Government

Analyst revamps SoFi stock price target ahead of earnings

Here’s what could happen to SoFi Technologies shares next.

Anthony Noto, chief executive of SoFi Technologies, used one word to describe 2023: "remarkable."

This was in January, when Noto was speaking to analysts about the online financial-services company's full-year and fourth-quarter results.

“We achieved multiple records and realized many of our aspirations despite seismic geopolitical and macroeconomic events,” he said during a conference call.

SoFi — a short form of Social Finance — beat Wall Street's fourth-quarter expectations, earning 2 cents a share on adjusted revenue of $594.3 million. Analysts surveyed by FactSet expected the company to break even on a per-share basis and post revenue of $575 million.

The company’s student-loan business saw origination volume nearly double year-over-year to $790 million. (The figure declined 14% from Q3.)

For the year-earlier fourth quarter, SoFi posted a loss of 5 cents a share on revenue of $443.4 million.

"We demonstrated that we have built a business to thrive in a host of challenging environments, reacting swiftly to change, driving our business forward with standout financial performance, while continuing to serve our member’s needs," Noto said.

The former U.S. Army Ranger, who was Twitter's chief financial officer before he took over at SoFi, oversaw the company’s initial public offering in 2021.

Shutterstock/TheStreet

SoFi sued US Education Department, dropped case

However, SoFi also saw some controversy last year.

In response to the 2020 COVID pandemic shutdown, Congress passed legislation that allowed holders of federal student loans to stop making payments without any financial penalty. The program was extended nine times.

In March 2023, SoFi, which has around $1 billion in revenue from private student loans and other offerings, sued the U.S. Department of Education to end the agency’s pause on federal student loan payments.

Related: JP Morgan CEO Jamie Dimon delivers stark warning on inflation, economy

The company said it had lost $150 million to $200 million of profit since the moratorium started and maintained that the pause had no legal basis.

The Department of Education stated that the lawsuit was “an attempt by a multibillion-dollar company to make money while they force 45 million borrowers back into repayment — putting many at serious risk of financial harm.”

SoFi later withdrew the lawsuit.

In March, SoFi said it planned to raise $750 million by issuing convertible senior notes. The company also said it entered into agreements with certain holders of existing convertible notes to exchange them for shares.

“We did this deal from a position of strength,” CEO Noto told CNBC’s Jim Cramer on March 20. "What we saw was an opportunity to lower our cost of debt.”

Noto said the company “saw it as an opportunity to do it and have a negligible impact on GAAP earnings per share and also, combined with a buyback, have it be accretive to tangible book value per share by 8% to 10%.”

“The reason why we did it is really important because I think this is what will put some momentum back into the stock,” he added.

SoFi set to report Q1 results April 29

SoFi is scheduled to report first-quarter results on April 29. FactSet calls for the company to earn 1 cent a share on revenue of $557 million.

Several analysts have been adjusting their stock-price targets for SoFi, including Citi analyst Ashwin Shirvaikar, who resumed company coverage on April 8 with a buy rating and an $11 price target.

More Wall Street Analysts:

- Analyst unveils Nvidia stock price 'line in the sand'

- Analyst revamps homebuilder stock price target before Fed rate call

- Analysts revamp Nvidia price targets as Blackwell tightens AI market grip

The analyst said the renewed buy rating with a high-risk designation is based on an updated financial model that includes the latest annual report data and recent capital markets transactions.

SoFi expects to save $40 million to $60 million in annual interest expense and dividend payments by using its issue of convertible senior notes to pay down higher-cost instruments.

Citi said that its fundamental bullish view on SoFi remains unchanged as the company's intended business diversification comes into focus, its ability to attract deposits continues to prove itself, and investors focus on forward profitability.

On April 6 Keefe, Bruyette & Woods analyst Timothy Switzer raised his price target on SoFi stock by 15% to $7.50 a share in January, the research firm lowered its price target to $6.50 from $7.50.

Switzer said he still was concerned about earnings risk over the long term, but the risk of near-term negative catalysts had been reduced due to the stock’s more than 20% decline in 2024 and the company's recent capital raise.

On April 3, Needham analyst Kyle Peterson initiated coverage of SoFi stock with a buy rating and a $10 price target.

The analyst told investors he viewed the company “as a long-term winner in the digital lending/neobank space.”

Peterson said this was due largely to its focus on prime and super-prime consumers and its possession of a full banking license. Those two factors, he said, give SoFi "superior unit economics compared to other consumer-finance platforms that focus on lower-income borrowers and/or lack a banking license.”

SoFi shares were trading at $9.65 on Jan. 2. At last check they were up 2.6% to $7.64.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic fed congress armyGovernment

Here’s Why “America Is Broken” And People Are Worried

Here’s Why "America Is Broken" And People Are Worried

The NY Times on Monday published an opinion piece by UPenn senior lecturer and Open…

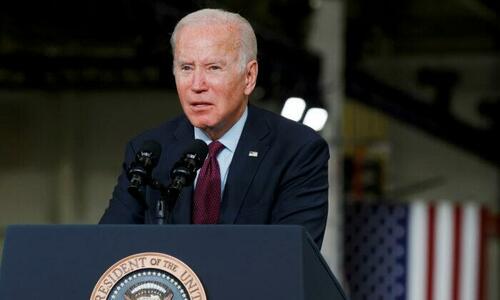

The NY Times on Monday published an opinion piece by UPenn senior lecturer and Open Society Project senior fellow (!) Damon Linker titled "Why Is Biden Struggling? Because America Is Broken."

And while it's more or less a recap of what ZeroHedge readers have known for years, the essay provides a sobering dose of reality for the "You should really watch Rachel Maddow" types.

Seven months away from a rematch election pitting President Biden against former President Donald Trump, the incumbent is struggling. Mr. Biden suffers from persistently low approval ratings, he barely manages to tie Mr. Trump in national head-to-head polls and he lags behind the former president in most of the swing states where the election will be decided (despite some recent modestly encouraging movement in his direction).

The question is why. -NY Times

Biden's defenders, and the administration itself, has chalked the president's unpopularity up to "a failure of communication," however Linker instead suggests "It's usually wiser to listen to what voters are saying" (beyond the obvious concerns about the president's age).

'Too Numerous to List'

Citing a January 2021 essay in Tablet titled "Everything Is Broken," and a follow-up essay by the same author, Alana Newhsouse, who wrote that "whole parts of American society were breaking down before our eyes," Linker encapsulates why Americans are so pissed (h/t Dean Baker):

The examples are almost too numerous to list: a disastrous war in Iraq; a ruinous financial crisis followed by a decade of anemic growth when most of the new wealth went to those who were already well off; a shambolic response to the deadliest pandemic in a century; a humiliating withdrawal from Afghanistan; rising prices and interest rates; skyrocketing levels of public and private debt; surging rates of homelessness and the spread of tent encampments in American cities; undocumented migrants streaming over the southern border; spiking rates of gun violence, mental illness, depression, addiction, suicide, chronic illness and obesity, coupled with a decline in life expectancy.

That’s an awful lot of failure over the past 20-odd years. Yet for the most part, the people who run our institutions have done very little to acknowledge or take responsibility for any of it, let alone undertake reforms that aim to fix what’s broken. -NYT

Linker then writes that the above is why "angry anti-establishment populism has become so prominent in our politics over the past decade," which both Donald Trump and Bernie Sanders have capitalized on.

And Biden, a career politician, has been part of the problem (and therefore implicated in these abject societal failures), and is "badly out of step with the national mood, speaking a language very far removed from the talk of a broken country that suffuses Mr. Trump’s meandering and often unhinged remarks on the subject." (gotta get that shot in!)

That leaves Mr. Biden as the lone institutionalist defender of the status quo surrounded by a small army of brokenists looking for support from an electorate primed to respond to their more downcast message.

Linker suggests that in order to recover, Biden 'stop being so upbeat' - about the economy in particular, and stop making the election about how awful Trump is. Biden "should admit Washington has gotten a lot of things wrong over the past two decades and sound unhappy about and humbled by it."

Further, Biden "could make the argument that all governments make mistakes because they are run by fallible human beings — but also point out that elected representatives in a democracy should be up front about error and resolve to learn from mistakes so that they avoid them in the future."

"Just acknowledging how much in America is broken could generate a lot of good will from otherwise skeptical and dismissive voters," Linker suggests.

Let's see how that goes.

International

United Airlines delays route passengers had looked forward to

The airline has poured a lot of resources into marketing its new Newark-Faro flight.

While the most common way for American travelers to get to Portugal had formerly been with a flight to Lisbon (or a transfer in a larger European hub), the country’s exploding popularity has pushed airlines to launch more routes not just to the capital but also to smaller cities that are common destinations for tourists.

For the summer of 2024, Delta Air Lines (DAL) resumed a Boston-Lisbon route that was lost to the pandemic while United Airlines (UAL) announced a new flight between Newark International Airport (EWR) and Faro in the country’s coastal Algarve region.

Related: This is why you won't be able to get a low-cost flight to Tulum anytime soon

The latter flight, which was initially scheduled to start running on May 24 on a Boeing 757-200 (BA) , is now put off indefinitely as both Boeing and United face investigations over several high-profile incidents such as when smoke filled the cabin on a plane taking off from Los Angeles and a tire falling off at San Francisco International Airport (SFO).

Shutterstock

There is a big reason that a glitzy new route was canceled

While no injuries were caused, the airline is holding off on the route that it would want to launch to great fanfare to focus on both the investigation and rebuilding its PR image.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

“It's unlike United to cancel such a splashy new route with such short notice, especially considering how the carrier made a big marketing push around the new route when it was originally announced in October,” writes Zach Griff of The Points Guy. “Turns out, the reason for United's close-in cancellation is due to the ongoing Federal Aviation Administration (FAA) audit that commenced just a few days ago due to recent safety events involving the airline, as confirmed by a carrier spokesperson.”

The same spokesperson said that it still plans to launch the Newark-Faro flight by the summer of 2025 but did not give any more concrete details about the schedule. It is also delaying a “fifth freedom” route that goes from the U.S. to Tokyo and later on to Cebu in the Philippines.

Both destinations have been seeing growing interest from American tourists and the airline tried to tap into a market that was formerly filled only by smaller local airlines that tourists from far away would catch after flying into a metropolis.

There’s been a wrinkle in United’s plan to tap into hot new tourist destinations

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's Senior Vice President of Global Network Planning Patrick Quayle said in a statement at the time.

Now, the airline is delaying such routes that it launched both to market itself as an airline that flies to such popular destinations and to slowly build out demand in order to focus on the investigation and bad publicity that came as a result of the recent safety incidents.

“This schedule change is a consequence of that,” United said in a statement while adding that those who had already booked flights to Faro or Cebu on their site will receive communication from the airline and a “full refund” of what they paid.

stocks pandemic europeanSpread & Containment

These National Parks are the most expensive to visit

A new report looks at the cost of entry fees at the country’s national parks.

While the 63 national parks spread across the U.S. are an inextricable part of American culture, visiting all of them is by no means a cheap endeavor.

Many are not easy to access without a car and, along with the usual travel and accommodation costs of going to so many states and territories, the parks themselves also charge visitors fees at different points in their visit. Sometimes this is exclusively for “extras” such a spot on a camping site but, increasingly, parks have been either raising or introducing entry and parking fees amid overcrowding.

Related: I visited two of the country's most underrated National Parks — here's what it was like

The most expensive national park in the U.S. is, as travel journalist Stephen Hanson recently identified in a fare comparison, the Gates Of The Arctic National Park & Preserve in Northern Alaska.

Veronika Bondarenko

This is the most remote (and often most expensive) national park to visit

Often dubbed the “most remote national park in the U.S.,” the Gates of the Arctic has no entry fee but is incredibly costly to get to due to its location in the far north of the Arctic. Without direct road access, the only way to get there is to fly from Anchorage to the nearest small settlement such as Kotzebue or Anaktuvuk Pass by charter plane. The Arctic terrain also means visitors often need to hire guides, pay inflated prices for the limited accommodation and bring special gear.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

“While many beautiful national parks in the US are well worth a trip despite their remote setting, Gates of the Arctic National Park & Preserve requires a particularly dedicated resolve from any traveler who wants to visit,” Hanson writes. “Though prices can vary depending on the length of the trip and the destination, passengers can expect to pay anywhere from a few hundred to a few thousand dollars for a ticket.”

Channel Islands National Park off the coast of Southern California is the country’s second-most expensive in the U.S. for a similar reason. The five Channel Islands sit in the Pacific Ocean and can only be accessed by ferry from Ventura Harbor. Depending on the time of day and year, the three-hour ferry ranges in price from $60 to $120 (the park itself, once you get there, has no entry fee.)

These national parks are also very expensive (here is why)

Parks that are easily accessible by car but have high entry fees due to overcrowding include Yosemite in California’s Sierra Nevada Mountains and Glacier National Park on the border between Montana and Canada’s British Columbia.

Both parks charge each vehicle coming in a $35 entry fee on top of additional additional fees for staying there overnight. In 2021, Yosemite raised the camping fee from $6 to $10 per person to keep up with the cost of running the park amid growing numbers of people who started visiting as part of their local travels during the pandemic.

“Visitors should be prepared to spend more money on gas and set aside an entire day for travel when heading out to the park,” Hanson writes of Glacier National Park. “Upon arriving, visitors to Glacier will have to pay a $35 entry fee.”

SEE THE FULL LIST OF MOST EXPENSIVE NATIONAL PARKS HERE.

stocks pandemic spread canada-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment4 weeks ago

Spread & Containment4 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 month ago

International1 month agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International1 month ago

International1 month agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized7 days ago

Uncategorized7 days agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized3 days ago

Uncategorized3 days agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Government2 days ago

Government2 days agoClimate-Con & The Media-Censorship Complex – Part 1

-

Uncategorized20 hours ago

Uncategorized20 hours agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?