Uncategorized

Futures Extend Last Week’s Blockbuster Rally As Oil, Yields Rise

Futures Extend Last Week’s Blockbuster Rally As Oil, Yields Rise

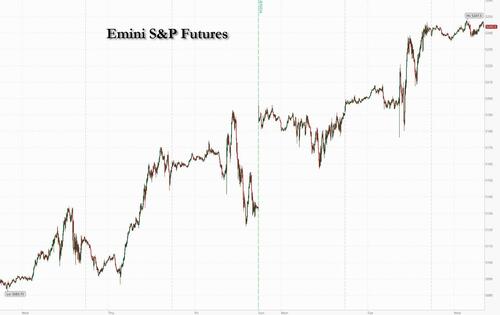

US equity futures extended gains after last week’s blockbuster rally, the…

US equity futures extended gains after last week’s blockbuster rally, the biggest of the year, despite some weakness in bonds, as traders remained optimistic that US and European central banks may start cutting interest rates as soon as next year. As of 7:40am, S&P emini futures were higher by 0.2%, near top of Friday’s range, while Europe's Estoxx 600 dropped 0.2% with materials leading declines. South Korea’s Kospi soared more than 5% after regulators banned short selling. The dollar fell for a fourth day. Crude futures rose more than 1.5% after Saudi Arabia and Russia reaffirmed they will stick with their supply curbs through year-end. Bitcoin continued its ascent, last seen above $35K, with Ethereum rising above $1900.

Among individual stock market movers, Ryanair jumped almost 7% after announcing its first regular dividend. Tesla rose in pre-market trading after Reuters reported the company would produce a new, more affordable electric car model in Germany. Albemarle fell 1% as UBS cut its recommendation on the lithium producer’s stock to neutral from buy. Meanwhile, Morgan Stanley slashed its price target to Street-low of $90 from $155. Here are the other notable premarket movers:

- Apple Inc. is upgraded to accumulate from neutral at Phillip Securities, a move that comes in the wake of the iPhone maker’s recent results. Shares are down 0.3%.

- BioNTech ADRs gain 4.7% after the vaccine maker reported a profit for the third quarter, exceeding analysts’ expectations of a loss. The firm also gave quarterly sales results that topped estimates.

- Birkenstock has received buy-equivalent recommendations from a majority of brokers initiating coverage after the so-called quiet period for analysts at firms that participated in the initial public offering. Shares are down 0.2%.

- Bumble slumps 7.1% after the Wall Street Journal reported that CEO Whitney Wolfe Herd is stepping down.

- Dish Network Corp. is down as much as 13% after a satellite television company reported revenue for the third quarter that missed the average analyst estimate and said its CEO Erik Carlson will resign effective November 12.

- Fortinet Inc. is downgraded to hold from buy at HSBC, a move that comes in the wake of the cybersecurity company’s recent results. Shares down 1.2% in premarket trading.

- Freshpet shares are up 12% in premarket trading, after the retailer of pet products reported third-quarter results that beat expectations and raised its full-year forecast.

- Hilton Grand Vacations falls 6% in premarket trading after the manager of timeshare resorts agreed to buy Bluegreen Vacations Holding for $75.00 per share in an all-cash transaction, representing a total enterprise value of approximately $1.5 billion, inclusive of net debt.

- Paramount Global slides 3.5% in premarket trading after BofA double-downgrades its rating to underperform from buy, on basis of no significant asset sales on the horizon for the media company.

- Tecnoglass Inc. shares fall 11% in premarket trading Monday after narrowing its full-year revenue outlook to a range of $835 million to $848 million, after previously forecasting between $830 million and $855 million.

- SolarEdge Technologies falls 0.3% as Wells Fargo adds to the slew of downgrades since the solar equipment supplier’s weak revenue forecast last week, cutting to equal-weight with uncertainties seen outweighing a discounted valuation.

Global equity markets are finding firmer footing after recent US data pointed to a cooling economy, leading traders to price lower rates by June. Ten-year Treasury yields, the benchmark rate for the global cost of capital, edged higher Monday, having slid in recent weeks from the 16-year highs touched last month.

“A better-than-expected US earnings season and the peak in interest rates are all pointing towards a year-end rally,” said Julius Baer strategist, Leonardo Pellandini, echoing a view that has rapidly become consensus when as recently as two weeks ago the Wall Street outlook was that a drop below 4,000 was in the cards. Which is not to say that the permabears are giving up: according to Morgan Stanley’s Michael Wilson who has been wrong most of the year, last week’s market bounce was more of a bear market rally than the start of a sustained upswing, particularly in light of a gloomy earnings outlook and weaker macro data.

More information about how policymakers see the trajectory of inflation may come later in week, with speeches due from Federal Reserve Chair Jerome Powell and Bank of England governor Andrew Bailey.

“There’s a bit more reason for investors to be more optimistic that the Fed is probably done with rate hikes, but one should not let one’s guard down,” Vasu Menon, managing director for investment strategy for OCBC Bank Singapore, said on Bloomberg Television. “If the economy proves to be more resilient, if inflation proves to be more stubborn, bond yields could go up once again.”

Here are the latest market observations from Goldman trader Rich Privorotsky:

Massive stop in of macro risk last week. Very visible in the PB stats with a huge jump in nets and some outsized flows to buy macro products ("Global book saw largest net buying since Dec '21") . It was really a beta chase and that is quite evident from the record amounts IWM calls, the ballooning of SPX calls and a corresponding jump in funding spreads.

L/S scrambling to lock in gains on short alpha bets drove portfolio destruction and the unwind of momentum across the market (later parts of last week saw some of the worst systematic alpha we've seen all year). Non-profitable tech 2 day return = 13.5%, 99th % of the last 5 years. Amazing to see that the market’s correlation to longer dated rates only go higher on the week (rolling 60-day basically back to the highs).

If you look at cross asset price action the market traded as if it had been delivered QE with bonds up/eq up, credit tighter/bonds up, Cyc/def up/bonds up and vol down/bonds up. To some extent that’s true, the QRA did curtail some of the bond supply overhang. As the dust has settled I’m not so sure just how big of an impact this really has, net duration might be platueing very temporarily but the change is really marginal. Market took NFP as Goldilocks print with economy slowing just enough to take pressure off the rate market and yet not enough to project recession. Last week had a lot of weak data with ISM manf, ISM services both coming in light of expectations. The market is repricing forward earnings expectations lower sharply in European and slightly so in the US. GIR actually decomposed the yield moves last a with the lion share driven by a downgrade to growth and to a lesser extent policy (see side-note).

The technicals are supportive: From here CTA are still going likely to be buying more, L/S nets have already jumped considerably after last week (more could come but think a lot of the squaring now rear view), asset mangers have length to add as the CFTC positioning data suggests they have trimmed exposure in SPX/NDX to early summer levels (but that’s a far cry from deeply underweight levels to start the year) and vol control probably will at some point start buying again but at at a gradual pace. Vol is back to a 14 handle so any exogenous risk premia for the multiple geopolitical conflicts has slipped to zero. Ironically SPX implied vs realized still shows pretty big downside to spot vol levels.

European stocks struggled to gain traction as bond yields pared some of Friday’s post-payrolls drop. The Stoxx 600 was modestly red after rising for five straight days. Travel and mining are the best performing sectors. Ryanair shares rise as much as 6.8%, the most since January, after the budget airline announced its first ever dividend and reported second-quarter results that analysts called solid. Here are other notable European movers:

- Melrose Industries shares rise as much as 4.8%, the most since September, after its subsidiary GKN Aerospace signed a new agreement with GE Aerospace, widening a long-term partnership on the GEnx program

- JD Sports rises as much as 2.4% in London as Citi initiates with a buy rating, citing that it sees Asia-Pacific representing the largest growth opportunity for sporting-goods stocks

- Stadler Rail rises as much as 1.5% after Oddo raised its recommendation for the Swiss train maker to neutral from underperform, citing increasingly “rational” multiples after the stock’s plunge over the past two years

- Evotec drops as much as 7.8%, as RBC downgrades the German pharma company to sector perform on major near-term uncertainty from factors including life science sector headwinds

- K+S shares slide as much as 7.8% to a June low after the potash producer was cut to sell from neutral at UBS, citing a lack of earnings momentum and a challenging environment for the crop nutrient

- Telecom Italia shares slip after erasing gains of as much as 5.4% at the open. The Italian carrier’s board approved a sale of its land-line network to KKR for as much as €22 billion

- Heidelberg Materials falls as much as 3% as UBS downgrades the cement maker to neutral from buy, citing potential for larger and higher-multiple M&A activity, which could weigh on shares

- PostNL falls as much as 13%, the steepest drop since May 2022, after third-quarter results missed estimates. A recovery in parcel volumes failed to match expectations in the third quarter

- Oerlikon drops as much as 7.4%, after RBC cuts the polymer processing group to sector perform in note saying that third-quarter results were “sobering” and a cautious outlook won’t help investor confidence

Earlier in the session, the MSCI Asia Pacific Index advances as much as 1.9%, rallying the most since July 13, after US Treasury yields fell on Friday following data releases that showed the US service sector expanded at the weakest pace in five months, job growth moderated and the unemployment rate climbed to 3.9%.

- Hang Seng and Shanghai Comp conformed to the gains in the region with sentiment supported by weekend comments from the Chinese Premier who stated China will soon release a plan to promote high-standard institutional opening up in the Shanghai Free Trade Zone, whilst the Finance Minister said China will accelerate the issuance and use of government bonds. Traders are also cognizant of the Chinese Trade Balance data due for release tomorrow.

- Korea’s Kospi index surges as much as 4.1%, the most since January 2021, following the nation’s move to reimpose a full ban on short-selling for about eight months; Kosdaq +6.2%.

- Japan's Nikkei 225 remained comfortably above the 32,500 level and hit levels last seen at the end of September with the Industrial sectors leading the gains, whilst Final Services and Composite PMIs were revised higher from the Prelim.

- Australia's ASX 200 posted modest gains as the index is hindered by losses in heavyweight Energy and Mining sectors, although gold names outperformed as the yellow metal held onto recent gains, while Financials were boosted by Westpac post earnings. Participants also look ahead to tomorrow’s RBA decision in which 35/39 analysts polled by Reuters expect a 25bps rate hike.

- Indian stocks climbed for the third straight day, reflecting the widespread gains across Asia. The S&P BSE Sensex rose 0.9% to 64,958.69 as of 03:45 p.m. in Mumbai, while the NSE Nifty 50 Index gained by a similar measure to 19,411.75. Today’s gain in the Nifty was the third-best Monday performance so far this year. The NSE metal index was the top-performing sector, with 12 of its 15 member stocks advancing on the day. All sectors except the gauge for state-run banks ended in the green.

In FX, the Bloomberg Dollar Spot Index was flat after the index on Friday posted its worst performance since mid-July. The Japanese yen is one of the weakest G-10 currencies, falling 0.2% versus the greenback; the USDJPY was boosted by short covering by leveraged funds; the yen pared losses after Bank of Japan Governor Kazuo Ueda cautiously hinted that gradual progress is being made toward achieving the bank’s inflation target “Another soft outcome on Japanese labor cash earnings will reinforce our view that BoJ policy tightening is a distant prospect,” Kristina Clifton, Commonwealth Bank of Australia strategist, wrote in a note, referring to data due to come out on Tuesday

In rates, treasuries are slightly cheaper across the curve amid deeper losses in core European rates, partially unwinding Friday’s sharp bull-steepening rally spurred by softer-than-expected October jobs report. US yields cheaper by up to 3bp across front-end of the curve which leads losses on the day, re-flattening 2s10s spread by around 1bp into early US session; 10-year yields around 4.59% with bunds and gilts lagging by 4bp and 3bp in the sector. Scant economic data is scheduled for this week, while auctions resume Tuesday with $48b 3-year note sale, followed by 10- and 30-year offerings Wednesday and Thursday. Powell is slated to speak Wednesday and Thursday, among more than a dozen planned appearances by Fed officials this week. Dollar IG issuance slate already includes a handful of deals; forecasts for the week suggest around $40b of issuance on deck, higher than average, during economic data drought.

In commodities, oil prices advance, with WTI rising 1.8% to trade near $81.90. Spot gold falls 0.3%.

No US economic data scheduled for the session; ahead this week are trade balance, wholesale inventories and University of Michigan sentiment

Market Snapshot

- S&P 500 futures up 0.1% to 4,382.00

- STOXX Europe 600 little changed at 444.09

- MXAP up 2.0% to 159.84

- MXAPJ up 2.2% to 499.71

- Nikkei up 2.4% to 32,708.48

- Topix up 1.6% to 2,360.46

- Hang Seng Index up 1.7% to 17,966.59

- Shanghai Composite up 0.9% to 3,058.41

- Sensex up 0.9% to 64,930.04

- Australia S&P/ASX 200 up 0.3% to 6,997.38

- Kospi up 5.7% to 2,502.37

- German 10Y yield little changed at 2.69%

- Euro up 0.1% to $1.0745

- Brent Futures up 1.4% to $86.04/bbl

- Brent Futures up 1.3% to $86.01/bbl

- Gold spot down 0.3% to $1,986.56

- U.S. Dollar Index little changed at 104.93

Top Overnight News

- China will further expand market access and increase imports, its premier told a trade fair in Shanghai on Sunday, amid criticism from European firms who said they wanted to see more tangible improvement in the country's business environment. RTRS

- China will accelerate the issuance and use of government bonds, state-run news agency Xinhua reported on Sunday citing an interview with new finance minister Lan Foan. The finance ministry will steadily promote the resolution of local government debt risk and increase efforts to better leverage the role of special bonds to boost the economy, Xinhua cited Foan as saying. RTRS

- Foreign firms yanked more than $160 billion in total earnings from China during six successive quarters through the end of September, according to an analysis of Chinese data, an unusually sustained run of profit outflows that shows how much the country’s appeal is waning for foreign capital. WSJ

- Chinese brokerages surged after authorities proposed to relax capital requirements for firms and signaled support for more acquisitions. BBG

- Shares in South Korea surged on Monday morning after the country’s financial regulator issued a blanket ban on short selling to appease retail investors ahead of parliamentary elections next year. FT

- Saudi Arabia and Russia reaffirmed that they will stick with oil supply curbs of more than 1 million barrels a day until the end of the year, even as turmoil in the Middle East roils global markets. The leaders of the OPEC+ coalition announced the plans in separate official statements on Sunday. Riyadh has slashed daily crude production by 1 million barrels and Moscow is curbing exports by 300,000 barrels, on top of earlier cuts made with fellow OPEC+ nations. BBG

- Trump leads Biden in nearly all the important battleground states according to a new poll (Biden leads among voters under 30 by just a single point and his advantage with Hispanic voters is down to the single digits). NYT

- Israeli troops encircled Gaza City, effectively cutting off the northern part of the strip from the south, an army spokesman said. Antony Blinken is in Turkey after making unannounced stops in the West Bank and Iraq. White House officials are frustrated at the scale of civilian casualties in Gaza. WaPo

- Hedge funds extended short positions on Treasuries to a record, CFTC data showed — just before smaller-than-expected US bond sales and weaker jobs data spurred a rally. Also on a collision course: Money markets have raised policy-easing wagers, betting the first Fed rate cut will be in June, with 100 bps of reductions by end-2024. BBG

- Consumer Discretionary was the most net bought sector on the US Prime book last week and saw the largest net buying since Dec ’21, driven almost entirely by long buys. Last week’s long buying in US Cons Disc ranks in the 93rd percentile vs. the past five years.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher across the board following the post-NFP tailwinds from Wall Street on Friday, with sentiment in the region also boosted by South Korea announcing a ban on stock short-shelling which catapulted the KOSPI index to gain over 4%. ASX 200 posted modest gains as the index is hindered by losses in heavyweight Energy and Mining sectors, although gold names outperformed as the yellow metal held onto recent gains, while Financials were boosted by Westpac post earnings. Participants also look ahead to tomorrow’s RBA decision in which 35/39 analysts polled by Reuters expect a 25bps rate hike. Nikkei 225 remained comfortably above the 32,500 level and hit levels last seen at the end of September with the Industrial sectors leading the gains, whilst Final Services and Composite PMIs were revised higher from the Prelim. Hang Seng and Shanghai Comp conformed to the gains in the region with sentiment supported by weekend comments from the Chinese Premier who stated China will soon release a plan to promote high-standard institutional opening up in the Shanghai Free Trade Zone, whilst the Finance Minister said China will accelerate the issuance and use of government bonds. Traders are also cognizant of the Chinese Trade Balance data due for release tomorrow.

Top Asian News

- China Premier said China will continue to promote opening up and market opportunities, and China will actively expand imports, and promote coordination of trading goods and services. He added China will further expand market access and remove barriers to foreign investment in manufacturing. China Premier said in the next five years, China's imports of goods and services are expected to reach USD 17tln on cumulative terms, and China will soon release a plan to promote high-standard institutional opening up in the Shanghai Free Trade Zone, according to Reuters.

- China's Finance Minister said China will accelerate the issuance and use of government bonds, and China will steadily promote the resolution of local government debt risks, according to Reuters citing state media.

- Alibaba's (9988 HK/BABA) Ant Group has received Chinese government approval to release products powered by its 'Bailing' AI model to the public, according to Reuters.

- PBoC injected CNY 18bln via 7-day reverse repos with the rate at 1.80% for a CNY 658bln net daily drain, according to Reuters.

- China's Shenzhen state asset regulator says if Vanke (2202 HK) faces extreme conditions it has sufficient liquidity to assist, via Reuters citing sources.

- South Korea to ban all stock short-selling through the first half of 2024 to help create a "level playing field" for both retail investors and institutional and foreign investors, according to financial regulators cited by Reuters.

- The Japanese government reportedly plans to submit an extra budget to Parliament on November 20th, according to Asahi.

- BoJ Governor Ueda reiterated that Japan's economy is recovering moderately and is likely to continue recovering and repeated that the BoJ will patiently maintain monetary easing to support economic activity, according to Reuters. He said long-term interest rates may rise somewhat, but what's important is to look at the real interest rate that takes into account inflation expectations. He added the BoJ will continue massive bond-buying even under the new operation decided last week and will conduct nimble market operations when interest rates rise, depending on the level and speed of moves of long-term rates. He said even if long-term rates come under upward pressure, he doesn't expect the 10-year JGB yield to sharply exceed 1%, and BoJ needs to carefully weigh the effect of the policy in stimulating the economy and the potential side-effects under YCC. Ueda said the BoJ will keep Yield Curve Control and negative short-term rates intact until the sustained achievement of 2% inflation is foreseen. Ueda said the BoJ needs to have more conviction that wages will keep rising.

- BoJ Minutes from the September 21-22 meeting (two meetings ago) said members expressed the need to continue patiently with monetary easing to achieve the sustainable inflation target, alongside wage growth, according to Reuters.

- Japanese government is to hold a meeting with management and labor unions this month, via Nikkei.

- RBA Shadow Board calls for a rate hike to curb inflation, according to Canberra Times.

European bourses are in the red with trade thus far relatively cagey and contained after last week's action and as the region awaits fresh catalysts, Euro Stoxx 50 -0.3%. Sectors are mixed with outperformance in Travel & Leisure post-Ryanair while the likes of Real Estate, Construction and Chemicals lag. Stateside, futures are modestly firmer in a continuation of Friday's action going into a week that features numerous Fed speakers incl. Chair Powell and data prints such as Manheim & UoM; ES & NQ +0.2%. Berkshire Hathaway (BRK): Reported a +40.6% increase in Q3 operating earnings to USD 10.76bln (exp. 8.95bln), or around USD 4.96/shr per Class B share (exp. 4.42), and around USD 7,442 for each Class A share (exp. 6,625). Q3 revenue USD 93.2bln (exp. 88.1bln); Q3 insurance underwriting operating income USD 2.422bln (vs USD 1.247bln Q/Q), Q3 insurance investment income USD 2.47bln (vs 2.369bln Q/Q). Ended the quarter with USD 157.2bln of cash. Executed USD 1.1bln of share repurchases in Q3 (vs USD 1.4bln in Q2). Its outlook acknowledges challenges like the pandemic's impact, geopolitical risks, and inflation pressures. +0.6% in pre-market trade.

Top European News

- ECB President Lagarde said the ECB is determined to bring inflation down to 2%. “According to our projections, we will get there in 2025”, according to an interview with Greek press conducted on 30th October and released on 4th November.

- UK PM Sunak will reportedly unveil a North Sea annual oil and gas licensing bill which will allow companies to bid yearly for new licences to drill for fossil fuels, according to the FT. "There is currently no fixed period between licensing rounds - but this would change under a bill to be announced in Tuesday's King's Speech... Ministers said projects would have to meet net-zero targets and claimed the policy would guarantee energy security.", according to the BBC.

- UK Chancellor Hunt is facing calls from Tory MPs to lower taxes after figures revealed a multi-billion GBP improvement in public finances since March's budget, according to The Times.

FX

- Buck continues to buckle after 'dovish' Fed, NFP and ISM misses as DXY slips into a softer 105.15-104.84 range, Pound, Euro and Franc all extend gains vs Dollar to form 1.2400+ triple top, probe 1.0750 and approach 0.8950 respectively.

- EUR/USD faces decent option expiry interest below 1.0800.

- USD/JPY capped by 21 DMA and expiries at 150.00 strike after BoJ Governor Ueda maintains that patient monetary easing is still needed.

- Aussie prepares for likely RBA hike, with AUD/USD holding above 0.6500 and AUD/NZD cross eyeing return to 1.0900.

- Loonie underpinned by a bounce in crude and hawkish line from BoC's Rogers ahead of Canadian Ivey PMIs and Market Participants Survey.

- PBoC sets USD/CNY mid-point at 7.1780 vs exp. 7.2868 (prev. 7.1796)

FX

- Bonds hand back more of Friday's post-payrolls and services ISM gains.

- Bunds towards the lower end of 129.90-130.38 band alongside EGB peers after stronger than expected German factory orders and not as weak as feared EZ Sentix index.

- Gilts and T-note near base of 94.78-95.15 and 108-02/07+ respective ranges.

Commodities

- Crude benchmarks are firmer and have continued to climb despite a lack of fundamental updates occurring in European hours, with the move primarily a recovery from Friday’s pressure and aided by geopolitics alongside a softer USD.

- As it stands, WTI Dec’23 and Brent Jan’24 contracts are at the top end of circa. USD 1.50/bbl parameters but remain well within Friday’s and by extensions last week’s parameters.

- Spot gold is little changed with the overall tone a tentative one as we await fresh catalysts and continue to analyse last week’s data and potential associated Fed implications. Finally, base metals are generally firmer owing to the constructive APAC tone.

- Saudi Arabia December OSPs: Arab Light prices maintained for Asia and the US, but large cut to NW Europe, according to Reuters: Asia +4.00/bbl (prev. +4.00/bbl) vs Oman/Dubai average, NW Europe +4.90/bbl (prev. +7.20/bbl) to Ice Brent settlement, US +7.45/bbl (prev. +7.45/bbl) vs ASCI.

- Saudi Ministry of Energy reaffirmed that Saudi Arabia will continue the voluntary cut of 1mln BPD through December, according to the state news agency SPA.

- Russia's Deputy PM Novak reaffirmed Russia to continue the additional voluntary supply cut of oil and petroleum products exports by 300k BPD until the end of December this year. He said the voluntary cut decision will be reviewed next month to consider deepening the cut or increasing oil production, according to Reuters.

Geopolitics: Israel-Hamas

- Israeli PM Netanyahu said there will be no ceasefire until hostages are returned, according to Reuters. Israel's army says it has cut the Gaza Strip in two, according to AFP.

- Four civilians, three of them children, were killed by an Israeli airstrike in south Lebanon on Sunday evening, according to Sky News.

- Hezbollah said it fired multiple Grad rockets at the northern Israeli town of Kiryat Shmona in retaliation for an Israeli airstrike in South Lebanon, according to Reuters.

- Hezbollah lawmaker Fadallah said the Israeli strike which killed children is a “dangerous development”, and will have repercussions, according to Reuters.

- Lebanon said it will submit a complaint to the United Nations over the killing of civilians including children in an Israeli strike in South Lebanon, according to the Lebanese Foreign Minister cited by Reuters.

- Israeli military spokesperson said their attacks in Lebanon are made based on intelligence information, according to Reuters.

- Evacuations from Gaza to Egypt through Rafah crossing were reportedly suspended since Saturday after Israeli strikes on ambulances, according to Egyptian official sources cited by Reuters.

- Qatar's Foreign Ministry spokesperson said the Hamas political office in Doha will remain open so long as it can be used towards peace, and there's no reason to close it now, and added that Qatar is working with Egypt to ensure Rafah crossing remains open, according to Reuters.

- Egyptian Foreign Minister Shoukry says he cannot justify Israel's actions against Palestinians as self-defence, according to Reuters.

- Diplomatic adviser to the UAE President said Israel's response to the October 7 attack is disproportionate, and added the Palestinian issue is an Arab issue, according to Reuters.

- Saudi Arabia strongly condemned the statement issued by an Israeli minister regarding dropping a nuclear bomb on the Gaza Strip, according to Reuters.

- US Central Command announced that the Ohio-class nuclear submarine has arrived in the Middle East.

- US President Biden said "yes" when asked if there has been any progress on a humanitarian pause in Gaza, according to Reuters.

- US Secretary of State Blinken said the US is intensely focused on bringing home hostages from Gaza. He said a humanitarian pause could advance the prospect of getting hostages back, while adding the current flow of aid to Gaza is grossly insufficient, according to Reuters.

- US Secretary of State Blinken told Palestinian leader Abbas that the Palestinian Authority should play a central role in what comes next in Gaza, according to a Senior State Department Official cited by Reuters. Blinken made clear that Palestinians must not be forcibly displaced and reiterated US commitment to advancing dignity, and security for Palestinians and Israelis alike, according to Reuters.

- Iran's Defense Minister warned the US it "will be hit hard" if it does not implement a ceasefire in Gaza, according to Tasnim cited by Reuters. Iran's Vice President said the tragedy in Gaza cannot be ignored, according to Reuters.

- The Turkish Foreign Minister reportedly discussed the situation in Gaza with the Egyptian and Jordanian counterparts. They exchanged views on stopping attacks on civilians in Gaza and achieving an urgent ceasefire, according to a Turkish diplomatic source cited by Reuters.

- French Foreign Minister said the humanitarian conference on November 9th will cover the respect of international law, and will call for a concrete mobilization for the civilian population in Gaza, according to Reuters.

- TotalEnergies (TTE FP) has raised security vigilance for its operations in the Middle East, according to Reuters.

Geopolitics: Others

- Armed factions claim to target Ain al-Assad base in Iraq with 4 missiles, according to Sky News Arabia citing their correspondent.

- US Secretary of State Blinken in Iraq, said he had a very good and candid conversation with the Iraqi leader and said attacks on US personnel are a matter of Iraqi sovereignty and against its own interests, according to Reuters.

- The Turkish military conducted air strikes against Kurdish militants in northern Iraq, hitting 15 targets, according to the Defense Ministry cited by Reuters.

- Russian Defense Ministry said a new atomic submarine conducted a test launch of a Bulava intercontinental missile in the White Sea, according to Reuters.

- Belarus Foreign Ministry summons Polish Charge D'Affaire over violation of its airspace on Nov 2nd, according to a statement.

- Russia is moving to expand its military presence in eastern Libya, according to Bloomberg.

- Japanese PM Kishida said Japan will continue to contribute to enhancements of Philippine security capabilities and stated that in the South China Sea, a trilateral cooperation to protect the freedom of the sea is underway, according to Reuters.

- China's Defense Ministry, in response to Canada accusing Chinese fighter jets of 'unsafe interception,' states that China's response was professional while adding Canada's move violates China's laws and jeopardizes China's security, according to Reuters.

- Iraqi PM arrived in the Iranian capital as part of an official visit, according to Asharq News.

- Russian President Putin has decided to run for President again in 2024, via Reuters citing sources; Russian President Putin has not announced he would run for another presidential term and no campaign yet, via Peskov.

US Event Calendar

- Nothing major scheduled

DB's Jim Reid concludes the overnight wrap

The week after payrolls is usually very light on US data and this rings true this week. The highlight for us will probably be today's US Senior Loan Officers Opinion Survey (SLOOS) even if it’s unlikely to be an immediate market mover. Bank lending standards are in deep recessionary territory and the longer they stay there the more risk that refinancings won't happen (or come at a much higher cost) which will slow the economy and potentially cause accidents. For now a combination of excess savings, private markets, and the lack of need for refis could have weakened the usual impact on the economy, even with the typical lag. So the trillion dollar question is can the economy get by long enough for bank lending standards to gradually improve to normal levels? I'm sceptical of this but we will see if any trends emerge today at 7pm London time.

The big story of last week was the epic rally in bonds and equities. It seems our seasonal chart we published on October 27th (link here), that basically said the bottom in US equity markets in H2 occurs on that day (using nearly 100 years of data), has picked the local lows perfectly. The S&P 500 (+5.85%) had its best week in a year and 10 and 30yr US yields rallied -26.4bps and -24.8bps respectively and had their best week since March and January. For Treasuries there was much talk about the QRA (quarterly refunding announcement) driving the rally. There's no doubt that this was the initial catalyst but the rally had 4 stages. First the QRA, then the weak ISM, then the dovish Fed (all on the same day), and then finally a weak payrolls report on Friday which we'll discuss at the end when we briefly recap the past week. The one thing we’ll say here is that the Sahm Rule got a little closer to being triggered with US unemployment (3.9%) now 0.5pp above its lows in April. The trigger is the 3m moving average being 0.5pp above the 3m moving average lows of the last 12 months and when this happens the US economy has always been in, or about to be in, recession (using post WWII data). It is currently 0.33% above the lows. So one to watch. The fascinating thing about markets is that the path to a hard landing is often via the appearance of a soft landing first. So we’re in this window where the data is softening but if it only ends up softens a bit, and then stabilising, then its great news. However if it's the start of something bigger it's not. The former scenario won out last week as you’ll see in more detail at the end in our review.

Moving onto this week, outside of the SLOOS, the week is full of Fed speak stored up from the Fed blackout period and with the FOMC being firmly behind us. See DB’s Brett Ryan week ahead here for more details on the Fed speakers but the main one is Powell at the IMF conference on Thursday. Last Wednesday he talked about tighter financial conditions doing some of the Fed’s work for them. After the huge 60/40 rally since, will he still feel the same way by Thursday? Elsewhere in the US, tomorrow’s trade numbers are of minor interest and then Friday’s University of Michigan's consumer confidence is the other main highlight with focus on the 1yr and longer-term inflation expectations. The former spiking from 3.2% to 4.2% last month and more importantly, the latter picking back up a couple of tenths.

Moving back across the pond, markets will focus on German factory orders (today) and industrial production tomorrow. Other notable indicators due include Italian retail sales (Wednesday) and industrial production (Friday), the trade balance for France (Wednesday), the ECB Consumer Expectations Survey (Wednesday), and UK monthly GDP (Friday).

In China, all eyes will be on the inflation data (Thursday) following last week's misses on the PMIs. Current median estimates on Bloomberg suggest the CPI is expected to fall back into negative territory (-0.1% YoY vs 0.0% in September) and the PPI is also seen falling (-2.7% vs -2.5%). Prior to the inflation prints, there will also be trade balance data tomorrow.

As well as Powell speaking this week, ECB President Lagarde (Thursday) and BoE Governor Bailey (Wednesday) will all make appearances. Staying with central banks, the RBA have their latest meeting tomorrow with our economists (more here) expecting a +25bps hike.

In corporate earnings, with more than 400 of the S&P 500 members having already reported, things will slow down a bit until Nvidia report on November 21st. The key names this week are in the day-by-day week ahead at the end. See our equity strategists' global review of earnings season so far here.

Asian equity markets are rallying this morning following Western markets on Friday. The KOSPI (+4.20%) is leading the way and is trading sharply higher after South Korea reimposed a ban on short selling until the end of June 2024. Elsewhere, the Nikkei (+2.41%) is also climbing after returning from a long weekend while the Hang Seng (+1.69%), the CSI (+1.34%) and the Shanghai Composite (+0.88%) are also trading higher. US stock futures are broadly flat with US Treasuries 0-2bps higher across the curve.

Early morning data showed that Japan’s services activity expanded at the softest pace this year as the final estimate of the au Jibun Bank services PMI fell to 51.6 in October from 53.8 in September. Meanwhile, the final composite PMI was at 50.5 in October, down from 52.1 in September.

Staying in Japan, BOJ Governor Kazuo Ueda has said this morning that the central bank is gradually making progress towards its inflation target as Japanese companies are becoming more proactive in setting prices and wages. However, he added that it was still insufficient to justify a pivot away from the central bank’s ultra-loose policy.

In commodities, oil prices are gaining ground in Asia with Brent futures up +0.47%, trading at $85.29/bbl after Saudi Arabia & Russia, two top oil exporters, reaffirmed that they will continue with their oil supply cuts of more than 1 million barrels a day until the end of the year.

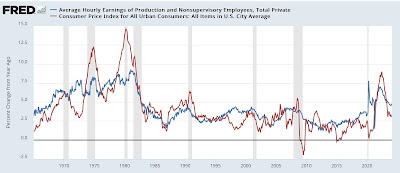

Looking back on last week now, Friday saw the release of US nonfarm payrolls for October. T he headline result came in below expectations at 150k (vs 180k expected), a significant drop from the revised 297k (previously 336k) in September. The unemployment rate drifted upwards to 3.9% (vs 3.8% expected), and average hourly earnings was at 0.2% (vs 0.3% expected). In sum, the data was weaker across the board, and was taken as further evidence of a cooling of the US economy and labour market.

Off the back of this, markets moved to price in meaningful and earlier cuts to the Fed rate. The rate priced in for the December 2024 meeting fell -19.8bps on Friday, and -22.3bps week-on-week, bringing the expected rate to 4.345%. In other words, c. 100bps of cuts are now priced until 2024 year-end. This Fed repricing saw the 2yr Treasury yield fall by -15.0bps on Friday, and -16.2bps over the week, reaching their lowest level since early August at 4.84%. Friday’s rally was less pronounced on the long-end, with the 10yr yield down -8.7bps and 30yr down -3.4bps. B ut longer-dated bonds outperformed over the week, with the 10yr down -26.4bps to 4.57%, and the 30yr down -24.8bps, their strongest weekly rallies since March and January respectively. Over in Europe, bonds saw slightly smaller gains, with 10yr German bunds down -18.7bps week-on-week (and -7.2bps on Friday).

The jobs data underpinned Friday’s rally in equity markets, with the S&P 500 up +0.94%. Friday marked the fifth consecutive day of gains for the index, with an overall weekly increase of +5.85%, its best week since this time last year. Tech also enjoyed a strong week, after the NASDAQ recorded a weekly gain of +6.61% (and +1.38% on Friday). But it was the small-cap Russel 2000 index that saw the largest outperformance, with a +7.56% weekly gain its largest since early 2021 (+2.71% on Friday). Friday’s rally did not falter in the face of a speech from Lebanese group Hezbollah, which emphasised that further conflict by the group would ‘depend on escalation’. On the whole, the speech was interpreted as limiting the risks an immediate broadening of the conflict. After the strong week, the VIX equity volatility measure fell -6.4pts week-on-week (and -0.8pts on Friday) to 14.9, its largest weekly decline since March 2022. Over in Europe, the STOXX 600 posted a more modest gain of +3.41% (and +0.17% on Friday).

Turning to commodities, oil prices declined for the second week in a row amid limited signs of escalation in the Middle East and softer economic data. Brent crude dropped -2.26% on Friday, and -6.18% on the week to $84.89/bbl. WTI crude fell -5.88% week-on-week (and -2.36% on Friday) to $80.51/bbl. Gold fell -0.68% on the week, but jumped +0.38% on Friday.

Finally in FX, lower rates and easing perceptions of geopolitical risk weighed on the dollar, with the broad dollar index seeing its largest daily and weekly declines since mid-July (-1.04% on Friday and -1.44% week-on-week).

Uncategorized

The most potent labor market indicator of all is still strongly positive

– by New Deal democratOn Monday I examined some series from last Friday’s Household survey in the jobs report, highlighting that they more frequently…

- by New Deal democrat

On Monday I examined some series from last Friday’s Household survey in the jobs report, highlighting that they more frequently than not indicated a recession was near or underway. But I concluded by noting that this survey has historically been noisy, and I thought it would be resolved away this time. Specifically, there was strong contrary data from the Establishment survey, backed up by yesterday’s inflation report, to the contrary. Today I’ll examine that, looking at two other series.

Uncategorized

Futures Flat At All-Time High As Bitcoin Surges To Record, Oil Rises

Futures Flat At All-Time High As Bitcoin Surges To Record, Oil Rises

US futures are trading modestly in positive territory and just shy of…

US futures are trading modestly in positive territory and just shy of all time highs, after swinging between gains and losses as Europe trades higher and Asia closed weaker after US markets shrugged of a higher core CPI print and focused on the more constructive disinflation components (Super core 47bps vs 85bps). As of 7:50am, S&P futures traded +0.1% while Nasdaq futures were modestly red; earlier, Germany's DAX hit 18K for first time, while EuroStoxx50 hit 5K for first time in 24 years.

Overnight newsflow was relatively quiet outside of early results from Japan’s wage negotiations which showed majority of companies agreeing to unions demands: previously, BOJ's Ueda said wage negotiations were critical in deciding when to phase out its big stimulus program while Japan PM Kishida noted in Parliament that Japan has not emerged out of deflation, pushing back some expectations of BOJ exiting negative rates next week. UK Jan Industrial Production printed softer, Jan GPD/Manf Production in-line, and EZ Industrial Production printed weaker as well. Donald Trump clinched the Republican presidential nomination, setting up a combative election race with President Joe Biden. Elsewhere, US TSY 10Y yields are trading 1bp higher at 4.17% while bond yields across Europe ticked lower; the Bloomberg dollar index is fractionally lower, WTI crude is +$1.05 at $78.65, and bitcoin just hit a new all time high above $73,000.

In premarket trading, Nvidia shares rose again after the chipmaker rallied 7.2% and added $153 billion in market value on Tuesday. Tesla slipped after Wells Fargo downgraded the stock to underweight from equal-weight. Dollar Tree slumped after reporting fourth-quarter sales and profit that missed Wall Street’s expectations. The retailer also announced plans to close about 600 Family Dollar stores in the first half of the fiscal year.

- Beauty Health soars 21% after the skin-care company reported fourth-quarter sales that topped consensus estimates. The company named Marla Beck as CEO after a stint as interim CEO that began in November.

- Clover Health rises 9% after the Medicare Advantage insurer reported revenue for the fourth quarter that beat the average analyst estimate.

- Dollar Tree slumps 6% after issuing an annual sales outlook that fell short of the average analyst estimate at the midpoint of the forecast range.

- Eli Lilly rises about 1% after teaming up with Amazon.com Inc. to expand its nascent business of selling weight-loss drugs directly to patients.

- Petco (WOOF) rises 3% after the company reported comparable sales for the fourth quarter that topped the consensus estimate. Petco also said Ron Coughlin has stepped down as CEO/Chairman.

- Tesla (TSLA) falls 2% after Wells Fargo cuts the recommendation on the EV maker’s stock to underweight, saying there are fresh risks to EV volumes as price cuts are not having as much impact as before.

- ZIM Integrated Shipping (ZIM) falls 4% after the marine shipping company reported its fourth-quarter results and gave an outlook.

Traders held onto Fed rate cut bets for this year even after US inflation came in higher than expected on Tuesday. Futures are pricing in nearly 70% odds that the central bank will start easing in June and enact at least three quarter-point cuts over the course of 2024. Policymakers next gather March 19-20, where investors will key into the Federal Open Market Committee’s quarterly forecasts for rates, including whether fresh employment and inflation figures have prompted any changes.

“It’s going to be hard for the Fed not to be hawkish in the next meeting as the fight against inflation clearly isn’t won yet,” said Justin Onuekwusi, chief investment officer at wealth manager St. James’s Place. “That print does make you sit up and be alert of the risk inflation remain stubbornly high and that has massive feed-across right across portfolios. Markets may be underestimating impact of sticky inflation as they are still aggressively pricing a June rate cut.”

European stocks rise with the Stoxx 600 hovering near a record high and the Stoxx 50 breaching 5,000 for the first time in 24 years. Retail shares are leading gains after positive updates from Zalando and Inditex. Utilities and banks also outperform. Here are some of the biggest movers on Wednesday:

- Zalando shares jump as much as 18%, the most in five years, after results that analysts describe as positive, with a beat on adjusted ebit for 2023 and updated targets for growth through 2028. RBC analysts say they are confident in the German company’s ability to capture growth as consumer demand recovers.

- Inditex shares climbed as much as 5.2% to a fresh record high after the Zara parent reported what analysts called strong results thanks to continued robust demand for its clothing collections. The Spanish retailer plans to increase its annual dividend by 28% to €1.54 per share. H&M and the broader retail index also gain.

- BNP Paribas rises as much as 3.4% after the lender forecast higher-than-expected profit and stepped up cost savings measures.

- Balfour Beatty shares gain as much as 10%, its biggest intraday gain since August 2022, after the construction and infrastructure group reported full-year adjusted earnings per share that came ahead of consensus expectations. Additionally, the company announced a share buyback of £100 million for 2024. Liberum noted the strength in the company’s Gammon Construction joint venture, with Jardine Matheson.

- E.On shares jump as much as 7%, most in more than a year, after it reported a positive update according to Jefferies, with outlook ahead of consensus. Company also announced CFO Marc Spieker will assume role of COO and Nadia Jakobi is set to become CFO.

- Keywords Studios shares gain as much as 13%, the most since May 2020, after the company maintained FY goals issued in January, offering reassurance in a video game industry marked by layoffs at bellwethers including Sony and Electronic Arts. Keywords provides external technical support to video-game makers.

- Vallourec shares gain 9.8% after ArcelorMittal said it’s buying a stake in the tubular steel company from Apollo Global Management for about €955 million. Analysts highlight the deal triggers M&A speculation around Vallourec, and Oddo BHF expects ArcelorMittal to launch a takeover bid once the six-month lock-up period expires.

- Adidas shares fall as much as 4.1% as a lack of a full-year guidance upgrade from the sportswear maker disappointed some analysts, even as results were in line with January’s pre-released figures. The focus turns to the German firm’s growth outlook for the first quarter, and whether it will indeed see a pick-up in trading in the second half of the year.

- Solvay drops as much as 5.2% after guidance for lower Ebitda in 2024. Analysts note that the chemicals company’s commitment to a stable or growing divided may offset negatives from falling Ebitda. Investors will focus on the soda ash price assumptions, Morgan Stanley said.

- Geberit falls as much as 4.8% after the Swiss maker of building materials missed earnings estimates. The stock had rallied ahead of the earnings, gaining almost 8% from the start of February through Tuesday.

- Stadler Rail shares fall 3.3% after the Swiss train manufacturer’s sales and operating margins came in lower than estimates. The company’s 2024 outlook also weighs on sentiment, according to Vontobel.

The European Central Bank is also poised to start rate cuts soon, with Governing Council member Martins Kazaks saying on Wednesday reductions could come “within the next few meetings.” Bank of France Governor Francois Villeroy de Galhau said borrowing costs may be cut in the spring, with June more likely than April for a first move.

In FX, the Bloomberg Spot Index slips to reverse modest earlier gains while the yen was the weakest of the G-10 currencies, falling 0.2% versus the greenback to 148.05; the krone led G-10 gains. “BOJ Governor Kazuo Ueda clearly indicated yesterday that wages were the last piece of information needed before the central bank could decide whether to end its negative interest rate policy next week, said David Forrester, a senior FX strategist at Credit Agricole CIB in Singapore. “So the partial tally of the spring wage negotiations this Friday will be a decisive factor for the BOJ and the JPY in the coming week.” The pound was flat.

In rates, treasuries edged lower, with US 10-year yields rising 1bps to 4.16%. Gilts fall after data showed the UK economy rebounded in January. UK 10-year yields rise 2bps to 3.96%. Gilts lag across core European rates as market digests an offering of 30-year inflation-linked debt and a wave of domestic data. US session includes 30-year bond reopening, following soft reception for Tuesday’s 10-year sale. Treasury auction cycle concludes with $22b 30-year bond reopening after $39b 10-year reopening tailed by 0.9bp, while Monday’s 3-year new issue stopped through by 1.3bp. WI 30-year yield at ~4.320% is roughly 4bp richer than February refunding, which stopped through by 2bp in a strong auction

In commodities, oil advanced after four days of losses as an industry report pointed to shrinking US crude stockpiles, offsetting wavering OPEC cuts. WTI rose 1.5% to trade near $78.70. Spot gold adds 0.2%. and trades near all time highs.

Bitcoin rises 3% to a record high above $73,000 with Ethereum (+2.7%) also catching wind.

To the day ahead now, and data releases include UK GDP and Euro Area industrial production for January. Central bank speakers include the ECB’s Cipollone and Stournaras. And in the US, there’s a 30yr Treasury auction taking place.

Market Snapshot

- S&P 500 futures little changed at 5,176.25

- STOXX Europe 600 little changed at 506.38

- MXAP down 0.3% to 176.21

- MXAPJ down 0.3% to 540.31

- Nikkei down 0.3% to 38,695.97

- Topix down 0.3% to 2,648.51

- Hang Seng Index little changed at 17,082.11

- Shanghai Composite down 0.4% to 3,043.84

- Sensex down 1.0% to 72,924.23

- Australia S&P/ASX 200 up 0.2% to 7,729.44

- Kospi up 0.4% to 2,693.57

- German 10Y yield little changed at 2.30%

- Euro little changed at $1.0929

- Brent Futures little changed at $81.99/bbl

- Gold spot up 0.0% to $2,158.75

- US Dollar Index little changed at 102.93

Top Overnight News

- US President Biden secured enough votes to clinch the Democratic presidential nomination and Donald Trump secured enough delegates to win the Republican nomination, according to Reuters.

- Eli Lilly (LLY) is partnering with Amazon Pharmacy (AMZN) to deliver prescriptions sold through direct-to-consumer website.

- Some of Japan’s biggest companies, including Toyota, Nissan, and Nippon Steel, hand out large wage hikes to their workers (the biggest increases in decades), paving the way for a BOJ rate hike next week. FT

- China is scrapping a string of infrastructure projects in indebted regions as it struggles to reconcile a need to save money with this year’s target for economic growth. FT

- Chinese state media has touted President Xi Jinping as a market-friendly reformer on par with the paramount leader Deng Xiaoping, in an apparent attempt to dispel skepticism over the country’s growth outlook. BBG

- The European Central Bank will lower borrowing costs in the spring, with June more likely than April for a first move, Bank of France Governor Francois Villeroy de Galhau said. BBG

- Putin says Russia is willing to resolve the Ukraine war “by peaceful means”, but insists Moscow would require security guarantees to do so. BBG

- Donald Trump and Joe Biden have both secured enough delegates to clinch their respective party nominations, cementing a November rematch. The 2024 election is expected to be one of the most expensive on record. BBG

- US crude stockpiles fell by 5.5 million barrels last week, the API is said to have reported, registering the first decline in seven weeks if confirmed by the EIA. Gasoline and distillate supplies also dropped. BBG

- Global dividends hit a record $1.66 trillion last year, according to Janus Henderson. Payouts were up 5%, with almost half the growth coming from the banking sector. It’s the third annual record for dividends and the fund manager expects another all-time high this year. BBG

- Hedge funds are unwinding short Treasury futures bets at a rapid clip, a sign that basis-trade positions are diminishing. This is probably due to asset managers pivoting into investment-grade credit. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as early momentum from the tech-led gains on Wall St was offset by Chinese developer default concerns and as participants digested Japanese wage hike announcements. ASX 200 was led higher by consumer stocks after China's MOFCOM released an interim proposal to remove tariffs on Australian wine although the advances in the index were limited by losses in the mining sector as iron ore prices continued to tumble. Nikkei 225 swung between gains and losses with initial strength reversed amid firm wage hike announcements. Hang Seng and Shanghai Comp. were varied and price action was contained within relatively narrow ranges with the Hong Kong benchmark kept afloat by strength in auto names and tech, while the mainland was pressured amid developer default fears and with the US House set to vote later on the TikTok crackdown bill.

Top Asian News

- Country Garden Holdings (2007 HK) onshore bondholders said they have not received a coupon payment due on Tuesday, while the developer said funds for a CNY 96mln coupon payment due on Tuesday were not fully in place and it plans to do its best to raise money for payment within a 30-day grace period, according to Reuters.

- TikTok US executives told headquarters recently that a ban wasn't an imminent risk, according to WSJ citing sources. However, it was separately reported that the US House plans to vote on the TikTok crackdown bill today at around 10:00EDT (14:00GMT).

European bourses, Stoxx600 (+0.2%), are modestly firmer, though with overall trade rangebound in what has been an uneventful session. The IBEX 35 (+1.3%) outperforms, led higher by post-earning strength in Inditex (+4.2%). European sectors are mixed; Retail outperforms, propped up by gains in Zalando (+13.5%) and Inditex. Autos is found at the foot of the pile, hampered by a poor Volkswagen (-0.8%) update. US equity futures (ES U/C, NQ -0.2%, RTY +0.1%) are trading around the unchanged mark, with slight underperformance in the NQ, paring back some of the strength seen in the prior session.

Top European News

- ECB's Villeroy noted broad agreement in the ECB to start cutting rates in spring as the battle against inflation is being won, while he noted the risk of waiting too long before loosening monetary policy and unduly hurting the economy is now “at least equal” to acting too soon and letting inflation rebound, according to an interview with Le Figaro; In another batch of comments: Says the ECB is winning the battle against inflation; will remain vigilant on inflation but victory is within sight; Spring rate cut remains probably; more likely to cut rates in June than April.

- ECB's Kazaks says ECB rate cut decision will come in the next few meetings; uncertainty remains high, and tensions in the labour market is still high.

- Citi expects BoE to start cutting rates in June (vs prev forecast of August).

Japan

- Japan Chief Cabinet Secretary Hayashi said it is important for wage hikes to spread to mid-sized and small companies, while he added they are seeing strong momentum for wage hikes. It was also reported that Toyota, Nissan, Panasonic, Hitachi & Nippon Steel were among the companies that have responded to unions' wage hike demands in full.

- Japanese PM Kishida says will call for pay hikes exceeding last year at small and mid-sized firms during the meeting with labour union and management; Japan not yet emerging out of deflation.

- BoJ Governor Ueda says BoJ will consider tweaking negative rates, YCC, and other monetary easing tools if the sustained achievement of price target comes into sight. We must scrutinize whether positive wage-inflation cycle merges in deciding whether conditions for phasing out stimulus are falling into place. This year's wage talks is critical in deciding timing on exit from stimulus. Unions have demanded higher pay, seeing many corporate management making offers that will stream in today and beyond. Will scrutinize the wage talk outcomes, as well as other data and information from hearings when making policy decisions.

- Japanese PM Adviser Yata says wage hikes this year likely to exceed last year's; Must continue pay rises next year and thereafter to defeat deflation; must broaden pay hikes to workers nationwide and in every prefecture. When asked if solid wage offers could trigger end to NIRP in march, Yata says government will not meddle with the BoJ's independent policy-making.

- BoJ is reportedly to mull ending all ETF purchases if price goal is in sight; likely to keep buying bonds to keep market stable and to intervene in the event of sharp yield upside, according to Bloomberg sources.

- Japan's Business Lobby Keidanren Head Tokura says wage increases indicated in the preliminary survey of big firms' wage talks are likely to exceed last years levels.

- Early signs of a strong outcome in this year's annual wage talks have heightened changes the BoJ will end its negative interest rate policy next week, according to Reuters sources; "There seems to be enough factors that justify a March policy shift".

FX

- Marginal upside for the USD which has seen DXY kiss the 103 mark in quiet trade. If the level is cleared, yesterday's 103.17 will come into view.

- Uneventful price action for EUR with ECB comments unable to shift the dial. As such, the pair is sticking to a 1.09 handle and within yesterday's 1.0902-43 range.

- GBP is steady vs. the USD and stuck on a 1.27 handle as in-line GDP metrics failed to inspire price action. For now, yesterday's 1.2746-1.2823 range holds.

- JPY is marginally softer vs. the USD but with losses tempered by reports that the BoJ could end ETF purchases. Today's 147.24-89 range sits within yesterday's 146.62-148.18 parameters. More broadly, focus is on in

- AUD is holding up vs. the USD despite falling iron ore prices, with AUD/USD maintaining 0.66 status and within yesterday's 0.6596-0.6627 range. Likewise, NZD/USD is unable to break out of yesterday's 0.6133-6184 range. RBNZ's Conway later today could help to decide direction.

- PBoC set USD/CNY mid-point at 7.0930 vs exp. 7.1775 (prev. 7.0963).

Fixed Income

- Gilts are the relative laggards, at lows of 99.68, with the paper unreactive to the UK's GDP data (which was broadly in-line). The downside can be attributed to Gilts paring some of Tuesday's outperformance following the labour data and a strong DMO sale.

- USTs are essentially unchanged in a quieter session for the US (on paper) after Tuesday's marked CPI moves and a soft 10yr auction, despite the marked concession built in by the post-CPI reaction. Currently holds near session lows at 111-04.

- Bunds are slightly firmer after Tuesday's marked US CPI-induced pressure. Specifics are relatively light thus far, but focus will be on the ECB Operational Framework Review (tentatively due today). Currently, Bunds hold around 133.24, with the peak for today at 133.27.

- Italy sells EUR 7.25bln vs exp. EUR 6-7.25bln 2.95% 2027, 3.50% 2031, 3.25% 2038 BTP Auction and EUR 1.25bln vs exp. EUR 1-1.25bln 4.0% 2031 BTP Green.

- Germany sells EUR 3.738bln vs exp. EUR 4.5bln 2.20% 2034 Bund: b/c 2.29x (prev. 2.10x), average yield 2.31% (prev. 2.38%) & retention 16.9% (prev. 17.5%)

Commodities

- Crude is firmer, taking impetus from Tuesday's bullish private inventory data, with specifics light in the session thus far; Brent holds near session highs at +1.1%.

- Flat trade in gold and a mild upward bias in silver with the Dollar steady, calendar light, and with the ongoing geopolitical landscape potentially providing a modest underlying bid; XAU trades in a tight USD 2,155.86-2,161.66/oz range.

- Base metals are mixed with copper prices outperforming following reports that top Chinese copper smelters have reportedly reached an agreement to take action to curb falling fees.

- Azerbaijan oil production stood at 476k BPD in Feb (prev. 474k BPD in Jan), according to the Energy Ministry.

- Top Chinese copper smelters have reportedly reached an agreement to take action to curb falling fees, according to Reuters sources; smelters to cut output at loss-making plants.

- BP (BP/ LN) and ADNOC suspend USD 2bln talks to take Israel-based Newmed private, via Bloomberg.

Geopolitics: Middle East

- CIA Director Burns said there is "still a possibility" of a Gaza ceasefire deal but added that many complicated issues are still to be worked through.

- US may urge partners and allies to fund a privately run operation to send aid by sea to Gaza that could begin before a much larger US military effort, according to sources cited by Reuters.

- US Central Command announced that Houthis fired a close-range ballistic missile from Yemen toward USS Laboon in the Red Sea on March 12th but it did not impact the vessel, while CENTCOM forces and a coalition vessel successfully engaged and destroyed two unmanned aerial systems launched from Yemen.

Geopolitics: Other

- Ukrainian Army Chief Syrskyi and Ukraine's Defence Minister Umerov held a phone call with US Defense Secretary Austin on weapons delivery to Ukraine, according to Reuters.

- A fire at oil refinery in Ryazan region extinguished, according to the governor cited by Reuters.

US event calendar

- 07:00: March MBA Mortgage Applications 7.1%, prior 9.7%

Government Agenda

- 4 p.m: US President Joe Biden delivers remarks in Milwaukee, Wisconsin on how his investments are rebuilding communities and creating jobs

- 11.15 a.m: US Secretary of State Antony Blinken meets with EU foreign affairs chief Josep Borrell

DB's Jim Reid concludes the overnight wrap

Next stop on the global tour is Singapore as I'm about to board the plane from Melbourne here this evening. My vaguely fascinating fact about Singapore is that my grandfather was a civil engineer there in the 1920s and 1930s and helped build much of its rapid development at the time. He was Scottish and met my Dutch grandmother there and got married without speaking each other's language and being able to understand each other. My wife says she's done the same thing! His brother owned a very successful industrial company on the island and lost all his wealth and his company after the 1929 stock market crash. My entire family were eventually left penniless after the 1930s crash and then WWII. 90 years later and my kids have had the same impact on me!

I'm looking forward to landing in the pretty standard 35 degree heat that Singapore always seems to have on landing. Talking of the heat, even with another hot US inflation print, risk assets put in another strong performance yesterday, with both the S&P 500 (+1.12%) and Europe’s STOXX 600 (+1.00%) driven by strong tech gains (sound familiar?). The highs in the main indices came despite the latest US CPI report for February, which saw inflation come in strongly for a second month running, and led to growing fears that the last phase of getting inflation back to target would be the hardest. But despite the persistence of inflation, investors were remarkably unphased for the most part, and they continue to see a June rate cut as the most likely outcome.

In terms of the details of the report, headline CPI came in at a 6-month high of +0.44%, which meant the year-on-year measure actually ticked up a bit to +3.2% (vs. +3.1% expected). Alongside that, core CPI was at +0.36%, which also meant annual core CPI was also above expectations at +3.8% (vs. +3.7% expected). Some of the blame was placed on shelter inflation, which was up by a monthly +0.43%. But even if you looked at core CPI excluding shelter, it was still up by +0.30%, so it’s difficult to say that shelter was the whole story behind the ongoing persistence. See our US economists’ reaction to the print here.

For the Fed, there must be some concern even if markets show little of this. For instance, if you look at core CPI on a 3-month annualised basis, it rose to +4.2%, so it’s getting harder to explain this away as just one month of bad data. Bear in mind that this is pretty high by historic standards as well, and apart from the post-Covid inflation, 3m core CPI hasn’t been that high since 1991. Alongside that, there was evidence that the inflation was coming from the stickier categories in the consumer basket. In fact the Atlanta Fed’s sticky CPI series is now up by +5.1% on a 3m annualised basis, the fastest it’s been since April 2023. So the concern for markets will be that inflation is showing some signs of rebounding, or at the very least stabilising at above-target levels.

When it comes to the Fed, the report led investors to dial back the rate cuts priced this year by -6.1bps, and futures now see 85bps of cuts by the December meeting. There was also a bit more doubt creeping into the chance of a cut by June, with 78% now priced in, down from 86% the previous day. But even with this slightly hawkish repricing, June is still considered the most likely timing for the first cut, which helped to support risk assets even though the print was above expectations. For the Fed, the most important question now will be how this affects the PCE measure of inflation, which is what they officially target. We won’t find that out until March 29th (Good Friday), but we should get a bit more info from the PPI report tomorrow, which has several components that feed into PCE.

The report led to a selloff for US Treasuries, with the 2yr yield (+5.0bps) up to 4.59%, whilst the 10yr yield (+5.4bps) rose to 4.15%. The 10yr yield had peaked at 4.17% intra-day shortly after the latest 10yr Treasury auction which saw slightly soft demand, with bonds issued +0.9bps above the pre-sale yield.

The fixed income selloff was echoed in Europe too, even if the overall performance was better there, with yields on 10yr bunds (+2.7bps) and OATs (+1.6bps) rising by a smaller amount. At the same time, markets remain confident of an ECB cut by June (priced at 91% vs 95% the day before). This is consistent with the latest ECB commentary, with Austria’s Holzmann (strong hawk) saying that a June cut was more likely than April, while France’s Villeroy suggested that “there’s a very broad agreement” to cut rates by the June meeting.

Yesterday’s main outperformer in the rates space were 10yr gilts (-2.5bps), which came after the UK labour market data was a bit weaker than expected over the three months to January. Notably, wage growth slowed to an 18-month low of +5.6% (vs. +5.7 expected), and the unemployment rate ticked up to 3.9% (vs. 3.8% expected).

Although sovereign bonds struggled yesterday for the most part, there was a much better performance for equities. In the US, the S&P 500 (+1.12%) closed at a new record, with tech stocks and the Magnificent 7 (+2.88%) leading the advance. Nvidia was +7.16% higher. Likewise in Europe, the STOXX 600 (+1.00%) hit an all-time high, and there were new records for the DAX (+1.23%) and the CAC 40 (+0.84%) as well. That said, gains more moderate outside of tech, with the equal-weighted S&P 500 up by +0.26%, while the small-cap Russell 2000 (-0.02%) narrowly lost ground for a 3rd consecutive day.

This backdrop was mostly positive for other risk assets. US HY credit spread fell -6bps, closing just 3bps above their 2-year low reached in late February. Meanwhile, Bitcoin posted a new intra-day high just shy of $73,000, surpassing the market cap of silver. Marion Laboure and Cassidy Ainsworth-Grace's new report this morning discusses the upcoming halving event's impact on Bitcoin prices, along with the Dencun upgrade scheduled for Ethereum today (link here).

Asian equity markets are mixed this morning with the Hang Seng (+0.26%) and the KOSPI (+0.11%) edging higher while the Nikkei (-0.36%) continues to drift back from last week's all time highs. Elsewhere, stocks in mainland China are also seeing losses with the CSI (-0.59%) and the Shanghai Composite (-0.26%) dragged lower by property developers as Country Garden Holdings Co. missed a 96-million-yuan ($13 million) coupon payment on a yuan bond for the first time. Outside of Asia, US stock futures are struggling to gain momentum with those on the S&P 500 (-0.03%) and NASDAQ 100 (-0.06%) flat. In early morning data, the unemployment rate in South Korea unexpectedly dropped to +2.6% in February from January's 3.0% level (v/s +3.0% consensus expectation).

Although the CPI release was the main data focus yesterday, there was also the NFIB’s small business optimism index from the US. That f ell to a 9-month low in February of 89.4 (vs. 90.5 expected). And there were also further signs of softening in the labour market, as the share planning to increase employment was down to a net +12, the lowest since May 2020 at the height of the Covid-19 pandemic. Likewise, the share of firms with positions they weren’t able to fill hit a three-year low of 37%.

To the day ahead now, and data releases include UK GDP and Euro Area industrial production for January. Central bank speakers include the ECB’s Cipollone and Stournaras. And in the US, there’s a 30yr Treasury auction taking place.

Uncategorized

Bougie Broke The Financial Reality Behind The Facade

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive…

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

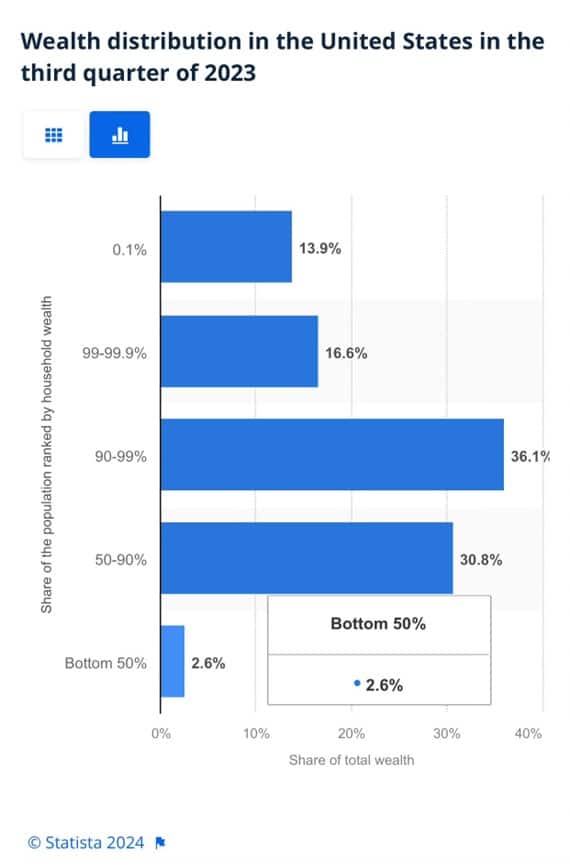

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.