Craig Hallum: 3 Top Tech Picks With Over 40% Upside Potential

Craig Hallum: 3 Top Tech Picks With Over 40% Upside Potential

Investment research firm Craig-Hallum maintains a cadre of 30 financial analysts, who combined have more than 1,400 stock recommendations logged into the TipRanks database. Even after the recent market gyrations, the average return on their picks is 8.2%.

Anthony Stoss, a senior analyst with the firm, has turned his eye to the high-tech sector, with a report on wireless internet providers and on semiconductor chip makers.

Stoss highlights the features that denote strength in the sector, so that investors will know what to look for: high liquidity reserves, low exposure to manufacturing risk, reduced share price, and a strongly positive outlook for 2021. In Stoss’ view, this profile readily identifies stocks with a clear path out of the current volatile market. For investors interested in a long-term play, these are the names that will likely bring returns.

The quality of Stoss' research is clear from his TipRanks rating: 5 stars, and an overall ranking in the top 5% of Wall Street’s financial analysts. Here are three of his top picks in tech.

Boingo Wireless, Inc. (WIFI)

We’ll start with Boingo Wireless. This small-cap company is a provider of mobile internet access for wireless enabled devices – smartphones, tablets, gaming handsets, laptops. The company operates over a million small-cell network towers and boasts an annual reach of a billion customers. Last year, Boingo entered a partnership with Verizon, the second-largest wireless services provider in the US, to provide Verizon 5G access for stadiums, airports, hotels, and other indoor public spaces.

Like many tech companies that run at the leading edge of their sector, Boingo typically operates at a net loss. Declines in advertising and retail revenue hurt the company in Q4 as 2019 ended, and offset gains in multifamily and wholesale wifi. Total revenues slipped 5.5% yoy to $64.1 million. EPS was in line with the forecasts, however, coming in at a 12-cent loss. Looking ahead, the Q1 earnings are expected show a net loss of 6 cents.

In his notes, Stoss points out that Boingo’s business is based on long-term contracts; more than 95% of its customers are in that model, and contractual minimums will guarantee income no matter what happens in the economic short term. He writes, of the company’s forward prospects, “We look for WIFI to return to strong growth in CY21 as the largest contract win in the company’s history (NYC MTA) rolls out… While we continue to believe WIFI’s business model is durable, we think the company remains in talks with multiple bidders and a deal is likely to get done…”

As a result, Stoss reiterates his Buy rating on WIFI shares, while his $22 price target shows confidence in a 70% upside potential for the stock in 2020. (To watch Stoss’ track record, click here)

If we step back and look at the bigger picture, we can see that overall the stock has a ‘Strong Buy’ analyst consensus rating. In the last three months, the stock has received 3 'buy' ratings and just 1 'hold.' With an average analyst price target of $20.83, analysts are projecting upside potential of 61% from the current share price. (See Boingo stock analysis on TipRanks)

Knowles Corporation (KN)

Next up is Knowles, a leader in mobile audio systems. The company provides solutions for micro-acoustics and audio processors for a range of mobile devices, including consumer electronics, communications sets, medical systems, defense hardware, and cars. Knowles’ tech provides improved audio signal clarity, and is found in Amazon’s Alexa. The company’s best-known products are found in hearing aids, and in cell phones’ built-in mics.

Offering high-demand niche products for expensive gadgets is a path to profitability, and KN typically reports quarterly net gains. The company shows a typical patter: low EPS in the first half of the calendar year, followed by strong earnings in Q3 and Q4. With that in mind, it’s no surprise that Q4, with 30 cents EPS and $233.9 million in revenues, was the company’s second-best last year. And looking forward to the coming Q1 report, the expected 4-cent per share net loss makes sense as both a cyclical low and an indicator of just how strongly the COVID-19 epidemic has impacted overall consumer demand.

Looking at KN, Craig-Hallum’s Stoss points out two major assets for the company: it has access to plenty of cash, with $78 million on hand and another $400 million available in a revolving credit facility, and it doesn’t have to worry about any near-term debt turnover, as it does not have any debt maturing until November 2021. In addition, KN only outsources 10% of its manufacturing production, and so has control over its own inventory.

Regarding Knowles’ prospects, the analyst writes, “[With] the world moving online, networks are being constrained pushing for a faster 5G rollout. We look for KN’s 5G solutions to drive growth as 5G adoption accelerates… While near-term the company will see coronavirus impacts, we think KN will bounce back quickly and earn $1.12 in pro-forma EPS for FY21…”

Stoss puts a Buy rating on KN, with a $21 price target that implies a 47% upside.

Overall, Knowles is given a Moderate Buy rating from the analyst consensus. This is based on 7 recent reviews, split three ways: 5 Buys, and 1 each Hold and Sell. Once again, the market slide of February and March has pushed the share price far down – this stock is selling for $14.33. The average price target is $20.29, and suggests room for a 42% upside potential in the coming 12 months. (See Knowles stock analysis on TipRanks)

ON Semiconductor (ON)

This year has not been kind to the semiconductor chip industry. With the coronavirus pandemic and economic dislocations promising a recession, the chip industry has been buffeted around quite severely. ON has felt the impact worse than most; its stock is down by more than half since peaking near $25 in mid-January of this year.

A look at the company’s niche may help explain why. It provides analog and logic chips for data and power management. The company’s products are heavily used in automotive and industrial applications, and both of those sectors are hard-hit by epidemic-inspired shutdowns. With factories idled and workers in limbo, companies like ON are finding less demand for services. The company is not looking at a Q1 net loss – right now – but is expected to show a heavy sequential EPS decline when it reports first quarter financial results.

The upshot is, ON shares are selling at a deep discount, and combined with a clear path forward, that makes for an attractive point of entry. Stoss, in his Craig-Hallum notes on the stock, outlines that path forward: “We highlight ON is 85-90% insourced and can likely shift production to 100% insourced to protect GMs. Additionally, with networks being constrained with the world moving online driving a faster rollout of 5G as well as higher bandwidth needs from datacenters, ON should see ramping demand for both its 5G infrastructure and data center products.”

In line with his upbeat mid- to long-term outlook on ON, Stoss gives the stock a $20 price target, implying an eye-opening 72% upside potential. He rates the stock as a Buy, of course.

ON Semi has received 17 analyst reviews in recent weeks. Their breakdown – 8 Buys, 6 Holds, and 3 Sells – gives the stock a Moderate Buy consensus rating. The mixed ratings reflect some Wall Street caution after the stock’s sharp decline in recent months. The average price target, however, at $20.56, indicates a 48% upside potential, and suggests the possible rewards for investors willing to shoulder the risk. (See ON stock analysis at TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

The post Craig Hallum: 3 Top Tech Picks With Over 40% Upside Potential appeared first on TipRanks Financial Blog.

Government

Survey Shows Declining Concerns Among Americans About COVID-19

Survey Shows Declining Concerns Among Americans About COVID-19

A new survey reveals that only 20% of Americans view covid-19 as "a major threat"…

A new survey reveals that only 20% of Americans view covid-19 as "a major threat" to the health of the US population - a sharp decline from a high of 67% in July 2020.

What's more, the Pew Research Center survey conducted from Feb. 7 to Feb. 11 showed that just 10% of Americans are concerned that they will catch the disease and require hospitalization.

"This data represents a low ebb of public concern about the virus that reached its height in the summer and fall of 2020, when as many as two-thirds of Americans viewed COVID-19 as a major threat to public health," reads the report, which was published March 7.

According to the survey, half of the participants understand the significance of researchers and healthcare providers in understanding and treating long COVID - however 27% of participants consider this issue less important, while 22% of Americans are unaware of long COVID.

What's more, while Democrats were far more worried than Republicans in the past, that gap has narrowed significantly.

"In the pandemic’s first year, Democrats were routinely about 40 points more likely than Republicans to view the coronavirus as a major threat to the health of the U.S. population. This gap has waned as overall levels of concern have fallen," reads the report.

More via the Epoch Times;

The survey found that three in ten Democrats under 50 have received an updated COVID-19 vaccine, compared with 66 percent of Democrats ages 65 and older.

Moreover, 66 percent of Democrats ages 65 and older have received the updated COVID-19 vaccine, while only 24 percent of Republicans ages 65 and older have done so.

“This 42-point partisan gap is much wider now than at other points since the start of the outbreak. For instance, in August 2021, 93 percent of older Democrats and 78 percent of older Republicans said they had received all the shots needed to be fully vaccinated (a 15-point gap),” it noted.

COVID-19 No Longer an Emergency

The U.S. Centers for Disease Control and Prevention (CDC) recently issued its updated recommendations for the virus, which no longer require people to stay home for five days after testing positive for COVID-19.

The updated guidance recommends that people who contracted a respiratory virus stay home, and they can resume normal activities when their symptoms improve overall and their fever subsides for 24 hours without medication.

“We still must use the commonsense solutions we know work to protect ourselves and others from serious illness from respiratory viruses, this includes vaccination, treatment, and staying home when we get sick,” CDC director Dr. Mandy Cohen said in a statement.

The CDC said that while the virus remains a threat, it is now less likely to cause severe illness because of widespread immunity and improved tools to prevent and treat the disease.

“Importantly, states and countries that have already adjusted recommended isolation times have not seen increased hospitalizations or deaths related to COVID-19,” it stated.

The federal government suspended its free at-home COVID-19 test program on March 8, according to a website set up by the government, following a decrease in COVID-19-related hospitalizations.

According to the CDC, hospitalization rates for COVID-19 and influenza diseases remain “elevated” but are decreasing in some parts of the United States.

International

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

Government

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While “Waiting” For Deporation, Asylum

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While "Waiting" For Deporation, Asylum

Over the past several…

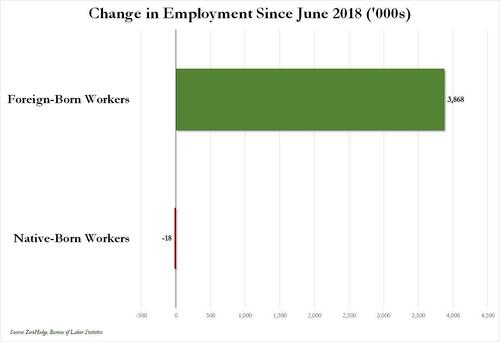

Over the past several months we've pointed out that there has been zero job creation for native-born workers since the summer of 2018...

... and that since Joe Biden was sworn into office, most of the post-pandemic job gains the administration continuously brags about have gone foreign-born (read immigrants, mostly illegal ones) workers.

And while the left might find this data almost as verboten as FBI crime statistics - as it directly supports the so-called "great replacement theory" we're not supposed to discuss - it also coincides with record numbers of illegal crossings into the United States under Biden.

In short, the Biden administration opened the floodgates, 10 million illegal immigrants poured into the country, and most of the post-pandemic "jobs recovery" went to foreign-born workers, of which illegal immigrants represent the largest chunk.

'But Tyler, illegal immigrants can't possibly work in the United States whilst awaiting their asylum hearings,' one might hear from the peanut gallery. On the contrary: ever since Biden reversed a key aspect of Trump's labor policies, all illegal immigrants - even those awaiting deportation proceedings - have been given carte blanche to work while awaiting said proceedings for up to five years...

... something which even Elon Musk was shocked to learn.

Wow, learn something new every day https://t.co/8MDtEEZGam

— Elon Musk (@elonmusk) March 10, 2024

Which leads us to another question: recall that the primary concern for the Biden admin for much of 2022 and 2023 was soaring prices, i.e., relentless inflation in general, and rising wages in particular, which in turn prompted even Goldman to admit two years ago that the diabolical wage-price spiral had been unleashed in the US (diabolical, because nothing absent a major economic shock, read recession or depression, can short-circuit it once it is in place).

Well, there is one other thing that can break the wage-price spiral loop: a flood of ultra-cheap illegal immigrant workers. But don't take our word for it: here is Fed Chair Jerome Powell himself during his February 60 Minutes interview:

PELLEY: Why was immigration important?

POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans do. But that's largely because of the age difference. They tend to skew younger.

PELLEY: Why is immigration so important to the economy?

POWELL: Well, first of all, immigration policy is not the Fed's job. The immigration policy of the United States is really important and really much under discussion right now, and that's none of our business. We don't set immigration policy. We don't comment on it.

I will say, over time, though, the U.S. economy has benefited from immigration. And, frankly, just in the last, year a big part of the story of the labor market coming back into better balance is immigration returning to levels that were more typical of the pre-pandemic era.

PELLEY: The country needed the workers.

POWELL: It did. And so, that's what's been happening.

Translation: Immigrants work hard, and Americans are lazy. But much more importantly, since illegal immigrants will work for any pay, and since Biden's Department of Homeland Security, via its Citizenship and Immigration Services Agency, has made it so illegal immigrants can work in the US perfectly legally for up to 5 years (if not more), one can argue that the flood of illegals through the southern border has been the primary reason why inflation - or rather mostly wage inflation, that all too critical component of the wage-price spiral - has moderated in in the past year, when the US labor market suddenly found itself flooded with millions of perfectly eligible workers, who just also happen to be illegal immigrants and thus have zero wage bargaining options.

None of this is to suggest that the relentless flood of immigrants into the US is not also driven by voting and census concerns - something Elon Musk has been pounding the table on in recent weeks, and has gone so far to call it "the biggest corruption of American democracy in the 21st century", but in retrospect, one can also argue that the only modest success the Biden admin has had in the past year - namely bringing inflation down from a torrid 9% annual rate to "only" 3% - has also been due to the millions of illegals he's imported into the country.

We would be remiss if we didn't also note that this so often carries catastrophic short-term consequences for the social fabric of the country (the Laken Riley fiasco being only the latest example), not to mention the far more dire long-term consequences for the future of the US - chief among them the trillions of dollars in debt the US will need to incur to pay for all those new illegal immigrants Democrat voters and low-paid workers. This is on top of the labor revolution that will kick in once AI leads to mass layoffs among high-paying, white-collar jobs, after which all those newly laid off native-born workers hoping to trade down to lower paying (if available) jobs will discover that hardened criminals from Honduras or Guatemala have already taken them, all thanks to Joe Biden.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex