KANSAS CITY, MO–Since the beginning of the pandemic, a loss of smell has emerged as one of the telltale signs of COVID-19. Though most people regain their sense of smell within a matter of weeks, others can find that familiar odors become distorted. Coffee smells like gasoline; roses smell like cigarettes; fresh bread smells like rancid meat.

This odd phenomenon is not just disconcerting. It also represents the disruption of the ancient olfactory circuitry that has helped to ensure the survival of our species and others by signaling when a reward (caffeine!) or a punishment (food poisoning!) is imminent.

Scientists have long known that animals possess an inborn ability to recognize certain odors to avoid predators, seek food, and find mates. Now, in two related studies, researchers from the Yu Lab at the Stowers Institute for Medical Research show how that ability, known as innate valence, is encoded. The findings, published in the journals Current Biology and eLife, indicate that our sense of smell is more complicated–and malleable–than previously thought.

Our current understanding of how the senses are encoded falls into two contradictory views–the labeled-line theory and the pattern theory. The labeled-line theory suggests that sensory signals are communicated along a fixed, direct line connecting an input to a behavior. The pattern theory maintains that these signals are distributed across different pathways and different neurons.

Some research has provided support for the labeled-line theory in simple species like insects. But evidence for or against that model has been lacking in mammalian systems, says Ron Yu, PhD, an Investigator at the Stowers Institute and corresponding author of the reports. According to Yu, if the labeled-line model is true, then the information from one odor should be insulated from the influence of other odors. Therefore, his team mixed various odors and tested their impact on the predicted innate responses of mice.

“It’s a simple experiment,” says Qiang Qiu, PhD, a research specialist in the Yu Lab and first author of the studies. Qiu mixed up various combinations of odors that were innately attractive (such as the smell of peanut butter or the urine of another mouse) or aversive (such as the smell of rotting food or the urine of a predator). He then presented those odor mixtures to the mice, using a device the lab specially designed for the purpose. The device has a nose cone that can register how often mice investigate an odor. If mice find a particular mixture attractive, they poke their nose into the cone repeatedly. If they find the mixture aversive, they avoid the nose cone at all costs.

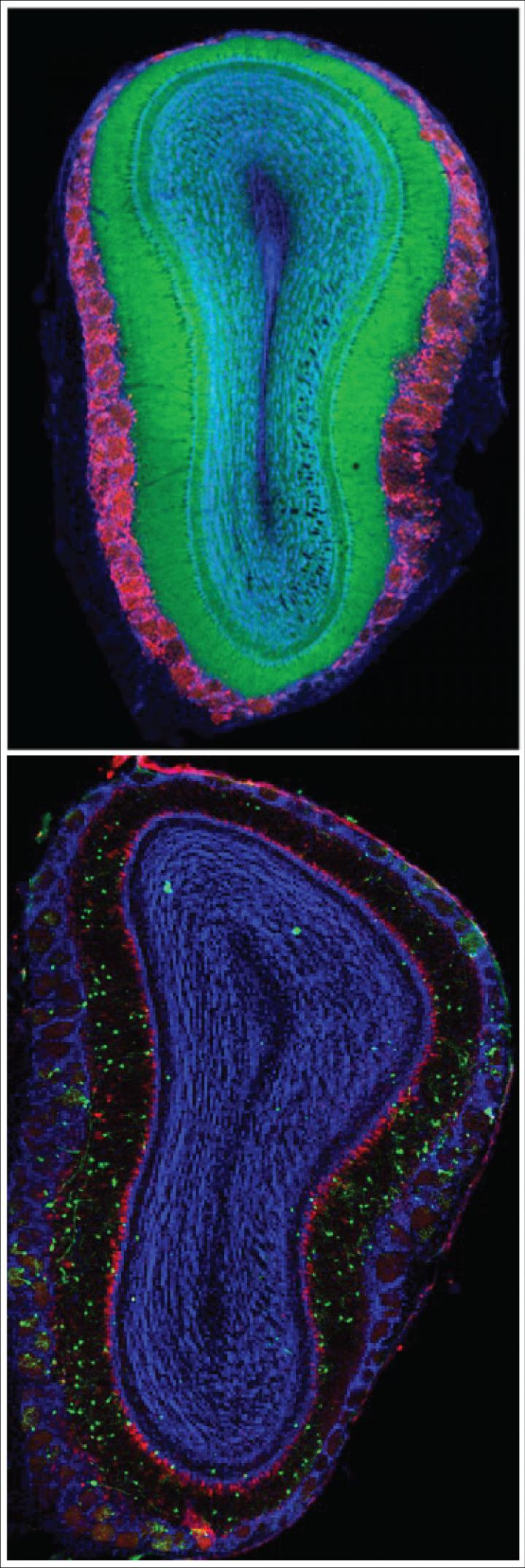

To their surprise, the researchers discovered that mixing different odors, even two attractive odors or two aversive odors, erased the mice’s innate behavioral responses. “That made us wonder whether it was simply a case of one odor masking another, which the perfume industry does all the time when they develop pleasant scents to mask foul ones,” says Yu. However, when the team looked at the activity of the neurons in the olfactory bulb that respond to aversive and attractive odors, they found that was not the case.

Rather, the patterns of activity that represented the odor mixture were strikingly different from that for individual odors. Apparently, the mouse brain perceived the mixture as a new odor identity, rather than the combination of two odors. The finding supports the pattern theory, whereby a sensory input activates not just one neuron but a population of neurons, each to varying degrees, creating a pattern or population code that is interpreted as a particular odor (coyote urine! run!). The study was published online March 1, 2021, in Current Biology.

But is this complicated neural code hardwired from birth, or can it be influenced by new sensory experiences? Yu’s team explored that question by silencing sensory neurons early in life, when mice were only a week old. They found that the manipulated mice lost their innate ability to recognize attractive or aversive odors, indicating that the olfactory system is still malleable during this critical period of development.

Interestingly, the researchers found that when they exposed mice during this critical period to a chemical component of bobcat urine called PEA, the animals no longer avoided that odor later in life. “Because the mice encountered this odor while they were still with their mothers in a safe environment and found that it did not pose a danger, they learned to not be afraid of it anymore,” says Yu. This study was published online March 26, 2021, in eLife.

Though the COVID-19 pandemic has warped the sense of smell in millions of people, Yu does not predict that it will have significant implications for most adults who recover from the disease. However, he thinks this altered sensory experience could have a major impact on affected infants and children, especially considering the role that many odors play in social connections and mental health.

“The sense of smell has a strong emotional component to it–it’s the smell of home cooking that gives you a feeling of comfort and safety,” says Yu. “Most people don’t recognize how important it is until they lose it.”

Other co-authors from Stowers include Yunming Wu, PhD Limei Ma, PhD, Wenjing Xu, PhD, Max Hills, and Vivekanandan Ramalingam, PhD.

The work was funded by the Stowers Institute for Medical Research and the National Institute on Deafness and Other Communication Disorders of the National Institutes of Health (award numbers R01DC008003, R01DC014701, and R01DC016696). The content is solely the responsibility of the authors and does not necessarily represent the official views of the NIH.

Lay Summary of Findings

Animals possess an inborn ability to recognize certain odors to avoid predators, seek food, and find mates. Two new studies from the lab of Investigator Ron Yu, PhD, at the Stowers Institute for Medical Research uncover details about how this ability–known as innate valence–is encoded in the nervous system of mice.

In a study published online March 1, 2021, in the journal Current Biology, the researchers showed that whether a particular odor is attractive or aversive is communicated through a complicated computational code, in which different olfactory neurons are activated to varying degrees to spell out the odor’s valence. In a separate study published online March 26, 2021, in the journal eLife, the research team found that this coding for innate valence is not hardwired at birth, but rather is malleable and can be shaped by exposure to different odors during a critical period early in life.

###

About the Stowers Institute for Medical Research

Founded in 1994 through the generosity of Jim Stowers, founder of American Century Investments, and his wife, Virginia, the Stowers Institute for Medical Research is a non-profit, biomedical research organization with a focus on foundational research. Its mission is to expand our understanding of the secrets of life and improve life’s quality through innovative approaches to the causes, treatment, and prevention of diseases.

The Institute consists of twenty independent research programs. Of the approximately 500 members, over 370 are scientific staff that includes principal investigators, technology center directors, postdoctoral scientists, graduate students, and technical support staff. Learn more about the Institute at http://www.