Bitcoin ETF may come to US, but not all crypto investors think it’s needed

As Bitcoin ETFs launch in Canada, an approval from U.S. authorities appears to be closer than ever before as naysayers start to run out of reasons to deny it.

The United States Securities and Exchange Commission’s floor is littered…

As Bitcoin ETFs launch in Canada, an approval from U.S. authorities appears to be closer than ever before as naysayers start to run out of reasons to deny it.

The United States Securities and Exchange Commission’s floor is littered with failed crypto fund filings, but this year, following Canada’s lead, the U.S. might actually have an exchange-traded fund that tracks digital assets.

After all, the price of Bitcoin (BTC) is booming, the SEC has a new crypto-savvy chairman, and Canada, which is sometimes viewed as a beta test site by U.S. regulators, debuted a Bitcoin ETF in late February that by most accounts has been stunningly popular. But does a crypto ETF really matter anymore?

Clearly, a lot has changed in the past year — what with a global pandemic, a change in administrations in Washington and new price records being set regularly on the crypto front. Whereas many predicted as recently as June 2020 that an SEC-sanctioned Bitcoin ETF would be a very “BIG Deal” and “open the flood gates” to BTC adoption, with a crypto ETF now on the brink, some observers aren’t so sure anymore.

“I used to think it would be a game-changer but now I think it would be just another step in the evolution of crypto,” Lee Reiners, executive director of the Global Financial Markets Center at Duke University School of Law, told Cointelegraph.

Eric Ervin, CEO of Blockforce Capital and Reality Shares and co-founder of Onramp Invest, told Cointelegraph: “I think a crypto ETF is less significant than we thought before because a lot of institutional investors finally got tired of waiting and figured it out.” Ervin’s firm was one of nearly a dozen whose application was sideswiped by the SEC — the Reality Shares ETF Trust application was pulled in February 2019 “on SEC advice.” That said, Ervin acknowledged that there “are still a massive number of investors on the sidelines” who might welcome such an investment option.

Meanwhile, applications to the U.S. agency keep flowing. Most recently, the Chicago Board Options Exchange requested permission to list a Bitcoin ETF proposed by asset manager VanEck.

State Street Corporation — one of the world’s largest custodians, with $38.8 trillion in assets under custody and/or administration — will be servicing the VanEck ETF, if approved. Nadine Chakar, head of State Street Global Markets, told Cointelegraph that the company is working to bring ETFs and exchange-traded notes to market in Europe and the Asia-Pacific region, adding that “Our clients have seen interest grow in Bitcoin and [...] there is a feeling the market is maturing.” Indeed, in the three years since early 2018 when Bitcoin interest last peaked:

“They feel that the market has become more efficient, crypto custody solutions have evolved to offer better security that they are comfortable with, and regulatory clarity has increased such as we’ve seen with the OCC’s [Office of the Comptroller of the Currency] recent announcements.”

More success in 2021?

Has the crypto ETF climate really changed in Washington though? Michael Venuto, co‑founder and chief investment officer of Toroso Investments, told Cointelegraph: “I believe the odds of a U.S. Bitcoin ETF being approved are higher than in previous years.” Improved crypto custody, reporting and transaction transparency have calmed many regulators’ concerns, he said, and “The fact that BNY Mellon announced its move towards crypto custody on the same day as a Bitcoin ETF was approved in Canada is not a coincidence.”

“Investors have been looking to the US as the next potential market for ETFs that track digital assets,” wrote FTSE Russell, a subsidiary of London Stock Exchange Group that produces stock market indices, in a recent blog post, adding: “And speculation has only increased in recent weeks with the first Bitcoin ETF launch in Canada joining crypto ETP listings in Germany and Switzerland, as well as the continued popularity of the Grayscale investment trusts tracking this market.”

Regarding Gary Gensler’s nomination as SEC chairman, “This goes a long way towards advancing innovation in the US financial markets,” added Ervin, who agreed that the likelihood that U.S. regulators will approve a Bitcoin ETF this year has improved. He added further:

“As a former Chair of the CFTC, Gensler understands the importance of financial innovation, but he also has a healthy respect for the potential damage that unchecked markets bring.”

Reiners observed that based on what the SEC had been saying recently ETFwise — which isn’t much — a U.S. crypto ETF seems to be no closer than a year ago. However, when taking a broader look at the maturation of the crypto market and the subsequent institutional interest, he believes “It’s getting harder for the SEC to continue to say no.”

Is an ETF better than a trust?

But would an SEC-sanctioned ETF really be of major consequence now? What, for instance, does an ETF offer Bitcoin investors that current “trusts” like Grayscale Bitcoin Trust don’t?

GBTC and other trusts trade over the counter, not on major exchanges like the New York Stock Exchange, noted Reiners. By comparison, “An ETF is widely accessible to all,” including retail investors without access to OTC markets.

State Street’s Chakar noted that GBTC is essentially a closed-end fund open to qualified investors, and although shares of the trust are available on the secondary market to retail investors, those shares “are not tied directly to the price of Bitcoin. As such shares most times trade at a premium — or a discount — to the underlying price of Bitcoin.”

Venuto added further: “The ETF structure provides for intra-day creation and redemption to meet demand. This function removes the premium and discount issues which have impacted the pricing of GBTC” — though he opined that if regulators were to approve a Bitcoin ETF, “Then in short order they would allow GBTC to convert to a similar ETF like structure.”

Along these lines, Canada-based investment manager Ninepoint Partners, which launched a Bitcoin trust two months ago, this week announced plans to convert its trust to an ETF on the Toronto Stock Exchange — following other Canadian investment firms seeking to capitalize on the untapped crypto ETF market in the country.

More adoption?

If a U.S. crypto ETF comes to pass, how would it play out? Would it bring in more institutional investors, for example? “Many institutions can only invest in funds, so the ETF is a wonderful step in the right direction,” Ervin said.

Institutional interest will continue to build regardless of an ETF, opined Venuto: “In terms of institutional adoption, that ship has sailed. [...] An ETF will be primarily used by individual investors and financial advisors.”

“An ETF is more attractive to both institutions and retail investors in that it does tend to carry much less liquidity risk and more transparency to the underlying price of the asset — and fees associated with it,” said Chakar.

But what about Bitcoin and cryptocurrency adoption in general? Would a U.S. crypto ETF transform that landscape? Reiners told Cointelegraph:

“There are now lots of ways for retail investors to get exposure to crypto, and the list keeps growing. Plus now we have Tesla and other public companies investing in Bitcoin. The barrier between the crypto sector and the traditional financial system has been eroding for several years now; a Bitcoin ETF would further blur this boundary.”

Regarding Tesla, MicroStrategy and other public companies that have purchased Bitcoin recently, Chakar told Cointelegraph that “Investing in a company that has publicly acknowledged that it’s buying Bitcoin is probably not what most institutional [investors] would do to gain exposure to the asset.”

She added that crypto has been around for 10-plus years now, “But it has never been packaged in a way that allows for integration into a portfolio that is seamless.” By comparison, “ETFs have proven themselves to be a preferred and growing investment alternative thanks to the fact they offer a lower cost, liquidity and tax efficiency that direct investments may not, especially in nascent vehicles like Bitcoin.” Ervin told Cointelegraph that he likes the idea of an ETF for things like gold or silver, but for him, “Wrapping bitcoin up into a fund seems silly to me.” He added:

“There is no doubt that it is a better vehicle than a closed-end product, and competition will bring better fees and price discovery, but I don’t think most investors realize that they can buy Bitcoin directly without worrying about the cumbersome burden and costs of a fund.”

“Bitcoin doesn’t need an ETF”?

All in all, it looks like a U.S. crypto ETF will eventually come. As Reiners noted: “Regardless of their [the SEC’s] view on the merits of an ETF, if they are the lone holdouts, you have to wonder how much longer before they cave to the immense pressure and interest for an ETF.”

Under present circumstances, a U.S. government-approved Bitcoin exchange-traded fund may not be the game changer that some once predicted. A year ago, most didn’t anticipate the current institutional absorption of digital assets.

As Macrae Sykes, portfolio manager and research analyst at Gabelli Funds — an investment management firm — told Cointelegraph, institutional interest in cryptocurrency continues to grow. Coinbase’s initial public offering filing and Bank of New York Mellon’s recent announcement that it will support digital currencies offer further evidence of potential growing demand: “The ETF approval in Canada is just another step in the evolving regulatory process for accessing digital assets.”

“Bitcoin doesn’t need an ETF,” Venuto told Cointelegraph. Still, even if no longer a game changer, there is little for a crypto enthusiast not to like about an SEC-sanctioned crypto ETF: “Access is access and the more access to the asset class, the better,” said Ervin. After all, “Not everyone wants to own bitcoin directly.”

cryptocurrency bitcoin crypto btc pandemicGovernment

Stock Market Today: Stocks turn lower as factory inflation spikes, retail sales miss target

Stocks will navigate the last major data releases prior to next week’s Fed rate meeting in Washington.

Check back for updates throughout the trading day

U.S. stocks edged lower Thursday following a trio of key economic releases that have added to the current inflation puzzle as investors shift focus to the Federal Reserve's March policy meeting next week in Washington.

Updated at 9:59 AM EDT

Red start

Stocks are now falling sharply following the PPI inflation data and retail sales miss, with the S&P 500 marked 18 points lower, or 0.36%, in the opening half hour of trading.

The Dow, meanwhile, was marked 92 points lower while the Nasdaq slipped 67 points.

Treasury yields are also on the move, with 2-year notes rising 5 basis points on the session to 4.679% and 10-year notes pegged 7 basis points higher at 4.271%.

The probability of a June rate cut has moved below 60% after the higher-than-expected CPI/PPI reports. A week ago this probability was 74% and a month ago it was 82%. pic.twitter.com/9W01oWU96G

— Charlie Bilello (@charliebilello) March 14, 2024

Updated at 9:44 AM EDT

Under Water

Under Armour (UAA) shares slumped firmly lower in early trading following the sportswear group's decision to bring back founder Kevin Plank as CEO, replacing the outgoing Stephanie Linnartz.

Plank, who founded Under Armour in 1996, left the group in May of 2021 just weeks before the group revealed that it was co-operating with investigations from both the Securities and Exchange Commission and the U.S. Department of Justice into the company's revenue recognition accounting.

Under Armour shares were marked 10.6% lower in early trading to change hands at $7.21 each.

Updated at 9:22 AM EDT

Steely resolve

U.S. Steel (X) shares extended their two-day decline Thursday, falling 5.75% in pre-market trading following multiple reports that suggest President Joe Biden will push to prevent Japan's Nippon Steel from buying the Pittsburgh-based group.

Both Reuters and the Associated Press have said Biden will express his views to Prime Minister Kishida Yuko ahead of a planned State Visit next month at the White House.

Related: US Steel soars on $15 billion Nippon Steel takeover; United Steelworkers slams deal

Updated at 8:52 AM EDT

Clear as mud

Retail sales rebounded last month, but the overall tally of $700.7 billion missed Street forecasts and suggests the recent uptick in inflation could be holding back discretionary spending.

A separate reading of factory inflation, meanwhile, showed prices spiking by 1.6%, on the year, and 0.6% on the month, amid a jump in goods prices.

U.S. stocks held earlier gains following the data release, with futures tied to the S&P 500 indicating an opening bell gain of 10 points, while the Dow was called 140 points higher. The Nasdaq, meanwhile, is looking at a more modest 40 point gain.

Benchmark 10-year Treasury note yields edged 3 basis points lower to 4.213% while two-year notes were little-changed at 4.626%.

The #PPI troughed 8 months ago, yet the economic consensus and even the #Fed believes #inflation has been conquered. Forget the forecasts for multiple rate cuts. pic.twitter.com/ZNIiKLWdFA

— Richard Bernstein Advisors (@RBAdvisors) March 14, 2024

Stock Market Today

Stocks finished lower last night, with the S&P 500 ending modestly in the red and the Nasdaq falling around 0.5%. The declines came amid an uptick in Treasury yields tied to concern that inflation pressures have failed to ease over the opening months of the year.

A better-than-expected auction of $22 billion in 30-year bonds, drawing the strongest overall demand since last June, steadied the overall market, but stocks still slipped into the close with an eye towards today's dataset.

The Commerce Department will publish its February reading of factory-gate inflation at 8:30 am Eastern Time. Analysts are expecting a slowdown in the key core reading, which feeds into the Fed's favored PCE price index.

Retail sales figures for the month are also set for an 8:30 am release as investors search for clues on consumer strength, tied to a resilient job market. Those factors could give the Fed more justification to wait until the summer months to begin the first of its three projected rate cuts.

"The case for a gradual but sustained slowdown in growth in consumers’ spending from 2023’s robust pace is persuasive," said Ian Shepherdson of Pantheon Macroeconomics.

"Most households have run down the excess savings accumulated during the pandemic, while the cost of credit has jumped and last year’s plunge in home sales has depressed demand housing-related retail items like furniture and appliances," he added.

Benchmark 10-year Treasury yields are holding steady at 4.196% heading into the start of the New York trading session, while 2-year notes were pegged at 4.628%.

With Fed officials in a quiet period, requiring no public comments ahead of next week's meeting in Washington, the U.S. dollar index is trading in a narrow range against its global peers and was last marked 0.06% higher at 102.852.

On Wall Street, futures tied to the S&P 500 are indicating an opening bell gain of around 19 points, with the Dow Jones Industrial Average indicating a 140-point advance.

The tech-focused Nasdaq, which is up 7.77% for the year, is priced for a gain of around 95 points, with Tesla (TSLA) once again sliding into the red after ending the Wednesday session at a 10-month low.

In Europe, the regionwide Stoxx 600 was marked 0.35% higher in early Frankfurt trading, while Britain's FTSE 100 slipped 0.09% in London.

Overnight in Asia, the Nikkei 225 gained 0.29% as investors looked to a key series of wage negotiation figures from key unions that are likely to see the biggest year-on-year pay increases in three decades.

The broader MSCI ex-Japan benchmark, meanwhile, rose 0.18% into the close of trading.

Related: Veteran fund manager picks favorite stocks for 2024

bonds pandemic dow jones sp 500 nasdaq ftse stocks rate cut fed federal reserve home sales white house japan europeUncategorized

Walmart and Target make key self-checkout changes to fight theft

Both chains are making changes customers may not like, but self-checkout isn’t going anywhere, according to one industry expert.

In parts of the world, public bathrooms come with a charge, but people pay on the honor system. The money charged allows for better upkeep of the facilities and most people don't mind dropping a small bill or some coins into a lockbox and many of the people who don't are likely dealing with larger problems.

The honor system, however, requires honor. It's based on the idea that most people are trustworthy and that they will pay their fair share.

Related: Beloved mall retailer files Chapter 7 bankruptcy, will liquidate

In the case of a bathroom, people cheating the system are only stealing a low-value service. In the case of self-checkout, a variation on the honor system, people looking to steal by "forgetting" to scan an item can be a very expensive problem.

That has led retailers including Target, Walmart, and Dollar General to make changes. Target has limited the amount of items you can scan at self-checkout at some stores while Dollar General has literally eliminated it in some locations.

Walmart, like Target, has experimented with item limits and limiting the hours of operation for self-checkout. Now, in some stores, the chain has decided to designate some of its self-checkout stations for Walmart+ members and delivery drivers using the Spark app.

Advantage Solutions General Manager Andy Keenan answered some questions about Walmart, self-checkout, and theft from TheStreet via email.

Image source: John Smith/VIEWpress.

What Walmart's self-checkout changes mean

TheStreet: What are the benefits of reserving self-checkout registers for Spark drivers and Walmart+ customers?

Keenan: The benefits include exclusivity and perks of membership, speed, and convenience when shopping.

TheStreet: If this rolls out more broadly, what do you anticipate being the impact on non-Walmart+ customers?

Keenan: There is the potential for non-Walmart+ customers to become agitated, they are losing convenience because they are not enrolled. Customers who are looking for convenience will have fewer options for speed to check out.

TheStreet: Do lane restrictions like limiting lanes to 10 items or fewer help reduce time spent waiting in lines?

Keenan: Yes, but retailers must have a diverse amount of check lane options including 10 items or fewer to ensure that the speed of checkout actually transpires.

TheStreet: Do you believe self-checkout is leading to partial shrink? If so, do you think that this move to shut off self-checkout lanes will help prevent theft in the future?

Keenan: Yes, self-checkout is leading to partial shrink. We believe this tends to be more due to errors in scanning and intentional theft.

There are already front-end transformation tests going on in stores, reducing the number of self-checkouts and shifting back to cashier checkouts in order to measure the reduction in shrink. Early indicators show that a move back to cashier checkouts combined with other shrink initiatives will help prevent theft.

Self-checkout is not going away

While changes are ongoing, Keenan believes self-checkout is here to stay.

“Self-checkout is not, as one recent article called it, a failed experiment. It’s actually part of the next evolution of the retail customer experience, and evolutions take time,” Keenan said in a web post about the findings of the 2024 Advantage Shopper Outlook survey.

He makes it clear that rising labor costs and struggles to find workers make some for of self-checkout inevitable.

“Since the pandemic, there’s been a revolution on hourly labor,” Keenan said. “Labor in certain markets that would cost you $16 an hour now costs you $19 or $20 an hour, and it’s a gig economy. The people who once stood at a checkout stand in the front of a store are now driving for Instacart or DoorDash because the hours are more flexible. They want to make their own schedule, and it’s varied work. Today, most retailers can’t offer that.”

Basically, while there are kinks to work out, self-checkout simply makes sense for retailers.

“The notion that we’re going to pivot away from technology that helps offset labor needs and will ultimately continue to improve customer experience because of some challenges is far-fetched. We need to continue to embrace the technology and realize that it may always be imperfect, but it will always be evolving. The noise that, ‘Oh, self-checkout might not be working,’ that’s just a moment in time,” he added.

bankruptcy pandemicUncategorized

Hitting Home: Housing Affordability in the U.S.

The Issue:

Housing is becoming unaffordable to a widening swathe of the American population. This deteriorating affordability directly impacts American…

The Issue:

Housing is becoming unaffordable to a widening swathe of the American population. This deteriorating affordability directly impacts American lives, including where people choose to live and work. It has also been cited as a major contributor to key social problems like rising homelessness and worsening child wellbeing.

The Facts:

- Median house prices are now 6 times the median income, up from a range of between 4 and 5 two decades ago. In cities along the coasts, the numbers are higher, exceeding 10 in San Francisco.

- The ratio of median rents to median income has also crept from 25 percent to 30 percent in two decades.

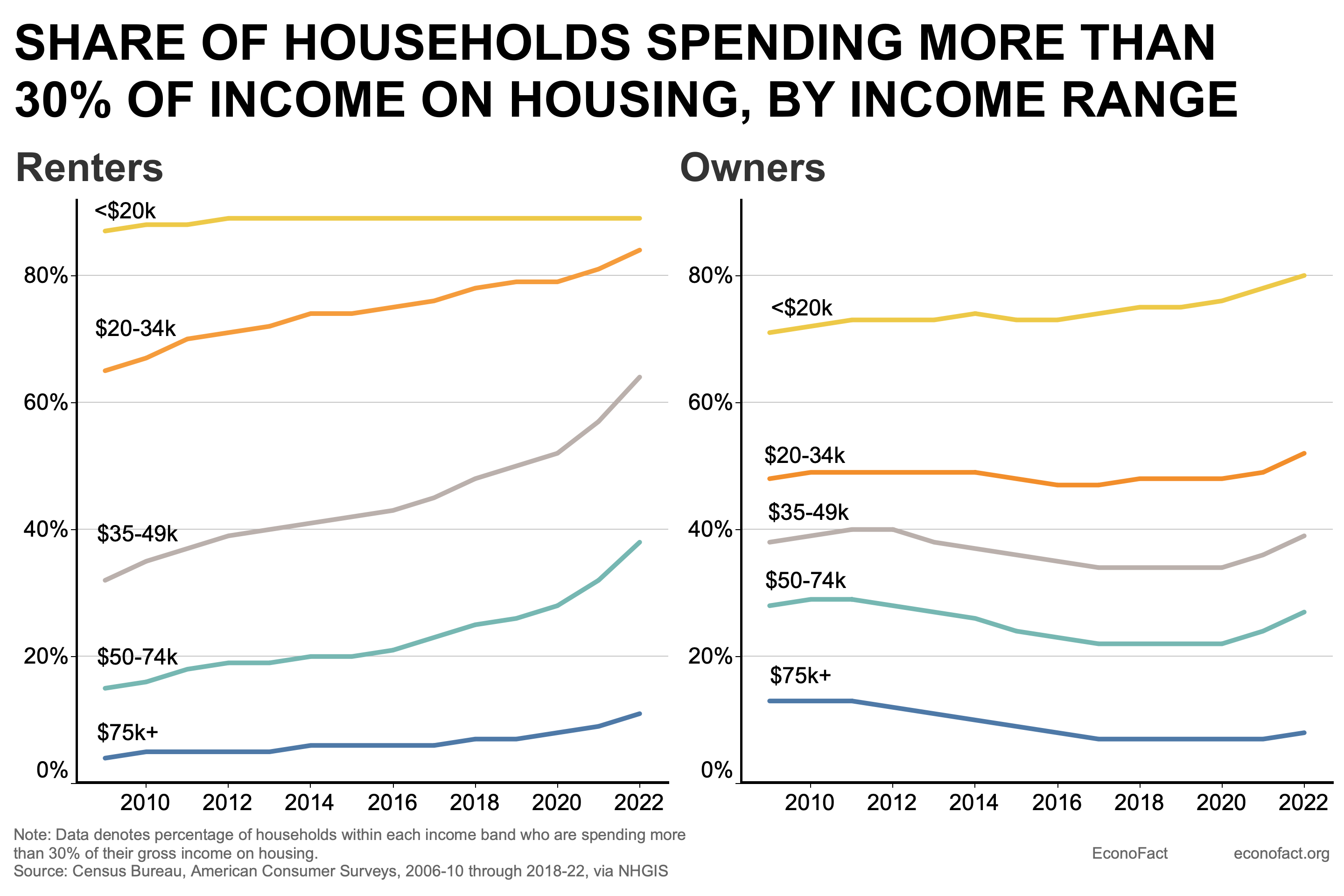

- Households — renters in particular — are increasingly cost-burdened, having to spend more than 30% of their income on rent, mortgage and other housing needs. Among homeowners, about 40 percent of those in the $35-49 income range are cost-burdened. The share of cost-burdened renters in that income range has risen sharply from under 40 percent of households in 2010 to over 60 percent today (see chart).

- Historically, rural and interior areas of the country have been more affordable. But, even prior to the pandemic, migration toward these locations has helped drive faster house price appreciation than in more expensive regions.

- Demographic developments have contributed to the demand-supply imbalance. Supply is crimped by more older Americans opting to age in place. On the demand side, the biggest driver is new household formation. Americans formed about a million new households a year between 2015-2017, but the pace has almost doubled according to the most recent data, largely reflecting a pickup in household formation rates among millennials.

- A long-standing lack of homebuilding, which partly reflects tight regulatory restrictions in many parts of the country, has also contributed to rising home prices.

- More recently, higher interest rates since 2022 have exacerbated these secular trends to make housing even more unaffordable. The mortgage rate on a 30-year home loan soared from 3 ½ percent in early 2022 to nearly 8% in October 2023 as the Fed raised policy interest rates; the mortgage rate had only eased to about 7% in March 2024 as the tightening cycle had peaked. The problem is compounded by mortgage lock-in: higher interest rates have left many homeowners — many of whom bought homes or refinanced at the lows of 2020-21 — with cheaper-than-market mortgages, reluctant to sell their house and reset their mortgage at current, higher rates.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges