Spread & Containment

A Plethora Of New Macro Trends

A Plethora Of New Macro Trends

Via Crescat Capital,

We are currently experiencing profound changes in the global economy that are likely…

We are currently experiencing profound changes in the global economy that are likely to unleash a plethora of early-stage secular trends in a new inflationary regime. These are long-overdue structural shifts powered by decades of easy money policies and record levels of debt-to-GDP among developed economies:

-

Governments and central banks to seek high-quality international reserves in attempt to restore the credibility of fiat currencies; gold will play a major role as a monetary asset

-

Monetary metals and other tangible assets to regain relevance in crowded 60/40 portfolios as inflationary hedges

-

Central banks ultimately forced to cap long-term yields creating a major tailwind for inflationary assets

-

The beginning of a commodities cycle after chronic under-investment in natural resource industries

-

A new “Exploration Age” for commodities as major producers address their supply cliff

-

Deglobalization trends prompt a long-overdue manufacturing re-build in developed economies including a boost to non-residential construction

-

Rising geopolitical tensions spur increase in defense spending from historic low levels compared to GDP

-

The continuation of one of the most extensive fiscal agendas in history, driven by the Green Revolution, social equality programs, infrastructure revamp, and defense spending

-

Ongoing flood of sovereign debt issuances and persistent inflationary pressure to cause long-term interest rates to rise globally

-

Overall corporate margins to be squeezed by the rise in cost of capital, commodity prices, and labor cost as the Fed tightens monetary conditions

-

The resurgence of fundamental analysis and value investing principles as profitability becomes a priority

-

A re-pricing of long duration growth stocks from record valuations as cost of capital increases

-

A major shift in market leadership from technology to natural resources related businesses

-

Geopolitically neutral and commodity-driven economies to gain relevance on the global stage, i.e. Brazil

-

Upcoming challenges to historically indebted net importers of commodities, i.e. China

Unparalleled to any other time in history, the current macro imbalances have drastically distorted the market perception of value and risk. This scenario is setting the stage for significant changes in portfolio allocations from crowded and overvalued assets to unloved and historically cheap alternatives. For macro investors, we think this is one of the most opportunistic times ever.

Let’s dive in on each of these themes to share our detailed views about the global economy.

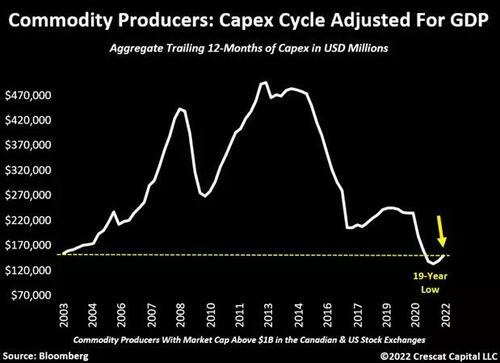

Natural Resource Under Investments

If there was ever a time to own tangible assets and businesses that benefit from the appreciation of these underlying assets, that time would be now. Ultimately, the sustainability of commodity bull markets is predicated on the spending trends for natural resource industries. By and large, these are long-term cycles that take time to reverse. Years of misallocation of capital, equity dilution, corporate mismanagement and money-losing operations have now turned into excessive conservatism. When adjusted for GDP levels, the aggregate capex for commodity producers remains lower than it was in 2003, almost 20 years ago.

Cash-Flow Machines

Natural resource industries are now generating more free-cash-flow than any other time in history. To be exact, they reported three times more annual free-cash-flow than their historical peak. While these companies have turned into incredibly profitable businesses, they have yet to become new darlings for investors.

Early Signs

Commodity producers remain so financially restrained to invest in their businesses that they are almost giving more capital back to shareholders than what they spend on CAPEX. In the last year, nearly 30% of the cash flow from operations generated by these companies was spent on dividends and share buybacks. The chart below reflects how natural resource industries are more focused on attracting investors by these shareholder friendly actions than through trying to grow their businesses. This is a classic sign of a commodities cycle in its early innings.

How can anyone claim commodities are overextended when prices relative to overall equity markets remain near 50-year lows? Every time we reach such suppressed levels in this ratio it marked the beginning of commodities cycles. The chart below is an incredible illustration of the opportunity still ahead of us. The credit goes to our good friends at Incrementum AG for always providing outstanding research.

In our Global Macro, Long Short and Large Cap strategies, we hold a large and diversified position in raw materials businesses on all fronts, including metals, energy, agriculture, and forest products. On a side note, we do think that gold and silver miners, more than any other natural resource industry, are overdue for a major catch-up with their peers.

Here is one interesting fact to consider: precious metals mining companies are not only the most profitable they have ever been in history, but they also have the strongest operating margins among all other commodity producers. That is despite the recent increase in energy prices and surge in labor costs.

Silver remains one of the most mispriced opportunities in financial markets today. While the overall commodities market has drastically risen, this high-beta version of gold remains at historically cheap levels. If silver were to just catch up to the move in other tangible assets, it would imply a doubling from current levels.

Precious metals companies have been performing incredibly well recently despite the significant rise in US Treasury yields. Remarkably, the industry has underperformed gold prices for over 26 years. With rising profitability, balance sheet improvements, extreme capital spending conservatism by corporate management, there is so much value still to be unlocked in this industry.

Defense Spending Resurgence

The Russian invasion of Ukraine has marked a tectonic shift in the geopolitical landscape with innumerable long-lasting ramifications. The trade deglobalization trend that had already begun with respect to disengagement with China is only more likely to continue now and brings with it long-lasting inflationary implications.

We further believe that US defense spending is now set to increase drastically from current historic low levels of GDP. If the US were to move back to Cold War spending levels, we could see a doubling from here to about 6.6% of GDP which would unleash $1.5 trillion of new government spending. But even half or a quarter of that amount would be an extraordinary boost to the defense industry that has a total market capitalization of just $500 billion and a mere $240 billion in annual revenues today. Other NATO countries are also likely to drastically increase their defense budgets. We have already started buying US defense companies that are supported by our equity model in our Global Macro, Long Short and Large Cap strategies.

However, with military spending ripe to go significantly higher from here, it will only further fuel the inflationary problem due to increased deficit spending. The US is already facing one of its worst fiscal imbalances ever while running one of its lowest defense budgets in history.

A Manufacturing Revamp Ahead of Us

After many decades of benefiting from a highly globalized world economy, US corporations will likely be forced to re-establish their manufacturing plans domestically to avoid international reliance on labor and supply resources. These shifts may drive the long-overdue revamp of American infrastructure. A potential uptrend in non-residential construction from historic lows could substantially boost the demand for commodities.

“Gold is Money, Everything Else is Credit”

Once again, gold is playing a major role serving as a monetary asset and tangible anchor for fiat currencies. As insane as it sounds, the most credible central bank balance sheets today are the ones that have built that reputation by owning debt of other massively levered economies. As shown in the chart below, this is already in the process of changing.

After many years of strong positive correlation with fixed income securities, gold is now rising despite the historic rout in global bonds. In our view, global bonds yielding negative in nominal terms are about to become obsolete. Their overall outstanding value just went $18 trillion to less than $3 trillion. Outflows from fixed income markets are likely to become inflows for tangible assets like gold. With rising inflation, particularly among developed economies, central banks and governments are being forced to improve the quality of their international reserves as an attempt to restore the credibility of their monetary systems.

Five Pillars of Inflation

We are currently facing five early-stage structural changes in the macro environment that are likely to fuel a long-term inflationary problem:

-

The “demand-pull” from rising wages and salaries and a tight labor market

-

“Cost-push” supply shortages caused by a chronic period of under-investment in natural resource industries

-

Reckless fiscal spending

-

Rising deglobalization trends

-

The need to deleverage debt-to-GDP though rising inflation

As shown on the chart below, we have only seen 13 consecutive months where CPI stayed above 2.5%. This measurement puts into perspective how much longer CPI stayed above such levels during other inflationary regimes that also experienced similar macro forces serving as tailwinds for consumer prices.

Inflation is concerning but the real issue is how policy makers are dealing with the situation. Amid the highest CPI prints in 40 years, today we have one of the most aggressive fiscal policies in history for how strong the labor market is. Hard to believe inflation will cool off from here. The Fed’s interest rate hikes can cool demand but work against the need to help finance an increased supply of critical resources.

Inflationary Crises

Bonds have served as incredible hedges during the last several downturns in equity markets. The rising inflation environment that led up to the tech and housing busts proved to be a cyclical force as the economy entered a significant downturn and nominal yields collapsed as a result. Inflation also decelerated drastically during the Covid crash in March 2020 and long-term rates declined in tandem. We fear investors are “fighting the last war” in expecting the same correlation to play out in the next major equity downturn. The structural changes in inflation today are causing this relationship to change drastically. Market participants are conditioned to think of sovereign bonds as safe havens, but that was not a reality during other inflationary regimes.

In 1968-69 and 1973-74, as equity markets collapsed and the economy entered a recession, long-term nominal yields increased instead. Such market developments are consequences of an economy facing long-term inflationary pressure rather than cyclical forces. We think Treasury yields and equity market correlations will look similar in the next recession.

Gold and Miners Prevail During Inflationary Crises

Contrary to today’s conventional wisdom, note how gold miners increased 5-fold while the stock market declined 50% during the 1973-74 inflationary recession. We think a similar development will follow in the next economic downturn.

But does today’s macro setup really resemble the 1970s?

As tempting as it can be, the use of any one point in history as a guide may offer an incomplete assessment of what is likely ahead of us. For the first time in 120 years, the US economy is facing a trifecta of economic extremes. We need to combine the debt problem of the 1940s, the structural commodity shortages of the 1970s, and the speculative equity valuation environment of the late 1920s and 1990s in order to get a more complete picture of the macro setup that we have today. These imbalances create true political constraints to governments and central banks. It is hard for us to believe how inflation will not continue to be one of the major forces infiltrating the economy over the next several years to reconcile these imbalances.

Peak of the Business Cycle

We are seeing a list of recession indicators flashing warning signals today. Beware of times when the spread of consumer confidence “present situation” vs. “expectation” is at cyclical highs. Last time this spread was as extreme as today was right before the tech bust and the 1973-4 recession.

Corporate Margins at Risk

The rise in material prices, wages, and now cost of capital is likely to truly impact corporate margins. To recall, earnings always reach a cyclical top at the peak of the business cycle. We think this time is no different. Similarly, labor markets tend to be very reliant contrarian indicators. The U-3 unemployment rate and initial jobless claims are both at one of the lowest levels in history.

Eerie Resemblance

The US 2-year yield just re-tested its multi-decade resistance. This move happened four other times in the last 40 years, and all of them were followed by significant economic downturns.

We are likely at the peak of the business cycle. While we think the 2-year yield could easily break out above this trend, finally, it won’t change our view about a major deceleration of growth after inflation ahead. Given the current political constraints, it is a 1973-74 setup on steroids.

Tech Bubble 2.0

This could be just a coincidence, but the S&P 500 technology sector is almost as overvalued relative to the overall market as it was at the peak of the tech bubble. Note that the ratio perfectly re-tested the same level we saw in March 2000 right before technology companies suffered from a severe bear market in the next two years. We think this sector is unlikely to be the next sector to lead equity markets and these companies are at major risk of being re-rated at significantly lower prices relative to their fundamentals.

Insanely Speculative

Easy-money policies and excess liquidity have created one of the worst asset valuation distortions in history. Almost every fundamental multiple that we track is currently at historically expensive levels. To put into perspective, US market cap to GDP needs to fall another 15% just to reach peak Tech Bubble levels.

US Stocks vs. Gold

Not to be overlooked, US stocks in gold terms are just as expensive as they were at the 1929 peak prior to the Great Depression.

Sell Overall Stocks & Buy Gold Miners

We believe S&P 500-to-gold miners ratio is headed lower from here. The macro and fundamental case for owning precious metals companies vs. overall equities has never been more attractive.

Flood of Treasury Issuances

While most market participants often focus on the demand factors for US Treasuries, we think the supply side of the argument remains the most relevant part of our bearish thesis. We are experiencing a flood of Treasury issuances as of late. Just in the last three months the government issued over $840 billion of these instruments amid the worst inflationary problem in 40 years. Meanwhile, the Fed just went from being the largest buyer of Treasuries to now wanting to become a seller.

In addition to the Fed’s policy reversal, US banks, which supposedly should be making up for the lower demand from other parties, only purchased about 20% of overall US debt issuances.

Where We Think Nominal Yields Are Headed

After the largest annual decline in US Treasuries in 50 years, we think these instruments are looking significantly oversold in the short term. Therefore, we expect a relief rally before another bigger selloff. In a similar fashion to what is unfolding in Japan, we think the Fed will be forced to cap long-term yields.

How high are they likely to go? We think it is unnecessary to answer this question now. As usual, policy makers should be very vocal when long-term yields get too high and become an issue.

We also believe that any potential increase in the balance sheet assets to suppress nominal rates would create a massive tailwind for a massive surge in inflation-hedge assets. This policy reversal might be what causes gold to move violently higher in price.

Energy Shortage

Given the macro and fundamental backdrop, we continue to be buyers of oil and gas businesses. These energy companies are currently generating more free-cash-flow than any other time in history. Meanwhile, political efforts towards ESG policies are still preventing them from performing at full capacity which remains very bullish for commodity prices. In fact, oil production still is almost 10% lower than it was at its prior peak in February 2020.

Essential to Function the Economy but Priced as Irrelevant

A reminder that the energy sector makes up less than 4% of the S&P 500 weight today, which remains to be one of the lowest levels ever.

Energy Disconnect

The performance by sector in the US equity market since the pandemic lows has been astonishing. The disconnect in energy stocks simply reflects the macro regime we just entered.

Brazil: Geopolitically Neutral & Commodity-Driven Economy

Brazil is one of the few economies in the world that could do exceptionally well in today’s macro environment. It is a commodity-driven economy with a long history of dealing with inflationary problems and political shifts. From a value perspective, Brazilian equities are just as undervalued as they were at the early stages of a multi-year bull market in early 2000s. The upcoming elections add a degree of uncertainty and fear, but at such attractive prices we think the risks are mostly priced in. Historically, the Brazilian economy has an incredibly strong correlation to commodity markets. We view this opportunity as a high-beta version of our long positions in natural resources. Different than the Fed, the Brazilian central bank has gone long ways to proactively tighten financial conditions as inflation gained momentum. Short-term interest rates, also known as Selic rates, went from 2% to 11.75% in the last 13 months. Inflation remains elevated but slightly below interest rates. Brazil is one of the few economies in the world running a positive real interest policy.

See below the price-to-sales differential between Brazilian and US equities.

China Yuan Devaluation

The relative performance of Chinese vs. US stocks has been dismal. Meanwhile, the yuan remains unsustainably strong, though is finally starting to slip. The economy with the largest credit imbalance in the world has been grinding to a halt. The People’s Bank of China has no choice but to loosen credit conditions to counter its real estate and stock market implosion. At the same time, the Federal Reserve has no choice but to raise interest rates to fight inflation. The renminbi is at risk of a major devaluation.

The PBOC is easing while the Fed is tightening, and that is only likely to continue with many lead indicators signaling much further yuan devaluation ahead. That is the crux of it, and it’s a big deal. Crescat’s asymmetric laddered long USD vs. CNH call options in the Global Macro fund have been performing extremely well in April MTD. We think there is much more to play out.

A Final Note on Gold

We have been in a de facto Bretton Woods system for the last several decades with many parallels today to the 1968 to 1971 period. Like then, there is a good chance we are about to move away from a system of Western central bank cooperation. The need to deleverage debt-to-GDP globally with fiat currency devaluation is being met with a serious structural global commodity supply shortage.

Western central bank coordination has kept gold suppressed versus dollars, euros, yen, etc. It has also created historic debt-to-GDP levels in these countries creating tremendous pressure on the system. Here is the best macro academic paper on the Collapse of the London Gold Pool and end of Bretton Woods: https://economics.ucdavis.edu/events/papers/copy2_of_417Bordo.pdf. It is a must-read because it discusses the bigger issues surrounding “central bank cooperation”.

We need to remember that it was inflation, not deflation as posited by the Triffin dilemma, that led to the breakdown of the Bretton Woods system. We face the same problem today. Due to an unsustainable set of macro extremes, inflation has become unhinged and will likely only continue to spiral. Many will be slow to abandon their belief that too much debt in the world means we will necessarily face deflation. At this juncture, we think people will be better served by coming to the realization that inflation is the ultimate path of least resistance to deleveraging debt to GDP.

With France having repatriated its gold from the UK recently, it echoes De Gaulle breaking from the London Gold Pool in 1968. Even with the writing on the wall at that time, it was not until 1971 that the dam broke. Forward thinking investors today likely still have time to get ahead of the curve, but who knows exactly how much time?

Soon enough, individual investors, institutions, and central banks themselves will be breaking from the Western sovereign debt and fiat cabal and grabbing for the gold. At Crescat, we have always referred to the inherent problem with central bank cooperation as a “prisoner’s dilemma”, a game theory problem that ensures the ultimate breakdown of the entire system. It has taken a long time to get here, but we believe we are finally on the precipice.

Contrary to much gold conspiracy thought, it does not mean that we are facing the demise of the Western banking system nor the rise of authoritarian economies and their fiat currencies. It doesn’t necessarily mean the rise of non-government backed intangible currencies either. Governments will maintain legal authority and power over currency systems. Individuals and businesses will use those currencies. The strongest fiat currencies are likely to continue to be those in advanced economies where the principles of liberty, justice, democracy, entrepreneurship, and free markets reign.

The macro setup today portends a deleveraging of the global economy through inflation, including a probable step-function devaluation of all fiat currency systems relative to gold, a persistent phenomenon throughout world history.

Government

Survey Shows Declining Concerns Among Americans About COVID-19

Survey Shows Declining Concerns Among Americans About COVID-19

A new survey reveals that only 20% of Americans view covid-19 as "a major threat"…

A new survey reveals that only 20% of Americans view covid-19 as "a major threat" to the health of the US population - a sharp decline from a high of 67% in July 2020.

What's more, the Pew Research Center survey conducted from Feb. 7 to Feb. 11 showed that just 10% of Americans are concerned that they will catch the disease and require hospitalization.

"This data represents a low ebb of public concern about the virus that reached its height in the summer and fall of 2020, when as many as two-thirds of Americans viewed COVID-19 as a major threat to public health," reads the report, which was published March 7.

According to the survey, half of the participants understand the significance of researchers and healthcare providers in understanding and treating long COVID - however 27% of participants consider this issue less important, while 22% of Americans are unaware of long COVID.

What's more, while Democrats were far more worried than Republicans in the past, that gap has narrowed significantly.

"In the pandemic’s first year, Democrats were routinely about 40 points more likely than Republicans to view the coronavirus as a major threat to the health of the U.S. population. This gap has waned as overall levels of concern have fallen," reads the report.

More via the Epoch Times;

The survey found that three in ten Democrats under 50 have received an updated COVID-19 vaccine, compared with 66 percent of Democrats ages 65 and older.

Moreover, 66 percent of Democrats ages 65 and older have received the updated COVID-19 vaccine, while only 24 percent of Republicans ages 65 and older have done so.

“This 42-point partisan gap is much wider now than at other points since the start of the outbreak. For instance, in August 2021, 93 percent of older Democrats and 78 percent of older Republicans said they had received all the shots needed to be fully vaccinated (a 15-point gap),” it noted.

COVID-19 No Longer an Emergency

The U.S. Centers for Disease Control and Prevention (CDC) recently issued its updated recommendations for the virus, which no longer require people to stay home for five days after testing positive for COVID-19.

The updated guidance recommends that people who contracted a respiratory virus stay home, and they can resume normal activities when their symptoms improve overall and their fever subsides for 24 hours without medication.

“We still must use the commonsense solutions we know work to protect ourselves and others from serious illness from respiratory viruses, this includes vaccination, treatment, and staying home when we get sick,” CDC director Dr. Mandy Cohen said in a statement.

The CDC said that while the virus remains a threat, it is now less likely to cause severe illness because of widespread immunity and improved tools to prevent and treat the disease.

“Importantly, states and countries that have already adjusted recommended isolation times have not seen increased hospitalizations or deaths related to COVID-19,” it stated.

The federal government suspended its free at-home COVID-19 test program on March 8, according to a website set up by the government, following a decrease in COVID-19-related hospitalizations.

According to the CDC, hospitalization rates for COVID-19 and influenza diseases remain “elevated” but are decreasing in some parts of the United States.

Spread & Containment

‘I couldn’t stand the pain’: the Turkish holiday resort that’s become an emergency dental centre for Britons who can’t get treated at home

The crisis in NHS dentistry is driving increasing numbers abroad for treatment. Here are some of their stories.

It’s a hot summer day in the Turkish city of Antalya, a Mediterranean resort with golden beaches, deep blue sea and vibrant nightlife. The pool area of the all-inclusive resort is crammed with British people on sun loungers – but they aren’t here for a holiday. This hotel is linked to a dental clinic that organises treatment packages, and most of these guests are here to see a dentist.

From Norwich, two women talk about gums and injections. A man from Wales holds a tissue close to his mouth and spits blood – he has just had two molars extracted.

The dental clinic organises everything for these dental “tourists” throughout their treatment, which typically lasts from three to 15 days. The stories I hear of what has caused them to travel to Turkey are strikingly similar: all have struggled to secure dental treatment at home on the NHS.

“The hotel is nice and some days I go to the beach,” says Susan*, a hairdresser in her mid-30s from Norwich. “But really, we aren’t tourists like in a proper holiday. We come here because we have no choice. I couldn’t stand the pain.”

This is Susan’s second visit to Antalya. She explains that her ordeal started two years earlier:

I went to an NHS dentist who told me I had gum disease … She did some cleaning to my teeth and gums but it got worse. When I ate, my teeth were moving … the gums were bleeding and it was very painful. I called to say I was in pain but the clinic was not accepting NHS patients any more.

The only option the dentist offered Susan was to register as a private patient:

I asked how much. They said £50 for x-rays and then if the gum disease got worse, £300 or so for extraction. Four of them were moving – imagine: £1,200 for losing your teeth! Without teeth I’d lose my clients, but I didn’t have the money. I’m a single mum. I called my mum and cried.

Susan’s mother told her about a friend of hers who had been to Turkey for treatment, then together they found a suitable clinic:

The prices are so much cheaper! Tooth extraction, x-rays, consultations – it all comes included. The flight and hotel for seven days cost the same as losing four teeth in Norwich … I had my lower teeth removed here six months ago, now I’ve got implants … £2,800 for everything – hotel, transfer, treatments. I only paid the flights separately.

In the UK, roughly half the adult population suffers from periodontitis – inflammation of the gums caused by plaque bacteria that can lead to irreversible loss of gums, teeth, and bone. Regular reviews by a dentist or hygienist are required to manage this condition. But nine out of ten dental practices cannot offer NHS appointments to new adult patients, while eight in ten are not accepting new child patients.

Some UK dentists argue that Britons who travel abroad for treatment do so mainly for cosmetic procedures. They warn that dental tourism is dangerous, and that if their treatment goes wrong, dentists in the UK will be unable to help because they don’t want to be responsible for further damage. Susan shrugs this off:

Dentists in England say: ‘If you go to Turkey, we won’t touch you [afterwards].’ But I don’t worry because there are no appointments at home anyway. They couldn’t help in the first place, and this is why we are in Turkey.

‘How can we pay all this money?’

As a social anthropologist, I travelled to Turkey a number of times in 2023 to investigate the crisis of NHS dentistry, and the journeys abroad that UK patients are increasingly making as a result. I have relatives in Istanbul and have been researching migration and trading patterns in Turkey’s largest city since 2016.

In August 2023, I visited the resort in Antalya, nearly 400 miles south of Istanbul. As well as Susan, I met a group from a village in Wales who said there was no provision of NHS dentistry back home. They had organised a two-week trip to Turkey: the 12-strong group included a middle-aged couple with two sons in their early 20s, and two couples who were pensioners. By going together, Anya tells me, they could support each other through their different treatments:

I’ve had many cavities since I was little … Before, you could see a dentist regularly – you didn’t even think about it. If you had pain or wanted a regular visit, you phoned and you went … That was in the 1990s, when I went to the dentist maybe every year.

Anya says that once she had children, her family and work commitments meant she had no time to go to the dentist. Then, years later, she started having serious toothache:

Every time I chewed something, it hurt. I ate soups and soft food, and I also lost weight … Even drinking was painful – tea: pain, cold water: pain. I was taking paracetamol all the time! I went to the dentist to fix all this, but there were no appointments.

Anya was told she would have to wait months, or find a dentist elsewhere:

A private clinic gave me a list of things I needed done. Oh my God, almost £6,000. My husband went too – same story. How can we pay all this money? So we decided to come to Turkey. Some people we know had been here, and others in the village wanted to come too. We’ve brought our sons too – they also need to be checked and fixed. Our whole family could be fixed for less than £6,000.

By the time they travelled, Anya’s dental problems had turned into a dental emergency. She says she could not live with the pain anymore, and was relying on paracetamol.

In 2023, about 6 million adults in the UK experienced protracted pain (lasting more than two weeks) caused by toothache. Unintentional paracetamol overdose due to dental pain is a significant cause of admissions to acute medical units. If left untreated, tooth infections can spread to other parts of the body and cause life-threatening complications – and on rare occasions, death.

In February 2024, police were called to manage hundreds of people queuing outside a newly opened dental clinic in Bristol, all hoping to be registered or seen by an NHS dentist. One in ten Britons have admitted to performing “DIY dentistry”, of which 20% did so because they could not find a timely appointment. This includes people pulling out their teeth with pliers and using superglue to repair their teeth.

In the 1990s, dentistry was almost entirely provided through NHS services, with only around 500 solely private dentists registered. Today, NHS dentist numbers in England are at their lowest level in a decade, with 23,577 dentists registered to perform NHS work in 2022-23, down 695 on the previous year. Furthermore, the precise division of NHS and private work that each dentist provides is not measured.

The COVID pandemic created longer waiting lists for NHS treatment in an already stretched public service. In Bridlington, Yorkshire, people are now reportedly having to wait eight-to-nine years to get an NHS dental appointment with the only remaining NHS dentist in the town.

In his book Patients of the State (2012), Argentine sociologist Javier Auyero describes the “indignities of waiting”. It is the poor who are mostly forced to wait, he writes. Queues for state benefits and public services constitute a tangible form of power over the marginalised. There is an ethnic dimension to this story, too. Data suggests that in the UK, patients less likely to be effective in booking an NHS dental appointment are non-white ethnic groups and Gypsy or Irish travellers, and that it is particularly challenging for refugees and asylum-seekers to access dental care.

This article is part of Conversation Insights

The Insights team generates long-form journalism derived from interdisciplinary research. The team is working with academics from different backgrounds who have been engaged in projects aimed at tackling societal and scientific challenges.

In 2022, I experienced my own dental emergency. An infected tooth was causing me debilitating pain, and needed root canal treatment. I was advised this would cost £71 on the NHS, plus £307 for a follow-up crown – but that I would have to wait months for an appointment. The pain became excruciating – I could not sleep, let alone wait for months. In the same clinic, privately, I was quoted £1,300 for the treatment (more than half my monthly income at the time), or £295 for a tooth extraction.

I did not want to lose my tooth because of lack of money. So I bought a flight to Istanbul immediately for the price of the extraction in the UK, and my tooth was treated with root canal therapy by a private dentist there for £80. Including the costs of travelling, the total was a third of what I was quoted to be treated privately in the UK. Two years on, my treated tooth hasn’t given me any more problems.

A better quality of life

Not everyone is in Antalya for emergency procedures. The pensioners from Wales had contacted numerous clinics they found on the internet, comparing prices, treatments and hotel packages at least a year in advance, in a carefully planned trip to get dental implants – artificial replacements for tooth roots that help support dentures, crowns and bridges.

In Turkey, all the dentists I speak to (most of whom cater mainly for foreigners, including UK nationals) consider implants not a cosmetic or luxurious treatment, but a development in dentistry that gives patients who are able to have the procedure a much better quality of life. This procedure is not available on the NHS for most of the UK population, and the patients I meet in Turkey could not afford implants in private clinics back home.

Paul is in Antalya to replace his dentures, which have become uncomfortable and irritating to his gums, with implants. He says he couldn’t find an appointment to see an NHS dentist. His wife Sonia went through a similar procedure the year before and is very satisfied with the results, telling me: “Why have dentures that you need to put in a glass overnight, in the old style? If you can have implants, I say, you’re better off having them.”

Most of the dental tourists I meet in Antalya are white British: this city, known as the Turkish Riviera, has developed an entire economy catering to English-speaking tourists. In 2023, more than 1.3 million people visited the city from the UK, up almost 15% on the previous year.

Read more: NHS dentistry is in crisis – are overseas dentists the answer?

In contrast, the Britons I meet in Istanbul are predominantly from a non-white ethnic background. Omar, a pensioner of Pakistani origin in his early 70s, has come here after waiting “half a year” for an NHS appointment to fix the dental bridge that is causing him pain. Omar’s son had been previously for a hair transplant, and was offered a free dental checkup by the same clinic, so he suggested it to his father. Having worked as a driver for a manufacturing company for two decades in Birmingham, Omar says he feels disappointed to have contributed to the British economy for so long, only to be “let down” by the NHS:

At home, I must wait and wait and wait to get a bridge – and then I had many problems with it. I couldn’t eat because the bridge was uncomfortable and I was in pain, but there were no appointments on the NHS. I asked a private dentist and they recommended implants, but they are far too expensive [in the UK]. I started losing weight, which is not a bad thing at the beginning, but then I was worrying because I couldn’t chew and eat well and was losing more weight … Here in Istanbul, I got dental implants – US$500 each, problem solved! In England, each implant is maybe £2,000 or £3,000.

In the waiting area of another clinic in Istanbul, I meet Mariam, a British woman of Iraqi background in her late 40s, who is making her second visit to the dentist here. Initially, she needed root canal therapy after experiencing severe pain for weeks. Having been quoted £1,200 in a private clinic in outer London, Mariam decided to fly to Istanbul instead, where she was quoted £150 by a dentist she knew through her large family. Even considering the cost of the flight, Mariam says the decision was obvious:

Dentists in England are so expensive and NHS appointments so difficult to find. It’s awful there, isn’t it? Dentists there blamed me for my rotten teeth. They say it’s my fault: I don’t clean or I ate sugar, or this or that. I grew up in a village in Iraq and didn’t go to the dentist – we were very poor. Then we left because of war, so we didn’t go to a dentist … When I arrived in London more than 20 years ago, I didn’t speak English, so I still didn’t go to the dentist … I think when you move from one place to another, you don’t go to the dentist unless you are in real, real pain.

In Istanbul, Mariam has opted not only for the urgent root canal treatment but also a longer and more complex treatment suggested by her consultant, who she says is a renowned doctor from Syria. This will include several extractions and implants of back and front teeth, and when I ask what she thinks of achieving a “Hollywood smile”, Mariam says:

Who doesn’t want a nice smile? I didn’t come here to be a model. I came because I was in pain, but I know this doctor is the best for implants, and my front teeth were rotten anyway.

Dentists in the UK warn about the risks of “overtreatment” abroad, but Mariam appears confident that this is her opportunity to solve all her oral health problems. Two of her sisters have already been through a similar treatment, so they all trust this doctor.

The UK’s ‘dental deserts’

To get a fuller understanding of the NHS dental crisis, I’ve also conducted 20 interviews in the UK with people who have travelled or were considering travelling abroad for dental treatment.

Joan, a 50-year-old woman from Exeter, tells me she considered going to Turkey and could have afforded it, but that her back and knee problems meant she could not brave the trip. She has lost all her lower front teeth due to gum disease and, when I meet her, has been waiting 13 months for an NHS dental appointment. Joan tells me she is living in “shame”, unable to smile.

In the UK, areas with extremely limited provision of NHS dental services – known as as “dental deserts” – include densely populated urban areas such as Portsmouth and Greater Manchester, as well as many rural and coastal areas.

In Felixstowe, the last dentist taking NHS patients went private in 2023, despite the efforts of the activist group Toothless in Suffolk to secure better access to NHS dentists in the area. It’s a similar story in Ripon, Yorkshire, and in Dumfries & Galloway, Scotland, where nearly 25,000 patients have been de-registered from NHS dentists since 2021.

Data shows that 2 million adults must travel at least 40 miles within the UK to access dental care. Branding travel for dental care as “tourism” carries the risk of disguising the elements of duress under which patients move to restore their oral health – nationally and internationally. It also hides the immobility of those who cannot undertake such journeys.

The 90-year-old woman in Dumfries & Galloway who now faces travelling for hours by bus to see an NHS dentist can hardly be considered “tourism” – nor the Ukrainian war refugees who travelled back from West Sussex and Norwich to Ukraine, rather than face the long wait to see an NHS dentist.

Many people I have spoken to cannot afford the cost of transport to attend dental appointments two hours away – or they have care responsibilities that make it impossible. Instead, they are forced to wait in pain, in the hope of one day securing an appointment closer to home.

‘Your crisis is our business’

The indignities of waiting in the UK are having a big impact on the lives of some local and foreign dentists in Turkey. Some neighbourhoods are rapidly changing as dental and other health clinics, usually in luxurious multi-storey glass buildings, mushroom. In the office of one large Istanbul medical complex with sections for hair transplants and dentistry (plus one linked to a hospital for more extensive cosmetic surgery), its Turkish owner and main investor tells me:

Your crisis is our business, but this is a bazaar. There are good clinics and bad clinics, and unfortunately sometimes foreign patients do not know which one to choose. But for us, the business is very good.

This clinic only caters to foreign patients. The owner, an architect by profession who also developed medical clinics in Brazil, describes how COVID had a major impact on his business:

When in Europe you had COVID lockdowns, Turkey allowed foreigners to come. Many people came for ‘medical tourism’ – we had many patients for cosmetic surgery and hair transplants. And that was when the dental business started, because our patients couldn’t see a dentist in Germany or England. Then more and more patients started to come for dental treatments, especially from the UK and Ireland. For them, it’s very, very cheap here.

The reasons include the value of the Turkish lira relative to the British pound, the low cost of labour, the increasing competition among Turkish clinics, and the sheer motivation of dentists here. While most dentists catering to foreign patients are from Turkey, others have arrived seeking refuge from war and violence in Syria, Iraq, Afghanistan, Iran and beyond. They work diligently to rebuild their lives, careers and lost wealth.

Regardless of their origin, all dentists in Turkey must be registered and certified. Hamed, a Syrian dentist and co-owner of a new clinic in Istanbul catering to European and North American patients, tells me:

I know that you say ‘Syrian’ and people think ‘migrant’, ‘refugee’, and maybe think ‘how can this dentist be good?’ – but Syria, before the war, had very good doctors and dentists. Many of us came to Turkey and now I have a Turkish passport. I had to pass the exams to practise dentistry here – I study hard. The exams are in Turkish and they are difficult, so you cannot say that Syrian doctors are stupid.

Hamed talks excitedly about the latest technology that is coming to his profession: “There are always new materials and techniques, and we cannot stop learning.” He is about to travel to Paris to an international conference:

I can say my techniques are very advanced … I bet I put more implants and do more bone grafting and surgeries every week than any dentist you know in England. A good dentist is about practice and hand skills and experience. I work hard, very hard, because more and more patients are arriving to my clinic, because in England they don’t find dentists.

While there is no official data about the number of people travelling from the UK to Turkey for dental treatment, investors and dentists I speak to consider that numbers are rocketing. From all over the world, Turkey received 1.2 million visitors for “medical tourism” in 2022, an increase of 308% on the previous year. Of these, about 250,000 patients went for dentistry. One of the most renowned dental clinics in Istanbul had only 15 British patients in 2019, but that number increased to 2,200 in 2023 and is expected to reach 5,500 in 2024.

Like all forms of medical care, dental treatments carry risks. Most clinics in Turkey offer a ten-year guarantee for treatments and a printed clinical history of procedures carried out, so patients can show this to their local dentists and continue their regular annual care in the UK. Dental treatments, checkups and maintaining a good oral health is a life-time process, not a one-off event.

Many UK patients, however, are caught between a rock and a hard place – criticised for going abroad, yet unable to get affordable dental care in the UK before and after their return. The British Dental Association has called for more action to inform these patients about the risks of getting treated overseas – and has warned UK dentists about the legal implications of treating these patients on their return. But this does not address the difficulties faced by British patients who are being forced to go abroad in search of affordable, often urgent dental care.

A global emergency

The World Health Organization states that the explosion of oral disease around the world is a result of the “negligent attitude” that governments, policymakers and insurance companies have towards including oral healthcare under the umbrella of universal healthcare. It as if the health of our teeth and mouth is optional; somehow less important than treatment to the rest of our body. Yet complications from untreated tooth decay can lead to hospitalisation.

The main causes of oral health diseases are untreated tooth decay, severe gum disease, toothlessness, and cancers of the lip and oral cavity. Cases grew during the pandemic, when little or no attention was paid to oral health. Meanwhile, the global cosmetic dentistry market is predicted to continue growing at an annual rate of 13% for the rest of this decade, confirming the strong relationship between socioeconomic status and access to oral healthcare.

In the UK since 2018, there have been more than 218,000 admissions to hospital for rotting teeth, of which more than 100,000 were children. Some 40% of children in the UK have not seen a dentist in the past 12 months. The role of dentists in prevention of tooth decay and its complications, and in the early detection of mouth cancer, is vital. While there is a 90% survival rate for mouth cancer if spotted early, the lack of access to dental appointments is causing cases to go undetected.

The reasons for the crisis in NHS dentistry are complex, but include: the real-term cuts in funding to NHS dentistry; the challenges of recruitment and retention of dentists in rural and coastal areas; pay inequalities facing dental nurses, most of them women, who are being badly hit by the cost of living crisis; and, in England, the 2006 Dental Contract that does not remunerate dentists in a way that encourages them to continue seeing NHS patients.

The UK is suffering a mass exodus of the public dentistry workforce, with workers leaving the profession entirely or shifting to the private sector, where payments and life-work balance are better, bureaucracy is reduced, and prospects for career development look much better. A survey of general dental practitioners found that around half have reduced their NHS work since the pandemic – with 43% saying they were likely to go fully private, and 42% considering a career change or taking early retirement.

Reversing the UK’s dental crisis requires more commitment to substantial reform and funding than the “recovery plan” announced by Victoria Atkins, the secretary of state for health and social care, on February 7.

The stories I have gathered show that people travelling abroad for dental treatment don’t see themselves as “tourists” or vanity-driven consumers of the “Hollywood smile”. Rather, they have been forced by the crisis in NHS dentistry to seek out a service 1,500 miles away in Turkey that should be a basic, affordable right for all, on their own doorstep.

*Names in this article have been changed to protect the anonymity of the interviewees.

For you: more from our Insights series:

GP crisis: how did things go so wrong, and what needs to change?

Insomnia: how chronic sleep problems can lead to a spiralling decline in mental health

To hear about new Insights articles, join the hundreds of thousands of people who value The Conversation’s evidence-based news. Subscribe to our newsletter.

Diana Ibanez Tirado receives funding from the School of Global Studies, University of Sussex.

pound pandemic treatment therapy spread recovery iran brazil european europe uk germany ukraine world health organizationSpread & Containment

The Coming Of The Police State In America

The Coming Of The Police State In America

Authored by Jeffrey Tucker via The Epoch Times,

The National Guard and the State Police are now…

Authored by Jeffrey Tucker via The Epoch Times,

The National Guard and the State Police are now patrolling the New York City subway system in an attempt to do something about the explosion of crime. As part of this, there are bag checks and new surveillance of all passengers. No legislation, no debate, just an edict from the mayor.

Many citizens who rely on this system for transportation might welcome this. It’s a city of strict gun control, and no one knows for sure if they have the right to defend themselves. Merchants have been harassed and even arrested for trying to stop looting and pillaging in their own shops.

The message has been sent: Only the police can do this job. Whether they do it or not is another matter.

Things on the subway system have gotten crazy. If you know it well, you can manage to travel safely, but visitors to the city who take the wrong train at the wrong time are taking grave risks.

In actual fact, it’s guaranteed that this will only end in confiscating knives and other things that people carry in order to protect themselves while leaving the actual criminals even more free to prey on citizens.

The law-abiding will suffer and the criminals will grow more numerous. It will not end well.

When you step back from the details, what we have is the dawning of a genuine police state in the United States. It only starts in New York City. Where is the Guard going to be deployed next? Anywhere is possible.

If the crime is bad enough, citizens will welcome it. It must have been this way in most times and places that when the police state arrives, the people cheer.

We will all have our own stories of how this came to be. Some might begin with the passage of the Patriot Act and the establishment of the Department of Homeland Security in 2001. Some will focus on gun control and the taking away of citizens’ rights to defend themselves.

My own version of events is closer in time. It began four years ago this month with lockdowns. That’s what shattered the capacity of civil society to function in the United States. Everything that has happened since follows like one domino tumbling after another.

It goes like this:

1) lockdown,

2) loss of moral compass and spreading of loneliness and nihilism,

3) rioting resulting from citizen frustration, 4) police absent because of ideological hectoring,

5) a rise in uncontrolled immigration/refugees,

6) an epidemic of ill health from substance abuse and otherwise,

7) businesses flee the city

8) cities fall into decay, and that results in

9) more surveillance and police state.

The 10th stage is the sacking of liberty and civilization itself.

It doesn’t fall out this way at every point in history, but this seems like a solid outline of what happened in this case. Four years is a very short period of time to see all of this unfold. But it is a fact that New York City was more-or-less civilized only four years ago. No one could have predicted that it would come to this so quickly.

But once the lockdowns happened, all bets were off. Here we had a policy that most directly trampled on all freedoms that we had taken for granted. Schools, businesses, and churches were slammed shut, with various levels of enforcement. The entire workforce was divided between essential and nonessential, and there was widespread confusion about who precisely was in charge of designating and enforcing this.

It felt like martial law at the time, as if all normal civilian law had been displaced by something else. That something had to do with public health, but there was clearly more going on, because suddenly our social media posts were censored and we were being asked to do things that made no sense, such as mask up for a virus that evaded mask protection and walk in only one direction in grocery aisles.

Vast amounts of the white-collar workforce stayed home—and their kids, too—until it became too much to bear. The city became a ghost town. Most U.S. cities were the same.

As the months of disaster rolled on, the captives were let out of their houses for the summer in order to protest racism but no other reason. As a way of excusing this, the same public health authorities said that racism was a virus as bad as COVID-19, so therefore it was permitted.

The protests had turned to riots in many cities, and the police were being defunded and discouraged to do anything about the problem. Citizens watched in horror as downtowns burned and drug-crazed freaks took over whole sections of cities. It was like every standard of decency had been zapped out of an entire swath of the population.

Meanwhile, large checks were arriving in people’s bank accounts, defying every normal economic expectation. How could people not be working and get their bank accounts more flush with cash than ever? There was a new law that didn’t even require that people pay rent. How weird was that? Even student loans didn’t need to be paid.

By the fall, recess from lockdown was over and everyone was told to go home again. But this time they had a job to do: They were supposed to vote. Not at the polling places, because going there would only spread germs, or so the media said. When the voting results finally came in, it was the absentee ballots that swung the election in favor of the opposition party that actually wanted more lockdowns and eventually pushed vaccine mandates on the whole population.

The new party in control took note of the large population movements out of cities and states that they controlled. This would have a large effect on voting patterns in the future. But they had a plan. They would open the borders to millions of people in the guise of caring for refugees. These new warm bodies would become voters in time and certainly count on the census when it came time to reapportion political power.

Meanwhile, the native population had begun to swim in ill health from substance abuse, widespread depression, and demoralization, plus vaccine injury. This increased dependency on the very institutions that had caused the problem in the first place: the medical/scientific establishment.

The rise of crime drove the small businesses out of the city. They had barely survived the lockdowns, but they certainly could not survive the crime epidemic. This undermined the tax base of the city and allowed the criminals to take further control.

The same cities became sanctuaries for the waves of migrants sacking the country, and partisan mayors actually used tax dollars to house these invaders in high-end hotels in the name of having compassion for the stranger. Citizens were pushed out to make way for rampaging migrant hordes, as incredible as this seems.

But with that, of course, crime rose ever further, inciting citizen anger and providing a pretext to bring in the police state in the form of the National Guard, now tasked with cracking down on crime in the transportation system.

What’s the next step? It’s probably already here: mass surveillance and censorship, plus ever-expanding police power. This will be accompanied by further population movements, as those with the means to do so flee the city and even the country and leave it for everyone else to suffer.

As I tell the story, all of this seems inevitable. It is not. It could have been stopped at any point. A wise and prudent political leadership could have admitted the error from the beginning and called on the country to rediscover freedom, decency, and the difference between right and wrong. But ego and pride stopped that from happening, and we are left with the consequences.

The government grows ever bigger and civil society ever less capable of managing itself in large urban centers. Disaster is unfolding in real time, mitigated only by a rising stock market and a financial system that has yet to fall apart completely.

Are we at the middle stages of total collapse, or at the point where the population and people in leadership positions wise up and decide to put an end to the downward slide? It’s hard to know. But this much we do know: There is a growing pocket of resistance out there that is fed up and refuses to sit by and watch this great country be sacked and taken over by everything it was set up to prevent.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex