China’s COVID crisis and the dilemma facing its leaders, by experts who have monitored it since the Wuhan outbreak

What can China do to resolve a crisis that threatens not only the health and security of its people and economy, but the future of Chinese Communist Party…

More than two years after a deadly strain of coronavirus was first identified in the central city of Wuhan, China remains locked in a COVID crisis. Around 400 million people are currently thought to be living under some form of lockdown across the country. One of China’s largest cities, Shanghai, has been paralysed for the past month, with many of its residents hemmed in by hastily erected metal fences. The capital, Beijing, is now striving to avoid a similar fate.

The extraordinary story of China’s ongoing, and increasingly desperate, struggle against COVID-19 combines hubris at its own early public health successes with a failure to sufficiently vaccinate its elderly people, and is fuelled by rising anti-Western sentiment over the last five years. The result is that China now faces a dilemma: either the high numbers of deaths and overwhelmed health services that would result from a rampant virus, or the rapidly mounting social and economic costs of prolonged lockdowns and stay-at-home orders nationwide.

But resolving China’s COVID dilemma and finding a route out of the pandemic is complicated by the difficulties of challenging a “zero-COVID” strategy so closely associated with China’s top leader, Xi Jinping. Xi is due to be re-appointed for a controversial third term as General Secretary of the Chinese Communist Party at its five-yearly Congress in the autumn. He will not want a rampant virus and high death rates to tarnish his reputation and undermine his, and the Party’s, claims that they have handled the pandemic better than other countries.

How did China get to this point? And what can it do to resolve a crisis that threatens not just the health and security of its people, but of the world’s largest economy – and those of the many countries that rely on its vast supply chains. At the University of Glasgow’s Scottish Centre for China Research, we have been tracking the rollercoaster evolution of the Chinese government’s COVID strategy, and the impacts of its containment measures, since news of the virus first reached us in early 2020. Combining on-the-ground reports from researchers with reviews of policy documents and social media outpourings, this is our analysis of China’s COVID crisis – present, past and future.

Groundhog day

“Every day I wake up to find it is the first day of the 14-day cycle.” This is the title of a Wechat blogpost (now deleted) by Wei Zhou, a well-known reporter, columnist and long-term resident of Shanghai. The city he shares with more than 26 million people has been under a strict COVID lockdown for more than a month now. Wei Zhou’s title refers to the regulation that states a residential compound’s 14-day lockdown period must reset to zero every time someone new tests positive. As a result, residents find themselves in a world of Kafka-esque absurdity, potentially subject to the ire of their neighbours if they test positive, unsure about what happens next.

But just as Shanghai residents may now regard every day as Groundhog Day, the Communist Party leadership might also be wondering how China can escape this pandemic – and the dilemma it has created. More than two years after the first COVID lockdown in Wuhan, China is again struggling to contain the spread of the latest variant, omicron.

In a desperate attempt to avoid the socioeconomic chaos and political damage seen in Shanghai, China’s capital Beijing began eight rounds of mass testing in early May following an outbreak of cases. It has re-opened a mass isolation centre, forbidden dining in all restaurants, and closed kindergartens, schools and colleges until at least May 11. The situation is fast-changing: all 6.6 million residents of Chaoyang and Haidian districts have just been told to follow stay-at-home orders, three metro lines have been suspended and six others partially closed.

Meanwhile in Shanghai, whose streets remain hauntingly empty despite falling infection rates, the future is unclear. Since cases began to appear in early March, residents have experienced a series of measures that demonstrate the authorities’ still-evolving approach to dealing with outbreaks. After first sealing off Shanghai, cutting transport links in and out, they rolled out mass testing across the entire population, dividing the city into two halves and preventing movement in between. They then introduced three-zone prevention and control measures that divided the city into “sealed control zones” subject to stay-at-home orders, “managed control zones” allowing people limited local mobility, and “precautionary zones” with (supposedly) fewer restrictions.

This story is part of Conversation Insights

The Insights team generates long-form journalism and is working with academics from different backgrounds who have been engaged in projects to tackle societal and scientific challenges.

In theory, this approach would avoid a city-wide lockdown through highly localised measures. In practice, it has done the opposite because the rules have been implemented so strictly. Despite infection rates falling steadily since mid-April, even residents in precautionary zones still need a permit to leave their immediate area and go on to the streets. Private cars require a permit to move around the city. University students in Shanghai have been notified their classes will continue online until at least the end of June.

At the same time as doubling down on their efforts to contain omicron, the Chinese authorities have done their best to downplay them. Local governments sometimes employ euphemistic terms while asserting they are not deploying city-wide lockdowns. The three-zone policy is an example, but while it creates confusion for residents – such that Tencent and other online companies now provide real-time maps of restrictions in different neighbourhoods and cities – it also offers some hope of a route to fewer restrictions. In so doing, it may switch residents’ attention from criticising the government to caring about case numbers in their neighbourhoods.

And while Shanghai’s lockdown has made the news internationally, it is far from the only place to be experiencing severe restrictions. Reliable national figures on the extent of travel restrictions and stay-at-home orders are difficult to acquire, but it has been estimated that between 45 and 87 of China’s cities, from the north-east to the south-west, may now have some form of stay-at-home order in place. Even before Beijing and Zhengzhou, capital of Henan province, went into lockdown on May 4, estimates suggested as many as 375 million people were affected.

The countryside is being hit too, even in less densely populated rural areas. Farmers in some parts of the north-east require “spring sowing certificates” to be able to work their fields. At least one farmer has been detained for breaking COVID restrictions while simply working alone in his field.

Rising social and economic costs

For some Chinese citizens, the social costs of the authorities’ stringent measures have been extremely serious – and in some cases, fatal. With stay-at-home orders heavy-handedly enforced by officials under pressure to prevent the virus spreading, we have seen numerous reports on social media of delivery drivers being confined in residential compounds, shoppers returning home to find they are unable to get back into their apartments, and children as young as two being separated from their parents and forced to quarantine in isolation centres. With highways and service areas around Shanghai closed at short notice, many drivers have been trapped inside their trucks, including one who spent two weeks on the road between Chongqing and Shanghai – a drive that should have taken two days.

Read more: COVID: China is developing its own mRNA vaccine – and it's showing early promise

In some parts of Shanghai, residents have suffered food shortages. Others have been unable to seek hospital treatment because they cannot get the permits they now need for treatment of even chronic and terminal illnesses. A 98-year-old woman died while waiting for a COVID test result before she could get medical treatment for chronic renal failure, and an elderly man died because he could not get his regular dialysis treatment. A retired infectious disease expert, Dr Miu Xiaohui, estimated in a subsequently-censored blogpost that the excess mortality from diabetes alone during Shanghai’s one-month lockdown had been 2,141 people.

Suicides, mental health issues and other social problems have been reported on Chinese social media. In Shanghai, a female journalist apparently fell from a building on May 5 after her anti-depressants ran out and a district health official reportedly took his own life while at work on April 13 due to the stress of his COVID enforcement duties. Meanwhile, across China’s locked-down cities, we have seen reports that domestic violence is on the rise. The charity Orange Umbrella, which campaigns against gender violence, published three posts on May 5 under the heading: “A Guide for Seeking Help in Lockdown”.

And then there are the economic costs. In Shanghai, suspended manufacturing activities can only restart if businesses commit to “closed loop management” – a system used during the recent Winter Olympics in Beijing that creates a self-contained environment so the virus cannot be brought in. Employees are required to remain on site at all times – difficult for employers with no dormitory facilities. Production problems, compounded by difficulties transporting goods due to travel restrictions, are currently disrupting supply chains in the Shanghai area, with knock-on effects for global supply chains.

Within China, consumer demand is down, negatively affecting financial markets, and China’s currency, the Renminbi, has been weakened. The International Monetary Fund has revised down its economic growth forecast for China in 2022 from 5.5% last October to 4.4% in April, with some investment banks even less optimistic.

There are more than 70,000 foreign-invested companies in Shanghai alone. According to a survey by the EU Chamber of Commerce in China, 65% of responding EU companies’ logistics and warehousing and 53% of their supply chains are being “significantly” disrupted by China’s zero-COVID strategy. It reports: “Supply chains have taken a pounding … 23% of respondents are now considering shifting current or planned investments out of China to other markets – more than double the number that were considering doing so at the beginning of 2022, and the highest proportion in a decade.”

Frustration, criticism and censorship

As the social and economic costs rise, the Chinese authorities are encountering more dissatisfaction and online criticism than at any time in the pandemic. In Shanghai in particular, some residents have reached the end of their tether, leading to disputes with local officials in the streets, and refusals to take tests or go into centralised isolation facilities. A blog entitled “Shanghainese endurance has reached the extreme point”, published by the anonymous Ordinary Shanghainese, received more than 20 million hits.

While the government stubbornly maintains its dynamic zero-COVID strategy, overzealous implementation by local officials has sparked outrage and a sense that the anti-COVID policies are more damaging than the virus itself. A fierce argument broke out in Shanghai, for example, when local officials tried to seal residents’ front doors to keep them in their apartments, attracting widespread attention. Confined to their homes, Chinese citizens can still share their experiences and frustrations online using the social media platforms WeChat, Tik-tok and the microblogging site Sina Weibo. Despite government efforts to censor this content, our researchers pick up some of what is being said before it is removed, while some also reaches international audiences via Twitter in particular.

These netizens’ posts and videos show citizens coming together to bulk-buy food and basic necessities, as well as satirising the authorities and exposing problems. A video of an official brutally killing a pet dog inspired outrage across Chinese social media before being censored. A video called Voices of April, a compilation of Shanghai citizens’ pleas for help and cries of distress, also went viral, as have rap songs mocking the government’s policies and slogans. Other users have collated online data about deaths – so far they claim at least 197 – linked to the Shanghai containment measures rather than the virus itself, using blockchain so their statistics cannot be deleted.

Residents’ online reports and opinions are mixed with those of medical researchers, local officials and COVID volunteers. These personal, family stories demystify and sometimes defy the official picture of omicron, which continues to dominate state-affiliated television, radio and social media accounts. China’s generational digital divide means older people who are dependent on traditional media for their information may typically be much less critical of the situation.

Despite some attempts to question how the pandemic is currently being handled, the Chinese government’s policy remains “dynamic zero” or “static management” – enforcing localised lockdowns throughout the country. But why? First, an uncontrolled spread of COVID coupled with its low vaccination rates among older people could lead to overwhelmed hospitals and high fatality rates, as was seen recently in Hong Kong.

But there is also a political dimension to the dilemma facing China’s authorities. President Xi has personally advocated the zero-tolerance approach and is closely associated with it. He is reported to have told the World Health Organization’s Director-General, Dr Tedros Adhanom Ghebreyesus, that he was “personally commanding” the response. He restated his commitment to the policy this year and, during the Winter Olympics in February, quoted an international athlete saying that China deserved a “gold medal” for its COVID control.

Read more: Silenced in China: the COVID 'truth-tellers' and political dissent

Should the virus spread out of control, the damage to Xi could be highly significant in this politically important year. The 20th Communist Party Congress will take place sometime in the autumn, and a devastating spread of the virus could jeopardise Xi’s chances of reappointment. This means there is even greater pressure on local officials to prevent and contain outbreaks, and the result is the excesses that have been seen. Local officials have sometimes deployed mass testing and stay-at-home orders even when there have been only a handful of cases – for example, in Baotou after two cases, in Baoding after four cases, and in Shaoyang in Hunan province after just one case. Elsewhere, the city government of Qian‘an in Hebei province has demanded that its residents should hand over the keys to their homes to prevent them from leaving.

How did China get here?

When the opthalmologist Li Wenliang warned colleagues in his WeChat group of a dangerous new virus spreading in Wuhan in late December 2019, he was silenced and reprimanded for spreading rumours. The local government covered up and played down the seriousness of the situation. Yet three weeks later, the Chinese authorities were forced to publicly acknowledge “human-to-human” COVID-19 transmission, and announce the sudden lockdown of this entire city.

When Li died of COVID in early February 2020, public outrage appeared briefly to be threatening the Communist Party’s authority and legitimacy. Yet the Party managed to turn this situation around. It deployed its substantial powers to censor online criticism and generate positive (often nationalist) media narratives, calling for the Chinese nation to support its heroic doctors and locked down citizens in Wuhan.

Many of the personal tragedies in Wuhan during January and February 2020 were widely shared on social media: the teenager with cerebral palsy who died after his carers were taken away to an isolation centre; the migrants without work and income; people dragged from their homes after testing positive. But the Party’s internet and traditional media censors and controls gradually established a more positive narrative while removing these stories and accounts of overwhelmed hospitals, morgues and crematoriums.

At the same time, the authorities mobilised all their resources to create and adapt containment measures, building two enormous (temporary) cabin hospitals and ensuring supplies of food, medicine and doctors into Wuhan. Travel restrictions and strictly policed stay-at-home orders, mass testing and “centralised isolation” of close contacts – though painful for some citizens – appeared to be vindicated when infections fell to zero and the number of reported deaths remained static at fewer than 5,000.

Read more: Why politicians should be wary of publicly pursuing the Wuhan lab-leak investigation

State-controlled media began to boast that this demonstrated the superiority of China’s political system as compared with western democracies. They reported the high numbers of COVID deaths in the US and Europe, building on the Party’s call in 2012 for greater national confidence, and ratcheting up nationalist and anti-western rhetoric that had been fuelled by a trade war with the US during the Trump administration.

After Wuhan was reopened in early April 2020, just as COVID cases were soaring around the world, the Chinese authorities moved to hone the approach they had developed. They shifted from whole-city lockdowns to a more targeted approach that restricted movement only in residential areas where cases emerged. In late-summer 2020, this “dynamic zero” approach successfully contained isolated outbreaks in Hebei and Beijing, then elsewhere during 2021. The Party-led “war against COVID” had seemingly turned the situation around.

China’s key mistakes

It now looks, however, as though hubris over the successful containment of COVID in 2020 and 2021 led the Chinese leadership to underestimate the importance of vaccinating the most vulnerable of its population. Furthermore, nationalist rhetoric around the pandemic has led it to rely solely on Chinese-produced vaccines.

As the world raced to develop COVID vaccines in 2020, the Chinese authorities pumped resources into their own vaccine development. But Chinese vaccines, which use long-established techniques, have proved less effective than new mRNA vaccines available internationally: Hong Kong scientists have recommended a fourth shot of Sinovac’s CoronaVac vaccine to ensure full protection. Despite this, the Chinese authorities still have not imported vaccines, instead investing in developing mRNA vaccines – yet to be approved – at home.

Compounding the problems of this nationalist vaccine strategy, the authorities sought first to vaccinate healthcare workers and other frontline workers, rather than older cohorts of the population. This made sense in 2020, when infection rates nationwide were low, but as vaccinations were rolled out nationwide, we saw an insufficient push to reach the elderly. So while overall levels of vaccination seem high at around 86%, older people are still much less likely to be adequately vaccinated.

In April 2022, China’s National Health Commission reported that 44% of people aged 60–69, 52% of people aged 70–79, and 81% of people aged over 80 had not had a third (booster) dose. This means some 92 million people in China over the age of 60 are at risk of serious illness and death. In Hong Kong, which had a similar pattern (58%, 69% and 83% in the same three age groups) but used the better-performing BioNTech vaccine as well as CoronaVac, an outbreak of the omicron variant from mid-February to April 2022 led to the world’s highest-recorded death rates.

The reason for the low vaccination rates among older Chinese people is not well understood. However, it seems to be a combination of China’s policy of not prioritising older groups, a lack of trust in the vaccine and fears about adverse health effects of the vaccines on the elderly. More recently, the available medical resources have been concentrated on mass testing, perhaps at the expense of vaccinating people.

Today, the Chinese government still reports relatively low rates of COVID infections and deaths compared with many other countries around the world. Indeed, until recently, its reported deaths had barely increased since the original Wuhan outbreak was brought under control. However, official deaths in the Shanghai outbreak are creeping up: by May 7, 535 deaths caused by COVID had been declared, taking the total in China since the start of the pandemic to 5,166. But a recent BBC report questioned the reliability of these numbers, suggesting that many COVID-related deaths were going unrecorded.

Because Xi and the rest of the Communist Party leadership have made clear their priority is to minimise COVID deaths, and since they have used their low death figures to tout the superiority of their political system, officials nationwide are under pressure to keep deaths low and may be encouraged to under-count or under-report them. But herein lies another dilemma: if the Shanghai numbers are so low, this leaves the authorities open to criticism that its anti-COVID policies are excessive, with as many people at risk from the consequences of containment than from the virus itself.

Another challenge to China shifting its COVID policy may, in fact, be its success in communicating how deadly the virus is. In early March 2022, when some university students tested positive in Jilin Province, fellow students on the same dormitory floor were distraught – horrified they might die from COVID. Another citizen was reportedly relieved to have been diagnosed with lung cancer rather than COVID. And in Shanghai last month, some residents refused to have any contact with their neighbours who had returned from a cabin isolation centre, even after they had tested negative for the virus.

Policy shift ruled out

Even if COVID is contained in Shanghai, Beijing and other cities, China’s citizens face the continued prospect of restrictions being imposed at any moment. There is no indication that the Communist Party leadership intends to modify its approach, despite several high-profile medical professionals recently signalling that an exit strategy is needed.

On May 5, Chinese state media reported a speech by President Xi in which he not only reiterated the leadership’s commitment to the zero-COVID policy, but also signalled that dissenting voices had been noticed but would not be heeded. A carefully choreographed shift in policy now seems to have been ruled out at least until the end of this year.

Read more: China: don't mistake Xi Jinping's crackdowns for a second Cultural Revolution

The leadership knows that any relaxation of the zero-COVID approach is likely to result in escalating deaths across the country, particularly given the pattern of vaccinations. Its policies – reliance on vaccines developed in China, failure to ensure that more vulnerable older people were fully vaccinated – therefore look like crucial errors, and ones for which the country is now paying a high price, both socially and economically. These errors have been ruthlessly exposed by the more transmissible omicron variant.

Given the Communist Party’s longstanding reliance on economic growth for support, it now faces an enormous challenge ahead of the autumn Party Congress, which some think will set Xi up as leader for life. While the authorities can censor criticism and information on the economic and social costs of its strategies, the threat of major outbreaks across China’s largest cities mean the risks remain high for Xi and his party. It will be a long six months until the Party Congress.

For you: more from our Insights series:

How China combined authoritarianism with capitalism to create a new communism

Embracing uncertainty: what Kenyan herders can teach us about living in a volatile world

To hear about new Insights articles, join the hundreds of thousands of people who value The Conversation’s evidence-based news. Subscribe to our newsletter.

Jane Duckett receives funding from the United Kingdom's Medical Research Council and the National Institute for Health Research.

Meixuan Chen receives funding from the United Kingdom's Medical Research Council and the National Institute for Health Research.

William Wang receives funding from the United Kingdom's Medical Research Council and the National Institute for Health Research.

blockchain pandemic coronavirus covid-19 goldInternational

MIPIM 2024 Reflects Mixed Feelings on CRE Recovery

Reportedly, concerns at the forefront include the plunging commercial real estate market (CRE). During the pandemic, many offices were vacated by staff,…

Reportedly, concerns at the forefront include the plunging commercial real estate market (CRE). During the pandemic, many offices were vacated by staff, and businesses established remote work practices. Since then, the market never fully recovered.

Based on Reuters information, the 20,000 attendees include property giants such as LaSalle, Greystar, AEW, Patrizia and Federated Hermes (FHI.N). Some representatives were cautiously optimistic and said there are tentative indications of CRE recovery.

Others, such as the head of Europe at LaSalle Investment Management, Philip La Pierre, could have been more positive. He reportedly said:

There’s a lot of hot air being pushed through the Croisette. So you’ve got to navigate that quite carefully.

Rising borrowing costs and post-pandemic open offices cast a shadow on property investments. Reuters reported that year-on-year European commercial capital values dropped by 13.9% in the last quarter of 2023. La Pierre opined that about 30% of European office space is a waste.

Don’t miss out the latest news, subscribe to LeapRate’s newsletter

The US commercial property sector mirrored the European situation. An 11 March 2024 MSCI report indicated that deteriorating office prices placed a yoke on the performance of the entire property market. This report did, however, note the uptick in the European hotel market.

The post MIPIM 2024 Reflects Mixed Feelings on CRE Recovery appeared first on LeapRate.

real estate pandemic recovery european europeInternational

Net Zero, The Digital Panopticon, & The Future Of Food

Net Zero, The Digital Panopticon, & The Future Of Food

Authored by Colin Todhunter via Off-Guardian.org,

The food transition, the energy…

Authored by Colin Todhunter via Off-Guardian.org,

The food transition, the energy transition, net-zero ideology, programmable central bank digital currencies, the censorship of free speech and clampdowns on protest. What’s it all about? To understand these processes, we need to first locate what is essentially a social and economic reset within the context of a collapsing financial system.

Writer Ted Reece notes that the general rate of profit has trended downwards from an estimated 43% in the 1870s to 17% in the 2000s. By late 2019, many companies could not generate enough profit. Falling turnover, squeezed margins, limited cashflows and highly leveraged balance sheets were prevalent.

Professor Fabio Vighi of Cardiff University has described how closing down the global economy in early 2020 under the guise of fighting a supposedly new and novel pathogen allowed the US Federal Reserve to flood collapsing financial markets (COVID relief) with freshly printed money without causing hyperinflation. Lockdowns curtailed economic activity, thereby removing demand for the newly printed money (credit) in the physical economy and preventing ‘contagion’.

According to investigative journalist Michael Byrant, €1.5 trillion was needed to deal with the crisis in Europe alone. The financial collapse staring European central bankers in the face came to a head in 2019. The appearance of a ‘novel virus’ provided a convenient cover story.

The European Central Bank agreed to a €1.31 trillion bailout of banks followed by the EU agreeing to a €750 billion recovery fund for European states and corporations. This package of long-term, ultra-cheap credit to hundreds of banks was sold to the public as a necessary programme to cushion the impact of the pandemic on businesses and workers.

In response to a collapsing neoliberalism, we are now seeing the rollout of an authoritarian great reset — an agenda that intends to reshape the economy and change how we live.

SHIFT TO AUTHORITARIANISM

The new economy is to be dominated by a handful of tech giants, global conglomerates and e-commerce platforms, and new markets will also be created through the financialisation of nature, which is to be colonised, commodified and traded under the notion of protecting the environment.

In recent years, we have witnessed an overaccumulation of capital, and the creation of such markets will provide fresh investment opportunities (including dodgy carbon offsetting Ponzi schemes) for the super-rich to park their wealth and prosper.

This great reset envisages a transformation of Western societies, resulting in permanent restrictions on fundamental liberties and mass surveillance. Being rolled out under the benign term of a ‘Fourth Industrial Revolution’, the World Economic Forum (WEF) says the public will eventually ‘rent’ everything they require (remember the WEF video ‘you will own nothing and be happy’?): stripping the right of ownership under the guise of a ‘green economy’ and underpinned by the rhetoric of ‘sustainable consumption’ and ‘climate emergency’.

Climate alarmism and the mantra of sustainability are about promoting money-making schemes. But they also serve another purpose: social control.

Neoliberalism has run its course, resulting in the impoverishment of large sections of the population. But to dampen dissent and lower expectations, the levels of personal freedom we have been used to will not be tolerated. This means that the wider population will be subjected to the discipline of an emerging surveillance state.

To push back against any dissent, ordinary people are being told that they must sacrifice personal liberty in order to protect public health, societal security (those terrible Russians, Islamic extremists or that Sunak-designated bogeyman George Galloway) or the climate. Unlike in the old normal of neoliberalism, an ideological shift is occurring whereby personal freedoms are increasingly depicted as being dangerous because they run counter to the collective good.

The real reason for this ideological shift is to ensure that the masses get used to lower living standards and accept them. Consider, for instance, the Bank of England’s chief economist Huw Pill saying that people should ‘accept’ being poorer. And then there is Rob Kapito of the world’s biggest asset management firm BlackRock, who says that a “very entitled” generation must deal with scarcity for the first time in their lives.

At the same time, to muddy the waters, the message is that lower living standards are the result of the conflict in Ukraine and supply shocks that both the war and ‘the virus’ have caused.

The net-zero carbon emissions agenda will help legitimise lower living standards (reducing your carbon footprint) while reinforcing the notion that our rights must be sacrificed for the greater good. You will own nothing, not because the rich and their neoliberal agenda made you poor but because you will be instructed to stop being irresponsible and must act to protect the planet.

NET-ZERO AGENDA

But what of this shift towards net-zero greenhouse gas emissions and the plan to slash our carbon footprints? Is it even feasible or necessary?

Gordon Hughes, a former World Bank economist and current professor of economics at the University of Edinburgh, says in a new report that current UK and European net-zero policies will likely lead to further economic ruin.

Apparently, the only viable way to raise the cash for sufficient new capital expenditure (on wind and solar infrastructure) would be a two decades-long reduction in private consumption of up to 10 per cent. Such a shock has never occurred in the last century outside war; even then, never for more than a decade.

But this agenda will also cause serious environmental degradation. So says Andrew Nikiforuk in the article The Rising Chorus of Renewable Energy Skeptics, which outlines how the green techno-dream is vastly destructive.

He lists the devastating environmental impacts of an even more mineral-intensive system based on renewables and warns:

“The whole process of replacing a declining system with a more complex mining-based enterprise is now supposed to take place with a fragile banking system, dysfunctional democracies, broken supply chains, critical mineral shortages and hostile geopolitics.”

All of this assumes that global warming is real and anthropogenic. Not everyone agrees. In the article Global warming and the confrontation between the West and the rest of the world, journalist Thierry Meyssan argues that net zero is based on political ideology rather than science. But to state such things has become heresy in the Western countries and shouted down with accusations of ‘climate science denial’.

Regardless of such concerns, the march towards net zero continues, and key to this is the United Nations Agenda 2030 for Sustainable Development Goals.

Today, almost every business or corporate report, website or brochure includes a multitude of references to ‘carbon footprints’, ‘sustainability’, ‘net zero’ or ‘climate neutrality’ and how a company or organisation intends to achieve its sustainability targets. Green profiling, green bonds and green investments go hand in hand with displaying ‘green’ credentials and ambitions wherever and whenever possible.

It seems anyone and everyone in business is planting their corporate flag on the summit of sustainability. Take Sainsbury’s, for instance. It is one of the ‘big six’ food retail supermarkets in the UK and has a vision for the future of food that it published in 2019.

Here’s a quote from it:

“Personalised Optimisation is a trend that could see people chipped and connected like never before. A significant step on from wearable tech used today, the advent of personal microchips and neural laces has the potential to see all of our genetic, health and situational data recorded, stored and analysed by algorithms which could work out exactly what we need to support us at a particular time in our life. Retailers, such as Sainsbury’s could play a critical role to support this, arranging delivery of the needed food within thirty minutes — perhaps by drone.”

Tracked, traced and chipped — for your own benefit. Corporations accessing all of our personal data, right down to our DNA. The report is littered with references to sustainability and the climate or environment, and it is difficult not to get the impression that it is written so as to leave the reader awestruck by the technological possibilities.

However, the promotion of a brave new world of technological innovation that has nothing to say about power — who determines policies that have led to massive inequalities, poverty, malnutrition, food insecurity and hunger and who is responsible for the degradation of the environment in the first place — is nothing new.

The essence of power is conveniently glossed over, not least because those behind the prevailing food regime are also shaping the techno-utopian fairytale where everyone lives happily ever after eating bugs and synthetic food while living in a digital panopticon.

FAKE GREEN

The type of ‘green’ agenda being pushed is a multi-trillion market opportunity for lining the pockets of rich investors and subsidy-sucking green infrastructure firms and also part of a strategy required to secure compliance required for the ‘new normal’.

It is, furthermore, a type of green that plans to cover much of the countryside with wind farms and solar panels with most farmers no longer farming. A recipe for food insecurity.

Those investing in the ‘green’ agenda care first and foremost about profit. The supremely influential BlackRock invests in the current food system that is responsible for polluted waterways, degraded soils, the displacement of smallholder farmers, a spiralling public health crisis, malnutrition and much more.

It also invests in healthcare — an industry that thrives on the illnesses and conditions created by eating the substandard food that the current system produces. Did Larry Fink, the top man at BlackRock, suddenly develop a conscience and become an environmentalist who cares about the planet and ordinary people? Of course not.

Any serious deliberations on the future of food would surely consider issues like food sovereignty, the role of agroecology and the strengthening of family farms — the backbone of current global food production.

The aforementioned article by Andrew Nikiforuk concludes that, if we are really serious about our impacts on the environment, we must scale back our needs and simplify society.

In terms of food, the solution rests on a low-input approach that strengthens rural communities and local markets and prioritises smallholder farms and small independent enterprises and retailers, localised democratic food systems and a concept of food sovereignty based on self-sufficiency, agroecological principles and regenerative agriculture.

It would involve facilitating the right to culturally appropriate food that is nutritionally dense due to diverse cropping patterns and free from toxic chemicals while ensuring local ownership and stewardship of common resources like land, water, soil and seeds.

That’s where genuine environmentalism and the future of food begins.

Government

Five Aerospace Investments to Buy as Wars Worsen Copy

Five aerospace investments to buy as wars worsen give investors a chance to acquire shares of companies focused on fortifying national defense. The five…

Five aerospace investments to buy as wars worsen give investors a chance to acquire shares of companies focused on fortifying national defense.

The five aerospace investments to buy provide military products to help protect freedom amid Russia’s ongoing onslaught against Ukraine that began in February 2022, as well as supply arms in the Middle East used after Hamas militants attacked and murdered civilians in Israel on Oct. 7. Even though the S&P 500 recently reached all-time highs, these five aerospace investments have remained reasonably priced and rated as recommendations by seasoned analysts and a pension fund chairman.

State television broadcasts in Russia show the country’s soldiers advancing further into Ukrainian territory, but protests have occurred involving family members of those serving in perilous conditions in the invasion of their neighboring nation to be brought home. Even though hundreds of thousands of Russians also have fled to other countries to avoid compulsory military service, the aggressor’s President Vladimir Putin has vowed to continue to send additional soldiers into the fierce fighting.

While Russia’s land-grab of Crimea and other parts of Ukraine show no end in sight, Israel’s war with Hamas likely will last for at least additional months, according to the latest reports. United Nations’ leaders expressed alarm on Dec. 26 about intensifying Israeli attacks that killed more than 100 Palestinians over two days in part of the Gaza Strip, when 15 members of the Israel Defense Force (IDF) also lost their lives.

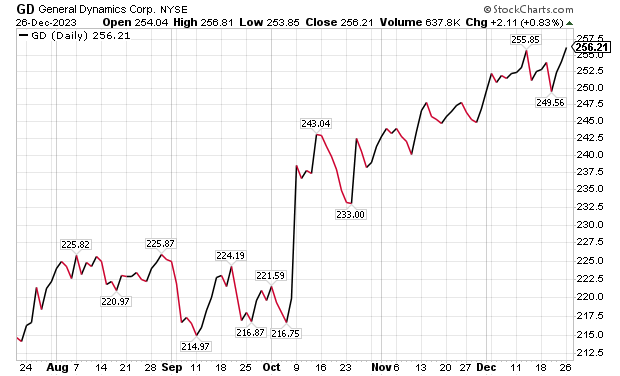

Five Aerospace Investments to Buy as Wars Worsen: General Dynamics

One of the five aerospace investments to buy as wars worsen is General Dynamics (NYSE: GD), a Reston, Virginia-based aerospace company with more than 100,000 employees in 70-plus countries. A key business unit of General Dynamics is Gulfstream Aerospace Corporation, a manufacturer of business aircraft. Other segments of General Dynamics focus on making military products such as Abrams tanks, Stryker fighting vehicles, ASCOD fighting vehicles like the Spanish PIZARRO and British AJAX, LAV-25 Light Armored Vehicles and Flyer-60 lightweight tactical vehicles.

For the U.S. Navy and other allied armed forces, General Dynamics builds Virginia-class attack submarines, Columbia-class ballistic missile submarines, Arleigh Burke-class guided missile destroyers, Expeditionary Sea Base ships, fleet logistics ships, commercial cargo ships, aircraft and naval gun systems, Hydra-70 rockets, military radios and command and control systems. In addition, the company provides radio and optical telescopes, secure mobile phones, PIRANHA and PANDUR wheeled armored vehicles and mobile bridge systems.

Chicago-based investment firm William Blair & Co. is among those recommending General Dynamics. The Chicago firm gave an “outperform” rating to General Dynamics in a Dec. 21 research note.

Gulfstream is seeking G700 FAA certification by the end of 2023, suggesting potentially positive news in the next 10 days, William Blair wrote in its recent research note. The investment firm projected that General Dynamics would trade upward upward upon the G700’s certification.

“General Dynamics’ 2023 aircraft delivery guidance of approximately 134 planes assumes that 19 G700s are delivered in the fourth quarter,” wrote William Blair’s aerospace and defense analyst Louie DiPalma. “Even if deliveries fall short of this target, we believe investors will take a glass-half-full approach upon receipt of the certification.”

Chart courtesy of www.stockcharts.com.

Five Aerospace Investments to Buy as Wars Worsen: GD Outlook

The G700 is a major focus area for investors because it is Gulfstream’s most significant aircraft introduction since the iconic G650 in 2012, DiPalma wrote. Gulfstream has the highest market share in the long-range jet segment of the private aircraft market, the highest profit margin of aircraft peers and the most premium business aviation brand, he added.

“The aircraft remains immensely popular today with corporations and high-net-worth individuals,” Di Palma wrote. “Elon Musk has reportedly placed an order for a G700 to go along with his existing G650. Qatar Airways announced at the Paris Air Show that 10 G700 aircraft will become part of its fleet.”

G700 deliveries and subsequent G800 deliveries are expected to be the cornerstone of Gulfstream’s growth and margin expansion for the next decade, DiPalma wrote. This should lead to a rebound in the stock price as the margins for the G700 and G800 are very attractive, he added.

Management’s guidance is for the aerospace operating margin to increase from about 13.2% in 2022 to roughly 14.0% in 2023 and 15.8% in 2024. Longer term, a high-teens profit margin appears within reach, DiPalma projected.

In other General Dynamics business segments, William Blair expects several yet-unannounced large contract awards for General Dynamics IT, to go along with C$1.7 billion, or US$1.29 billion, in General Dynamics Mission Systems contracts announced on Dec. 20 for the Canadian Army. General Dynamics shares are poised to have a strong 2024, William Blair wrote.

Five Aerospace Investments to Buy as Wars Worsen: VSE Corporation

Alexandria, Virginia-based VSE Corporation’s (NASDAQ: VSEC) price-to-earnings (P/E) valuation multiple of 22 received support when AAR Corp. (NYSE: AIR), a Wood Dale, Illinois, provider of aviation services, announced on Dec. 21 that it would acquire the product support business of Triumph Group (NYSE: TGI), a Berwyn, Pennsylvania, supplier of aerospace services, structures and systems. AAR’s purchase price of $725 million reflects confidence in a continued post-pandemic aerospace rebound.

VSE, a provider of aftermarket distribution and repair services for land, sea and air transportation assets used by government and commercial markets, is rated “outperform” by William Blair. The company’s core services include maintenance, repair and operations (MRO), parts distribution, supply chain management and logistics, engineering support, as well as consulting and training for global commercial, federal, military and defense customers.

“Robust consumer travel demand and aging aircraft fleets have driven elevated maintenance visits,” William Blair’s DiPalma wrote in a Dec. 21 research note. “The AAR–Triumph deal is valued at a premium 13-times 2024 EBITDA multiple, which was in line with the valuation multiple that Heico (NYSE: HEI) paid for Wencor over the summer.”

VSE currently trades at a discounted 9.5 times consensus 2024 earnings before interest, taxes, depreciation and amortization (EBITDA) estimates, as well as 11.6 times consensus 2023 EBITDA.

Five Aerospace Investments to Buy as Wars Worsen: VSE Undervalued?

“We expect that VSE shares will trend higher as investors process this deal,” DiPalma wrote. “VSE shares trade at 9.5 times consensus 2024 adjusted EBITDA, compared with peers and M&A comps in the 10-to-14-times range. We think that VSE’s multiple will expand as it closes the divestiture of its federal and defense business and makes strategic acquisitions. We see consistent 15% annual upside for shares as VSE continues to take share in the $110 billion aviation aftermarket industry.”

William Blair reaffirmed its “outperform” rating for VSE on Dec. 21. The main risk to VSE shares is lumpiness associated with its aviation services margins, Di Palma wrote. However, he raised 2024 estimates to further reflect commentary from VSE’s analysts’ day in November.

Chart courtesy of www.stockcharts.com.

Five Aerospace Investments to Buy as Wars Worsen: HEICO Corporation

HEICO Corporation (NYSEL: HEI), is a Hollywood, Florida-based technology-driven aerospace, industrial, defense and electronics company that also is ranked as an “outperform” investment by William Blair’s DiPalma. The aerospace aftermarket parts provider recently reported fourth-quarter financials above consensus analysts’ estimates, driven by 20% organic growth in HEICO’s flight support group.

HEICO’s management indicated that the performance of recently acquired Wencor is exceeding expectations. However, HEICO leaders offered color on 2024 organic growth and margin expectations that forecast reduced gains. Even though consensus estimates already assumed slowing growth, it is still not a positive for HEICO, DiPalma wrote.

William Blair forecasts 15% annual upside to HEICO’s shares, based on EBITDA growth. HEICO’s management cited a host of reasons for its quarterly outperformance, highlighted by the continued commercial air travel recovery. The company also referenced new product introductions and efficiency initiatives.

HEICO’s defense product sales increased by 26% sequentially, marking the third consecutive sequential increase in defense product revenue. The company’s leaders conveyed that defense in general is moving in the right direction to enhance financial performance.

Chart courtesy of www.stockcharts.com.

Five Dividend-paying Defense and Aerospace Investments to Purchase: XAR

A fourth way to obtain exposure to defense and aerospace investments is through SPDR S&P Aerospace and Defense ETF (XAR). That exchange-traded fund tracks the S&P Aerospace & Defense Select Industry Index. The fund is overweight in industrials and underweight in technology and consumer cyclicals, said Bob Carlson, a pension fund chairman who heads the Retirement Watch investment newsletter.

Bob Carlson, who heads Retirement Watch, answers questions from Paul Dykewicz.

XAR has 34 securities, and 44.2% of the fund is in the 10 largest positions. The fund is up 25.82% in the last 12 months, 22.03% in the past three months and 7.92% for the last month. Its dividend yield recently measured 0.38%.

The largest positions in the fund recently were Axon Enterprise (NASDAQ: AXON), Boeing (NYSE: BA), L3Harris Technologies (NYSE: LHX), Spirit Aerosystems (NYSE: SPR) and Virgin Galactic (NYSE: SPCE).

Chart courtesy of www.stockcharts.com

Five Dividend-paying Defense and Aerospace Investments to Purchase: PPA

The second fund recommended by Carlson is Invesco Aerospace & Defense ETF (PPA), which tracks the SPADE Defense Index. It has the same underweighting and overweighting as XAR, he said.

PPA recently held 52 securities and 53.2% of the fund was in its 10 largest positions. With so many holdings, the fund offers much reduced risk compared to buying individual stocks. The largest positions in the fund recently were Boeing (NYSE: BA), RTX Corp. (NYSE: RTX), Lockheed Martin (NYSE: LMT), Northrop Grumman (NYSE: NOC) and General Electric (NYSE:GE).

The fund is up 19.07% for the past year, 50.34% in the last three months and 5.30% during the past month. The dividend yield recently touched 0.69%.

Chart courtesy of www.stockcharts.com

Other Fans of Aerospace

Two fans of aerospace stocks are Mark Skousen, PhD, and seasoned stock picker Jim Woods. The pair team up to head the Fast Money Alert advisory service They already are profitable in their recent recommendation of Lockheed Martin (NYSE: LMT) in Fast Money Alert.

Mark Skousen, a scion of Ben Franklin, meets with Paul Dykewicz.

Jim Woods, a former U.S. Army paratrooper, co-heads Fast Money Alert.

Bryan Perry, who heads the Cash Machine investment newsletter and the Micro-Cap Stock Trader advisory service, recommends satellite services provider Globalstar (NYSE American: GSAT), of Covington, Louisiana, that has jumped 50.00% since he advised buying it two months ago. Perry is averaging a dividend yield of 11.14% in his Cash Machine newsletter but is breaking out with the red-hot recommendation of Globalstar in his Micro-Cap Stock Trader advisory service.

Bryan Perry heads Cash Machine, averaging an 11.14% dividend yield.

Military Equipment Demand Soars amid Multiple Wars

The U.S. military faces an acute need to adopt innovation, to expedite implementation of technological gains, to tap into the talents of people in various industries and to step-up collaboration with private industry and international partners to enhance effectiveness, U.S. Joint Chiefs of Staff Gen. Charles Q. Brown Jr. told attendees on Nov 16 at a national security conference. Prime examples of the need are showed by multiple raging wars, including the Middle East and Ukraine. A cold war involves China and its increasingly strained relationships with Taiwan and other Asian nations.

The shocking Oct. 7 attack by Hamas on Israel touched off an ongoing war in the Middle East, coupled with Russia’s February 2022 invasion and continuing assault of neighboring Ukraine. Those brutal military conflicts show the fragility of peace when determined aggressors are willing to use any means necessary to achieve their goals. To fend off such attacks, rapid and effective response is required.

“The Department of Defense is doing more than ever before to deter, defend, and, if necessary, defeat aggression,” Gen. Brown said at the National Security Innovation Forum at the Johns Hopkins University Bloomberg Center in Washington, D.C.

One of Russia’s war ships, the 360-foot-long Novocherkassk, was damaged on Dec. 26 by a Ukrainian attack on the Black Sea port of Feodosia in Crimea. This video of an explosion at the port that reportedly shows a section of the ship hit by aircraft-guided missiles.

Chairman Joint Chiefs of Staff Gen. Charles Q. Brown, Jr.

Photo By: Benjamin Applebaum

National security threats can compel immediate action, Gen. Brown said he quickly learned since taking his post on Oct. 1.

“We may not have much warning when the next fight begins,” Gen. Brown said. “We need to be ready.”

In a pre-recorded speech at the national security conference, Michael R. Bloomberg, founder of Bloomberg LP, told the John Hopkins national security conference attendees about the critical need for collaboration between government and industry.

“Building enduring technological advances for the U.S. military will help our service members and allies defend freedom across the globe,” Bloomberg said.

The “horrific terrorist attacks” against Israel and civilians living there on Oct. 7 underscore the importance of that mission, Bloomberg added.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Attention Holiday Gift Buyers! Consider purchasing Paul’s inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases or autographed copies! Follow Paul on Twitter @PaulDykewicz. He is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper, after writing for the Baltimore Business Journal and Crain Communications.

The post Five Aerospace Investments to Buy as Wars Worsen Copy appeared first on Stock Investor.

dow jones sp 500 nasdaq stocks pandemic etf micro-cap army recovery russia ukraine china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges