Government

Futures Fade Rally With Congress Set To Avert Government Shutdown

Futures Fade Rally With Congress Set To Avert Government Shutdown

US equity futures faded an overnight rally on the last day of September as lingering global-growth risks underscored by China’s official manufacturing PMI contracted for the…

US equity futures faded an overnight rally on the last day of September as lingering global-growth risks underscored by China's official manufacturing PMI contracted for the first time since Feb 2020 as widely expected offset a debt-ceiling deal in Washington and central-bank assurances about transitory inflation. The deal to extend government funding removes one uncertainty from the minds of investors, amid China risks and concerns over Federal Reserve tapering. Comments from Fed Chair Powell and ECB head Christine Lagarde about inflation being transitory rather than permanent also helped sentiment, even if nobody actually believes them any more.In China, authorities told bankers to help local governments support the property market and homebuyers, signaling concern at the economic fallout from the debt crisis at China Evergrande

As of 7:15am ET, S&P futures were up 18 points ot 0.44%, trimming an earlier gain of 0.9%. Dow eminis were up 135 or 0.4% and Nasdaq futs rose 0.43%. 10Y TSY yields were higher, rising as high as 1.54% and last seen at 1.5289%; the US Dollar erased earlier losses and was unchanged.

All the three major indexes are set for a monthly drop, with the benchmark S&P 500 on track to break its seven-month winning streak as worries about persistent inflation, the fallout from China Evergrande’s potential default and political wrangling over the debt ceiling rattled sentiment. The index was, however, on course to mark its sixth straight quarterly gain, albeit its smallest, since March 2020’s drop. The rate-sensitive FAANG stocks have lost about $415 billion in value this month after the Federal Reserve’s hawkish shift on monetary policy sparked a rally in Treasury yields and prompted investors to move into energy, banks and small-cap sectors that stand to benefit the most from an economic revival.

Among individual stocks, oil-and-gas companies APA Corp. and Devon Energy Corp. led premarket gains among S&P 500 members. Virgin Galactic shares surged 9.7% in premarket trading after the U.S. aviation regulator gave the company a green-light to resume flights to the brink of space. Perrigo climbed 14% after reporting a settlement in a tax dispute with Ireland. U.S.-listed Macau casino operators may get a boost Thursday after Macau Chief Executive Ho Iat Seng said the region will strive to resume quarantine-free travel to Zhuhai by Oct. 1, the start of the Golden Week holiday, if the Covid-19 situation in Macau is stable. Here are some of the other biggest U.S. movers today:

- Retail investor favorites Farmmi (FAMI US) and Camber Energy (CEI US) both rise in U.S. premarket trading, continuing their strong recent runs on high volumes

- Virgin Galactic (SPCE US) shares rise 8.9% in U.S. premarket trading after the U.S. aviation regulator gave co. a green-light to resume flights to the brink of space

- Perrigo (PRGO US) rises 15% in U.S. premarket trading after reporting a settlement in a tax dispute with Ireland. The stock was raised to buy from hold at Jefferies over the “very favorable” resolution

- Landec (LNDC US) shares fell 17% in Wednesday postmarket trading after fiscal 1Q revenue and adjusted loss per share miss consensus estimates

- Affimed (AFMD US) rises 4.3% in Wednesday postmarket trading after Stifel analyst Bradley Canino initiates at a buy with a $12 price target, implying the stock may more than double over the next year

- Herman Miller (MLHR US) up ~2.8% in Wednesday postmarket trading after the office furnishings maker posts fiscal 1Q net sales that beat the consensus estimate

- Orion Group Holdings (ORN US) shares surged as much as 43% in Wednesday extended trading after the company disclosed two contract awards for its Marine segment totaling nearly $200m

- Kaival Brands (KAVL US) fell 18% Wednesday postmarket after offering shares, warrants via Maxim

An agreement among U.S. lawmakers to extend government funding removes one uncertainty from a litany of risks investors are contenting with, ranging from China’s growth slowdown to Federal Reserve tapering.

“Republicans and Democrats showed some compromise by averting a government shutdown,” Sebastien Galy, a senior macro strategist at Nordea Investment Funds. “By removing what felt like a significant risk for a retail audience, it helps sentiment in the equity market.”

Still, president Joe Biden’s agenda remains at risk of being derailed by divisions among his own Democrats, as moderates voiced anger on Wednesday at the idea of delaying a $1 trillion infrastructure bill ahead of a critical vote to avert a government shutdown.

The big overnight economic news came from China whose September NBS manufacturing PMI fell to 49.6 from 50.1 in August, the first contraction since Feb 2020, likely due to the production cuts caused by energy constraints. Both the output sub-index and the new orders sub-index in the NBS manufacturing PMI survey decreased in September. The NBS non-manufacturing PMI rebounded to 53.2 in September from 47.5 in August on a recovery of services activities as COVID restrictions eased. However, the numbers may not capture full impact of energy restrictions as the NBS survey was taken around 22nd-25th of the month: expect far worse number in the months ahead unless China manages to contain its energy crisis.

Europe’s Stoxx 600 Index advanced 0.3%, trimming a monthly loss but fading an earlier gain of 0.9%, led by gains in basic resources companies as iron ore climbed, with the CAC and FTSE 100 outperforming at the margin. Technology stocks, battered earlier this week, also extended their rebound. Miners, oil & gas and media are the strongest sectors; utility and industrial names lag. European natural gas and power markets hit fresh record highs as supply constraints persist. Perrigo jumped 13.8% after the drugmaker agreed to settle with Irish tax authorities over a 2018 issue by paying $1.90 billion in taxes

Asian stocks were poised to cap their first quarterly loss since March 2020 as Chinese technology names fell and as investors remained wary over a recent rise in U.S. Treasury yields. The MSCI Asia Pacific Index is set to end the September quarter with a loss of more than 5%, snapping a winning streak of five straight quarters. A combination of higher yields, Beijing’s corporate crackdown and worry over slowing economic growth in Asia’s biggest economy have hurt sentiment, bringing the market down following a brief rally in late August. The Asian benchmark rose less than 0.1% after posting its worst single-day drop in six weeks on Wednesday. Consumer discretionary and communication services groups fell, while financials advanced. The Hang Seng Tech Index ended 1.3% lower as Beijing announced new curbs on the sector, while higher yields hurt sentiment toward growth stocks.

“Because there’s growing worry over U.S. inflation, we need to keep an eye on the potential risks, globally,” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management. “Also, there’s the Evergrande issue. The market is in a wait-and-see mode now, with a focus on whether the group will be able to make future interest rate payments.” Benchmarks in Thailand and Malaysia were the biggest losers, while Indonesia and Australia outperformed. Japan’s Topix and the Nikkei 225 Stock Average slipped for a fourth day as investors weighed Fumio Kishida’s election victory as the new ruling party leader.

Global stocks are poised to end the quarter with a small loss, after a five-quarter rally, as investors braced for the Fed to wind down its stimulus. They also remain concerned about slowing growth and elevated inflation, supply-chain bottlenecks, an energy crunch and regulatory risks emanating from China. A majority of participants in a Citigroup survey said a 20% pullback in stocks is more likely than a 20% rally.

In rates, Treasuries were slightly cheaper across the curve, off session lows as stock futures pare gains. 10-year TSY yields were around 1.53%, cheaper by 1.2bp on the day vs 2.3bp for U.K. 10-year; MPC-dated OIS rates price in ~65bps of BOE hikes by December 2022. Gilts lead the selloff, with U.K. curve bear-steepening as BOE rate-hike expectations continue to ramp up. Host of Fed speakers are in focus during U.S. session, while month-end extension may serve to underpin long-end of the curve.

A gauge of the dollar’s strength headed for its first drop in five days as Treasury yields steadied after a recent rise, and amid quarter-end flows. The Bloomberg Dollar Spot Index fell as the dollar steady or weaker against most of its Group-of-10 peers. The euro hovered around $1.16 and the pound was steady while Gilts inched lower, underperforming Bunds and Treasuries. Money markets now see around 65 basis points of tightening by the BOE’s December 2022 meeting, according to sterling overnight index swaps. That means they’re betting the key rate will rise to 0.75% next year from 0.1% currently. The Australian dollar led gains after it rose off its lowest level since August 23 amid exporter month-end demand and as iron ore buyers locked in purchases ahead of a week-long holiday in China. Norway’s krone was the worst G-10 performer and slipped a fifth day versus the dollar, its longest loosing streak in a year.

In commodities, oil surrendered gains, still heading for a monthly gain amid tighter supplies. West Texas Intermediate futures briefly recaptured the level above $75 per barrel, before trading at $74.71. APA and Devon rose at least 1.8% in early New York trading. European gas prices meanwhile hit a new all time high.

Looking at the day ahead, one of the highlights will be Fed Chair Powell’s appearance at the House Financial Services Committee, alongside Treasury Secretary Yellen. Other central bank speakers include the Fed’s Williams, Bostic, Harker, Evans, Bullard and Daly, as well as the ECB’s Centeno, Visco and Hernandez de Cos. On the data side, today’s highlights include German, French and Italian CPI for September, while in the US there’s the weekly initial jobless claims, the third estimate of Q2 GDP and the MNI Chicago PMI for September.

Market Snapshot

- S&P 500 futures up 0.7% to 4,379.00

- STOXX Europe 600 up 0.6% to 457.59

- MXAP little changed at 196.85

- MXAPJ up 0.3% to 635.71

- Nikkei down 0.3% to 29,452.66

- Topix down 0.4% to 2,030.16

- Hang Seng Index down 0.4% to 24,575.64

- Shanghai Composite up 0.9% to 3,568.17

- Sensex down 0.3% to 59,239.76

- Australia S&P/ASX 200 up 1.9% to 7,332.16

- Kospi up 0.3% to 3,068.82

- Brent Futures up 0.4% to $78.98/bbl

- Gold spot up 0.4% to $1,732.86

- U.S. Dollar Index little changed at 94.27

- German 10Y yield fell 0.5 bps to -0.212%

- Euro little changed at $1.1607

Top Overnight News from Bloomberg

- U.K. gross domestic product rose 5.5% in the second quarter instead of the 4.8% earlier estimated, official figures published Thursday show. The data, which reflected the reopening of stores and the hospitality industry, mean the economy was still 3.3% smaller than it was before the pandemic struck.

- China has urged financial institutions to help local governments stabilize the rapidly cooling housing market and ease mortgages for some home buyers, another signal that authorities are worried about fallout from the debt crisis at China Evergrande Group.

- The U.S. currency’s surge is helping the Chinese yuan record its largest gain in eight months on a trade-weighted basis in September. It adds to headwinds for the world’s second- largest economy already slowing due to a resurgence in Covid cases, a power crisis and regulatory curbs.

- The Swiss National Bank bought foreign exchange worth 5.44 billion francs ($5.8 billion) in the second quarter, part of its long-running policy to alleviate appreciation pressure on the franc

- A few members of the Riksbank’s executive board discussed a rate path that could indicate a rate rise at the end of the forecast period, Sweden’s central bank says in minutes from its Sept. 20 meeting

- French inflation accelerated in September as households in the euro area’s second-largest economy faced a jump in the costs of energy and services.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded somewhat varied with the region indecisive at quarter-end and as participants digested a slew of data releases including mixed Chinese PMI figures. ASX 200 (+1.7%) was underpinned by broad strength across its industries including the top-weighted financials sector and with the large cap miners lifted as iron ore futures surge by double-digit percentages, while the surprise expansion in Building Approvals also helped markets overlook the 51% spike in daily new infections for Victoria state. Nikkei 225 (+0.1%) was subdued for most of the session after disappointing Industrial Production and Retail Sales data which prompted the government to cut its assessment of industrial output which it stated was stalling. The government also warned that factory output could decline for a third consecutive month in September and that October has large downside risk due to uncertainty from auto manufacturing cuts. However, Nikkei 225 then recovered with the index marginally supported by currency flows. Hang Seng (-1.0%) and Shanghai Comp. (+0.4%) diverged heading into the National Day holidays and week-long closure for the mainland with tech names in Hong Kong pressured by ongoing regulatory concerns as China is to tighten regulation of algorithms related to internet information services. Nonetheless, mainland bourses were kept afloat after a further liquidity injection by the PBoC ahead of the Golden Week celebrations and as markets took the latest PMI figures in their strides whereby the official headline Manufacturing PMI disappointed to print its first contraction since February 2020, although Non-Manufacturing PMI and Composite PMI returned to expansionary territory and Caixin Manufacturing PMI topped estimates to print at the 50-benchmark level.

Top Asian News

- S&P Points to Progress as Bondholders Wait: Evergrande Update

- Bank Linked to Kazakh Leader Buys Kcell Stake After Share Slump

- Goldman Sachs Names Andy Tai Head of IBD Southeast Asia: Memo

- What Japan’s Middle-of-the-Road New Leader Means for Markets

The upside momentum seen across US and European equity futures overnight stalled, with European cash also drifting from the best seen at the open (Euro Stoxx 50 +0.1%; Stoxx 600 +0.4%). This follows somewhat mixed APAC handover, and as newsflow remains light on month and quarter-end. US equity futures are firmer across the board, but again off best levels, although the RTY (+0.8%) outperforms the ES (+0.4%), YM (+0.4%) and NQ (+0.5%). Back to Europe, the periphery lags vs core markets, whilst the DAX 40 (-0.3%) underperforms within the core market. Sectors in Europe are mostly in the green but do not portray a particular risk bias. Basic Resources top the chart with aid from overnight action in some base metals, particularly iron, in turn aiding the large iron miners BHP (+2.2%), Rio Tinto (+3.4%) and Anglo American (+2.9%). The bottom of the sectors meanwhile consists of Travel & Leisure, Autos & Parts and Industrial Goods & Services, with the former potentially feeling some headwinds from China’s travel restrictions during its upcoming National Day holiday. In terms of M&A, French press reported that CAC-listed Carrefour (-1.3%) is reportedly looking at options for sector consolidation, and talks are said to have taken place with the chain stores Auchan, with peer Casino (Unch) also initially seeing a leg higher in sympathy amid the prospect of sector consolidation. That being said, Carrefour has now reversed its earlier upside with no particular catalyst for the reversal. It is, however, worth keeping in mind that regulatory/competition hurdles cannot be ruled out – as a reminder, earlier this year, France blocked the takeover of Carrefour by Canada’s Alimentation Couche-Tard. In the case of a successful deal, Carrefour will likely be the acquirer as the largest supermarket in France. Sticking with M&A, Eutelsat (+14%) was bolstered at the open amid source reports that French billionaire Patrick Drahi is said to have made an unsolicited takeover offer of EUR 12.10/shr for Eutelsat (vs EUR 10.35 close on Wednesday), whilst the FT reported that this offer was rejected.

Top European News

- European Banks Dangle $26 Billion in Payouts as ECB Cap Ends

- U.K. Economy Emerged From Lockdown Stronger Than Expected

- In a First, Uber Joins Drivers in Strike Against Brussels Rules

- EU, U.S. Seek to Avert Chip-Subsidy Race, Float Supply Links

In FX, The non-US Dollars are taking advantage of the Greenback’s loss of momentum, and the Aussie in particular given an unexpected boost from building approvals completely confounding expectations for a fall, while a spike in iron ore prices overnight provided additional incentive amidst somewhat mixed external impulses via Chinese PMIs. Hence, Aud/Usd is leading the chasing pack and back up around 0.7200, Usd/Cad is retreating through 1.2750 and away from decent option expiry interest at 1.2755 and between 1.2750-40 (in 1.3 bn and 1 bn respectively) with some assistance from the latest bounce in crude benchmarks and Nzd/Usd is still trying to tag along, but capped into 0.6900 as the Aud/Nzd cross continues to grind higher and hamper the Kiwi.

- DXY/GBP/JPY/EUR/CHF - It’s far too early to call time on the Buck’s impressive rally and revival from recent lows, but it has stalled following a midweek extension that propelled the index to the brink of 94.500, at 94.435. The DXY subsequently slipped back to 94.233 and is now meandering around 94.300 having topped out at 94.401 awaiting residual rebalancing flows for the final day of September, Q3 and the half fy that Citi is still classifying as Dollar positive, albeit with tweaks to sd hedges for certain Usd/major pairings. Also ahead, the last US data and survey releases for the month including final Q2 GDP, IJC and Chicago PMI before another raft of Fed speakers. Meanwhile, Sterling has gleaned some much needed support from upward revisions to Q2 UK GDP, a much narrower than forecast current account deficit and upbeat Lloyds business barometer rather than sub-consensus Nationwide house prices to bounce from the low 1.3600 area vs the Greenback and unwind more of its underperformance against the Euro within a 0.8643-12 range. However, the latter is keeping tabs on 1.1600 vs its US peer in wake of firmer German state CPI prints and with the aforementioned Citi model flagging a sub-1 standard deviation for Eur/Usd in contrast to Usd/Jpy that has been elevated to 1.85 from a prelim 1.12. Nevertheless, the Yen is deriving some traction from the calmer yield backdrop rather than disappointing Japanese data in the form of ip and retail sales to contain losses under 112.00, and the Franc is trying to do the same around 0.9350.

- SCANDI/EM - The tables have been turning and fortunes changing for the Nok and Sek, but the former has now given up all and more its post-Norges Bank hike gains and more as Brent consolidates beneath Usd 80/brl and the foreign currency purchases have been set at the same level for October as the current month. Conversely, the latter has taken heed of a hawkish hue to the latest set of Riksbank minutes and the fact that a few Board members discussed a rate path that could indicate a rise at the end of the forecast period. Elsewhere, the Zar looks underpinned by marginally firmer than anticipated SA ppi and private sector credit, while the Mxn is treading cautiously ahead of Banxico and a widely touted 25 bp hike.

In commodities, WTI and Brent futures are choppy but trade with modest gains heading into the US open and in the run-up to Monday’s OPEC+ meeting. The European session thus far has been quiet from a news flow standpoint, but the contracts saw some fleeting upside after breaking above overnight ranges, albeit the momentum did not last long. Eyes turn to OPEC+ commentary heading into the meeting, which is expected to be another smooth affair, according to Argus sources. As a reminder, the group is expected to stick to its plan to raise output by 400k BPD despite outside pressure to further open the taps in a bid to control prices. Elsewhere, as a mild proxy for Chinese demand, China’s Sinopec noted that all LNG receiving terminals are to be operated at full capacity. WTI trades on either side of USD 75/bbl (vs low USD 74.54/bbl), while its Brent counterpart remains north of USD 78/bbl (vs low USD 77.66/bbl). Turning to metals, spot gold and silver continue to consolidate after yesterday’s Dollar induced losses, with the former finding some support around the USD 1,725/oz mark and the latter establishing a floor around USD 21.50/oz. Over to base metals, Dalian iron ore futures rose to three-week highs amid pre-holiday Chinese demand and after Fortescue Metals Group halted mining operations at a Pilbara project. Conversely, LME copper is on a softer footing as the Buck holds onto recent gains.

US Event Calendar

- 8:30am: 2Q PCE Core QoQ, est. 6.1%, prior 6.1%

- 8:30am: 2Q GDP Price Index, est. 6.1%, prior 6.1%

- 8:30am: 2Q Personal Consumption, est. 11.9%, prior 11.9%

- 8:30am: Sept. Continuing Claims, est. 2.79m, prior 2.85m

- 8:30am: 2Q GDP Annualized QoQ, est. 6.6%, prior 6.6%

- 8:30am: Sept. Initial Jobless Claims, est. 330,000, prior 351,000

- 9:45am: Sept. MNI Chicago PMI, est. 65.0, prior 66.8

Central Bank speakers

- 10am: Fed’s Williams Discusses the Fed’s Pandemic Response

- 10am: Powell and Yellen Appear Before House Finance Panel

- 11am: Fed’s Bostic Discusses Economic Mobility

- 11:30am: Fed’s Harker Discusses Sustainable Assets and Financial...

- 12:30pm: Fed’s Evans Discusses Economic Outlook

- 1:05pm: Fed’s Bullard Makes Opening Remarks at Book Launch

- 2:30pm: Fed’s Daly Speaks at Women and Leadership Event

Government Calendar

- 10am ET: Treasury Secretary Yellen, Fed Chair Powell appear at a House Financial Services Committee hearing on the Treasury, Fed’s pandemic response

- 10:30am ET: Senate begins voting process for continuing resolution that extends U.S. government funding to December 3

- 10:30am ET: Senate Commerce subcommittee holds hearing on Facebook, Instagram’s influence on kids with Antigone Davis, Director, Global Head of Safety, Facebook

- 10:45am ET: House Speaker Nancy Pelosi holds weekly press briefing

DB's Jim Reid concludes the overnight wrap

I’ll be getting my stitches out of my knee today and will have a chance to grill the surgeon who I think told me I’ll probably soon need a knee replacement. I say think as it was all a bit of a medicated blur post the operation 2 weeks ago. These have been a painfully slow 2 weeks of no weight bearing with another 4 to go and perhaps all to no avail. As you can imagine I’ve done no housework, can’t fend much for myself, or been able to control the kids much over this period. I’m not sure if having bad knees are grounds for divorce but I’m going to further put it to the test over the next month. In sickness and in health I plea.

Like me, markets are hobbling into the end of Q3 today even if they’ve seen some signs of stabilising over the last 24 hours following their latest selloff, with equities bouncing back a bit and sovereign bond yields taking a breather from their recent relentless climb. It did feel that we hit yield levels on Tuesday that started to hurt risk enough that some flight to quality money recycled back into bonds. So the next leg higher in yields (which I think will happen) might be met with more risk off resistance, and counter rallies.

The latest moves came amidst relatively dovish and supportive comments from central bank governors at the ECB’s forum yesterday, but sentiment was dampened somewhat as uncertainty abounds over a potential US government shutdown and breaching of the debt ceiling, after both houses of Congress could not agree on a plan to extend government funding. Overnight, there have been signs of progress on the shutdown question, with Majority Leader Schumer saying that senators had reached agreement on a stopgap funding measure that will fund the government through December 3, with the Senate set to vote on the measure this morning.However, we’re still no closer to resolving the debt ceiling issue (where the latest estimates from the Treasury Department point to October 18 as the deadline), and tensions within the Democratic party between moderates and progressives are threatening to sink both the $550bn bipartisan infrastructure bill and the $3.5tn reconciliation package, which together contain much of President Biden’s economic agenda.

We could see some developments on that soon however, as Speaker Pelosi said yesterday that the House was set to vote on the infrastructure bill today. Assuming the vote goes ahead later, this will be very interesting since a number of progressive Democrats have said that they don’t want to pass the infrastructure bill without the reconciliation bill (which contains the administration’s other priorities on social programs). This is because they fear that with the infrastructure bill passed (which moderates are keen on), the moderates could then scale back the spending in the reconciliation bill, and by holding out on passing the infrastructure bill, this gives them leverage on reconciliation. House Speaker Pelosi and Majority Leader Schumer were in the Oval Office with President Biden yesterday, and a White House statement said that Biden spoke on the phone with lawmakers and engagement would continue into today. So an important day for Biden’s agenda.

Against this backdrop, risk assets made a tentative recovery yesterday, with the S&P 500 up +0.16% and Europe’s STOXX 600 up +0.59%. However, unless we get a big surge in either index today, both indices remain on track for their worst monthly performances so far this year, even if they’re still in positive territory for Q3 as a whole. Looking elsewhere, tech stocks had appeared set to pare back some of the previous day’s losses, but a late fade left the NASDAQ down -0.24% and the FANG+ index down a greater -0.72%. Much of the tech weakness was driven by falling semiconductor shares (-1.53%), as producers have offered investors poor revenue guidance on the heels of the ongoing supply chain issues that are driving chip shortages globally. Outside of tech, US equities broadly did better yesterday with 17 of 24 industry groups gaining, led by utilities (+1.30%), biotech (+1.05%) and food & beverages (+1.00%). Similarly, while they initially staged a recovery, small caps in the Russell 2000 (-0.20%) continued to struggle.

One asset that remained on trend was the US dollar. The greenback continued its climb yesterday, with the dollar index increasing +0.61% to close at its highest level in over a year, exceeding its closing high from last November.

Over in sovereign bond markets, the partial rebound saw yields on 10yr Treasuries down -2.1bps at 1.517%, marking their first move lower in a week. And there was much the same pattern in Europe as well, where yields on 10yr bunds (-1.4bps), OATs (-1.3bps) and BTPs (-3.1bps) all moved lower as well. One continued underperformer were UK gilts (+0.3bps), and yesterday we saw the spread between 10yr gilt and bund yields widen to its biggest gap in over 2 years, at 120bps.

Staying on the UK, the pound (-0.81%) continued to slump yesterday, hitting its lowest level against the dollar since last December, which comes as the country has continued to face major issues over its energy supply. Yesterday actually saw natural gas prices take another leg higher in both the UK (+10.09%) and Europe (+10.24%), and the UK regulator said that three smaller suppliers (who supply fewer than 1% of domestic customers between them) had gone out of business. This energy/inflation/BoE conundrum is confusing the life out of Sterling 10 year breakevens. They rose +18bps from Monday morning to Tuesday lunchtime but then entirely reversed the move into last night’s close. This is an exaggerated version of how the world’s financial markets are puzzling over whether breakevens should go up because of energy or go down because of the demand destruction and central bank response.

Central bankers were in no mood to panic yesterday though as we saw Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey and BoJ Governor Kuroda all appear on a policy panel at the ECB’s forum on central banking. There was much to discuss but the central bank heads all maintained that this current inflation spike will relent with Powell saying that it was “really a consequence of supply constraints meeting very strong demand, and that is all associated with the reopening of the economy -- which is a process that will have a beginning, a middle and an end.” ECB President Lagarde shared that sentiment, adding that “we certainly have no reason to believe that these price increases that we are seeing now will not be largely transitory going forward.”

Overnight in Asia, equities have seen a mixed performance, with the Nikkei (-0.40%), and the Hang Seng (-1.08%) both losing ground, whereas the Kospi (+0.41%) and the Shanghai Composite (+0.30%) have posted gains. The moves came amidst weak September PMI data from China, which showed the manufacturing PMI fall to 49.6 (vs. 50.0 expected), marking its lowest level since the height of the Covid crisis in February 2020. The non-manufacturing PMI held up better however, at a stronger 53.2 (vs. 49.8 expected), although new orders were beneath 50 for a 4th consecutive month. Elsewhere, futures on the S&P 500 (+0.50%) and those on European indices are pointing to a higher start later on, as markets continue to stabilise after their slump earlier in the week.

Staying on Asia, shortly after we went to press yesterday, former Japanese foreign minister Fumio Kishida was elected as leader of the governing Liberal Democratic Party, and is set to become the country’s next Prime Minister. The Japanese Diet will hold a vote on Monday to elect Kishida as the new PM, after which he’ll announce a new cabinet, and attention will very soon turn to the upcoming general election, which is due to take place by the end of November. Our Chief Japan economist has written more on Kishida’s victory and his economic policy (link here), but he notes that on fiscal policy, Kishida’s plans to redistribute income echo the shift towards a greater role for government in the US and elsewhere.

There wasn’t a massive amount of data yesterday, though Spain’s CPI reading for September rose to an above-expected +4.0% (vs. 3.5% expected), so it will be interesting to see if something similar happens with today’s releases from Germany, France and Italy, ahead of the Euro Area release tomorrow. Otherwise, UK mortgage approvals came in at 74.5k in August (vs. 73.0k expected), and the European Commission’s economic sentiment indicator for the Euro Area rose to 117.8 in September (vs. 117.0 expected).

To the day ahead now, and one of the highlights will be Fed Chair Powell’s appearance at the House Financial Services Committee, alongside Treasury Secretary Yellen. Other central bank speakers include the Fed’s Williams, Bostic, Harker, Evans, Bullard and Daly, as well as the ECB’s Centeno, Visco and Hernandez de Cos. On the data side, today’s highlights include German, French and Italian CPI for September, while in the US there’s the weekly initial jobless claims, the third estimate of Q2 GDP and the MNI Chicago PMI for September.

Government

The Grinch Who Stole Freedom

The Grinch Who Stole Freedom

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

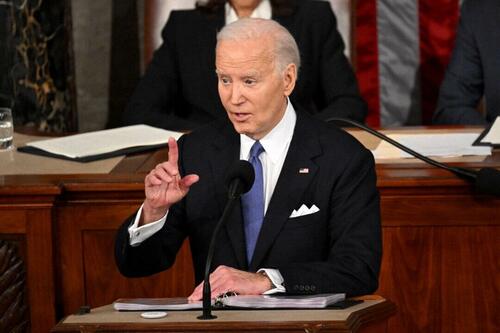

Before President Joe Biden’s State of the…

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

Before President Joe Biden’s State of the Union address, the pundit class was predicting that he would deliver a message of unity and calm, if only to attract undecided voters to his side.

He did the opposite. The speech revealed a loud, cranky, angry, bitter side of the man that people don’t usually see. It seemed like the real Joe Biden I remember from the old days, full of venom, sarcasm, disdain, threats, and extreme partisanship.

The base might have loved it except that he made reference to an “illegal” alien, which is apparently a trigger word for the left. He failed their purity test.

The speech was stunning in its bile and bitterness. It’s beyond belief that he began with a pitch for more funds for the Ukraine war, which has killed 10,000 civilians and some 200,000 troops on both sides. It’s a bloody mess that could have been resolved early on but for U.S. tax funding of the conflict.

Despite the push from the higher ends of conservative commentary, average Republicans have turned hard against this war. The United States is in a fiscal crisis and every manner of domestic crisis, and the U.S. president opens his speech with a pitch to protect the border in Ukraine? It was completely bizarre, and lent some weight to the darkest conspiracies about why the Biden administration cares so much about this issue.

From there, he pivoted to wildly overblown rhetoric about the most hysterically exaggerated event of our times: the legendary Jan. 6 protests on Capitol Hill. Arrests for daring to protest the government on that day are growing.

The media and the Biden administration continue to describe it as the worst crisis since the War of the Roses, or something. It’s all a wild stretch, but it set the tone of the whole speech, complete with unrelenting attacks on former President Donald Trump. He would use the speech not to unite or make a pitch that he is president of the entire country but rather intensify his fundamental attack on everything America is supposed to be.

Hard to isolate the most alarming part, but one aspect really stood out to me. He glared directly at the Supreme Court Justices sitting there and threatened them with political power. He said that they were awful for getting rid of nationwide abortion rights and returning the issue to the states where it belongs, very obviously. But President Biden whipped up his base to exact some kind of retribution against the court.

Looking this up, we have a few historical examples of presidents criticizing the court but none to their faces in a State of the Union address. This comes two weeks after President Biden directly bragged about defying the Supreme Court over the issue of student loan forgiveness. The court said he could not do this on his own, but President Biden did it anyway.

Here we have an issue of civic decorum that you cannot legislate or legally codify. Essentially, under the U.S. system, the president has to agree to defer to the highest court in its rulings even if he doesn’t like them. President Biden is now aggressively defying the court and adding direct threats on top of that. In other words, this president is plunging us straight into lawlessness and dictatorship.

In the background here, you must understand, is the most important free speech case in U.S. history. The Supreme Court on March 18 will hear arguments over an injunction against President Biden’s administrative agencies as issued by the Fifth Circuit. The injunction would forbid government agencies from imposing themselves on media and social media companies to curate content and censor contrary opinions, either directly or indirectly through so-called “switchboarding.”

A ruling for the plaintiffs in the case would force the dismantling of a growing and massive industry that has come to be called the censorship-industrial complex. It involves dozens or even more than 100 government agencies, including quasi-intelligence agencies such as the Cybersecurity and Infrastructure Security Agency (CISA), which was set up only in 2018 but managed information flow, labor force designations, and absentee voting during the COVID-19 response.

A good ruling here will protect free speech or at least intend to. But, of course, the Biden administration could directly defy it. That seems to be where this administration is headed. It’s extremely dangerous.

A ruling for the defense and against the injunction would be a catastrophe. It would invite every government agency to exercise direct control over all media and social media in the country, effectively abolishing the First Amendment.

Close watchers of the court have no clear idea of how this will turn out. But watching President Biden glare at court members at the address, one does wonder. Did they sense the threats he was making against them? Will they stand up for the independence of the judicial branch?

Maybe his intimidation tactics will end up backfiring. After all, does the Supreme Court really think it is wise to license this administration with the power to control all information flows in the United States?

The deeper issue here is a pressing battle that is roiling American life today. It concerns the future and power of the administrative state versus the elected one. The Constitution contains no reference to a fourth branch of government, but that is what has been allowed to form and entrench itself, in complete violation of the Founders’ intentions. Only the Supreme Court can stop it, if they are brave enough to take it on.

If you haven’t figured it out yet, and surely you have, President Biden is nothing but a marionette of deep-state interests. He is there to pretend to be the people’s representative, but everything that he does is about entrenching the fourth branch of government, the permanent bureaucracy that goes on its merry way without any real civilian oversight.

We know this for a fact by virtue of one of his first acts as president, to repeal an executive order by President Trump that would have reclassified some (or many) federal employees as directly under the control of the elected president rather than have independent power. The elites in Washington absolutely panicked about President Trump’s executive order. They plotted to make sure that he didn’t get a second term, and quickly scratched that brilliant act by President Trump from the historical record.

This epic battle is the subtext behind nearly everything taking place in Washington today.

Aside from the vicious moment of directly attacking the Supreme Court, President Biden set himself up as some kind of economic central planner, promising to abolish hidden fees and bags of chips that weren’t full enough, as if he has the power to do this, which he does not. He was up there just muttering gibberish. If he is serious, he believes that the U.S. president has the power to dictate the prices of every candy bar and hotel room in the United States—an absolutely terrifying exercise of power that compares only to Stalin and Mao. And yet there he was promising to do just that.

Aside from demonizing the opposition, wildly exaggerating about Jan. 6, whipping up war frenzy, swearing to end climate change, which will make the “green energy” industry rich, threatening more taxes on business enterprise, promising to cure cancer (again!), and parading as the master of candy bar prices, what else did he do? Well, he took credit for the supposedly growing economy even as a vast number of Americans are deeply suffering from his awful policies.

It’s hard to imagine that this speech could be considered a success. The optics alone made him look like the Grinch who stole freedom, except the Grinch was far more articulate and clever. He’s a mean one, Mr. Biden.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

International

Chinese migration to US is nothing new – but the reasons for recent surge at Southern border are

A gloomier economic outlook in China and tightening state control have combined with the influence of social media in encouraging migration.

The brief closure of the Darien Gap – a perilous 66-mile jungle journey linking South American and Central America – in February 2024 temporarily halted one of the Western Hemisphere’s busiest migration routes. It also highlighted its importance to a small but growing group of people that depend on that pass to make it to the U.S.: Chinese migrants.

While a record 2.5 million migrants were detained at the United States’ southwestern land border in 2023, only about 37,000 were from China.

I’m a scholar of migration and China. What I find most remarkable in these figures is the speed with which the number of Chinese migrants is growing. Nearly 10 times as many Chinese migrants crossed the southern border in 2023 as in 2022. In December 2023 alone, U.S. Border Patrol officials reported encounters with about 6,000 Chinese migrants, in contrast to the 900 they reported a year earlier in December 2022.

The dramatic uptick is the result of a confluence of factors that range from a slowing Chinese economy and tightening political control by President Xi Jinping to the easy access to online information on Chinese social media about how to make the trip.

Middle-class migrants

Journalists reporting from the border have generalized that Chinese migrants come largely from the self-employed middle class. They are not rich enough to use education or work opportunities as a means of entry, but they can afford to fly across the world.

According to a report from Reuters, in many cases those attempting to make the crossing are small-business owners who saw irreparable damage to their primary or sole source of income due to China’s “zero COVID” policies. The migrants are women, men and, in some cases, children accompanying parents from all over China.

Chinese nationals have long made the journey to the United States seeking economic opportunity or political freedom. Based on recent media interviews with migrants coming by way of South America and the U.S.’s southern border, the increase in numbers seems driven by two factors.

First, the most common path for immigration for Chinese nationals is through a student visa or H1-B visa for skilled workers. But travel restrictions during the early months of the pandemic temporarily stalled migration from China. Immigrant visas are out of reach for many Chinese nationals without family or vocation-based preferences, and tourist visas require a personal interview with a U.S. consulate to gauge the likelihood of the traveler returning to China.

Social media tutorials

Second, with the legal routes for immigration difficult to follow, social media accounts have outlined alternatives for Chinese who feel an urgent need to emigrate. Accounts on Douyin, the TikTok clone available in mainland China, document locations open for visa-free travel by Chinese passport holders. On TikTok itself, migrants could find information on where to cross the border, as well as information about transportation and smugglers, commonly known as “snakeheads,” who are experienced with bringing migrants on the journey north.

With virtual private networks, immigrants can also gather information from U.S. apps such as X, YouTube, Facebook and other sites that are otherwise blocked by Chinese censors.

Inspired by social media posts that both offer practical guides and celebrate the journey, thousands of Chinese migrants have been flying to Ecuador, which allows visa-free travel for Chinese citizens, and then making their way over land to the U.S.-Mexican border.

This journey involves trekking through the Darien Gap, which despite its notoriety as a dangerous crossing has become an increasingly common route for migrants from Venezuela, Colombia and all over the world.

In addition to information about crossing the Darien Gap, these social media posts highlight the best places to cross the border. This has led to a large share of Chinese asylum seekers following the same path to Mexico’s Baja California to cross the border near San Diego.

Chinese migration to US is nothing new

The rapid increase in numbers and the ease of accessing information via social media on their smartphones are new innovations. But there is a longer history of Chinese migration to the U.S. over the southern border – and at the hands of smugglers.

From 1882 to 1943, the United States banned all immigration by male Chinese laborers and most Chinese women. A combination of economic competition and racist concerns about Chinese culture and assimilability ensured that the Chinese would be the first ethnic group to enter the United States illegally.

With legal options for arrival eliminated, some Chinese migrants took advantage of the relative ease of movement between the U.S. and Mexico during those years. While some migrants adopted Mexican names and spoke enough Spanish to pass as migrant workers, others used borrowed identities or paperwork from Chinese people with a right of entry, like U.S.-born citizens. Similarly to what we are seeing today, it was middle- and working-class Chinese who more frequently turned to illegal means. Those with money and education were able to circumvent the law by arriving as students or members of the merchant class, both exceptions to the exclusion law.

Though these Chinese exclusion laws officially ended in 1943, restrictions on migration from Asia continued until Congress revised U.S. immigration law in the Hart-Celler Act in 1965. New priorities for immigrant visas that stressed vocational skills as well as family reunification, alongside then Chinese leader Deng Xiaoping’s policies of “reform and opening,” helped many Chinese migrants make their way legally to the U.S. in the 1980s and 1990s.

Even after the restrictive immigration laws ended, Chinese migrants without the education or family connections often needed for U.S. visas continued to take dangerous routes with the help of “snakeheads.”

One notorious incident occurred in 1993, when a ship called the Golden Venture ran aground near New York, resulting in the drowning deaths of 10 Chinese migrants and the arrest and conviction of the snakeheads attempting to smuggle hundreds of Chinese migrants into the United States.

Existing tensions

Though there is plenty of precedent for Chinese migrants arriving without documentation, Chinese asylum seekers have better odds of success than many of the other migrants making the dangerous journey north.

An estimated 55% of Chinese asylum seekers are successful in making their claims, often citing political oppression and lack of religious freedom in China as motivations. By contrast, only 29% of Venezuelans seeking asylum in the U.S. have their claim granted, and the number is even lower for Colombians, at 19%.

The new halt on the migratory highway from the south has affected thousands of new migrants seeking refuge in the U.S. But the mix of push factors from their home country and encouragement on social media means that Chinese migrants will continue to seek routes to America.

And with both migration and the perceived threat from China likely to be features of the upcoming U.S. election, there is a risk that increased Chinese migration could become politicized, leaning further into existing tensions between Washington and Beijing.

Meredith Oyen does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress pandemic deaths south america mexico chinaGovernment

Vaccine-skeptical mothers say bad health care experiences made them distrust the medical system

Vaccine skepticism, and the broader medical mistrust and far-reaching anxieties it reflects, is not just a fringe position in the 21st century.

Why would a mother reject safe, potentially lifesaving vaccines for her child?

Popular writing on vaccine skepticism often denigrates white and middle-class mothers who reject some or all recommended vaccines as hysterical, misinformed, zealous or ignorant. Mainstream media and medical providers increasingly dismiss vaccine refusal as a hallmark of American fringe ideology, far-right radicalization or anti-intellectualism.

But vaccine skepticism, and the broader medical mistrust and far-reaching anxieties it reflects, is not just a fringe position.

Pediatric vaccination rates had already fallen sharply before the COVID-19 pandemic, ushering in the return of measles, mumps and chickenpox to the U.S. in 2019. Four years after the pandemic’s onset, a growing number of Americans doubt the safety, efficacy and necessity of routine vaccines. Childhood vaccination rates have declined substantially across the U.S., which public health officials attribute to a “spillover” effect from pandemic-related vaccine skepticism and blame for the recent measles outbreak. Almost half of American mothers rated the risk of side effects from the MMR vaccine as medium or high in a 2023 survey by Pew Research.

Recommended vaccines go through rigorous testing and evaluation, and the most infamous charges of vaccine-induced injury have been thoroughly debunked. How do so many mothers – primary caregivers and health care decision-makers for their families – become wary of U.S. health care and one of its most proven preventive technologies?

I’m a cultural anthropologist who studies the ways feelings and beliefs circulate in American society. To investigate what’s behind mothers’ vaccine skepticism, I interviewed vaccine-skeptical mothers about their perceptions of existing and novel vaccines. What they told me complicates sweeping and overly simplified portrayals of their misgivings by pointing to the U.S. health care system itself. The medical system’s failures and harms against women gave rise to their pervasive vaccine skepticism and generalized medical mistrust.

The seeds of women’s skepticism

I conducted this ethnographic research in Oregon from 2020 to 2021 with predominantly white mothers between the ages of 25 and 60. My findings reveal new insights about the origins of vaccine skepticism among this demographic. These women traced their distrust of vaccines, and of U.S. health care more generally, to ongoing and repeated instances of medical harm they experienced from childhood through childbirth.

As young girls in medical offices, they were touched without consent, yelled at, disbelieved or threatened. One mother, Susan, recalled her pediatrician abruptly lying her down and performing a rectal exam without her consent at the age of 12. Another mother, Luna, shared how a pediatrician once threatened to have her institutionalized when she voiced anxiety at a routine physical.

As women giving birth, they often felt managed, pressured or discounted. One mother, Meryl, told me, “I felt like I was coerced under distress into Pitocin and induction” during labor. Another mother, Hallie, shared, “I really battled with my provider” throughout the childbirth experience.

Together with the convoluted bureaucracy of for-profit health care, experiences of medical harm contributed to “one million little touch points of information,” in one mother’s phrase, that underscored the untrustworthiness and harmful effects of U.S. health care writ large.

A system that doesn’t serve them

Many mothers I interviewed rejected the premise that public health entities such as the Centers for Disease Control and Prevention and the Food and Drug Administration had their children’s best interests at heart. Instead, they tied childhood vaccination and the more recent development of COVID-19 vaccines to a bloated pharmaceutical industry and for-profit health care model. As one mother explained, “The FDA is not looking out for our health. They’re looking out for their wealth.”

After ongoing negative medical encounters, the women I interviewed lost trust not only in providers but the medical system. Frustrating experiences prompted them to “do their own research” in the name of bodily autonomy. Such research often included books, articles and podcasts deeply critical of vaccines, public health care and drug companies.

These materials, which have proliferated since 2020, cast light on past vaccine trials gone awry, broader histories of medical harm and abuse, the rapid growth of the recommended vaccine schedule in the late 20th century and the massive profits reaped from drug development and for-profit health care. They confirmed and hardened women’s suspicions about U.S. health care.

The stories these women told me add nuance to existing academic research into vaccine skepticism. Most studies have considered vaccine skepticism among primarily white and middle-class parents to be an outgrowth of today’s neoliberal parenting and intensive mothering. Researchers have theorized vaccine skepticism among white and well-off mothers to be an outcome of consumer health care and its emphasis on individual choice and risk reduction. Other researchers highlight vaccine skepticism as a collective identity that can provide mothers with a sense of belonging.

Seeing medical care as a threat to health

The perceptions mothers shared are far from isolated or fringe, and they are not unreasonable. Rather, they represent a growing population of Americans who hold the pervasive belief that U.S. health care harms more than it helps.

Data suggests that the number of Americans harmed in the course of treatment remains high, with incidents of medical error in the U.S. outnumbering those in peer countries, despite more money being spent per capita on health care. One 2023 study found that diagnostic error, one kind of medical error, accounted for 371,000 deaths and 424,000 permanent disabilities among Americans every year.

Studies reveal particularly high rates of medical error in the treatment of vulnerable communities, including women, people of color, disabled, poor, LGBTQ+ and gender-nonconforming individuals and the elderly. The number of U.S. women who have died because of pregnancy-related causes has increased substantially in recent years, with maternal death rates doubling between 1999 and 2019.

The prevalence of medical harm points to the relevance of philosopher Ivan Illich’s manifesto against the “disease of medical progress.” In his 1982 book “Medical Nemesis,” he insisted that rather than being incidental, harm flows inevitably from the structure of institutionalized and for-profit health care itself. Illich wrote, “The medical establishment has become a major threat to health,” and has created its own “epidemic” of iatrogenic illness – that is, illness caused by a physician or the health care system itself.

Four decades later, medical mistrust among Americans remains alarmingly high. Only 23% of Americans express high confidence in the medical system. The United States ranks 24th out of 29 peer high-income countries for the level of public trust in medical providers.

For people like the mothers I interviewed, who have experienced real or perceived harm at the hands of medical providers; have felt belittled, dismissed or disbelieved in a doctor’s office; or spent countless hours fighting to pay for, understand or use health benefits, skepticism and distrust are rational responses to lived experience. These attitudes do not emerge solely from ignorance, conspiracy thinking, far-right extremism or hysteria, but rather the historical and ongoing harms endemic to the U.S. health care system itself.

Johanna Richlin does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

disease control extremism pandemic covid-19 vaccine treatment testing fda deaths-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex