International

Futures Extend Gains, Escape Technical Bear Market After China Hints At Massive Stimulus

Futures Extend Gains, Escape Technical Bear Market After China Hints At Massive Stimulus

US equity futures rose for a 3rd day, rising above…

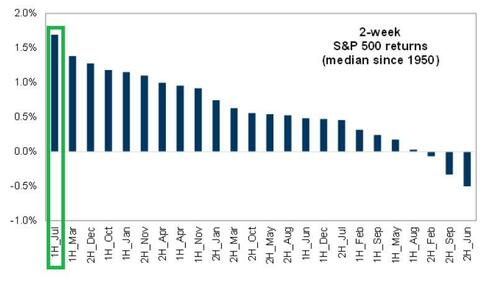

US equity futures rose for a 3rd day, rising above the -20% clutches of a technical bear market, and validating the best period of the year for risk assets...

... as investor fears about surging inflation were assuaged by the cooling of the oil rally and comments from the Federal Reserve about taking a tougher stance to cool price increases. Nasdaq 100 futures rose 0.4% by 730 a.m. ET, while S&P 500 contracts added 0.3%. Both indexes finished Wednesday’s session higher following the minutes from the Fed’s latest policy meeting, which showed officials considered raising interest rates for longer to tame runaway inflation.

Global stocks also rose as did bond yields, adding to cheapening pressure on Treasuries after a Bloomberg report that China is weighing a $220 billion stimulus plan. Europe's Estoxx50 gained 1.7%; Asia stocks closed higher led by Nikkei’s 1.5% rise as a revenue surge by Samsung assuaged fears about weakening consumer demand and soaring material costs. That sparked a rally in chipmakers, helping MSCI Inc.’s Asia-Pacific share index add more than 1%. The British pound gained after sources report PM Boris Johnson plans to resign.

Among notable premarket movers, Freeport-McMoRan Inc. advanced 4.3%. Copper rebounded from a five-day selloff in London, heading for the biggest gain since September 2018. Shares of US semiconductor companies rose in premarket trading on Thursday after Samsung Electronics reported a better-than-anticipated 21% jump in revenue. Bed Bath & Beyond shares jumped 9% after the home furnishings retailer’s interim chief executive officer and a pair of directors bought shares in the firm. GameStop shares surged 9.8% in premarket trading on Thursday after the video game retailer announced a four-for-one stock split in the form of a dividend. Other notable premarket movers:

- US biotech stocks, especially those involved in developing cancer-related treatments, could be active following a Wall Street Journal report that Merck and Co. (MRK US) is said to be in advanced talks to buy Seagen (SGEN US) for above $200 a share. Watch shares in Iovance Biotherapeutics (IOVA US), Mirati Therapeutics (MRTX US), Arcus Biosciences (RCUS US), ALX Oncology (ALXO US), Cullinan Oncology (CGEM US). Seagen rises 5.4% in premarket trading; Merck slides 1%

- Watch Endeavor Group (EDR US) and Lamar Advertising (LAMR US) shares as they were upgraded to buy from neutral at Citi, which in note says that even with new lower estimates, both stocks have attractive risk/reward at current levels.

- Keep an eye on Consolidated Communications Holdings (CNSL US) as it was cut to sell at Citi, with the bank citing outperformance compared to some wireline pure-play peers, which leaves the stock trading on a “meaningful” valuation premium.

Fears of a recession have haunted US stocks this year, sending S&P 500 Index into a bear market, although as of this morning futures are once again out of the -20% drawdown. And with the FOMC minutes indicating the Fed remains on hiking autopilot for now, investors are now looking to the second-quarter earnings season to gauge whether the company profits are holding up against the surge in prices and supply constraints.

“Global equities bounce as pressure points such as rates, oil and the dollar begin to ease,” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. “Momentum has swung higher, with tech-heavy benchmarks outperforming after Samsung’s revenue was better than feared.”

European equities trade well. Euro Stoxx 50 rises as much as 1.9%, completely erasing Tuesday’s rout. Miners, autos and energy names outperform within the Stoxx 600 which rose 1.4%, while UK mid-cap shares slightly increased gains following a report that Boris Johnson plans to resign as prime minister. Miners outperformed the rising Stoxx Europe 600 index amid a rebound in metals and iron ore on news China is mulling $200 billion stimulus package to boost economy, while iron ore and metals rebound after recent declines; energy stocks also outpace broader market gains this morning after losing almost 8% over the last two sessions. Iron ore in Singapore and copper in London rose about 2%, recovering some ground after recent declines. Citigroup expects iron ore to outperform base metals amid China policy easing, while UBS downgraded its 2022-2023 estimate for the raw material, pointing to a demand slowdown. The Stoxx Energy sub- index rises 2.2% as oil edged higher with investors weighing concerns about a potential global slowdown against signs of still-tight physical markets. Carmakers posted some of the biggest gains in the benchmark Stoxx 600 index, which gained for a second day. Here are the most notable European movers:

- Tenaris shares advance as much as 8.8% as Jefferies analysts upgraded the stock to buy, noting that they prefer Oil Country

- Tubular Goods exposure among steel sector. Analysts upgrade OCTG steel price forecasts, while cutting stainless and carbon prices.

- Drax jumps as much as 7.2% following an update that saw the power company forecast adjusted Ebitda for 2022 that’s above analyst expectations and an agreement to support the security of UK electricity supplies during the winter.

- Nordex shares gain as much as 7.6% after reporting stronger than expected 2Q order volumes. Jefferies expects an acceleration of order volumes for the remainder of the year, mainly driven by additional onshore installations in the European market.

- Storytel shares soar as much as 15% after the Swedish audiobook company released a 2Q streaming update that DNB’s analyst calls a “step in the right direction.”

- Semiconductor equipment makers lead a rally in European chip stocks after Samsung posted preliminary 2Q sales that were slightly above expectations, easing fears that global chip demand might have already started tapering off. ASML rises as much as 4.9%, ASM International +5%, BE Semi +5%

- Persimmon drops as much as 6.7% after it reported revenue for the first half that missed the average analyst estimate. Citi said home completions missed its estimate amid planning delays and labor shortages.

- Chr. Hansen falls as much as 11% after narrowing its topline growth guidance. Based on quarter’s performance, company narrows organic revenue growth target for 2021/22 to 8-10%, from previous outlook of 7-11%.

- SAS saw its share price fall 5% on Thursday as the airline revealed a drop in bookings toward the end of June due to notice of a pilot strike that became a reality on July 4.

- SUSE shares slide as much as 11% before paring losses, after the software firm cuts its growth target for the annual contract value in the emerging segment. Jefferies says the 2Q results are in-line with expectations, but the outlook references macro impacts

Earlier in the session, Asian stocks rose, recovering most of their losses from yesterday, as semiconductor shares rallied and investors assessed the outlook for oil prices. The MSCI Asia Pacific Index climbed as much as 1.3%, hauled up by chip shares after Samsung Electronics reported a better-than-expected jump in revenue in the latest quarter. A gauge of chip stocks soared nearly 4%, on track for its best day since March. The surge in tech shares helped benchmarks in Taiwan and South Korea lead gains in the region. Meanwhile, Hong Kong shares reversed losses as an easing of travel curbs in the city overshadowed broader concerns about a resurgence of Covid outbreaks in China. Traders in Asia also took some solace in lower oil prices with the West Texas Intermediate futures trading below $100 a barrel, supporting the outlook for earnings in the oil-importing region. “We are seeing short squeezes in tech,” said Jessica Amir, a strategist at Saxo Capital Markets. Meanwhile, there’s optimism that a retreat in oil prices will allow people to spend less at the pump and more on retail goods, she said. Still, higher input costs and worries about a global slowdown have pushed Asia’s stock benchmark down more than 18% this year, with traders debating over the scope of future US interest-rate hikes and the outlook for inflation. The record of the Fed’s June meeting showed the potential for even more restrictive policy to curb inflation. “The market correction over 1H2022 has improved the valuation proposition of equities, and the key going forward is for companies to better manage their profit margins,” Tai Hui, chief Asia market strategist at JPMorgan Asset Management, wrote in a note. “Value and quality should remain in favor until there is a clear peak in interest rates.”

Japanese stocks gained amid lower commodity prices, which could ease inflationary pressures moving forward and potentially lead to a softer stance from the Federal Reserve. The Topix Index rose 1.4% to 1,882.33 as of market close Tokyo time, while the Nikkei advanced 1.5% to 26,490.53. Sony Group Corp. contributed the most to the Topix Index gain, increasing 3.7%. Out of 2,170 shares in the index, 1,550 rose and 526 fell, while 94 were unchanged. “The situation has changed since the June FOMC meeting. With weaker economic indicators and the price of crude oil falling below $100 per barrel, some believe that perhaps the hawkish stance may not be as strong as it was in June at this point,” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management.

Australia's S&P/ASX 200 index rose 0.8% to close 6,648.00, boosted by banks and rebounding mining shares as iron ore prices rose. The index was still trading near a seven-month low. Australia’s trade surplus skyrocketed to a record high in May, driven by stronger prices of its key export - coal -while imports surged too in a sign of solid domestic demand. In New Zealand, the S&P/NZX 50 index fell 0.3% to 11,112.16.

In FX, Bloomberg dollar spot index falls 0.3%. JPY and CHF are the weakest performers in G-10 FX, AUD and NZD outperform. Cable pops higher, stalling just shy of a 1.20-handle after news of PM Johnson’s resignation. The dollar fell versus most of its Group-of-10 currency peers as risk assets advanced. Antipodean currencies led gains while the Swiss franc and the yen underperformed. The euro fluctuated around $1.02. The pound rose by as much as 0.6% to $1.1999 on UK Prime Minister Boris Johnson’s plans to resign, following an unprecedented wave of resignations from his government over the past two days. He will stay on as caretaker prime minister until October, with a new Conservative leader set to be installed in time for the party’s annual conference. Gilts fell, led by shorter maturities. The Aussie and kiwi strengthened in risk-on price action as rising stocks and a weaker US dollar fuel a position squeeze. Aussie was also boosted by a report showing the trade surplus widened to a record high in May.

In rates, Treasuries were cheaper across the curve, extending Wednesday’s aggressive bear-flattening move following release of FOMC meeting minutes. 10Y TSYs traded around 2.93% after rising 12bp in Wednesday’s selloff; 10-year bund yields are higher by 8.6bp, gilts by 3.9bp. US curve spreads are within a basis point of Wednesday’s close, which for inverted 2s10s was -7.6bp, approaching YTD low. The IG dollar issuance slate remains empty so far; just two names priced $4.2b Wednesday, paying more than 20bps in concessions on demand just shy of 3 times covered. Bunds extended their bear flattening move as haven buying waned and money markets raised wagers on the pace of ECB tightening. Short-dated German bonds lead a pronounced sell off with 2y yields rising over 13bps near 0.53%. Gilts follow with both curves bear-flattening. Peripheral bonds are mixed: tighter to core at the short end, wider in long-dates. Red pack euribor futures drop 18-19 ticks as money markets raise wagers on the pace of ECB tightening.

In commodities, WTI trades within Wednesday’s range, adding 1% to trade near $99.48. Base metals trade in the green; LME copper and tin rise over 4%. Spot gold rises roughly $6 to trade near $1,745/oz.

Looking at the day ahead now, data releases include the US trade balance for May and the weekly initial jobless claims, as well as German industrial production for May. Meanwhile from central banks, we’ll get the ECB’s minutes from their June meeting, and hear from the Fed’s Waller and Bullard, the ECB’s Lane, Stournaras, Centeno and Herodotou, and the BoE’s Mann and Pill.

Market Snapshot

- S&P 500 futures up 0.4% to 3,864.25

- STOXX Europe 600 up 1.4% to 413.23

- German 10Y yield little changed at 1.29%

- Euro up 0.3% to $1.0209

- Brent Futures little changed at $100.77/bbl

- MXAP up 1.1% to 157.65

- MXAPJ up 1.1% to 521.21

- Nikkei up 1.5% to 26,490.53

- Topix up 1.4% to 1,882.33

- Hang Seng Index up 0.3% to 21,643.58

- Shanghai Composite up 0.3% to 3,364.40

- Sensex up 0.7% to 54,101.85

- Australia S&P/ASX 200 up 0.8% to 6,647.96

- Kospi up 1.8% to 2,334.27

- Gold spot up 0.2% to $1,741.73

- U.S. Dollar Index down 0.22% to 106.86

Top Overnight News from Bloomberg

- Gone are the days when investors would be buying cheap euro options on a relative basis ahead of this month’s meetings by the European Central Bank and the Federal Reserve. The relative premium to own exposure is now near 200 basis points on both the two-week tenor, that captures the ECB decision, and the three- week tenor, that envelopes the Fed meeting

- The French government’s new round of measures to combat surging inflation will cost about 20 billion euros ($20.4 billion), according to Finance Minister Bruno Le Maire

- The Bank of Japan is likely to consider revising its inflation and growth forecasts later this month as a weaker yen and cost-push inflation force more companies to pass on higher costs to consumers, according to people familiar with the matter

- Treasury yields surged after minutes of the most recent Federal Reserve meeting underscored commitment to tighten aggressively to keep inflation from becoming entrenched

- European electricity prices broke new records Thursday as gas futures soared, further squeezing households and businesses across the continent and forcing politicians to find ways to ease the pain of relentless cost increases

- Hungary’s biggest interest rate increase since 2008 failed to stem the forint’s plunge as policy makers sought to support the weakest currency in emerging markets

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mostly positive but with gains capped following the choppy performance on Wall St and after an uneventful FOMC Minutes which noted participants judged a rate increase of 50bps or 75bps would likely be appropriate at the July meeting. ASX 200 was kept afloat alongside strength in the mining and materials sectors, as well as encouraging trade data. Nikkei 225 was underpinned amid reports the BoJ was said to be completely committed to its easing policy. Hang Seng and Shanghai Comp. were mixed with Hong Kong pressured by tech weakness, while the mainland was initially subdued after the PBoC drained liquidity and with Beijing to impose China’s first-ever COVID-19 vaccine mandate, although Chinese bourses then pared losses as markets also digested MOFCOM's announcement to rollout measures to support auto consumption.

Top Asian News

- China Builder CIFI Says No Perp-Bond Talks as USD Notes Tumble

- China Official Reserves Drop to Lowest Since June 2020

- China’s Cabinet Urges Greater Cybersecurity After Data Leak

- Tokyo Reports 8,529 New Covid Cases, Most Since April

European bourses are firmer across the board, Euro Stoxx 50 +1.7%, in a continuation of the constructive APAC handover though action remains choppy. Stateside, futures are firmer across the board but the magnitudes more contained that European peers after yesterday's choppy action; note, relatively brief upside was sparked on China stimulus reports, via BBG. Within Europe, sectors feature noted outperformance in Basic Resources and Autos while some of the more defensively-inclined components are in the red.

Top European News

- UK PM Johnson is to resign today (expected around 12:00-13:00BST/07:00-08:00ET), according to multiple reports. As it stands, it appears that Johnson wants to remain in place as a caretaker until a new Conservative Party leader can be assigned, which is likely to occur around the autumn given the impending summer recess. However, MPs are seemingly divided on whether they want to allow Johnson to remain, with some calling for the immediate appointment of an alternative caretaker such as current Deputy PM Raab.

- Hungarian PM Orban's Chief of Staff says discussions with the EU have progressed re. funds, adopted the Commission's stance on four issues. Accepted the proposal that funds must be spent on energy independence, via Reuters.

- Pound Rises on Report UK Prime Minster Johnson Plans to Resign

- Sanctions Act as ‘Weapons of Mass Destruction,’ Says Melnichenko

- France’s Public Finances Are a Risk for Euro Zone, Auditor Says

Central Banks

- ECB's Enria (supervisory board) says conservative capital trajectories should be utilized by banks when announcing distribution plans; from the point of view of capital adequacy, we are asking individual banks to review their capital trajectories.

- BoJ is expected to increase its FY22 inflation forecast marginally to slightly above 2% from 1.9% in its quarterly outlook due on July 21st, according to Reuters sources. Expected to lower economic growth forecast (currently 2.9%). BoJ will likely maintain ultra-low interest rates and dovish policy bias.

FX

- Pound perks up as UK PM prepares to stand down in face of mass ministerial and party mutiny, Cable back over 1.2000 vs low 1.1900 base, EUR/GBP closer to 0.8500 than 0.8550.

- Aussie rebounds with risk sentiment and on back of record trade surplus, AUD/USD approaching 0.6850 from recent lows near 0.6760.

- Greenback fades after forging further gains in advance of hawkish line from Fed minutes, DXY pivoting 107.000 within range below 107.270 high on Wednesday.

- Loonie regroups with WTI ahead of Canadian trade and Ivey PMIs as USD/CAD probes 1.3000 from 1.3050+, Euro regains sight of 1.0200 level amidst retreat in EGBs pre-ECB minutes.

- Yen slips on rate dynamics and digests source reports suggesting BoJ may tweak inflation forecast a fraction above 2% and trim growth projection in quarterly outlook next week, USD/JPY rebounds towards 136.00 from around 135.55.

- Forint gets fleeting fillip from 200bp 1-week depo rate hike by NBH, while Zloty awaits 75bp tightening move from NBP; EUR/HUF tops 415.00, while EUR/PLN holds near 4.7850.

Fixed Income

- Bonds back under pressure as risk sentiment continues to improve and most Central Banks remain hawkish

- Bunds reverse from 151.65 to 150.15 before finding underlying bids, Gilts from 115.60 to 114.66 and the 10 year T-note from 119-05 to 115-15

- Curves flatter or more inverted after FOMC minutes flag potential for even more restrictive policy

Commodities

- WTI and Brent are modestly bid benefiting from stimulus reports and the relative reprieve in the USD's recent ascension; benchmarks firmer by USD ~0.80/bbl.

- US Private Inventory Data: Crude +3.8mln (exp. -1.0mln), Cushing +0.5mln, Gasoline -1.8mln (exp. -0.5mln), Distillate -0.6mln (exp. +1.1mln)

- Dutch Minister says gas storage is 58% full, therefore the 80% winter target is achievable. Groningen gas field could be tapped in a emergency scenario

- BofA says copper prices could slip below USD 6,000/tonne in the coming months. Click here for the full list of price forecasts from BofA.

- Spot gold is, in a similar vein to crude, modestly supported on the USD breather, and steady between touted resistance/support at USD 1750.70/oz and USD 1735-37/oz respectively.

US Event Calendar

- 07:30: June Challenger Job Cuts YoY, prior -15.8%

- 08:30: June Continuing Claims, est. 1.33m, prior 1.33m

- 08:30: July Initial Jobless Claims, est. 230,000, prior 231,000

- 08:30: May Trade Balance, est. -$84.7b, prior -$87.1b

Central Banks

- 13:00: Fed’s Bullard to Discuss US Economy and Monetary Policy

- 13:00: Fed’s Waller Interviewed During NABE Event

DB's Jim Reid concludes the overnight wrap

If you're in any doubt about inflation I must say I was bowled over with shock at how much the tooth fairy left Maisie overnight as the first baby tooth in our household fell out yesterday. My wife told me over dinner that the tooth fairy was going to come tonight and I asked her what the going rate was? I mentioned 20p or maybe a bit more as it's the first one. My wife replied that the tooth fairy and her had agreed ten pounds. I nearly choked on my dinner and made it quite clear that this was a dangerous precedent to set one tooth into a three child settlement period. Inflation expectations can get ingrained this way. However this is one way of solving the intergenerational wealth divide I suppose.

If you’re looking for positives in a world as wobbly as my daughter's front teeth, in spite of all the bleak newsflow this week, the S&P 500 (+0.36% last night) has been up for three days in a row. However sentiment is bad enough that you'd be forgiven for not noticing. Indeed fears of a recession continue to abound in markets, with yesterday seeing another round of commodity price declines (outside of Euro Gas and electricity), further inversions of the Treasury yield curve, rising US yields with 2yr yields up an astonishing +24.5bps from the European afternoon lows, and continued concerns about a European energy crisis that left the Euro at its weakest level against the US Dollar since 2002. Some stronger US data was the bright spot that may have helped equities but it's been a bit of a random walk of late as weaker data has also recently helped equities by reining in Fed expectations. So tough markets to find a consistent narrative in at the moment. Makes calling the market reaction to payrolls tomorrow hard.

Looking at some of these moves and stories in more detail, commodities across the board were one of the biggest losers yesterday (ex EU gas and electricity), with the prospect of a global slowdown or recession sending Brent crude oil prices (-2.02%) beneath $100/bbl intraday for the first time since April, with only a partial recovery to $101.23/bbl this morning. When it came to metals, copper slid another -1.95%, taking the industrial bellwether down to a 19-month low (-29.54% from the peak 16 weeks ago), whilst even the classic safe haven of gold (-1.47%) hit a 9-month low. I mentioned in my chart of the day how the extent of the commodity declines we’re seeing right now have only been rivalled at three other points since the 1930s, which are during the initial Covid shock, the GFC, and the German invasion of France in 1940, which brings home just how infrequent declines of this sort are. As usual however, one exception to that pattern were European natural gas futures, which edged up another +3.59% to a post-March high of €171 per megawatt-hour. Meanwhile German electricity prices have surged, with 1-month forward power baseload prices increasing +7.38% to €371, their highest since the start of Russia’s invasion of Ukraine, which risks hurting the all-important German manufacturing sector.

Treasury yields sold off and the yield curve flattened, driven by strong data and a still resolutely hawkish Fed per the June meeting minutes. 2yr yields climbed +18.3bps (24.5bps off the lows), marking their largest daily increase since the WSJ article hinting the Fed was ‘considering’ a +75bp hike, and bringing 2yr yields back above 3%. Further out the curve, 10yr yields increased +12.3bps to 2.93%, led by real yields gaining +12.6bps. The renewed bout of flattening left 2s10s -7.6bps inverted, the most since early April. So a big day in US bonds. As we go to press, yields on the 10yr USTs (-1.1 bps) have slipped to 2.92% in Asia trading, although the 2s10s has steepened slightly back to a still-inverted -5.0bps.

Looking at the drivers, on the data side the ISM services index for June came in above expectations at 55.3 (vs. 54.0 expected), whilst the final composite PMI for June was revised up to 52.3 (vs. flash 51.2). And the JOLTS data on job openings showed a labour market that was still historically tight in May, albeit a bit less tight than it had been, with the number of openings coming down for a second consecutive month for the first time since the pandemic began, at 11.254m in May (vs. 11.0m expected).

The June Fed Minutes added to the narrative, where policymakers steadfastly communicated their desire to tighten policy to fight inflation. As with any minutes release, the comments are at risk of being stale, but it was illuminating that policymakers appeared to be in agreement that policy needed to get into restrictive territory, and that the risks were tilted toward losing control of inflation and having expectations un-anchor. Indeed, something relevant to recent market pricing that’s become more dovish since the June meeting, it said “many participants judged that a significant risk now facing the Committee was that elevated inflation could become entrenched if the public began to question the resolve of the Committee”. When all was said and done, Fed futures pricing by December 2022 increased +9.7bps to 3.37%.

On that theme of central banks, gilts underperformed their counterparts elsewhere in Europe, with the 10yr yield up +4.4bps after there were further signals that the BoE were considering a 50bps hike at their next meeting. Chief economist Pill said that their vow to “act forcefully” in their June statement “reflects both my willingness to adopt a faster pace of tightening than implemented thus far in this tightening cycle, while simultaneously emphasizing the conditionality of any such change in pace on the flow of new data and analysis”. However, sovereign bonds had a better performance elsewhere in Europe, with yields on 10yr bunds (-1.2bps) and OATs (-2.3bps) both moving lower. This was largely before the bulk of the US bond sell off.

Despite the accumulation of bad news, equities appeared to continue marching to the beat of their own drum. The S&P 500 staged another impressive late-day rally which left the index up +0.36%, after spending the morning in the red. Contrary to Tuesday, where only three sectors were in the green, only three sectors were in the red yesterday, so a much more broad-based rally. Tech names performed about in line, with the NASDAQ up +0.35%. Meanwhile the tails of the market underperformed, with the mega-cap FANG+ flat, and the small-cap Russell 2000 down -0.79%. European equities gained, with the STOXX 600 up +1.66%, although most of the increase came at the open to catch up with Tuesday’s late Wall Street rally. Significantly however, we saw the Euro weaken a further -0.82% against the US dollar to take it to its weakest level since 2002, at just $1.0182. My colleague George Saravelos evaluated how much lower the Euro could depreciate against the US dollar depending on which of four heuristics you believe. As a spoiler, yes, parity is in play, but do check out the full piece, here.

Those modest gains in the US stocks are echoing in majority of the Asian markets in early trade. The Kospi (+1.87%) is outperforming across the region, supported by a rise in Samsung Electronics after the company indicated in its earnings guidance that its operating profit likely rose to 14.1 trillion won ($10.8 billion) in 2Q22, up from 12.57 trillion won a year ago. Meanwhile, the Nikkei (+0.73%), Shanghai Composite (+0.51%), and the CSI (+0.56%) all are trading in positive territory, recovering some of their losses in the previous session. Elsewhere, the S&P/ASX 200 (+0.41%) is moving higher as Australia’s trade surplus hit a record high, although the exception to this positive trend has been the Hang Seng (-0.43%). Outside of Asia, DM stock futures are pointing to a steady start with contracts on the S&P 500 (+0.12%), NASDAQ 100 (+0.15%) and DAX (+0.87%) all rising.

Finally in terms of UK politics, PM Johnson lives to fight another day in the face of an unprecedented pace of resignations from his government and substantial pressure to quit. Since the resignations of Health Secretary Javid and Chancellor Sunak on Tuesday evening, more than 40 MPs have resigned as ministers or aides from the government, with Welsh Secretary Simon Hart becoming the third minister at cabinet level to resign. Otherwise, Attorney General Suella Braverman said publicly that Johnson should step down and that she’d stand in a leadership election, although she remains in post for now, whilst Levelling Up Secretary Michael Gove was sacked from the cabinet last night. In terms of next steps with increasing numbers of MPs calling for his removal, there are elections to the 1922 Committee of Conservative MPs next week, and if enough anti-Johnson MPs are elected to that, they are seeking to change the rules so that another confidence vote in Johnson can be held imminently (rather than waiting for a year since the last challenge as under the existing rules).

To the day ahead now, and data releases include the US trade balance for May and the weekly initial jobless claims, as well as German industrial production for May. Meanwhile from central banks, we’ll get the ECB’s minutes from their June meeting, and hear from the Fed’s Waller and Bullard, the ECB’s Lane, Stournaras, Centeno and Herodotou, and the BoE’s Mann and Pill.

Government

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

Spread & Containment

‘I couldn’t stand the pain’: the Turkish holiday resort that’s become an emergency dental centre for Britons who can’t get treated at home

The crisis in NHS dentistry is driving increasing numbers abroad for treatment. Here are some of their stories.

It’s a hot summer day in the Turkish city of Antalya, a Mediterranean resort with golden beaches, deep blue sea and vibrant nightlife. The pool area of the all-inclusive resort is crammed with British people on sun loungers – but they aren’t here for a holiday. This hotel is linked to a dental clinic that organises treatment packages, and most of these guests are here to see a dentist.

From Norwich, two women talk about gums and injections. A man from Wales holds a tissue close to his mouth and spits blood – he has just had two molars extracted.

The dental clinic organises everything for these dental “tourists” throughout their treatment, which typically lasts from three to 15 days. The stories I hear of what has caused them to travel to Turkey are strikingly similar: all have struggled to secure dental treatment at home on the NHS.

“The hotel is nice and some days I go to the beach,” says Susan*, a hairdresser in her mid-30s from Norwich. “But really, we aren’t tourists like in a proper holiday. We come here because we have no choice. I couldn’t stand the pain.”

This is Susan’s second visit to Antalya. She explains that her ordeal started two years earlier:

I went to an NHS dentist who told me I had gum disease … She did some cleaning to my teeth and gums but it got worse. When I ate, my teeth were moving … the gums were bleeding and it was very painful. I called to say I was in pain but the clinic was not accepting NHS patients any more.

The only option the dentist offered Susan was to register as a private patient:

I asked how much. They said £50 for x-rays and then if the gum disease got worse, £300 or so for extraction. Four of them were moving – imagine: £1,200 for losing your teeth! Without teeth I’d lose my clients, but I didn’t have the money. I’m a single mum. I called my mum and cried.

Susan’s mother told her about a friend of hers who had been to Turkey for treatment, then together they found a suitable clinic:

The prices are so much cheaper! Tooth extraction, x-rays, consultations – it all comes included. The flight and hotel for seven days cost the same as losing four teeth in Norwich … I had my lower teeth removed here six months ago, now I’ve got implants … £2,800 for everything – hotel, transfer, treatments. I only paid the flights separately.

In the UK, roughly half the adult population suffers from periodontitis – inflammation of the gums caused by plaque bacteria that can lead to irreversible loss of gums, teeth, and bone. Regular reviews by a dentist or hygienist are required to manage this condition. But nine out of ten dental practices cannot offer NHS appointments to new adult patients, while eight in ten are not accepting new child patients.

Some UK dentists argue that Britons who travel abroad for treatment do so mainly for cosmetic procedures. They warn that dental tourism is dangerous, and that if their treatment goes wrong, dentists in the UK will be unable to help because they don’t want to be responsible for further damage. Susan shrugs this off:

Dentists in England say: ‘If you go to Turkey, we won’t touch you [afterwards].’ But I don’t worry because there are no appointments at home anyway. They couldn’t help in the first place, and this is why we are in Turkey.

‘How can we pay all this money?’

As a social anthropologist, I travelled to Turkey a number of times in 2023 to investigate the crisis of NHS dentistry, and the journeys abroad that UK patients are increasingly making as a result. I have relatives in Istanbul and have been researching migration and trading patterns in Turkey’s largest city since 2016.

In August 2023, I visited the resort in Antalya, nearly 400 miles south of Istanbul. As well as Susan, I met a group from a village in Wales who said there was no provision of NHS dentistry back home. They had organised a two-week trip to Turkey: the 12-strong group included a middle-aged couple with two sons in their early 20s, and two couples who were pensioners. By going together, Anya tells me, they could support each other through their different treatments:

I’ve had many cavities since I was little … Before, you could see a dentist regularly – you didn’t even think about it. If you had pain or wanted a regular visit, you phoned and you went … That was in the 1990s, when I went to the dentist maybe every year.

Anya says that once she had children, her family and work commitments meant she had no time to go to the dentist. Then, years later, she started having serious toothache:

Every time I chewed something, it hurt. I ate soups and soft food, and I also lost weight … Even drinking was painful – tea: pain, cold water: pain. I was taking paracetamol all the time! I went to the dentist to fix all this, but there were no appointments.

Anya was told she would have to wait months, or find a dentist elsewhere:

A private clinic gave me a list of things I needed done. Oh my God, almost £6,000. My husband went too – same story. How can we pay all this money? So we decided to come to Turkey. Some people we know had been here, and others in the village wanted to come too. We’ve brought our sons too – they also need to be checked and fixed. Our whole family could be fixed for less than £6,000.

By the time they travelled, Anya’s dental problems had turned into a dental emergency. She says she could not live with the pain anymore, and was relying on paracetamol.

In 2023, about 6 million adults in the UK experienced protracted pain (lasting more than two weeks) caused by toothache. Unintentional paracetamol overdose due to dental pain is a significant cause of admissions to acute medical units. If left untreated, tooth infections can spread to other parts of the body and cause life-threatening complications – and on rare occasions, death.

In February 2024, police were called to manage hundreds of people queuing outside a newly opened dental clinic in Bristol, all hoping to be registered or seen by an NHS dentist. One in ten Britons have admitted to performing “DIY dentistry”, of which 20% did so because they could not find a timely appointment. This includes people pulling out their teeth with pliers and using superglue to repair their teeth.

In the 1990s, dentistry was almost entirely provided through NHS services, with only around 500 solely private dentists registered. Today, NHS dentist numbers in England are at their lowest level in a decade, with 23,577 dentists registered to perform NHS work in 2022-23, down 695 on the previous year. Furthermore, the precise division of NHS and private work that each dentist provides is not measured.

The COVID pandemic created longer waiting lists for NHS treatment in an already stretched public service. In Bridlington, Yorkshire, people are now reportedly having to wait eight-to-nine years to get an NHS dental appointment with the only remaining NHS dentist in the town.

In his book Patients of the State (2012), Argentine sociologist Javier Auyero describes the “indignities of waiting”. It is the poor who are mostly forced to wait, he writes. Queues for state benefits and public services constitute a tangible form of power over the marginalised. There is an ethnic dimension to this story, too. Data suggests that in the UK, patients less likely to be effective in booking an NHS dental appointment are non-white ethnic groups and Gypsy or Irish travellers, and that it is particularly challenging for refugees and asylum-seekers to access dental care.

This article is part of Conversation Insights

The Insights team generates long-form journalism derived from interdisciplinary research. The team is working with academics from different backgrounds who have been engaged in projects aimed at tackling societal and scientific challenges.

In 2022, I experienced my own dental emergency. An infected tooth was causing me debilitating pain, and needed root canal treatment. I was advised this would cost £71 on the NHS, plus £307 for a follow-up crown – but that I would have to wait months for an appointment. The pain became excruciating – I could not sleep, let alone wait for months. In the same clinic, privately, I was quoted £1,300 for the treatment (more than half my monthly income at the time), or £295 for a tooth extraction.

I did not want to lose my tooth because of lack of money. So I bought a flight to Istanbul immediately for the price of the extraction in the UK, and my tooth was treated with root canal therapy by a private dentist there for £80. Including the costs of travelling, the total was a third of what I was quoted to be treated privately in the UK. Two years on, my treated tooth hasn’t given me any more problems.

A better quality of life

Not everyone is in Antalya for emergency procedures. The pensioners from Wales had contacted numerous clinics they found on the internet, comparing prices, treatments and hotel packages at least a year in advance, in a carefully planned trip to get dental implants – artificial replacements for tooth roots that help support dentures, crowns and bridges.

In Turkey, all the dentists I speak to (most of whom cater mainly for foreigners, including UK nationals) consider implants not a cosmetic or luxurious treatment, but a development in dentistry that gives patients who are able to have the procedure a much better quality of life. This procedure is not available on the NHS for most of the UK population, and the patients I meet in Turkey could not afford implants in private clinics back home.

Paul is in Antalya to replace his dentures, which have become uncomfortable and irritating to his gums, with implants. He says he couldn’t find an appointment to see an NHS dentist. His wife Sonia went through a similar procedure the year before and is very satisfied with the results, telling me: “Why have dentures that you need to put in a glass overnight, in the old style? If you can have implants, I say, you’re better off having them.”

Most of the dental tourists I meet in Antalya are white British: this city, known as the Turkish Riviera, has developed an entire economy catering to English-speaking tourists. In 2023, more than 1.3 million people visited the city from the UK, up almost 15% on the previous year.

Read more: NHS dentistry is in crisis – are overseas dentists the answer?

In contrast, the Britons I meet in Istanbul are predominantly from a non-white ethnic background. Omar, a pensioner of Pakistani origin in his early 70s, has come here after waiting “half a year” for an NHS appointment to fix the dental bridge that is causing him pain. Omar’s son had been previously for a hair transplant, and was offered a free dental checkup by the same clinic, so he suggested it to his father. Having worked as a driver for a manufacturing company for two decades in Birmingham, Omar says he feels disappointed to have contributed to the British economy for so long, only to be “let down” by the NHS:

At home, I must wait and wait and wait to get a bridge – and then I had many problems with it. I couldn’t eat because the bridge was uncomfortable and I was in pain, but there were no appointments on the NHS. I asked a private dentist and they recommended implants, but they are far too expensive [in the UK]. I started losing weight, which is not a bad thing at the beginning, but then I was worrying because I couldn’t chew and eat well and was losing more weight … Here in Istanbul, I got dental implants – US$500 each, problem solved! In England, each implant is maybe £2,000 or £3,000.

In the waiting area of another clinic in Istanbul, I meet Mariam, a British woman of Iraqi background in her late 40s, who is making her second visit to the dentist here. Initially, she needed root canal therapy after experiencing severe pain for weeks. Having been quoted £1,200 in a private clinic in outer London, Mariam decided to fly to Istanbul instead, where she was quoted £150 by a dentist she knew through her large family. Even considering the cost of the flight, Mariam says the decision was obvious:

Dentists in England are so expensive and NHS appointments so difficult to find. It’s awful there, isn’t it? Dentists there blamed me for my rotten teeth. They say it’s my fault: I don’t clean or I ate sugar, or this or that. I grew up in a village in Iraq and didn’t go to the dentist – we were very poor. Then we left because of war, so we didn’t go to a dentist … When I arrived in London more than 20 years ago, I didn’t speak English, so I still didn’t go to the dentist … I think when you move from one place to another, you don’t go to the dentist unless you are in real, real pain.

In Istanbul, Mariam has opted not only for the urgent root canal treatment but also a longer and more complex treatment suggested by her consultant, who she says is a renowned doctor from Syria. This will include several extractions and implants of back and front teeth, and when I ask what she thinks of achieving a “Hollywood smile”, Mariam says:

Who doesn’t want a nice smile? I didn’t come here to be a model. I came because I was in pain, but I know this doctor is the best for implants, and my front teeth were rotten anyway.

Dentists in the UK warn about the risks of “overtreatment” abroad, but Mariam appears confident that this is her opportunity to solve all her oral health problems. Two of her sisters have already been through a similar treatment, so they all trust this doctor.

The UK’s ‘dental deserts’

To get a fuller understanding of the NHS dental crisis, I’ve also conducted 20 interviews in the UK with people who have travelled or were considering travelling abroad for dental treatment.

Joan, a 50-year-old woman from Exeter, tells me she considered going to Turkey and could have afforded it, but that her back and knee problems meant she could not brave the trip. She has lost all her lower front teeth due to gum disease and, when I meet her, has been waiting 13 months for an NHS dental appointment. Joan tells me she is living in “shame”, unable to smile.

In the UK, areas with extremely limited provision of NHS dental services – known as as “dental deserts” – include densely populated urban areas such as Portsmouth and Greater Manchester, as well as many rural and coastal areas.

In Felixstowe, the last dentist taking NHS patients went private in 2023, despite the efforts of the activist group Toothless in Suffolk to secure better access to NHS dentists in the area. It’s a similar story in Ripon, Yorkshire, and in Dumfries & Galloway, Scotland, where nearly 25,000 patients have been de-registered from NHS dentists since 2021.

Data shows that 2 million adults must travel at least 40 miles within the UK to access dental care. Branding travel for dental care as “tourism” carries the risk of disguising the elements of duress under which patients move to restore their oral health – nationally and internationally. It also hides the immobility of those who cannot undertake such journeys.

The 90-year-old woman in Dumfries & Galloway who now faces travelling for hours by bus to see an NHS dentist can hardly be considered “tourism” – nor the Ukrainian war refugees who travelled back from West Sussex and Norwich to Ukraine, rather than face the long wait to see an NHS dentist.

Many people I have spoken to cannot afford the cost of transport to attend dental appointments two hours away – or they have care responsibilities that make it impossible. Instead, they are forced to wait in pain, in the hope of one day securing an appointment closer to home.

‘Your crisis is our business’

The indignities of waiting in the UK are having a big impact on the lives of some local and foreign dentists in Turkey. Some neighbourhoods are rapidly changing as dental and other health clinics, usually in luxurious multi-storey glass buildings, mushroom. In the office of one large Istanbul medical complex with sections for hair transplants and dentistry (plus one linked to a hospital for more extensive cosmetic surgery), its Turkish owner and main investor tells me:

Your crisis is our business, but this is a bazaar. There are good clinics and bad clinics, and unfortunately sometimes foreign patients do not know which one to choose. But for us, the business is very good.

This clinic only caters to foreign patients. The owner, an architect by profession who also developed medical clinics in Brazil, describes how COVID had a major impact on his business:

When in Europe you had COVID lockdowns, Turkey allowed foreigners to come. Many people came for ‘medical tourism’ – we had many patients for cosmetic surgery and hair transplants. And that was when the dental business started, because our patients couldn’t see a dentist in Germany or England. Then more and more patients started to come for dental treatments, especially from the UK and Ireland. For them, it’s very, very cheap here.

The reasons include the value of the Turkish lira relative to the British pound, the low cost of labour, the increasing competition among Turkish clinics, and the sheer motivation of dentists here. While most dentists catering to foreign patients are from Turkey, others have arrived seeking refuge from war and violence in Syria, Iraq, Afghanistan, Iran and beyond. They work diligently to rebuild their lives, careers and lost wealth.

Regardless of their origin, all dentists in Turkey must be registered and certified. Hamed, a Syrian dentist and co-owner of a new clinic in Istanbul catering to European and North American patients, tells me:

I know that you say ‘Syrian’ and people think ‘migrant’, ‘refugee’, and maybe think ‘how can this dentist be good?’ – but Syria, before the war, had very good doctors and dentists. Many of us came to Turkey and now I have a Turkish passport. I had to pass the exams to practise dentistry here – I study hard. The exams are in Turkish and they are difficult, so you cannot say that Syrian doctors are stupid.

Hamed talks excitedly about the latest technology that is coming to his profession: “There are always new materials and techniques, and we cannot stop learning.” He is about to travel to Paris to an international conference:

I can say my techniques are very advanced … I bet I put more implants and do more bone grafting and surgeries every week than any dentist you know in England. A good dentist is about practice and hand skills and experience. I work hard, very hard, because more and more patients are arriving to my clinic, because in England they don’t find dentists.

While there is no official data about the number of people travelling from the UK to Turkey for dental treatment, investors and dentists I speak to consider that numbers are rocketing. From all over the world, Turkey received 1.2 million visitors for “medical tourism” in 2022, an increase of 308% on the previous year. Of these, about 250,000 patients went for dentistry. One of the most renowned dental clinics in Istanbul had only 15 British patients in 2019, but that number increased to 2,200 in 2023 and is expected to reach 5,500 in 2024.

Like all forms of medical care, dental treatments carry risks. Most clinics in Turkey offer a ten-year guarantee for treatments and a printed clinical history of procedures carried out, so patients can show this to their local dentists and continue their regular annual care in the UK. Dental treatments, checkups and maintaining a good oral health is a life-time process, not a one-off event.

Many UK patients, however, are caught between a rock and a hard place – criticised for going abroad, yet unable to get affordable dental care in the UK before and after their return. The British Dental Association has called for more action to inform these patients about the risks of getting treated overseas – and has warned UK dentists about the legal implications of treating these patients on their return. But this does not address the difficulties faced by British patients who are being forced to go abroad in search of affordable, often urgent dental care.

A global emergency

The World Health Organization states that the explosion of oral disease around the world is a result of the “negligent attitude” that governments, policymakers and insurance companies have towards including oral healthcare under the umbrella of universal healthcare. It as if the health of our teeth and mouth is optional; somehow less important than treatment to the rest of our body. Yet complications from untreated tooth decay can lead to hospitalisation.

The main causes of oral health diseases are untreated tooth decay, severe gum disease, toothlessness, and cancers of the lip and oral cavity. Cases grew during the pandemic, when little or no attention was paid to oral health. Meanwhile, the global cosmetic dentistry market is predicted to continue growing at an annual rate of 13% for the rest of this decade, confirming the strong relationship between socioeconomic status and access to oral healthcare.

In the UK since 2018, there have been more than 218,000 admissions to hospital for rotting teeth, of which more than 100,000 were children. Some 40% of children in the UK have not seen a dentist in the past 12 months. The role of dentists in prevention of tooth decay and its complications, and in the early detection of mouth cancer, is vital. While there is a 90% survival rate for mouth cancer if spotted early, the lack of access to dental appointments is causing cases to go undetected.

The reasons for the crisis in NHS dentistry are complex, but include: the real-term cuts in funding to NHS dentistry; the challenges of recruitment and retention of dentists in rural and coastal areas; pay inequalities facing dental nurses, most of them women, who are being badly hit by the cost of living crisis; and, in England, the 2006 Dental Contract that does not remunerate dentists in a way that encourages them to continue seeing NHS patients.

The UK is suffering a mass exodus of the public dentistry workforce, with workers leaving the profession entirely or shifting to the private sector, where payments and life-work balance are better, bureaucracy is reduced, and prospects for career development look much better. A survey of general dental practitioners found that around half have reduced their NHS work since the pandemic – with 43% saying they were likely to go fully private, and 42% considering a career change or taking early retirement.

Reversing the UK’s dental crisis requires more commitment to substantial reform and funding than the “recovery plan” announced by Victoria Atkins, the secretary of state for health and social care, on February 7.

The stories I have gathered show that people travelling abroad for dental treatment don’t see themselves as “tourists” or vanity-driven consumers of the “Hollywood smile”. Rather, they have been forced by the crisis in NHS dentistry to seek out a service 1,500 miles away in Turkey that should be a basic, affordable right for all, on their own doorstep.

*Names in this article have been changed to protect the anonymity of the interviewees.

For you: more from our Insights series:

GP crisis: how did things go so wrong, and what needs to change?

Insomnia: how chronic sleep problems can lead to a spiralling decline in mental health

To hear about new Insights articles, join the hundreds of thousands of people who value The Conversation’s evidence-based news. Subscribe to our newsletter.

Diana Ibanez Tirado receives funding from the School of Global Studies, University of Sussex.

pound pandemic treatment therapy spread recovery iran brazil european europe uk germany ukraine world health organizationInternational

Beloved mall retailer files Chapter 7 bankruptcy, will liquidate

The struggling chain has given up the fight and will close hundreds of stores around the world.

It has been a brutal period for several popular retailers. The fallout from the covid pandemic and a challenging economic environment have pushed numerous chains into bankruptcy with Tuesday Morning, Christmas Tree Shops, and Bed Bath & Beyond all moving from Chapter 11 to Chapter 7 bankruptcy liquidation.

In all three of those cases, the companies faced clear financial pressures that led to inventory problems and vendors demanding faster, or even upfront payment. That creates a sort of inevitability.

Related: Beloved retailer finds life after bankruptcy, new famous owner

When a retailer faces financial pressure it sets off a cycle where vendors become wary of selling them items. That leads to barren shelves and no ability for the chain to sell its way out of its financial problems.

Once that happens bankruptcy generally becomes the only option. Sometimes that means a Chapter 11 filing which gives the company a chance to negotiate with its creditors. In some cases, deals can be worked out where vendors extend longer terms or even forgive some debts, and banks offer an extension of loan terms.

In other cases, new funding can be secured which assuages vendor concerns or the company might be taken over by its vendors. Sometimes, as was the case with David's Bridal, a new owner steps in, adds new money, and makes deals with creditors in order to give the company a new lease on life.

It's rare that a retailer moves directly into Chapter 7 bankruptcy and decides to liquidate without trying to find a new source of funding.

Image source: Getty Images

The Body Shop has bad news for customers

The Body Shop has been in a very public fight for survival. Fears began when the company closed half of its locations in the United Kingdom. That was followed by a bankruptcy-style filing in Canada and an abrupt closure of its U.S. stores on March 4.

"The Canadian subsidiary of the global beauty and cosmetics brand announced it has started restructuring proceedings by filing a Notice of Intention (NOI) to Make a Proposal pursuant to the Bankruptcy and Insolvency Act (Canada). In the same release, the company said that, as of March 1, 2024, The Body Shop US Limited has ceased operations," Chain Store Age reported.

A message on the company's U.S. website shared a simple message that does not appear to be the entire story.

"We're currently undergoing planned maintenance, but don't worry we're due to be back online soon."

That same message is still on the company's website, but a new filing makes it clear that the site is not down for maintenance, it's down for good.

The Body Shop files for Chapter 7 bankruptcy

While the future appeared bleak for The Body Shop, fans of the brand held out hope that a savior would step in. That's not going to be the case.

The Body Shop filed for Chapter 7 bankruptcy in the United States.

"The US arm of the ethical cosmetics group has ceased trading at its 50 outlets. On Saturday (March 9), it filed for Chapter 7 insolvency, under which assets are sold off to clear debts, putting about 400 jobs at risk including those in a distribution center that still holds millions of dollars worth of stock," The Guardian reported.

After its closure in the United States, the survival of the brand remains very much in doubt. About half of the chain's stores in the United Kingdom remain open along with its Australian stores.

The future of those stores remains very much in doubt and the chain has shared that it needs new funding in order for them to continue operating.

The Body Shop did not respond to a request for comment from TheStreet.

bankruptcy pandemic canada-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex