Bitcoin Is A Savings Account With An Average Growth Of Over 100% A Year

The solution to the problem facing billions of people around the world: access to a cheap, secure and reliable savings account.

The solution to the problem facing billions of people around the world: access to a cheap, secure and reliable savings account.

Note: This article is not investment advice and is for informational purposes only. Do your own research.

With its fixed supply, open-source software and peer-to-peer (p2p) structure, bitcoin is the global money of the people, by the people, for the people.

What Is Bitcoin?

There are countless responses to this simple question and bitcoin analogies are plentiful from bamboo to mycelium and, most relevant for this article, gold 2.0. For people unfamiliar with bitcoin’s attributes, the following infographic by Bitcoin OG Wences Casares is useful:

Bitcoin’s Inventor Satoshi Nakamoto Was A Polymath

Bitcoin is a fascinating entity which sits at the intersection of cryptography, economics and money, open-source software and computer science, game theory, politics and law, and more. Because of bitcoin’s multifaceted nature, it means different things to different people. In this article, I aim to show that bitcoin solves a critical problem facing many of the world’s citizens: unsound money (this term is unpacked below) and the striking absence of a savings technology that can successfully store value into the future. I am far from the first person to draw attention to bitcoin’s supreme savings technology — or “Number Go Up” (NGU) properties. The aim of this article is to put the case to everyday people around the world that bitcoin should not simply be viewed as speculation or a “get rich quick scheme,” as the mainstream media often likes to portray it, but a rational choice by an increasing number of individuals and institutions to benefit from the best savings technology the world has ever seen. In my opinion, this is one of the extremely rare instances where something is not “too good to be true.” That said, as with any decision about where to place your hard-earned money, it does not come without risk. Historically, bitcoin has had significant price corrections, although this cycle has been less volatile than previous ones. To begin with, I would encourage people to only put in the amount they are willing to lose. You can start with as little as one or two U.S. dollars — each bitcoin consists of a hundred million satoshis, meaning you can buy a fraction of a bitcoin.

I am a believer that having at least some “skin in the game” will incentivize you to further educate yourself on bitcoin, which may, in turn, enable you to consider saving a larger portion of your wealth in bitcoin. But there is no shortcut to increasing your conviction. To do so, you need to put the time in — fortunately nowadays there’s a wealth of excellent podcasts, articles and books if you are curious to learn more. . As I mentioned, bitcoin is not a get rich quick scheme and anything you do choose to save in bitcoin, you should be thinking about holding for at least four years or more. The reason being, if you were unlucky enough to buy the top of either the 2014 or 2017 bull markets, within four years of each you would be back in the green, and over a longer time frame even more so.

Software Is Eating The World

Bitcoin’s meteoric rise fits in with the broader digital revolution which is dematerializing the physical world. The investor Marc Andreessen famously said: “Software is eating the world.” Software’s inexorable march has already swallowed our social networks (Facebook), telephone directories and maps (Google), video shops (Netflix), music players, calculators and countless other items (smartphones) and the list goes on.

By being hundreds of billions of dollars larger than its nearest competitor, combined with its superior monetary properties and decentralized nature, it is clear that bitcoin is the winner of the monetary network and asset crown. Stemming from its significant network effects and size compared to competitors, it is not the “Myspace of crypto,” as some people have sought to characterize it. In its 12-year existence, bitcoin has already eaten a $1 trillion-sized chunk out of the legacy financial system. When you zoom out from the daily price fluctuations and consider bitcoin’s total addressable market is in the many hundreds of trillions of dollars, it is only getting started. @Croesus_BTC’s graphic below shows bitcoin’s current size relative to its total addressable market (other “store of value” instruments) and just how early it still is. If you’d like a more in depth look at how early it still is, see here.

The Soundest Money

At its core bitcoin is the soundest money ever invented by human civilization.The term “sound money” is contested and in this article I define sound money as one in which its total supply is not at risk of being devalued by the arbitrary printing of vast quantities of additional monetary units. A form of money which is continually devalued through the printing of additional units is known as “unsound” or “easy” money. Such currency devaluation is a feature, not a bug, of most, if not all, fiat currencies around the world. Fiat, in this context, meaning a legal tender or currency by government order. Fiat currencies imply a degree of coercion by the state on its citizens; for example, citizens are forced to pay taxes in their country’s fiat currency. Bitcoin, on the other hand, is a free-market money which citizens from around the world are free to opt into if they wish to.

Bitcoin is sound money because, for the first time in human history, building on 40 years of research, development and demand (see timeline below), Satoshi Nakamoto invented digital scarcity and gave bitcoin a fixed supply of 21 million coins. Unlike fiat currencies, after the 21 million coins have been minted, no more can be minted. As a result, holders of bitcoin know that the amount they hold cannot ever be debased or devalued. For example, if someone holds 0.1 bitcoin (or ten million satoshis) today, they know that their share of bitcoin’s total supply will be 0.1 ÷ 21 million, or 0.00000048% of the total supply — forever.

Satoshi also designed bitcoin to be incredibly resilient in a hostile environment. To date, despite having $1 trillion on the network, Bitcoin has not been hacked. One way Satoshi achieved this with bitcoin by solving the problem of fiat currency’s reliance on a trusted third party to operate. By drawing on the technology underpinning other peer-to-peer networks, such as file-sharing network BitTorrent (launched in 2001), Satoshi successfully launched the Bitcoin protocol on January 3, 2009, using “unstoppable code.” Bitcoin does not have a headquarters with a physical front door for anyone to knock on. To paraphrase Michael Saylor, Satoshi started a fire in cyberspace. And unlike previous iterations of free-market monies, which relied on trusted third parties, bitcoin’s decentralized nature means there is no single physical location for a person or authority to douse out the flames.

Theoretically, bitcoin’s open-source software Bitcoin Core can be changed, but, much like the U.S. constitution, the threshold to alter it is high and requires consensus among the network of computers running Bitcoin’s code (known as nodes). No single actor, however powerful, has undue influence over the system and the more people who run their own node, the more decentralized and resilient the system becomes to undesirable changes. Consequently, incremental changes to Bitcoin Core are implemented because the majority of the network deems them to be in the interests of the Bitcoin project as a whole.

For a more in-depth discussion of bitcoin’s sound money properties and why they are arguably superior to its competitors, including gold, see Vijay Boyapati’s article, “The Bullish Case for Bitcoin,” which is a must-read and is accessible in terms of complexity.

Why Does Sound Money Matter?

If you need to ask this question, it is likely that you are privileged enough not to have lived in a country which has experienced high levels of inflation or, at the extreme, hyperinflation (when a country’s currency becomes essentially worthless). Countries that have experienced this in living memory are, among others, Weimar Germany, Venezuela, Lebanon, Argentina, Zimbabwe and Turkey. One way hyperinflation occurs is when central banks print their national currencies to such an extent that the currency becomes worthless. Unsurprisingly, such a process is detrimental to human security and dignity. Common stories include people trying to spend all of their currency (the very opposite of saving) immediately because they know that its purchasing power the next day will be significantly reduced. Citizens forced to use unsound money has too often resulted in their impoverishment and the value of their hard-earned savings — often generational wealth — evaporating in front of their eyes, with no choice but to suffer the tragic results. By way of example, on August 16, 2018, in Caracas, Venezuela, a roll of toilet paper cost 2.6 million bolívars (the equivalent of $0.40). In Zimbabwe, in 2009, 100 trillion Zimbabwe dollar bills were introduced, and, at the time, when in a bar, it was not uncommon for the price of the drinks to double by the time of the second round. Though, as we will see, it is not just “developing” world countries who suffer the effects of unsound money, citizens in “developed” countries have been left increasingly exposed to its deleterious effects.

For the first time, as a result of its fixed supply and open-source nature, bitcoin offers citizens a choice to place their hard-earned savings in a savings account which, algorithmically, cannot be devalued through the printing of additional monetary units. By taking the money printing press out of human hands, bitcoin has liberated savers and their families around the world, bringing back hope to people as they now have the means to save and, therefore, be in control of their own destinies.

Bitcoin Offers People A Choice

Bitcoin offers people who can access the internet the opportunity to choose to save in the sound money of bitcoin. A system which has a known and predictable monetary policy, and, importantly, is reliable — it has had 99.98% of uptime since going live in 2009 and is accessible 24/7 and 365 days per year. Unlike traditional banking, bitcoin does not have inconvenient opening times as it does not sleep. According to the Lindy effect, popularized by Nassim Nicholas Taleb, with every block the Bitcoin protocol adds to its blockchain — approximately every 10 minutes (which can be thought of as the heartbeat of the world’s first global, open-source monetary network) — the longer it is probabilistically likely to exist into the future. Bitcoin has existed for 12 years and, therefore, the Lindy effect indicates that we should expect its future lifetime to be at least a further 12 years.

Unsound Money With Minuscule Or Zero Interest Rates

On the other hand, people around the world can choose to store their wealth in their national currency which is being ever-increasingly devalued by the printing of additional units — or in unsound money. Not only that, but, saving in bank accounts with interest rates which are commonly close to zero or negative, it means savers are not rewarded for saving and, at worst, are paying their bank to save. It is also worth adding that, in the world of modern economics, fiat currencies only came into existence in 1971 when President Nixon passed a law taking the United States off the gold standard — before which dollars were redeemable in gold. After 1971, dollars were redeemable with nothing, zilch, nada. Ultimately, a fiat currency’s value is in large part derived from the government’s ability to maintain trust in said currency.

It is not just savers in countries experiencing high levels of inflation or hyperinflation who are turning to bitcoin to store their wealth. The same is true in the United States, home of the current global reserve currency. The economic fallout from the 2008 crisis, and more recently the Covid-19 pandemic, has accelerated the devaluing of the USD. Data from the Federal Reserve — the central bank of the United States — indicates that the broad measure of the stock of dollars, known as the M2 money supply, rose from $15.34 trillion at the start of 2020 to $18.72 trillion in September 2020. The increase of $3.38 trillion equals 18% of the total supply of dollars.

This means nearly one in five dollars was created in 2020.

It also means that, at a stroke of a computer key, every other dollar in existence had an 18% reduction in purchasing power. The chart below illustrates this.

Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, is even on record on CBS on March 22, 2020, as saying: “There’s no end to our ability to [flood the system with money].” Each “flooding” inevitably devalues every other dollar in existence, reducing the purchasing power of hard-earned USD cash savings.

If In Doubt, Zoom Out

Bitcoin’s price has experienced high levels of volatility, however, as it has become increasingly adopted its volatility has reduced. It is worth noting that no monetary asset is able to be bootstrapped from zero to becoming a global money without having volatility — to do so would defy the laws of physics. It is also worth noting that, since inception, bitcoin’s volatility trends to the upside. Consequently, the longer people have held a portion of their savings in bitcoin the more it has increased in purchasing power.

The chart below — created by the former Dutch institutional investor PlanB — shows that bitcoin, priced in USD, has not fallen beneath the 200 Week Moving Average (WMA). Since launching, bitcoin’s 200 WMA has consistently moved in an upward direction. Put another way, bitcoin holders, who hold over a sequence of at least four years, have had their savings accrue in value in US dollar terms. Hence, a simple strategy (but tricky to implement at first, as people tend to think they can increase profits by trading) for accumulating savings in bitcoin is: buy an initial position, buy the dip (when there is a significant price drop — historically 20–30% but seemingly less in this cycle) and Hold On for Dear Life (HODL); .the HODL meme originates from a post on bitcointalk.org by a drunk user who famously misspelt HOLDING.

Institutional Adoption Has De-Risked Bitcoin

Led by the visionary bitcoin advocate and longest serving, publicly listed company CEO Michael Saylor (who happens to be an actual rocket scientist), numerous publicly listed companies, including electric car giant Tesla, have put bitcoin on their company balance sheets. Many other types of institutions have also purchased bitcoin, including the insurance firm MassMutual, typically the most risk averse category of institution. Real estate firms, sovereign wealth funds, and small and medium enterprises have also been acquiring bitcoin.

The next part of the article briefly touches on altcoins (cryptocurrencies other than bitcoin), bitcoin and the environment, and central bank digital currencies (CBDCs). These are big topics in their own right and, given the scope of this article, I will only touch on them at a high level.

A Brief Note On Altcoins

You might be wondering whether the next bitcoin is lying in wait in the 9,191 (and counting) other cryptocurrencies currently listed on CoinMarketCap. The short answer is monetary history has shown that there is a tendency for the market to converge on the soundest money at the expense of all other monies.² No other altcoin can compete with bitcoin’s superior monetary properties, established market cap, network effects, mining and hardware infrastructure, ATMs and so forth. If an altcoin is able to do gazillions of transactions per second, it is because they have made a trade-off somewhere else, most likely in it not being truly decentralized. If you remember, the latter is a fundamental feature in order to keep the temptation to print more monetary units out of human hands. Second, such a take fails to appreciate that increased transaction throughput and speed can be achieved on the second layer of Bitcoin, such as the Lightning Network. This way the decentralization of bitcoin’s base layer is not compromised.

Altcoins should be thought of in the same way as startups — 99% will fail. Some will strike it rich by selecting the 1%, but most people will lose money. If you’re looking for a reliable store of value and savings account, I would recommend looking no further than bitcoin.

However, if you’re looking for high risk, high reward, and you’re willing to put research and time in, you might be successful in the altcoin space — though you might also lose everything, so make sure you go in with your eyes open. Also, remember to compare any profits to bitcoin terms because, if you’re not beating bitcoin, you might as well stick to bitcoin and save yourself the time, and stress, and tax bill on trading altcoins. Willy Woo’s article on “degen” and “oscillator” altcoins is well worth a read.

A Brief Note On Bitcoin And The Environment

There is a lot of talk in the mainstream media about bitcoin being terrible for the environment. First, it is important to understand that the computational power (or hash rate) which the Bitcoin network expends is proportional to the network’s security. Currently, there is $1 trillion sitting in the middle of the table, and it is Bitcoin’s hash rate which secures this. If you see value in the world having access to a cheap, secure and reliable savings account then the energy is put to good use. Bitcoin itself inspires and funds green energy research as it incentivizes the usage of otherwise stranded natural resources.

Second, in his article on the environmental impact of bitcoin mining, Christopher Bendiksen hits on an important point: “Bitcoin is as green as an electric car. Nothing about Bitcoin requires emissions. It will take whatever electricity you feed it. If the world goes green, so does Bitcoin.” Since the cost to produce renewable energy is becoming increasingly competitive compared with fossil fuels, the probability that bitcoin mining continues to become greener increases.

However, and arguably most importantly of all, as a result of its sound money properties, bitcoin enables a deflationary (meaning a reduction in global prices) economic system which would allow us to break out of the current, “endless growth” economic model. Meaning, shock and horror!, Bbitcoin is actually good for the environment.³ This is such an important and under-discussed topic that I will be writing about it in a future article.

A Brief Note On Central Bank Digital Currencies

The majority of central banks are working on creating national CBDCs as they offer a route out, of sorts, from the post-2008, post-Covid monetary quagmire that they find themselves in. Across the world, central banks have become “the only game in town”⁴ and a consistent policy response has been to print more money, otherwise known by the popular meme: “Money Printer Go Brrr.”

Of all the CBDCs under development, China’s digital yuan is at the furthest stage and is already being trialed in certain states. With CBDCs, central banks will be able to offer digital dollars, pounds or yuan directly to citizens. Some people think this will threaten bitcoin’s rise, the short answer is “no” as they will still be a form of unsound money — meaning endless units can be printed — unlike bitcoin’s fixed supply of 21 million. As CBDCs no longer require commercial banks to distribute these digital currency units, the writing is on the wall for our high street banks. In my opinion, this is part of the reason for the banks’ Uu-turn on bitcoin, as recently lots of major and long-established banks have announced that they will offer bitcoin custody and banking services.

What will CBDCs mean for savers? Well, because they will be digital and programmable, they will give central banks much more optionality in terms of how they distribute capital into the economic system. For example, it is theoretically possible for them to set different interest rates for different citizens in the same country — a low or negative interest rate for older, wealthier citizens and a higher interest rate for younger, less wealthy citizens. In China’s digital yuan trial, it has come to light that the system enables an expiration date to be set for certain amounts of currency when seeking to “boost” the economy. In this way, CBDCs would have the capability to actively prevent or discourage saving, and impinge on citizens’ rights to choose when and how to spend their money. On the other hand, bitcoin — because you are your own bank and own all of your satoshis directly (when held on a hardware wallet or similar self-custody solutions) — has no expiration date and you are free to do what you want with it when you want to.

CBDCs would also give central banks the functionality to switch off citizens’ CBDC accounts if they were in breach, or considered to be in breach, of certain rules and regulations. In the wrong hands, they hold the capacity to be a one-way road to greater levels of state control, and, at worst, a “1984”-esque dystopia. I am not saying all this will happen, only that the possibility exists and — as history tends to show — if the ability to do something exists, for the purposes of power and control, over a long enough time span, some humans in leadership positions are likely to choose to use such functionality to further their own interests and agendas. If you’re interested to find out more about this topic, then Simon Dixon is a well-informed source.

Bitcoin’s Too Expensive, I’m Too Late To The Party

People have been saying this since the bitcoin price was $1, $100, $1,000 and $10,000 per coin and the same will be said when the price is $100,000, $1 million and beyond.

The following three facts put the “bitcoin’s too expensive, I’m too late to the party” statement into context:

1. Global bitcoin adoption currently stands at around 2% of the world’s population and bitcoin solves a problem facing billions of people around the world — that of unsound money and the lack of a cheap, secure and reliable savings account.

2. Bitcoin’s market cap is $1 trillion and its addressable market is in the hundreds of trillions.

3. Monetary history is full of examples of more technologically sound monies replacing less technologically sound competitors: shells ➡ glass beads ➡ silver ➡ gold ➡ ?.

It can be argued that bitcoin can already be seen to be eating into gold, owing to its superior monetary technology, as expressed in the chart below.

By exhibiting superior monetary properties compared to other existing monies, technology. In my opinion, bitcoin is on track to becoming the primary store of value for global citizens. The latest development in monetary technological development, its consistent appreciation in price is merely signaling that an increasing number of individuals (and more recently institutions) are rationally choosing to store their wealth in the soundest money available to them. As a result of bitcoin’s open-source nature, this choice is open to you as well too.

Conclusion

As I hope this article has demonstrated, bitcoin’s fixed supply of 21 million coins, decentralized nature and unstoppable code make it the soundest money invented by human civilization.

Currently, people around the world are working increasingly harder for ever-devaluing national currencies. Bitcoin’s growth at over 100% per year for the last 10 years offers global citizens the choice to store their wealth in the latter and not the former. By giving people around the world access to a cheap, secure and reliable savings account, Satoshi has returned hope to individuals that the future will be better not only for them but for their family, friends and community.

In light of what I have outlined above, I recommend that everyone tries to place at least a small portion of their savings in bitcoin to get off zero, even if it is one dollar’s worth (1,673 satoshis at the time of writing). If you are or aren’t ready to do that, I strongly recommend you take some more time to educate yourself further on what bitcoin is and why it is important. (see the Resources section below). It is a fascinating and rewarding topic and there’s always something new to learn.

References:

¹ Bitcoin’s compound annual growth rate* over 10 years was 132.65% on 24 May 2021.

* Compound annual growth rate (CAGR) is the rate of return that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each year of the investment’s lifespan.

² “The Bitcoin Standard: The Decentralized Alternative to Central Banking” by Saifedean Ammous; the early chapters provide a solid framework around the history of money. If you read only one book on bitcoin, you’ll be hard-pressed to find a better one than this.

³ “The Price of Tomorrow” by Jeff Booth; A must-read about how technological improvements are naturally deflationary and result in the fall in prices of goods.

⁴ “The Only Game in Town: Central Banks, Instability, and Avoiding the Next Collapse” by Mohamed A. El-Erian; a thought-provoking take on central banks and the prospects for the global economy from more of an insider perspective.

This is a guest post by Harry Duncan. Opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

bitcoin blockchain btc pandemic covid-19 real estate currencies us dollar yuan crypto goldUncategorized

Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution…

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

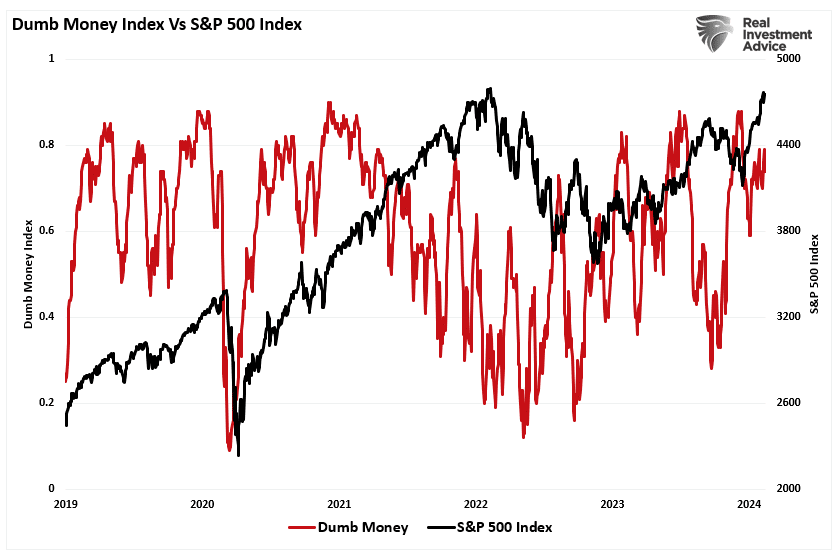

“Such is unsurprising, given that retail investors often fall victim to the psychological behavior of the “fear of missing out.” The chart below shows the “dumb money index” versus the S&P 500. Once again, retail investors are very long equities relative to the institutional players ascribed to being the “smart money.””

“The difference between “smart” and “dumb money” investors shows that, more often than not, the “dumb money” invests near market tops and sells near market bottoms.”

That enthusiasm has increased sharply since last November as stocks surged in hopes that the Federal Reserve would cut interest rates. As noted by Sentiment Trader:

“Over the past 18 weeks, the straight-up rally has moved us to an interesting juncture in the Sentiment Cycle. For the past few weeks, the S&P 500 has demonstrated a high positive correlation to the ‘Enthusiasm’ part of the cycle and a highly negative correlation to the ‘Panic’ phase.”

That frenzy to chase the markets, driven by the psychological bias of the “fear of missing out,” has permeated the entirety of the market. As noted in “This Is Nuts:”

“Since then, the entire market has surged higher following last week’s earnings report from Nvidia (NVDA). The reason I say “this is nuts” is the assumption that all companies were going to grow earnings and revenue at Nvidia’s rate. There is little doubt about Nvidia’s earnings and revenue growth rates. However, to maintain that growth pace indefinitely, particularly at 32x price-to-sales, means others like AMD and Intel must lose market share.”

Of course, it is not just a speculative frenzy in the markets for stocks, specifically anything related to “artificial intelligence,” but that exuberance has spilled over into gold and cryptocurrencies.

Birds Of A Feather

There are a couple of ways to measure exuberance in the assets. While sentiment measures examine the broad market, technical indicators can reflect exuberance on individual asset levels. However, before we get to our charts, we need a brief explanation of statistics, specifically, standard deviation.

As I discussed in “Revisiting Bob Farrell’s 10 Investing Rules”:

“Like a rubber band that has been stretched too far – it must be relaxed in order to be stretched again. This is exactly the same for stock prices that are anchored to their moving averages. Trends that get overextended in one direction, or another, always return to their long-term average. Even during a strong uptrend or strong downtrend, prices often move back (revert) to a long-term moving average.”

The idea of “stretching the rubber band” can be measured in several ways, but I will limit our discussion this week to Standard Deviation and measuring deviation with “Bollinger Bands.”

“Standard Deviation” is defined as:

“A measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is calculated as the square root of the variance.”

In plain English, this means that the further away from the average that an event occurs, the more unlikely it becomes. As shown below, out of 1000 occurrences, only three will fall outside the area of 3 standard deviations. 95.4% of the time, events will occur within two standard deviations.

A second measure of “exuberance” is “relative strength.”

“In technical analysis, the relative strength index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is displayed as an oscillator (a line graph that moves between two extremes) and can read from 0 to 100.

Traditional interpretation and usage of the RSI are that values of 70 or above indicate that a security is becoming overbought or overvalued and may be primed for a trend reversal or corrective pullback in price. An RSI reading of 30 or below indicates an oversold or undervalued condition.” – Investopedia

With those two measures, let’s look at Nvidia (NVDA), the poster child of speculative momentum trading in the markets. Nvidia trades more than 3 standard deviations above its moving average, and its RSI is 81. The last time this occurred was in July of 2023 when Nvidia consolidated and corrected prices through November.

Interestingly, gold also trades well into 3 standard deviation territory with an RSI reading of 75. Given that gold is supposed to be a “safe haven” or “risk off” asset, it is instead getting swept up in the current market exuberance.

The same is seen with digital currencies. Given the recent approval of spot, Bitcoin exchange-traded funds (ETFs), the panic bid to buy Bitcoin has pushed the price well into 3 standard deviation territory with an RSI of 73.

In other words, the stock market frenzy to “buy anything that is going up” has spread from just a handful of stocks related to artificial intelligence to gold and digital currencies.

It’s All Relative

We can see the correlation between stock market exuberance and gold and digital currency, which has risen since 2015 but accelerated following the post-pandemic, stimulus-fueled market frenzy. Since the market, gold and cryptocurrencies, or Bitcoin for our purposes, have disparate prices, we have rebased the performance to 100 in 2015.

Gold was supposed to be an inflation hedge. Yet, in 2022, gold prices fell as the market declined and inflation surged to 9%. However, as inflation has fallen and the stock market surged, so has gold. Notably, since 2015, gold and the market have moved in a more correlated pattern, which has reduced the hedging effect of gold in portfolios. In other words, during the subsequent market decline, gold will likely track stocks lower, failing to provide its “wealth preservation” status for investors.

The same goes for cryptocurrencies. Bitcoin is substantially more volatile than gold and tends to ebb and flow with the overall market. As sentiment surges in the S&P 500, Bitcoin and other cryptocurrencies follow suit as speculative appetites increase. Unfortunately, for individuals once again piling into Bitcoin to chase rising prices, if, or when, the market corrects, the decline in cryptocurrencies will likely substantially outpace the decline in market-based equities. This is particularly the case as Wall Street can now short the spot-Bitcoin ETFs, creating additional selling pressure on Bitcoin.

Just for added measure, here is Bitcoin versus gold.

Not A Recommendation

There are many narratives surrounding the markets, digital currency, and gold. However, in today’s market, more than in previous years, all assets are getting swept up into the investor-feeding frenzy.

Sure, this time could be different. I am only making an observation and not an investment recommendation.

However, from a portfolio management perspective, it will likely pay to remain attentive to the correlated risk between asset classes. If some event causes a reversal in bullish exuberance, cash and bonds may be the only place to hide.

The post Digital Currency And Gold As Speculative Warnings appeared first on RIA.

bonds pandemic sp 500 equities stocks bitcoin currencies goldSpread & Containment

Four Years Ago This Week, Freedom Was Torched

Four Years Ago This Week, Freedom Was Torched

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare…

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare quotes the soothsayer’s warning Julius Caesar about what turned out to be an impending assassination on March 15. The death of American liberty happened around the same time four years ago, when the orders went out from all levels of government to close all indoor and outdoor venues where people gather.

It was not quite a law and it was never voted on by anyone. Seemingly out of nowhere, people who the public had largely ignored, the public health bureaucrats, all united to tell the executives in charge – mayors, governors, and the president – that the only way to deal with a respiratory virus was to scrap freedom and the Bill of Rights.

And they did, not only in the US but all over the world.

The forced closures in the US began on March 6 when the mayor of Austin, Texas, announced the shutdown of the technology and arts festival South by Southwest. Hundreds of thousands of contracts, of attendees and vendors, were instantly scrapped. The mayor said he was acting on the advice of his health experts and they in turn pointed to the CDC, which in turn pointed to the World Health Organization, which in turn pointed to member states and so on.

There was no record of Covid in Austin, Texas, that day but they were sure they were doing their part to stop the spread. It was the first deployment of the “Zero Covid” strategy that became, for a time, official US policy, just as in China.

It was never clear precisely who to blame or who would take responsibility, legal or otherwise.

This Friday evening press conference in Austin was just the beginning. By the next Thursday evening, the lockdown mania reached a full crescendo. Donald Trump went on nationwide television to announce that everything was under control but that he was stopping all travel in and out of US borders, from Europe, the UK, Australia, and New Zealand. American citizens would need to return by Monday or be stuck.

Americans abroad panicked while spending on tickets home and crowded into international airports with waits up to 8 hours standing shoulder to shoulder. It was the first clear sign: there would be no consistency in the deployment of these edicts.

There is no historical record of any American president ever issuing global travel restrictions like this without a declaration of war. Until then, and since the age of travel began, every American had taken it for granted that he could buy a ticket and board a plane. That was no longer possible. Very quickly it became even difficult to travel state to state, as most states eventually implemented a two-week quarantine rule.

The next day, Friday March 13, Broadway closed and New York City began to empty out as any residents who could went to summer homes or out of state.

On that day, the Trump administration declared the national emergency by invoking the Stafford Act which triggers new powers and resources to the Federal Emergency Management Administration.

In addition, the Department of Health and Human Services issued a classified document, only to be released to the public months later. The document initiated the lockdowns. It still does not exist on any government website.

The White House Coronavirus Response Task Force, led by the Vice President, will coordinate a whole-of-government approach, including governors, state and local officials, and members of Congress, to develop the best options for the safety, well-being, and health of the American people. HHS is the LFA [Lead Federal Agency] for coordinating the federal response to COVID-19.

Closures were guaranteed:

Recommend significantly limiting public gatherings and cancellation of almost all sporting events, performances, and public and private meetings that cannot be convened by phone. Consider school closures. Issue widespread ‘stay at home’ directives for public and private organizations, with nearly 100% telework for some, although critical public services and infrastructure may need to retain skeleton crews. Law enforcement could shift to focus more on crime prevention, as routine monitoring of storefronts could be important.

In this vision of turnkey totalitarian control of society, the vaccine was pre-approved: “Partner with pharmaceutical industry to produce anti-virals and vaccine.”

The National Security Council was put in charge of policy making. The CDC was just the marketing operation. That’s why it felt like martial law. Without using those words, that’s what was being declared. It even urged information management, with censorship strongly implied.

The timing here is fascinating. This document came out on a Friday. But according to every autobiographical account – from Mike Pence and Scott Gottlieb to Deborah Birx and Jared Kushner – the gathered team did not meet with Trump himself until the weekend of the 14th and 15th, Saturday and Sunday.

According to their account, this was his first real encounter with the urge that he lock down the whole country. He reluctantly agreed to 15 days to flatten the curve. He announced this on Monday the 16th with the famous line: “All public and private venues where people gather should be closed.”

This makes no sense. The decision had already been made and all enabling documents were already in circulation.

There are only two possibilities.

One: the Department of Homeland Security issued this March 13 HHS document without Trump’s knowledge or authority. That seems unlikely.

Two: Kushner, Birx, Pence, and Gottlieb are lying. They decided on a story and they are sticking to it.

Trump himself has never explained the timeline or precisely when he decided to greenlight the lockdowns. To this day, he avoids the issue beyond his constant claim that he doesn’t get enough credit for his handling of the pandemic.

With Nixon, the famous question was always what did he know and when did he know it? When it comes to Trump and insofar as concerns Covid lockdowns – unlike the fake allegations of collusion with Russia – we have no investigations. To this day, no one in the corporate media seems even slightly interested in why, how, or when human rights got abolished by bureaucratic edict.

As part of the lockdowns, the Cybersecurity and Infrastructure Security Agency, which was and is part of the Department of Homeland Security, as set up in 2018, broke the entire American labor force into essential and nonessential.

They also set up and enforced censorship protocols, which is why it seemed like so few objected. In addition, CISA was tasked with overseeing mail-in ballots.

Only 8 days into the 15, Trump announced that he wanted to open the country by Easter, which was on April 12. His announcement on March 24 was treated as outrageous and irresponsible by the national press but keep in mind: Easter would already take us beyond the initial two-week lockdown. What seemed to be an opening was an extension of closing.

This announcement by Trump encouraged Birx and Fauci to ask for an additional 30 days of lockdown, which Trump granted. Even on April 23, Trump told Georgia and Florida, which had made noises about reopening, that “It’s too soon.” He publicly fought with the governor of Georgia, who was first to open his state.

Before the 15 days was over, Congress passed and the president signed the 880-page CARES Act, which authorized the distribution of $2 trillion to states, businesses, and individuals, thus guaranteeing that lockdowns would continue for the duration.

There was never a stated exit plan beyond Birx’s public statements that she wanted zero cases of Covid in the country. That was never going to happen. It is very likely that the virus had already been circulating in the US and Canada from October 2019. A famous seroprevalence study by Jay Bhattacharya came out in May 2020 discerning that infections and immunity were already widespread in the California county they examined.

What that implied was two crucial points: there was zero hope for the Zero Covid mission and this pandemic would end as they all did, through endemicity via exposure, not from a vaccine as such. That was certainly not the message that was being broadcast from Washington. The growing sense at the time was that we all had to sit tight and just wait for the inoculation on which pharmaceutical companies were working.

By summer 2020, you recall what happened. A restless generation of kids fed up with this stay-at-home nonsense seized on the opportunity to protest racial injustice in the killing of George Floyd. Public health officials approved of these gatherings – unlike protests against lockdowns – on grounds that racism was a virus even more serious than Covid. Some of these protests got out of hand and became violent and destructive.

Meanwhile, substance abuse rage – the liquor and weed stores never closed – and immune systems were being degraded by lack of normal exposure, exactly as the Bakersfield doctors had predicted. Millions of small businesses had closed. The learning losses from school closures were mounting, as it turned out that Zoom school was near worthless.

It was about this time that Trump seemed to figure out – thanks to the wise council of Dr. Scott Atlas – that he had been played and started urging states to reopen. But it was strange: he seemed to be less in the position of being a president in charge and more of a public pundit, Tweeting out his wishes until his account was banned. He was unable to put the worms back in the can that he had approved opening.

By that time, and by all accounts, Trump was convinced that the whole effort was a mistake, that he had been trolled into wrecking the country he promised to make great. It was too late. Mail-in ballots had been widely approved, the country was in shambles, the media and public health bureaucrats were ruling the airwaves, and his final months of the campaign failed even to come to grips with the reality on the ground.

At the time, many people had predicted that once Biden took office and the vaccine was released, Covid would be declared to have been beaten. But that didn’t happen and mainly for one reason: resistance to the vaccine was more intense than anyone had predicted. The Biden administration attempted to impose mandates on the entire US workforce. Thanks to a Supreme Court ruling, that effort was thwarted but not before HR departments around the country had already implemented them.

As the months rolled on – and four major cities closed all public accommodations to the unvaccinated, who were being demonized for prolonging the pandemic – it became clear that the vaccine could not and would not stop infection or transmission, which means that this shot could not be classified as a public health benefit. Even as a private benefit, the evidence was mixed. Any protection it provided was short-lived and reports of vaccine injury began to mount. Even now, we cannot gain full clarity on the scale of the problem because essential data and documentation remains classified.

After four years, we find ourselves in a strange position. We still do not know precisely what unfolded in mid-March 2020: who made what decisions, when, and why. There has been no serious attempt at any high level to provide a clear accounting much less assign blame.

Not even Tucker Carlson, who reportedly played a crucial role in getting Trump to panic over the virus, will tell us the source of his own information or what his source told him. There have been a series of valuable hearings in the House and Senate but they have received little to no press attention, and none have focus on the lockdown orders themselves.

The prevailing attitude in public life is just to forget the whole thing. And yet we live now in a country very different from the one we inhabited five years ago. Our media is captured. Social media is widely censored in violation of the First Amendment, a problem being taken up by the Supreme Court this month with no certainty of the outcome. The administrative state that seized control has not given up power. Crime has been normalized. Art and music institutions are on the rocks. Public trust in all official institutions is at rock bottom. We don’t even know if we can trust the elections anymore.

In the early days of lockdown, Henry Kissinger warned that if the mitigation plan does not go well, the world will find itself set “on fire.” He died in 2023. Meanwhile, the world is indeed on fire. The essential struggle in every country on earth today concerns the battle between the authority and power of permanent administration apparatus of the state – the very one that took total control in lockdowns – and the enlightenment ideal of a government that is responsible to the will of the people and the moral demand for freedom and rights.

How this struggle turns out is the essential story of our times.

CODA: I’m embedding a copy of PanCAP Adapted, as annotated by Debbie Lerman. You might need to download the whole thing to see the annotations. If you can help with research, please do.

* * *

Jeffrey Tucker is the author of the excellent new book 'Life After Lock-Down'

Government

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A U.S. Centers for Disease Control (CDC) paper released Thursday found that thousands of young children have been taken to the emergency room over the past several years after taking the very common sleep-aid supplement melatonin.

The agency said that melatonin, which can come in gummies that are meant for adults, was implicated in about 7 percent of all emergency room visits for young children and infants “for unsupervised medication ingestions,” adding that many incidents were linked to the ingestion of gummy formulations that were flavored. Those incidents occurred between the years 2019 and 2022.

Melatonin is a hormone produced by the human body to regulate its sleep cycle. Supplements, which are sold in a number of different formulas, are generally taken before falling asleep and are popular among people suffering from insomnia, jet lag, chronic pain, or other problems.

The supplement isn’t regulated by the U.S. Food and Drug Administration and does not require child-resistant packaging. However, a number of supplement companies include caps or lids that are difficult for children to open.

The CDC report said that a significant number of melatonin-ingestion cases among young children were due to the children opening bottles that had not been properly closed or were within their reach. Thursday’s report, the agency said, “highlights the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight,” including melatonin.

The approximately 11,000 emergency department visits for unsupervised melatonin ingestions by infants and young children during 2019–2022 highlight the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight.

The CDC notes that melatonin use among Americans has increased five-fold over the past 25 years or so. That has coincided with a 530 percent increase in poison center calls for melatonin exposures to children between 2012 and 2021, it said, as well as a 420 percent increase in emergency visits for unsupervised melatonin ingestion by young children or infants between 2009 and 2020.

Some health officials advise that children under the age of 3 should avoid taking melatonin unless a doctor says otherwise. Side effects include drowsiness, headaches, agitation, dizziness, and bed wetting.

Other symptoms of too much melatonin include nausea, diarrhea, joint pain, anxiety, and irritability. The supplement can also impact blood pressure.

However, there is no established threshold for a melatonin overdose, officials have said. Most adult melatonin supplements contain a maximum of 10 milligrams of melatonin per serving, and some contain less.

Many people can tolerate even relatively large doses of melatonin without significant harm, officials say. But there is no antidote for an overdose. In cases of a child accidentally ingesting melatonin, doctors often ask a reliable adult to monitor them at home.

Dr. Cora Collette Breuner, with the Seattle Children’s Hospital at the University of Washington, told CNN that parents should speak with a doctor before giving their children the supplement.

“I also tell families, this is not something your child should take forever. Nobody knows what the long-term effects of taking this is on your child’s growth and development,” she told the outlet. “Taking away blue-light-emitting smartphones, tablets, laptops, and television at least two hours before bed will keep melatonin production humming along, as will reading or listening to bedtime stories in a softly lit room, taking a warm bath, or doing light stretches.”

In 2022, researchers found that in 2021, U.S. poison control centers received more than 52,000 calls about children consuming worrisome amounts of the dietary supplement. That’s a six-fold increase from about a decade earlier. Most such calls are about young children who accidentally got into bottles of melatonin, some of which come in the form of gummies for kids, the report said.

Dr. Karima Lelak, an emergency physician at Children’s Hospital of Michigan and the lead author of the study published in 2022 by the CDC, found that in about 83 percent of those calls, the children did not show any symptoms.

However, other children had vomiting, altered breathing, or other symptoms. Over the 10 years studied, more than 4,000 children were hospitalized, five were put on machines to help them breathe, and two children under the age of two died. Most of the hospitalized children were teenagers, and many of those ingestions were thought to be suicide attempts.

Those researchers also suggested that COVID-19 lockdowns and virtual learning forced more children to be at home all day, meaning there were more opportunities for kids to access melatonin. Also, those restrictions may have caused sleep-disrupting stress and anxiety, leading more families to consider melatonin, they suggested.

The Associated Press contributed to this report.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 days ago

International4 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges