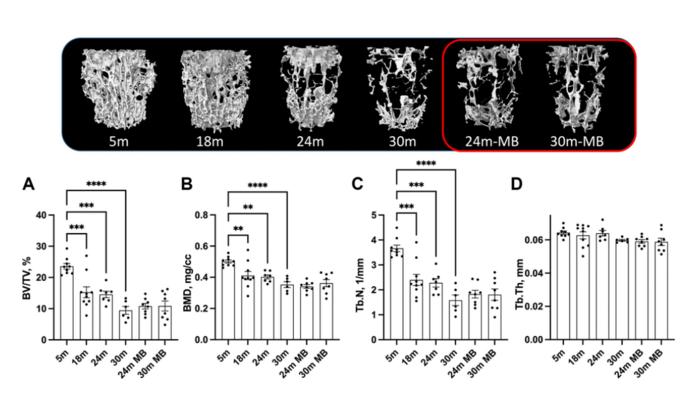

“[…] long-term administration of MB or MitoQ did not have an effect on skeletal morphology during the aging process […]”

BUFFALO, NY- April 3, 2024 – A new research paper was published in Aging (listed by MEDLINE/PubMed as “Aging (Albany NY)” and “Aging-US” by Web of Science) Volume 16, Issue 6, entitled, “Targeting mitochondrial dysfunction using methylene blue or mitoquinone to improve skeletal aging.”

Methylene blue (MB) is a well-established antioxidant that has been shown to improve mitochondrial function in both in vitro and in vivo settings. Mitoquinone (MitoQ) is a selective antioxidant that specifically targets mitochondria and effectively reduces the accumulation of reactive oxygen species. In this new study, researchers Sher Bahadur Poudel, Dorra Frikha-Benayed, Ryan R. Ruff, Gozde Yildirim, Manisha Dixit, Ron Korstanje, Laura Robinson, Richard A. Miller, David E. Harrison, John R. Strong, Mitchell B. Schaffler, and Shoshana Yakar from New York University College of Dentistry, City College of New York, The Jackson Laboratory, University of Michigan, South Texas Veterans Health Care System, and The University of Texas Health Science Center investigated the effect of long-term administration of MB or MitoQ on skeletal morphology during the aging process.

“[…] we administered MB to aged (18 months old) female C57BL/J6 mice, as well as to adult male and female mice with a genetically diverse background (UM-HET3). Additionally, we used MitoQ as an alternative approach to target mitochondrial oxidative stress during aging in adult female and male UM-HET3 mice.”

Although the researchers observed some beneficial effects of MB and MitoQ in vitro, the administration of these compounds in vivo did not alter the progression of age-induced bone loss. Specifically, treating 18-month-old female mice with MB for 6 or 12 months did not have an effect on age-related bone loss. Similarly, long-term treatment with MB from 7 to 22 months or with MitoQ from 4 to 22 months of age did not affect the morphology of cortical bone at the mid-diaphysis of the femur, trabecular bone at the distal-metaphysis of the femur, or trabecular bone at the lumbar vertebra-5 in UM-HET3 mice.

“Based on our findings, it appears that long-term treatment with MB or MitoQ alone, as a means to reduce skeletal oxidative stress, is insufficient to inhibit age-associated bone loss. This supports the notion that interventions solely with antioxidants may not provide adequate protection against skeletal aging.”

Read the full paper: DOI: https://doi.org/10.18632/aging.205147

Corresponding Author: Shoshana Yakar

Corresponding Email: sy1007@nyu.edu

Keywords: methylene blue, mitoquinone, bone, micro-CT, antioxidants

Click here to sign up for free Altmetric alerts about this article.

About Aging:

Aging publishes research papers in all fields of aging research including but not limited, aging from yeast to mammals, cellular senescence, age-related diseases such as cancer and Alzheimer’s diseases and their prevention and treatment, anti-aging strategies and drug development and especially the role of signal transduction pathways such as mTOR in aging and potential approaches to modulate these signaling pathways to extend lifespan. The journal aims to promote treatment of age-related diseases by slowing down aging, validation of anti-aging drugs by treating age-related diseases, prevention of cancer by inhibiting aging. Cancer and COVID-19 are age-related diseases.

Aging is indexed by PubMed/Medline (abbreviated as “Aging (Albany NY)”), PubMed Central, Web of Science: Science Citation Index Expanded (abbreviated as “Aging‐US” and listed in the Cell Biology and Geriatrics & Gerontology categories), Scopus (abbreviated as “Aging” and listed in the Cell Biology and Aging categories), Biological Abstracts, BIOSIS Previews, EMBASE, META (Chan Zuckerberg Initiative) (2018-2022), and Dimensions (Digital Science).

Please visit our website at www.Aging-US.com and connect with us:

- X, formerly Twitter

- YouTube

- Spotify, and available wherever you listen to podcasts

Click here to subscribe to Aging publication updates.

For media inquiries, please contact media@impactjournals.com.

Aging (Aging-US) Journal Office

6666 E. Quaker Str., Suite 1B

Orchard Park, NY 14127

Phone: 1-800-922-0957, option 1

###

Journal

Aging-US

DOI

10.18632/aging.205147

Method of Research

Experimental study

Subject of Research

People

Article Title

Targeting mitochondrial dysfunction using methylene blue or mitoquinone to improve skeletal aging

Article Publication Date

25-Mar-2024