Futures Flat As Crushing 37bps Curve Inversion Screams Recession

Futures Flat As Crushing 37bps Curve Inversion Screams Recession

US futures are mixed on Thursday, first trading in the red, then turning…

US futures are mixed on Thursday, first trading in the red, then turning green before moving unchanged, as investors shrugged off growth warnings from the bond market while Taiwan war fears faded further despite drills launched by China overnight. Oil bounced back from the lowest level in almost six months. Contracts on the S&P 500 were flat while Nasdaq futures were modestly green, suggesting the tech-heavy Nasdaq will extend an advance of 19% from its June 16 low on the back of a massive CTA, buyback and retail-driven buying frenzy.

In premarket trading, Alibaba gained 3.4% after reporting revenue for the first quarter that beat the average analyst estimate. Adjusted earnings per American depositary receipt also topped expectations. Altice USA shares jumped 5% after the cable television provider reported second-quarter results and announced it received inquiries for its Suddenlink assets. US-listed Chinese tech stocks including JD.com, Pinduoduo and Baidu rise in premarket trading Thursday as Alibaba shares jump 3.9% after reporting better-than-expected revenue in the first quarter. Here are some other notable premarket movers:

- AMTD Idea (AMTD) shares slump 11.5% putting the Hong-Kong based financial services firm on track to slump for a second straight day after a wild 237% jump earlier this week.

- Eli Lilly (LLY) falls 2% after the company cut its adjusted earnings per share forecast for the full year.

- Equinox Gold Corp. (EQX) slides 2.5% after reporting second quarter results that missed consensus analyst estimates for revenue and posted a loss per share, and announced a CEO change.

- Fastly Inc. (FSLY) shares are down 7% after the infrastructure software company reported second quarter revenue that beat expectations.

- Gannett Co. Inc. (GCI) shares plunge 5% after the company lowered its full-year revenue and Ebitda outlook, citing “current economic conditions.”.

- Kohl’s Corp. (KSS) was downgraded to market perform from outperform at Cowen, with analyst Oliver Chen saying a “weakening and inflationary consumer backdrop” could drive EPS downside. Shares decline 3%.

- Pacific Biosciences (PACB) 2Q results look broadly in line but guidance has been cut significantly, albeit this is not a major surprise, analysts say. Shares down 4% in US premarket trading.

- Revolve Group Inc. (RVLV) shares are down 13% after the e-commerce fashion company reported quarterly net sales and earnings per share that fell short of analysts’ expectations.

- Skillz (SKLZ) shares tumble 11.6% after the mobile games platform operator cut its full-year guidance for revenue, with Citi noting that revenue and user metrics disappointed.

- Under Armour (UAA) is downgraded to neutral from outperform at Baird, which says its view of the athletic-wear retailer’s near-term prospects has “deteriorated materially” over the past two quarters, and faces further pressure from an uncertain macroeconomic environment. The stock declines 0.5% in premarkettrading.

- Yellow Corp. (YELL) shares jump 37% after the logistics company reported earnings per share for the second quarter that beat the average analyst estimate.

So far US stocks have proven resilient to heightened bond market anxiety and an inverted Treasury yield curve flashing warnings on economic risks, as the S&P 500 climbs back toward the highest level in two months ignoring the screaming recession warning from the 2s10s curve which is now 37bps inverted.

But a global wave of monetary tightening risks upending those gains. The Bank of England unleashed its first half-point hike since 1995 in an effort to control inflation, joining some 70 other institutions around the world moving rates up in outsized steps.

“There’s an intense tug-of-war happening in the economy and markets,” said Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors. “On one side, you have a narrative that reasonable growth is going to support continued inflation pressure and keep the Fed hiking. The other narrative is that slowing growth is going to ease inflation and allow the Fed to stop hiking.”

Meanwhile, US-China tension remains among the uncertainties clouding the outlook. Taiwan braced for the Chinese military to start firing in exercises being held around the island in response to US House Speaker Nancy Pelosi’s visit. Here are the latest headlines surrounding Taiwan/Pelosi:

- China's Taiwan Affairs Office said the Taiwan issue is not a regional issue but is a China internal affairs issue, while it added that punishment of pro-Taiwan independence diehards and external forces is reasonable and lawful.

- Taiwan's Defence Ministry said unidentified aircraft which were likely drones, flew above Kinmen Islands on Wednesday night, while the military fired flares to drive away the aircraft, according to Reuters.

- Taiwan's Defence Ministry said troops will continue to reinforce alertness level and are carrying out daily training as usual, while the military will react appropriately to an enemy situation and safeguard national security and sovereignty, according to Reuters.

- ASEAN Foreign Ministers are concerned about international and regional volatility and are concerned volatility could lead to a miscalculation, serious confrontation, open conflicts, and unpredictable consequences among major powers, according to Reuters.

- US House Speaker Pelosi plans to visit an inter-Korean border area jointly controlled by the American-led UN Command and North Korea, according to a South Korean official cited by Reuters.

- China's PLA has added an additional zone for its military exercise encircling Taiwan starting Thursday, exercises have been extended until Monday at 10:00, via dwnews' Yang citing Taiwan's port authority. Now seven zones around Taiwan.

Gains in the Stoxx Europe 600 Index were led by retailers, leisure and technology firms, alongside an advance in shares of Chinese tech companies. Among individual stock moves, Glencore Plc shares fell as much as 2% as its capital return plans overshadowed solid first-half results. Ubisoft shares surged as much as 21% after Tencent reached out to Ubisoft’s founding Guillemot family and expressed interest in increasing its stake, according to Reuters. Here are the most notable European movers:

- Rolls-Royce drops as much as 12% in London. Jefferies highlights that 1H adjusted Ebit came in 24% below consensus, is disappointed Civil margin “once stripped of a number of one-offs, remains well below breakeven.”

- SES shares drop as much as 10%, the most intraday since April 2020, as some analysts raised doubts about a potential combination with Intelsat after the FT reported deal talks between the two companies.

- Ambu falls as much as 16%, the most intraday since May 6, after the company slashed its organic revenue forecast for the full year and said it will cut about 200 jobs from its global workforce.

- Lufthansa gains as much as 7.4% after the airline forecast a “significant increase” in earnings in the third quarter compared to the second and provided a clearer outlook for full-year profit, predicting adjusted Ebit of more than EU500m.

- Next shares climb as much as 3.2% after the UK apparel retailer reported better-than-expected 2Q sales and raised its profit outlook for the year.

- Adidas shares gain as much as 4.4% after the German sportswear company reported 2Q results that were largely in line with expectations, following last week’s profit warning.

- Merck KGaA shares rise as much as 1.7% after the German pharmaceutical group’s 2Q report showed stable growth for its Life Science division despite abating Covid-19 tailwinds, with Jefferies saying it sends a “positive message” for the rest of 2022.

Earlier in the session, Asian stocks rebounded as easing tensions over Taiwan and overnight gains on the Nasdaq fueled a rally in Chinese tech shares ahead of key earnings reports. The MSCI Asia Pacific Index climbed 0.5%, set for its first gain in three sessions. Alibaba, which is scheduled to release earnings later Thursday, and e-commerce peers Meituan and JD.com helped boost the Hang Seng Tech Index as much as 3.4%, most in more than a month. Other benchmarks in Hong Kong and South Korea’s tech-heavy Kosdaq were among the region’s outperformers.

“Hong Kong stock markets are getting re-rated after seeing the risk-off mood due to Taiwan tensions, as there were no military conflicts,” said Xuehua Cui, a China equity analyst at Meritz Securities in Seoul. US House Speaker Nancy Pelosi left Taiwan after reaffirming US support for the democratically elected government in Taipei. China responded with trade curbs and military drills. Elsewhere in Asia, the main Philippine index reached its highest since June 10 on foreign inflows. Asia’s key stock benchmark has rebounded from its July low, but its recent recovery has been lagging behind US peers amid a property crisis in China and heightened geopolitical risks.

Japanese equities erased earlier gains and slipped as Toyota announced first-quarter earnings that missed estimates and as investors continue to evaluate corporate earnings both domestically and abroad. The Topix Index was virtually unchanged at 1,930.73 with Toyota Motor leading declines as of market close Tokyo time, while the Nikkei advanced 0.7% to 27,932.20. Toyota Motor shares dropped during market hours as the automaker reported disappointing first quarter earnings and kept its conservative outlook for the current year. Out of 2,170 shares in the index, 1,198 rose and 849 fell, while 123 were unchanged. “Toyota Motor’s financial results confirmed that the impact of high raw material and fuel prices was strong enough to offset the effects of the weak yen,” said Shuji Hosoi, an analyst at Daiwa Securities. “The fact that the company didn’t change its full-year operating income forecast negatively impacted the markets, which had been expecting an upward revision.”

India’s Sensex index snapped a six-session rally, dragged by Reliance Industries and leading lenders, on risk-aversion ahead of a monetary-policy announcement on Friday. The S&P BSE Sensex fell 0.1% to 58,298.80, in Mumbai, after paring decline of as much as 1.3% in the session. The NSE Nifty 50 Index was flat. Both gauges posted early gains and appeared headed for their longest winning streaks since October 2021, but reversed course. “The sudden drop in indexes is most likely led by ‘basket selling’ from foreign portfolio investors ahead of the central bank’s rate decision on Friday,” said Abhay Agarwal, a fund manager at Piper Serica Advisors. “Stocks have gained for six straight sessions and investors may want to reap gains ahead of a major policy event.” Reliance Industries fell 1.3%, while State Bank of India and Axis Bank led declines among lenders. Economists expect the Reserve Bank of India to raise rates for a third consecutive time on Friday but remain divided on the level of the hike aimed at fighting inflation and supporting a weakening currency. Of 30 shares in the Sensex index, 17 rose and 13 fell. Both of India’s equity benchmarks had gained least 5.5% in previous six sessions driven by $1.7 billion of net purchases by foreigners since the end of June amid signs that inflationary pressures are cooling. Eight of the 19 sector sub-indexes compiled by BSE Ltd. declined on Thursday. A measure of telecom stocks was the worst performer among the sectoral measures.

In FX, the dollar consolidated as traders awaited US payrolls data due later in the day for clues on the pace of future Federal Reserve rate hikes. Sterling tumbled after the BOE delivered its biggest rate hike in 27 years, pushing rates up by 50bps, however it also warned of a devastating stagflation, hiking its inflation forecast to 13.3% in October even as it predicted a harrowing 5-quarter long recession.

In rates, Treasuries were moderately cheaper across the curve - which continues to invert deeply with the 2s10s now -37bps, the biggest yield curve inversion since 2000 as traders increased wagers on Federal Reserve rate hikes ahead of Friday’s US jobs data - as US stock futures added to Wednesday’s gains. The US 10-year yield dropping to 2.70% as Federal Reserve officials indicated they were resolute on aggressive hikes to cool inflation, dashing market hopes they were ready to embark on a shallower rate path. Treasuries offered little initial reaction to Bank of England decision to hike rates 50bp in an 8-1 vote while warning of a 5 quarter-long recession. Front-end yields cheaper by ~2bp on the day, flattening 2s10s and 5s30s spreads by ~1.5bp and ~0.5bp; 10-year yields around 2.71% trade cheaper by 5bp vs bunds. European long-end bonds nudged higher. In the UK, focus is on the Bank of England’s rate decision, with a majority of economists anticipating a 50-basis-point hike.

In commodities, oil drifted 0.2% lower to trade at the $90 level as investors weighed weaker US gasoline demand and rising inventories against a token supply increase from OPEC+. Spot gold rises roughly $20 to trade near $1,787/oz. Base metals are mixed; LME lead falls 1.1% while LME zinc gains 1.2%.

Bitcoin slips back below the USD 23k mark but remains in relative proximity to the level in a tight range.

Looking to the day ahead now and we have US June trade balance and Initial Jobless Claims, Germany June factory orders, July construction PMI, UK July new car registrations, construction PMI, Canada June building permits and international merchandise trade. Earnings will include Alibaba, Eli Lilly, Toyota, ICE, ConocoPhillips, Bayer, Glencore, Cigna, Rolls-Royce, adidas, Cheniere, DBS, Apollo, Lyft, Expedia, Deutsche Lufthansa, Warner Bros Discovery, Vertex Pharmaceuticals, DoorDash, Atlassian, Amgen, Block, EOG, Kellogg and AMC.

Market Snapshot

- S&P 500 futures little changed at 4,153.75

- STOXX Europe 600 up 0.2% to 439.32

- MXAP up 0.4% to 159.68

- MXAPJ up 0.6% to 521.36

- Nikkei up 0.7% to 27,932.20

- Topix little changed at 1,930.73

- Hang Seng Index up 2.1% to 20,174.04

- Shanghai Composite up 0.8% to 3,189.04

- Sensex down 0.6% to 57,993.23

- Australia S&P/ASX 200 little changed at 6,974.93

- Kospi up 0.5% to 2,473.11

- German 10Y yield little changed at 0.89%

- Euro up 0.1% to $1.0178

- Brent Futures little changed at $96.78/bbl

- Brent Futures little changed at $96.75/bbl

- Gold spot up 0.4% to $1,773.19

- U.S. Dollar Index down 0.13% to 106.37

Top Overnight News from Bloomberg

- China’s military fired missiles into the sea on Thursday in live-fire military exercises around the island in response to US House Speaker Nancy Pelosi’s visit, even as Taipei played down the impact on flights and shipping.

- The Bank of England on Thursday is expected to push through the biggest interest-rate increase in 27 years despite growing risks of a recession.

- European stocks edged higher on Thursday as investors continued to weigh the path of corporate earnings, while attention turned to the Bank of England’s policy decision later in the day.

- The dollar is close to a 20-year high, despite talk of its inevitable demise. While reluctant to add another article that ends up in traders’ trash cans, current pricing is extreme.

- Asia’s emerging economies are drawing on large foreign exchange reserves to help prop up their currencies rather than going all-out with interest-rate hikes.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were firmer as the positive momentum rolled over from global peers. ASX 200 was kept afloat by tech after similar outperformance of the sector stateside. Nikkei 225 briefly reclaimed the 28k level amid recent JPY weakness and as the earnings deluge continued. Hang Seng and Shanghai Comp conformed to the heightened risk appetite with firm gains in tech including Alibaba ahead of its earnings and with Hong Kong set to provide HKD 2k in consumption vouchers from Sunday.

Top Asian News

- China’s Yiwu city will conduct mass testing and China's Sanya city is on lockdown amid a COVID flare-up, according to state media.

- China Cancels Japan Meeting Over G-7 Criticism of Taiwan Drills

- SoftBank Raises $22 Billion Through Alibaba Derivatives: FT

- China State-Backed Builder’s Dollar Bonds Slump as Worries Mount

- Tiger Global Fund Halves Stake in India Food Platform Zomato

- Additional Share Sales Break Asia’s Usual Summer Lull: ECM Watch

- Li Ka-shing’s CK to Sell AMTD Stake After Unit Soars 14,000%

European bourses are firmer across the board, Euro Stoxx 50 +0.9%, with the general tone constructive though the FTSE 100 lags pre-BoE amid GBP strength. Stateside, US futures have lifted from initial rangebound action, ES +0.3%, with specific newsflow limited pre-data/Fed speak

Top European News

- Next Raises Profit Outlook as Hot Spell Spurs Fashion Buying

- French Tech Startup Back Market Said to Start Early IPO Prep

- Goldman, Bernstein Strategists Say Stocks Rally Can Fizzle Out

- European Retailers Outperform, Fueled by Zalando Relief Rally

- Czech Finance Minister Attending Central Bank’s Rate Meeting

- Credit Agricole’s Investment Bank Drives Earnings Beat

FX

- DXY remains subdued in early European trade following a relatively contained APAC session; fresh session lows are seen heading into the US entrance.

- GBP/USD and EUR/USD are currently buoyed, but seemingly more as a function of the Dollar with the former gearing up for the BoE.

- A mixed session thus far for the non-US Dollars, with the Antipodeans leading the charge whilst the Loonie remained suppressed by crude prices.

- JPY resides as the current G10 laggard with recent Fed rhetoric fuelling a retracement of last week’s USD/JPY downside.

Fixed Income

- Core consolidation after recent rampant upward move, knife-edge BoE looms; Bund Sep'22 towards mid-point of a +100 tick range.

- USTs are following suit with the yield curve flattening modestly but generally quite contained ahead of Mester (2022 voter, Hawk) who has provided commentary recently.

- Pre-BoE Gilts are supported, but in narrower parameters than EGB peers, as participants look for clarity on the 25/50bp debate as pricing implies a 90% chance of 50bp and circa. 150bp total by end-2022.

Commodities

- Crude consolidates and moves with broader sentiment post-OPEC & pre-JCPOA.

- Currently, benchmarks are firmer by circa. USD 1.00bbl and towards the top-end of relatively/comparably narrow ranges.

- Saudi Arabia OSPs (Sep) vs Oman/Dubai average: Arab Light to Asia at USD +9.80/bbl (exp. 9.80-11.10/bbl), according to Reuters sources.

- Spot gold is bid and benefitting from a USD pullback that has sent the yellow-metal above the 50-DMA at best; base metals somewhat mixed.

US Event Calendar

- 07:30: July Challenger Job Cuts YoY, prior 58.8%

- 08:30: June Trade Balance, est. -$80b, prior -$85.5b

- 08:30: July Initial Jobless Claims, est. 260,000, prior 256,000; Continuing Claims, est. 1.38m, prior 1.36m

DB's Jim Reid concludes the overnight wrap

One thing we can say for sure is that August hasn’t been dull so far and we’ve only had three days. This is all before the biggest BoE hike for 27 years (50bps) likely today, and then US payrolls tomorrow.

Indeed, there have been some remarkable ranges in treasuries so far in the three days of August. In just over 24 hours from mid-afternoon London time on Tuesday, 2yr US yields moved from 2.83% to 3.18%, 5yrs from 2.58% to 2.96% and 10yrs from 2.52% to 2.83%. These all marked the high points as the three closed at 3.07% (+1.4bps on the day), 2.83% (-2.4bps) and 2.71% (-4.5bps) respectively, 11bps to 13bps off their intra-day highs immediately after a strong US services ISM yesterday. This led to a big curve flattening as 2s10s closed c.6bps lower at -36bps. This morning in Asia, treasury yields are pretty much unchanged.

If that wasn’t enough, the Nasdaq 100 (+2.73%) surged to finish the day at a level last seen on May 4th leaving a strong S&P 500 (+1.59%) slightly behind. The narratives at the moment are struggling to be consistent though as equities have recently rallied on weaker growth that has been seen as helping to limit how far the Fed can hike. However yesterday equities rallied on stronger economic data regardless of the potential Fed impact.

Discretionary (+2.52%), IT (+2.69%) and communications stocks (+2.48%) were the major drivers of the S&P. The broad rally lifted 79% of benchmark’s members with energy (-2.97%) being the only sector to close in the red as oil plummeted. Speaking of which, although the OPEC+ agreed to increase its September output by 100k bpd, way below the July and August increases north of 600k, crude’s short-lived almost +3% gain unwound fairly quickly, with both WTI (-3.87%) and Brent (-3.60%) weaker on lower US gasoline demand as consumers seem to be driving less. Oil is very slightly higher in Asia.

In terms of earnings, Moderna (+16%), PayPal (+9.25%) and CVS (+6.3%) were among top performers in the S&P 500 after a combination of upbeat results and perhaps more importantly buy back announcements. Another interesting snippet from this earnings season came when Bloomberg reported that Meta is looking for a potential debut in bond markets. News of debt sales by Apple and Intel already came through earlier this week as well, supporting narratives of resilience in corporate debt markets.

Dissecting the data, just before the ISM services was released, we got a slight upward revision for the US services PMI (47.3 vs 47.0) but the real surprise was the ISM services index itself. The print showed an unexpected expansion from 55.3 in June to 56.7 last month, the highest since April, while the median Bloomberg estimate stood at 53.5. The employment index also improved to 49.1 from 47.4 and business activity and new orders indicators were the highest since January, while prices paid plunged from 80.1 to 72.3. Another strong reading came from June factory orders that increased +2.0% (vs +1.2% expected), up from May’s revised reading of +1.8% (from +1.6% previously).

This data dovetailed with comments from a list of Fed speakers over the last 24 hours, including Bullard, Daly, Barkin and Kashkari, all saying that the central bank is not close to finishing its work and markets shouldn’t expect a quick reversal to cuts.

This all supports our view that the US isn’t in recession yet. As we’ve said many times before we think it’s almost inevitable it does go into one within say 12 months but that we still might need the lagged impact of an aggressive (but necessary) series of rate hikes first to get us there. The risks to this view in terms of an earlier recession would probably be due to a sudden self fulfilling loss of confidence as everyone talks about imminent recession risk, or if financial conditions dramatically collapse. To be fair the latter was very worrying by mid-June but we’ve seen a tremendous loosening since.

Over to Asia and the strong gains in US equities are echoing in Asia with all the key markets trading higher. As I type, the Hang Seng (+1.78%) is leading the way across the region helped by gains in Chinese technology companies with shares of Alibaba climbing around +5.0% ahead of its earnings results later today. Elsewhere, the Nikkei (+0.54%), and the Kospi (+0.36%) are trading higher in early trade. Over in Mainland China, the Shanghai Composite (+0.15%) and the CSI (+0.40%) are both trading in the green.

Outside of Asia, stock futures in the US are pausing for breath with contracts on the S&P 500 (-0.10%) and NASDAQ 100 (-0.20%) moving slightly lower.

Early morning data showed that Australia’s trade balance swelled to a record high of A$17.67bn in June (v/s A$14.0bn expected) from A$15.97bn in May driven by strong prices of key exports from grains to metals and gold.

Elsewhere, although Pelosi left Taiwan yesterday without incident, remember that China will start 4 days of military drills today around the island. So be prepared for headlines to come through.

Back to yesterday and European shares rallied but missed the main part of the US climb with the STOXX 600 closing with a +0.51% advance for the day after a steady march higher throughout the session. It was an across-the-board rally led by IT (+2.78%), financials (+1.60%) and discretionary (+1.52%) stocks. The few sectors in the red - utilities (-0.94%), healthcare (-0.92%) and communications (-0.35%) - were left behind by a risk-on mood.

Speaking of European utilities, it is a sector that has faced challenges not only amid the Russian gas story but also the extreme heat in Europe. Our European economists cover implications of the drought-driven low water levels for the German economy here. As a reminder, it was an important topic back in 2018 but today’s situation with gas supplies reinforces its effect given coal plants’ reliance on waterways for supplies. Linked in, yesterday’s announcement by Uniper about potentially limiting output at a coal plant in Germany sent gas futures in New York up by almost +10%, with contracts holding on to a +7.71% gain by the close of US markets. Other companies depend on water traffic too and water-intensive industries are likely to get affected as well. Earlier this week EDF has warned about potential further nuclear power cuts as river water, used for plant cooling, becomes too warm. Expect this to be an increasingly pertinent and market-moving issue across industries.

Diving back into market movements, the bullish sentiment in European stocks was strong enough to overpower surging yields. In Germany the belly of the curve surged, with 5y yields (+7.6bps) racing ahead of both the front end (+6.9bps) and the 10y (+5.6bps) that was mainly upheld by higher breakevens (+6.1bps). While a similar story was seen in France (OATs +3.4bps), Italy stood out with an across the curve decline in yields. 2s10s still flattened as the 2y yield (-1.5ps) fell by less than the 10y (-4.1bps). We should note that US yields rallied 7-8bps after Europe closed.

Central banks and yields will be in focus today as well since today’s BoE’s meeting will likely be top of the list in terms of events for European markets and our UK economists expect the Bank to hike by +50bps (taking the Bank Rate to 1.75%). Their full preview is here. This hike would imply the largest single Bank Rate increase since 1995 and come amid the 9.4% CPI print for June, a 40-year high. They also updated their growth outlook for the country yesterday (link here) and now expect the economy to contract in Q4-22 and Q1-23 in a short and mild technical recession. Gilts behaved similar to other European bond markets yesterday, with the 2y yield (+7.1bps) rising by more than the 10y (+4.4bps) but both lagging the 5y (+9.0bps).

Staying with Europe and briefly returning to yesterday’s other data releases, Germany’s exports accelerated to +4.5% in June, way ahead of the +1.0% median estimate on Bloomberg’s and May’s revised +1.3% (from -0.5% previously). Imports came in softer than expected, however, slowing to just +0.2% (+1.3% expected). Elsewhere, Eurozone’s retail sales contracted -3.7% yoy in June, missing estimates of -1.7%. The PPI accelerated to a monthly gain of +1.1% in June relative to the prior +0.5% (revised from +0.7%).

To the day ahead now and we have US June trade balance, Germany June factory orders, July construction PMI, UK July new car registrations, construction PMI, Canada June building permits and international merchandise trade. Earnings will include Alibaba, Eli Lilly, Toyota, ICE, ConocoPhillips, Bayer, Glencore, Cigna, Rolls-Royce, adidas, Cheniere, DBS, Apollo, Lyft, Expedia, Deutsche Lufthansa, Warner Bros Discovery, Vertex Pharmaceuticals, DoorDash, Atlassian, Amgen, Block, EOG, Kellogg and AMC.

International

Net Zero, The Digital Panopticon, & The Future Of Food

Net Zero, The Digital Panopticon, & The Future Of Food

Authored by Colin Todhunter via Off-Guardian.org,

The food transition, the energy…

Authored by Colin Todhunter via Off-Guardian.org,

The food transition, the energy transition, net-zero ideology, programmable central bank digital currencies, the censorship of free speech and clampdowns on protest. What’s it all about? To understand these processes, we need to first locate what is essentially a social and economic reset within the context of a collapsing financial system.

Writer Ted Reece notes that the general rate of profit has trended downwards from an estimated 43% in the 1870s to 17% in the 2000s. By late 2019, many companies could not generate enough profit. Falling turnover, squeezed margins, limited cashflows and highly leveraged balance sheets were prevalent.

Professor Fabio Vighi of Cardiff University has described how closing down the global economy in early 2020 under the guise of fighting a supposedly new and novel pathogen allowed the US Federal Reserve to flood collapsing financial markets (COVID relief) with freshly printed money without causing hyperinflation. Lockdowns curtailed economic activity, thereby removing demand for the newly printed money (credit) in the physical economy and preventing ‘contagion’.

According to investigative journalist Michael Byrant, €1.5 trillion was needed to deal with the crisis in Europe alone. The financial collapse staring European central bankers in the face came to a head in 2019. The appearance of a ‘novel virus’ provided a convenient cover story.

The European Central Bank agreed to a €1.31 trillion bailout of banks followed by the EU agreeing to a €750 billion recovery fund for European states and corporations. This package of long-term, ultra-cheap credit to hundreds of banks was sold to the public as a necessary programme to cushion the impact of the pandemic on businesses and workers.

In response to a collapsing neoliberalism, we are now seeing the rollout of an authoritarian great reset — an agenda that intends to reshape the economy and change how we live.

SHIFT TO AUTHORITARIANISM

The new economy is to be dominated by a handful of tech giants, global conglomerates and e-commerce platforms, and new markets will also be created through the financialisation of nature, which is to be colonised, commodified and traded under the notion of protecting the environment.

In recent years, we have witnessed an overaccumulation of capital, and the creation of such markets will provide fresh investment opportunities (including dodgy carbon offsetting Ponzi schemes) for the super-rich to park their wealth and prosper.

This great reset envisages a transformation of Western societies, resulting in permanent restrictions on fundamental liberties and mass surveillance. Being rolled out under the benign term of a ‘Fourth Industrial Revolution’, the World Economic Forum (WEF) says the public will eventually ‘rent’ everything they require (remember the WEF video ‘you will own nothing and be happy’?): stripping the right of ownership under the guise of a ‘green economy’ and underpinned by the rhetoric of ‘sustainable consumption’ and ‘climate emergency’.

Climate alarmism and the mantra of sustainability are about promoting money-making schemes. But they also serve another purpose: social control.

Neoliberalism has run its course, resulting in the impoverishment of large sections of the population. But to dampen dissent and lower expectations, the levels of personal freedom we have been used to will not be tolerated. This means that the wider population will be subjected to the discipline of an emerging surveillance state.

To push back against any dissent, ordinary people are being told that they must sacrifice personal liberty in order to protect public health, societal security (those terrible Russians, Islamic extremists or that Sunak-designated bogeyman George Galloway) or the climate. Unlike in the old normal of neoliberalism, an ideological shift is occurring whereby personal freedoms are increasingly depicted as being dangerous because they run counter to the collective good.

The real reason for this ideological shift is to ensure that the masses get used to lower living standards and accept them. Consider, for instance, the Bank of England’s chief economist Huw Pill saying that people should ‘accept’ being poorer. And then there is Rob Kapito of the world’s biggest asset management firm BlackRock, who says that a “very entitled” generation must deal with scarcity for the first time in their lives.

At the same time, to muddy the waters, the message is that lower living standards are the result of the conflict in Ukraine and supply shocks that both the war and ‘the virus’ have caused.

The net-zero carbon emissions agenda will help legitimise lower living standards (reducing your carbon footprint) while reinforcing the notion that our rights must be sacrificed for the greater good. You will own nothing, not because the rich and their neoliberal agenda made you poor but because you will be instructed to stop being irresponsible and must act to protect the planet.

NET-ZERO AGENDA

But what of this shift towards net-zero greenhouse gas emissions and the plan to slash our carbon footprints? Is it even feasible or necessary?

Gordon Hughes, a former World Bank economist and current professor of economics at the University of Edinburgh, says in a new report that current UK and European net-zero policies will likely lead to further economic ruin.

Apparently, the only viable way to raise the cash for sufficient new capital expenditure (on wind and solar infrastructure) would be a two decades-long reduction in private consumption of up to 10 per cent. Such a shock has never occurred in the last century outside war; even then, never for more than a decade.

But this agenda will also cause serious environmental degradation. So says Andrew Nikiforuk in the article The Rising Chorus of Renewable Energy Skeptics, which outlines how the green techno-dream is vastly destructive.

He lists the devastating environmental impacts of an even more mineral-intensive system based on renewables and warns:

“The whole process of replacing a declining system with a more complex mining-based enterprise is now supposed to take place with a fragile banking system, dysfunctional democracies, broken supply chains, critical mineral shortages and hostile geopolitics.”

All of this assumes that global warming is real and anthropogenic. Not everyone agrees. In the article Global warming and the confrontation between the West and the rest of the world, journalist Thierry Meyssan argues that net zero is based on political ideology rather than science. But to state such things has become heresy in the Western countries and shouted down with accusations of ‘climate science denial’.

Regardless of such concerns, the march towards net zero continues, and key to this is the United Nations Agenda 2030 for Sustainable Development Goals.

Today, almost every business or corporate report, website or brochure includes a multitude of references to ‘carbon footprints’, ‘sustainability’, ‘net zero’ or ‘climate neutrality’ and how a company or organisation intends to achieve its sustainability targets. Green profiling, green bonds and green investments go hand in hand with displaying ‘green’ credentials and ambitions wherever and whenever possible.

It seems anyone and everyone in business is planting their corporate flag on the summit of sustainability. Take Sainsbury’s, for instance. It is one of the ‘big six’ food retail supermarkets in the UK and has a vision for the future of food that it published in 2019.

Here’s a quote from it:

“Personalised Optimisation is a trend that could see people chipped and connected like never before. A significant step on from wearable tech used today, the advent of personal microchips and neural laces has the potential to see all of our genetic, health and situational data recorded, stored and analysed by algorithms which could work out exactly what we need to support us at a particular time in our life. Retailers, such as Sainsbury’s could play a critical role to support this, arranging delivery of the needed food within thirty minutes — perhaps by drone.”

Tracked, traced and chipped — for your own benefit. Corporations accessing all of our personal data, right down to our DNA. The report is littered with references to sustainability and the climate or environment, and it is difficult not to get the impression that it is written so as to leave the reader awestruck by the technological possibilities.

However, the promotion of a brave new world of technological innovation that has nothing to say about power — who determines policies that have led to massive inequalities, poverty, malnutrition, food insecurity and hunger and who is responsible for the degradation of the environment in the first place — is nothing new.

The essence of power is conveniently glossed over, not least because those behind the prevailing food regime are also shaping the techno-utopian fairytale where everyone lives happily ever after eating bugs and synthetic food while living in a digital panopticon.

FAKE GREEN

The type of ‘green’ agenda being pushed is a multi-trillion market opportunity for lining the pockets of rich investors and subsidy-sucking green infrastructure firms and also part of a strategy required to secure compliance required for the ‘new normal’.

It is, furthermore, a type of green that plans to cover much of the countryside with wind farms and solar panels with most farmers no longer farming. A recipe for food insecurity.

Those investing in the ‘green’ agenda care first and foremost about profit. The supremely influential BlackRock invests in the current food system that is responsible for polluted waterways, degraded soils, the displacement of smallholder farmers, a spiralling public health crisis, malnutrition and much more.

It also invests in healthcare — an industry that thrives on the illnesses and conditions created by eating the substandard food that the current system produces. Did Larry Fink, the top man at BlackRock, suddenly develop a conscience and become an environmentalist who cares about the planet and ordinary people? Of course not.

Any serious deliberations on the future of food would surely consider issues like food sovereignty, the role of agroecology and the strengthening of family farms — the backbone of current global food production.

The aforementioned article by Andrew Nikiforuk concludes that, if we are really serious about our impacts on the environment, we must scale back our needs and simplify society.

In terms of food, the solution rests on a low-input approach that strengthens rural communities and local markets and prioritises smallholder farms and small independent enterprises and retailers, localised democratic food systems and a concept of food sovereignty based on self-sufficiency, agroecological principles and regenerative agriculture.

It would involve facilitating the right to culturally appropriate food that is nutritionally dense due to diverse cropping patterns and free from toxic chemicals while ensuring local ownership and stewardship of common resources like land, water, soil and seeds.

That’s where genuine environmentalism and the future of food begins.

Government

Five Aerospace Investments to Buy as Wars Worsen Copy

Five aerospace investments to buy as wars worsen give investors a chance to acquire shares of companies focused on fortifying national defense. The five…

Five aerospace investments to buy as wars worsen give investors a chance to acquire shares of companies focused on fortifying national defense.

The five aerospace investments to buy provide military products to help protect freedom amid Russia’s ongoing onslaught against Ukraine that began in February 2022, as well as supply arms in the Middle East used after Hamas militants attacked and murdered civilians in Israel on Oct. 7. Even though the S&P 500 recently reached all-time highs, these five aerospace investments have remained reasonably priced and rated as recommendations by seasoned analysts and a pension fund chairman.

State television broadcasts in Russia show the country’s soldiers advancing further into Ukrainian territory, but protests have occurred involving family members of those serving in perilous conditions in the invasion of their neighboring nation to be brought home. Even though hundreds of thousands of Russians also have fled to other countries to avoid compulsory military service, the aggressor’s President Vladimir Putin has vowed to continue to send additional soldiers into the fierce fighting.

While Russia’s land-grab of Crimea and other parts of Ukraine show no end in sight, Israel’s war with Hamas likely will last for at least additional months, according to the latest reports. United Nations’ leaders expressed alarm on Dec. 26 about intensifying Israeli attacks that killed more than 100 Palestinians over two days in part of the Gaza Strip, when 15 members of the Israel Defense Force (IDF) also lost their lives.

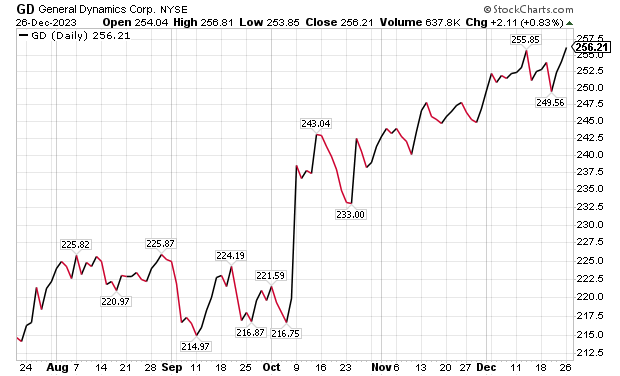

Five Aerospace Investments to Buy as Wars Worsen: General Dynamics

One of the five aerospace investments to buy as wars worsen is General Dynamics (NYSE: GD), a Reston, Virginia-based aerospace company with more than 100,000 employees in 70-plus countries. A key business unit of General Dynamics is Gulfstream Aerospace Corporation, a manufacturer of business aircraft. Other segments of General Dynamics focus on making military products such as Abrams tanks, Stryker fighting vehicles, ASCOD fighting vehicles like the Spanish PIZARRO and British AJAX, LAV-25 Light Armored Vehicles and Flyer-60 lightweight tactical vehicles.

For the U.S. Navy and other allied armed forces, General Dynamics builds Virginia-class attack submarines, Columbia-class ballistic missile submarines, Arleigh Burke-class guided missile destroyers, Expeditionary Sea Base ships, fleet logistics ships, commercial cargo ships, aircraft and naval gun systems, Hydra-70 rockets, military radios and command and control systems. In addition, the company provides radio and optical telescopes, secure mobile phones, PIRANHA and PANDUR wheeled armored vehicles and mobile bridge systems.

Chicago-based investment firm William Blair & Co. is among those recommending General Dynamics. The Chicago firm gave an “outperform” rating to General Dynamics in a Dec. 21 research note.

Gulfstream is seeking G700 FAA certification by the end of 2023, suggesting potentially positive news in the next 10 days, William Blair wrote in its recent research note. The investment firm projected that General Dynamics would trade upward upward upon the G700’s certification.

“General Dynamics’ 2023 aircraft delivery guidance of approximately 134 planes assumes that 19 G700s are delivered in the fourth quarter,” wrote William Blair’s aerospace and defense analyst Louie DiPalma. “Even if deliveries fall short of this target, we believe investors will take a glass-half-full approach upon receipt of the certification.”

Chart courtesy of www.stockcharts.com.

Five Aerospace Investments to Buy as Wars Worsen: GD Outlook

The G700 is a major focus area for investors because it is Gulfstream’s most significant aircraft introduction since the iconic G650 in 2012, DiPalma wrote. Gulfstream has the highest market share in the long-range jet segment of the private aircraft market, the highest profit margin of aircraft peers and the most premium business aviation brand, he added.

“The aircraft remains immensely popular today with corporations and high-net-worth individuals,” Di Palma wrote. “Elon Musk has reportedly placed an order for a G700 to go along with his existing G650. Qatar Airways announced at the Paris Air Show that 10 G700 aircraft will become part of its fleet.”

G700 deliveries and subsequent G800 deliveries are expected to be the cornerstone of Gulfstream’s growth and margin expansion for the next decade, DiPalma wrote. This should lead to a rebound in the stock price as the margins for the G700 and G800 are very attractive, he added.

Management’s guidance is for the aerospace operating margin to increase from about 13.2% in 2022 to roughly 14.0% in 2023 and 15.8% in 2024. Longer term, a high-teens profit margin appears within reach, DiPalma projected.

In other General Dynamics business segments, William Blair expects several yet-unannounced large contract awards for General Dynamics IT, to go along with C$1.7 billion, or US$1.29 billion, in General Dynamics Mission Systems contracts announced on Dec. 20 for the Canadian Army. General Dynamics shares are poised to have a strong 2024, William Blair wrote.

Five Aerospace Investments to Buy as Wars Worsen: VSE Corporation

Alexandria, Virginia-based VSE Corporation’s (NASDAQ: VSEC) price-to-earnings (P/E) valuation multiple of 22 received support when AAR Corp. (NYSE: AIR), a Wood Dale, Illinois, provider of aviation services, announced on Dec. 21 that it would acquire the product support business of Triumph Group (NYSE: TGI), a Berwyn, Pennsylvania, supplier of aerospace services, structures and systems. AAR’s purchase price of $725 million reflects confidence in a continued post-pandemic aerospace rebound.

VSE, a provider of aftermarket distribution and repair services for land, sea and air transportation assets used by government and commercial markets, is rated “outperform” by William Blair. The company’s core services include maintenance, repair and operations (MRO), parts distribution, supply chain management and logistics, engineering support, as well as consulting and training for global commercial, federal, military and defense customers.

“Robust consumer travel demand and aging aircraft fleets have driven elevated maintenance visits,” William Blair’s DiPalma wrote in a Dec. 21 research note. “The AAR–Triumph deal is valued at a premium 13-times 2024 EBITDA multiple, which was in line with the valuation multiple that Heico (NYSE: HEI) paid for Wencor over the summer.”

VSE currently trades at a discounted 9.5 times consensus 2024 earnings before interest, taxes, depreciation and amortization (EBITDA) estimates, as well as 11.6 times consensus 2023 EBITDA.

Five Aerospace Investments to Buy as Wars Worsen: VSE Undervalued?

“We expect that VSE shares will trend higher as investors process this deal,” DiPalma wrote. “VSE shares trade at 9.5 times consensus 2024 adjusted EBITDA, compared with peers and M&A comps in the 10-to-14-times range. We think that VSE’s multiple will expand as it closes the divestiture of its federal and defense business and makes strategic acquisitions. We see consistent 15% annual upside for shares as VSE continues to take share in the $110 billion aviation aftermarket industry.”

William Blair reaffirmed its “outperform” rating for VSE on Dec. 21. The main risk to VSE shares is lumpiness associated with its aviation services margins, Di Palma wrote. However, he raised 2024 estimates to further reflect commentary from VSE’s analysts’ day in November.

Chart courtesy of www.stockcharts.com.

Five Aerospace Investments to Buy as Wars Worsen: HEICO Corporation

HEICO Corporation (NYSEL: HEI), is a Hollywood, Florida-based technology-driven aerospace, industrial, defense and electronics company that also is ranked as an “outperform” investment by William Blair’s DiPalma. The aerospace aftermarket parts provider recently reported fourth-quarter financials above consensus analysts’ estimates, driven by 20% organic growth in HEICO’s flight support group.

HEICO’s management indicated that the performance of recently acquired Wencor is exceeding expectations. However, HEICO leaders offered color on 2024 organic growth and margin expectations that forecast reduced gains. Even though consensus estimates already assumed slowing growth, it is still not a positive for HEICO, DiPalma wrote.

William Blair forecasts 15% annual upside to HEICO’s shares, based on EBITDA growth. HEICO’s management cited a host of reasons for its quarterly outperformance, highlighted by the continued commercial air travel recovery. The company also referenced new product introductions and efficiency initiatives.

HEICO’s defense product sales increased by 26% sequentially, marking the third consecutive sequential increase in defense product revenue. The company’s leaders conveyed that defense in general is moving in the right direction to enhance financial performance.

Chart courtesy of www.stockcharts.com.

Five Dividend-paying Defense and Aerospace Investments to Purchase: XAR

A fourth way to obtain exposure to defense and aerospace investments is through SPDR S&P Aerospace and Defense ETF (XAR). That exchange-traded fund tracks the S&P Aerospace & Defense Select Industry Index. The fund is overweight in industrials and underweight in technology and consumer cyclicals, said Bob Carlson, a pension fund chairman who heads the Retirement Watch investment newsletter.

Bob Carlson, who heads Retirement Watch, answers questions from Paul Dykewicz.

XAR has 34 securities, and 44.2% of the fund is in the 10 largest positions. The fund is up 25.82% in the last 12 months, 22.03% in the past three months and 7.92% for the last month. Its dividend yield recently measured 0.38%.

The largest positions in the fund recently were Axon Enterprise (NASDAQ: AXON), Boeing (NYSE: BA), L3Harris Technologies (NYSE: LHX), Spirit Aerosystems (NYSE: SPR) and Virgin Galactic (NYSE: SPCE).

Chart courtesy of www.stockcharts.com

Five Dividend-paying Defense and Aerospace Investments to Purchase: PPA

The second fund recommended by Carlson is Invesco Aerospace & Defense ETF (PPA), which tracks the SPADE Defense Index. It has the same underweighting and overweighting as XAR, he said.

PPA recently held 52 securities and 53.2% of the fund was in its 10 largest positions. With so many holdings, the fund offers much reduced risk compared to buying individual stocks. The largest positions in the fund recently were Boeing (NYSE: BA), RTX Corp. (NYSE: RTX), Lockheed Martin (NYSE: LMT), Northrop Grumman (NYSE: NOC) and General Electric (NYSE:GE).

The fund is up 19.07% for the past year, 50.34% in the last three months and 5.30% during the past month. The dividend yield recently touched 0.69%.

Chart courtesy of www.stockcharts.com

Other Fans of Aerospace

Two fans of aerospace stocks are Mark Skousen, PhD, and seasoned stock picker Jim Woods. The pair team up to head the Fast Money Alert advisory service They already are profitable in their recent recommendation of Lockheed Martin (NYSE: LMT) in Fast Money Alert.

Mark Skousen, a scion of Ben Franklin, meets with Paul Dykewicz.

Jim Woods, a former U.S. Army paratrooper, co-heads Fast Money Alert.

Bryan Perry, who heads the Cash Machine investment newsletter and the Micro-Cap Stock Trader advisory service, recommends satellite services provider Globalstar (NYSE American: GSAT), of Covington, Louisiana, that has jumped 50.00% since he advised buying it two months ago. Perry is averaging a dividend yield of 11.14% in his Cash Machine newsletter but is breaking out with the red-hot recommendation of Globalstar in his Micro-Cap Stock Trader advisory service.

Bryan Perry heads Cash Machine, averaging an 11.14% dividend yield.

Military Equipment Demand Soars amid Multiple Wars

The U.S. military faces an acute need to adopt innovation, to expedite implementation of technological gains, to tap into the talents of people in various industries and to step-up collaboration with private industry and international partners to enhance effectiveness, U.S. Joint Chiefs of Staff Gen. Charles Q. Brown Jr. told attendees on Nov 16 at a national security conference. Prime examples of the need are showed by multiple raging wars, including the Middle East and Ukraine. A cold war involves China and its increasingly strained relationships with Taiwan and other Asian nations.

The shocking Oct. 7 attack by Hamas on Israel touched off an ongoing war in the Middle East, coupled with Russia’s February 2022 invasion and continuing assault of neighboring Ukraine. Those brutal military conflicts show the fragility of peace when determined aggressors are willing to use any means necessary to achieve their goals. To fend off such attacks, rapid and effective response is required.

“The Department of Defense is doing more than ever before to deter, defend, and, if necessary, defeat aggression,” Gen. Brown said at the National Security Innovation Forum at the Johns Hopkins University Bloomberg Center in Washington, D.C.

One of Russia’s war ships, the 360-foot-long Novocherkassk, was damaged on Dec. 26 by a Ukrainian attack on the Black Sea port of Feodosia in Crimea. This video of an explosion at the port that reportedly shows a section of the ship hit by aircraft-guided missiles.

Chairman Joint Chiefs of Staff Gen. Charles Q. Brown, Jr.

Photo By: Benjamin Applebaum

National security threats can compel immediate action, Gen. Brown said he quickly learned since taking his post on Oct. 1.

“We may not have much warning when the next fight begins,” Gen. Brown said. “We need to be ready.”

In a pre-recorded speech at the national security conference, Michael R. Bloomberg, founder of Bloomberg LP, told the John Hopkins national security conference attendees about the critical need for collaboration between government and industry.

“Building enduring technological advances for the U.S. military will help our service members and allies defend freedom across the globe,” Bloomberg said.

The “horrific terrorist attacks” against Israel and civilians living there on Oct. 7 underscore the importance of that mission, Bloomberg added.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Attention Holiday Gift Buyers! Consider purchasing Paul’s inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases or autographed copies! Follow Paul on Twitter @PaulDykewicz. He is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper, after writing for the Baltimore Business Journal and Crain Communications.

The post Five Aerospace Investments to Buy as Wars Worsen Copy appeared first on Stock Investor.

dow jones sp 500 nasdaq stocks pandemic etf micro-cap army recovery russia ukraine chinaGovernment

Health Officials: Man Dies From Bubonic Plague In New Mexico

Health Officials: Man Dies From Bubonic Plague In New Mexico

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

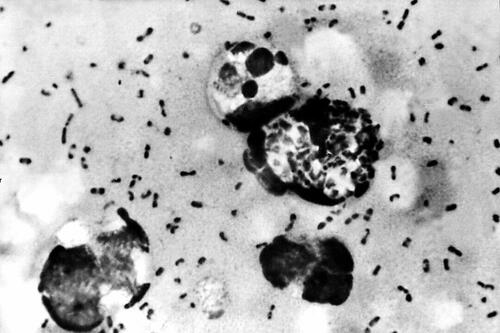

Officials in New Mexico confirmed that a resident died from the plague in the United States’ first fatal case in several years.

The New Mexico Department of Health, in a statement, said that a man in Lincoln County “succumbed to the plague.” The man, who was not identified, was hospitalized before his death, officials said.

They further noted that it is the first human case of plague in New Mexico since 2021 and also the first death since 2020, according to the statement. No other details were provided, including how the disease spread to the man.

The agency is now doing outreach in Lincoln County, while “an environmental assessment will also be conducted in the community to look for ongoing risk,” the statement continued.

“This tragic incident serves as a clear reminder of the threat posed by this ancient disease and emphasizes the need for heightened community awareness and proactive measures to prevent its spread,” the agency said.

A bacterial disease that spreads via rodents, it is generally spread to people through the bites of infected fleas. The plague, known as the black death or the bubonic plague, can spread by contact with infected animals such as rodents, pets, or wildlife.

The New Mexico Health Department statement said that pets such as dogs and cats that roam and hunt can bring infected fleas back into homes and put residents at risk.

Officials warned people in the area to “avoid sick or dead rodents and rabbits, and their nests and burrows” and to “prevent pets from roaming and hunting.”

“Talk to your veterinarian about using an appropriate flea control product on your pets as not all products are safe for cats, dogs or your children” and “have sick pets examined promptly by a veterinarian,” it added.

“See your doctor about any unexplained illness involving a sudden and severe fever, the statement continued, adding that locals should clean areas around their home that could house rodents like wood piles, junk piles, old vehicles, and brush piles.

The plague, which is spread by the bacteria Yersinia pestis, famously caused the deaths of an estimated hundreds of millions of Europeans in the 14th and 15th centuries following the Mongol invasions. In that pandemic, the bacteria spread via fleas on black rats, which historians say was not known by the people at the time.

Other outbreaks of the plague, such as the Plague of Justinian in the 6th century, are also believed to have killed about one-fifth of the population of the Byzantine Empire, according to historical records and accounts. In 2013, researchers said the Justinian plague was also caused by the Yersinia pestis bacteria.

But in the United States, it is considered a rare disease and usually occurs only in several countries worldwide. Generally, according to the Mayo Clinic, the bacteria affects only a few people in U.S. rural areas in Western states.

Recent cases have occurred mainly in Africa, Asia, and Latin America. Countries with frequent plague cases include Madagascar, the Democratic Republic of Congo, and Peru, the clinic says. There were multiple cases of plague reported in Inner Mongolia, China, in recent years, too.

Symptoms

Symptoms of a bubonic plague infection include headache, chills, fever, and weakness. Health officials say it can usually cause a painful swelling of lymph nodes in the groin, armpit, or neck areas. The swelling usually occurs within about two to eight days.

The disease can generally be treated with antibiotics, but it is usually deadly when not treated, the Mayo Clinic website says.

“Plague is considered a potential bioweapon. The U.S. government has plans and treatments in place if the disease is used as a weapon,” the website also says.

According to data from the U.S. Centers for Disease Control and Prevention, the last time that plague deaths were reported in the United States was in 2020 when two people died.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges