Uncategorized

First National Financial Corporation Reports Third Quarter 2022 Results, Increases Common Share Dividend

First National Financial Corporation Reports Third Quarter 2022 Results, Increases Common Share Dividend

Canada NewsWire

TORONTO, Oct. 25, 2022

TORONTO, Oct. 25, 2022 /CNW/ – First National Financial Corporation (TSX: FN) (TSX: FN.PR.A) (TSX: FN.PR…

First National Financial Corporation Reports Third Quarter 2022 Results, Increases Common Share Dividend

Canada NewsWire

TORONTO, Oct. 25, 2022

TORONTO, Oct. 25, 2022 /CNW/ - First National Financial Corporation (TSX: FN) (TSX: FN.PR.A) (TSX: FN.PR.B) (the "Company" or "FNFC") today announced its financial results for the three and nine months ended September 30, 2022. The Company derives virtually all of its earnings from its wholly owned subsidiary, First National Financial LP ("FNFLP" or "First National"), one of Canada's largest non-bank mortgage originators and underwriters.

Third Quarter Summary

- Mortgages under administration ("MUA") were a record $129.3 billion compared to $122.3 billion at September 30, 2021

- Revenue was $392.4 million compared to $353.7 million a year ago

- Net income was $40.1 million ($0.66 per share), compared to $47.6 million ($0.78 per share) a year ago

- Pre-FMV Income(1) was $48.2 million compared to $64.9 million a year ago

Common Share Dividend Increase

Today, First National's Board of Directors announced an increase in the Company's regular monthly dividend effective with the payment to be made December 15, 2022 to shareholders of record at the close of business November 30, 2022. At that time, the monthly dividend will rise to an annualized rate of $2.40 per common share from the current annualized rate of $2.35 per common share.

Management Commentary

"During this period of market adjustment brought on by rapidly rising interest rates, we continue to manage First National with a long-term mindset," said Jason Ellis, President and Chief Executive Officer. "Our focus on providing responsive, differentiated services to Canadian borrowers and independent mortgage brokers enabled us to profitably originate $6.9 billion of new mortgages in the quarter and renew $2.3 billion despite much lower activity levels in most Canadian real estate markets and strong competition pursing fewer opportunities. For shareholders, solid performance brought with it the opportunity to increase our dividend for the 15th time since our initial public offering in 2006. By growing MUA and adding to our portfolio of mortgages pledged under securitization, we are creating a platform for future earnings through mortgage administration, net securitization margin and renewal opportunities. Going forward, we will remain locked in on our fundamentals including enhancement of business processes and efficiencies to ensure First National performs for all stakeholders."

Third Quarter Review

Quarter Ended | Nine months ended | |||

September 30, | September 30, 2021 | September 30, | September 30, 2021 | |

For the Period | ($000s) | |||

Revenue | 392,413 | 353,704 | 1,159,508 | 1,055,313 |

Income before income taxes | 54,645 | 65,134 | 210,813 | 206,710 |

Pre-FMV Income (1) | 48,219 | 64,867 | 149,270 | 200,231 |

At Period End | ||||

Total assets | 42,392,225 | 40,763,169 | 42,392,225 | 40,763,169 |

Mortgages under administration | 129,321,654 | 122,311,392 | 129,321,654 | 122,311,392 |

1 This non-IFRS measure adjusts income before income taxes by eliminating the impact of changes in fair value by adding back losses on the valuation of financial instruments. See "Reconciliation of Quarterly Determination of Pre-FMV Income." |

First National's MUA, the source of most of its earnings, increased 6% to $129.3 billion at September 30, 2022 from $122.3 billion a year earlier and at an annualized rate of 6% since June 30, 2022. At September 30, 2022, single-family MUA was $87.6 billion, up 3% from $84.7 billion at September 30, 2021, while commercial MUA was $41.7 billion, up 11% from $37.6 billion a year ago.

New single-family mortgage origination in the quarter was $4.7 billion compared to $6.1 billion in 2021, a decrease of 23%. Volumes reflected reduced housing market activity brought on by rising interest rates and strong competition for fewer origination opportunities. Even so, new single- family originations were above the level generated immediately prior to the pandemic. (First National's Q3 2019 single family originations were $4.2 billion.) Single-family renewals were $1.9 billion compared to $1.7 billion a year ago, a 12% increase reflecting available renewal opportunities and normalization of prepayment speeds that had been elevated in 2021. First National's MERLIN technology and operating systems continued to support efficient and effective mortgage underwriting across the country.

New commercial segment originations were $2.2 billion compared to $2.3 billion a year ago, a 4% decrease, as strong demand for insured multi-unit property mortgages was offset by lower volumes of conventional mortgages. Even so, new commercial originations were well above the level generated immediately prior to the pandemic. (First National's Q3 2019 commercial mortgage originations were $1.4 billion.) Commercial mortgage renewals of $362 million decreased 40% from $604 million a year ago. In 2021, there were $330 million short-term renewals (less than six months) as commercial borrowers waited to make a longer-term decision.

Of the Company's $9.1 billion of new originations and renewals in third quarter of 2022, $5.5 billion was placed with institutional investors (Q3 2021 - $7.7 billion) and $3.4 billion was originated for First National's own securitization programs (Q3 2021 - $2.6 billion).

Revenue increased 11% to $392.4 million from $353.7 million a year ago. This growth reflected a rapidly rising interest rate environment with bond yields and mortgage rates increasing as monetary policy tightened to counteract inflation. These changes had a wide-ranging impact and led to higher interest earned on securitized mortgages, higher interest revenue earned on mortgages accumulated for securitization and higher interest earned on mortgage investments. These revenue increases were partially offset by the impact of lower residential origination volumes on placement fees as noted in the summary below.

Third quarter revenue performance included:

- $58.5 million of placement fees, 31% or $26.5 million lower than a year ago due to lower single-family origination which affected the volume of mortgages that the Company placed with its institutional investors

- $55.4 million of mortgage servicing income, 8% or $4.0 million higher than a year ago primarily due to growing interest earned on funds held in escrow as a result of higher overnight interest rates and to lesser extent, growth in administration revenue

- $43.2 million of net interest revenue – securitized mortgages, 8% or $3.1 million higher than a year ago on 2% portfolio growth, despite temporary compression between the Company's prime lending rate and its short term, CDOR-based funding costs

- $30.0 million of mortgage investment income, 87% or $14.0 million higher than a year ago due primarily to the higher interest rate environment which resulted in more interest income earned on both the mortgage loan investment portfolio and mortgages accumulated for securitization

- $4.6 million of gains on deferred placement fees, 31% or $1.1 million higher than a year ago reflecting a 50% increase in multi-unit residential mortgages originated and sold to institutional investors

Income before income taxes decreased 16% to $54.6 million from $65.1 million a year ago. These figures were affected marginally by the impact of changing capital market conditions between the comparative quarters. Earnings before income taxes and gains and losses on financial instruments ("Pre-FMV Income1") which excludes the impact of these changes, decreased 26% to $48.2 million from $64.9 million in the third quarter of 2021. This change was the result of several factors: a 23% reduction in new residential origination due to reduced housing transactions with the significant increase in mortgage rates, the Company's response to competitive pressures to temporarily increase broker incentives, tight interest rate spreads for Prime-based securitized floating rate mortgages, and headcount in relation to current origination levels.

Net income was $40.1 million ($0.66 per share) in the third quarter of 2022 compared to $47.6 million ($0.78 per share) a year ago.

Dividends

Total common share dividends paid or declared in the third quarter amounted to $35.2 million, unchanged from a year ago. The common share payout ratio in the third quarter was 89%. If gains and losses on financial instruments are excluded, the dividend payout ratio would have been 101% compared to 75% in the third quarter a year ago.

First National paid $0.8 million of dividends on its preferred shares in the third quarter compared to $0.7 million in the same period a year ago. As announced on June 15, 2022, the dividend rate for the Class A Series 2 Preference Shares for the period July 1 to September 30, 2022, was set at 3.547%, as determined in accordance with the terms of the Series 2 Preference Shares (up from 2.685% in the immediately preceding quarter).

For the purposes of the Income Tax Act (Canada) and any similar provincial legislation, First National advises that its dividends are eligible dividends, unless otherwise indicated.

Outstanding Securities

At September 30, 2022 and October 25, 2022 there were 59,967,429 common shares; 2,984,835 Class A preference shares, Series 1; 1,015,165 Class A preference shares, Series 2; 200,000 November 2024 senior unsecured notes; and 200,000 November 2025 senior unsecured notes outstanding.

Outlook

The third quarter saw the continuation of trends established at the beginning of 2022: a competitive marketplace and reduced origination activity. The quarter also featured more increases in Bank of Canada's ("BoC") overnight rate as it addressed risks associated with inflation. Between July 1, 2022 and September 30, 2022, the overnight rate increased by another 100 basis points. Equally important as the increases were the BoC's statements indicating the likelihood of more interest rate hikes to come. These increases contributed to significantly higher mortgage rates and reduced the affordability of housing across the country. Despite this uncertain business environment, the Company successfully grew MUA and continued to build its portfolio of mortgages pledged under securitization. First National will benefit from this growth in the future: earning income from mortgage administration, net securitization margin and increased renewal opportunities.

In the short term, the expectation for the remainder of 2022 is lower origination as higher mortgage rates further reduce housing affordability and dampen activity across the country. Management recognizes that home purchasing activity through the second half of 2020 and all of 2021 was unsustainable and that while drivers such as higher immigration might support the market, a continued moderation in housing activity is possible. Although, management is confident that First National will remain competitive and a leader in the marketplace, it estimates that year-over-year origination will moderate in line with housing activity across Canada. Management anticipates commercial origination will also slow as the market digests changing property valuations given the new underlying financial environment. At this time, the Company foresees a solid fourth quarter for commercial originations but weaker commitments going into 2023.

During the pandemic, the value of First National's business model has been demonstrated. By designing systems that do not rely on face-to-face interactions, the Company's business practices have resonated with mortgage brokers and borrowers alike. The economic effects of COVID-19 are expected to slowly diminish although the duration and impact of the pandemic is unknown at this time, as is the long-term efficacy of the government and central bank interventions. It is still not possible to reliably estimate the length and severity of these developments and the impact on the financial results and condition of the Company and its operating subsidiaries in future periods.

First National is well prepared to execute its business plan. The Company expects to enjoy the value of its continued goodwill with broker partners earned over the last 30+ years and reinforced during the pandemic. With diverse relationships over an array of institutional investors and solid securitization markets, the Company has access to consistent and reliable sources of funding.

The Company is confident that its strong relationships with mortgage brokers and diverse funding sources will continue to set First National apart from its competition. The Company will continue to generate income and cash flow from its $36 billion portfolio of mortgages pledged under securitization and $90 billion servicing portfolio and focus on the value inherent in its significant single-family renewal book.

Conference Call and Webcast

October 26, 2022 10:00 am ET | (888) 390-0605 or (416) 764-8609 www.firstnational.ca |

A taped rebroadcast of the conference call will be available until November 2, 2022 at midnight ET. To access the rebroadcast, please dial (416) 764-8677 or (888) 390-0541 and enter passcode 618771 followed by the number sign. The webcast is also archived at www.firstnational.ca for three months.

Complete consolidated financial statements for the Company as well as management's discussion and analysis are available at www.sedar.com and at www.firstnational.ca.

About First National Financial Corporation

First National Financial Corporation (TSX:FN, TSX:FN.PR.A, TSX:FN.PR.B) is the parent company of First National Financial LP, a Canadian-based originator, underwriter and servicer of predominantly prime residential (single-family and multi-unit) and commercial mortgages. With over $129 billion in mortgages under administration, First National is one of Canada's largest non-bank mortgage originators and underwriters and is among the top three in market share in the mortgage broker distribution channel. For more information, please visit www.firstnational.ca.

Forward-Looking Information

Certain information included in this news release may constitute forward-looking information within the meaning of securities laws. In some cases, forward-looking information can be identified by the use of terms such as "may", "will, "should", "expect", "plan", "anticipate", "believe", "intend", "estimate", "predict", "potential", "continue" or other similar expressions concerning matters that are not historical facts. Forward-looking information may relate to management's future outlook and anticipated events or results, and may include statements or information regarding the future financial position, business strategy and strategic goals, product development activities, projected costs and capital expenditures, financial results, risk management strategies, hedging activities, geographic expansion, licensing plans, taxes and other plans and objectives of or involving the Company. Particularly, information regarding growth objectives, any future increase in mortgages under administration, future use of securitization vehicles, industry trends and future revenues is forward-looking information. Forward-looking information is based on certain factors and assumptions regarding, among other things, interest rate changes and responses to such changes, the demand for institutionally placed and securitized mortgages, the status of the applicable regulatory regime and the use of mortgage brokers for single family residential mortgages. This forward-looking information should not be read as providing guarantees of future performance or results, and will not necessarily be an accurate indication of whether or not, or the times by which, those results will be achieved. While management considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Forward looking-information is subject to certain factors, including risks and uncertainties listed under ''Risks and Uncertainties Affecting the Business'' in the MD&A, that could cause actual results to differ materially from what management currently expects. These factors include reliance on sources of funding, concentration of institutional investors, reliance on relationships with independent mortgage brokers and changes in the interest rate environment. This forward-looking information is as of the date of this release, and is subject to change after such date. However, management and First National disclaim any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

1 Non-GAAP Measures

The Company uses IFRS as its accounting framework. IFRS are generally accepted accounting principles (GAAP) for Canadian publicly accountable enterprises for years beginning on or after January 1, 2011. The Company also refers to certain measures to assist in assessing financial performance. These "non-GAAP measures" such as "Pre-FMV EBITDA" and "After tax Pre-FMV Dividend Payout Ratio" should not be construed as alternatives to net income or loss or other comparable measures determined in accordance with GAAP as an indicator of performance or as a measure of liquidity and cash flow. Non-GAAP measures do not have standard meanings prescribed by GAAP and therefore may not be comparable to similar measures presented by other issuers.

Reconciliation of Quarterly Determination of Pre-FMV Income1

($000s) | Income before | Add/ deduct | Deduct (losses), add gains | Pre-FMV Income |

2022 | ||||

Third quarter | $54,645 | ($5,846) | ($580) | $48,219 |

Second quarter | $83,081 | ($27,217) | $— | $55,864 |

First quarter | $73,087 | ($27,900) | $— | $45,187 |

2021 | ||||

Fourth quarter | $57,111 | $71 | ($137) | $57,045 |

Third quarter | $65,134 | $383 | ($650) | $64,867 |

Second quarter | $70,101 | $1,217 | ($100) | $71,218 |

First quarter | $71,475 | ($7,486) | $157 | $64,146 |

1 This non-IFRS measure adjusts income before income taxes by eliminating the impact of changes in fair value by adding back losses on the valuation of financial instruments (except those on mortgage investments) and deducting gains on the valuation of financial instruments. See Key Performance Indicators section of the Company's MD&A. |

SOURCE First National Financial Corporation

Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Uncategorized

‘Bougie Broke’ – The Financial Reality Behind The Facade

‘Bougie Broke’ – The Financial Reality Behind The Facade

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

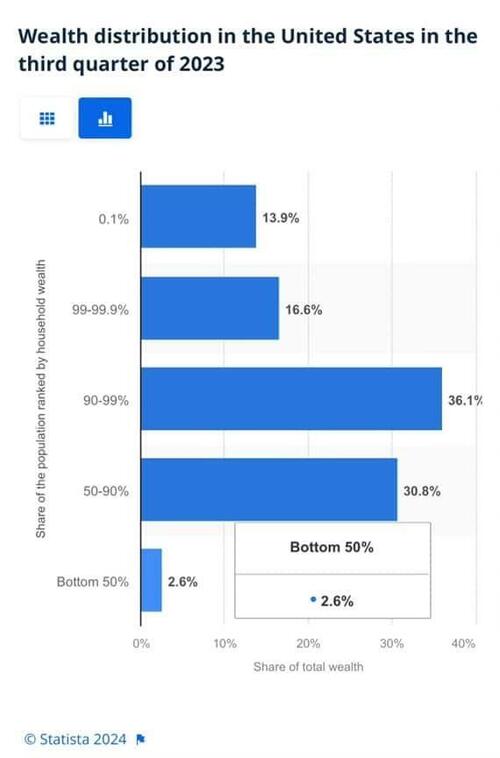

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

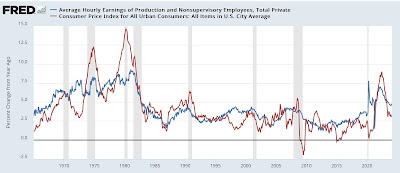

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

Uncategorized

The most potent labor market indicator of all is still strongly positive

– by New Deal democratOn Monday I examined some series from last Friday’s Household survey in the jobs report, highlighting that they more frequently…

- by New Deal democrat

On Monday I examined some series from last Friday’s Household survey in the jobs report, highlighting that they more frequently than not indicated a recession was near or underway. But I concluded by noting that this survey has historically been noisy, and I thought it would be resolved away this time. Specifically, there was strong contrary data from the Establishment survey, backed up by yesterday’s inflation report, to the contrary. Today I’ll examine that, looking at two other series.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges