International

Disinflation Narrative Dies As Manufacturing PMIs Show Prices Soaring Most In 20 Months

Disinflation Narrative Dies As Manufacturing PMIs Show Prices Soaring Most In 20 Months

Update (1115ET): Treasury yields are exploding higher…

Update (1115ET): Treasury yields are exploding higher and rate-cuts odds tumbling after the resurgent 'price' data in today's PMIs.

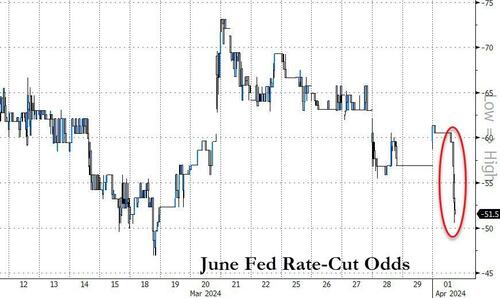

The odds of a June rate-cut has dropped to just 50% (from 75% last week)...

Source: Bloomberg

And amid the illiqidity of European market holidays, UST yields are exploding higher...

Source: Bloomberg

This is also putting pressure on stocks (for a change)...

As we detailed earlier, 'Hard' data has been soaring since the start of the year - as 'soft' data collapses - so all eyes are on this morning's Manufacturing PMIs (surveys) for an end to that trend.

Source: Bloomberg

But, of course, there is normally something for everyone in this data as last month saw ISM's data tumble while S&P Global's soared. Both were expected to improve marginally in March final data today.

ISM's Manufacturing PMI surprised to the upside, rising from 47.8 to 50.3, better than the 48.4 expected (breaking a 15-month streak below 50).

But, S&P Global's US Manufacturing PMI disappointed, falling from its 'flash' print of 52.5 to 51.9 - also down from the final print of 52.2 in February.

Source: Bloomberg

However, a common theme from both surveys was that of soaring prices!!

S&P Global noted that higher oil and raw material costs, plus increased transportation rates, reportedly added to cost burdens at the end of the first quarter... and the impact of rising labor costs was mentioned as a factor pushing up selling prices at a number of manufacturers.

Employment remains in contraction for the sixth straight month and Prices Paid surged to its highest since July 2022...

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“The final reading of the S&P Global Manufacturing PMI signaled a further encouraging improvement in business conditions in March, adding to signs that the US economy looks to have expanded at a solid pace again in the first quarter.

“A key development in recent months has been the broadening-out of the upturn from services to manufacturing, with reviving demand for goods driving the fastest increase in factory production since May 2022. Jobs growth has also picked up as firms boost capacity to meet demand. Rising capex spending has likewise buoyed orders for machinery and equipment, in a further sign of firms gaining confidence in the outlook.

But the 'improvement' comes at a cost:

“The upturn is, however, being accompanied by some strengthening of pricing power. Average selling prices charged by producers rose at the fastest rate for 11 months in March as factories passed higher costs on to customers, with the rate of inflation running well above the average recorded prior to the pandemic.

Most notable was an especially steep rise in prices charged for consumer goods, which rose at a pace not seen for 16 months, underscoring the likely bumpy path in bringing inflation down to the Fed's 2% target.”

So slower growth and much faster inflation - that does not sound like a recipe for rate-cuts... in fact quite the opposite.

Government

Key Events This Week: Payrolls, Powell, ISM And Fed Speakers Galore

Key Events This Week: Payrolls, Powell, ISM And Fed Speakers Galore

With the first quarter officially in the books, and just days until we…

With the first quarter officially in the books, and just days until we start getting Q1 earnings (it sure does feel like we now live in one extra long earnings season), we have quite a few events this busy week starting with today's March manufacturing ISM print - which as noted earlier printed at 50.3, up from 47.8, above the 48.3 consensus and the first print above the 50 threshold reading since September 2022 (sparking a selloff in Treasuries and pushing the USD lower). Beyond today we get lots of Fed Speak (at least 8 speakers on deck including Jerome Powell), Friday's Payrolls, Euro Zone CPI and OPEC+ EURA.

The flood of scheduled Fed speakers will likely set the tone for the new quarter and month, including appearances from Chair Jerome Powell (who also spoke on Friday reiterating his previous non-committal comments) and the incoming St. Louis Fed President Alberto Musalem. The US jobs report due on Friday needs no introduction while the ISM surveys are also worth watching for an update on the health of the US economy.

The March jobs report (Apr 5) will be the main focus in the coming week. Consensus expects nonfarm payrolls to increase by 200k (vs. 275k in February). One of the reasons BofA is calling for a slowdown in job growth is that payrolls in the month of March have shown a tendency to be weak relative to February in recent years. For a similar reason, the bank is expecting private payrolls to slow from +223k in February to a below-consensus +150k in March. Average hourly earnings (AHE), meanwhile, are likely to rise by 0.3% m/m or 4.1% y/y. The quits rate and posted wage growth from Indeed point to a moderation in y/y rates for AHE. Average weekly hours should increase by a tenth to 34.4.

On the household (HH) survey side, BofA expects the unemployment rate (u-rate) to remain at 3.9%. But the HH employment data have been much weaker than NFP in recent months. This means we could see some payback – e.g. stronger HH employment growth than NFP and a lower u-rate. But if the divergence continues, there is risk of a higher u-rate. Also, expect the labor force participation rate to recover by a tenth to 62.6%. This is because BofA expects a rebound in the 16-24 years category, which declined by 0.4ppt in February

In Europe, consumer price data from the euro area should help shape interest-rate cut expectations with traders close to fully pricing in a 25 basis point European Central Bank reduction in June. Swiss inflation will also garner some interest after the surprise rate cut by the Swiss National Bank last week.

The OPEC+ joint ministerial monitoring committee will meet on Wednesday although delegates see no need to recommend any changes to oil supply policy.

Here is a day by day analysis of key global events, courtesy of Bloomberg:

Monday, April 1

- China Caixin manufacturing PMI

- US ISM manufacturing and construction spending

- Fed’s Cook speaks

Tuesday, April 2

- RBA minutes

- German CPI

- ECB consumer expectations survey

- US factory orders and JOLTS

- Fed’s Bowman, Williams, Mester and Daly

- Chile central bank rate decision

Wednesday, April 3

- China Caixin service PMI

- Euro zone CPI and unemployment rate

- US ADP employment change and ISM services

- Fed’s Powell, Bowman, Barr, Goolsbee and Kugler

- OPEC+ JMMC meeting

Thursday, April 4

- Swiss CPI

- Euro zone PPI

- ECB minutes

- BOE decision maker panel survey

- US initial jobless claims and trade balance

- Fed’s Harker, Goolsbee, Barkin, Mester and Musalem

Friday, April 5

- German factory orders

- Euro zone retail sales

- US nonfarm payrolls, unemployment rate and average hourly earnings

- Canada employment change and unemployment rate

- Fed’s Bowman, Logan, Barkin and Kugler

* * *

Focusing just on the US, Goldman writes that the key economic data releases this week are the ISM manufacturing report on Monday, the JOLTS job openings report on Tuesday, the ISM services report on Wednesday, and the employment situation report on Friday. There are many speaking engagements from Fed officials this week, including a speech by Chair Powell on Wednesday.

Monday, April 1

- 09:45 AM S&P Global US manufacturing PMI, March final (Bloomberg consensus 52.5, last 52.5)

- 10:00 AM Construction spending, February (GS +1.1%, consensus +0.7%, last -0.2%)

- 10:00 AM ISM manufacturing index, March (GS 49.1, consensus 48.4, last 47.8): We estimate the ISM manufacturing index rebounded 1.3pt to 49.1 in March, reflecting the rebound in global manufacturing activity.

- 06:50 PM Fed Governor Cook speaks: Fed Governor Lisa Cook will give acceptance remarks at the Lifetime Achievement Awards Ceremony held by the Cook Center at Duke University in Washington, DC. Speech text will be made available. On March 25th, Cook said that “the risks to achieving our employment and inflation goals are moving into better balance. Nonetheless, fully restoring price stability may take a cautious approach to easing monetary policy over time.”

Tuesday, April 2

- 10:00 AM JOLTS job openings, February (GS 8,650k, consensus 8,775k, last 8,863k): We estimate that JOLTS job openings fell by 0.2mn to 8.65mn in February, reflecting the pullback in online job postings.

- 10:00 AM Factory orders, February (GS +0.7%, consensus +1.0%, last -3.6%); Durable goods orders, February final (consensus +1.4%, last +1.4%); Durable goods orders ex-transportation, February final (last +0.5%); Core capital goods orders, February final (last +0.7%); Core capital goods shipments, February final (last -0.4%)

- 10:10 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will speak on “Bank Mergers and Acquisitions, and De Novo Bank Formation: Implications for the Future of the Banking System” at a virtual event. Speech text will be made available. On February 27th, Bowman noted that, “should the incoming data continue to indicate that inflation is moving sustainably toward our 2 percent goal, it will eventually become appropriate to gradually lower our policy rate to prevent monetary policy from becoming overly restrictive. In my view, we are not yet at that point.”

- 12:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will moderate a discussion at the Economic Club of New York with Jeremy Siegel, professor of Finance at the Wharton School of the University of Pennsylvania. On February 28th, Williams said that “something like three [fed funds] rate cuts is a reasonable starting point” for 2024. President Williams also noted that “the risks to my forecast are two sided. Inflation may surprise to the upside, or consumer strength may fade more quickly than I anticipate.”

- 12:05 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will give remarks on the economic outlook at the Cleveland Association for Business Economics and Team NEO Luncheon. A moderated Q&A is expected. On February 29th, Mester said that three rate cuts “feel about right to me if the economy evolves as I anticipate it will.”

- 01:30 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will participate in a Southern Nevada fireside chat, followed by a moderated Q&A. On February 29th, Daly said that “It would be appropriate as inflation comes down to bring the nominal rate of interest down to make sure we’re not holding on even tighter. We want to avoid holding on all the way to 2%, putting policy very tight and then cause an unnecessary downturn.”

- 05:00 PM Lightweight motor vehicle sales, March (GS 16.1mn, consensus 15.9mn, last 15.8mn)

Wednesday, April 3

- 08:15 AM ADP employment change, March (GS +120k, consensus +150k, last +140k): We estimate a 120k rise in ADP payroll employment in March, reflecting a solid underlying pace of job growth but a drag from residual seasonality: the ADP measure has slowed in March in each of the last three years and four of the last six.

- 09:45 AM S&P Global US services PMI, March final (consensus 51.7, last 51.7)

- 09:45 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will speak on Bank Liquidity, Regulation and the Fed’s Role as the Lender of Last Resort in Washington, DC. Speech text will be made available.

- 10:00 AM ISM services index, March (GS 53.6, consensus 52.8, last 52.6): We estimate that the ISM services index rose 1.0pt to 53.6 in March, reflecting solid growth and favorable seasonality. Our non-manufacturing survey tracker edged up 0.1pt to 52.1.

- 12:00 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will give opening remarks at the virtual event “Preventing Elder Financial Exploitation: Research, Policies and Strategies.” On March 25th, Goolsbee said that he expected three rate cuts this year and noted that “we are in this murky period where we have to strike a balance of the dual mandate.”

- 12:10 PM Fed Chair Powell speaks: Fed Chair Jerome Powell will give a speech on the economic outlook at the Stanford Business, Government, and Society Forum. Speech text and Q&A are expected. On March 29th, Powell said that that February PCE inflation data “were pretty much in-line with our expectations” and the committee is looking to see “more good inflation readings like the ones we were getting last year” to feel “confident that inflation is moving down to 2% on a sustained basis.” Powell also noted that he doesn’t think interest rates will go back down to the very low levels they were before the pandemic, but exactly where they will settle is “hard to say.”

- 01:10 PM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will speak about the Community Reinvestment Act in Washington, DC. A moderated Q&A is expected. On February 14th, Barr said that “my FOMC colleagues and I are confident we are on a path to 2% inflation, but we need to see continued good data before we can begin the process of reducing the federal funds rate.”

- 04:30 PM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will speak on the "Outlook for the US Economy and Monetary Policy" in St. Louis. Speech text and Q&A are expected. On March 1st, Kugler said “I am cautiously optimistic that we will see continued progress on disinflation without significant deterioration of the labor market.”

Thursday, April 4

- 08:30 AM Trade balance, February (GS -$68.3bn, consensus -$67.0bn, last -$67.4bn)

- 08:30 AM Initial jobless claims, week ended March 30 (GS 205k, consensus 215k, last 210k): Continuing jobless claims, week ended March 23 (consensus 1,810k, last 1,819k)

- 10:00 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will participate in a fireside chat about second chance employment. A Q&A is expected. On February 22nd, Harker said “I believe we may be in the position to see the rate decrease this year. But I would caution anyone from looking for it right now and right away. We have time to get this right, as we must.”

- 12:15 PM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will deliver a speech on his economic outlook to the Home Building Association of Richmond. Speech text and Q&A are expected. On March 1st, Barkin said “I'm still hopeful inflation is going to come down and if inflation normalizes then it makes the case for why you want to normalize rates, but to me it starts with inflation.”

- 12:45 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will participate in a moderated Q&A at the Multi-Chamber Economic Outlook Luncheon and Expo.

- 02:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will speak on the economic outlook in a virtual event. A Q&A is expected.

- 07:20 PM St. Louis Fed President Musalem (FOMC non-voter) speaks: St. Louis Fed President Alberto Musalem will give introductory remarks at the 2024 Women in Economics Symposium. This is Musalem’s first public appearance since he was named the president of the Federal Reserve Bank of St. Louis on January 4th 2024.

- 07:30 PM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will speak on enriching data and analysis with real life experiences. Speech text will be made available.

Friday, April 5

- 08:30 AM Nonfarm payroll employment, March (GS +215k, consensus +200k, last +275k); Private payroll employment, March (GS +175k, consensus +165k, last +223k); Average hourly earnings (mom), March (GS +0.25%, consensus +0.3%, last +0.1%); Average hourly earnings (yoy), March (GS +4.04%, consensus +4.1%, last +4.3%); Unemployment rate, March (GS 3.8%, consensus 3.8%, last 3.9%); Labor force participation rate, March (GS 62.5%, consensus 62.5%, last 62.5%): We estimate nonfarm payrolls rose by 215k in March (mom sa), reflecting a continued boost from above-normal immigration as new entrants to the labor force are matched to open positions. Big Data measures also generally indicate a solid or strong pace of job gains, and our layoff tracker indicates that the pace of layoffs remains low. We nonetheless assume a slowdown from the February payroll gain of +275k because we believe a favorable swing in the weather boosted that report by as much as 75k. We estimate that the unemployment rate fell one tenth to 3.8%. Foreign-born unemployment increased by nearly 250k over the last three months, and we assume many of the new entrants found jobs during the March payroll month. We assume a flat-to-up labor force participation rate of 62.5%. We estimate average hourly earnings rose 0.25% (mom sa), which would lower the year-on-year rate by three tenths to 4.0%, reflecting waning wage pressures but a roughly 5bp boost from calendar effects (mom sa).

- 09:15 AM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will deliver a speech on economic outlook. Speech text and Q&A are expected.

- 11:00 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will speak at an event hosted by the Duke University Economics Department. Speech text and audience Q&A are expected. On March 1st, Logan said “slower [balance sheet] runoff is a way to approach the ample point more gradually, allowing banks to redistribute funds and the FOMC to carefully judge when we have gone far enough. This strategy will mitigate the risk of undesired liquidity stresses from QT.”

- 12:15 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will speak on the "Risks and Uncertainty in Monetary Policy: Current & Past Considerations" at the Shadow Open Market Committee spring meeting in New York. Speech text and Q&A are expected.

Source: BBG, Goldman

International

Fight Like a Mother: When an ICD-10 Code Determines Life or Death

By Frieda Wiley Treating chronic illnesses usually saves lives. However, when that condition lacks a billing code, seeking treatment can become a death…

By Frieda Wiley

Treating chronic illnesses usually saves lives. However, when that condition lacks a billing code, seeking treatment can become a death sentence. At least that’s what doctors told Amber Freed, a 43-year-old mother of two who learned that something seemingly as trivial as a billing code could become a life-or-death situation.

It all began shortly after Freed gave birth to fraternal twins Maxwell and Riley in March 2017. The newly found joys of motherhood quickly transformed into fear after she observed marked differences between her two children’s developmental progression.

“I noticed Riley was advancing faster than Maxwell,” she said, “[Maxwell] had strange movements, his eyes were open, and he didn’t know his name,” she recalls.

He also felt different in her arms. “He felt floppy to me compared to Riley.”

Freed could easily fill Riley’s baby book with fun memories and important milestones. Meanwhile, Maxwell’s book lacked a similar narrative and remained largely empty.

Maternal instincts trump a doctor’s experience

Worried, the new mother took her son to his pediatrician, who immediately dismissed her concerns. He assured her Maxwell was progressing normally, telling her that girls develop faster than boys. Still, Freed could not shake the feeling that something was wrong. Her gnawing gut instinct prompted her to schedule an appointment at the Children’s Hospital in Denver, Colorado, where the family lived. There, Maxwell saw a variety of specialists, including an ophthalmologist who gave Freed some startling news after conducting an eye exam on Maxwell.

“His eyes are fine, but I think you should be prepared for him not to live,” he told her.

Completely floored, Freed asked the doctor what he had seen in the exam.

“I saw nothing,” the doctor reiterated. “However, I see parents like you all day long searching for answers and thinking something’s wrong with their kids’ eyes when it’s really their brain.”

Her greatest fears now confirmed, Freed struggled to maintain her composure as she prepared to take her son in for additional testing.

The ophthalmologist’s feedback eventually led to a diagnosis she could never have fathomed. Maxwell had an SLC6A1 mutation that causes epilepsy—a condition so rare it had no name, let alone a cure. Lacking a moniker also meant limited funding for research or other supportive services.

In addition to many of these conditions being incurable or lacking sufficient treatments, patients and their families often struggle to pay for treatments at times because no International Classification of Diseases (ICD) codes have been developed for the conditions they face. The World Health Organization has ownership of the ICD codes, which are designed to track morbidity and mortality data. However, the U.S. health insurance industry has commercialized the codes by using them for billing and payment.

As Freed would soon learn, securing medical treatment for the kind of rare disease Maxwell had would prove quite challenging in the U.S. Rare conditions such as Tay-Sachs disease, hereditary hemochromatosis, Wilson’s disease, and cystic fibrosis are all rare conditions with ICD codes recognized by insurance companies for coverage. Yet, these conditions may be more of the exception than the rule. In the U.S., many other diseases the lack billing codes that insurance companies would use to provide financial coverage and reimbursement. The void amplifies a climate where the privatized and commercialized insurance system fragments healthcare coverage as much as the lack of universally available medical records fractures continuity of care.

“If we were living in Europe, Maxwell’s treatment would be covered because of the nationalized medical systems they have there,” she said.

In addition to the rarity of her son’s condition decreasing the chances of insurance coverage, Freed made another startling discovery. Many billing codes covered seemingly bizarre and rare injuries. Yet not a single billing code acknowledged her son’s nameless condition in any way. Lacking a billing code meant insurance would neither pay for nor reimburse any treatment.

“It’s funny,” she said. “There’s an International Classification Code (ICD)-10 for being bitten by a goose, but there’s no code to treat my child for his condition.”

According to the ICD-10.CM, the code, known as W61.51XD, “describes the circumstance of the injury,” if a goose attacks a person. Goose-inflicted injury is one of many billing codes one might not expect to see listed. Other bizarre ICD-10 codes include Y93.J1, which covers neck injuries from playing the piano, and V97.21, which applies to a parachutist involved in an accident. Billing code V91.07XD addresses burns caused by water skiing and 16.V97.33XD describes a “subsequent encounter” of getting sucked into a jet engine. Curiously, Y92.146 describes a “swimming-pool of prison as the place of occurrence of the external cause.”

Pediatric Emergency Medicine physician The American Academy of Pediatrics

According to Jeffrey Linzer, Sr., MD, a pediatric emergency medicine physician representing the American Academy of Pediatrics, the origins of the seemingly bizarre billing codes stem from a very unlikely source: the U.S. Congress.

“Congress directed the Department of Defense to create a distinction between codes for the military versus non-military,” he told Inside Precision Medicine. “In fact, they recommended 10,000 codes.”

It’s all about the Benjamins

As incredulous as it sounds, Freed’s challenges are not unique. Many patients and families of people with rare diseases living in the U.S. face the same challenge.

The National Institutes of Health defines a rare disease as a disease affecting less than 200,000 people living in the U.S. However, rare diseases have a substantially greater collective impact, affecting 25–30 million U.S. residents. Despite the sizeable total population affected, the prognosis looks grim for most of these 10,000-plus rare diseases as only 500 of them have any type of treatment.,

In addition, the few treatments available often prove far more expensive than the average cost of treating more common chronic conditions in the U.S. According to the U.S. Government Accountability Office, costs for treating rare diseases in the U.S. approached nearly $966 billion in 2019.

When a rare disease affects a child, parents and other caregivers must often assume the costs while juggling additional responsibilities of advocating for their patients and the disease itself while becoming both caregivers to the child and educators to medical professionals, the federal government, and other stakeholders. The arduous undertaking has a sizeable impact on the rare disease community as children account for 50% of people diagnosed with a rare disease.3 Disturbingly, three out of ten children diagnosed with a rare disease will die before their fifth birthday.

“The doctors told me, ‘You will become the expert’,” recalled Freed.

The growing list of insurmountable obstacles Freed faced became overwhelming. Doctors told Freed that she would likely have to give up her burgeoning career to devote herself full-time not only to her son’s care but to educating herself—and others—on the condition. She eventually resigned from her position as an equity and research analyst at a financial firm.

Freed’s fastidious search for solutions ultimately led to a partnership with a scientist to develop a gene therapy for her son, but the clinical trial was halted during the COVID-19 pandemic. In the interim, her son has been receiving injections of an off-label therapy called glycerol phenylbutyrate (Ravicti®). While not a cure, it makes Maxwell’s signs and symptoms more manageable.

When the Food and Drug Administration first approved the drug for urea cycle disorder on February 1, 2013, its cost ranged between $250,000 and $290,000 annually. However, the price skyrocketed once doctors began prescribing it off-label to treat Maxwell’s condition. As of early 2024, glycerol phenylbutyrate ranks among the top ten most expensive therapies in the U.S., costing nearly $800,000 annually for its on-label indication.

Even the cheaper option doesn’t run cheap

“The effect of glycerol phenylbutyrate on children with SLC6A1 is compelling,” Zachary Grinspan, MD, a pediatric neurologist at Weill Cornell Medicine in New York City, told Inside Precision Medicine. “[However, the manufacturer], Horizon Therapeutics, did not pursue a new clinical indication, and Amgen’s strategy is unclear.”

pediatric neurologist

Weill Cornell Medicine, New York City

Prescriptive authority allows Grinspan to prescribe glycerol phenylbutyrate, but it does not fill the void of the noticeably absent ICD-10 code from Maxwell’s medical charts. Insurance companies are less likely to cover a drug written for an off-label indication—especially for such a high-dollar drug.

In the meantime, Grinspan aims to get the drug listed in one of the U.S. four drug compendia (i.e., American Hospital Formulary Service-Drug Information [AHFS-DI], Micromedex DrugDEX [DrugDEX], National Comprehensive Cancer Network [NCCN] Drugs, and Biologics, Compendium, and Clinical Pharmacology) to help increase awareness of the drug.

Although a beneficial treatment, the positive effects of glycerol phenylbutyrate therapy wear off after about a year. Much like developing gene therapy for her son, Freed will continue facing the obstacle of footing the six-figure cost.

ICD-10: the rate-limiting step to treatment, access, and potential cures

Unlike many other developed countries with universal healthcare systems, the privatization of insurance contributes to soaring medical costs. This in turn often makes access to care and treatments cost-prohibitive. However, the federal government also plays a role in this narrative as they oversee the ICD-10 codes.

The Centers for Disease Control and Prevention (CDC) is responsible for tracking mortality and morbidity information at a national level and using the data to generate information on disease incidence and prevalence. The process is relatively simple for chronic diseases affecting the masses, such as hypertension or diabetes, as these conditions have ICD-10 codes.

The Centers for Medicaid and Medicare Services, commonly known as CMS, develops and maintains what is known as the International Classification of Diseases, 10th, Revision, Procedure Coding System (ICD-10-PCS). The CMS classifies treatment for diseases, impairments, and injuries for patients who are hospitalized. However, the approval of coding changes and other changes to the ICD-10 coding systems is a collaborative process between the CMS and the CDC’s National Centers for Health Statistics through a body known as the ICD-10 Coordination and Maintenance Committee. This interdepartmental committee meets biannually and accepts modification suggestions from both the public and private sectors.

“There are only two opportunities to apply for the code, and your application may not even be reviewed given that there’s no formal process,” Freed said.

Could another rare disease change the game?

Although many rare diseases remain unassigned, the success of another rare disease may offer a blueprint for successful ICD-10 applications in the rare disease community.

According to data published in 2022, assigning Angelman syndrome an ICD-10 code on October 1, 2018, resulted in a significant uptick in adoption and uptake in the three years following its release. Billed under ICD-10 code Q93.51, a wide variety of clinicians, including pediatric neurologists, geneticists, and developmental-behavioral medicine specialists, now use this code. In addition, the top five healthcare organizations using the billing code gained prescribing privileges at major medical institutions in the U.S., including the Children’s Medical Center Dallas, the Cincinnati Children’s Hospital Medical Center- Community, and Massachusetts General Hospital.

The Angelman syndrome ICD-10 code assignment results give Grinspan hope for a potential strategy to overcome the ICD-10 code void for SLC6A1.

“For people with rare epilepsies, improving epidemiological estimates and clinical descriptions will guide clinical diagnosis and management, support research initiatives, spur pharmaceutical and medical device development, and help families understand these devastating diseases,” Grinspan said. “ICD-10 codes for specific rare epilepsies are foundational for that effort.”

Grinspan further elaborated that the statistical data captured by the CDC helps clinicians prioritize testing when working up new patients and conduct more thorough workups. This enhances their ability to comprehensively evaluate the patient. Robust data therefore enhances the physicians’ ability to diagnose a condition and forecast the patient’s prognosis.

In addition to the ICD-10 code, clinical trials, and funding, physicians need education to improve outcomes

Clinical trials could support treatment and provide more long-term data for diseases as ultra-rare as Maxwell’s. However, clinical trials in children with rare diseases often prove more complex as they require considerations transcending those typically seen in trials for adults. Parents and caregivers often face higher demands in managing the child, observing and helping the children report their signs and symptoms, and sometimes acting as key decision-makers when enrolling a child into a clinical trial.

Historically, commercial sponsors have been less likely to support clinical trials involving child participants than those involving adults. This trend further amplifies cost woes, as pediatric trials may require more study sites and accrue additional costs for coordination. In addition, clinical trials for rare diseases are typically underpowered due to difficulties in recruiting an ample number of participants.

Various other factors inflate the cost of pediatric clinical trials. For example, they may require more time to complete study procedures and specialized (and therefore pricier) laboratory equipment that can accommodate smaller-volume biological samples. Off-label prescribing of treatments occurs much more frequently in pediatric patients, shrinking potential incentives that might entice funders to finance drugs that are already approved for the adult population. These are just a few factors unique to the pediatric population contributing to the already hefty price tags associated with clinical trials.

Pediatric population aside, clinical trials are costly regardless of the number of enrollees or disease state. In addition to population-specific idiosyncrasies, the number of sites, the anticipated number of enrollees, and phases play a factor. Lastly, the cost of the type of therapy (i.e., small molecule versus large molecule, gene therapy, etc.) is a significant factor affecting the total cost.

According to Kimberly Goodspeed, MD, assistant professor in the departments of pediatrics, neurology, and psychiatry at UT Southwestern Medical Center in Dallas, small molecule clinical trials like one involving glycerol phenylbutyrate can range from $25 million to $50 million.

Trials investigating gene therapies cost significantly more.

“You can imagine if you could enroll multiple disorders into a blanket protocol for one multi-site clinical trial at $50 million versus doing ten disorders with individual protocols at $50 million per individual protocol, the costs can climb quickly—especially in the case of gene therapy,” said Goodspeed.

Even if clinical trials were not cost-prohibitive, there remains the clinician factor. From a practical standpoint, many physicians already feel overwhelmed by the need to memorize ICD-10 codes. As Linzer stated during on March 9, 2023, during the ICD-10 Coordination & Maintenance Committee Meeting led by CMS, committing countless ICD-10 codes to memory for each rare disease may not be plausible.

“We’re very sympathetic to [the cause], but that’s not the issue,” he told the audience. “Our concern is the number of potential patients and developing unique codes for a tiny group of patients.”

Linzer went on to cite situations where proposals for larger populations were denied, as examples.

“If this proposal was to move forward, we certainly have already expressed our disagreement with the expansion to the sixth character on the ‘under the epilepsy [category]’ … but we do have concerns about unique codes for very small patient populations,” he said. “We understand it’s helpful in the research and clinical areas, but it’s just an issue of how many codes can there be?”

In a separate interview with Inside Precision Medicine, Linzer stated that creating additional codes can create problems in data tracking. Problems arise when the medical community uncovers additional information about a condition that leads to code expansion. Because the original intent of the code is to track morbidity and mortality, the code cannot be deleted.

Now approaching his seventh birthday, Maxwell Freed has already beat the odds that claim nearly one-third of children with a rare disease succumbing to their condition before their fifth birthday. Yet, the battle is far from over, as his mother, and countless other parents, continue advocating for their children in search of Federal support and cures.

“Mothers can pull from a source of energy that doesn’t exist,” Freed said of her ongoing efforts. “You hold your baby and know there’s nothing you wouldn’t give.”

As of press time, Freed’s applications for an ICD-10 assigned to SLC6A1 have remained unsuccessful and she received her most recent rejection in early 2024. Meanwhile, her son’s life—and those of others—hang in the balance.

Her solution? “I’ve learned how to fight like a mother.”

A mother’s enduring love is unmatched, and mothers never give up.

Read more:

- What We Do. The National Institutes of Health website. Accessed on February 25, 2024.

- The Promise of Precision Medicine: Rare Diseases. The National Institutes of Health website. Accessed on February 28, 2024

- Numbers: Rare Disease Facts. The Global Genes website. Accessed on February 28, 2024.

- Rare Disease: Although Limited, available Evidence Suggests Medical and Other Costs Can Be Substantial. The U.S. Government Accountability Office website. Accessed on February 28, 2024.

- Guha, M. Urea cycle disorder drug approved. Nat Biotechnol 31, 274 (2013).

- “The 10 Most Expensive Drugs on the Market.” The Talk to Mira website. Accessed on February 28, 2024.

- ICD-10 Coordination and Maintenance Committee. The Centers for Disease Control and Prevention website. Last reviewed October 17, 2022. Accessed on February 24, 2024.

- Kamada’s Prism Healthcare Map. Prism 2022.

- Kern SE. Challenges in conducting clinical trials in children: approaches for improving performance. Expert Rev Clin Pharmacol. 2009 Nov 1;2(6):609-617. doi: 10.1586/ecp.09.40. PMID: 20228942; PMCID: PMC2835973.

- Institute of Medicine (US) Committee on Clinical Research Involving Children; Field MJ, Behrman RE, editors. Ethical Conduct of Clinical Research Involving Children. Washington (DC): National Academies Press (US); 2004. 2, The Necessity and Challenges of Clinical Research Involving Children.

Frieda Wiley, PharmD, is an award-winning medical writer, best-selling author, speaker, and pharmacist who has written for O, Oprah Magazine, the National Institutes of Health, American History, Pfizer, Merck, AstraZeneca, and many more notable organizations.

The post Fight Like a Mother: When an ICD-10 Code Determines Life or Death appeared first on Inside Precision Medicine.

cdc disease control congress trump pandemic covid-19 treatment testing clinical trials therapy mortality europe world health organizationInternational

Did The COVID Psyop Fail?

Did The COVID Psyop Fail?

Authored by Todd Hayen via Off-Guardian.org,

As you all know, I have not been one to believe that the tides are…

Authored by Todd Hayen via Off-Guardian.org,

As you all know, I have not been one to believe that the tides are turning. But lots of people think they are. They cite many victories, in court, in the streets, with family and friends.

The fact that the agenda has not sent out a second wave of horror and fear propaganda is also rather telling to these folks. Where is the next pandemic? What happened to Covid’s diabolic never-ending run of mutations, what happened to Monkey Pox? What happened to Disease X?

Yes, all this could still happen, but it seems there have been more false starts—starts that didn’t go anywhere. But if so, you would think they wouldn’t have put them out there just to not have them continue. It’s been rather weird, like an electrical storm you see on the horizon with its threatening lightning strikes, but it never gets close enough to warrant closing the cellar door.

How about CBDCs? And the Digital IDs? You hear a lot about these, but nothing that is concretely happening to implement them. Is it happening in other places? Australia? Germany? The UK? Of course, a lot is said about it, on YouTube, and in alt media. Lots of talking heads, but how imminent is it? Actually, I won’t dwell on this, I have no doubt all of this is coming, but has the dragon been wounded? Even a little bit? Has this march into oblivion been slowed down?

Maybe there is no wounding of the general juggernaut of world rule by the schmucks who are claiming power. Although even that sacrosanct organization may have suffered from shell damage. Wasn’t DAVOS not all that they expected this past year? Hasn’t there been some pretty obvious whiplash from some leaders in their little club? How about the UN and the “sustainable development” circus? How is that going?

Anyway, I digress. Although the health of the world agenda, including all of these projects I mention, are all part of it, Covid, and pandemics in general, are the specific topics of this article.

I don’t buy any of this talk of victory for a New York minute. This is like cancer, you can’t claim victory until it is ALL gone, every last scrap of it. Remissions are nice, but if you’ve still got cancer in your body somewhere, it is only a time-out. I feel that this is similar. Even if one cell survived, it would start multiplying again and wouldn’t stop until it was big and gnarly and spitting out all the garbage this monster has been known to spit out. So, I don’t buy it…but…

Is it possible that at least one battle was won? Maybe, but just because they have pulled the troops back doesn’t mean they didn’t still take the city and got essentially what they stormed in for. I may still say that is a possibility. I mean, what did they want as a consequence of their Covid campaign? Did they want 100% compliance, with billions of sheep bowing down to them? Did they want everyone locked up in their own little cage, ala 1984, each of us in a squalid apartment with just a giant TV in the middle of it so Big Brother could blab at us all day long? If that is true, then indeed the psyop failed, because they didn’t get that—at least not yet.

But what if they got this: a toxic injection placed in billions of people worldwide that will kill untold millions over the course of about 20 years? Not only that, but the injection will render another untold millions sterile. Do the math here: how many people would need to be sterilized over 20 years to reduce the population worldwide by 1 billion? 2 billion? What other havoc could such a death jab wreak? What untold horrors are yet to overcome us? Your guess is as good as mine. Think zombies here, think soulless ghouls, think humans with no empathy, think lost humanity.

And that’s just the physical consequences. What about the psychological success they have had with the Covid campaign? Sure, many participants have shot them the bird regarding more boosters, and have ignored more threats of losing jobs over vaccine resistance. Sure, the courts have ruled in Canada that the illustrious leader here performed a no-no with his reckless enactment of the Emergency Act, and as a result, lawsuits are flowing into the courts. Does all this mean that no one fell for the psychological operation? That no one was mentally affected by the lockdowns, the masks, the closure of schools, churches, and other institutions? Does it mean that we have all recovered from the trauma of those three years, and mentally and emotionally we are just back to square one—all normal again?

If anyone reading this knows anything about hypnosis, they probably understand what hypnotic suggestion is all about. It is real, folks. What has been altered subliminally in our unconscious minds could be quite formidable. We are being programmed for better performance in future projects the agenda has in store for us. Most of the shrews reading this are safe from this brainwashing (hopefully) because we closed our eyes during the deadly meteor storm perpetrated by the fear-mongering agenda (watch The Day of the Triffids to understand that reference!) But those out there who got caught up in it and drank the delayed-reaction Kool-Aid—are all like sleeper spies from the Cold War, soon to be re-activated at some future date to continue complying with TPTB’s bidding.

Here I go again. I am supposed to be entertaining the possibility that the Covid psyop failed, not suggesting evidence to prove its great success. Sorry. Well, maybe it didn’t go as well as they wanted it to go. It does seem there was a lot more gas in the tank and that they could have pushed it a bit further than they did. They were doing pretty well, but they just fizzled out. Maybe they did expect more people to get vaxxed, maybe that was a disappointment. They sure looked like they were going for the whole enchilada with all their “you’ve GOT to get vaccinated!!” hoopla. Maybe they got too much pushback from us shrews. So many angry shrews showed up pretty quickly. And the shrews that were already on the scene, who were not surprised with all these shenanigans to begin with, just got louder and louder. Sure, not many sheep flipped, but some did. Their booster campaign is floundering (in my opinion, only because they turned the heat down, or off entirely).

So maybe they did get nicked a bit. Maybe a few arrows penetrated the armour, and they backed off a step or two. Maybe we did surprise the bastards with our resolve, tenacity, wit, and refusal to play the game.

But then again, maybe not.

-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

International3 weeks ago

International3 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 weeks ago

International3 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoEvidence And Insights About Gold’s Long-Term Uptrend

-

Uncategorized1 month ago

Uncategorized1 month agoA Global, Digital Coup d’État

-

Spread & Containment1 week ago

Spread & Containment1 week agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoWhen Complex Systems Collide