Authored by William Stebbins Jr. via Bitcoin Magazine,

Tension is building in the mines.

As the 4th Halving nears and the block reward trims to 3.125 bitcoin per block, miners must not only adapt to a significantly diminished reward, but contend with an increasingly profit-hostile future which might have surprised even the prescient Nakamoto. Indeed, despite widespread hope that fiat states will come to accept peaceful coexistence with bitcoin—I, too, would prefer this outcome—and despite some modest grounds for optimism, history would remind us that kings and emperors do not willingly relinquish power. This is no less true of modern fiat empires, as Lyn Alden’s survey of U.S. fiat interventionism explains.1 History, coupled with ongoing observation of federal actions—foreign and domestic—will be sufficient to calibrate our expectations and help guard us against understandable, yet self-deceptive naivete.

Accordingly, of all the imminent mining challenges, the most formidable might well be increasing state opposition. If accurate, then conditions may rapidly deteriorate such that off-planet mining might merit serious consideration.

THE MINERS’ EARTHLY DILEMMA

As the Halvings inexorably march on, the mining equation keeps changing. For example, in 14 short years mining has evolved from enthusiasts on personal computers to mammoth structures housing thousands of water-cooled Antminer S19s with 5nm chips pulling over 750 MW of electricity.

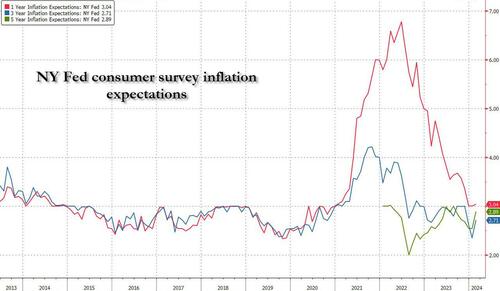

Each stage of mining evolution has faced unique challenges. Those anticipated with the 4th Halving this April will include, among others: assured access to cheaper energy, acquisition of more efficient ASIC chips despite a global shortage and shipment delays (exacerbated by U.S.-China-Taiwan animus), the possibility of 3nm chip miners, hashrate increase, hashprice decline, the impact of AI, environmental propaganda attacks, and maddeningly-inscrutable bitcoin value projections made no less easier by the advent of large investment firms in the bitcoin ecosystem—all within the context of a frangible, debt-bloated, de-dollarizing economy.

Were these the only issues to resolve they’d be sufficiently daunting. However, a more problematic attack vector, as I’ve presented previously,2 is the possibility of the fiat-empowered superpower and its retinue of dollar-subservient vassals hindering free market bitcoin activities.

Logically, the character and magnitude of state friction would be correlated and proportionate to bitcoin popularity over fiat's existing sphere of influence and control. If the U.S. monetary system, reaping the ill effects of decades of manipulation and recent global de-dollarization, begins imploding while bitcoin strengthens, federal response will be strong. It will be unlikely to accept contraction of its fiat power and be open to a bitcoin standard. Rather, it will cling to the legacy system from which it so easily accumulated its power and attack the emergence. In so doing, upon realizing that it can’t kill bitcoin, it will first seek to isolate it from its owners in cyberspace.3 A complementary line of attack would then be to neutralize mining. With bitcoin isolated and mining disrupted, in their view, public trust in bitcoin would dissolve; the threat would be neutralized.

Elements of a mining attack might include two elements: First, a propaganda operation: facts notwithstanding, miners would be slandered as shadowy crypto profiteers irresponsibly increasing CO2 emissions and consuming vast stores of finite energy while driving prices up and diverting energy from socially-beneficial uses. Second, a bureaucratic operation: miners would face a torrent of regulation, from licensing and zoning requirements, environmental restrictions, energy and CO2 quotas, to unreasonable reporting requirements replete with unprecedented KYC intrusions, and punitive taxation. In short, the combined economic, regulatory, and propaganda challenges of such an attack would be near insurmountable.

In recent years, when a jurisdiction became inhospitable—one is reminded of China’s mining ban still in effect since mid 20214—the conventional playbook offered but two options: attempt to go underground (risky), or relocate to a bitcoin-hospitable jurisdiction (disruptive and costly).

THE SEARCH FOR NEW SANCTUARY

Analyzing this potential quandary militarily, we might turn to a concept from the field of counterinsurgent warfare: sanctuary. U.S. Army doctrine recognizes the historic principle that insurgents require areas of sanctuary within which to rest, reconsolidate, and sustain operations:

Access to external . . . sanctuaries [have] always influenced the effectiveness of insurgencies . . . provid[ing] insurgents places to rebuild and reorganize without fear of counterinsurgent interference. . . Sanctuaries traditionally were physical safe havens, such as base areas, and this form of safe haven still exists . . . [But,] modern target acquisition and intelligence-gathering technology make insurgents in isolation, even in neighboring states, more vulnerable.5

How might this apply to bitcoin mining? If we posit the State inevitably regarding bitcoin as a monetary insurgent against which it must act to preserve its fiat power, miners will scramble to find inviolable sanctuaries in order to continue operations.

Currently, miners possess adequate jurisdictions within which to mine. In fact, hope yet flickers as we see a few bitcoin-friendly jurisdictions emerging, such as Oman,6—usually within what the West calls the “third world,” but which might be accurately labelled the neo-colonial, fiat-wrecked world. Additionally, even despite the 2021 mining ban the hashrate in China quickly recovered and exceeded its previous rate.7 This situation, however, can change with astonishing speed. Accommodating jurisdictions today can quickly turn inhospitable tomorrow.

Viewed differently: Bitcoin already has existential sanctuary— anchored securely in the blockchain, it is existentially permissionless and will continue existing untouchable in cyberspace. Its existence may be said to be inviolate. However, it currently lacks reproductive sanctuary. Mining occurs not in cyberspace, but in geographic space, within nations where market hospitality, regulation, and energy access is unpredictable. Further, mining now largely occurs within extensive, immobile structures which cannot easily “go underground” or quickly relocate.

But even the above simplification is inaccurate in that bitcoin’s existence is not fully secure in cyberspace without mining. As Andreas Antonopoulos explains,

Mining secures the bitcoin system and enables the emergence of network-wide consensus without a central authority. . . The purpose of mining is not the creation of new bitcoin. That’s the incentive system. Mining is the mechanism by which bitcoin’s security is decentralized.8

Thus, mining is necessary to secure the bitcoin ecosystem as well as to forge new coin. As such, if earthly mining sanctuaries start dwindling under persecution of an ailing fiat geriatric, in light of recent commercial space success, miners might do well to look starward, to the ungoverned frontier of space. Space offers the ultimate physical sanctuary, freed from the hostile overreaches of earthbound authorities. It might provide the physical sanctuary elegantly complementing bitcoin’s cyber sanctuary.

EXTRATERRESTRIAL DREAMS

Inspired by Elon Musk’s Space-X and Starlink ventures which provide conceptual proof-of-principle for considering the feasibility of off-planet solar mining, what form might such an endeavor take?

One could visualize mining rigs nestled in modular, expandable mining satellites, minesats, outfitted with wings of ultra-light solar cells and inflatable mirrors placed into high, sun-synchronous orbits (SSO) (~ 600-1000 km above the Earth) perpetually facing the sun for uninterrupted energy harvesting. Incidentally, a number of nations including the U.S, China, Japan, and the UK, also see incredible potential in off-planet solar energy and are already pursuing Space-Based Solar Power (SBSP) for use on Earth.9

Ever the earthbound miner’s challenge, heat dissipation remains a problem even in frigid space as it cannot be dissipated through conduction or convection. Instead, satellites and other structures usually rely on radiation to offload heat. For example, the International Space Station (ISS) employs a system called the External Active Thermal Control System (EATCS) employing heat radiators positioned in the shade side.10 Minesats would likely use a similar system for cooling.

Again, borrowing from Musk’s Starlink example, these higher orbit, SSO minesats would either network to a constellation of lower orbit smallsats (small satellites) which provide broadband internet connectivity to the planet, or connect directly to the bitcoin nodal network themselves.

Operating from the frontier of space, ungoverned by nation states, mining would be freed of licensing and zoning requirements, as well as CO2 and energy propaganda smear campaigns.

To take our thought experiment further, one could imagine this fleet of solar-powered minesats transported to their orbits from launchpads in forward-thinking, bitcoin-embracing nations, such as El Salvador, and potentially Argentina (should the pro-bitcoin presidential candidate Javier Milei win his upcoming election). In the case of El Salvador, it could provide not only physical sanctuary for politically-attacked firms like Space-X11 but, located over a thousand miles nearer the equator than any U.S. launch location, would provide a geographically superior planetary location enabling spacecraft to achieve escape velocity more efficiently. One could even postulate the migration of bitcoin-specific mining chip research and manufacturing to such a visionary nation, symbiotically co-locating the essential elements and activities of bitcoin.

Not long ago the idea of a private company outperforming NASA by employing reusable, upright-landing spacecraft and deploying a constellation of satellites providing global internet access would have been considered quixotic and naïve. Equally outlandish: that a nation would declare bitcoin legal tender. Perhaps the idea of extraterrestrial, satellite-based bitcoin mining facilitated by a visionary company that is repeatedly taking NASA to school, and partnering with a bitcoin-embracing nation of the Global South is not such a long shot. Indeed, it might well be the bright orange path.