International

Why starting an innovation journey isn’t sexy

Chugai Pharmaceutical’s UK innovation lead, Martin Ellgood explores the challenges pharma companies face when devising innovation strategies. On

The post Why starting an innovation journey isn’t sexy appeared first on .

Chugai Pharmaceutical’s UK innovation lead, Martin Ellgood explores the challenges pharma companies face when devising innovation strategies.

On a hot July morning, our managing director called me aside for a “quick word”. Five minutes later I emerged smugly with a new job title: UK innovation lead. I got ready to update my LinkedIn profile.

I must confess that in that moment, the image of a golden chalice was floating in my mind. This was going to be a piece of cake. I pictured myself cordoning off part of the office, buying hundreds of beanbags, installing smartboards, and a room full of 3D printers whirring away.

This was my first mistake.

It is incredibly easy to create ‘Innovation Theatre’. I’ve realised that fostering true innovation is hard and less sexy than it first seems. It is an arduous journey – but it is worth it, if you’re up for the challenge.

I work at Chugai: an organisation that perhaps few have heard of outside of Asia. We have a large footprint in Japan, and as part of the Roche Group, we have a great tradition of bringing innovative medicines to market in Europe. In 2017/18 lots of talk began filtering down to Europe about the need to become an organisation that embraced a new mantra: Innovation Beyond Imagination.

For me, Innovation Beyond Imagination is about knowing that if you reach for the stars and try and create something new, you will have the support of the organisation behind you. It is a marvellous cause – but what it does not provide you with is any kind of blueprint to inspire that innovative thinking in the first place.

As it transpires, Chugai is not unique on this journey to find innovative methods. Pharma is queuing up to ‘co-create value’, provide ‘beyond the pill solutions’ and work in partnership with others. These changes represent a paradigm shift in the model of pharmaceutical business. They require businesses to realise that traditional sales is rapidly becoming the stuff of dinosaurs. COVID-19 has only accelerated this change, as quickly as it has closed some of our favourite high street brands.

Starting out, one of my biggest fears was how to keep pace with the Pparma ‘Big Boys’ with so much work to do. But I soon realised that was an excuse. Netflix would never have taken on Blockbuster and Sky with that mentality. In many ways our small size and agility was our strength. All that was needed was a quick reality check for us… what was our innovation baseline?

Starting a journey towards innovation

To find our baseline, we conducted a Value Chain Analysis of Chugai Pharma UK. To be frank, we were “somewhat lacking” in innovation. More positively what we lacked, we made up for in desire.

There were lots of reasons for our score. Our organisation was very traditionally structured. While our European team was incredibly diverse, we were not tapping into that vast pool of innovative energy as much as we could.

Culturally we needed to shift, and this is where (depending on your mood of the day) creating a naturally curious, innovative culture represented an exciting challenge – or a severe migraine. I pored over McKinsey’s “3 Horizons Model of Innovation” to search for an answer. It sets some gloomy timelines for transitioning any organisation into one that is able to realise truly disruptive innovations and solutions.

However, there’s a popular Chinese proverb that says: “The best time to plant a tree was 20 years ago. The second-best time is now.”

Step 1: Find your Firestarters

We needed to untap our creativity, and the first step was to look for it through our people. This is where every organisation will differ in its approach. With hindsight, my energy was best spent on finding early adopters of change. I call them Firestarters. They carry the torch for innovation in the organisation. They are the kind of people that would queue all night to get the next iPhone even though they could saunter in the following week to pick one up without the hassle.

We have chosen to formalise these Firestarters by creating a group of Innovation Ambassadors as it were. These will be our go-to innovators who can inspire, lead, apply tools techniques and help install the philosophy of being curious, take risks, work iteratively and quickly.

Step 2. Choose the right innovation journey for your organisation

The next step is to decide what kind of innovation journey feels right for the organisation. There are typically two kinds of innovation journeys that pharmaceutical businesses follow:

- The first keeps innovation boxed away in an exclusive innovation hub or engine with its own rules and culture. It has the advantage of letting its innovators work independently, in a ‘start-up’ like culture, free of the bureaucracy of the mothership, whilst the rest of the organisation does what they do best.

- The second is to engage the whole organisation on a journey towards innovation kicking or screaming.

I believe we have found a happy medium at Chugai. Our team considers innovation not as a culture, but as a key skill, and is experienced in searching for innovative solutions with our partners. Through training programmes, we have upskilled the team in digital technology and the application of ideation techniques. We have also encouraged our Firestarters to enrol in Agile skills programmes. This has not been easy: the programmes are relatively expensive financially speaking, but perhaps even more so in terms of time and resource.

We have also invested some serious time and effort in getting people to understand their ‘Why?’ and how that consolidates with Chugai’s. We have re-shaped our organisational capability framework to reflect high-performing team dynamics and have taken a brave step to apportion some of the incentive scheme to peer-review how well colleagues live these capabilities.

Step 3. Arm yourself with the tools for change

You can spend a lot of time debating the merits of Miro, over Google Jamboard, or Microsoft Teams. It’s up to any organisation to decide their financial, IT and security processes. What is important though, is getting a tool which can help inspire and gather innovations.

When it comes to measuring the success of your innovation journey, it can be tempting to set the dial to measure quantity over quality for incoming ideas. It is far more rewarding to ensure that teams are ideating around clearly defined challenge areas – tight, but not so tight that they stifle innovation. Less can be more.

Step 4. Choose wisely and join a network

Which brings me to the next point – operate in a lean fashion. Pick the innovation with the highest return and maximise the resource you can offer to it. Spreading resource across several projects because they all ‘look great’ dilutes your efforts and prevents you from creating elongated efforts.

During our innovation journey at Chugai we also had a burning realisation: if we were to apply innovation and move at pace, we needed to grow our innovation network rapidly. Again, this was resource-heavy but fun; seeking out and making contacts in ever increasing circles has been great, and we focused on healthcare with AHSN, NHSx, Knowledge Transfer Network, into start-ups, app designers and finally into Google Health and Amazon Web Services.

Having laid its foundations, Chugai’s journey is now progressing at pace. It is very easy to get wrapped up in the theatre that surrounds innovation and transformation. On our journey I have learned that innovation is at its most valuable not when it is some sexy, shiny thing, but when you are taking a cold, hard look under the bonnet and taking your people on a journey. Because, at its heart, if we are to become truly innovative, it is our people that will get us there.

About the author

Martin Ellgood is the head of operations and UK innovation at Chugai Pharma UK. He oversees investment in Key Account Management programmes to drive a solution focus throughout the organisation. As a member of the Executive Committee and the UK innovation lead, he has devised and delivered innovation strategies across the business.

The post Why starting an innovation journey isn’t sexy appeared first on .

japan european europe uk covid-19International

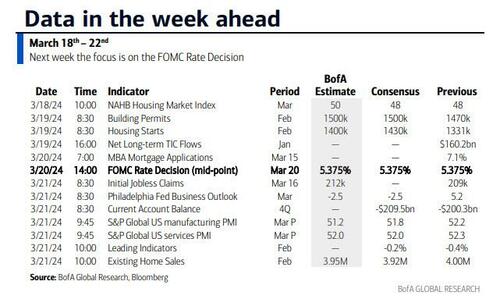

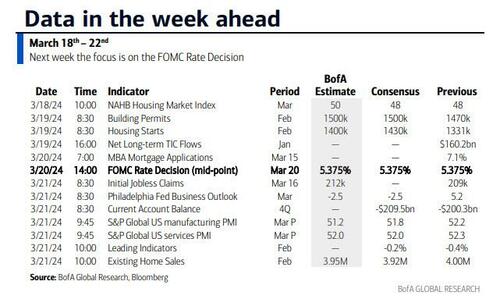

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

International

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

International

Free school meals for all may reduce childhood obesity, while easing financial and logistical burdens for families and schools

Since nutrition standards were strengthened in 2010, eating at school provides many students better diet quality compared with other major U.S. food s…

School meals are critical to child health. Research has shown that school meals can be more nutritious than meals from other sources, such as meals brought from home.

A recent study that one of us conducted found the quality of school meals has steadily improved, especially since the 2010 Healthy, Hunger-Free Kids Act strengthened nutrition standards for school meals. In fact, by 2017, another study found that school meals provided the best diet quality of any major U.S. food source.

Many American families became familiar with universal free school meals during the COVID-19 pandemic. To ease the financial and logistical burdens of the pandemic on families and schools, the U.S. Department of Agriculture issued waivers that allowed schools nationwide to provide free breakfast and lunch to all students. However, these waivers expired by the 2022-23 school year.

Since that time, there has been a substantial increase in schools participating in the Community Eligibility Provision, a federal policy that allows schools in high poverty areas to provide free breakfast and lunch to all attending students. The policy became available as an option for low-income schools nationwide in 2014 and was part of the Healthy, Hunger-Free Kids Act. By the 2022-23 school year, over 40,000 schools had adopted the Community Eligibility Provision, an increase of more than 20% over the prior year.

We are public health researchers who study the health effects of nutrition-related policies, particularly those that alleviate poverty. Our newly published research found that the Community Eligibility Provision was associated with a net reduction in the prevalence of childhood obesity.

Improving the health of American children

President Harry Truman established the National School Lunch Program in 1946, with the stated goal of protecting the health and well-being of American children. The program established permanent federal funding for school lunches, and participating schools were required to provide free or reduced-price lunches to children from qualifying households. Eligibility is determined by income based on federal poverty levels, both of which are revised annually.

In 1966, the Child Nutrition Act piloted the School Breakfast Program, which provides free, reduced-price and full-price breakfasts to students. This program was later made permanent through an amendment in 1975.

The Community Eligibility Provision was piloted in several states beginning in 2011 and became an option for eligible schools nationwide beginning in 2014. It operates through the national school lunch and school breakfast programs and expands on these programs.

The policy allows all students in a school to receive free breakfast and lunch, rather than determine eligibility by individual households. Entire schools or school districts are eligible for free lunches if at least 40% of their students are directly certified to receive free meals, meaning their household participated in a means-based safety net program, such as the Supplemental Nutrition Assistance Program, or the child is identified as runaway, homeless, in foster care or enrolled in Head Start. Some states also use Medicaid for direct certification.

The Community Eligibility Provision increases school meal participation by reducing the stigma associated with receiving free meals, eliminating the need to complete and process applications and extending access to students in households with incomes above the eligibility threshold for free meals. As of 2023, the eligibility threshold for free meals is 130% of the federal poverty level, which amounts to US$39,000 for a family of four.

Universal free meals and obesity

We analyzed whether providing universal free meals at school through the Community Eligibility Provision was associated with lower childhood obesity before the COVID-19 pandemic.

To do this, we measured changes in obesity prevalence from 2013 to 2019 among 3,531 low-income California schools. We used over 3.5 million body mass index measurements of students in fifth, seventh and ninth grade that were taken annually and aggregated at the school level. To ensure rigorous results, we accounted for differences between schools that adopted the policy and eligible schools that did not. We also followed the same schools over time, comparing obesity prevalence before and after the policy.

We found that schools participating in the Community Eligibility Provision had a 2.4% relative reduction in obesity prevalence compared with eligible schools that did not participate in the provision. Although our findings are modest, even small improvements in obesity levels are notable because effective strategies to reduce obesity at a population level remain elusive. Additionally, because obesity disproportionately affects racially and ethnically marginalized and low-income children, this policy could contribute to reducing health disparities.

The Community Eligibility Provision likely reduces obesity prevalence by substituting up to half of a child’s weekly diet with healthier options and simultaneously freeing up more disposable income for low-to-middle-income families. Families receiving free breakfast and lunch save approximately $4.70 per day per child, or $850 per year. For low-income families, particularly those with multiple school-age children, this could result in meaningful savings that families can use for other health-promoting goods or services.

Expanding access to school meals

Childhood obesity has been increasing over the past several decades. Obesity often continues into adulthood and is linked to a range of chronic health conditions and premature death.

Growing research is showing the benefits of universal free school meals for the health and well-being of children. Along with our study of California schools, other researchers have found an association between universal free school meals and reduced obesity in Chile, South Korea and England, as well as among New York City schools and school districts in New York state.

Studies have also linked the Community Eligibility Provision to improvements in academic performance and reductions in suspensions.

While our research observed a reduction in the prevalence of obesity among schools participating in the Community Eligibility Provision relative to schools that did not, obesity increased over time in both groups, with a greater increase among nonparticipating schools.

Universal free meals policies may slow the rise in childhood obesity rates, but they alone will not be sufficient to reverse these trends. Alongside universal free meals, identifying other population-level strategies to reduce obesity among children is necessary to address this public health issue.

As of 2023, several states have implemented their own universal free school meals policies. States such as California, Maine, Colorado, Minnesota and New Mexico have pledged to cover the difference between school meal expenditures and federal reimbursements. As more states adopt their own universal free meals policies, understanding their effects on child health and well-being, as well as barriers and supports to successfully implementing these programs, will be critical.

Jessica Jones-Smith receives funding from the National Institutes of Health.

Anna Localio does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

south korea mexico pandemic covid-19-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex