Uncategorized

Alternative credentials market size for higher education to grow by USD 2,275.05 million from 2022 to 2027: A descriptive analysis of customer landscape, vendor assessment, and market dynamics – Technavio

Alternative credentials market size for higher education to grow by USD 2,275.05 million from 2022 to 2027: A descriptive analysis of customer landscape, vendor assessment, and market dynamics – Technavio

PR Newswire

NEW YORK, Jan. 9, 2023

NEW YORK…

Alternative credentials market size for higher education to grow by USD 2,275.05 million from 2022 to 2027: A descriptive analysis of customer landscape, vendor assessment, and market dynamics - Technavio

PR Newswire

NEW YORK, Jan. 9, 2023

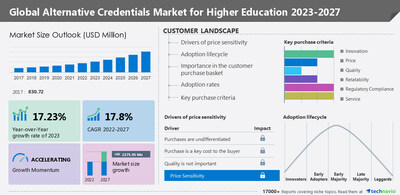

NEW YORK, Jan. 9, 2023 /PRNewswire/ -- Technavio categorizes the global alternative credentials market for higher education as a part of the global education services market, which covers products, services, and solutions that are offered to educational institutions, corporate institutions, students, parents, individuals, and teachers. The size of the global alternative credentials market for higher education is estimated to increase by USD 2,275.05 million between 2022 and 2027. The market's growth momentum will progress at a CAGR of 17.8%.

Discover some insights on market size before buying the full report - Request a sample report

Vendor offerings -

- 2U Inc. - The company offers alternative credentials that help companies create skills pathways with verifiable and stackable credentials to upskill and train employees with high-quality educational experience in the most job-relevant subjects.

- Bisk Ventures - The company offers alternative credentials with innovative use of technology to engage students in impactful learning experiences and to strengthen education to employment pathways.

- Carroll Community College Foundation Inc. - The company offers alternative credentials with the use of the latest technologies to engage students in learning experiences.

- Cengage Learning Holdings II Inc. - The company offers alternative credentials with quality digital products and services to millions of students, equipping them with the skills and competencies needed to advance their careers and improve their lives.

- For details on vendors and their offerings – Buy the report!

Vendor landscape -

The global alternative credentials market for higher education is fragmented, with the presence of several global as well as regional vendors. A few prominent vendors that offer alternative credentials for higher education in the market are 2U Inc., Bisk Ventures, Carroll Community College Foundation Inc., Cengage Learning Holdings II Inc., City and Guilds Group, Coursera Inc., Credly, Inc., New York State Education Department, NIIT Ltd, Northeastern University, Pearson Plc, Purdue University Global, Simplilearn Solutions Pvt. Ltd., Strategic Education Inc., Temple University, Udacity Inc., Udemy Inc, University of Michigan, University Professional and Continuing Education Association, and XuetangX and others.

The global alternative credentials market for higher education is subject to rapidly changing consumer demands and preferences. The vendors compete based on factors such as price, quality, innovation, packaging, reputation, marketing channels, and even distribution. Therefore, to survive and even succeed in this competitive environment, it is important for the players in the market to distinguish their product offerings through a clear and unique value proposition.

To help companies evaluate and develop growth strategies, the report outlines –

- Key purchase criteria

- Adoption rates

- Adoption lifecycle

- Drivers of price sensitivity

Segment overview

Technavio has segmented the market based on product (non-credit training courses, non-credit certificate programs, digital badges, competency-based education, and boot camps) and delivery mode (online, blended, and face-to-face).

- The non-credit training courses segment will contribute significantly during the forecast period. In these courses, students should attain a certain level of expertise in the latest tools and technologies prior to being recruited. The providers of non-credit training courses also help students build hands-on skills through short-term courses.

Geography overview

Based on geography, the global alternative credentials market for higher education is segmented into North America, Europe, APAC, South America, and Middle East and Africa. The report provides actionable insights and estimates the contribution of all regions to the growth of the global alternative credentials market for higher education.

- North America is estimated to account for 56% of the growth of the global market during the forecast period. Higher education institutions in the region are implementing numerous ed-tech products and services and are introducing new forms of teaching and learning. They are also adopting experiential learning, flipped classrooms, blended learning, and active learning in classrooms at a large scale. In addition, many schools and colleges have partnered with ed-tech companies that provide alternative credentials to learners. These factors will drive the growth of the market during the forecast period.

Leading drivers - The widening skills gap is driving the alternative credentials market for higher education market growth. There is a high disparity in demand and supply in terms of skilled employees. The rise in competition has led to an increase in demand for skills that can prove employment readiness. The alternative credentials allow students to acquire non-traditional skills. This helps recruiters easily verify students' achievements. This, in turn, is driving the adoption of alternative credentials by higher education institutions globally.

Key trends - The rise in non-traditional offerings is a key trend in the alternative credentials market for the higher education market. These offerings include credit and non-credit graduate and undergraduate certificate programs, training courses, continuing education units, and micro-credentialing. The providers of these courses include baccalaureate colleges, universities, community colleges, and doctorate-granting universities, which operate in both public and private domains. As the courses are available through different channels, providers can easily create non-credit programs at a much faster pace. These factors will support the growth of the market during the forecast period.

Major challenges - The threat from traditional degree program providers is challenging the alternative credentials market for the higher education market growth. Evolving learning methodologies and digitization of the overall learning process are helping universities enhance the quality of course offerings. As a result, universities and colleges are able to train graduates as per industry requirements. These developments can reduce the dependency on alternative credentials, as traditional degree programs will start to provide the same services as part of conventional course offerings. Such factors are expected to hamper the focused market growth.

Drivers, trends, and challenges have an impact on market dynamics, which can impact businesses. Find some insights from a sample report!

What are the key data covered in this alternative credentials market for higher education report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the alternative credentials market for higher education between 2023 and 2027

- Precise estimation of the size of the alternative credentials market for higher education and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the alternative credentials market for higher education across North America, Europe, APAC, South America, and Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of the alternative credentials market for higher education vendors

Gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

The higher education market in Vietnam is estimated to grow at a CAGR of 15.3% between 2022 and 2027. The size of the market is forecasted to increase by USD 481.32 million. This report extensively covers market segmentation by product (software and hardware), end-user (private colleges, state universities, and community colleges), and courses (undergraduate, masters, and PhD).

The higher education testing and assessment market is estimated to grow at a CAGR of 6.32% between 2022 and 2027. The size of the market is forecast to increase by USD 6,481.55 million. This report extensively covers market segmentation by product (academic and non-academic), end-user (educational institutions, universities, training organizations, and others), and geography (North America, Europe, APAC, Middle East and Africa, and South America).

Alternative Credentials Market For Higher Education Scope | |

Report Coverage | Details |

Page number | 177 |

Base year | 2022 |

Historic period | 2017-2021 |

Forecast period | 2023-2027 |

Growth momentum & CAGR | Accelerate at a CAGR of 17.8% |

Market growth 2023-2027 | USD 2,275.05 million |

Market structure | Fragmented |

YoY growth 2022-2023 (%) | 17.23 |

Regional analysis | North America, Europe, APAC, South America, and Middle East and Africa |

Performing market contribution | North America at 56% |

Key countries | US, China, India, Germany, and UK |

Competitive landscape | Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

Key companies profiled | 2U Inc., Bisk Ventures, Carroll Community College Foundation Inc., Cengage Learning Holdings II Inc., City and Guilds Group, Coursera Inc., Credly, Inc., New York State Education Department, NIIT Ltd, Northeastern University, Pearson Plc, Purdue University Global, Simplilearn Solutions Pvt. Ltd., Strategic Education Inc., Temple University, Udacity Inc., Udemy Inc, University of Michigan, University Professional and Continuing Education Association, and XuetangX |

Market dynamics | Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Browse for Technavio's consumer discretionary market reports

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Product

- Exhibit 06: Executive Summary – Chart on Market Segmentation by Delivery Mode

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global - Market size and forecast 2022-2027 ($ million)

- Exhibit 15: Data Table on Global - Market size and forecast 2022-2027 ($ million)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global alternative credentials market for higher education 2017 - 2021

- Exhibit 18: Historic Market Size – Data Table on Global alternative credentials market for higher education 2017 - 2021 ($ million)

- 4.2 Geography Segment Analysis 2017 - 2021

- Exhibit 19: Historic Market Size – Geography Segment 2017 - 2021 ($ million)

- 4.3 Product Segment Analysis 2017 - 2021

- Exhibit 20: Historic Market Size – Product Segment 2017 - 2021 ($ million)

- 4.4 Delivery mode Segment Analysis 2017 - 2021

- Exhibit 21: Historic Market Size – Delivery mode Segment 2017 - 2021 ($ million)

- 4.5 Country Segment Analysis 2017 - 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 - 2021 ($ million)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis - Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition - Five forces 2022 and 2027

6 Market Segmentation by Product

- 6.1 Market segments

- Exhibit 30: Chart on Product - Market share 2022-2027 (%)

- Exhibit 31: Data Table on Product - Market share 2022-2027 (%)

- 6.2 Comparison by Product

- Exhibit 32: Chart on Comparison by Product

- Exhibit 33: Data Table on Comparison by Product

- 6.3 Non-credit training courses - Market size and forecast 2022-2027

- Exhibit 34: Chart on Non-credit training courses - Market size and forecast 2022-2027 ($ million)

- Exhibit 35: Data Table on Non-credit training courses - Market size and forecast 2022-2027 ($ million)

- Exhibit 36: Chart on Non-credit training courses - Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Non-credit training courses - Year-over-year growth 2022-2027 (%)

- 6.4 Non-credit certificate programs - Market size and forecast 2022-2027

- Exhibit 38: Chart on Non-credit certificate programs - Market size and forecast 2022-2027 ($ million)

- Exhibit 39: Data Table on Non-credit certificate programs - Market size and forecast 2022-2027 ($ million)

- Exhibit 40: Chart on Non-credit certificate programs - Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Non-credit certificate programs - Year-over-year growth 2022-2027 (%)

- 6.5 Digital badges - Market size and forecast 2022-2027

- Exhibit 42: Chart on Digital badges - Market size and forecast 2022-2027 ($ million)

- Exhibit 43: Data Table on Digital badges - Market size and forecast 2022-2027 ($ million)

- Exhibit 44: Chart on Digital badges - Year-over-year growth 2022-2027 (%)

- Exhibit 45: Data Table on Digital badges - Year-over-year growth 2022-2027 (%)

- 6.6 Competency-based education - Market size and forecast 2022-2027

- Exhibit 46: Chart on Competency-based education - Market size and forecast 2022-2027 ($ million)

- Exhibit 47: Data Table on Competency-based education - Market size and forecast 2022-2027 ($ million)

- Exhibit 48: Chart on Competency-based education - Year-over-year growth 2022-2027 (%)

- Exhibit 49: Data Table on Competency-based education - Year-over-year growth 2022-2027 (%)

- 6.7 Boot camps - Market size and forecast 2022-2027

- Exhibit 50: Chart on Boot camps - Market size and forecast 2022-2027 ($ million)

- Exhibit 51: Data Table on Boot camps - Market size and forecast 2022-2027 ($ million)

- Exhibit 52: Chart on Boot camps - Year-over-year growth 2022-2027 (%)

- Exhibit 53: Data Table on Boot camps - Year-over-year growth 2022-2027 (%)

- 6.8 Market opportunity by Product

- Exhibit 54: Market opportunity by Product ($ million)

7 Market Segmentation by Delivery Mode

- 7.1 Market segments

- Exhibit 55: Chart on Delivery Mode - Market share 2022-2027 (%)

- Exhibit 56: Data Table on Delivery Mode - Market share 2022-2027 (%)

- 7.2 Comparison by Delivery Mode

- Exhibit 57: Chart on Comparison by Delivery Mode

- Exhibit 58: Data Table on Comparison by Delivery Mode

- 7.3 Online - Market size and forecast 2022-2027

- Exhibit 59: Chart on Online - Market size and forecast 2022-2027 ($ million)

- Exhibit 60: Data Table on Online - Market size and forecast 2022-2027 ($ million)

- Exhibit 61: Chart on Online - Year-over-year growth 2022-2027 (%)

- Exhibit 62: Data Table on Online - Year-over-year growth 2022-2027 (%)

- 7.4 Blended - Market size and forecast 2022-2027

- Exhibit 63: Chart on Blended - Market size and forecast 2022-2027 ($ million)

- Exhibit 64: Data Table on Blended - Market size and forecast 2022-2027 ($ million)

- Exhibit 65: Chart on Blended - Year-over-year growth 2022-2027 (%)

- Exhibit 66: Data Table on Blended - Year-over-year growth 2022-2027 (%)

- 7.5 Face to face - Market size and forecast 2022-2027

- Exhibit 67: Chart on Face to face - Market size and forecast 2022-2027 ($ million)

- Exhibit 68: Data Table on Face to face - Market size and forecast 2022-2027 ($ million)

- Exhibit 69: Chart on Face to face - Year-over-year growth 2022-2027 (%)

- Exhibit 70: Data Table on Face to face - Year-over-year growth 2022-2027 (%)

- 7.6 Market opportunity by Delivery Mode

- Exhibit 71: Market opportunity by Delivery Mode ($ million)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 72: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 73: Chart on Market share by geography 2022-2027 (%)

- Exhibit 74: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 75: Chart on Geographic comparison

- Exhibit 76: Data Table on Geographic comparison

- 9.3 North America - Market size and forecast 2022-2027

- Exhibit 77: Chart on North America - Market size and forecast 2022-2027 ($ million)

- Exhibit 78: Data Table on North America - Market size and forecast 2022-2027 ($ million)

- Exhibit 79: Chart on North America - Year-over-year growth 2022-2027 (%)

- Exhibit 80: Data Table on North America - Year-over-year growth 2022-2027 (%)

- 9.4 Europe - Market size and forecast 2022-2027

- Exhibit 81: Chart on Europe - Market size and forecast 2022-2027 ($ million)

- Exhibit 82: Data Table on Europe - Market size and forecast 2022-2027 ($ million)

- Exhibit 83: Chart on Europe - Year-over-year growth 2022-2027 (%)

- Exhibit 84: Data Table on Europe - Year-over-year growth 2022-2027 (%)

- 9.5 APAC - Market size and forecast 2022-2027

- Exhibit 85: Chart on APAC - Market size and forecast 2022-2027 ($ million)

- Exhibit 86: Data Table on APAC - Market size and forecast 2022-2027 ($ million)

- Exhibit 87: Chart on APAC - Year-over-year growth 2022-2027 (%)

- Exhibit 88: Data Table on APAC - Year-over-year growth 2022-2027 (%)

- 9.6 South America - Market size and forecast 2022-2027

- Exhibit 89: Chart on South America - Market size and forecast 2022-2027 ($ million)

- Exhibit 90: Data Table on South America - Market size and forecast 2022-2027 ($ million)

- Exhibit 91: Chart on South America - Year-over-year growth 2022-2027 (%)

- Exhibit 92: Data Table on South America - Year-over-year growth 2022-2027 (%)

- 9.7 Middle East and Africa - Market size and forecast 2022-2027

- Exhibit 93: Chart on Middle East and Africa - Market size and forecast 2022-2027 ($ million)

- Exhibit 94: Data Table on Middle East and Africa - Market size and forecast 2022-2027 ($ million)

- Exhibit 95: Chart on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- Exhibit 96: Data Table on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- 9.8 US - Market size and forecast 2022-2027

- Exhibit 97: Chart on US - Market size and forecast 2022-2027 ($ million)

- Exhibit 98: Data Table on US - Market size and forecast 2022-2027 ($ million)

- Exhibit 99: Chart on US - Year-over-year growth 2022-2027 (%)

- Exhibit 100: Data Table on US - Year-over-year growth 2022-2027 (%)

- 9.9 China - Market size and forecast 2022-2027

- Exhibit 101: Chart on China - Market size and forecast 2022-2027 ($ million)

- Exhibit 102: Data Table on China - Market size and forecast 2022-2027 ($ million)

- Exhibit 103: Chart on China - Year-over-year growth 2022-2027 (%)

- Exhibit 104: Data Table on China - Year-over-year growth 2022-2027 (%)

- 9.10 Germany - Market size and forecast 2022-2027

- Exhibit 105: Chart on Germany - Market size and forecast 2022-2027 ($ million)

- Exhibit 106: Data Table on Germany - Market size and forecast 2022-2027 ($ million)

- Exhibit 107: Chart on Germany - Year-over-year growth 2022-2027 (%)

- Exhibit 108: Data Table on Germany - Year-over-year growth 2022-2027 (%)

- 9.11 UK - Market size and forecast 2022-2027

- Exhibit 109: Chart on UK - Market size and forecast 2022-2027 ($ million)

- Exhibit 110: Data Table on UK - Market size and forecast 2022-2027 ($ million)

- Exhibit 111: Chart on UK - Year-over-year growth 2022-2027 (%)

- Exhibit 112: Data Table on UK - Year-over-year growth 2022-2027 (%)

- 9.12 India - Market size and forecast 2022-2027

- Exhibit 113: Chart on India - Market size and forecast 2022-2027 ($ million)

- Exhibit 114: Data Table on India - Market size and forecast 2022-2027 ($ million)

- Exhibit 115: Chart on India - Year-over-year growth 2022-2027 (%)

- Exhibit 116: Data Table on India - Year-over-year growth 2022-2027 (%)

- 9.13 Market opportunity by geography

- Exhibit 117: Market opportunity by geography ($ million)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 118: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 119: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 120: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 121: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 122: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 123: Matrix on vendor position and classification

- 12.3 2U Inc.

- Exhibit 124: 2U Inc. - Overview

- Exhibit 125: 2U Inc. - Business segments

- Exhibit 126: 2U Inc. - Key news

- Exhibit 127: 2U Inc. - Key offerings

- Exhibit 128: 2U Inc. - Segment focus

- 12.4 Bisk Ventures

- Exhibit 129: Bisk Ventures - Overview

- Exhibit 130: Bisk Ventures - Product / Service

- Exhibit 131: Bisk Ventures - Key offerings

- 12.5 Carroll Community College Foundation Inc.

- Exhibit 132: Carroll Community College Foundation Inc. - Overview

- Exhibit 133: Carroll Community College Foundation Inc. - Product / Service

- Exhibit 134: Carroll Community College Foundation Inc. - Key offerings

- 12.6 Cengage Learning Holdings II Inc.

- Exhibit 135: Cengage Learning Holdings II Inc. - Overview

- Exhibit 136: Cengage Learning Holdings II Inc. - Business segments

- Exhibit 137: Cengage Learning Holdings II Inc. - Key offerings

- Exhibit 138: Cengage Learning Holdings II Inc. - Segment focus

- 12.7 City and Guilds Group

- Exhibit 139: City and Guilds Group - Overview

- Exhibit 140: City and Guilds Group - Product / Service

- Exhibit 141: City and Guilds Group - Key offerings

- 12.8 Coursera Inc.

- Exhibit 142: Coursera Inc. - Overview

- Exhibit 143: Coursera Inc. - Business segments

- Exhibit 144: Coursera Inc. - Key news

- Exhibit 145: Coursera Inc. - Key offerings

- Exhibit 146: Coursera Inc. - Segment focus

- 12.9 Credly, Inc.

- Exhibit 147: Credly, Inc. - Overview

- Exhibit 148: Credly, Inc. - Product / Service

- Exhibit 149: Credly, Inc. - Key offerings

- 12.10 New York State Education Department

- Exhibit 150: New York State Education Department - Overview

- Exhibit 151: New York State Education Department - Product / Service

- Exhibit 152: New York State Education Department - Key offerings

- 12.11 NIIT Ltd

- Exhibit 153: NIIT Ltd - Overview

- Exhibit 154: NIIT Ltd - Product / Service

- Exhibit 155: NIIT Ltd - Key news

- Exhibit 156: NIIT Ltd - Key offerings

- 12.12 Pearson Plc

- Exhibit 157: Pearson Plc - Overview

- Exhibit 158: Pearson Plc - Business segments

- Exhibit 159: Pearson Plc - Key offerings

- Exhibit 160: Pearson Plc - Segment focus

- 12.13 Simplilearn Solutions Pvt. Ltd.

- Exhibit 161: Simplilearn Solutions Pvt. Ltd. - Overview

- Exhibit 162: Simplilearn Solutions Pvt. Ltd. - Product / Service

- Exhibit 163: Simplilearn Solutions Pvt. Ltd. - Key offerings

- 12.14 Strategic Education Inc.

- Exhibit 164: Strategic Education Inc. - Overview

- Exhibit 165: Strategic Education Inc. - Business segments

- Exhibit 166: Strategic Education Inc. - Key offerings

- Exhibit 167: Strategic Education Inc. - Segment focus

- 12.15 Udacity Inc.

- Exhibit 168: Udacity Inc. - Overview

- Exhibit 169: Udacity Inc. - Product / Service

- Exhibit 170: Udacity Inc. - Key news

- Exhibit 171: Udacity Inc. - Key offerings

- 12.16 Udemy Inc

- Exhibit 172: Udemy Inc - Overview

- Exhibit 173: Udemy Inc - Product / Service

- Exhibit 174: Udemy Inc - Key news

- Exhibit 175: Udemy Inc - Key offerings

- 12.17 University of Michigan

- Exhibit 176: University of Michigan - Overview

- Exhibit 177: University of Michigan - Business segments

- Exhibit 178: University of Michigan - Key offerings

- Exhibit 179: University of Michigan - Segment focus

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 180: Inclusions checklist

- Exhibit 181: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 182: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 183: Research methodology

- Exhibit 184: Validation techniques employed for market sizing

- Exhibit 185: Information sources

- 13.5 List of abbreviations

- Exhibit 186: List of abbreviations

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/alternative-credentials-market-size-for-higher-education-to-grow-by-usd-2-275-05-million-from-2022-to-2027-a-descriptive-analysis-of-customer-landscape-vendor-assessment-and-market-dynamics---technavio-301714425.html

SOURCE Technavio

Uncategorized

Bougie Broke The Financial Reality Behind The Facade

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive…

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

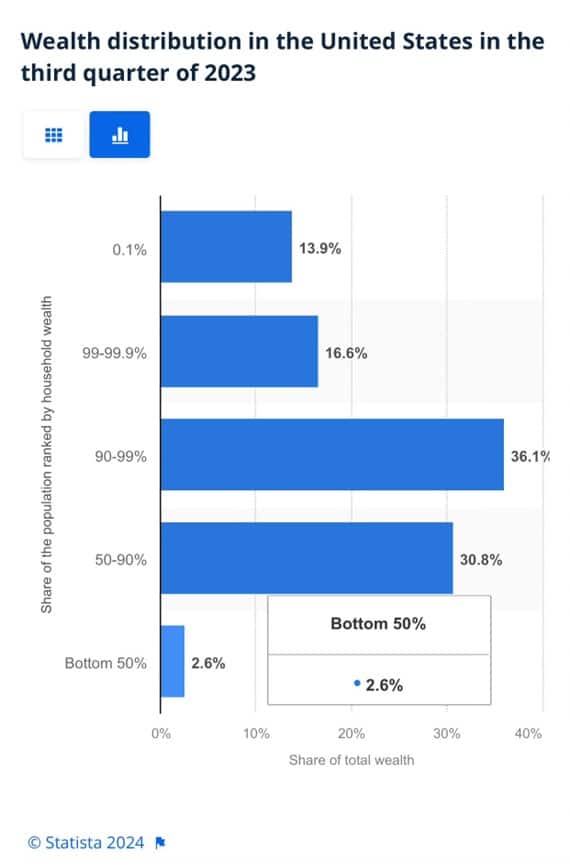

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

The post Bougie Broke The Financial Reality Behind The Facade appeared first on RIA.

recession unemployment pandemic economic recovery stimulus fed recession recovery interest rates unemployment stimulusUncategorized

Bitcoin on Wheels: The Story of Bitcoinetas

Meet the Bitcoinetas, a fleet of transformative vehicles on a mission to spread the bitcoin message everywhere they go. From Argentina to South Africa,…

You may have seen that picture of Michael Saylor in a bitcoin-branded van, with a cheerful guy right next to the car door. This one:

That car is the Bitcoineta European Edition, and the cheerful guy is Ariel Aguilar. Ariel is part of the European Bitcoineta team, and has previously driven another similar car in Argentina. In fact, there are currently five cars around the world that carry the name Bitcoineta (in some cases preceded with the Spanish definite article “La”).

Argentina: the original La Bitcoineta

The story of Bitcoinetas begins with the birth of 'La Bitcoineta' in Argentina, back in 2017. Inspired by the vibrancy of the South American Bitcoin community, the original Bitcoineta was conceived after an annual Latin American Conference (Labitconf), where the visionaries behind it recognized a unique opportunity to promote Bitcoin education in remote areas. Armed with a bright orange Bitcoin-themed exterior and a mission to bridge the gap in financial literacy, La Bitcoineta embarked on a journey to bring awareness of Bitcoin's potential benefits to villages and towns that often remained untouched by mainstream financial education initiatives. Operated by a team of dedicated volunteers, it was more than just a car; it was a symbol of hope and empowerment for those living on the fringes of financial inclusion.

Ariel was part of that initial Argentinian Bitcoineta team, and spent weeks on the road when the car became a reality. The original dream to bring bitcoin education even to remote areas within Argentina and other South American countries came true, and the La Bitcoineta team took part in dozens of local bitcoin meetups in the subsequent years.

One major hiccup came in late 2018, when the car was crashed into while parked in Puerto Madryn. The car was pretty much destroyed, but since the team was possessed by a honey badger spirit, nothing could stop them from keeping true to their mission. It is a testament to the determination and resilience of the Argentinian team that the car was quickly restored and returned on its orange-pilling quest soon after.

Over the more than 5 years that the Argentinian Bitcoineta has been running, it has traveled more than 80,000 kilometers - and as we’ll see further, it inspired multiple similar initiatives around the world.

Follow La Bitcoineta’s journey:

Twitter: https://twitter.com/labitcoineta

Instagram: https://www.instagram.com/bitcoineta/

El Salvador: Bitcoin Beach

In early 2021, the president of El Salvador passed the Bitcoin Law, making bitcoin legal tender in the country. The Labitconf team decided to celebrate this major step forward in bitcoin adoption by hosting the annual conference in San Salvador, the capital city of El Salvador. And correspondingly, the Argentinian Bitcoineta team made plans for a bold 7000-kilometer road trip to visit the Bitcoin country with the iconic Bitcoin car.

However, it proved to be impossible to cross so many borders separating Argentina and Salvador, since many governments were still imposing travel restrictions due to a Covid pandemic. So two weeks before the November event, the Labitconf team decided to fund a second Bitcoineta directly in El Salvador, as part of the Bitcoin Beach circular economy. Thus the second Bitcoineta was born.

The eye-catching Volkswagen minibus has been donated to the Bitcoin Beach team, which uses the car for the needs of its circular economy based in El Zonte.

Follow Bitcoin Beach:

Twitter: https://twitter.com/Bitcoinbeach

South Africa: Bitcoin Ekasi

Late 2021 saw one other major development in terms of grassroots bitcoin adoption. On the other side of the planet, in South Africa, Hermann Vivier initiated the Bitcoin Ekasi project. “Ekasi” is a colloquial term for a township, and a township in the South African context is an underdeveloped urban area with a predominantly black population, a remnant of the segregationist apartheid regime. Bitcoin Ekasi emerged as an attempt to introduce bitcoin into the economy of the JCC Camp township located in Mossel Bay, and has gained a lot of success on that front.

Bitcoin Ekasi was in large part inspired by the success of the Bitcoin Beach circular economy back in El Salvador, and the respect was mutual. The Bitcoin Beach team thus decided to pass on the favor they received from the Argentinian Bitcoineta team, and provided funds to Bitcoin Ekasi for them to build a Bitcoineta of their own.

Bitcoin Ekasi emerged as a sister organization of Surfer Kids, a non-profit organization with a mission to empower marginalized youths through surfing. The Ekasi Bitcoineta thus partially serves as a means to get the kids to visit various surfer competitions in South Africa. A major highlight in this regard was when the kids got to meet Jordy Smith, one of the most successful South African surfers worldwide.

Coincidentally, South African surfers present an intriguing demographic for understanding Bitcoin due to their unique circumstances and needs. To make it as a professional surfer, the athletes need to attend competitions abroad; but since South Africa has tight currency controls in place, it is often a headache to send money abroad for travel and competition expenses. The borderless nature of Bitcoin offers a solution to these constraints, providing surfers with an alternative means of moving funds across borders without any obstacles.

Photo taken at the South African Junior Surfing Championships 2023. Back row, left to right:

Mbasa, Chuma, Jordy Smith, Sandiso. Front, left to right: Owethu, Sibulele.

To find out more about Bitcoineta South Africa and the non-profit endeavors it serves, watch Lekker Feeling, a documentary by Aubrey Strobel:

Follow Bitcoin Ekasi:

Twitter: https://twitter.com/BitcoinEkasi

Fundraiser: https://support.bitcoinekasi.com/

Europe: Bitcoineta Europa

The European Bitcoineta started its journey in early 2023, with Ariel Aguilar being one of the main catalysts behind the idea. Unlike its predecessors in El Salvador and South Africa, the European Bitcoineta was not funded by a previous team but instead secured support from individual donors, reflecting a grassroots approach to spreading financial literacy.

The European Bitcoineta is a Mercedes box van adorned with a prominent Bitcoin logo and inspiring messages, and serves as a mobile hub for education and discussion at numerous European Bitcoin conferences and local meetups. Inside its spacious interior, both notable bitcoiners and bitcoin plebs share their insights on the walls, fostering a sense of camaraderie and collaboration.

Follow Bitcoineta Europa’s journey:

Twitter: https://twitter.com/BitcoinetaEU

Instagram: https://www.instagram.com/bitcoinetaeu/

Ghana: Bitcoineta West Africa

Embed: https://youtu.be/8oWgIU17aIY?si=hrsKmMIA7lI6jX4k

Introduced in December 2023 at the Africa Bitcoin Conference in Ghana, the fifth Bitcoineta was donated to the Ghanaian Bitcoin Cowries educational initiative as part of the Trezor Academy program.

Bitcoineta West Africa was funded by the proceeds from the bitcoin-only limited edition Trezor device, which was sold out within one day of its launch at the Bitcoin Amsterdam conference.

With plans for an extensive tour spanning Ghana, Togo, Benin, Nigeria, and potentially other countries within the ECOWAS political and economic union, Bitcoineta West Africa embodies the spirit of collaboration and solidarity in driving Bitcoin adoption and financial inclusion throughout the Global South.

Follow Bitcoineta West Africa’s journey:

Twitter: https://twitter.com/BitcoinetaWA

Instagram: https://www.instagram.com/bitcoinetawa/

—

All the Bitcoineta cars around the world share one overarching mission: to empower their local communities through bitcoin education, and thus improve the lives of common people that might have a strong need for bitcoin without being currently aware of such need. As they continue to traverse borders and break down barriers, Bitcoinetas serve as a reminder of the power of grassroots initiatives and the importance of financial education in shaping a more inclusive future. The tradition of Bitcoinetas will continue to flourish, and in the years to come we will hopefully encounter a brazenly decorated bitcoin car everywhere we go.

If the inspiring stories of Bitcoinetas have ignited a passion within you to make a difference in your community, we encourage you to take action! Reach out to one of the existing Bitcoineta teams for guidance, support, and inspiration on how to start your own initiative. Whether you're interested in spreading Bitcoin education, promoting financial literacy, or fostering empowerment in underserved areas, the Bitcoineta community is here to help you every step of the way. Together, we will orange pill the world!

This is a guest post by Josef Tetek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

bitcoin btc pandemicUncategorized

Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution…

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

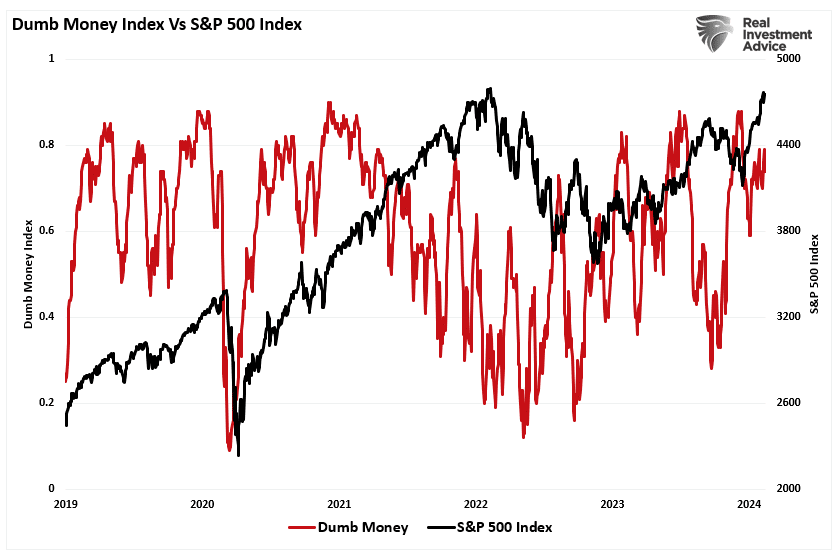

“Such is unsurprising, given that retail investors often fall victim to the psychological behavior of the “fear of missing out.” The chart below shows the “dumb money index” versus the S&P 500. Once again, retail investors are very long equities relative to the institutional players ascribed to being the “smart money.””

“The difference between “smart” and “dumb money” investors shows that, more often than not, the “dumb money” invests near market tops and sells near market bottoms.”

That enthusiasm has increased sharply since last November as stocks surged in hopes that the Federal Reserve would cut interest rates. As noted by Sentiment Trader:

“Over the past 18 weeks, the straight-up rally has moved us to an interesting juncture in the Sentiment Cycle. For the past few weeks, the S&P 500 has demonstrated a high positive correlation to the ‘Enthusiasm’ part of the cycle and a highly negative correlation to the ‘Panic’ phase.”

That frenzy to chase the markets, driven by the psychological bias of the “fear of missing out,” has permeated the entirety of the market. As noted in “This Is Nuts:”

“Since then, the entire market has surged higher following last week’s earnings report from Nvidia (NVDA). The reason I say “this is nuts” is the assumption that all companies were going to grow earnings and revenue at Nvidia’s rate. There is little doubt about Nvidia’s earnings and revenue growth rates. However, to maintain that growth pace indefinitely, particularly at 32x price-to-sales, means others like AMD and Intel must lose market share.”

Of course, it is not just a speculative frenzy in the markets for stocks, specifically anything related to “artificial intelligence,” but that exuberance has spilled over into gold and cryptocurrencies.

Birds Of A Feather

There are a couple of ways to measure exuberance in the assets. While sentiment measures examine the broad market, technical indicators can reflect exuberance on individual asset levels. However, before we get to our charts, we need a brief explanation of statistics, specifically, standard deviation.

As I discussed in “Revisiting Bob Farrell’s 10 Investing Rules”:

“Like a rubber band that has been stretched too far – it must be relaxed in order to be stretched again. This is exactly the same for stock prices that are anchored to their moving averages. Trends that get overextended in one direction, or another, always return to their long-term average. Even during a strong uptrend or strong downtrend, prices often move back (revert) to a long-term moving average.”

The idea of “stretching the rubber band” can be measured in several ways, but I will limit our discussion this week to Standard Deviation and measuring deviation with “Bollinger Bands.”

“Standard Deviation” is defined as:

“A measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is calculated as the square root of the variance.”

In plain English, this means that the further away from the average that an event occurs, the more unlikely it becomes. As shown below, out of 1000 occurrences, only three will fall outside the area of 3 standard deviations. 95.4% of the time, events will occur within two standard deviations.

A second measure of “exuberance” is “relative strength.”

“In technical analysis, the relative strength index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is displayed as an oscillator (a line graph that moves between two extremes) and can read from 0 to 100.

Traditional interpretation and usage of the RSI are that values of 70 or above indicate that a security is becoming overbought or overvalued and may be primed for a trend reversal or corrective pullback in price. An RSI reading of 30 or below indicates an oversold or undervalued condition.” – Investopedia

With those two measures, let’s look at Nvidia (NVDA), the poster child of speculative momentum trading in the markets. Nvidia trades more than 3 standard deviations above its moving average, and its RSI is 81. The last time this occurred was in July of 2023 when Nvidia consolidated and corrected prices through November.

Interestingly, gold also trades well into 3 standard deviation territory with an RSI reading of 75. Given that gold is supposed to be a “safe haven” or “risk off” asset, it is instead getting swept up in the current market exuberance.

The same is seen with digital currencies. Given the recent approval of spot, Bitcoin exchange-traded funds (ETFs), the panic bid to buy Bitcoin has pushed the price well into 3 standard deviation territory with an RSI of 73.

In other words, the stock market frenzy to “buy anything that is going up” has spread from just a handful of stocks related to artificial intelligence to gold and digital currencies.

It’s All Relative

We can see the correlation between stock market exuberance and gold and digital currency, which has risen since 2015 but accelerated following the post-pandemic, stimulus-fueled market frenzy. Since the market, gold and cryptocurrencies, or Bitcoin for our purposes, have disparate prices, we have rebased the performance to 100 in 2015.

Gold was supposed to be an inflation hedge. Yet, in 2022, gold prices fell as the market declined and inflation surged to 9%. However, as inflation has fallen and the stock market surged, so has gold. Notably, since 2015, gold and the market have moved in a more correlated pattern, which has reduced the hedging effect of gold in portfolios. In other words, during the subsequent market decline, gold will likely track stocks lower, failing to provide its “wealth preservation” status for investors.

The same goes for cryptocurrencies. Bitcoin is substantially more volatile than gold and tends to ebb and flow with the overall market. As sentiment surges in the S&P 500, Bitcoin and other cryptocurrencies follow suit as speculative appetites increase. Unfortunately, for individuals once again piling into Bitcoin to chase rising prices, if, or when, the market corrects, the decline in cryptocurrencies will likely substantially outpace the decline in market-based equities. This is particularly the case as Wall Street can now short the spot-Bitcoin ETFs, creating additional selling pressure on Bitcoin.

Just for added measure, here is Bitcoin versus gold.

Not A Recommendation

There are many narratives surrounding the markets, digital currency, and gold. However, in today’s market, more than in previous years, all assets are getting swept up into the investor-feeding frenzy.

Sure, this time could be different. I am only making an observation and not an investment recommendation.

However, from a portfolio management perspective, it will likely pay to remain attentive to the correlated risk between asset classes. If some event causes a reversal in bullish exuberance, cash and bonds may be the only place to hide.

The post Digital Currency And Gold As Speculative Warnings appeared first on RIA.

bonds pandemic sp 500 equities stocks bitcoin currencies gold-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges