Uncategorized

Chainlink hits Ethereum layer 2 Arbitrum for cross-chain DApp development

Chainlink’s CCIP protocol has launched on Ethereum layer 2 Arbitrum One to help developers build cross-chain decentralized applications.

…

Chainlink’s CCIP protocol has launched on Ethereum layer 2 Arbitrum One to help developers build cross-chain decentralized applications.

Blockchain oracle network Chainlink has tapped into Ethereum (ETH) layer 2 scaling protocol Arbitrum to drive cross-chain decentralized application development.

The two protocols announced the mainnet launch of the Chainlink Cross-Chain Interoperability Protocol (CCIP) on Arbitrum One on Sept .21, giving developers access to Chainlink’s solution that taps into Arbitrum’s high-throughput, low cost scaling.

The combination of CCIP and Arbitrum One’s ecosystem aims to unlock a myriad of use cases, including cross-chain tokenization and collateralization, blockchain gaming, data storage and computation.

Chainlink Labs chief business officer Johann Eid commented on the partnership, highlighting Arbitrum’s role in offloading transaction congestion from Ethereum’s base layer and providing a base to build DApps.

“CCIP now gives these users access to a highly secure and easy-to-use interoperability protocol built on Chainlink's time-tested infrastructure, powering cross-chain smart contracts in a way that will open up new avenues of growth, accessibility, and innovation.”

The integration will marry Arbitrum’s optimistic rollup technology that currently commands around 60% of total value locked in the wider Ethereum layer two ecosystem. Arbitrum facilitates fast and low fee transactions that are batched off-chain and then submitted to Ethereum’s base layer.

The optimistic rollup is assumed to be valid until proven otherwise by validators of the network.

Meanwhile CCIP allows developers to build cross-chain DApps that use arbitrary messaging and simplified token transfers. This taps into Chainlink’s decentralized oracle network that enables smart contracts to securely access off-chain data sources, APIs, and payment systems.

Related: Blockchains need an interoperable standard to evolve, say crypto execs

The protocol allows smart contracts to interact with real-world data and events, making it possible for them to be triggered by data from external sources.

Another prominent Ethereum scaling technology firm in StarkWare previously tapped into Chainlink’s oracle services. As Cointelegraph previously reported, StarkWare’s zero-knowledge proof rollup protocol StarkNet integrated Chainlink’s data and price feeds for its ecosystem in February 2023.

Magazine: NFT collapse and monster egos feature in new Murakami exhibition

ethereum blockchain crypto cryptoUncategorized

Meet Grab: Southeast Asia’s post-Uber “everything app”

While you may never have heard of it, the Grab app has become as ubiquitous in southeast Asia as Uber, DoorDash, and Venmo are in the U.S. — and it…

Grab (GRAB) , the Singapore-headquartered “Everyday Everything App,” is Southeast Asia’s answer to Uber, DoorDash, Instacart, and Venmo — all in a single platform.

Best known for its ride-hailing and delivery services, the Grab app also offers a wallet feature that allows users to make payments online and in person, send money to family and friends, finance purchases over time, and even buy travel insurance.

In essence, Grab is (attempting to become) the go-to digital toolkit for everyday life in the eight countries in which it operates — currently, that’s Cambodia, Indonesia, Singapore, Malaysia, Myanmar, the Philippines, Thailand, and Vietnam.

The app has been called Southeast Asia’s answer to Uber, and, as of late 2023, Grab reportedly serves 35 million unique users each month according to the Business Times.

Trading publicly in the United States on the Nasdaq exchange since its 2021 IPO, the company turned a profit for the first time during the fourth quarter of 2023 and shows no signs of slowing down.

Here’s what you need to know about Grab's features, its stock, and its ongoing quest to become Southeast Asia’s “one app to rule them all.”

Related: Surge pricing: Examples & how it works on Uber, Lyft, DoorDash & more

How did Grab become the Uber of Southeast Asia? A short history of the app

Grab was born in 2012 at Harvard Business School, the brainchild of Anthony Tan (CEO) and Tan Hooi Ling (COO), both Malaysian nationals who earned their MBAs there the year prior. The pair launched their mobile app — then called “My Teksi” — using a $25,000 grant from the school along with an unknown amount of personal capital.

The purpose of the app was to connect taxi drivers with passengers via their smartphones in order to create a simple and orderly alternative to Malaysia’s then-chaotic (and sometimes unsafe, especially for female riders) ride-hailing environment.

In 2013, the company — by then called GrabTaxi — expanded, making its digital ride-hailing app available in the Philippines that summer, then in Singapore and Thailand before the year’s end. The next year, the company rolled out a fleet of 100 electric taxis in Singapore, expanded operations to major cities in Vietnam and Indonesia, and launched GrabBike, a ride-hailing service for motorbike rides.

In 2015, the company launched GrabExpress as a package courier service. The following year, it rebranded (shortening its name to Grab and updating its logo) and introduced in-app messaging and translation for drivers and riders. It also created the GrabRewards program, through which users can earn points redeemable toward discounts on subsequent Grab services.

In 2017, the company launched GrabPay, its first financial technology offering, after acquiring an Indonesian payment company called Kudo. Next, it acquired Uber’s Southeast Asian assets and operations in early 2018, cementing Grab’s status as the dominant ride-hailing service in the region.

As a result of this acquisition, which included Uber Eats, Grab added food-delivery services to its suite of offerings, first in Singapore and Malaysia, and then in the remainder of its market before the year’s end.

Related: The 5 most startling Chapter 11 retailer bankruptcies since 2020

As part of this deal, Uber received a 27.5% stake in Grab, and Uber CEO Dara Khosrowshahi joined the company’s board. So, the American-based ride-hailing and delivery giant now has a vested interest in seeing Grab succeed in its own market. Also as part of this 2018 acquisition, Grab agreed to go public by March 2023, a promise it kept with a little over a year to spare.

Business Insider reported the same year that Grab had become Southeast Asia’s first “decacorn” after securing more funding than any other tech startup in the region during the three years prior. (Unicorns are privately held companies worth more than $1 billion, while “decacorns” are privately held companies worth over $10 million.)

The company continued to make acquisitions in the fintech space, gradually expanding its in-app financial offerings to include money transfers, payments to merchants, microloans, insurance services for drivers and passengers, and buy-now-pay-later programs.

By the time it went public on the U.S. stock market via a SPAC merger with Altimeter Growth Corp., the company had built a vast network of partnerships that allowed customers to hail car and motorbike rides, book travel, order food, pay for goods and services, send and receive money, and even obtain travel insurance policies.

In December 2021, Grab shares opened at $13.06 during the company’s first day trading on the Nasdaq, but they tumbled to around half that by the end of the day. Shares continued to fall, and for the next two years, they bobbed up and down in the $2.80 to $3.80 range.

In the fourth quarter of 2023, however, Grab moved into the black for the first time, posting a profit of $11 million on revenue of $653 million, up 30% from the 2022 fourth quarter.

So, what’s next for the Uber-backed “everything app?”

Related: A History of Reddit: From “front page of the internet” to billion-dollar valuation

Is Grab stock a buy?

The market has known since late February 2024 that Grab became profitable during 2023’s final quarter and that it was initiating its first-ever share repurchase program (both of these are usually positives for a stock). That news, however, didn’t seem to do much to bolster the company’s stock price, which sat at around $3.16 then and hadn’t moved much by early April.

The company’s first-quarter 2024 earnings call is set for May 16, and any guidance the company issues on the call could be the catalyst that pushes the stock out of its limbo.

As of this article's last update, company insiders held about a quarter of Grab's stock, while institutional investors — including Morgan Stanley, Blackrock, Invesco, and Bank of America — held just shy of 55% percent. Short interest stood at 2.73%, indicating largely positive sentiment.

Tipranks listed Grab as a "strong buy" based on 10 analyst ratings with an average 12-month upside of about 34%.

During the company’s last earnings call, CEO Anthony Tan said that Grab has grown to become the “largest on-demand platform in the region at a scale that is over 3x larger than [its] next-closest competitor.”

He also noted that, as pandemic-related travel hesitation has waned, the company’s “mobility revenues also increased by 26% YoY in Q4 and 36% YoY for the entire year, driven by an increase in tourist ride-hailing demand.”

During the call, Tan mentioned that the brand is increasing its focus on its travel segment. The travel business offers hotel booking and travel insurance services (more on these below), as non-local travelers tend to spend more than local customers in the markets where Grab operates.

All signs point to continued growth, but growth is expensive, so whether the company will continue to post profits in subsequent quarters will depend on how much it spends on acquisitions and partnerships vs. how much it leverages its current assets.

Related: Boeing's turbulent descent: The company’s scandals & mishaps explained

Grab’s services and features explained

Because Grab operates in hundreds of cities across eight different countries, the services it offers vary by location. So, some of the features explained here may not be available in all markets.

For instance, Grab users in Vietnam, where motorbikes are ubiquitous, can order motorbike rides as a cheaper alternative to hiring a car, whereas in Singapore, where motorbikes are less popular, only car taxi rides are available.

Ride-hailing

Taxi-hailing was Grab’s first offering when it launched in Malaysia in 2012. The company’s mobility arm remains one of its most important, although it now ranks second to delivery in terms of revenue.

Functionally, Grab rides work much like those booked through Uber or Lyft in the U.S. Grab users can enter their destination and book taxi rides through the app with the cost shown up-front. Those willing to wait longer for a ride, share a car with other riders, or ride on the back of a motorbike can access lower fares.

All riders can view drivers’ details and ETA, and message drivers with instructions (the app can translate these messages if the rider and driver use different languages). Larger vehicles, pet-friendly cars, cars with booster seats for children, and luxury vehicles are also available at various price points.

Delivery services

Grab offers three types of delivery services: food, mart, and express. Together, these services account for more revenue than the company’s ride-hailing services.

GrabFood

Grab’s food-delivery feature is quite similar to DoorDash and Uber Eats. Customers can browse the menus of a variety of restaurants, ranging from street carts to fine dining, and order food for delivery, pick-up, or dine-in. Deliveries can be immediate or scheduled, and in-app discounts, coupons, and rewards are sometimes made available.

GrabMart

Grab’s mart delivery feature is similar to American apps like Instacart and GoPuff. Users can browse the wares of partner grocery, pharmacy, and convenience stores and order anything from food staples to toiletries. Deliveries can scheduled ahead of time or placed on an ASAP basis.

GrabExpress

GrabExpress is the company’s courier feature, which offers the types of services bike messengers provide in large American cities. A user requests a delivery and then hands off their parcel to a Grab partner, who immediately totes it to its destination, providing photographic proof of delivery upon completion.

This service can be used to send anything from a confidential single-page document to a 50 kg (110 lb) package, and all deliveries are automatically insured up to $500 (additional protection of up to $2,000 can be purchased for higher-value deliveries).

Financial services

Since around 2017, Grab has been expanding the financial side of its app via strategic acquisitions and partnerships with fintech companies. Its financial products vary depending on location, but most center around the GrabPay Wallet.

GrabPay Wallet

The GrabPay Wallet is a cashless payment system Grab customers can use to pay for Grab services, pay bills, send money to others, and make purchases online and in-person at merchants that accept GrabPay.

The GrabPay Wallet’s functionality is similar to that of Paypal or Apple Pay, and by using it, customers accumulate GrabRewards points that can be redeemed toward any of the services the Grab app offers.

Rider and driver insurance

Grab riders are automatically insured up to $20,000 in personal accident coverage whenever they hail a car or bike, and supplementary coverage of up to $100,000 can be purchased for an additional $0.30 per ride.

Grab drivers are also insured automatically up to $20,000 for accident-caused death or disability and up to $2,000 for accident-caused medical expenses.

Third-party liability insurance also covers drivers up to $200,000 for injury or property damage to others. Driver insurance also pays out up to $200 per day for 60 days of hospitalized medical leave or 14 days of non-hospitalized medical leave.

Travel

Grab also offers some in-app solutions for non-local travelers, although these are still somewhat limited.

Travel insurance

Grab users who are traveling can use the app to purchase travel insurance that covers things like medical expenses, delays, and lost luggage. Users enter basic information like their destination and trip duration, and the app provides an instant quote, with daily premiums starting at around $4.

Hotel booking

Grab users can book stays at millions of hotels directly through the Grab app, sometimes with Grab-exclusive discounts, earning Grab rewards as they do so.

Related: Bitcoin's history: A timeline of the crypto's milestones ahead of halving event

nasdaq pandemic bitcoin cryptoUncategorized

Guest Contribution: “The Federal Funds Rate: FOMC Projections, Policy Rule Prescriptions, and Futures Market Probabilities from the March 2024 Meeting”

Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Economics Lecturer…

Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Economics Lecturer at Stanford University.

The Federal Open Market Committee (FOMC) maintained the target range for the federal funds rate (FFR) at 5.25 – 5.5 percent in its March 2024 meeting and, in the Summary of Economic Projections (SEP), continued to project a range for the FFR between 4.5 and 4.75 percent by the end of 2024. In contrast with experience through December 2023, futures markets summarized by the CME FedWatch Tool on the day following the meeting were in accord with the FOMC projections and also predicted a range for the FFR between 4.5 – 4.75 percent by the end of 2024.

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” however, is meaningless without a measure of “on the curve.” In our paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we use data from the SEP’s from September 2020 to December 2023 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual or projected FFR. In this post, we analyze four policy rules that are relevant for the future path of the FFR, update the policy rule prescriptions through the March 2024 SEP, and include futures market predictions.

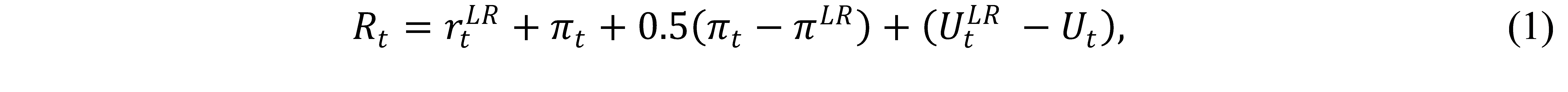

The Taylor (1993) rule with an unemployment gap is as follows,

where is the level of the short-term federal funds interest rate prescribed by the rule, is the inflation rate, is the 2 percent target level of inflation, is the 4 percent rate of unemployment in the longer run, is the current unemployment rate, and is the ½ percent neutral real interest rate from the current SEP.

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. We specify inertial versions of the rules based on Clarida, Gali, and Gertler (1999),

where is the degree of inertia and is the target level of the federal funds rate prescribed by Equations (1) and (2). We set as in Bernanke, Kiley, and Roberts (2019). equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

Figure 1 depicts the midpoint for the target range of the FFR for September 2020 to March 2024 and the projected FFR for June 2024 to December 2026 from the March 2024 SEP. Figure 1 also depicts policy rule prescriptions. Between September 2020 and March 2024, we use real-time inflation and unemployment data that was available at the time of the FOMC meetings. Between June 2024 and December 2026, we use inflation and unemployment projections from the March 2024 SEP. The differences in the prescribed FFR’s between the inertial and non-inertial rules are much larger than those between the Taylor and balanced approach rules.

Figure 1: The Federal Funds Rate and Policy Rule Prescriptions. Top panel: Non-Inertial Rules; Bottom panel: Inertial Rules.

Policy rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced approach rules. They are much higher than the FFR in 2022 and 2023 and are not in accord with the FOMC’s practice of smoothing rate increases when inflation rises. In contrast, the policy rule prescriptions for 2024 through 2026 from the March 2024 SEP are consistently lower than the FFR projections. The inertial rules in Panel B prescribe a much smoother path of rate increases from September 2021 through September 2023 than that adopted by the FOMC. If the Fed had followed the inertial Taylor or balanced approach rule instead of the FOMC’s forward guidance, it could have avoided the pattern of falling behind the curve, pivot, and getting back on track that characterized Fed policy during 2021 and 2022. Looking forward, the FFR projections from the March 2024 SEP are very close to the policy rule prescriptions through December 2026. The current and projected FFR is in accord with prescriptions from inertial policy rules.

It has been widely reported that market participants have been predicting a steeper downward path for the FFR than the FOMC. This is illustrated in Figure 2, which depicts the median predictions from futures markets described in the CME FedWatch Tool on February 1, 2024, the day following the January 2024 FOMC Meeting, through the end of the CME prediction horizon in December 2024. The futures market predictions fall below the projected FFR from June 2024 through December 2024. This is described in more detail in our February 9, 2024, Econbrowser post.

Figure 2: The FFR, CME FedWatch Tool, and Policy Rule Prescriptions in December 2023. Top panel: Taylor Rules; Bottom panel: Balanced Approach.

Futures markets are no longer predicting a steeper downward path for the FFR than the FFR projections. Figure 3 depicts the median predictions from futures markets described in the CME FedWatch Tool on March 21, 2024, the day following the March 2024 FOMC Meeting, through the end of the CME prediction horizon in September 2025. The markets are completely in accord with the FOMC, as the futures market predictions are identical to the FFR projections. The change from December 2023 to March 2024 is entirely due to the change in the CME predictions, as the FFR projections through December 2024 are unchanged. The markets have caught up to the Fed and not vice versa.

We add to this discussion by including prescriptions from policy rules. Figure 3 shows that, for both the Taylor and balanced approach rules, the prescriptions from the inertial policy rules for March 2024 through December 2025 are close to the (identical) FOMC projections and CME predictions. In contrast, the prescriptions from both non-inertial policy rules are considerably below the FOMC projections and CME predictions for the same period. Comparison between futures market predictions and policy rule prescriptions depends on the choice between inertial and non-inertial rules but not on the choice between Taylor and balanced approach rules.

Figure 3: The FFR, CME FedWatch Tool and Policy Rule Prescriptions in March 2024

Top panel: Taylor Rules; Bottom panel: Balanced Approach.

This post written by David Papell and Ruxandra Prodan-Boul.

recession unemployment covid-19 fomc open market committee fed recession unemploymentUncategorized

Penny-pinching buyers are driving down sales of the Big Three’s most profitable segment

Buyers are flocking to more affordable cars amid high prices and interest rates.

Despite the U.S. auto industry celebrating huge sales wins in the first quarter, a key segment containing some of the Detroit Big Three's most profitable nameplates is being left in the dust.

Related: Get ready for $5-a-gallon gasoline

As per a recent report by Automotive News, sales of full-size pickup trucks fell 4% year over year in the period between January and March 2024, with key models reporting reduced sales figures in the double digits.

Stellantis' (STLA) reported that its popular Ram 1500 took a sales hit of 15%, while Ford (F) reported that sales of its bestselling F-series line of pickups took a hit of 10%. On the other hand, General Motors (GM) reported overall sales gains of 2.4% with its Chevrolet Silverado and 2.1% with its GMC Sierra pickups thanks to heavy duty models, but sales of its light duty full-size models are down 1.2%.

Besides GM, Nissan (NSANF) was the only other automaker to sell more pickups this period than the same time in 2023. In total, pickup sales are down 6.4%, including a 31% drop for midsize models like the Ford Ranger and GM's Chevrolet Colorado.

Insiders, analysts and those in the know say that the high prices of cars, as well as high interest rates are causing consumers to cut back on their discretionary spending and explore smaller and cheaper options. As sales of full-size pickups dropped, compact pickups like Ford's hybrid Maverick pickup rose by 82%, while compact and subcompact crossovers rose roughly 25%.

In recent years, automakers like Detroit's Big Three have transformed pickup trucks from utilitarian workhorses into premium machines with MSRPs that rivaled luxury marques like Mercedes-Benz. In a statement to AutoNews, Cox Automotive senior economist Charlie Chesbrough noted that the high prices well equipped pickup's, as well as the slowdown of construction have affected the growth of the segment.

"Pickups have run into two hurdles — interest rates and high prices are having a negative impact directly on affordability and the slowdown in construction is likely impacting demand," Chesbrough told AutoNews. "We don't feel there is much pent-up demand remaining in fleet. Additional growth [in] the full-size pickup segment will be challenging over the near term. Buyers appear to want pickup functionality, but at lower prices."

More Automotive:

- BMW exec says it's the end of the line for a popular option among car enthusiasts

- Mercedes just took a subtle dig at its biggest luxury rival

- Ford is taking away a convenient feature because no one uses it

Additionally, Edmunds head of insights Jessica Caldwell noted that low interest rates during the COVID-19 pandemic allowed for buyers to opt for more expensive vehicles, such as premium trims of pickups like the Ford F-150 Platinum and the Chevrolet Silverado High Country.

She told AutoNews that consumers aren't "stretching their budgets in ways that they would have in the past," and that higher interest rates makes "financing these larger purchases really hard."

According to GlobalData, full-size pickups accounted for 12.4% of new car sales for the first quarter of 2024, compared to 13.7% during the same period in 2023.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic covid-19 interest rates-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment4 weeks ago

Spread & Containment4 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 month ago

International1 month agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International1 month ago

International1 month agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment59 mins ago

Spread & Containment59 mins agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized7 days ago

Uncategorized7 days agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Government2 days ago

Government2 days agoClimate-Con & The Media-Censorship Complex – Part 1

-

Uncategorized3 days ago

Uncategorized3 days agoCan language models read the genome? This one decoded mRNA to make better vaccines.