Spread & Containment

Beyond Meat vs. Kraft Heinz: What to Pick?

As people increasingly move towards a plant-based diet, there is rising adoption of plant-based food products, including meat alternatives. According to a ResearchandMarkets report, the global plant-based meat market is

Read More…

The post Beyond Meat..

As people increasingly move towards a plant-based diet, there is rising adoption of plant-based food products, including meat alternatives.

According to a ResearchandMarkets report, the global plant-based meat market is expected to be worth $13.3 billion this year, compared to $11.9 billion last year, and is expected to grow to $20.78 billion by 2025.

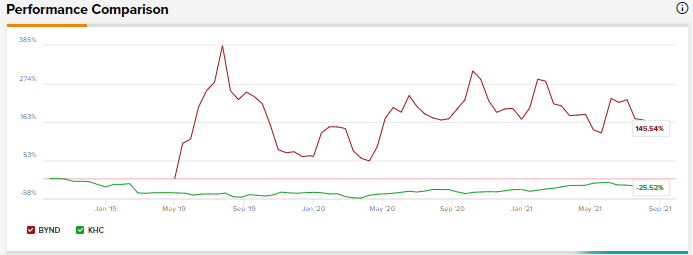

Using the TipRanks Stock Comparison tool, let's compare the plant-based meat company, Beyond Meat (BYND), with The Kraft Heinz Company (KHC), and see how Wall Street analysts feel about these stocks.

I am neutral about both stocks mentioned in the article.

Beyond Meat

Beyond Meat is a plant-based meat provider. Its flagship product is the Beyond Burger. The company distributes its products through retail channels like grocery and convenience stores, and foodservice channels like restaurants.

The company reported mixed second-quarter results, with a wider-than-expected loss and revenue beat. BYND posted Q2 revenues of $149.43 million, a jump of 31.8% year-over-year, outpacing the Street’s estimate of $142.62 million.

Net loss in Q2 widened to $0.31 per share, from a loss of $0.16 per share in the same quarter last year. This net loss per share was higher than analysts’ estimates of a loss of $0.23 per share.

In Q3, BYND anticipates net revenues in the range of $120 million to $140 million, a rise of 27% to 48% year-over-year. The company stated that while it continues to expect a recovery in foodservice channels, the outlook also assumes “reasonable containment of COVID-19 infection rates both in the U.S. and abroad.”

Earlier this month, McDonald’s (MCD) launched the McPlant, a plant-based sandwich in the U.K. and Ireland as part of its three-year strategic agreement with Beyond Meat.

BYND has entered into such strategic agreements with other companies, including PepsiCo (PEP) and Yum! Brands (YUM) in order to reach more consumers through its plant-based meat products. (See Beyond Meat stock charts on TipRanks)

Following the news, BTIG analyst Peter Saleh remained neutral, with a Hold rating, on the stock as he awaits more evidence of widespread adoption of the McPlant. Saleh doesn't expect meaningful revenue contributions from the product.

The analyst added that conversation with the company’s management indicated that while BYND intended for a national rollout of the McPlant range of menu items, it was not guaranteed.

The analyst concluded that while the company has a “strong brand awareness,” and the adoption of plant-based proteins among consumers is rising, there is also “prolonged weakness in the foodservice channel, increased competition, and heightened valuation.”

Turning to the rest of the Street, analysts are cautiously bearish on Beyond Meat, with a Moderate Sell consensus rating, based on five Holds and two Sells.

The average Beyond Meat price target of $108.50 implies 3.9% downside potential from current levels.

The Kraft Heinz Company

Kraft Heinz' product categories include: Condiments and Sauces, Cheese and Dairy, Ambient Foods, Frozen Foods, and Meat and Seafood Products.

Earlier this month, the company had to pay a fine of $62 million to the Securities and Exchange Commission (SEC) to settle charges of “bogus cost savings” worth $200 million.

The company denied any guilt, and commented, “The impact of the 59 transactions at issue in the Order did not affect the Company's reported adjusted EBITDA by more than 1 percent in any reporting period.”

Currently, the company is in the process of divesting some of its assets. Earlier this year, the company entered into an agreement with Hormel Foods (HRL) to sell certain assets in its nuts businesses for $3.4 billion.

Kraft Heinz has also entered into a deal worth $3.3 billion to sell certain assets of its Cheese and Dairy business to Groupe Lactalis, and plans to close the deal in the second half of this year.

In Q2, the company’s net sales declined 0.5% year-over-year to $6.6 billion. However, it beat the consensus estimate of $6.53 billion. (See Kraft-Heinz stock charts on TipRanks)

KHC’s adjusted earnings came in at $0.78 per share, easily outpacing consensus estimates of $0.72, but was down 2.5% compared to the prior-year quarter. The decline was primarily related to a 5.2% fall in adjusted EBITDA, which came in at $1.7 billion.

The company has projected 2021 adjusted EBITDA to come in ahead of 2019 levels. Additionally, the company expects Q3 organic net sales to increase by a mid-single-digit percentage.

Two months ago, Jeffries analyst Robert Dickerson reiterated a Hold rating on the stock, and lowered his price target from $41 to $40 (10% upside) on the stock.

Dickerson is of the view that the company’s margins in the second half of the year will be under pressure from “inflated costs and pricing timing combined with divestment-driven consensus revision risk outstanding for a company that’s lapping elevated food consumption and low promotional activity.”

Wall Street analysts are generally sidelined on the stock, with a Hold rating based on one Buy, six Holds, and one Sell.

The average Kraft Heinz price target of $39.38 implies 8.2% upside potential from current levels.

Bottom Line

While analysts are cautiously bearish about BYND, they are sidelined about Kraft Heinz.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.

The post Beyond Meat vs. Kraft Heinz: What to Pick? appeared first on TipRanks Financial Blog.

stocks covid-19 link containment recoveryGovernment

For-profit nursing homes are cutting corners on safety and draining resources with financial shenanigans − especially at midsize chains that dodge public scrutiny

Owners of midsize nursing home chains drain billions from facilities, hiding behind opaque accounting practices and harming the elderly as government,…

The care at Landmark of Louisville Rehabilitation and Nursing was abysmal when state inspectors filed their survey report of the Kentucky facility on July 3, 2021.

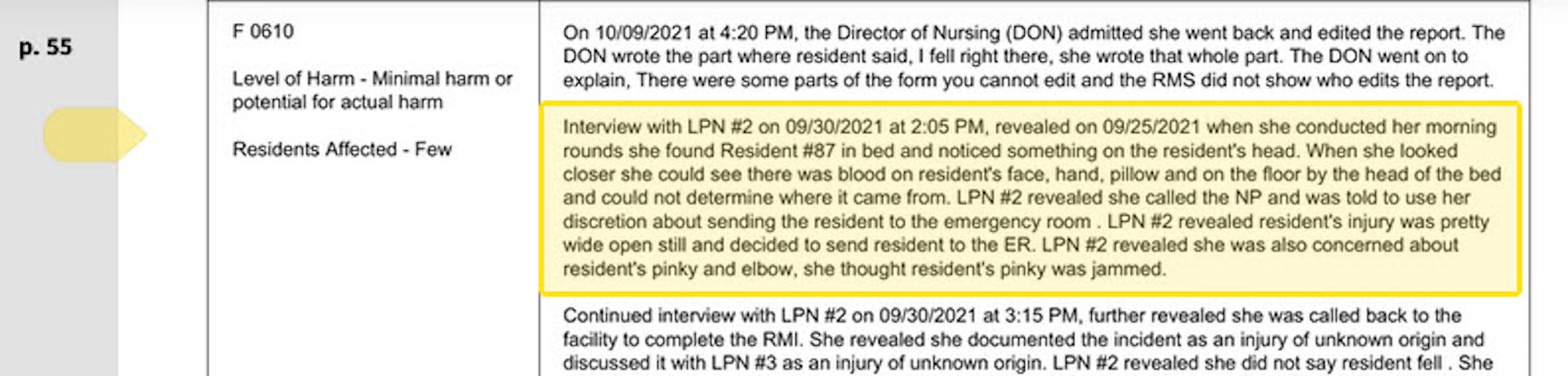

Residents wandered the halls in a facility that can house up to 250 people, yelling at each other and stealing blankets. One resident beat a roommate with a stick, causing bruising and skin tears. Another was found in bed with a broken finger and a bloody forehead gash. That person was allowed to roam and enter the beds of other residents. In another case, there was sexual touching in the dayroom between residents, according to the report.

Meals were served from filthy meal carts on plastic foam trays, and residents struggled to cut their food with dull plastic cutlery. Broken tiles lined showers, and a mysterious black gunk marred the floors. The director of housekeeping reported that the dining room was unsanitary. Overall, there was a critical lack of training, staff and supervision.

The inspectors tagged Landmark as deficient in 29 areas, including six that put residents in immediate jeopardy of serious harm and three where actual harm was found. The issues were so severe that the government slapped Landmark with a fine of over $319,000 − more than 29 times the average for a nursing home in 2021 − and suspended payments to the home from federal Medicaid and Medicare funds.

Persistent problems

But problems persisted. Five months later, inspectors levied six additional deficiencies of immediate jeopardy − the highest level − including more sexual abuse among residents and a certified nursing assistant pushing someone down, bruising the person’s back and hip.

Landmark is just one of the 58 facilities run by parent company Infinity Healthcare Management across five states. The government issued penalties to the company almost 4½ times the national average, according to bimonthly data that the Centers for Medicare & Medicaid Services first started to make available in late 2022. All told, Infinity paid nearly $10 million in fines since 2021, the highest among nursing home chains with fewer than 100 facilities.

Infinity Healthcare Management and its executives did not respond to multiple requests for comment.

Such sanctions are nothing new for Infinity or other for-profit nursing home chains that have dominated an industry long known for cutting corners in pursuit of profits for private owners. But this race to the bottom to extract profits is accelerating despite demands by government officials, health care experts and advocacy groups to protect the nation’s most vulnerable citizens.

To uncover the reasons why, The Conversation’s investigative unit Inquiry delved into the nursing home industry, where for-profit facilities make up more than 72% of the nation’s nearly 14,900 facilities. The probe, which paired an academic expert with an investigative reporter, used the most recent government data on ownership, facility information and penalties, combined with CMS data on affiliated entities for nursing homes.

The investigation revealed an industry that places a premium on cost cutting and big profits, with low staffing and poor quality, often to the detriment of patient well-being. Operating under weak and poorly enforced regulations with financially insignificant penalties, the for-profit sector fosters an environment where corners are frequently cut, compromising the quality of care and endangering patient health. Meanwhile, owners make the facilities look less profitable by siphoning money from the homes through byzantine networks of interconnected corporations. Federal regulators have neglected the problem as each year likely billions of dollars are funneled out of nursing homes through related parties and into owners’ pockets.

More trouble at midsize

Analyzing newly released government data, our investigation found that these problems are most pronounced in nursing homes like Infinity − midsize chains that operate between 11 and 100 facilities. This subsection of the industry has higher average fines per home, lower overall quality ratings, and are more likely to be tagged with resident abuse compared with both the larger and smaller networks. Indeed, while such chains account for about 39% of all facilities, they operate 11 of the 15 most-fined facilities.

With few impediments, private investors who own the midsize chains have quietly swooped in to purchase underperforming homes, expanding their holdings even further as larger chains divest and close facilities. As a result of the industry’s churn of facility ownership, over one fifth of the country’s nursing facilities changed ownership between 2016 and 2021, four times more changes than hospitals.

A 2023 report by Good Jobs First, a nonprofit watchdog, noted that a dozen of these chains in the midsize range have doubled or tripled in size while racking up fines averaging over $100,000 per facility since 2018. But unlike the large, multistate chains with easily recognizable names, the midsize networks slip through without the same level of public scrutiny, The Conversation’s investigations unit found.

“They are really bad, but the names − we don’t know these names,” said Toby Edelman, senior policy attorney with the Center for Medicare Advocacy, a nonprofit law organization.

“When we used to have those multistate chains, the facilities all had the same name, so you know what the quality is you’re getting,” she said. “It’s not that good − but at least you know what you’re getting.”

In response to The Conversation’s findings on nursing homes and request for an interview, a CMS spokesperson emailed a statement that said the CMS is “unwavering in its commitment to improve safety and quality of care for the more than 1.2 million residents receiving care in Medicare- and Medicaid-certified nursing homes.”

The statement pointed to data released by the oversight body on mergers, acquisitions, consolidations and changes of ownership in April 2023 along with additional ownership data released the following September. CMS also proposed a rule change that aims to increase transparency in nursing home ownership by collecting more information on facility owners and their affiliations.

“Our focus is on advancing implementable solutions that promote safe, high-quality care for residents and consider the challenging circumstances some long-term care facilities face,” the statement reads. “We believe the proposed requirements are achievable and necessary.”

CMS is slated to implement the disclosure rules in the fall and release the new data to the public later this year.

“We support transparency and accountability,” the American Health Care Association/National Center for Assisted Living, a trade organization representing the nursing home industry, wrote in response to The Conversation‘s request for comment. “But neither ownership nor line items on a budget sheet prove whether a nursing home is committed to its residents. Over the decades, we’ve found that strong organizations tend to have supportive and trusted leadership as well as a staff culture that empowers frontline caregivers to think critically and solve problems. These characteristics are not unique to a specific type or size of provider.”

It often takes years to improve a poor nursing home − or run one into the ground. The analysis of midsize chains shows that most owners have been associated with their current facilities for less than eight years, making it difficult to separate operators who have taken long-term investments in resident care from those who are looking to quickly extract money and resources before closing them down or moving on. These chains control roughly 41% of nursing home beds in the U.S., according to CMS’s provider data, making the lack of transparency especially ripe for abuse.

A churn of nursing home purchases even during the COVID-19 pandemic shows that investors view the sector as highly profitable, especially when staffing costs are kept low and fines for poor care can easily be covered by the money extracted from residents, their families and taxpayers.

“This is the model of their care: They come in, they understaff and they make their money,” said Sam Brooks, director of public policy at the Consumer Voice, a national resident advocacy organization. “Then they multiply it over a series of different facilities.”

Investor race

The explosion of a billion-dollar private marketplace found its beginnings in government spending.

The adoption of Medicare and Medicaid in 1965 set loose a race among investors to load up on nursing homes, with a surge in for-profit homes gaining momentum because of a reliable stream of government payouts. By 1972, a mere seven years after the inception of the programs, a whopping 106 companies had rushed to Wall Street to sell shares in nursing home companies. And little wonder: They pulled in profits through their ownership of 18% of the industry’s beds, securing about a third of the hefty $3.2 billion of government cash.

The 1990s saw substantial expansion in for-profit nursing home chains, marked by a wave of acquisitions and mergers. At the same time, increasing difficulties emerged in the model for publicly traded chains. Shareholders increasingly demanded rapid growth, and researchers have found that the publicly traded chains tried to appease that hunger by reducing nursing staff and cutting corners on other measures meant to improve quality and safety.

“I began to suspect a possibly inherent contradiction between publicly traded and other large investor-operated nursing home companies and the prerequisites for quality care,” Paul R. Willging, former chief lobbyist for the industry, wrote in a 2007 letter to the editor of The New York Times. “For many investors … earnings growth, quarter after quarter, is often paramount. Long-term investments in quality can work at cross purposes with a mandate for an unending progression of favorable earnings reports.”

One example of that clash can be found at the Ensign Group, founded in 1999 as a private chain of five facilities. Using a strategy of acquiring struggling nursing homes, the company went public in 2007 with more than 60 facilities. What followed was a year-after-year acquisition binge and a track record of growing profits almost every year. Yet the company kept staffing levels below the national average and levels recommended by experts. Its facilities had higher than average inspection deficiencies and higher COVID infection rates. Since 2021, it has racked up more than $6.5 million in penalties.

Ensign did not respond to requests for comment.

Even with that kind of expense cutting, not all publicly traded nursing homes survived as the costs of providing poor care added up. Residents sued over mistreatment. Legal fees and settlements ate into profits, shareholders grumbled, and executives searched for a way out of this Catch-22.

Recognizing the long-term potential for profit growth, private investors snapped up publicly traded for-profit chains, reducing the previous levels of public transparency and oversight. Between 2000 and 2017, 1,674 nursing homes were acquired by private-equity firms in 128 unique deals out of 18,485 facilities. But the same poor-quality problems persisted. Research shows that after snagging a big chain, private investors tended to follow the same playbook: They rebrand the company, increase corporate control and dump unprofitable homes to other investment groups willing to take shortcuts for profit.

Multiple academic studies show the results, highlighting the lower staffing and quality in for-profit homes compared with nonprofits and government-run facilities. Elderly residents staying long term in nursing homes owned by private investment groups experienced a significant uptick in trips to the emergency department and hospitalizations between 2013 and 2017, translating into higher costs for Medicare.

Overall, private-equity investors wreak havoc on nursing homes, slashing registered nurse hours per resident day by 12%, outpacing other for-profit facilities. The aftermath is grim, with a daunting 14% surge in the deficiency score index, a standardized metric for determining issues with facilities, according to a U.S. Department of Health and Human Services report.

The human toll comes in death and suffering. A study updated in 2023 by the National Bureau of Economic Research calculated that 22,500 additional deaths over a 12-year span were attributable to private-equity ownership, equating to about 172,400 lost life years. The calculations also showed that private-equity ownership was responsible for a 6.2% reduction in mobility, an 8.5% increase in ulcer development and a 10.5% uptick in pain intensity.

Hiding in complexity

Exposing the identities of who should be held responsible for such anguish poses a formidable task. Private investors in nursing home chains often employ a convoluted system of limited liability corporations, related companies and family relationships to obscure who controls the nursing homes.

These adjustments are crafted to minimize liability, capitalize on favorable tax policies, diminish regulatory scrutiny and disguise nursing home profitability. In this investigation, entities at every level of involvement with a nursing home denied ownership, even though the same people controlled each organization.

A rule put in place in 2023 by the Centers for Medicare & Medicaid Services requires the identification of all private-equity and real estate investment trust investors in a facility and the release of all related party names. But this hasn’t been enough to surface the players and relationships. More than half of ownership data provided to CMS is incomplete across all facilities, according to a March 2024 analysis of the newly released data.

Even the land under the nursing home is often owned by someone else. In 2021, publicly traded or private real estate investment trusts held a sizable chunk of the approximately $120 billion of nursing home real estate. As with homes owned by private-equity investors, quality measures collapse after REITs get involved, with facilities witnessing a 7% decline in registered nurses’ hours per resident day and an alarming 14% ascent in the deficiency score index. It’s a blatant pattern of disruption, leaving facilities and care standards in a dire state.

Part of that quality collapse comes from the way these investment entities make their money. REITs and their owners can drain cash out of the nursing homes in a number of different ways. The standard tactic for grabbing the money is known as a triple-net lease, where the REIT buys the property then leases it back to the nursing home, often at exorbitant rates. Although the nursing home then lacks possession of the property, it still gets slammed with costs typically shouldered by an owner − real estate taxes, insurance, maintenance and more. Topping it off, the facilities then must typically pay annual rent hikes.

A second tactic that REITs use involves a contracting façade that serves no purpose other than enriching the owners of the trusts. Since triple-net lease agreements prohibit REITs from taking profits from operating the facilities, the investors create a subsidiary to get past that hurdle. The subsidiary then contracts with a nursing home operator − often owned or controlled by another related party − and then demands a fee for providing operational guidance. The use of REITs for near-risk-free profits from nursing homes has proven to be an ever-growing technique, and the midsize chains, which our investigation found generally provided the worst care, grew in their reliance on REITs during the pandemic.

“When these REITs start coming in … nursing homes are saddled with these enormous rents, and then they wind up going out of business,” said Richard Mollot, executive director of the Long-Term Care Community Coalition, a nonprofit organization that advocates for better care at nursing homes. “It’s no longer a viable facility.”

The churn of nursing home purchases by midsize chains underscores investors’ perception of the sector’s profitability, particularly when staffing expenses are minimized and penalties for subpar care can be offset by money extracted through related transactions and payments from residents, their families and taxpayers. Lawsuits can drag out over years, and in the worst case, if a facility is forced to close, its land and other assets can be sold to minimize the financial loss.

Take Brius Healthcare, a name that resonates with a disturbing cadence in the world of nursing home ownership. A search of the federal database for nursing home ownership and penalties shows that Brius was responsible for 32 facilities as of the start of 2024, but the true number is closer to 80, according to BriusWatch.org, which tracks violations. At the helm of this still midsize network stands Shlomo Rechnitz, who became a billionaire in part by siphoning from government payments to his facilities scattered across California, according to a federal and state lawsuit.

In lawsuits and regulators’ criticisms, Rechnitz’s homes have been associated with tales of abuse, as well as several lawsuits alleging terrible care. The track record was so bad that, in the summer of 2014, then-California Attorney General Kamala Harris filed an emergency motion to block Rechnitz from acquiring 19 facilities, writing that he was “a serial violator of rules within the skilled nursing industry” and was “not qualified to assume such an important role.”

Yet, Rechnitz’s empire in California surged forward, scooping up more facilities that drained hundreds of millions of federal and state funds as they racked up pain and profit. The narrative played out at Windsor Redding Care Center in Redding, California. Rechnitz bought it from a competing nursing home chain and attempted to obtain a license to operate the facility. But in 2016, the California Department of Public Health refused the application, citing a staggering 265 federal regulatory violations across his other nursing homes over just three years.

According to court filings, Rechnitz formed a joint venture with other investors who in turn held the license. Rechnitz, through the Brius joint venture, became the unlicensed owner and operator of Windsor Redding.

Brius carved away at expenses, slashing staff and other care necessities, according to a 2022 California lawsuit. One resident was left to sit in her urine and feces for hours at a time. Overwhelmed staff often did not respond to her call light, so once she instead climbed out of bed unassisted, fell and fractured her hip. Other negligence led to pressure ulcers, and when she was finally transferred to a hospital, she was suffering from sepsis. She was not alone in her suffering. Numerous other residents experienced an unrelenting litany of injuries and illnesses, including pressure ulcers, urinary tract infections from poor hygiene, falls, and skin damage from excess moisture, according to the lawsuit.

In 2023, California moved forward with licensing two dozen of Rechnitz’s facilities with an agreement that included a two-year monitoring period, right before statewide reforms were set to take effect. The reforms don’t prevent existing owners like Rechnitz from continuing to run a nursing home without a license, but they do prevent new operators from doing so.

“We’re seeing more of that, I think, where you have a proliferation of really bad operators that keep being provided homes,” said Brooks, the director of public policy at the Consumer Voice. “There’s just so much money to be made here for unscrupulous people, and it just happens all the time.”

Rechnitz did not respond to multiple requests for comment. Bruis also did not respond.

Perhaps no other chain showcases the havoc that can be caused by one individual’s acquisition of multiple nursing homes than Skyline Health Care. The company’s owner, Joseph Schwartz, parlayed the sale of his insurance business into ownership of 90 facilities between mid-2016 and December 2017, according to a federal indictment. He ran the company out of an office above a New Jersey pizzeria and at its peak managed facilities in 11 states.

Schwartz went all-in on cost cutting, and by early 2018, residents were suffering from the shortage of staff. The company wasn’t paying its bills or its workers. More than a dozen lawsuits piled up. Last year, Schwartz was arrested and faced charges in federal district court in New Jersey for his role in a $38 million payroll tax scheme. In 2024, Schwartz pleaded guilty to his role in the fraud scheme. He is awaiting sentencing, where he faces a year in prison along with paying at least $5 million in restitution.

Skyline collapsed and disrupted thousands of lives. Some states took over facilities; others closed, forcing residents to relocate and throwing families into chaos. The case also highlights the ease with which some bad operators can snap up nursing homes with little difficulty, with federal and state governments allowing ownership changes with little or no review.

Schwartz’s lawyer did not respond to requests for comment.

Not that nursing homes have much to fear in the public perception of their reputation for quality. CMS uses what is known as the Five-Star Quality Rating System, designed to help consumers compare nursing homes to find one that provides good care. Theoretically, nursing homes with five-star ratings are supposed to be exceptional, while those with one-star ratings are deemed the worst. But research shows that nursing homes can game the system, with the result that a top star rating might reflect little more than a facility’s willingness to cheat.

A star rating is composed of three parts: The score from a government inspection and the facility’s self-reports of staffing and quality. This means that what the nursing homes say about themselves can boost the star rating of facilities even if they have poor inspection results.

Multiple studies have highlighted a concerning trend: Some nursing homes, especially for-profit ones, inflate their self-reported measures, resulting in a disconnect from actual inspection findings. Notably, research suggests that for-profit nursing homes, driven by significant financial motives, are more likely to engage in this practice of inflating their self-reported assessments.

At bottom, the elderly and their families seeking quality care unknowingly find themselves in an impossible situation with for-profit nursing homes: Those facilities tend to provide the worst quality, and the only measure available for consumers to determine where they will be treated well can be rigged. The result is the transformation of an industry meant to care for the most vulnerable into a profit-driven circus.

The pandemic

Nothing more clearly exposed the problems rampant in nursing homes than the pandemic. Throughout that time, nursing homes reported that almost 2 million residents had infections and 170,000 died.

No one should have been surprised by the mass death in nursing homes − the warning signs of what was to come had been visible for years. Between 2013 and 2017, infection control was the most frequently cited deficiency in nursing homes, with 40% of facilities cited each year and 82% cited at least once in the five-year period. Almost half were cited over multiple consecutive years for these deficiencies − if fixed, one of the big causes of the widespread transmission of COVID in these facilities would have been eliminated.

But shortly after coming into office in 2017, the Trump administration weakened what was already a deteriorating system to regulate nursing homes. The administration directed regulators to issue one-time fines against nursing homes for violations of federal rules rather than for the full time they were out of compliance. This shift meant that even nursing homes with severe infractions lasting weeks were exempted from fines surpassing the maximum per-instance penalty of $20,965.

Even that near-worthless level of regulation was not feeble enough for the industry, so lobbyists pressed for less. In response, just a few months before COVID emerged in China, the Trump administration implemented new regulations that effectively abolished a mandate for each to hire a full-time infection control expert, instead recommending outside consultants for the job.

The perfect storm had been reached, with no experts required to be on site, prepared to combat any infection outbreaks. On Jan. 20, 2020 − just 186 days after the change in rules on infection control − the CDC reported that the first laboratory-confirmed case of COVID had been found at a nursing home in Washington state.

The least prepared in this explosion of disease were the for-profit nursing homes, compared with nonprofit and government facilities. Research from the University of California at San Francisco found those facilities were linked to higher numbers of COVID cases. For-profits not only had fewer nurses on staff but also high numbers of infection-control deficiencies and lower compliance with health regulations.

Even as the United States went through the crisis, some owners of midsize chains continued snapping up nursing homes. For example, two Brooklyn businessmen named Simcha Hyman and Naftali Zanziper were going on a nursing home buying spree through their private-equity company, the Portopiccolo Group. Despite poor ratings in their previously owned facilities, nothing blocked the acquisitions.

One such facility was a struggling nursing home in North Carolina now known as The Citadel Salisbury. Following the traditional pattern forged by private investors in the industry, the new owners set up a convoluted network of business entities and then used them to charge the nursing home for services and property. A 2021 federal lawsuit of many plaintiffs claimed that they deliberately kept the facility understaffed and undersupplied to maximize profit.

Within months of the first case of COVID reported in America, The Citadel Salisbury experienced the largest nursing home outbreak in the state. The situation was so dire that on April 20, 2020, the local medical director of the emergency room took to the local newspaper to express his distress, revealing that he had pressed the facility’s leadership and the local health department to address the known shortcomings.

The situation was “a blueprint for exactly what not to do in a crisis,” medical director John Bream wrote. “Patients died at the Citadel without family members being notified. Families were denied the ability to have one last meaningful interaction with their family. Employees were wrongly denied personal protective equipment. There has been no transparency.”

After a series of scathing inspection reports, the facility finally closed in the spring of 2022. As for the federal lawsuit, court documents show that a tentative agreement was reached in 2023. But the case dragged out for nearly three years, and one of the plaintiffs, Sybil Rummage, died while seeking accountability through the court.

Still, the pandemic had been a time of great success for Hyman and Zanziper. At the end of 2020, they owned more than 70 facilities. By 2021, their portfolio had exploded to more than 120. Now, according to data from the Centers for Medicare & Medicaid Services, Hyman and Zanziper are associated with at least 131 facilities and have the highest amount of total fines recorded by the agency for affiliated entities, totaling nearly $12 million since 2021. And their average fine per facility, as calculated by CMS, is more than twice the national average at almost $90,000.

In a written statement, Portopiccolo Group spokesperson John Collins disputed that the facilities had skimped on care and argued that they were not managed by the firm. “We hire experienced, local health care teams who are in charge of making all on-the-ground decisions and are committed to putting residents first.” He added that the number of facilities given by CMS was inaccurate but declined to say how many are connected to its network of affiliates or owned by Hyman and Zanziper.

With the nearly 170,000 resident deaths from COVID and many related fatalities from isolation and neglect in nursing homes, in February 2022 President Biden announced an initiative aimed at improving the industry. In addition to promising to set a minimum staffing standard, the initiative is focused on improving ownership and financial transparency.

“As Wall Street firms take over more nursing homes, quality in those homes has gone down and costs have gone up. That ends on my watch,” Biden said during his 2022 State of the Union address. “Medicare is going to set higher standards for nursing homes and make sure your loved ones get the care they deserve and expect.”

Still, the current trajectory of actions appears to fall short of what’s needed. While penalties against facilities have sharply increased under Biden, some of the Trump administration’s weak regulations have not been replaced.

A rule proposed by CMS in September 2023 and released for review in March 2024 would require states to report what percentage of Medicaid funding is used to pay direct care workers and support staff and would require an RN on duty 24/7. It would also require a minimum of three hours of skilled staffing care per patient per day. But the three-hour minimum is substantially lower than the 4.1 hours of skilled staffing for nursing home residents suggested by CMS over two decades ago.

The requirements are also lower than the 3.8 average nursing staff hours already employed by U.S. facilities.

The current administration has also let stand the Trump administration reversal of an Obama rule that banned binding arbitration agreements in nursing homes.

It breaks a village

The Villages of Orleans Health and Rehabilitation Center in Albion, New York, was, by any reasonable measure, broken. Court records show that on some days there was no nurse and no medication for the more than 100 elderly residents. Underpaid staff spent their own cash for soap to keep residents clean. At times, the home didn’t feed its frail occupants.

Meanwhile, according to a 2022 lawsuit filed by the New York attorney general, riches were siphoned out of the nursing home and into the pockets of the official owner, Bernard Fuchs, as well as assorted friends, business associates and family. The lawsuit says $18.7 million flowed from the facility to entities owned by a group of men who controlled the Village’s operations.

Although these men own various nursing homes, Medicare records show few connections between them, despite them all being investors in Comprehensive Healthcare Management, which provided administrative services to the Villages. Either they or their families were also owners of Telegraph Realty, which leased what was once the Villages’ own property back to the facility at rates the New York attorney general deemed exorbitant, predatory and a sham.

So it goes in the world of nursing home ownership, where overlapping entities and investors obscure the interrelationships between them to such a degree that Medicare itself is never quite sure who owns what.

Glenn Jones, a lawyer representing Comprehensive Healthcare Management, declined to comment on the pending litigation, but he forwarded a court document his law firm filed that labels the allegations brought by the New York attorney general “unfounded” and reliant on “a mere fraction” of its residents.

The shadowy structure of ownership and related party transactions plays an enormous role in how investors enrich themselves, even as the nursing homes they control struggle financially. Compounding the issue, the figures reported by nursing homes regarding payments to related parties frequently diverge from the disclosures made by the related parties themselves.

As an illustration of the problems, consider Pruitt Health, a midsize chain with 87 nursing homes spread across Georgia, South Carolina, North Carolina and Florida that had low overall federal quality ratings and about $2 million in penalties. A report by The National Consumer Voice For Quality Long-Term Care, a consumer advocacy group, shows that Pruitt disclosed general related party costs nearing $482 million from 2018 to 2020. Yet in that same time frame, Pruitt reported payments to specific related parties amounting to about $570 million, indicating a $90 million excess. Its federal disclosures offer no explanation for the discrepancy. Meanwhile, the company reported $77 million in overall losses on its homes.

The same pattern holds in the major chains such as the Cleveland, Tennessee-based Life Care Centers of America, which operates roughly 200 nursing homes across 27 states, according to the report. Life Care’s financial disbursements are fed into a diverse spectrum of related entities, including management, staffing, insurance and therapy companies, all firmly under the umbrella of the organization’s ownership. In fiscal year 2018, the financial commitment to these affiliated entities reached $386,449,502; over the three-year period from 2018 to 2020, Life Care’s documented payments to such parties hit an eye-popping $1.25 billion.

Pruitt Health and Life Care Centers did not respond to requests for comment.

Overall, 77% of US nursing homes reported $11 billion in related-party transactions in 2019 − nearly 10% of total net revenues − but the data is unaudited and unverified. The facilities are not required to provide any details of what specific services were provided by the related parties, or what were the specific profits and administrative costs, creating a lack of transparency regarding expenses that are ambiguously categorized under generic labels such as “maintenance.” Significantly, there is no mandate to disclose whether any of these costs exceed fair market value.

What that means is that nursing home owners can profit handsomely through related parties even if their facilities are being hit with repeated fines for providing substandard care.

“What we would consider to be a big penalty really doesn’t matter because there’s so much money coming in,” said Mollot of the Long-Term Care Community Coalition. “If the facility fails, so what? It doesn’t matter. They pulled out the resources.’’

Hiding profit

Ultimately, experts say, this ability to drain cash out of nursing homes makes it almost impossible for anyone to assess the profitability of these facilities based on their public financial filings, known as cost reports.

"The profit margins (for nursing homes) also should be taken with a grain of salt in the cost reports,” said Dr. R. Tamara Konetzka, a University of Chicago professor of public health sciences, at a recent meeting of the Medicare Payment Advisory Commission. “If you sell the real estate to a REIT or to some other entity, and you pay sort of inflated rent back to make your profit margins look lower, and then you recoup that profit because it’s a related party, we’re not going to find that in the cost reports.”

That ability to hide profits is key to nursing homes’ ability to block regulations to improve quality of care and to demand greater government payments. For decades, the industry’s refrain has been that cuts in reimbursements or requirements to increase staffing will drive facilities into bankruptcy; already, they claim, half of all nursing homes are teetering on the edge of collapse, the result, they say, of inadequate Medicaid rates. All in all, the industry reports that less than 3% of their revenue goes to earnings.

But that does not include any of the revenue pulled out of the homes to boost profits of related parties controlled by the same owners pleading poverty. And this tactic is only one of several ways that the nursing home industry disguises its true profits, giving it the power to plead poverty to an unknowing government.

Under the regulations, only certain nursing home expenses are reimbursable, such as money spent for care. Many others − unreasonable payments to the headquarters of chains, luxury items, and fees for lobbyists and lawyers − are disallowed after Medicare reviews the cost reports. But by that time, the government has already reimbursed the nursing homes for those expenses − and none of those revenues have to be returned.

Data indicates that owners also profit by overcharging nursing homes for services and leases provided by related entities. A March 2024 study from Lehigh University and the University of California, Los Angeles shows that costs were inflated when nursing home owners changed from independent contractors to businesses owned or controlled directly or indirectly by the same people. Overall, spending on real estate increased 20.4%, and spending on management increased 24.6% when the businesses were affiliated, the research showed.

Nursing homes also claim that noncash depreciation cuts into their profits. Those expenses, which show up only in accounting ledgers, assume that assets such as equipment and facilities are gradually decreasing in value and ultimately will need to be replaced.

That might be reasonable if the chains purchased new items once their value depreciated to zero, but that is not always true. A 2004 report by the Medicare Payment Advisory Commission found that the depreciation claimed by health care companies, including nursing homes, may not reflect actual capital expenditures or the actual market value.

If disallowed expenses and noncash depreciation were not included, profit margins for the nursing home industry would jump to 8.8%, far more than the 3% it claims. And given that these numbers all come from nursing home cost reports submitted to the government, they may underestimate the profits even more. Audited cost reports are not required, and the Government Accountability Office has found that CMS does little to ensure the numbers are correct and complete.

This lack of basic oversight essentially gives dishonest nursing home owners the power to grab more money from Medicare and Medicaid while being empowered to claim that their financials prove they need more.

“They face no repercussions,” Brooks of Consumer Voice said, commenting on the current state of nursing home operations and their unscrupulous owners. “That’s why these people are here. It’s a bonanza to them.”

Ultimately, experts say, finding ways to force nursing homes to provide quality care has remained elusive. Michael Gelder, former senior health policy adviser to then-Gov. Pat Quinn of Illinois, learned that brutal lesson in 2010 as head of a task force formed by Quinn to investigate nursing home quality. That group successfully pushed a new law, but Gelder now says his success failed to protect this country’s most vulnerable citizens.

“I was perhaps naively convinced that someone like myself being in the right place at the right time with enough resources could really fix this problem,” he said. “I think we did the absolute best we could, and the best that had ever been done in modern history up to that point. But it wasn’t enough. It’s a battle every generation has to fight.”

Click here to learn more about how some existing tools can address problems with for-profit nursing homes.

Sean Campbell is an adjunct assistant professor at Columbia University and a contributing writer at the Garrison Project, an independent news organization that focuses on mass incarceration and criminal justice.

Harrington is an advisory board member of the nonprofit Veteran's Health Policy Institute and a board member of the nonprofit Center for Health Information and Policy. Harrington served as an expert witness on nursing home litigation cases by residents against facilities owned or operated by Brius and Shlomo Rechnitz in the past and in 2022. She also served as an expert witness in a case against The Citadel Salisbury in North Carolina in 2021.

bankruptcy pandemic covid-19 fed reit real estate cdc secretary of health trump medication therapy spread deaths transmission chinaGovernment

COVID-19 vaccines: CDC says people ages 65 and up should get a shot this spring – a geriatrician explains why it’s vitally important

As you get older, you’re at higher risk of severe infection and your immunity declines faster after vaccination.

In my mind, the spring season will always be associated with COVID-19.

In spring 2020, the federal government declared a nationwide emergency, and life drastically changed. Schools and businesses closed, and masks and social distancing were mandated across much of the nation.

In spring 2021, after the vaccine rollout, the Centers for Disease Control and Prevention said those who were fully vaccinated against COVID-19 could safely gather with others who were vaccinated without masks or social distancing.

In spring 2022, with the increased rates of vaccination across the U.S., the universal indoor mask mandate came to an end.

In spring 2023, the federal declaration of COVID-19 as a public health emergency ended.

Now, as spring 2024 fast approaches, the CDC reminds Americans that even though the public health emergency is over, the risks associated with COVID-19 are not. But those risks are higher in some groups than others. Therefore, the agency recommends that adults age 65 and older receive an additional COVID-19 vaccine, which is updated to protect against a recently dominant variant and is effective against the current dominant strain.

Increased age means increased risk

The shot is covered by Medicare. But do you really need yet another COVID-19 shot?

As a geriatrician who exclusively cares for people over 65 years of age, this is a question I’ve been asked many times over the past few years.

In early 2024, the short answer is yes.

Compared with other age groups, older adults have the worst outcomes with a COVID-19 infection. Increased age is, simply put, a major risk factor.

In January 2024, the average death rate from COVID-19 for all ages was just under 3 in 100,000 people. But for those ages 65 to 74, it was higher – about 5 for every 100,000. And for people 75 and older, the rate jumped to nearly 30 in 100,000.

Even now, four years after the start of the pandemic, people 65 years old and up are about twice as likely to die from COVID-19 than the rest of the population. People 75 years old and up are 10 times more likely to die from COVID-19.

Vaccination is still essential

These numbers are scary. But the No. 1 action people can take to decrease their risk is to get vaccinated and keep up to date on vaccinations to ensure top immune response. Being appropriately vaccinated is as critical in 2024 as it was in 2021 to help prevent infection, hospitalization and death from COVID-19.

The updated COVID-19 vaccine has been shown to be safe and effective, with the benefits of vaccination continuing to outweigh the potential risks of infection.

The CDC has been observing side effects on the more than 230 million Americans who are considered fully vaccinated with what it calls the “most intense safety monitoring in U.S. history.” Common side effects soon after receiving the vaccine include discomfort at the injection site, transient muscle or joint aches, and fever.

These symptoms can be alleviated with over-the-counter pain medicines or a cold compress to the site after receiving the vaccine. Side effects are less likely if you are well hydrated when you get your vaccine.

Long COVID and your immune system

Repeat infections carry increased risk, not just from the infection itself, but also for developing long COVID as well as other illnesses. Recent evidence shows that even mild to moderate COVID-19 infection can negatively affect cognition, with changes similar to seven years of brain aging. But being up to date with COVID-19 immunization has a fourfold decrease in risk of developing long COVID symptoms if you do get infected.

Known as immunosenescence, this puts people at higher risk of infection, including severe infection, and decreased ability to maintain immune response to vaccination as they get older. The older one gets – over 75, or over 65 with other medical conditions – the more immunosenescence takes effect.

All this is why, if you’re in this age group, even if you received your last COVID-19 vaccine in fall 2023, the spring 2024 shot is still essential to boost your immune system so it can act quickly if you are exposed to the virus.

The bottom line: If you’re 65 or older, it’s time for another COVID-19 shot.

Laurie Archbald-Pannone receives funding from PRIME, Accredited provider of medical and professional education; supported by an independent educational grant from GlaxoSmithKline, LLC as Course Director "Advancing Patient Engagement to Protect Aging Adults from Vaccine-Preventable Diseases: An Implementation Science Initiative to Activate and Sustain Participation in Recommended Vaccinations”

cdc disease control pandemic covid-19 vaccine death rate social distancingGovernment

Health Officials: Man Dies From Bubonic Plague In New Mexico

Health Officials: Man Dies From Bubonic Plague In New Mexico

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in New Mexico confirmed that a resident died from the plague in the United States’ first fatal case in several years.

The New Mexico Department of Health, in a statement, said that a man in Lincoln County “succumbed to the plague.” The man, who was not identified, was hospitalized before his death, officials said.

They further noted that it is the first human case of plague in New Mexico since 2021 and also the first death since 2020, according to the statement. No other details were provided, including how the disease spread to the man.

The agency is now doing outreach in Lincoln County, while “an environmental assessment will also be conducted in the community to look for ongoing risk,” the statement continued.

“This tragic incident serves as a clear reminder of the threat posed by this ancient disease and emphasizes the need for heightened community awareness and proactive measures to prevent its spread,” the agency said.

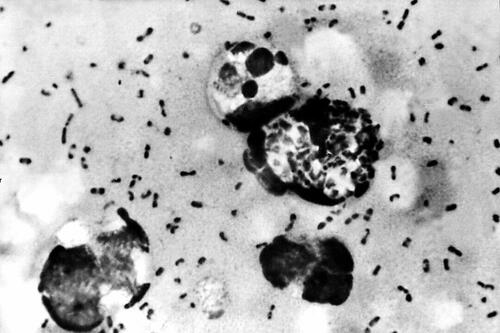

A bacterial disease that spreads via rodents, it is generally spread to people through the bites of infected fleas. The plague, known as the black death or the bubonic plague, can spread by contact with infected animals such as rodents, pets, or wildlife.

The New Mexico Health Department statement said that pets such as dogs and cats that roam and hunt can bring infected fleas back into homes and put residents at risk.

Officials warned people in the area to “avoid sick or dead rodents and rabbits, and their nests and burrows” and to “prevent pets from roaming and hunting.”

“Talk to your veterinarian about using an appropriate flea control product on your pets as not all products are safe for cats, dogs or your children” and “have sick pets examined promptly by a veterinarian,” it added.

“See your doctor about any unexplained illness involving a sudden and severe fever, the statement continued, adding that locals should clean areas around their home that could house rodents like wood piles, junk piles, old vehicles, and brush piles.

The plague, which is spread by the bacteria Yersinia pestis, famously caused the deaths of an estimated hundreds of millions of Europeans in the 14th and 15th centuries following the Mongol invasions. In that pandemic, the bacteria spread via fleas on black rats, which historians say was not known by the people at the time.

Other outbreaks of the plague, such as the Plague of Justinian in the 6th century, are also believed to have killed about one-fifth of the population of the Byzantine Empire, according to historical records and accounts. In 2013, researchers said the Justinian plague was also caused by the Yersinia pestis bacteria.

But in the United States, it is considered a rare disease and usually occurs only in several countries worldwide. Generally, according to the Mayo Clinic, the bacteria affects only a few people in U.S. rural areas in Western states.

Recent cases have occurred mainly in Africa, Asia, and Latin America. Countries with frequent plague cases include Madagascar, the Democratic Republic of Congo, and Peru, the clinic says. There were multiple cases of plague reported in Inner Mongolia, China, in recent years, too.

Symptoms

Symptoms of a bubonic plague infection include headache, chills, fever, and weakness. Health officials say it can usually cause a painful swelling of lymph nodes in the groin, armpit, or neck areas. The swelling usually occurs within about two to eight days.

The disease can generally be treated with antibiotics, but it is usually deadly when not treated, the Mayo Clinic website says.

“Plague is considered a potential bioweapon. The U.S. government has plans and treatments in place if the disease is used as a weapon,” the website also says.

According to data from the U.S. Centers for Disease Control and Prevention, the last time that plague deaths were reported in the United States was in 2020 when two people died.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges