What the DOGE Is Going on? TikTok Creates New Crypto Trading Paradigm

What the DOGE Is Going on? TikTok Creates New Crypto Trading Paradigm

The short-lived outburst of trading activity could hint at a larger trend in both cryptocurrency and stock trading.

Less than two weeks after the price and trade volume of Dogecoin (DOGE) exploded following a get-rich-quick TikTok challenge that went viral, the meme coin has been making headlines again. This time, Elon Musk’s humorous tweet briefly reversed the downward trend that the asset had entered since the TikTok boost began to wear off.

While the latest development might bolster the impression that Dogecoin only thrives on fleeting, whimsical cycles of the internet’s attention, it should not obscure the potentially bigger lessons of its earlier user-powered surge.

Meme factory meets meme coin

TikTok, the video-sharing app hailed as the fastest-growing social networking service in history, provides a perfect environment for creating and spreading audiovisual memes. TikTok challenges represent a particularly viral form of communication where information travels at lightning speed, potentially multiplying user engagement by orders of magnitude in a matter of days.

Video app user jamezg97 began posting videos calling fellow TikTokers to invest in Dogecoin sometime in late June, but it was the user’s July 2 post that appears to have triggered the subsequent buying surge. As of press time, the video has recorded more than 1.1 million views.

From the start of the steep upward movement around July 6 to the July 9 peak, the coin’s price has more than doubled, from $0.0023 to $0.0049, while the daily trade volume jumped tenfold from around $110 million to $1.1 billion, according to CoinMarketCap data. Google trends data showed a corresponding surge in Dogecoin-related search terms around the same time. From there, the short-lived effect of the TikTok campaign began to wane.

As a tongue-in-cheek currency inspired by a meme and designed back in 2013 to appeal to a broader audience less tech-savvy than the hardcore Bitcoin faithful, Dogecoin was well-suited to resonate with the entertainment-seeking TikTok base. Another selling point has been the minuscule price of a single coin, which has likely obscured the fact that driving it to $1 as proposed would require a percentage increase of tens of thousands.

Crypto ecosystem’s response

Regardless of the motivations that have triggered the influx of new users, it didn’t take long for some market participants to roll out the infrastructure necessary to accommodate them. On July 9, cryptocurrency exchange platform OKEx announced the launch of leveraged spot trading, perpetual swap contracts and saving features in Dogecoin, while Binance opened perpetual future contracts.

OKEx CEO Jay Hao explained the decision to expand Dogecoin offerings to the effect that, despite the reputation of a meme asset, the currency is not a joke, as it is fully functional as a method of payments and has a robust community. Another major trading platform to promptly list Dogecoin was Bitfinex, whose chief technology officer, Paolo Ardoino, referenced the style of Doge’s internal dialogue in a tweet: “Such wow! MegaDOGE on @bitfinex ! Release the gud boi!!!!!!!!!” Ardoino sounded more reserved when talking to Cointelegraph, saying that the decision to list the asset was made in response to consumer demand:

“We always listen to our user base and seek to offer the tokens that they want to trade. I can’t comment on the sentiment of one token or another. As an exchange, we’re token agnostic. We simply provide a platform on which people can trade. […] As an exchange, Bitfinex supports financial inclusion, so we see this as a largely positive trend but investors always need to carefully consider the risks.”

The stock rush of 2020

One internet influencers to comment on the Doge rush was Dave Portnoy, the founder of the sports and pop culture blog Barstool Sports. Portnoy took to stock trading during the sports dry season due to the pandemic and achieved impressive clout among retail traders with his entertaining if boisterous livestreamed sessions. In a recent video, he took a moment to describe the Dogecoin rally as a “pump and dump.”

Curiously, Portnoy’s own concept of how equity markets work could be more aligned with the forces behind the coin’s brief surge than his casual “bubbly rosé” dismissal would suggest. A huge part of his entertainment appeal comes from his lighthearted approach to trading. From openly admitting that he has “zero clue” what he is doing to repeatedly uttering that “stocks only go up,” Portnoy embodies the idea that equity valuations have little to do with any tangible economic reality, rendering day trading little different from sports betting.

While Portnoy does not explicitly promote the idea that retail investors’ mass behavior can drive asset valuations, there is evidence that it, in fact, does. Some Wall Street observers credit the influx of small traders for soaring stock prices despite the struggling economy. The boom appears to be fueled by sports bettors looking for action; people bored at home who view their stimulus checks as free money to play around with; and it is greatly assisted by gamified trading apps like Robinhood.

A community that formed around the Reddit forum r/WallStreetBets has gained much notoriety over the past few months. There, participants wage coordinated options trading campaigns in an attempt to drive target assets up — an aggressive strategy that looks like a distributed pump-and-dump. The underlying idea is that there are structural vulnerabilities in the stock market that can be exploited through collective action.

Crypto trading, zoomer style

If even traditional equity markets have become the arena for small investors’ betting on stocks and social media-powered, mass-scale manipulation, it’s hardly shocking for the cryptocurrency space — traditionally user-driven and responsive to popular sentiment — to generate an event such as the Dogecoin TikTok pump. Crypto market analyst Mati Greenspan commented to Cointelegraph:

“It’s not just DogeCoin either. Valuations of Tesla, Hertz, and Nikola are prime examples of how social media sentiment can drive prices. Figuratively speaking. In the cryptoasset space, this sentiment plays an even greater role as a large part of token value is derived from the network effect.”

It is hard to tell whether it’s demography or ideology that is the primary active ingredient contributing to the increasingly prevalent perception of trading — both in traditional stocks and digital assets — as a brand of cybersport. It is possible that Generation Zers beginning to pour into the ranks of retail investors are bringing bits of their playful online-first culture to the financial domain.

It is also possible that the glaring detachment of financial markets from the real economy, combined with the pandemic-era corporate bailouts and rampant money printing, is finally driving home the notion that there is something less “fundamental” about assets’ market value than there is arbitrary and contingent.

Bitfinex’s Ardoino opined that in the case of crypto markets, maturation of the asset class could eventually lead to diminished reliance on the social media mood swings: “The digital asset space will mature over time. As the industry matures, it may be the case that the sentiment that some analysts see driving markets will give way to fundamental analysis.” However, as the retail trading boom engulfs even more “mature” markets, it is reasonable to suspect that the new brand of social-driven trading could be here to stay, both in equity and cryptocurrency realms.

As opposed to singular events like extravagant billionaires’ humorous endorsements, mass support from scores of online users can be mustered systematically. Compared to bulkier traditional asset classes with their inertia-prone trading infrastructures, the cryptocurrency space is more flexible when it comes to capturing short-term bursts of online attention, as the prompt response to Dogecoin surge illustrates.

Investing in creative branding, online community building and usable interfaces could be the way for the cryptocurrency industry to capitalize on the demise of dead seriousness in retail trading and lure in both adrenaline- and fun-seekers who are becoming convinced that assets’ worth is a function of what the internet thinks it is.

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

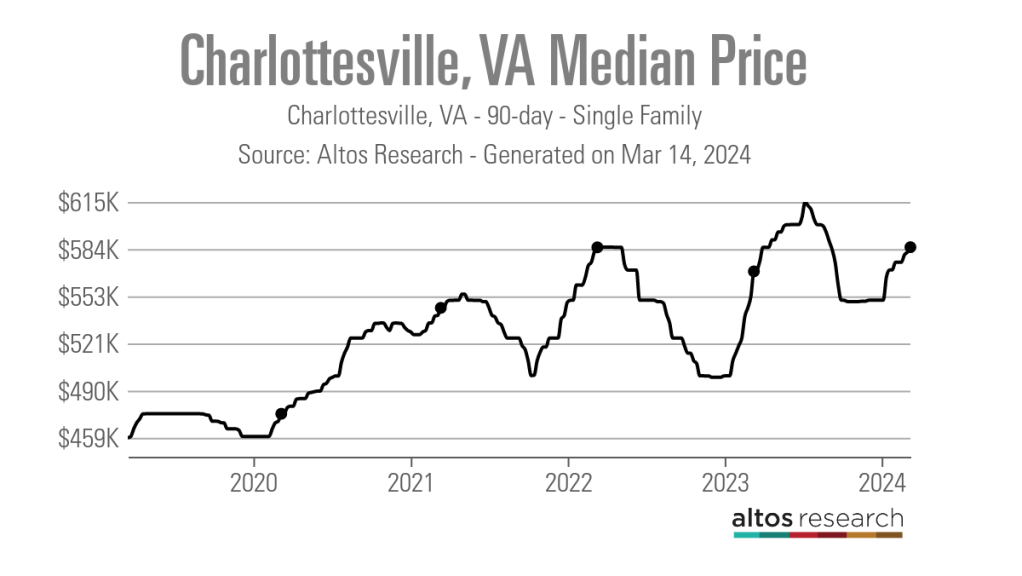

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A