Currency markets move sideways

US dollar in calm waters Currency markets contented themselves with consolidating recent moves, with no data of note released overnight to shift expectations materially. The dollar index was unchanged overnight at 92.69 but has edged 0.15% lower to 92.55.

US dollar in calm waters

Currency markets contented themselves with consolidating recent moves, with no data of note released overnight to shift expectations materially. The dollar index was unchanged overnight at 92.69 but has edged 0.15% lower to 92.55 in Asia. Today, the primary movers have been the Australian and New Zealand dollars, which have dragged the euro and sterling higher, depressing the dollar index.

NZD/USD has risen 0.53% to 0.7035 today after Covid-19 cases fell for the third day in a row, raising hopes that the kiwis have nipped the delta variant in the bud quickly, prompting reopening hops. NZD/USD looks to have triggered stops as it rose through 0.7010. That has lifted the AUD/USD 0.20% higher to 0.7310. NZD/USD has now unwound nearly all of its delta sell-off, which bottomed at 0.6800 last week. Should New Zealand have dodged another virus bullet, a rise by NZD/USD through 0.7100 could prompt further rallies to 0.7300, possibly quite quickly, as it will put the postponed RBNZ hikes back on the table.

USD/CNY has shown no reaction to the soft PMI data, being unchanged at 6.4660 today. Looking ahead, with another RRR cut on the horizon now and likely more stimulus domestically and to boost exports, a slightly weaker yuan would be another piece of the puzzle. The Fed may do that job by starting to taper in Q4, and don’t think a taper-tantrum is off the menu. USD/CNY is unlikely to spend much time below 6.4000 for the foreseeable, with the risks now skewed to the upside.

Today, Asia FX is firmer against the US dollar, with the Indonesian rupiah up 0.40%, the Thai baht up 0.50%, and the Korean won 0.30% higher. I can see no particular reason for the rally other than the momentum of last week continuing in the absence of any new information to continue the narrative. Tomorrow’s regional PMI data could test that resolve.

Overall, I expect US dollar weakness to continue this week, albeit at a slower pace, until the US employment data on Friday.

stimulus reopening covid-19 fed us dollar euro yuan stimulusGovernment

Analyst revamps SoFi stock price target ahead of earnings

Here’s what could happen to SoFi Technologies shares next.

Anthony Noto, chief executive of SoFi Technologies, used one word to describe 2023: "remarkable."

This was in January, when Noto was speaking to analysts about the online financial-services company's full-year and fourth-quarter results.

“We achieved multiple records and realized many of our aspirations despite seismic geopolitical and macroeconomic events,” he said during a conference call.

SoFi — a short form of Social Finance — beat Wall Street's fourth-quarter expectations, earning 2 cents a share on adjusted revenue of $594.3 million. Analysts surveyed by FactSet expected the company to break even on a per-share basis and post revenue of $575 million.

The company’s student-loan business saw origination volume nearly double year-over-year to $790 million. (The figure declined 14% from Q3.)

For the year-earlier fourth quarter, SoFi posted a loss of 5 cents a share on revenue of $443.4 million.

"We demonstrated that we have built a business to thrive in a host of challenging environments, reacting swiftly to change, driving our business forward with standout financial performance, while continuing to serve our member’s needs," Noto said.

The former U.S. Army Ranger, who was Twitter's chief financial officer before he took over at SoFi, oversaw the company’s initial public offering in 2021.

Shutterstock/TheStreet

SoFi sued US Education Department, dropped case

However, SoFi also saw some controversy last year.

In response to the 2020 COVID pandemic shutdown, Congress passed legislation that allowed holders of federal student loans to stop making payments without any financial penalty. The program was extended nine times.

In March 2023, SoFi, which has around $1 billion in revenue from private student loans and other offerings, sued the U.S. Department of Education to end the agency’s pause on federal student loan payments.

Related: JP Morgan CEO Jamie Dimon delivers stark warning on inflation, economy

The company said it had lost $150 million to $200 million of profit since the moratorium started and maintained that the pause had no legal basis.

The Department of Education stated that the lawsuit was “an attempt by a multibillion-dollar company to make money while they force 45 million borrowers back into repayment — putting many at serious risk of financial harm.”

SoFi later withdrew the lawsuit.

In March, SoFi said it planned to raise $750 million by issuing convertible senior notes. The company also said it entered into agreements with certain holders of existing convertible notes to exchange them for shares.

“We did this deal from a position of strength,” CEO Noto told CNBC’s Jim Cramer on March 20. "What we saw was an opportunity to lower our cost of debt.”

Noto said the company “saw it as an opportunity to do it and have a negligible impact on GAAP earnings per share and also, combined with a buyback, have it be accretive to tangible book value per share by 8% to 10%.”

“The reason why we did it is really important because I think this is what will put some momentum back into the stock,” he added.

SoFi set to report Q1 results April 29

SoFi is scheduled to report first-quarter results on April 29. FactSet calls for the company to earn 1 cent a share on revenue of $557 million.

Several analysts have been adjusting their stock-price targets for SoFi, including Citi analyst Ashwin Shirvaikar, who resumed company coverage on April 8 with a buy rating and an $11 price target.

More Wall Street Analysts:

- Analyst unveils Nvidia stock price 'line in the sand'

- Analyst revamps homebuilder stock price target before Fed rate call

- Analysts revamp Nvidia price targets as Blackwell tightens AI market grip

The analyst said the renewed buy rating with a high-risk designation is based on an updated financial model that includes the latest annual report data and recent capital markets transactions.

SoFi expects to save $40 million to $60 million in annual interest expense and dividend payments by using its issue of convertible senior notes to pay down higher-cost instruments.

Citi said that its fundamental bullish view on SoFi remains unchanged as the company's intended business diversification comes into focus, its ability to attract deposits continues to prove itself, and investors focus on forward profitability.

On April 6 Keefe, Bruyette & Woods analyst Timothy Switzer raised his price target on SoFi stock by 15% to $7.50 a share in January, the research firm lowered its price target to $6.50 from $7.50.

Switzer said he still was concerned about earnings risk over the long term, but the risk of near-term negative catalysts had been reduced due to the stock’s more than 20% decline in 2024 and the company's recent capital raise.

On April 3, Needham analyst Kyle Peterson initiated coverage of SoFi stock with a buy rating and a $10 price target.

The analyst told investors he viewed the company “as a long-term winner in the digital lending/neobank space.”

Peterson said this was due largely to its focus on prime and super-prime consumers and its possession of a full banking license. Those two factors, he said, give SoFi "superior unit economics compared to other consumer-finance platforms that focus on lower-income borrowers and/or lack a banking license.”

SoFi shares were trading at $9.65 on Jan. 2. At last check they were up 2.6% to $7.64.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic fed congress armyGovernment

Here’s Why “America Is Broken” And People Are Worried

Here’s Why "America Is Broken" And People Are Worried

The NY Times on Monday published an opinion piece by UPenn senior lecturer and Open…

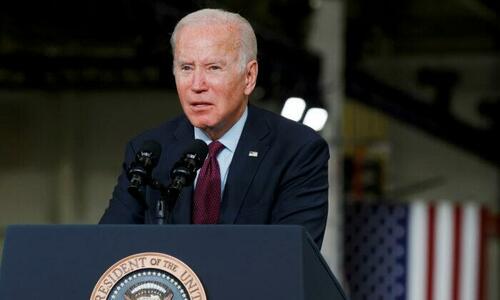

The NY Times on Monday published an opinion piece by UPenn senior lecturer and Open Society Project senior fellow (!) Damon Linker titled "Why Is Biden Struggling? Because America Is Broken."

And while it's more or less a recap of what ZeroHedge readers have known for years, the essay provides a sobering dose of reality for the "You should really watch Rachel Maddow" types.

Seven months away from a rematch election pitting President Biden against former President Donald Trump, the incumbent is struggling. Mr. Biden suffers from persistently low approval ratings, he barely manages to tie Mr. Trump in national head-to-head polls and he lags behind the former president in most of the swing states where the election will be decided (despite some recent modestly encouraging movement in his direction).

The question is why. -NY Times

Biden's defenders, and the administration itself, has chalked the president's unpopularity up to "a failure of communication," however Linker instead suggests "It's usually wiser to listen to what voters are saying" (beyond the obvious concerns about the president's age).

'Too Numerous to List'

Citing a January 2021 essay in Tablet titled "Everything Is Broken," and a follow-up essay by the same author, Alana Newhsouse, who wrote that "whole parts of American society were breaking down before our eyes," Linker encapsulates why Americans are so pissed (h/t Dean Baker):

The examples are almost too numerous to list: a disastrous war in Iraq; a ruinous financial crisis followed by a decade of anemic growth when most of the new wealth went to those who were already well off; a shambolic response to the deadliest pandemic in a century; a humiliating withdrawal from Afghanistan; rising prices and interest rates; skyrocketing levels of public and private debt; surging rates of homelessness and the spread of tent encampments in American cities; undocumented migrants streaming over the southern border; spiking rates of gun violence, mental illness, depression, addiction, suicide, chronic illness and obesity, coupled with a decline in life expectancy.

That’s an awful lot of failure over the past 20-odd years. Yet for the most part, the people who run our institutions have done very little to acknowledge or take responsibility for any of it, let alone undertake reforms that aim to fix what’s broken. -NYT

Linker then writes that the above is why "angry anti-establishment populism has become so prominent in our politics over the past decade," which both Donald Trump and Bernie Sanders have capitalized on.

And Biden, a career politician, has been part of the problem (and therefore implicated in these abject societal failures), and is "badly out of step with the national mood, speaking a language very far removed from the talk of a broken country that suffuses Mr. Trump’s meandering and often unhinged remarks on the subject." (gotta get that shot in!)

That leaves Mr. Biden as the lone institutionalist defender of the status quo surrounded by a small army of brokenists looking for support from an electorate primed to respond to their more downcast message.

Linker suggests that in order to recover, Biden 'stop being so upbeat' - about the economy in particular, and stop making the election about how awful Trump is. Biden "should admit Washington has gotten a lot of things wrong over the past two decades and sound unhappy about and humbled by it."

Further, Biden "could make the argument that all governments make mistakes because they are run by fallible human beings — but also point out that elected representatives in a democracy should be up front about error and resolve to learn from mistakes so that they avoid them in the future."

"Just acknowledging how much in America is broken could generate a lot of good will from otherwise skeptical and dismissive voters," Linker suggests.

Let's see how that goes.

Spread & Containment

The 5 most startling retailer bankruptcies since 2020

The pandemic sent waves through the economy, and since its onset, many businesses have filed for Chapter 11 bankruptcy. These are five of the most surprising…

When a business files Chapter 11 bankruptcy, that doesn’t mean it has declared itself kaput — far from it.

Filing Chapter 11 is like sending out a SOS signal: It allows the business to keep operating while attempting to restructure operations and pay down its debts (unlike a Chapter 7 bankruptcy filing, which closes the company and liquidates its assets). The recovery rate of a business filing Chapter 11 is said to be anywhere between 10% and 40%.

But no two Chapter 11 bankruptcies are alike. You might be surprised to hear that some of the world’s largest companies — such as American Airlines, Marvel Entertainment, and General Motors — have filed Chapter 11 at one point, but through mergers, new revenue streams, or simply by operating smarter, all managed to crawl back to profitability.

Other big names weren’t as fortunate: Funeral rites were observed for Lehman Brothers and WorldCom, for example, because they had been operating fraudulently — even though some argued, in the case of Lehman, that they were “too big to fail.”

Related: Boeing's turbulent descent: The company’s scandals & mishaps explained

How many businesses have filed Chapter 11 since the COVID-19 pandemic?

The COVID-19 pandemic, caused by the SARS-CoV-2 virus, not only made millions of people very sick; it also had a profound impact on the way we live, work, and shop. At the onset of 2020's stay-at-home-orders, hundreds of restaurants shuttered, including household names like Ruby Tuesday, California Pizza Kitchen, and Sizzler.

According to U.S. Federal Courts, business Chapter 11 filings spiked in 2020 while Chapter 7 filings actually decreased. But as vaccines were developed and people returned to work and school, they also resumed their former shopping habits — in fact, mall traffic in 2023 was down only 5.8% compared to 2019, which is much better than it was in 2021, when it was off 15%.

Yet more turbulence was felt in the years following the pandemic, as government stimulus from the CARES Act, which had helped many businesses make payroll and meet other operating expenses, expired in 2021.

Bankruptcy filings by chapter 2019–2023

| Year | Chapter 7 | Chapter 11 |

|---|---|---|

2023 | 261,277 | 7,456 |

2022 | 225,455 | 4,918 |

2021 | 288,327 | 4,836 |

2019 | 480,201 | 7,020 |

Through such choppy waters, we examine a few of the biggest-name retailers that went belly up — and which ones have risen from the ashes under new management.

5 big-name Chapter 11 bankruptcies in retail

FREDERIC J. BROWN/AFP via Getty Images

Rite Aid

It was the country’s third-largest drugstore chain — only Walgreens and CVS were bigger — but thanks to sluggish sales, mounting debt, and federal investigations into whether it illegally filled prescriptions during the opioid crisis, Rite Aid filed Chapter 11 in October 2023.

Earlier in the year, the chain had reported a $241 million quarterly loss due in part to a reduction in revenue from COVID-19 vaccines and rapid tests. Rite Aid simply couldn’t keep up with the convenience of shopping at the pharmacies at big-box stores like Walmart, Target, and Costco.

As part of its Chapter 11 agreement, the company secured $3.5 billion in financing and appointed a new chief executive, Jeff Stein, to lead its corporate reorganization. Rite Aid also planned to close 200 stores in 2024 but not before transferring customer prescriptions to nearby pharmacies. In addition, it gave its 45,000 employees the option to transfer to other stores “when possible.”

Related: How much does Walgreens pay? Entry-level positions, benefits & more

Bed Bath & Beyond

Many people thought Bed Bath & Beyond’s days were numbered when it filed Chapter 11 in April 2023 — after all, it closed all 376 stores across the U.S., and its stock was terminated from the over-the-counter trading market. This came after reporting a quarterly loss of $393 million and on the heels of several years of declining sales, competition from online home goods retailers like Wayfair, and a snarled COVID-19-related supply chain.

Plus, who could forget BBBY’s meme stock trading frenzy in January 2021, when Reddit contributors drove up prices 99%, only to come crashing back down? When the dust settled, Overstock bought the business for a blue-light special of $21.5 million in June 2023, then took its name and merged businesses.

Bed, Bath & Beyond now sells kitchen, bath, and furniture completely online and has added more than 600,000 new products to its inventory.

J. Crew

The first big retailer to capsize during the pandemic, J. Crew filed Chapter 11 in May 2020. But it wasn’t only the fact that retail sales in general withered at the start of COVID-19 — the Commerce Department reported a 50% decline in sales in March 2020 alone — J. Crew had also been saddled with $1.7 billion (that’s with a b) in long-term debt, which weighed heavily on its balance sheet even while its operations were profitable.

The upscale lifestyle apparel seller received a $400 million line of credit from hedge fund Anchorage Capital Management, which became majority owner and, combined with additional loans from Davidson Kempner Capital Management LP and Bank of America, managed to convert its debt into equity, exiting bankruptcy proceedings that August.

But J. Crew is not out of the woods. Ever since creative director Jenna Lyons left in 2017, it has yet to come out with a line of clothing consumers want to pay full price for, and Standard & Poor’s downgrade of parent company Chinos Intermediate 2 LLC from “stable” to “negative” in the third quarter of 2023 raised alarm bells.

However, the preppy chain posted a 9% sales increase for its fiscal year ending February 1, 2024, due in part to holiday sales, which slashed apparel prices by as much as 75%. Paradoxically, J. Crew just might now be one of the best stores to shop at for discounts.

Related: A pre-IPO History of Reddit: From “front page of the internet” to billion-dollar valuation

Justin Sullivan/Getty Images

JCPenney

You’d think a company that survived two World Wars and made a cameo in "Back to the Future" could stand the test of time — and it just well might. Founded in 1902 by James Cash Penney as a dry goods store in Kemmerer, Wyoming, the chain expanded throughout the American West before introducing clothing to its lineup in the 1960s.

Wisely venturing into the pharmacy business, launching a mail order catalog, and offering customers the option to make their purchases through credit paid off in spades, Penney’s peaked in the 1970s with more than 2,000 stores worldwide. But after decades of declining sales, accumulating a boatload of debt during the 2007-2008 financial crisis, and losing customers in droves to Target and Walmart (a familiar refrain), the COVID-19-related closure of Penney’s 800 remaining stores in early 2020 seemed like the final nail in the aging retailer's coffin.

JCPenney filed Chapter 11 that May, only to emerge, phoenix-like, eight months later. The brand permanently closed 200 stores, restructured its $4 billion debt, and took on two new owners — they just happened to be the country’s largest shopping mall owners, Simon Properties and Brookfield Asset Management, thus ensconcing Penney’s place as a retail “anchor.”

In 2021, Mark Rosen, formerly of Levi Strauss & Co., became CEO, and in 2023, he announced $1 billion worth of upgrades to the JCPenney website and app, as well as renovations of its brick-and-mortar stores. Here’s the cincher: Doing so wouldn’t require taking on any more debt. “We’re in a really strong financial position right now,” Rosen said.

AaronP/Bauer-Griffin/GC Images

Guitar Center

It’s hard to believe this mecca for rock n’ roll musicians was originally called Organ Center and sold church organs and small appliances. That all changed in 1964, shortly after The Beatles came to America, when one of owner Wayne Mitchell's vendors told him that he needed to buy Vox amplifiers in order to continue purchasing organs.

Mitchell figured that if he was selling amps, why not stock a few guitars, too? They quickly sold out; Mitchell changed his store’s name, and the rest was history. Riding the hair metal craze of the 1980s that glorified guitar virtuosos like Eddie Van Halen, Guitar Center expanded into 30 locations by the 1990s. It also diversified its portfolio with acquisitions of Musician’s Friend, a mail-order musical instrument company; Music & Arts, which provided in-store music lessons; and in the early 2000s, partnered with Activision, the video gaming giant, on its smash hit “Guitar Hero.”

But the good times and rock & roll didn’t last forever. Over the next decade, Guitar Center underwent a series of leveraged buyouts from private equity firms, each time saddling it with more debt. It tried cutting costs by stocking fewer name brands and laying off staff — many of whom had decades of experience that justified their salaries.

Customers noticed the changes and simply stopped coming, shopping online instead. But right before the pandemic, Guitar Center staged a comeback, posting 10 straight months of sales growth, but while new audiences were found for guitars and online lessons during the COVID-19 lockdown, Guitar Center faced the double whammy of seeing $1 billion in debt come due and the closure of its brick-and-mortar stores.

It entered Chapter 11 in November 2020, although its management team already had a strategy in place. It invested $165 million in the company while eliminating most of its debt. Guitar Center also issued $375 million in senior secured bonds and exited Chapter 11 that December.

Related: Is shrinkflation a big deal? Definition, examples & impact on headline inflation

bankruptcy bankruptcies pandemic covid-19 stimulus bonds lockdown recovery stimulus-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment4 weeks ago

Spread & Containment4 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 month ago

International1 month agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International1 month ago

International1 month agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized7 days ago

Uncategorized7 days agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Government2 days ago

Government2 days agoClimate-Con & The Media-Censorship Complex – Part 1

-

Uncategorized3 days ago

Uncategorized3 days agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized21 hours ago

Uncategorized21 hours agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?