Uncategorized

Digital PCR (dPCR) and Real-time PCR (qPCR) Market worth $12.4 billion | MarketsandMarkets

Digital PCR (dPCR) and Real-time PCR (qPCR) Market worth $12.4 billion | MarketsandMarkets

PR Newswire

CHICAGO, April 11, 2023

CHICAGO, April 11, 2023 /PRNewswire/ — The dPCR and qPCR industry is expected to experience significant growth in the ne…

Digital PCR (dPCR) and Real-time PCR (qPCR) Market worth $12.4 billion | MarketsandMarkets

PR Newswire

CHICAGO, April 11, 2023

CHICAGO, April 11, 2023 /PRNewswire/ -- The dPCR and qPCR industry is expected to experience significant growth in the near future. This is due to the increasing demand for precise, accurate, and efficient detection of nucleic acids for various applications, such as gene expression analysis, disease diagnosis, and food safety testing. Furthermore, the development of highly sensitive and specific instruments, reagents, and assays for dPCR and qPCR are expected to drive the market growth. Additionally, the introduction of next-generation sequencing (NGS) methods, such as single-cell sequencing, is expected to further fuel the growth of the dPCR and qPCR industry. Moreover, the increasing demand for personalized medicine and rapid diagnostics is expected to create numerous opportunities for the dPCR and qPCR industry.

Digital PCR (dPCR) and Real-time PCR (qPCR) Market in terms of revenue was estimated to be worth $8.5 billion in 2023 and is poised to reach $12.4 billion by 2028, growing at a CAGR of 7.8% from 2023 to 2028 according to a new report by MarketsandMarkets™. The growth of this market is due to factors such as the rising incidence and prevalence of target infectious diseases and genetic disorders, continuous advancements in PCR technologies and growing importance of PCR in biomarker discovery, increasing investments, and funds.

Download an Illustrative overview: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=174151204

Browse in-depth TOC on "Digital PCR (dPCR) and Real-time PCR (qPCR) Market"

502 - Tables

47 - Figures

488 - Pages

Digital PCR (dPCR) and Real-time PCR (qPCR) Market Scope:

Report Coverage | Details |

Market Revenue in 2023 | $8.5 billion |

Estimated Value by 2028 | $12.4 billion |

Growth Rate | Poised to grow at a CAGR of 7.8% |

Market Size Available for | 2021–2028 |

Forecast Period | 2023–2028 |

Forecast Units | Value (USD Billion) |

Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

Segments Covered | Product & Service, Application, End user and Region |

Geographies Covered | North America, Europe, Asia Pacific, Latin America (LATAM) and Middle East and Africa (MEA) |

Report Highlights | Updated financial information / product portfolio of players |

Key Market Opportunities | Growing market penetration in emerging countries offers significant growth opportunities for market players |

Key Market Drivers | Rising incidence and prevalence of target infectious diseases and genetic disorders is likely to upsurge the market growth |

qPCR and dPCR reagents and consumables accounted for the largest share of global dPCR and qPCR market

Based on products & services, the qPCR market is categorized into reagents and consumables, instruments and software & services. The qPCR reagents and consumables segment is expected to command the largest share of the qPCR products & services market in 2023. The dPCR and qPCR products are increasingly used by researchers and healthcare professionals due to the ongoing automation and miniaturization of qPCR/dPCR instruments, the commercialization of advanced software, and the availability of customized laboratory reagents. The increasing adoption of MIQE guidelines across the globe is also driving the use of qPCR/dPCR reagents among researchers. Expanding applications of qPCR (owing to its technological benefits over traditional PCR, such as real-time analysis and reduced analysis time), are expected to drive the growth of the reagents and consumables market.

Clinical application segment accounted for the largest share of qPCR market

Based on application, the qPCR and dPCR market is categorized into clinical applications (Infectious Disease Testing, Oncology Testing, Blood Screening, Transplant Diagnostics and Other Clinical Applications), research applications, environmental applications, forensic applications and other applications. The clinical applications segment is estimated to dominate the Dpcr & qPCR applications market in 2022. The clinical applications segment is estimated to dominate the qPCR applications market during the forecast period. The key factors driving the market growth include the growing usage of qPCR in disease diagnosis, rising incidence of infectious and genetic diseases, and growing public emphasis on early & effective disease diagnosis & treatment.

The clinical applications segment is expected to account for the largest share of the digital PCR (dPCR) market in 2022. The technological benefits offered by dPCR over qPCR & traditional PCR (such as high flexibility, increased device sensitivity, better precision, and absolute quantification of target molecule), the growing adoption of dPCR among hospitals & diagnostic centers, and the increasing global burden of cancer & AIDS are key factors that will drive the market for clinical applications during the study period. The key factors driving the market growth of clinical applications segment include the growing usage of qPCR in disease diagnosis, rising incidence of infectious and genetic diseases, and growing public emphasis on early & effective disease diagnosis & treatment.

The hospitals and diagnostic laboratories is the largest and fastest growing end user segment of the qPCR & dpcr market

On the basis of end user, the dPCR and qPCR market is segmented into Hospitals and Diagnostic Laboratories, Academic and Research Institutes, Pharmaceutical and Biotechnology Companies, CROs and CDMOs, Forensic Laboratories, and Other End Users. In 2022, the hospitals and diagnostic centers segment accounted for the largest share of the real-time PCR (qPCR) market. This can be attributed to the increasing market availability of qPCR reagents for clinical diagnostic applications, the ongoing expansion of healthcare infrastructure across emerging countries, the high prevalence of target diseases, and growing awareness among end users related to the benefits offered by qPCR for clinical diagnosis.

In 2022, the hospitals and diagnostic centers segment accounted for the largest share of the dPCR market. This can be attributed to the growing demand for early and efficient disease diagnosis and treatment, the increasing number of dPCR product launches for diagnostic applications, the benefits offered by dPCR in disease diagnosis (as compared to other PCR technologies), and the growing public awareness related to the benefits offered by dPCR in disease diagnosis.

North America accounted for the largest share of the dPCR and qPCR market

On the basis of region, In 2022, North America accounted for the largest share of the digital PCR (dPCR) and real-time PCR (qPCR) market, followed by Europe. The North American digital PCR (dPCR) and real-time PCR (qPCR) market is driven by the increased adoption of innovative and novel genomic analysis products (including advanced qPCR and dPCR products), availability of R&D funding for genomics research (coupled with the robust research infrastructure in the region), expanding use of PCR techniques in clinical diagnostics and forensics, and the early commercialization of qPCR/dPCR products in North America as compared to other regions.

Inquiry Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=174151204

Digital PCR (dPCR) and Real-time PCR (qPCR) Market Dynamics:

Drivers:

- Rising incidence and prevalence of target infectious diseases and genetic disorders

- Continuous advancements in PCR technologies

- Growing importance of PCR in biomarker discovery

Restraints:

- High device costs associated with dPCR

- Technical limitations of qPCR and dPCR

Opportunities:

- Growing market penetration in emerging countries

Challenges:

- Time-consuming methodology involving sample handling and post-PCR analysis

- Lack of accuracy & standardization in protocols

Key Market Players:

The prominent players operating in the dPCR and qPCR market are Thermo Fisher Scientific (US), Danaher Corporation (US), and F. Hoffmann-La Roche, Ltd. (Switzerland).

Get 10% Free Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=174151204

Recent Developments:

- In October 2022, Roche received FDA clearance for the COVID-19 PCR test for use on cobas 6800/8800 systems. The cobas SARS-CoV-2 Qualitative test is one of the first COVID-19 PCR tests performed on an automated, high-throughput platform to receive FDA 510(k) clearance.

- In August 2022, Roche launched the Digital LightCycler System, Roche's first digital polymerase chain reaction (PCR) system that will help clinical researchers better understand the nature of a patient's cancer, genetic disease, or infection.

- In May 2022, QIAGEN (Netherlands) acquired BLIRT S.A. (Poland) which produces kits for the isolation of DNA and RNA, as well as reagents for reverse transcription and real-time PCR.

- In September 2021, Thermo Fisher Scientific launched the Applied Biosystems QuantStudio Absolute Q Digital PCR System, the first fully integrated digital PCR (dPCR) system designed to provide highly accurate and consistent results within 90 minutes.

- In June 2020, Cepheid Inc. received US FDA EUA for the Xpert Xpress SARS-CoV-2/Flu/RSV test.

Digital PCR (dPCR) and Real-time PCR (qPCR) Market Advantages:

- dPCR and qPCR are both very sensitive, allowing for detection and quantification of even trace amounts of DNA or RNA.

- dPCR and qPCR can both be used to determine the amount of specific genetic material present in a sample.

- dPCR and qPCR are both fast and efficient, allowing for rapid and accurate results.

- dPCR and qPCR can both be used to identify and quantify multiple targets in a single sample.

- dPCR and qPCR can both be used to detect mutations, SNPs, and other genetic variations.

- dPCR and qPCR are both cost-effective, making them ideal for use in clinical and research applications.

- dPCR and qPCR can both be used to monitor gene expression, allowing for the identification of differentially expressed genes.

Digital PCR (dPCR) and Real-time PCR (qPCR) Market - Report Highlights:

- Market sizes are updated for the base year 2022 and forecasted from 2023 to 2028.

- The new edition of the report provides updated financial information till 2022 for each listed company based on the availability of data. This will help in the easy analysis of the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, and business segment focus in terms of the highest revenue-generating segment.

- The updated study includes additional market dynamics, technological analysis, indicative pricing, key conferences & events from 2022 to 2023, ecosystem analysis, key stakeholders & buying criteria, supply chain analysis, regulatory information, value chain analysis, patent analysis, the recession impact, and Porter's five forces analysis of the dPCR and qPCR market in the market overview chapter.

- The revised research study includes the impact of the recession on the digital PCR and real-time PCR market.

- The product & service segment is updated with the further segmentation of digital PCR instruments into droplet digital PCR, chip-based digital PCR, and beaming digital PCR.

- Competitive landscape chapter of the report is updated with the market evaluation framework, market share analysis, revenue share analysis, company evaluation matrix and competitive benchmarking of top players and emerging companies.

- The new edition of the report provides an updated product portfolio of the companies profiled in the report. Tracking product portfolios of prominent market players helps to analyze the major products in the digital PCR and real-time PCR market.

- The new study includes updated market developments of profiled players from January 2020 to March 2023. Recent developments are helpful to understand market trends and growth strategies adopted by players in the market.

Related Reports:

Next Generation Sequencing Market - Global Forecasts to 2027

In Vitro Diagnostics Market - Global Forecasts to 2027

Bioinformatics Market - Global Forecasts to 2027

Laboratory Freezers Market - Global Forecasts to 2026

Life Science Instrumentation Market - Global Forecasts to 2025

About MarketsandMarkets™:

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

Research Insight: https://www.marketsandmarkets.com/ResearchInsight/digital-pcr-market.asp

Visit Our Website: https://www.marketsandmarkets.com/

Content Source: https://www.marketsandmarkets.com/PressReleases/digital-pcr.asp

Logo: https://mma.prnewswire.com/media/660509/MarketsandMarkets_Logo.jpg

View original content:https://www.prnewswire.com/news-releases/digital-pcr-dpcr-and-real-time-pcr-qpcr-market-worth-12-4-billion--marketsandmarkets-301794101.html

SOURCE MarketsandMarkets

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

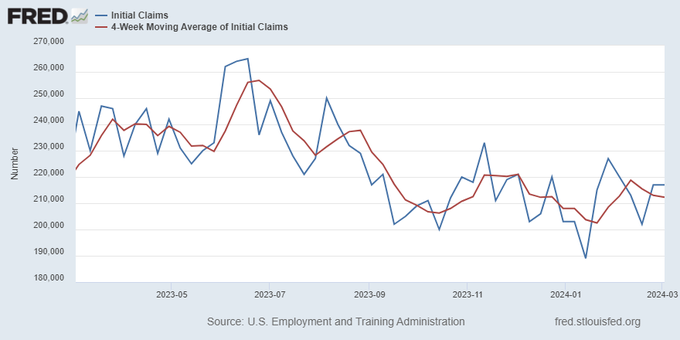

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemployment-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex