A Decade Of Elon Musk’s Tweets, Visualized

A Decade Of Elon Musk’s Tweets, Visualized

Elon Musk is known for many things, but one of his most buzzworthy claims to fame is his online…

Elon Musk is known for many things, but one of his most buzzworthy claims to fame is his online Twitter presence.

Because of its candid nature, Musk’s Twitter feed provides the public with a unique opportunity to catch an unfiltered look into his eccentric mind.

What can we learn from an in-depth look at Elon Musk’s Twitter feed? What subjects does he focus on the most, and how has his Twitter use changed over the past decade?

Visual Capitalist's Carmen Ang and Nick Routley sifted through his entire tweet history to find out.

Why Bother?

To gain a high-level understanding of Musk’s Twitter profile, our research team sifted through his entire Twitter feed and compiled 15,000 of his tweets into a comprehensive dataset.

Why go to all the effort? Here are a few reasons why we spent months sifting through Elon Musk’s Twitter feed:

-

People care about what he has to say: Musk has over 77 million followers on Twitter, and his account is currently the 11th most followed (coming in between Ellen DeGeneres and Narendra Modi, the Prime Minister of India). Even run-of-the-mill replies to regular Twitter users receive thousands of shares, likes, and comments. Clearly, people are interested in his ideas and interactions.

-

Musk tweets often, and candidly: These days, it’s not uncommon for Musk to share more than 30 tweets in a single day. And his Twitter conversations cover a wide range of topics, from serious conversations about technical aspects of his products to lighthearted memes. This is highly unusual for a person in his position.

-

Some of his tweets have had a big impact: Elon’s tweets consistently make headlines and ruffle the feathers of big shots in business and politics. Elon’s Twitter fingers have moved the needle on everything from Tesla’s stock price to cryptocurrency markets.

-

He’s become a public icon: He’s currently the richest person in the world, and last year, he was named Time Magazine’s Person of the Year. The companies that Musk runs are also hugely influential and disruptive. In other words, no matter how you feel about him personally, he’s a pretty big deal.

Because of the above, we thought digging into the depths of Elon Musk’s Twitter feed was a worthy pursuit. Below, we’ll get into our methodology, and how we went about analyzing the mountains of tweets.

How We Did It: Notes on Our Methodology

Once we scraped a decade worth of Elon Musk tweets, we dug through the data and sorted the information to answer two main questions:

-

What are Elon Musk’s most tweeted topics?

-

How has his Twitter activity changed over the years?

To answer the first question, we sorted Elon’s tweets into categories (based on keywords) and ranked each category based on the volume of mentions.

The results are visualized in the circle chart in the middle of the graphic, which shows Musk’s most tweeted subjects over the last decade.

To answer our second question (how has Elon’s Twitter activity changed over the years) we sorted Elon’s feed into three main topics—Tesla, SpaceX, and everything else—and showed which topics dominated his feed each year.

Main Takeaways from the Analysis

Perhaps unsurprisingly, we found that the two main things Elon talks about the most are Tesla and SpaceX. He’s mentioned both companies consistently over the last decade, and as the timeline shows, Tesla and SpaceX take turns in the spotlight, depending on what’s going on for the companies at the time.

While the topics and themes of his content have remained fairly consistent, the frequency of tweets has grown over the years.

Musk now uses Twitter very consistently, tweeting at least once on all but 14 days in 2021. His follower count has growth steadily over the years too:

As the above graphic shows, his follower growth started to escalate between late 2017 and mid-2018 as Musk began to burst into the public consciousness. Why? A lot was happening both personally and professionally for the busy founder:

-

December 2017: Announcement on Twitter that the Boring Company was planning to release a limited edition flamethrower. 20,000 units were sold before the product was discontinued.

-

February 2018: Tesla Roadster was launched into space.

-

July 2018: 12 boys and their teacher get trapped in a cave in Thailand, and Elon gets heavily involved in efforts to try and rescue them. This includes an awkward—now deleted—tweet referring to a British cave diver as a pedophile. (Musk later won a defamation case in 2019.)

-

August 2018: Elon announces on Twitter that he’s considering taking Tesla private at $420 a share. Tesla’s share price promptly dropped after this now infamous tweet was sent.

-

Sept 2018: Musk appears on Joe Rogan’s podcast, and smokes weed with him. The spectacle grabs headlines after the podcast is published.

-

From 2016 to 2018: A highly publicized, on-again-off-again relationship with actress Amber Heard.

No matter how outlandish or shocking his comments have been, Musk’s companies continue to see success, and people have continued to show interest in keeping up with the founder’s thoughts—and dank memes—on Twitter.

Highlights (and Lowlights) of Musk’s Twitter History

In the next section below, we’ll cover some of Elon’s most iconic Twitter moments, hand-selected by our research team.

The End of the Fake Elon Era

Elon Musk’s first real tweet was shared in 2010. Prior to that, someone was pretending to be him and using the Twitter handle @elonmusk to tweet random and controversial things.

Luckily, the imposter didn’t gain much traction, and the real Elon Musk cleared the air on June 4, 2010, with a tweet announcing his authentic arrival onto the platform:

Please ignore prior tweets, as that was someone pretending to be me :) This is actually me.

— Elon Musk (@elonmusk) June 4, 2010

After this initial tweet, Musk didn’t tweet again until the end of 2011, though his account was still verified that year. His Twitter activity remained relatively low until 2012.

A Splashdown to Remember

In May 2012, Musk went to Twitter to share his excitement after the Dragon spacecraft successfully returned home.

Splashdown successful!! Sending fast boat to Dragon lat/long provided by P3 tracking planes #Dragon

— Elon Musk (@elonmusk) May 31, 2012

This landing made history, as SpaceX became the first commercial spacecraft to deliver cargo to the International Space Station.

The engagement on this tweet highlights how much larger Musk’s audience is today. The tweet above, which is highlighting some very exciting news, only has about 350 retweets.

The Boring Company Flamethrower

In late 2017, Musk started selling Boring Company merchandise, mostly as a joke. But products were selling, and Elon decided to take things one step further, and announced to Twitter that he’d release a Boring Company flamethrower if 50,000 Boring branded hats sold:

After 50k hats, we will start selling The Boring Company flamethrower

— Elon Musk (@elonmusk) December 11, 2017

The hats did sell out, so true to his word, Musk released a limited edition flamethrower at $500 bucks apiece. All 20,000 units sold out.

The $20 Million Quip

In August 2018, Musk told Twitter that he was considering taking Tesla private, at $420 a share.

Am considering taking Tesla private at $420. Funding secured.

— Elon Musk (@elonmusk) August 7, 2018

This tweet was a cheeky reference to marijuana, but it ended up costing a fortune. The SEC sued him with fraudulent charges, claiming this irresponsible tweet misled investors.

He ended up paying millions in fines, and had to step down as Tesla’s chairman as a result of the drama.

Candid COVID Opinions

Musk hasn’t been shy about sharing his thoughts on the global pandemic. On March 6, 2020, he tweeted “the coronavirus panic is dumb.” Since then, he’s been vocal about his distrust in antigen tests, and isn’t afraid to share his frustrations around lockdowns with his followers:

FREE AMERICA NOW

— Elon Musk (@elonmusk) April 29, 2020

He’s also said that the virus isn’t that deadly and that COVID-19 related deaths were inflated because doctors were wrongfully attributing deaths to the virus instead of other causes.

Becoming the World’s Richest Human

In 2021, Musk surpassed Jeff Bezos to become the richest person in the world. His reaction was quite understated. In response to a tweet from @teslaownersSV sharing the news, he simply said, “how strange.”

From there, he tweeted:

Back to work I go …

— Elon Musk (@elonmusk) February 8, 2021

Musk is still currently the richest person on the planet as of this article’s publication date, with a net worth of $213 billion.

Bitcoin Boost

Elon Musk’s foray into Bitcoin boosterism ramped up on January 29, 2021, when he added “#bitcoin” to his Twitter profile page, a move that appeared to have an impact on the price of BTC.

Days later, Musk announced that Tesla acquired $1.5 billion in bitcoin, with plans to accept it as payment.

You can now buy a Tesla with Bitcoin

— Elon Musk (@elonmusk) March 24, 2021

The news caused the price of Bitcoin to jump 17% to $44,000, a record high at the time. Bitcoin remained in the spotlight through the year as the cryptocurrency continued to gather support from major financial institutions.

Just days prior, Musk also added fuel to the speculative fire surrounding the GameStop stock. By simply tweeting the word “Gamestonk” paired with a link to Reddit’s infamous r/wallstreetbets, GME’s price exploded more than 150% higher.

The Multi-Billion Dollar Question

After facing backlash over his significant stockpile of wealth, Musk turned to Twitter to ask users if he should sell 10% of his Tesla stock in order to pay taxes.

Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock.

— Elon Musk (@elonmusk) November 6, 2021

Do you support this?

The majority of Twitter users voted yes, and the billionaire actually followed through and sold more than $16 billion worth of Tesla stock.

Reconnecting Ukraine

In late February, as Russia launched its offensive in Ukraine, Mykhailo Fedorov, Ukraine’s Vice Prime Minister and Minister of Digital Transformation called the SpaceX founder out on Twitter, asking for support.

Starlink service is now active in Ukraine. More terminals en route.

— Elon Musk (@elonmusk) February 26, 2022

Musk would reply within 24 hours, and soon after, Fedorov would tweet a photo of Starlink terminals arriving safely in the country.

Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Uncategorized

‘Bougie Broke’ – The Financial Reality Behind The Facade

‘Bougie Broke’ – The Financial Reality Behind The Facade

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

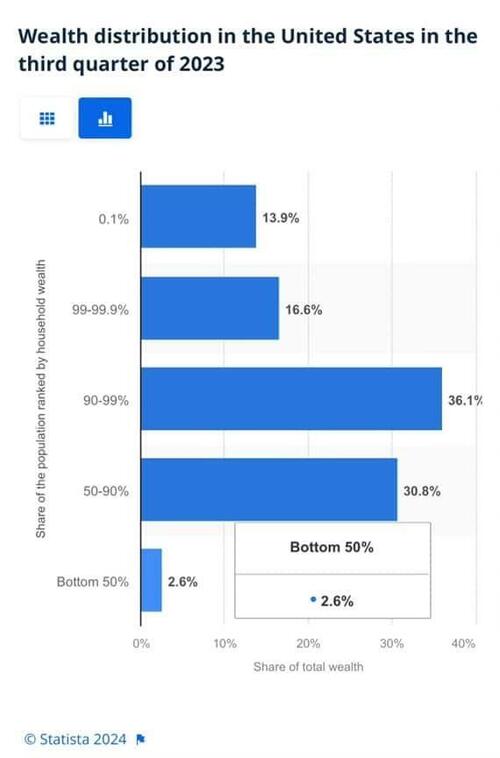

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

Government

Congress’ failure so far to deliver on promise of tens of billions in new research spending threatens America’s long-term economic competitiveness

A deal that avoided a shutdown also slashed spending for the National Science Foundation, putting it billions below a congressional target intended to…

Federal spending on fundamental scientific research is pivotal to America’s long-term economic competitiveness and growth. But less than two years after agreeing the U.S. needed to invest tens of billions of dollars more in basic research than it had been, Congress is already seriously scaling back its plans.

A package of funding bills recently passed by Congress and signed by President Joe Biden on March 9, 2024, cuts the current fiscal year budget for the National Science Foundation, America’s premier basic science research agency, by over 8% relative to last year. That puts the NSF’s current allocation US$6.6 billion below targets Congress set in 2022.

And the president’s budget blueprint for the next fiscal year, released on March 11, doesn’t look much better. Even assuming his request for the NSF is fully funded, it would still, based on my calculations, leave the agency a total of $15 billion behind the plan Congress laid out to help the U.S. keep up with countries such as China that are rapidly increasing their science budgets.

I am a sociologist who studies how research universities contribute to the public good. I’m also the executive director of the Institute for Research on Innovation and Science, a national university consortium whose members share data that helps us understand, explain and work to amplify those benefits.

Our data shows how underfunding basic research, especially in high-priority areas, poses a real threat to the United States’ role as a leader in critical technology areas, forestalls innovation and makes it harder to recruit the skilled workers that high-tech companies need to succeed.

A promised investment

Less than two years ago, in August 2022, university researchers like me had reason to celebrate.

Congress had just passed the bipartisan CHIPS and Science Act. The science part of the law promised one of the biggest federal investments in the National Science Foundation in its 74-year history.

The CHIPS act authorized US$81 billion for the agency, promised to double its budget by 2027 and directed it to “address societal, national, and geostrategic challenges for the benefit of all Americans” by investing in research.

But there was one very big snag. The money still has to be appropriated by Congress every year. Lawmakers haven’t been good at doing that recently. As lawmakers struggle to keep the lights on, fundamental research is quickly becoming a casualty of political dysfunction.

Research’s critical impact

That’s bad because fundamental research matters in more ways than you might expect.

For instance, the basic discoveries that made the COVID-19 vaccine possible stretch back to the early 1960s. Such research investments contribute to the health, wealth and well-being of society, support jobs and regional economies and are vital to the U.S. economy and national security.

Lagging research investment will hurt U.S. leadership in critical technologies such as artificial intelligence, advanced communications, clean energy and biotechnology. Less support means less new research work gets done, fewer new researchers are trained and important new discoveries are made elsewhere.

But disrupting federal research funding also directly affects people’s jobs, lives and the economy.

Businesses nationwide thrive by selling the goods and services – everything from pipettes and biological specimens to notebooks and plane tickets – that are necessary for research. Those vendors include high-tech startups, manufacturers, contractors and even Main Street businesses like your local hardware store. They employ your neighbors and friends and contribute to the economic health of your hometown and the nation.

Nearly a third of the $10 billion in federal research funds that 26 of the universities in our consortium used in 2022 directly supported U.S. employers, including:

A Detroit welding shop that sells gases many labs use in experiments funded by the National Institutes of Health, National Science Foundation, Department of Defense and Department of Energy.

A Dallas-based construction company that is building an advanced vaccine and drug development facility paid for by the Department of Health and Human Services.

More than a dozen Utah businesses, including surveyors, engineers and construction and trucking companies, working on a Department of Energy project to develop breakthroughs in geothermal energy.

When Congress shortchanges basic research, it also damages businesses like these and people you might not usually associate with academic science and engineering. Construction and manufacturing companies earn more than $2 billion each year from federally funded research done by our consortium’s members.

Jobs and innovation

Disrupting or decreasing research funding also slows the flow of STEM – science, technology, engineering and math – talent from universities to American businesses. Highly trained people are essential to corporate innovation and to U.S. leadership in key fields, such as AI, where companies depend on hiring to secure research expertise.

In 2022, federal research grants paid wages for about 122,500 people at universities that shared data with my institute. More than half of them were students or trainees. Our data shows that they go on to many types of jobs but are particularly important for leading tech companies such as Google, Amazon, Apple, Facebook and Intel.

That same data lets me estimate that over 300,000 people who worked at U.S. universities in 2022 were paid by federal research funds. Threats to federal research investments put academic jobs at risk. They also hurt private sector innovation because even the most successful companies need to hire people with expert research skills. Most people learn those skills by working on university research projects, and most of those projects are federally funded.

High stakes

If Congress doesn’t move to fund fundamental science research to meet CHIPS and Science Act targets – and make up for the $11.6 billion it’s already behind schedule – the long-term consequences for American competitiveness could be serious.

Over time, companies would see fewer skilled job candidates, and academic and corporate researchers would produce fewer discoveries. Fewer high-tech startups would mean slower economic growth. America would become less competitive in the age of AI. This would turn one of the fears that led lawmakers to pass the CHIPS and Science Act into a reality.

Ultimately, it’s up to lawmakers to decide whether to fulfill their promise to invest more in the research that supports jobs across the economy and in American innovation, competitiveness and economic growth. So far, that promise is looking pretty fragile.

This is an updated version of an article originally published on Jan. 16, 2024.

Jason Owen-Smith receives research support from the National Science Foundation, the National Institutes of Health, the Alfred P. Sloan Foundation and Wellcome Leap.

economic growth covid-19 grants congress vaccine china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges