Futures Fall, Europe Tumbles Amid Fears Reflation Trade Is Dead, Short Squeeze Turmoil

Futures Fall, Europe Tumbles Amid Fears Reflation Trade Is Dead, Short Squeeze Turmoil

US equity futures rebounded from an overnight selloff even as European shares wiped out their gains for the year early on Thursday, soured by Wednesday’s..

US equity futures rebounded from an overnight selloff even as European shares wiped out their gains for the year early on Thursday, soured by Wednesday's furious sell-off which sent the S&P down 2.6% in its worst rout since October, exacerbated by pandemic lockdowns with no end in sight and as retail traders piled into heavily-shorted companies, sparking losses at hedge funds who are forced to sell their favorite longs and causing turmoil in parts of the market.

Apple reported holiday-quarter sales and profit that beat Wall Street expectations, however, shares of the iPhone maker fell 1.8% premarket. Facebook dipped 0.6% as it warned Apple’s impending privacy changes could hurt revenue by interfering with ad targeting even after soundly beating quarterly revenue estimates. Tesla lost 4.4% after the electric-car maker reported disappointing fourth-quarter results and failed to provide a clear target for 2021 vehicle deliveries. Southwest Airlines’s shares fell 0.2% after the airline posted its first annual loss since 1972 and said it was facing stalled demand in January and February on high levels of COVID-19 cases.

“The initial optimism of early this year is starting to dissipate because of the prospects of tighter pandemic restrictions for longer, and concerns over ‘vaccine nationalism’,” said Michael Hewson, chief market analyst at CMC Markets. “We could see much more choppiness and much more volatility. We have a bit of a perfect storm heading into the month end, which is weighing on equity markets, but I don’t think at the moment we are in a place where it’s going to come crashing off,” Hewson said.

Meanwhile, as investors continued to pile into videogame retailer GameStop, whose shares are now set to surge for a fifth straight session, some investors are starting to question the sustainability of the rally and the impact it will have on markets when it ends.

“While I don’t think the surge in GameStop shares is a signal of euphoria in the broader stock market, the illumination of this trading environment may be the catalyst behind a near-term stock market correction,” said David Trainer, chief executive officer of New Constructs, an investment research firm.

Perhaps, yet as we showed last night, the initial catalyst that sparked the move higher - the massive short overhand - remains, so this rally could go on for quite some time.

Europe's Stoxx 600 Index tumbled to its lowest level this year, erasing all 2021 gains with almost every industry subgroup in the red. Earnings beats from chipmaker STMicroelectronics NV and Diageo Plc were overshadowed by a miss from Swatch and a revenue drop at EasyJet whose shares fell 2.3% after the airline warned it would fly no more than 10% of 2019’s capacity, highlighting the plight of sectors hit by lengthy lockdowns.

Also weighing on sentiment is an ongoing dispute between AstraZeneca Plc and the European Union over vaccine supplies for the region. The Stoxx 600 Tech Index dropped as much as 1.8% to a two-week low: tech stocks dropped led lower by a slide in Apple suppliers after the iPhone maker’s cautious outlook (AMS -2%, Infineon -2.5%, Dialog Semi -3.4%, battery supplier Varta -4.6%), while key customer Samsung missed analysts expectations for 4Q.

The European Union, locked in a public spat with vaccine producer AstraZeneca, wants a shortfall in the company’s supplies to the bloc topped up from production in Britain.

The move by investors into “reflation” trades at the start of the year on then-brighter growth prospects now looked premature, analysts said. “Amid concerns about the speed of vaccine distribution and the COVID-19 impact on economic growth recovery, cyclical credit looks most likely to underperform,” UniCredit analysts said.

Earlier in the session, Asian stocks fell for a third day as risk-off sentiment heightened following a slew of disappointing earnings in Asia and the U.S. The MSCI Asia Pacific Index ex-Japan fell 2%, its biggest drop since November, and was headed for its biggest three-day decline in more than seven months. Japan’s Nikkei fell 1.5%, its sharpest drop since October, and Chinese blue chips lost 2.7% as liquidity tightened before the Lunar New Year holidays.

Traders turned cautious after a series of earnings disappointments from global technology giants, while in Asia, Samsung’s quarterly profit missed estimates with the company warning of weaker results for the current quarter. In the U.S., Tesla’s quarterly profit came below analysts’ projections, while a cautious outlook from Apple executives overshadowed quarterly revenue that topped $100 billion for the first time. Stocks of both companies’ Asian suppliers took hits, dragging down the MSCI Asia Pacific IT Index by 3% and making it the worst gauge on the Asia benchmark. Every equity index in Asia declined. Vietnam was the worst-performing market in the region, with its benchmark gauge falling below its key 50-day moving average. China was also among the lagging markets, as its central bank withdrew short-term liquidity from the financial system at the fastest pace in three months.

In rates, the yield on the 10-year Treasury note briefly fell back below 1% in European morning hours amid haven demand. Treasury yields lower by less than 1bp across long-end of the curve while 10s trade around 1.01%, also slightly richer vs Wednesday’s close and broadly in line with bunds. Asia session saw muted futures volumes, although early weakness was erased after $1.1m/DV01 block purchase in 10-year contract. The Treasury auction cycle concludes at 1pm ET with $62b 7- year sale; 2- and 5-year auctions Monday and Tuesday were well- bid, trade at profits.

In FX, the Bloomberg Dollar Spot Index rose more than 0.3% to its highest since Dec. 22. The euro fell to $1.2093 amid reports the European Central Bank felt markets were under-pricing the risk of more rate cuts, while commodity currencies extended their slump among G-10 peers, led by the Australian and New Zealand dollars. Sweden’s krona edged lower, yet was among the top-performers after briefly erasing gains following a stronger-than-forecast economic confidence survey.

In commodities, the bounce in the dollar kept gold prices soft around $1,837 an ounce. Global demand concerns restrained oil prices despite a drop in U.S. crude stocks. WTI fell 34 cents to $52.51 a barrel. Brent crude futures dropped to $55.50.

On the data front, analysts said the focus will be on German inflation figures and fourth-quarter U.S. economic growth. The U.S. economy is expected to have contracted at its sharpest pace since World War Two in 2020 as COVID-19 ravaged services businesses such as restaurants and airlines, while about 875,000 people likely filed jobless claims last week.

Market Snapshot

- S&P 500 futures down 0.4% to 3,729.25

- STOXX Europe 600 down 2% to 394.98

- MXAP down 2% to 206.86

- MXAPJ down 2.2% to 693.24

- Nikkei down 1.5% to 28,197.42

- Topix down 1.1% to 1,838.85

- Hang Seng Index down 2.6% to 28,550.77

- Shanghai Composite down 1.9% to 3,505.18

- Sensex down 1.1% to 46,879.67

- Australia S&P/ASX 200 down 1.9% to 6,649.69

- Kospi down 1.7% to 3,069.05

- German 10Y yield fell 1.0 bps to -0.556%

- Euro down 0.04% to $1.2106

- Italian 10Y yield rose 0.8 bps to 0.544%

- Spanish 10Y yield fell 0.8 bps to 0.066%

- Brent futures little changed at $55.80/bbl

- Gold spot down 0.2% to $1,840.89

- U.S. Dollar Index up 0.1% to 90.74

Top Overnight News from Bloomberg

- The ECB is ready to use all the tools necessary to stimulate inflation, and is keeping a close eye on the euro’s appreciation, Governing Council member Olli Rehn said

- Euro-area economic confidence fell in January after governments extended restrictions to contain the spread of the coronavirus and vaccination campaigns got off to a slow start. A European Commission sentiment index dropped to 91.5 from a revised 92.4

- Norway’s sovereign wealth fund, the world’s biggest, returned $123 billion last year as markets rode a wave of unprecedented fiscal and monetary stimulus to fight the coronavirus crisis. Its performance was buoyed by the stratospheric rise in technology stocks, which generated a 41.9% return for the fund, it said on Thursday

- WallStreetBets, the internet forum fueling a frenzy of retail trading, briefly turned itself off to new users Wednesday after a deluge of new participants raised concerns about its ability to police content, a notice on the website said

- The EU remains at loggerheads with AstraZeneca Plc after the Anglo-Swedish drugmaker rejected demands that it take Covid-19 vaccine supplies from its U.K. factories to increase doses going to the bloc

A quick look at global markets courtesy of Newsquawk

Asia-Pac indices were negative on spillover selling from the US where stocks had their worst day since October. There wasn't a specific headline catalyst for the downside; analysts had cited some forced hedge fund liquidations, covering shorts in some of the stocks subject to 'retail activism', forcing desks to cut profitable longs elsewhere. Better-than-expected earnings from tech giants Apple and Facebook failed to provide any meaningful reprieve in either index futures or their respective stocks during extended trade. ASX 200 (-1.9%) was dragged lower in which tech led the broad declines and with miners also subdued following weaker quarterly production updates from the likes of Fortescue Metals and Newcrest Mining. Nikkei 225 (-1.5%) suffered alongside the widespread risk aversion and as earnings season picked up in Japan, while the KOSPI (-1.7%) was predominantly influenced by corporate results including index heavyweight Samsung Electronics which disappointed on its Q4 net. Hang Seng (-2.6%) and Shanghai Comp. (-1.9%) also weakened after the PBoC continued to drain liquidity and amid mixed signals from the US as the White House reaffirmed the view that telecom equipment from untrusted vendors such as China's Huawei was a threat to security, although it was also reported that the US issued a General License 1A which authorizes transactions involving securities of certain Communist Chinese military companies and that MSCI reversed its decision on index deletions for Chinese firms. Finally, 10yr JGBs were uneventful and failed to take advantage of the subdued risk appetite with prices constrained within this week’s tight range beneath the 152.00 level and which follows a mixed 2yr auction.

Top Asian News

- Stocks in Vietnam Slump Most Since 2001 on Virus Outbreak

- ThaiBev Is Said to Near Singapore IPO Filing for $10 Billion Unit

- Border Clashes Put India-China Ties Under ‘Exceptional Stress’

- SoftBank Group Boosts Size of Planned Bond in Market Return

European stocks trade in a sea of red (Euro Stoxx 50 -0.3%), but well off worst levels after the region picked up a similarly pessimistic lead from APAC with some citing “retail activism”, although it’s also worth bearing in mind that any regulations imposed on retail traders could hinder one of the driving forces behind stocks since the pandemic hit markets. Meanwhile, the after-market State-side tech space continued to unwind its recent gains despite better-than-expected earnings from Apple (-3.0%) and Facebook (-1.3%) – albeit analysts cite the lack of forecasts for the former’s downside, whilst Tesla’s (-5.8%) release underwhelmed markets as it missed on EPS and provided vague guidance; as such, the Nasdaq future is the current underperformer with losses just shy of 1.0%. Back to Europe, sectors are all in negative territory with Oil & Gas the marginal underperformer as prices in the crude complex remain somewhat capped. Consumer Staples meanwhile is cushioned but the Food & Beverage sector outperforms as Diageo (+3.6%) provides some post-earnings support whilst noting that it delivered strong sequential improvement compared to the H2 2020. Elsewhere, Industrials bear the brunt of the weaker base metal prices (see commodities section below), whilst construction sees some benefit from this price action. In terms of individual movers, Nokia (unch) opened higher by 10% due to Reddit's retail traders bolstering the Co’s ADR almost 70% at one point yesterday. Onto some earnings-related movers – STMicroelectronics (+4%) is firmer following improvements in Y/Y earnings alongside firm demand in Auto products and Microcontrollers. On the flip side Swatch (-3.5%) shares are pressured amid worse-than-expected pandemic-hit numbers coupled with a decline in Swiss watch exports.

Top European News

- ECB Ready to Use All Tools Needed to Lift Inflation, Rehn Says

- UBS CEO Hamers Splits COO Role, Appoints Transformation Officer

- STMicro to Invest $2 Billion to Deal With Chip Supply Crisis

- BaFin Files Criminal Complaint Against Employee Over Wirecard

In FX, USD - No need for Buck bulls, or bears for that matter, to fight the Fed as policy-makers and chair Powell in the post-meeting press conference stuck rigidly to the script by maintaining caution over the near term economic outlook amidst moderation in the pace of recovery, and retaining guidance for accommodation to continue with no prospect of tapering QE anytime soon. Hence, the Dollar has swiftly returned to its sentiment vigil and dependency on fluctuations in the general market mood for direction, which is still gloomy amidst concerns that the supply of COVID-19 vaccines won’t stretch far enough to meet demand and/or delivery times lag to the extent that restrictions and lockdowns last even longer. In DXY terms, some consolidation has ensued between 90.859-627 after the index peaked at 90.896 on Wednesday, but the Greenback retains a firmer bias ahead of a busy post-FOMC docket and showing little sign of the moderate selling for month end rebalancing, yet.

- AUD/NZD/CAD - More pain and underperformance due to high beta and risk correlations for the Aussie, Kiwi and Loonie, with Aud/Usd and Nzd/Usd only just keeping in close proximity of 0.7600 and 0.7100, as the former also takes on board latest worrying reports from China about the Iron and Steel Association calling for the Government to lower its reliance on iron ore imports. Meanwhile, NZ trade data revealed a narrower surplus as imports outpaces exports, and Usd/Cad is above 1.2850 at new post-BoC highs awaiting Canadian building permits and average earnings before monthly GDP and PPI on Friday.

- CHF/JPY/GBP - All softer vs their US counterpart as the Franc struggles to contain losses through 0.8900 in wake of a smaller Swiss trade surplus, Yen loses ground following the more concerted breach of 104.00 and Pound pulls back further from 1.3750+ at one stage yesterday to trip some stops sub-1.3650. Note, however, while Cable has now fallen beneath the 200 HMA (1.3665), Usd/Jpy is respecting the 100 DMA (104.40), albeit barely in the run up to a raft of Japanese releases including Tokyo CPI, national labour data, ip and the BoJ’s Summary of Opinions.

- EUR - Far from all change, but the Euro is a relative outperformer after its midweek meltdown on dovish ECB vibes directly from the GC and via ‘official sources’. Indeed, Eur/Usd is displaying resilience around 1.2100 having lurched to circa 1.2059 on Wednesday, though mainly in corrective trade rather than fundamentals even though Eurozone sentiment indicators largely beat consensus and German state inflation reports are in line with forecasts for the national y/y rate to snap back from deflationary territory.

- SCANDI/EM - Conflicting data and survey news for the Sek via retail sales and unemployment misses vs upbeat sentiment, but the Swedish Krona continues to outpace the Norwegian Crown amidst equally mixed macro inputs in the form of a fall in the LFS jobless rate and much weaker than expected consumption. Eur/Sek has eased back from 10.1400+, while Eur/Nok remains elevated near 10.5000 as Norway heads into virtual complete international border lockdown and the SWF concedes that ROI is unlikely to hit levels achieved in the last 25 years. Conversely, the Try is back to winning ways amidst hawkish CBRT rhetoric and an improvement in Turkish economic sentiment.

In commodities, WTI and Brent front month futures traded modestly softer in early European hours before nursing losses as the downbeat sentiment across the market seeps into the crude complex, albeit prices remain contained within recent ranges on continued vaccine optimism, OPEC+ support and this week’s substantial surprise draws in crude inventory data. Brent dipped below USD 55.50/bbl in early trade, while its WTI counterpart rebounded after trickling under USD 52.50/bbl. Elsewhere, metals markets are pressured amid the firmer Buck, with spot gold extending losses below USD 1850/oz ahead of yesterday’s USD 1830.80/oz low ahead of the 15th Jan base at around USD 1823/oz. Spot silver meanwhile holds its +25/oz status after briefly dipping below the psychological mark from its current USD 25.30/oz high. Base metals see more pronounced losses as the effect of lockdowns rippled across the complex, with Shanghai copper hitting more than one-month lows as sentiment was tainted overnight. Dalian iron ore futures meanwhile slumped over 5% after the China’s Iron and Steel association called on the government to ease the country’s reliance on imports of iron ore

US Event Calendar

- 8:30am: Advance Goods Trade Balance, est. $84.0b deficit, prior $84.8b deficit

- 8:30am: Retail Inventories MoM, est. 0.55%, prior 0.7%; Wholesale Inventories MoM, est. 0.5%, prior 0.0%

- 8:30am: Initial Jobless Claims, est. 875,000, prior 900,000; Continuing Claims, est. 5.09m, prior 5.05m

- 8:30am: GDP Annualized QoQ, est. 4.2%, prior 33.4%

- 8:30am: Personal Consumption, est. 3.1%, prior 41.0%

- 10am: New Home Sales, est. 868,000, prior 841,000; New Home Sales MoM, est. 3.21%, prior -11.0%

- 11am: Kansas City Fed Manf. Activity, est. 12.5, prior 14

DB's Jim Reid concludes the overnight wrap

The increasing signs of bubble tendencies has been one of the main reasons why I’ve been suggesting over the last month that it was becoming increasingly clear to me that this was not going to a low vol year. Having said that I wasn’t expecting signs of this to appear so soon. Indeed yesterday saw one of the biggest selloffs in markets for some months, unless you were a r/wallstreetbets stock buyer where you potentially saw a lifetimes worth of positive performance in a day. What a contrast. At the close the S&P 500 (-2.57%) suffered its worst day since October, as the VIX index of volatility rose +14.2pts to its highest level (37.2) since the last day of October, and saw its biggest one day rise since March 16 at the height of the pandemic selloff and the largest percentage move higher since February 2018.

It was a pretty broad-based selloff, though small-cap stocks held up the best, with the Russell 2000 index “only” losing -1.91%, whilst tech stocks were hit the hardest as profits were taken in winning trades, causing the NASDAQ to fall -2.61%. And there were also large declines in Europe, with the STOXX 600 (-1.16%) just about managing to cling on to its YTD positive performance, as the DAX (-1.81%) moved back into negative territory on a YTD basis.

Immediately after the US close we then had the mega tech earnings triple header with Apple, Tesla and Facebook out. Apple’s shares fell -3.2% after hours even as quarterly revenue set a record, topping 100 billion for the first time. The company did not offer guidance for the fourth quarter in a row, but expects sales growth from AirPods and other wearables to decelerate this current quarter, while services are also expected to lag year-on-year. Telsa similarly fell in after-market trading, declining -5.1%. The car maker missed on earnings, coming in at $0.80 vs $1.03 consensus estimate, which was mostly due to price cuts. Facebook saw 4Q sales rising 33% as online shopping continues to fuel digital-ad demand. The company’s shares settled -1.9% lower after the close as it warned of “significant uncertainty” in 2021. In Asia, Samsung electronics also reported a weaker set of earnings with net income in the three months ending December of KRW 6.45tn (vs. KRW 7.3tn expected).

Overnight, these earnings are weighing on S&P 500 and Nasdaq futures with both down -0.19% and -0.40% respectively. Asian markets are also sliding with the Nikkei (-1.49%), Hang Seng (-1.73%), Shanghai Comp (-1.33%) and Kospi (-1.72%) all down. In overnight data releases, Japan’s December retail sales came in at -0.3% yoy vs. (-0.5% yoy expected).

In other overnight news, r/wallstreetbets briefly turned itself off (from 6:30pm – 7:30pm New York Time) to new users after a deluge of new participants raised concerns about its ability to police content. Meanwhile, communications platform Discord has banned WallStreetBets for allowing “hateful and discriminatory content after repeated warnings”. Overnight, shares of GameStop and AMC are down -16.26% (was down as much as -37.6% at one point) and -26.33% (-44.7% at one point) respectively and are paring some of yesterday’s gains.

On those gains, GameStop shares advanced a further +133% in normal hours as the power of r/wallstreetbets continued to power the stock higher – it touched +162% intraday. $25.3bn worth of stock traded yesterday and for the second day it was the most traded stock in the whole of the US, while the company’s market cap grew to $24bn. This were not the Reddit group’s best trades though as AMC (+300%) and Express (+217%) were the chosen ones yesterday as this remarkable story powers on. AMC finished trading at its highs, but Express was up as much as +359% intraday before “settling” for just tripling on the session. These trades are battering some hedge funds and the Goldman Sachs Hedge Industry VIP ETF, which tracks hedge funds’ most-popular stocks, tumbled -4.3% yesterday for its worst day since September. There was also confirmation that the new Treasury Secretary Yellen and the administration’s economic team is monitoring the market activity around GameStop, AMC and others. In my chart of the day yesterday (link here) I pointed out how GameStop shares were the most traded US stock by value on Tuesday which is remarkable given its “small” market cap and shows the collective power of this group. Could they move on to other targets outside of heavily shorted low value equities? Is this more proof we are in a colossal bubble or just a fascinating side show?

Another recently popular asset that didn’t have such a good day was Bitcoin however, which fell a further -3.2% to close at its lowest level since New Year’s Day. When compared to GameStop, BitCoin is so two weeks ago!

Moving on to what was a pretty low key Fed meeting (see our economists’ review here) and one of Powell’s key statements was that “the whole focus on exit is premature,” while promising that the Fed would take special care to communicate clearly when that may change. The FOMC is indeed keeping it bond-buying program at the current pace of $120bn per month until “substantial further progress” toward its dual mandate had been made, while making no changes to the contents of purchases. Powell also fielded a question on GameStop’s recent price action, and though he declined to speak to any individual stock he said that financial-stability vulnerabilities overall are “moderate.” Moreover, on the topic of asset inflation, the Fed chair cited vaccine breakthroughs and expectations of fiscal stimulus as the main driver of quickly rising asset prices, while acknowledging that monetary policy plays a role. Powell went on to say that “the connection between low interest rates and asset values is probably something that’s not as tight as people think.” This was a bit of surprise as for many the one thing keeping many assets at elevated valuations are indeed ultra low yields.

Back to markets and as non-reddit risk assets lost ground across multiple asset classes, investors moved into safe havens, helping the US dollar index (+0.53%) record its second best daily performance in the last month, whilst the yield on 10yr US Treasuries fell beneath 1% in trading for the first time since the Georgia senate runoff results. By the close, they had recovered to be down just -1.9bps at 1.016%, though concerns over the global outlook saw 10yr breakevens down -1.6bps at their lowest level in 3 weeks. Meanwhile in Europe, bunds were the beneficiary, seeing 10yr yields down -1.3bps, as those on OATs (-0.6bps) and BTPs (-0.5bps) also fell back, while gilt yields (+0.3bps) rose slightly.

On the coronavirus, the row between the EU and AstraZeneca continued. In a call last night EU officials demanded that AstraZeneca use British production facilities to cover the shortfalls in supply that was promised to the continent. EU officials are insisting on receiving the AstraZeneca vaccine around the same time as the U.K. going forward despite putting in its order three months later. German Economy Minister Altmaier said yesterday that the EU could establish restrictions on vaccine exports out of the region. This story risks getting politically explosive over the next few days.

Sticking with vaccines, Pfizer/BioNTech have said that results of studies indicate their vaccine is effective against both the U.K. and South Africa variants while adding that neutralisation against the South African variant was slightly lower compared to other mutations. The companies said that the small difference is unlikely to lead to a significant reduction in the effectiveness of the vaccine and that this doesn’t indicate the need for a new vaccine to address the emerging variants. This is in slight contrast to Moderna which is working on trials to adopt its vaccine to tackle the South African variant more effectively.

Here in the UK, Prime Minister Johnson announced that schools in England would not be going back immediately after the February half-term break, and that it was the government’s hope to start reopening them from March 8. Furthermore, it was announced that international travellers from countries with a risk of known variants would be required to quarantine in government-provided accommodation for 10 days. To highlight the vaccine shortages in Europe, Madrid had to halt their vaccination program due to only receiving half of the expected amount of doses last week. In France, a government spokesman said that tighter measures were under consideration as the number of new cases has risen in recent weeks, but that the government was holding off for now as President Macron called “for additional analysis”. Finally in the US, restrictions in much of New York State was eased yesterday, with Governor Cuomo, saying the “holiday surge is over.” This means that in-residence gatherings are allowed up to 10 people, nonessential businesses can remain open with indoor and outdoor dining allowed under certain restrictions. Also schools can remain open for in-person learning with increased testing.

There wasn’t a massive amount of data out yesterday, though US durable goods orders in December rose by a lower-than-expected +0.2% (vs. +1.0% expected). Separately, the German government cut their 2021 growth forecast to 3%, having been at 4.4% previously.

To the day ahead now, and data releases from the US include the advance reading of Q4 GDP, along with the weekly initial jobless claims, and December’s new home sales and leading index. Meanwhile from Europe, we’ll get the final Euro Area consumer confidence reading for January, and the preliminary German CPI reading for January. From central banks, the ECB’s Schnabel will be speaking, and earnings releases include Visa, Mastercard, Comcast, Danaher and McDonald’s.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

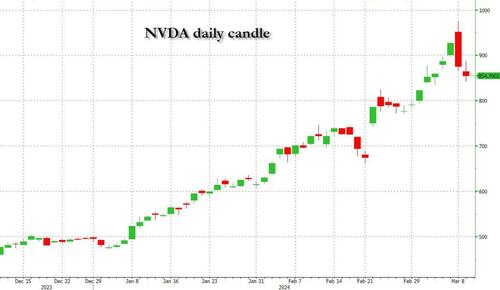

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Government

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19 vaccination was a mistake due to ethical and other concerns, a top government doctor warned Dr. Anthony Fauci after Dr. Fauci promoted mass vaccination.

“Coercing or forcing people to take a vaccine can have negative consequences from a biological, sociological, psychological, economical, and ethical standpoint and is not worth the cost even if the vaccine is 100% safe,” Dr. Matthew Memoli, director of the Laboratory of Infectious Diseases clinical studies unit at the U.S. National Institute of Allergy and Infectious Diseases (NIAID), told Dr. Fauci in an email.

“A more prudent approach that considers these issues would be to focus our efforts on those at high risk of severe disease and death, such as the elderly and obese, and do not push vaccination on the young and healthy any further.”

Employing that strategy would help prevent loss of public trust and political capital, Dr. Memoli said.

The email was sent on July 30, 2021, after Dr. Fauci, director of the NIAID, claimed that communities would be safer if more people received one of the COVID-19 vaccines and that mass vaccination would lead to the end of the COVID-19 pandemic.

“We’re on a really good track now to really crush this outbreak, and the more people we get vaccinated, the more assuredness that we’re going to have that we’re going to be able to do that,” Dr. Fauci said on CNN the month prior.

Dr. Memoli, who has studied influenza vaccination for years, disagreed, telling Dr. Fauci that research in the field has indicated yearly shots sometimes drive the evolution of influenza.

Vaccinating people who have not been infected with COVID-19, he said, could potentially impact the evolution of the virus that causes COVID-19 in unexpected ways.

“At best what we are doing with mandated mass vaccination does nothing and the variants emerge evading immunity anyway as they would have without the vaccine,” Dr. Memoli wrote. “At worst it drives evolution of the virus in a way that is different from nature and possibly detrimental, prolonging the pandemic or causing more morbidity and mortality than it should.”

The vaccination strategy was flawed because it relied on a single antigen, introducing immunity that only lasted for a certain period of time, Dr. Memoli said. When the immunity weakened, the virus was given an opportunity to evolve.

Some other experts, including virologist Geert Vanden Bossche, have offered similar views. Others in the scientific community, such as U.S. Centers for Disease Control and Prevention scientists, say vaccination prevents virus evolution, though the agency has acknowledged it doesn’t have records supporting its position.

Other Messages

Dr. Memoli sent the email to Dr. Fauci and two other top NIAID officials, Drs. Hugh Auchincloss and Clifford Lane. The message was first reported by the Wall Street Journal, though the publication did not publish the message. The Epoch Times obtained the email and 199 other pages of Dr. Memoli’s emails through a Freedom of Information Act request. There were no indications that Dr. Fauci ever responded to Dr. Memoli.

Later in 2021, the NIAID’s parent agency, the U.S. National Institutes of Health (NIH), and all other federal government agencies began requiring COVID-19 vaccination, under direction from President Joe Biden.

In other messages, Dr. Memoli said the mandates were unethical and that he was hopeful legal cases brought against the mandates would ultimately let people “make their own healthcare decisions.”

“I am certainly doing everything in my power to influence that,” he wrote on Nov. 2, 2021, to an unknown recipient. Dr. Memoli also disclosed that both he and his wife had applied for exemptions from the mandates imposed by the NIH and his wife’s employer. While her request had been granted, his had not as of yet, Dr. Memoli said. It’s not clear if it ever was.

According to Dr. Memoli, officials had not gone over the bioethics of the mandates. He wrote to the NIH’s Department of Bioethics, pointing out that the protection from the vaccines waned over time, that the shots can cause serious health issues such as myocarditis, or heart inflammation, and that vaccinated people were just as likely to spread COVID-19 as unvaccinated people.

He cited multiple studies in his emails, including one that found a resurgence of COVID-19 cases in a California health care system despite a high rate of vaccination and another that showed transmission rates were similar among the vaccinated and unvaccinated.

Dr. Memoli said he was “particularly interested in the bioethics of a mandate when the vaccine doesn’t have the ability to stop spread of the disease, which is the purpose of the mandate.”

The message led to Dr. Memoli speaking during an NIH event in December 2021, several weeks after he went public with his concerns about mandating vaccines.

“Vaccine mandates should be rare and considered only with a strong justification,” Dr. Memoli said in the debate. He suggested that the justification was not there for COVID-19 vaccines, given their fleeting effectiveness.

Julie Ledgerwood, another NIAID official who also spoke at the event, said that the vaccines were highly effective and that the side effects that had been detected were not significant. She did acknowledge that vaccinated people needed boosters after a period of time.

The NIH, and many other government agencies, removed their mandates in 2023 with the end of the COVID-19 public health emergency.

A request for comment from Dr. Fauci was not returned. Dr. Memoli told The Epoch Times in an email he was “happy to answer any questions you have” but that he needed clearance from the NIAID’s media office. That office then refused to give clearance.

Dr. Jay Bhattacharya, a professor of health policy at Stanford University, said that Dr. Memoli showed bravery when he warned Dr. Fauci against mandates.

“Those mandates have done more to demolish public trust in public health than any single action by public health officials in my professional career, including diminishing public trust in all vaccines.” Dr. Bhattacharya, a frequent critic of the U.S. response to COVID-19, told The Epoch Times via email. “It was risky for Dr. Memoli to speak publicly since he works at the NIH, and the culture of the NIH punishes those who cross powerful scientific bureaucrats like Dr. Fauci or his former boss, Dr. Francis Collins.”

Government

Trump “Clearly Hasn’t Learned From His COVID-Era Mistakes”, RFK Jr. Says

Trump "Clearly Hasn’t Learned From His COVID-Era Mistakes", RFK Jr. Says

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President…

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President Joe Biden claimed that COVID vaccines are now helping cancer patients during his State of the Union address on March 7, but it was a response on Truth Social from former President Donald Trump that drew the ire of independent presidential candidate Robert F. Kennedy Jr.

During the address, President Biden said: “The pandemic no longer controls our lives. The vaccines that saved us from COVID are now being used to help beat cancer, turning setback into comeback. That’s what America does.”

President Trump wrote: “The Pandemic no longer controls our lives. The VACCINES that saved us from COVID are now being used to help beat cancer—turning setback into comeback. YOU’RE WELCOME JOE. NINE-MONTH APPROVAL TIME VS. 12 YEARS THAT IT WOULD HAVE TAKEN YOU.”

An outspoken critic of President Trump’s COVID response, and the Operation Warp Speed program that escalated the availability of COVID vaccines, Mr. Kennedy said on X, formerly known as Twitter, that “Donald Trump clearly hasn’t learned from his COVID-era mistakes.”

“He fails to recognize how ineffective his warp speed vaccine is as the ninth shot is being recommended to seniors. Even more troubling is the documented harm being caused by the shot to so many innocent children and adults who are suffering myocarditis, pericarditis, and brain inflammation,” Mr. Kennedy remarked.

“This has been confirmed by a CDC-funded study of 99 million people. Instead of bragging about its speedy approval, we should be honestly and transparently debating the abundant evidence that this vaccine may have caused more harm than good.

“I look forward to debating both Trump and Biden on Sept. 16 in San Marcos, Texas.”

Mr. Kennedy announced in April 2023 that he would challenge President Biden for the 2024 Democratic Party presidential nomination before declaring his run as an independent last October, claiming that the Democrat National Committee was “rigging the primary.”

Since the early stages of his campaign, Mr. Kennedy has generated more support than pundits expected from conservatives, moderates, and independents resulting in speculation that he could take votes away from President Trump.

Many Republicans continue to seek a reckoning over the government-imposed pandemic lockdowns and vaccine mandates.

President Trump’s defense of Operation Warp Speed, the program he rolled out in May 2020 to spur the development and distribution of COVID-19 vaccines amid the pandemic, remains a sticking point for some of his supporters.

Operation Warp Speed featured a partnership between the government, the military, and the private sector, with the government paying for millions of vaccine doses to be produced.

President Trump released a statement in March 2021 saying: “I hope everyone remembers when they’re getting the COVID-19 Vaccine, that if I wasn’t President, you wouldn’t be getting that beautiful ‘shot’ for 5 years, at best, and probably wouldn’t be getting it at all. I hope everyone remembers!”

President Trump said about the COVID-19 vaccine in an interview on Fox News in March 2021: “It works incredibly well. Ninety-five percent, maybe even more than that. I would recommend it, and I would recommend it to a lot of people that don’t want to get it and a lot of those people voted for me, frankly.

“But again, we have our freedoms and we have to live by that and I agree with that also. But it’s a great vaccine, it’s a safe vaccine, and it’s something that works.”

On many occasions, President Trump has said that he is not in favor of vaccine mandates.

An environmental attorney, Mr. Kennedy founded Children’s Health Defense, a nonprofit that aims to end childhood health epidemics by promoting vaccine safeguards, among other initiatives.

Last year, Mr. Kennedy told podcaster Joe Rogan that ivermectin was suppressed by the FDA so that the COVID-19 vaccines could be granted emergency use authorization.

He has criticized Big Pharma, vaccine safety, and government mandates for years.

Since launching his presidential campaign, Mr. Kennedy has made his stances on the COVID-19 vaccines, and vaccines in general, a frequent talking point.

“I would argue that the science is very clear right now that they [vaccines] caused a lot more problems than they averted,” Mr. Kennedy said on Piers Morgan Uncensored last April.

“And if you look at the countries that did not vaccinate, they had the lowest death rates, they had the lowest COVID and infection rates.”

Additional data show a “direct correlation” between excess deaths and high vaccination rates in developed countries, he said.

President Trump and Mr. Kennedy have similar views on topics like protecting the U.S.-Mexico border and ending the Russia-Ukraine war.

COVID-19 is the topic where Mr. Kennedy and President Trump seem to differ the most.

Former President Donald Trump intended to “drain the swamp” when he took office in 2017, but he was “intimidated by bureaucrats” at federal agencies and did not accomplish that objective, Mr. Kennedy said on Feb. 5.

Speaking at a voter rally in Tucson, where he collected signatures to get on the Arizona ballot, the independent presidential candidate said President Trump was “earnest” when he vowed to “drain the swamp,” but it was “business as usual” during his term.

John Bolton, who President Trump appointed as a national security adviser, is “the template for a swamp creature,” Mr. Kennedy said.

Scott Gottlieb, who President Trump named to run the FDA, “was Pfizer’s business partner” and eventually returned to Pfizer, Mr. Kennedy said.

Mr. Kennedy said that President Trump had more lobbyists running federal agencies than any president in U.S. history.

“You can’t reform them when you’ve got the swamp creatures running them, and I’m not going to do that. I’m going to do something different,” Mr. Kennedy said.

During the COVID-19 pandemic, President Trump “did not ask the questions that he should have,” he believes.

President Trump “knew that lockdowns were wrong” and then “agreed to lockdowns,” Mr. Kennedy said.

He also “knew that hydroxychloroquine worked, he said it,” Mr. Kennedy explained, adding that he was eventually “rolled over” by Dr. Anthony Fauci and his advisers.

MaryJo Perry, a longtime advocate for vaccine choice and a Trump supporter, thinks votes will be at a premium come Election Day, particularly because the independent and third-party field is becoming more competitive.

Ms. Perry, president of Mississippi Parents for Vaccine Rights, believes advocates for medical freedom could determine who is ultimately president.

She believes that Mr. Kennedy is “pulling votes from Trump” because of the former president’s stance on the vaccines.

“People care about medical freedom. It’s an important issue here in Mississippi, and across the country,” Ms. Perry told The Epoch Times.

“Trump should admit he was wrong about Operation Warp Speed and that COVID vaccines have been dangerous. That would make a difference among people he has offended.”

President Trump won’t lose enough votes to Mr. Kennedy about Operation Warp Speed and COVID vaccines to have a significant impact on the election, Ohio Republican strategist Wes Farno told The Epoch Times.

President Trump won in Ohio by eight percentage points in both 2016 and 2020. The Ohio Republican Party endorsed President Trump for the nomination in 2024.

“The positives of a Trump presidency far outweigh the negatives,” Mr. Farno said. “People are more concerned about their wallet and the economy.

“They are asking themselves if they were better off during President Trump’s term compared to since President Biden took office. The answer to that question is obvious because many Americans are struggling to afford groceries, gas, mortgages, and rent payments.

“America needs President Trump.”

Multiple national polls back Mr. Farno’s view.

As of March 6, the RealClearPolitics average of polls indicates that President Trump has 41.8 percent support in a five-way race that includes President Biden (38.4 percent), Mr. Kennedy (12.7 percent), independent Cornel West (2.6 percent), and Green Party nominee Jill Stein (1.7 percent).

A Pew Research Center study conducted among 10,133 U.S. adults from Feb. 7 to Feb. 11 showed that Democrats and Democrat-leaning independents (42 percent) are more likely than Republicans and GOP-leaning independents (15 percent) to say they have received an updated COVID vaccine.

The poll also reported that just 28 percent of adults say they have received the updated COVID inoculation.

The peer-reviewed multinational study of more than 99 million vaccinated people that Mr. Kennedy referenced in his X post on March 7 was published in the Vaccine journal on Feb. 12.

It aimed to evaluate the risk of 13 adverse events of special interest (AESI) following COVID-19 vaccination. The AESIs spanned three categories—neurological, hematologic (blood), and cardiovascular.

The study reviewed data collected from more than 99 million vaccinated people from eight nations—Argentina, Australia, Canada, Denmark, Finland, France, New Zealand, and Scotland—looking at risks up to 42 days after getting the shots.

Three vaccines—Pfizer and Moderna’s mRNA vaccines as well as AstraZeneca’s viral vector jab—were examined in the study.

Researchers found higher-than-expected cases that they deemed met the threshold to be potential safety signals for multiple AESIs, including for Guillain-Barre syndrome (GBS), cerebral venous sinus thrombosis (CVST), myocarditis, and pericarditis.

A safety signal refers to information that could suggest a potential risk or harm that may be associated with a medical product.

The study identified higher incidences of neurological, cardiovascular, and blood disorder complications than what the researchers expected.

President Trump’s role in Operation Warp Speed, and his continued praise of the COVID vaccine, remains a concern for some voters, including those who still support him.

Krista Cobb is a 40-year-old mother in western Ohio. She voted for President Trump in 2020 and said she would cast her vote for him this November, but she was stunned when she saw his response to President Biden about the COVID-19 vaccine during the State of the Union address.

“I love President Trump and support his policies, but at this point, he has to know they [advisers and health officials] lied about the shot,” Ms. Cobb told The Epoch Times.

“If he continues to promote it, especially after all of the hearings they’ve had about it in Congress, the side effects, and cover-ups on Capitol Hill, at what point does he become the same as the people who have lied?” Ms. Cobb added.

“I think he should distance himself from talk about Operation Warp Speed and even admit that he was wrong—that the vaccines have not had the impact he was told they would have. If he did that, people would respect him even more.”

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges