced with WTI rising 0.5% to trade near $76.10. Spot gold is little changed around $1,978. Bitcoin rises 0.7%.

Looking to the day ahead now, and data releases include the aforementioned UK CPI reading for June, along with US housing starts and building permits for June. From central banks, we’ll hear from the ECB’s Vujcic and BoE Deputy Governor Ramsden. Lastly, today’s earnings include Tesla, Netflix, Goldman Sachs and IBM.

Market Snapshot

- S&P 500 futures little changed at 4,589.25

- MXAP little changed at 167.90

- MXAPJ down 0.3% to 528.26

- Nikkei up 1.2% to 32,896.03

- Topix up 1.2% to 2,278.97

- Hang Seng Index down 0.3% to 18,952.31

- Shanghai Composite little changed at 3,198.84

- Sensex up 0.2% to 66,919.59

- Australia S&P/ASX 200 up 0.5% to 7,323.72

- Kospi little changed at 2,608.24

- STOXX Europe 600 up 0.3% to 462.35

- German 10Y yield little changed at 2.34%

- Euro little changed at $1.1221

- Brent Futures up 0.3% to $79.86/bbl

- Gold spot down 0.1% to $1,977.71

- U.S. Dollar Index up 0.24% to 100.18

Top Overnight News from Bloomberg

- The pound weakened and bonds rallied after inflation in Britain slowed more than expected, reviving speculation about how many more times the Bank of England will increase interest rates. Stocks in the UK and Europe advanced

- Big corporate bankruptcies are piling up at the second-fastest pace since 2008, eclipsed only by the early days of the pandemic

- Deep-pocketed sovereign funds are deploying billions of dollars to get private equity takeovers across the line, helping grease the wheels of dealmaking in a year when other funding sources are drying up

- Chinese stocks declined, a sign that traders are increasingly pricing in the lack of major stimulus from the government. Equity markets in the rest of Asia climbed, pacing US gains

- Deutsche Bank AG has drawn fresh criticism from the European Central Bank over foreign-exchange sales even after the lender completed an internal probe into past practices that led to initial changes

- The European Central Bank plans to substantially tighten how it monitors liquidity after several bank runs in the US and Switzerland heightened concerns about a risk that several regulators say hasn’t received sufficient attention

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed as the ongoing China economic woes partially offset the constructive lead from Wall St where risk sentiment was underpinned after strong bank earnings results and recent dovish ECB commentary. ASX 200 was positive with gains led by the energy sector after the recent upside in oil prices which facilitated the resilience of Woodside Energy despite its quarterly decline in output and revenue, while the mining sector was choppy amid indecision in Rio Tinto due to a mixed quarterly update. Nikkei 225 outperformed after recent comments by BoJ Governor Ueda provided the latest hints regarding the unlikelihood of a policy tweak at next week’s monetary policy meeting. Hang Seng and Shanghai Comp were lower as Hong Kong suffered from tech losses and with a non-committal tone in the mainland amid ongoing economic woes and recent support efforts.

Top Asian News

- China's Industry Ministry said China's industrial sector faces difficulties and challenges such as insufficient demand and declining revenues, while it will formulate plans to stabilise the growth of 10 sectors including auto and steel, according to Reuters.

- US Climate Envoy Kerry said his talks with Chinese officials this week were constructive but complicated with the two sides still dealing with political externalities including Taiwan. Kerry added that they are just reconnecting and trying to re-establish the process they have worked on for years, according to Reuters.

- US Climate Envoy Kerry meets with China's Vice President Han Zheng in Beijing and told him that if they can come together over the next months heading into COP28, they will have an opportunity to make a profound difference on climate change, while he added that the US side pledges to work closely with China in order to help their presidents to be able to produce real results. Furthermore, Han told Kerry that both countries have had close communication and dialogue after Kerry became the special envoy for climate and said China and the US have maintained long-term good communication and exchanges on climate, as well as reached some important consensus'.

- US President Biden's administration formally halted the Wuhan Institute of Virology’s access to US funding due to COVID probe failures, according to Bloomberg.

- China's Commerce Ministry says China's foreign trade faces an extremely severe situation in H2.

European bourses are in proximity to the unchanged mark as opening gains have pared in a relatively quiet second half of the session; Euro Stoxx 50 +0.3%. With the exception of the FTSE 100 +1.4% following cooler-than-expected UK CPI and substantial gains in UK equities as a result, particularly housebuilders. As such, Real Estate is the outperforming sector while Basic Resources lag given base metals action and after Rio Tinto cut its FY refined copper/alumina guidance. Stateside, futures are a touch firmer and hanging onto the majority of Tuesday's RTY & MSFT/Tech driven upside ahead of key earnings incl. Netflix, Tesla & GS. ASML (ASML NA) Q2 (EUR): Revenue 6.9bln (exp. 6.73bln), Net Income 1.9bln (exp. 1.82bln), Interim Dividend 1.45/shr, Gross Margin 51.3%. Q3 Outlook: Revenue 6.5-7.0bln (exp. 6.42bln), Gross Margin 50%. US DoJ and FTC have proposed merger guidelines which signal a tougher stance against private equity and Tech, via FT. Reminder, the DoJ and FTC heads are both appearing on CNBC 13:30BST/08:30ET. UK CMA has provisionally cleared the Broadcom (AVGO) and VMware (VMW) deal; deal unlikely to harm innovation, would not weaken competition.

Top European News

- UK PM Sunak is set to delay a decision on whether Britain should rejoin the EU's Horizon science program until after the summer holidays, according to FT.

- ECB is to push banks for weekly liquidity data, according to Bloomberg sources; reflects need for information rather than acute concerns.

- ECB's Nagel says "‘Inflation is a greedy beast. That's why it would be a mistake to ease up on the fight too soon and cut interest rates again prematurely." adding that "practically everyone expects an increase of 25bp" re. July.

- ECB's Simkus says there is a clear need to hike in July, option for a hike should be discussed in September, via Econostream. Would not be surprised if ECB continues to hike in September. The risk of doing too little is still higher than the risk of doing too much.

FX

- Pound plunges post-UK inflation data as headline and core CPI slow more than expected, Cable probes Fib at 1.2933 after pulling up shy of 1.3050 and EUR/GBP eyes Fibs just under 0.8700 vs low close to round number below.

- Dollar gathers momentum at the expense of Sterling and other rivals as DXY rebounds further from recent lows to 100.300, Yen extends reversal vs Greenback from 138.77 to 139.79 after BoJ Governor Ueda underscored dovish guidance.

- Aussie labours ahead of employment report and amidst renewed Yuan weakness on Chinese economic jitters, AUD/USD towards base of 0.6820-0.6764 range.

- Euro underpinned by EUR/GBP and EUR/JPY tailwinds, but EUR/USD capped by decent option expiry interest at 1.1250.

- Kiwi loses momentum following brief pop on the back of firmer than forecast NZ Q2 CPI, NZD/USD at lower end of 0.6315-0.6226 bounds.

- PBoC set USD/CNY mid-point at 7.1486 vs exp. 7.1798 (prev. 7.1453)

Fixed Income

- Gilts gains slowing, but still growing in wake of softer than forecast UK inflation data.

- 10 year bond extends to 97.84 from a 96.64 Liffe low and 95.85 close.

- Bunds fade after less well covered long-dated German supply within a 134.88-01 range and T-note midway between 113-06+/112-22 bounds before US housing metrics and USD 12bln 20 year issuance.

Commodities

- Crude benchmarks are firmer this morning, detaching themselves somewhat from the tepid equity tone (ex-UK) as market focus continues to centre around upcoming US earnings, with a particularly key after-market docket.

- Elsewhere, nat gas continues to pullback following the resumption of the Nyhamma plant.

- Finally, metals are contained and caught between the tentative tone and the USD’s Sterling-driven resurgence.

- US Energy Inventory Data (bbls): Crude -0.8mln (exp. -2.3mln), Gasoline -2.8mln (exp. -2.1mln), Distillate -0.1mln (exp. -0.1mln), Cushing -3.0mln.

Geopolitics

- US assessed that North Korea's launches do not pose an immediate threat but show the destabilising impact of North Korea's illicit weapons program, according to the US military.

- South Africa claimed it cannot arrest Russian President Putin at a planned BRICS summit in Johannesburg next month as Russia has threatened to “declare war” if the International Criminal Court warrant against its leader is enforced, according to FT.

- US official said Secretary of State Blinken signed a new 120-day waiver to allow Iraq to pay Iran for electricity and that the waiver was expanded to allow Iraq to deposit payments for Iranian electricity into non-Iraqi banks, while it is hoped that the waiver will ease Iran's pressure on Iraq for access to funds which previously only went to restricted accounts in Iraq.

US Event Calendar

- 07:00: July MBA Mortgage Applications 1.1%, prior 0.9%

- 08:30: June Building Permits, est. 1.5m, prior 1.49m, revised 1.5m

- 08:30: June Building Permits MoM, est. 0.2%, prior 5.2%, revised 5.6%

- 08:30: June Housing Starts, est. 1.48m, prior 1.63m

- 08:30: June Housing Starts MoM, est. -9.3%, prior 21.7%

DB's Jim Reid concludes the overnight wrap

There are two quite important prints today that might give markets some direction one way or another. The first is UK CPI just after we go to print with the second US housing starts which after a surprise spike up last month is expected to normalise back to low levels. But there will be fun and games if it doesn't. In terms of earnings, stand by for Tesla, Netflix and IBM after the bell and Goldman Sachs before.

With regards to the UK, it has the highest inflation rate in the G7 at 8.7%, and we’ve had upside surprises in all of the last 4 CPI prints, so it’s generated more and more focus. In turn, that’s driven a big reappraisal as to how far the Bank of England will need to hike rates, whilst gilts have significantly underperformed their counterparts elsewhere this year. In terms of what to expect today, our UK economist sees the year-on-year measure coming down half a point to 8.2%. However, he thinks that core CPI will inch up to 7.2%, which would be the highest in 31 years. Last month saw the BoE surprise with a 50bp hike, and today’s reading will be an important factor in whether they go for 50bps in August again or dial back to a 25bps pace. As it stands, markets are pricing in a decent 75% chance of a 50bps move.

In terms of US housing starts. The May reading saw a massive surge in the measure to a 13-month high, whilst it marked the biggest monthly jump in percentage terms since October 2016. So the big question is whether that can be sustained. Our US economists expect that to fall back in June, coming in at 1.425m, down from 1.631m in May. So back to relatively subdued levels. However, there is other evidence that US housing is continuing to rebound, with yesterday’s NAHB housing market index rising to 56 as expected, which marks its 7th consecutive monthly gain.

The biggest moves over the last 24 hours have been in European rates after Dutch central bank governor Knot, one of the biggest hawks on the Governing Council, partially pushed back on the idea of a second ECB hike in September. He said that “beyond July it would at most be a possibility but by no means a certainty”. The fact that was coming from a more hawkish voice added to the sense that the ECB’s widely-expected hike next week might be their last of this cycle. 10yr bunds (-9.7bps), OATs (-10.1bps) and BTPs (-14.1bps) saw significant declines. The terminal ECB rate priced in for December 2023 fell by -3.3bps, though this is still pricing in 47bp of further hikes, while June 2024 pricing saw a more pronounced -10.2bp decline.

The data was a bit mixed yesterday with US industrial production contracting for a second consecutive month in June. In fact, it’s now in negative territory on a year-on-year basis for the first time since the pandemic, so that’s another indicator pointing towards stagnating growth in a week where the more optimistic soft-landing narrative rules the waves.

In terms of the details of that release, the main headline was a -0.5% contraction in June (vs. unch expected), as well as a downward revision to May. On top of that, the capacity utilisation number came in at a 20-month low of 78.9% (vs. 79.5% expected). And if that wasn’t enough, US retail sales were also fairly mixed, with the headline measure up just +0.2% in June (vs. +0.5% expected), albeit with modest upward revisions to May. However, retail control (which feeds directly into GDP) was strong at +0.6% versus +0.2% expected.

Nonetheless, market optimism dominated during the US session. Confidence in the view that the Fed will hike next week inched up a fraction, with a 96% chance of a move priced in, while June 2024 Fed pricing rose +3.6bps yesterday to 4.68%. This front-end move saw the 2yr Treasury yield rise slightly (+2.4bps), closing +11bps above its intra-day lows. The 10yr yield partially reversed its earlier rally during European hours to finish -1.9bp on the day but has dipped back another -1.7bps this morning.

US equities put in another strong performance, with the S&P 500 (+0.71%) advancing to a fresh 15-month high. Energy stocks outperformed as oil and gas prices saw a decent rebound, with Brent Crude up +1.44% to $79.63/bbl. Bank stocks also outperformed (+1.90%) as results from Bank of America (+4.42%) and Morgan Stanley (+6.45%) beat expectations with investors seeing optimism in the outlooks. Tech stocks performed strongly as well, with the NASDAQ (+0.76%) and the FANG+ (+1.36%) gaining ahead of earnings from Tesla and Netflix after the close today. Back in Europe equities saw a solid rise after Monday’s declines, with the STOXX 600 recovering by +0.62%.

Asian equity markets are mostly lower this morning erasing their earlier gains as China’s growth concerns continue to weigh on risk sentiment. As I type, the Hang Seng (-1.43%) is extending its losses and is the worst performer across the region with the CSI (-0.32%), the Shanghai Composite (-0.25%) and the KOSPI (-0.15%) also trading in negative territory. Elsewhere, the Nikkei (+0.97%) is bucking the trend. S&P 500 (-0.05%) and NASDAQ 100 (-0.09%) futures are marginally lower ahead of a busy earnings day.

In FX, the Japanese yen (-0.28%) has weakened for a second consecutive day against the dollar, trading at 139.22, after the Bank of Japan (BOJ) Governor Kazuo Ueda indicated that the central bank would maintain its ultra-easy monetary policy as there is still some distance to sustainably achieve its inflation target.

There wasn’t much other data to speak of yesterday, but we got a mixed picture from the latest Canadian inflation release. That showed headline CPI was down to 2.8% in June (vs. 3.0% expected), but the core measures were more resilient than expected. For instance, the core CPI median measure remained at 3.9% (vs. 3.7% expected), and the core CPI trim measure only fell to 3.7% (vs. 3.6% expected).

To the day ahead now, and data releases include the UK CPI reading for June, along with US housing starts and building permits for June. From central banks, we’ll hear from the ECB’s Vujcic and BoE Deputy Governor Ramsden. Lastly, today’s earnings include Tesla, Netflix, Goldman Sachs and IBM.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire