Spread & Containment

Bring Top-Shelf Brands to Your Home Bar (and Save Money)

If you ask for two fingers of 18-year-old Glenlivet in a bar, you may pay $60 for a drink while $150 will buy you the whole bottle (16 drinks).

If you ask for two fingers of 18-year-old Glenlivet in a bar, you may pay $60 for a drink while $150 will buy you the whole bottle (16 drinks).

Thanks to inflation, everyone is looking for creative ways to save money right now. And if the 2020 coronavirus lockdown taught us anything, it's that drinking at home is much cheaper than drinking out. You're pouring less cash into your at-home drink cart, sure. But are you taking every advantage to save your dollars?

The liquor market is heavily saturated with products. There are several major companies that distribute a lot of the most well-known brands. You've also got every celebrity and their mom creating their own tequila brand. In a liquor store full of too many brands, it's easy to bargain shop and walk out with some quality spirits.

Some of the most renowned brands are tied to long-standing market exposure and label clout. And while there are some solid well-known brands on shelves, most people are paying $5-$15 extra for a recognized brand.

What's more, those brands sometimes lack the nuanced flavors and craftsmanship you'll get from a more localized brand. What are the chances that you've never even heard of your new favorite liquor brand? Pretty high.

Find a Bar/Liquor Expert to Help Build a Home Bar

If you want the best quality booze for less bucks, an industry expert isn't as hard to find as you might think. If you've got a local liquor store, you've probably had a friendly chat with the person behind the counter when you check out. Next time, it might be worth your while to ask for their input.

Each liquor store will also have someone on staff who chooses what the store will carry. Ask the staff at your liquor store who does the ordering, and if that person is available, make them your buddy.

If your local liquor store isn't the jazziest, there may be a bar in town that prides itself on its selection of a certain kind of liquor. For example, say you want to have a good mezcal on hand, there might be a bar in your town that prides itself on its mezcal selection. Some bars will even offer tasting experiences, which are a great way to celebrate a special occasion.

Even if the bar doesn't offer tastings, sidling up to the bar is still one of the most effective ways to get a feel for your local liquor market. Bartenders and bar managers meet alcohol company representatives almost daily. These reps come in, pour samples, and talk about tasting notes and price points to encourage the sale of their products. Your local bar doesn't opt to carry every spirit that reps bring in, but the bartender is very likely to remember anything that stands out, particularly the local stuff.

Shutterstock

Look for Local Brands

The brewing and distilling market has seen a boom in more local products over the last decade, and almost every state has its own beer, wine, or liquor maker it takes pride in.

Visiting your local distilleries and sampling their products is a memorable alternative to a regular date night, and it puts a little money in the pockets of the service workers who are also struggling due to inflation. Plus, you'll get a better assessment of what your local area's vodka or whiskey tastes like compared to the bigger brands.

Large liquor chains and corner liquor stores alike usually carry what's local. Those brands are often much more affordable than major brands because the distribution circle is much smaller. If you know you like a whiskey after a long day's work, local distilleries often offer bulk shipping options and promotions, helping you spend less per bottle.

Love Your Brand? Consider Buying Stock In It.

Okay, so you're devoted to your mainstream liquor brand and there's no swaying that tide. Have you considered adding your favorite liquor company into your portfolio? Stocks like Constellation Brands (STZ) - Get Constellation Brands Inc. Report, Brown Foreman Corporation (BF.B) - Get Brown Forman Inc Class B Report, and Diageo (DEO) - Get Diageo plc Report own some of biggest, most recognizable liquor brands in the world.

It's a known fact that alcohol stocks can be volatile. Despite what some may say, they aren't entirely recession-proof -- premium liquor? In this economy? Sure, your direct purchases won't have much effect on the stock, but an awareness and engagement in a company's stock price can have its benefits.

In a bear market, it's easy to feel pessimistic about stock prices. Having a personal connection to companies in your portfolio can help you maintain your optimism. A tie to the product may help discourage you from making an emotional decision when you feel like the chips are down.

TheStreet Smarts

TheStreet’s Single Smartest Insight From The Day

Exclusive newsletter delivered to your inbox daily covering important investing topics pulled from TheStreet’s premium content.

- Cut Through The Noise

- Your Personal Financial Advisor

- Investing Cheat Sheet

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

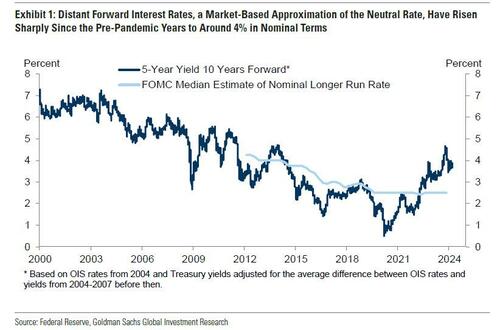

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

Spread & Containment

Household Net Interest Income Falls As Rates Spike

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

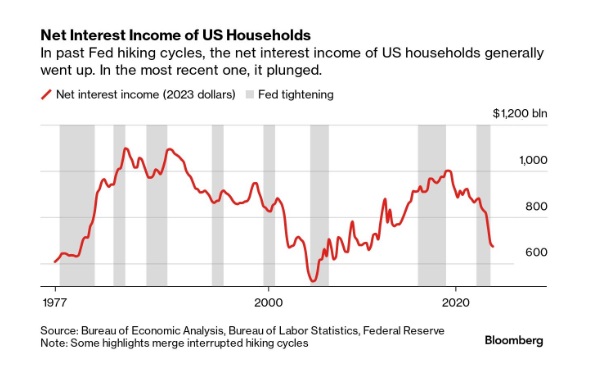

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

Spread & Containment

TJ Maxx and Marshalls follow Costco and Target on upcoming closures

Many of these stores have information customers need to know.

U.S. consumers have come to increasingly rely on the near ubiquity of convenience stores and big-box retailers.

Many of us depend on these stores being open practically all day, every day, even during some of the biggest holidays. After all, Black Friday beckons retail stores to open just hours after a Thanksgiving Day dinner in hopes of attracting huge crowds of shoppers in search of early holiday sales.

Related: Walmart announces more store closures for 2024

And it's largely true that before the covid pandemic most of our favorite stores were open all the time. Practically nothing — from inclement weather to bad news to holidays — could shut down a major operation like Walmart (WMT) or Target (TGT) .

Then the pandemic hit, and it turned everything we thought we knew about retail operations upside down.

Everything from grocery stores to shopping malls shut down in an effort to contain potential spread. And when they finally reopened to the public, different stores took different precautionary measures. Some monitored how many shoppers were inside at once, while others implemented foot-traffic rules dictating where one could enter and exit an aisle. And almost every one of them mandated wearing masks at one point or another.

Though these safety measures seem like a distant memory, one relic from the early 2020s remains firmly a part of our new American retail life.

Store closures announced for spring 2024

Many retailers have learned to adapt after a volatile start to this third decade, and in many ways this requires serving customers better and treating employees better to retain a workforce.

In some cases, the changes also reflect a change in shopping behavior, as more customers order online and leave more breathing room for brick-and-mortar operations. This also means more time for employees.

Thanks to this, big retailers have recently changed how they operate, especially during holiday hours, with Walmart recently saying it would close during Thanksgiving to give employees more time to spend with loved ones.

"I am delighted to share that once again, we'll be closing our doors for Thanksgiving this year," Walmart U.S. CEO John Furner told associates in a video posted to Twitter in November. "Thanksgiving is such a special day during a very busy season. We want you to spend that day at home with family and loved ones."

Other retailers have now followed suit, with Costco (COST) , Aldi, and Target all saying they would close their doors for 24 hours on Easter Sunday, March 31.

Now, the stores that operate under TJX Cos. (TJX) will also shut down during the holiday, including HomeGoods, TJ Maxx and Marshalls.

Though it closed on Thanksgiving, Walmart says it will remain open for shoppers on Easter.

Here's a list of stores that are closing for Easter 2024:

- Target

- Costco

- Aldi

- TJ Maxx

- Marshalls

- HomeGoods

- Publix

- Macy's

- Best Buy

- Apple

- ACE Hardware

Others are expected to remain open, including:

- Walmart

- Ikea

- Petco

- Home Depot

Most of the stores closing on Sunday will reopen for regular business hours on Monday.

spread pandemic-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex