Uncategorized

4 Penny Stocks To Watch As ARM IPO Sparks Momentum In The Stock Market Today

ARM Stock IPO Sparks Surge In Tech Penny Stocks To Watch.

The post 4 Penny Stocks To Watch As ARM IPO Sparks Momentum In The Stock Market Today appeared…

What Is The ARM IPO?

This article reviews a list of penny stocks to watch after the much anticipated ARM IPO. But before we dive into that watch list, let’s explain what the ARM IPO is and why it might influence certain stocks.

The ARM IPO is a highly anticipated public offering of stock from Arm. The chip design company supplies tech to companies like Nvidia and Apple. The ARM IPO was priced at $51 per share, and Arm Holdings (NASDAQ: ARM) began trading under the ticker symbol “ARM” on September 14th.

Other than Apple and Nvidia, ARM also caters to Google, Samsung, AMD, Intel, and Taiwan Semi. These same customers also expressed interest in being part of the offering. The latest ARM IPO comes seven years after it was taken private in a $32 billion deal by SoftBank. In 2020, SoftBank signed a $40 billion transaction with Nvidia, which was later abandoned in the face of regulatory hurdles.

With chip demand getting a boost from a surge in AI tech development, some see ARM stock as well-positioned this year. Meanwhile, there is also a case against it as its sales have seemingly slumped due to lower smartphone sales. Whichever side you’re on, it’s worth noting that Thursday’s ARM IPO has woken up the risk-on appetite for some traders.

Hot Penny Stocks To Watch

Is ARM a penny stock? Far from it, with trading levels above $60 at times on Thursday. However, it has caused a stir in higher-risk assets and shined a brighter light on the IPO market overall. With this, some traders are turning their attention to higher volatility stocks in sectors like tech. In this article, we look into a handful to see if there are any recent or upcoming milestones to consider, while sympathy sentiment from ARM stock could also play a role.

- Qudian (NYSE: QD)

- WiSA Technologies Inc. (NASDAQ: WISA)

- Rigetti Computing Inc. (NASDAQ: RGTI)

- GrafTech International (NYSE: EAF)

Qudian (QD)

This year has been a significant one for Qudian regarding share price. The penny stock began trading in January at around 90 cents. Since then, it has climbed as high as $2.54. Recent earnings results put a blip on the chart via a multi-day sell-off that took shares to lows of $1.64. Qudian reported lower earnings per share and sales than the prior year’s second quarter. Its EPS loss was 5 cents compared to 3 cents, and sales were down from $15.74 million to just $1.53 million.

– Cheap Penny Stocks To Buy Now? 3 For Your Watch List

Min Luo, Founder, Chairman, and Chief Executive Officer of Qudian, said, “We continued to execute our business transition and establish our new last-mile delivery business while maintaining a healthy balance sheet by pursuing efficient cash management…Our new last-mile delivery business has made steady progress since we launched it on a trial basis in December 2022 and started to achieve initial shape and scale in the second quarter of 2023 in Australia under the name of “Fast Horse.”

Since the earnings report sell-off, QD stock has managed to rebound strongly. This week, the price has spiked back above the $2 mark.

WiSA Technologies Inc. (WISA)

Tech stocks have gotten some attention thanks to the ARM IPO this week. WiSA Technologies is one of the penny stocks to watch amid this surge. The company provides immersive wireless sound technology for smart devices and home entertainment systems. Unlike Qudian, WiSA reported a more substantial earnings performance for the second quarter in terms of EPS. However, a sales miss left some mixed sentiment in the market.

Earlier this month, a subsidiary of the company, WiSA Association, entered the CEDIA Expos with a new technology based on a wireless multichannel platform designed for soundbars and speakers. While that news didn’t seem to awaken the stock market bulls, the company attended the HC Wainwright Global Investment Conference this week. In connection with the event, WISA stock appears to have made a stronger rebound.

Some specific comments of note from the Q2 update came from CEO Brett Moyer. He explained, “We continue to explore strategic opportunities, and the team just completed two weeks of discussions in Asia focused particularly on ways to leverage the value of our intellectual property…Concurrently, progress is being made toward a definitive agreement to acquire Comhear and expand our IP portfolio…For the first time since May of 2022, we are seeing consumers return to purchasing audio products. Our unaudited consumer audio product sales in July 2023 have essentially matched Q2 2023 sales.”

Rigetti Computing Inc. (RGTI)

Shares of Rigetti Computing stock continued holding their overall 2023 uptrend this week. The penny stock saw a sell-off late last month and one of the catalysts in play is its recent earnings.

Rigetti Computing posted stronger-than-expected results in its recent quarterly earnings report. It exceeded analyst estimates for both revenue and earnings per share. In response, analysts at Benchmark and Needham reconsidered their outlook on RGTI stock. Benchmark upgraded its rating on Rigetti shares to a Buy. Needham initiated coverage with a Buy rating.

Both firms set bullish price targets on the quantum computing company’s stock. Benchmark forecasts $4 per share, and Needham predicts $3 per share. The upgraded recommendations and positive price outlooks highlight analysts’ optimism for Rigetti following the company’s upbeat quarterly performance.

“After having launched the Ankaa-1 system internally, we are excited to have our longtime partner, Riverlane, as the first external partner using the system to work on improving error correction techniques on our new architecture,” said Dr. Subodh Kulkarni, Rigetti Chief Executive Officer. “We also look forward to making Ankaa-2, our most innovative system to date, available to the general public in Q4 of this year.”

– Best Penny Stocks To Buy Now? 10 Under $1 To Watch

The quantum computing company has gained interest as the sector grows in popularity. Rigetti is expecting to launch its Ankaa-1 quantum processor to customers in mid-2023. It was also awarded a US Patent titled “Parametrically activated quantum logic gates,” helping to add to the positive sentiment in the stock market. Right before the end of July, Rigetti also announced a collaboration deal with ADIA Lab to develop quantum machine learning solutions for resolving certain challenges in quantitative finance.

GrafTech International (EAF)

GrafTech recently put in new 52-week lows of $3.32 earlier this week. The tech company was slipping lower after a big blow from its latest earnings. The graphite electrode manufacturing company posted an EPS miss and a sales beat for its second quarter 2023. But the greater-than-expected loss and lower-than-anticipated guidance made its mark on the penny stock.

Shares of EAF stock tumbled from over $5 to these latest lows. The company set expectations for the remainder of the year, saying, “While we continue to move past the Monterrey suspension-driven impact on our sales volume, we expect demand for graphite electrodes in the second half of 2023 will be tempered by ongoing softness in the commercial environment. As a result, we now estimate our sales volume for the full year of 2023 will be in the range of 95 thousand MT to 105 thousand MT, as compared to our previous estimate of 100 thousand MT to 115 thousand MT. Sales volume in the third quarter of 2023 is expected to be broadly in line with sales volume for the second quarter of 2023.”

EAF stock is another on the list of penny stocks to watch as shares rebound another 8% on Thursday.

The post 4 Penny Stocks To Watch As ARM IPO Sparks Momentum In The Stock Market Today appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

nasdaq stocksUncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

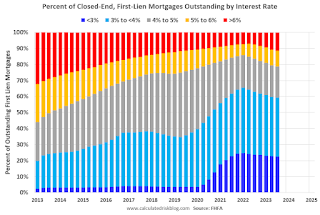

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Uncategorized

‘Bougie Broke’ – The Financial Reality Behind The Facade

‘Bougie Broke’ – The Financial Reality Behind The Facade

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

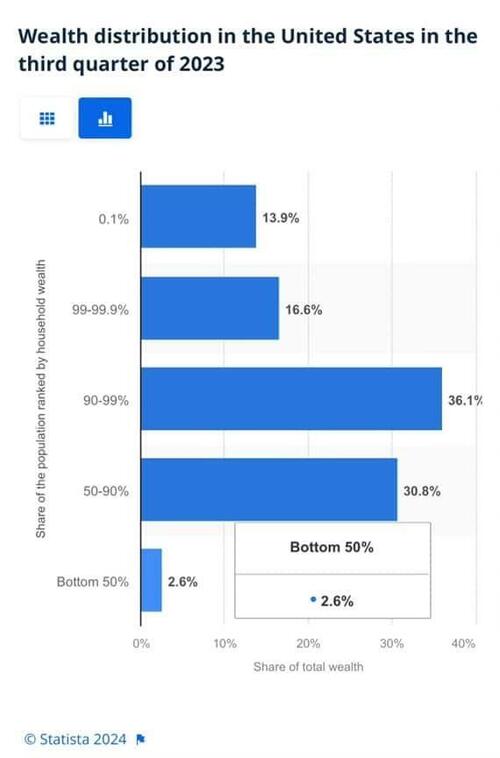

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

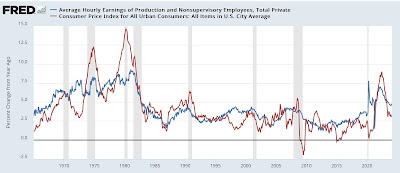

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

Uncategorized

The most potent labor market indicator of all is still strongly positive

– by New Deal democratOn Monday I examined some series from last Friday’s Household survey in the jobs report, highlighting that they more frequently…

- by New Deal democrat

On Monday I examined some series from last Friday’s Household survey in the jobs report, highlighting that they more frequently than not indicated a recession was near or underway. But I concluded by noting that this survey has historically been noisy, and I thought it would be resolved away this time. Specifically, there was strong contrary data from the Establishment survey, backed up by yesterday’s inflation report, to the contrary. Today I’ll examine that, looking at two other series.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges