BTC miners ‘finally capitulating’ — 5 things to know in Bitcoin this week

Bitcoin rebounds strongly off the weekly close, but for BTC miners, it may be a case of "too little too late."

Bitcoin (BTC) starts…

Bitcoin rebounds strongly off the weekly close, but for BTC miners, it may be a case of "too little too late."

Bitcoin (BTC) starts a new week nearing key resistance as the shock of the latest United States inflation data passes — can the strength continue?

The July 17 weekly close may have been practically identical to the last, but BTC/USD is showing some much needed strength prior to the July 18 Wall Street open.

Last week was a testing time for crypto hodlers everywhere, with inflation dictating the mood across risk assets and the U.S. dollar capping the gloomy atmosphere. With those pressures now easing — at least temporarily — the mood has room to relax.

At the same time, on-chain data suggests that now is a make or break moment for Bitcoin miners, and capitulation across the market feels close.

As talk over where Bitcoin’s macro bottom could lie continues, Cointelegraph takes a look at several factors primed to shape BTC price performance in the coming days.

All eyes on weekly moving averages

Those watching the weekly chart on BTC will have a sense of deja vu this time around — BTC/USD finished July 17 under $100 away from where it was on July 10.

The latest weekly close is something of a disappointment in and of itself, with Bitcoin erasing gains at the last minute to print a “red” candle for the past seven days.

What happened next, on the other hand, had the opposite tone — a swift overnight march higher, the largest cryptocurrency adding $1,400 in under twelve hours.

It all leads up to a familiar challenge on intraday timeframes — BTC/USD is approaching both $22,000 and a key trendline at $22,600 in the form of the 200-week moving average (WMA).

Previously acting as support in bear markets, the 200 WMA has in fact flipped to resistance this time around, having been lost in mid-June and never reclaimed.

As such, analysts are eyeing that level as a key area of interest should bulls be able to sustain upside pressure.

For PlanB, creator of the Stock-to-Flow family of BTC price models, a factor beyond spot price is meanwhile reinforcing its importance. As in previous bear markets, the 200 WMA briefly went above Bitcoin’s realized price this year, providing a classic market reversal signal.

Realized price refers to the average price at which all the bitcoins in existence last moved.

“In the bear market of 2014/15 and 2018/19 (blue) realized price was above 200WMA and the bull market did not start until realized price and 200WMA touched,” PlanB told Twitter followers on July 17 alongside an accompanying chart.

“Now realized price and 200WMA already touched at $22K. For the next bull market we need BTC above realized price and 200WMA.”

As Cointelegraph reported, bulls seem to need to play a game of moving averages on longer timeframes, too. In addition to the 200 WMA, the 50-week and 100-week exponential moving averages (EMAs) also figure in forecasts.

The 50 EMA currently sits at $36,000 and the 100 EMA at just above $34,300, data from Cointelegraph Markets Pro and TradingView shows.

Ethereum nears $1,500 in potential trendsetter move

One catalyst that could take Bitcoin over its key resistance mark at $22,600 could come from an unlikely source — altcoins.

While normally moves on Bitcoin see other cryptocurrencies before copycat moves up or down, this week, some are waiting to see if BTC/USD will follow largest altcoin Ether (ETH) higher.

Amid news that its transition to Proof-of-Stake (PoS) mining could soon complete, Ethereum has outperformed in terms of price gains in recent days, and is up 25% over the past week alone.

At the time of writing, ETH/USD was about to challenge $1,500 for the first time since June 12.

“$eth reclaimed its 200 week moving average this week, btc will probably next week, the time to be bearish has defo to an end imo,” popular Twitter account Bluntz summarized on the day.

Fellow commentator Light likewise considered that Ethereum’s strength should keep upward pressure on Bitcoin, noting liquidations among those traders ignoring the ETH moves and continuing to be short BTC.

shorts had days to get out on BTC. 0 reason to be short it when ETH did what it did.

— light (@lightcrypto) July 18, 2022

A large asset in the ecosystem ripping 40% stokes risk seeking behavior everywhere else. It makes people consider that assets can in fact go up in price. It leads to catch-up/rotational flows. https://t.co/nae0WIys9M

Cross-crypto short liquidations in the 24 hours into July 18 totaled around $132 million, data from on-chain monitoring resource Coinglass confirms.

Going forward, however, not everyone is convinced that Ethereum will be able to break its overall downtrend, with the implications obvious for other tokens as a result.

Cointelegraph contributor Michaël van de Poppe argued that the pull of the weekend CME futures gap on Bitcoin could provide a downside force to puncture the optimism.

CME futures finished their previous trading day, July 15, at around $21,200.

“With the potential of a CME gap beneath us (and Bitcoin swimming around the previous CME gap), I won't be surprised with a fake-out move and retest lower for $ETH,” he wrote in an update.

“Looking to get into longs around the $1,250-1,280 region.”

Dollar strength finally flips in Bitcoin's favor

On the topic of macro movements, the landscape looks overall less frenetic than that which greeted crypto investors last week.

Inflation data has come and gone, and the debate over whether inflation has or has not peaked in the U.S. thus cools until the next Consumer Price Index (CPI) print in August.

The Federal Reserve will decide on how to tackle inflation as regards key interest rate hikes later this month, the Federal Open Markets Committee (FOMC) nonetheless set to meet only on July 26.

Any macro cues when it comes to BTC price action will thus be coming from other areas, with geopolitical triggers high on the list of potential factors.

Asian markets were stronger as the week began thanks to a modest recovery in Chinese tech stocks previously hammered by Coronavirus nerves.

At the same time, the U.S. dollar, the star of recent weeks as equities worldwide felt pressure, began to consolidate its gains.

The U.S. dollar index (DXY), strength in which has long been inversely correlated with cryptoasset performance, headed south under 108 on the day, having reached fresh two-decade highs the previous week.

“Finally seeing a drop on the daily,” Twitter analyst IncomeSharks commented, highlighting the potential for DXY to test a trendline from May.

“Even a drop to this trend line would be big for Stocks and Crypto. Would line up perfectly with a bullish week before the FED meeting.”

Fellow account Rickus also felt that Bitcoin would not “break down again” despite a pullback still being possible — thanks to the DXY comedown and a stronger finish for the S&P 500.

SPX had a good close before the weekend, DXY also looks a bit weak on ltf while BTC is close to resistance levels..Lines I am watching..I personally don't think we break down again although I am looking for a pullback. pic.twitter.com/KcYRJFrrbS

— Rickus (@rickus_trades) July 17, 2022

“Should give room this week for equities & crypto to bounce until it find near support,” 0xWyckoff, creator of crypto trading resource Rekt Academy, added in part of a thread about the DXY.

In a separate observation meanwhile, Dan Tapiero, managing partner and CEO at 10T Holdings, noted that a macro USD high versus the Chinese yuan should mark a turnaround point for BTC.

“Last 3 major BTC highs in 2014, 2018, 2021 roughly coincided with highs in Chinese RMB/lows in USD,” he noted in part of a tweet on July 18.

“Suggests that Dollar peak soon would be supportive of BTC low.”

Miners dump 14,000 BTC in days

With so much hope that a trend turnaround could be on the cards, on-chain data showing Bitcoin miners selling inventory looks all the more bleak.

According to data from on-chain analytics platform CryptoQuant, beginning July 14, miners removed a significant chunk of BTC from their reserves.

The effect was that miner reserves fell to their lowest levels since July 2021, a point which also marked a BTC price low.

Reserves stood at 1.84 million BTC on July 18, down 14,000 BTC versus the July 14 tally.

For CryptoQuant contributor Edris, the numbers were an encouraging sign, hinting that miners were now contributing to establishing a macro BTC price floor.

“Bitcoin miners are finally capitulating,” he summarized over the weekend.

“BTC price has been consolidating at the $20K level for the past few weeks, making investors wonder whether an accumulation or distribution phase is going on. Looking at the Miners' Reserve chart, it seems like the latter is the case.”

Macro analyst Alex Krueger meanwhile described June’s miner sales as a “clear sign of capitulation,” adding that miners “tend to accumulate on the way up then puke when things go bad.”

RSI sparks "very rare" BTC price inflection point

Finally, a “rare” event on the Bitcoin chart may just have provided the fuel for a historic turnaround, analysis suggests.

Related: Top 5 cryptocurrencies to watch this week: BTC, ETH, MATIC, FTT, ETC

Taking the BTC/USD chart from the beginning of Bitcoin’s lifespan, Stockmoney Lizards noted that Bitcoin’s relative strength index (RSI) is now at suitably low levels and has combined with a touch of a log chart trendline which sparked the greatest BTC price recoveries.

“Current exciting and very rare situation now,” it announced at the weekend.

“RSI below 45 and logaritmic bottom showed a great reversal in the past, followed by a crazy bull run. Cross = RSI<45 + log. Bottom.”

An accompanying chart showed the power of such an event, which follows RSI hitting its lowest levels on record.

For CoinPicks analyst Johnny Szerdi, meanwhile, Bitcoin needed to break the 50 mark on RSI, a key resistance zone in recent months, to avoid the risk of a fresh sell-off.

GM! #Bitcoin is at a critical point. It hasn't been able to break 50 RSI since 3/14. It rejected from it 5 times since 4/20. Notice the vertical lines to where it matches up with the big sell offs. With volume, if we reject here for a 6th time, it could mean another sell off. pic.twitter.com/znZNpfJ3K8

— Johnny Szerdi (@johnnyszerdi) July 17, 2022

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

sp 500 equities stocks coronavirus cryptocurrency bitcoin ethereum crypto btc yuan cryptoInternational

The next pandemic? It’s already here for Earth’s wildlife

Bird flu is decimating species already threatened by climate change and habitat loss.

I am a conservation biologist who studies emerging infectious diseases. When people ask me what I think the next pandemic will be I often say that we are in the midst of one – it’s just afflicting a great many species more than ours.

I am referring to the highly pathogenic strain of avian influenza H5N1 (HPAI H5N1), otherwise known as bird flu, which has killed millions of birds and unknown numbers of mammals, particularly during the past three years.

This is the strain that emerged in domestic geese in China in 1997 and quickly jumped to humans in south-east Asia with a mortality rate of around 40-50%. My research group encountered the virus when it killed a mammal, an endangered Owston’s palm civet, in a captive breeding programme in Cuc Phuong National Park Vietnam in 2005.

How these animals caught bird flu was never confirmed. Their diet is mainly earthworms, so they had not been infected by eating diseased poultry like many captive tigers in the region.

This discovery prompted us to collate all confirmed reports of fatal infection with bird flu to assess just how broad a threat to wildlife this virus might pose.

This is how a newly discovered virus in Chinese poultry came to threaten so much of the world’s biodiversity.

The first signs

Until December 2005, most confirmed infections had been found in a few zoos and rescue centres in Thailand and Cambodia. Our analysis in 2006 showed that nearly half (48%) of all the different groups of birds (known to taxonomists as “orders”) contained a species in which a fatal infection of bird flu had been reported. These 13 orders comprised 84% of all bird species.

We reasoned 20 years ago that the strains of H5N1 circulating were probably highly pathogenic to all bird orders. We also showed that the list of confirmed infected species included those that were globally threatened and that important habitats, such as Vietnam’s Mekong delta, lay close to reported poultry outbreaks.

Mammals known to be susceptible to bird flu during the early 2000s included primates, rodents, pigs and rabbits. Large carnivores such as Bengal tigers and clouded leopards were reported to have been killed, as well as domestic cats.

Our 2006 paper showed the ease with which this virus crossed species barriers and suggested it might one day produce a pandemic-scale threat to global biodiversity.

Unfortunately, our warnings were correct.

A roving sickness

Two decades on, bird flu is killing species from the high Arctic to mainland Antarctica.

In the past couple of years, bird flu has spread rapidly across Europe and infiltrated North and South America, killing millions of poultry and a variety of bird and mammal species. A recent paper found that 26 countries have reported at least 48 mammal species that have died from the virus since 2020, when the latest increase in reported infections started.

Not even the ocean is safe. Since 2020, 13 species of aquatic mammal have succumbed, including American sea lions, porpoises and dolphins, often dying in their thousands in South America. A wide range of scavenging and predatory mammals that live on land are now also confirmed to be susceptible, including mountain lions, lynx, brown, black and polar bears.

The UK alone has lost over 75% of its great skuas and seen a 25% decline in northern gannets. Recent declines in sandwich terns (35%) and common terns (42%) were also largely driven by the virus.

Scientists haven’t managed to completely sequence the virus in all affected species. Research and continuous surveillance could tell us how adaptable it ultimately becomes, and whether it can jump to even more species. We know it can already infect humans – one or more genetic mutations may make it more infectious.

At the crossroads

Between January 1 2003 and December 21 2023, 882 cases of human infection with the H5N1 virus were reported from 23 countries, of which 461 (52%) were fatal.

Of these fatal cases, more than half were in Vietnam, China, Cambodia and Laos. Poultry-to-human infections were first recorded in Cambodia in December 2003. Intermittent cases were reported until 2014, followed by a gap until 2023, yielding 41 deaths from 64 cases. The subtype of H5N1 virus responsible has been detected in poultry in Cambodia since 2014. In the early 2000s, the H5N1 virus circulating had a high human mortality rate, so it is worrying that we are now starting to see people dying after contact with poultry again.

It’s not just H5 subtypes of bird flu that concern humans. The H10N1 virus was originally isolated from wild birds in South Korea, but has also been reported in samples from China and Mongolia.

Recent research found that these particular virus subtypes may be able to jump to humans after they were found to be pathogenic in laboratory mice and ferrets. The first person who was confirmed to be infected with H10N5 died in China on January 27 2024, but this patient was also suffering from seasonal flu (H3N2). They had been exposed to live poultry which also tested positive for H10N5.

Species already threatened with extinction are among those which have died due to bird flu in the past three years. The first deaths from the virus in mainland Antarctica have just been confirmed in skuas, highlighting a looming threat to penguin colonies whose eggs and chicks skuas prey on. Humboldt penguins have already been killed by the virus in Chile.

How can we stem this tsunami of H5N1 and other avian influenzas? Completely overhaul poultry production on a global scale. Make farms self-sufficient in rearing eggs and chicks instead of exporting them internationally. The trend towards megafarms containing over a million birds must be stopped in its tracks.

To prevent the worst outcomes for this virus, we must revisit its primary source: the incubator of intensive poultry farms.

Diana Bell does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

genetic pandemic mortality spread deaths south korea south america europe uk chinaUncategorized

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

One month after the inflation outlook tracked…

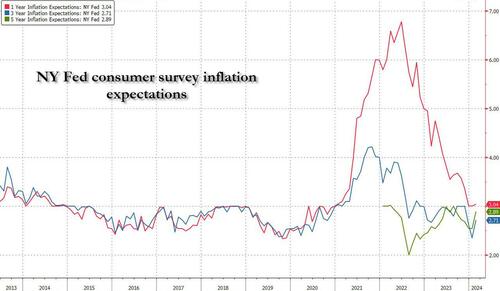

One month after the inflation outlook tracked by the NY Fed Consumer Survey extended their late 2023 slide, with 3Y inflation expectations in January sliding to a record low 2.4% (from 2.6% in December), even as 1 and 5Y inflation forecasts remained flat, moments ago the NY Fed reported that in February there was a sharp rebound in longer-term inflation expectations, rising to 2.7% from 2.4% at the three-year ahead horizon, and jumping to 2.9% from 2.5% at the five-year ahead horizon, while the 1Y inflation outlook was flat for the 3rd month in a row, stuck at 3.0%.

The increases in both the three-year ahead and five-year ahead measures were most pronounced for respondents with at most high school degrees (in other words, the "really smart folks" are expecting deflation soon). The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at all horizons, while the median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined at the one- and three-year ahead horizons and remained unchanged at the five-year ahead horizon.

Going down the survey, we find that the median year-ahead expected price changes increased by 0.1 percentage point to 4.3% for gas; decreased by 1.8 percentage points to 6.8% for the cost of medical care (its lowest reading since September 2020); decreased by 0.1 percentage point to 5.8% for the cost of a college education; and surprisingly decreased by 0.3 percentage point for rent to 6.1% (its lowest reading since December 2020), and remained flat for food at 4.9%.

We find the rent expectations surprising because it is happening just asking rents are rising across the country.

At the same time as consumers erroneously saw sharply lower rents, median home price growth expectations remained unchanged for the fifth consecutive month at 3.0%.

Turning to the labor market, the survey found that the average perceived likelihood of voluntary and involuntary job separations increased, while the perceived likelihood of finding a job (in the event of a job loss) declined. "The mean probability of leaving one’s job voluntarily in the next 12 months also increased, by 1.8 percentage points to 19.5%."

Mean unemployment expectations - or the mean probability that the U.S. unemployment rate will be higher one year from now - decreased by 1.1 percentage points to 36.1%, the lowest reading since February 2022. Additionally, the median one-year-ahead expected earnings growth was unchanged at 2.8%, remaining slightly below its 12-month trailing average of 2.9%.

Turning to household finance, we find the following:

- The median expected growth in household income remained unchanged at 3.1%. The series has been moving within a narrow range of 2.9% to 3.3% since January 2023, and remains above the February 2020 pre-pandemic level of 2.7%.

- Median household spending growth expectations increased by 0.2 percentage point to 5.2%. The increase was driven by respondents with a high school degree or less.

- Median year-ahead expected growth in government debt increased to 9.3% from 8.9%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.6 percentage point to 26.1%, remaining below its 12-month trailing average of 30%.

- Perceptions about households’ current financial situations deteriorated somewhat with fewer respondents reporting being better off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off and a slightly larger share of respondents expecting to be worse off a year from now.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 1.4 percentage point to 38.9%.

- At the same time, perceptions and expectations about credit access turned less optimistic: "Perceptions of credit access compared to a year ago deteriorated with a larger share of respondents reporting tighter conditions and a smaller share reporting looser conditions compared to a year ago."

Also, a smaller percentage of consumers, 11.45% vs 12.14% in prior month, expect to not be able to make minimum debt payment over the next three months

Last, and perhaps most humorous, is the now traditional cognitive dissonance one observes with these polls, because at a time when long-term inflation expectations jumped, which clearly suggests that financial conditions will need to be tightened, the number of respondents expecting higher stock prices one year from today jumped to the highest since November 2021... which incidentally is just when the market topped out during the last cycle before suffering a painful bear market.

Spread & Containment

A major cruise line is testing a monthly subscription service

The Cruise Scarlet Summer Season Pass was designed with remote workers in mind.

While going on a cruise once meant disconnecting from the world when between ports because any WiFi available aboard was glitchy and expensive, advances in technology over the last decade have enabled millions to not only stay in touch with home but even work remotely.

With such remote workers and digital nomads in mind, Virgin Voyages has designed a monthly pass that gives those who want to work from the seas a WFH setup on its Scarlet Lady ship — while the latter acronym usually means "work from home," the cruise line is advertising as "work from the helm.”

Related: Royal Caribbean shares a warning with passengers

"Inspired by Richard Branson's belief and track record that brilliant work is best paired with a hearty dose of fun, we're welcoming Sailors on board Scarlet Lady for a full month to help them achieve that perfect work-life balance," Virgin Voyages said in announcing its new promotion. "Take a vacation away from your monotonous work-from-home set up (sorry, but…not sorry) and start taking calls from your private balcony overlooking the Mediterranean sea."

Shutterstock

This is how much it'll cost you to work from a cruise ship for a month

While the single most important feature for successful work at sea — WiFi — is already available for free on Virgin cruises, the new Scarlet Summer Season Pass includes a faster connection, a $10 daily coffee credit, access to a private rooftop, and other member-only areas as well as wash and fold laundry service that Virgin advertises as a perk that will allow one to concentrate on work

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The pass starts at $9,990 for a two-guest cabin and is available for four monthlong cruises departing in June, July, August, and September — each departs from ports such as Barcelona, Marseille, and Palma de Mallorca and spends four weeks touring around the Mediterranean.

Longer cruises are becoming more common, here's why

The new pass is essentially a version of an upgraded cruise package with additional perks but is specifically tailored to those who plan on working from the ship as an opportunity to market to them.

"Stay connected to your work with the fastest at-sea internet in the biz when you want and log-off to let the exquisite landscape of the Mediterranean inspire you when you need," reads the promotional material for the pass.

Amid the rise of remote work post-pandemic, cruise lines have been seeing growing interest in longer journeys in which many of the passengers not just vacation in the traditional sense but work from a mobile office.

In 2023, Turkish cruise line operator Miray even started selling cabins on a three-year tour around the world but the endeavor hit the rocks after one of the engineers declared the MV Gemini ship the company planned to use for the journey "unseaworthy" and the cruise ship line dealt with a PR scandal that ultimately sank the project before it could take off.

While three years at sea would have set a record as the longest cruise journey on the market, companies such as Royal Caribbean (RCL) (both with its namesake brand and its Celebrity Cruises line) have been offering increasingly long cruises that serve as many people’s temporary homes and cross through multiple continents.

stocks pandemic testing-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex