Uncategorized

What is the CryptoNight mining algorithm, and how does it work?

Blockchain technology relies on mining algorithms, such as CryptoNight, to regulate cryptocurrency projects. Find out here what CryptoNight is and how…

Blockchain technology relies on mining algorithms, such as CryptoNight, to regulate cryptocurrency projects. Find out here what CryptoNight is and how it works.

Understanding mining algorithms

Mining algorithms are the backbone of blockchain-based networks like Bitcoin and other protocols.

In blockchain technology, mining algorithms are necessary for transaction verification and network security. A mining algorithm instructs miners’ computers to follow a set of rules to generate a valid block.

Proof-of-work (PoW) is the well-known consensus algorithm used by Bitcoin and other cryptocurrencies. In PoW, miners compete using computational power to find a specific hash value that will give them the new block. Application-specific integrated circuits (ASICs) are the specialized hardware necessary for miners to be competitive in such an energy-intensive process, but before ASICs, lower-scale CPU and GPU mining equipment was utilized by users at home.

ASIC mining primarily uses the SHA-256 hash function, which was designed by the United States National Security Agency (NSA) and published in 2001 as a data integrity standard. Bitcoin uses SHA-256 to ensure maximum security and integrity, as the slightest change to the algorithm would alter the mining hash function output.

To keep up with industrial-scale mining operations, many miners join mining pools to combine their computational power, thereby increasing the chances of successfully mining a block. Block rewards are shared proportionally based on each member’s contribution.

Choosing the mining algorithm is a crucial decision for a cryptocurrency project, as it determines the rules and requirements necessary to create and secure the blockchain network, other than how the participants are rewarded with newly minted coins. Examples of other popular mining algorithms include Ethash, used by the Ethereum blockchain, and CryptoNight, used by the Monero Network.

What is the CryptoNight algorithm?

CryptoNight is one of the fastest mining algorithms and part of the CryptoNote consensus protocol.

CryptoNight is a PoW mining algorithm for CPU and GPU mining, designed to be ASIC-resistant to prevent the centralization of mining power. It hopes to help users mine more efficiently using a combination of hashing functions, including the CryptoNight and the Keccak hash functions.

Its cryptographic hash function works around the Advanced Encryption Standard (AES), a military-level algorithm for extreme security, making CryptoNight a mining algorithm highly focused on security. Since Monero started using it as the hash algorithm for its blockchain consensus, CryptoNight’s reputation as a security algorithm has strengthened across the crypto world.

The CryptoNight algorithm’s creation is fascinating and recalls the origin of Bitcoin. Its creator — who goes by the fictitious name of Nicolas van Saberhagen — disappeared, just like the famous Satoshi Nakamoto.

Given the similarity, many believe that the two developers are the same person, with the mystery further enhanced by the spooky release date of CryptoNote, Dec. 12, 2012 (12/12/2012). CryptoNote was a security protocol and a privacy tool that promoted confidential transactions, non-linkable transactions and ring signatures.

How does the CryptoNight mining algorithm work?

CryptoNight uses the CryptoNote consensus protocol to strengthen privacy so that nobody can tell which participant in the transaction is paying and who is receiving the money.

CryptoNight is GPU-mining friendly, but its characteristics make it ideal for CPU mining. With its set of 64-bit fast multipliers for maximum speed, the CPU architecture is very efficient; moreover, the heavy use of CPU caches guarantees the best performance.

Its working process involves three main steps:

Creating a “scratchpad”

A large memory with intermediate values is stored during a hashing function. The first input data is hashed with the Keccak-1600 hashing function, resulting in 200 bytes of randomly generated data.

Encryption transformation

It then takes the first 31 bytes of this Keccak-1600 hash and transforms them into the encryption key for an AES-256 algorithm, the highest value within the AES family.

Final hashing

CryptoNight takes the entire data set created by the AES-256 and Keccak functions in the previous step and passes it through the rest of the hash functions. Ultimately, a final hash results from the CryptoNight proof-of-work. This hash has a 256-bit extension or a total of 64 characters.

Why is CryptoNight important?

CryptoNight was designed to give CPUs and GPUs an equal opportunity to mine blocks and discourage ASIC miners’ use.

CryptoNight is important for three crucial reasons: It provides stronger privacy with untraceable transactions, its ASIC resistance feature, and scalability. Most cryptocurrencies, including Bitcoin (BTC), are all but private, as someone’s transactions and balance can be easily traced on the open-source blockchain through a public address.

On the other hand, CryptoNight was designed to satisfy more privacy-concerned users who want to execute private blockchain trades. Its creators integrated two crucial privacy tools into the algorithm to achieve maximum security and anonymity: ring signatures and stealth addresses, both developed by the Monero team.

Mitigating growing concerns around cryptocurrency centralization due to ASIC mining rigs was one crucial rationale behind the development of CryptoNight. The project’s developers focused on challenging ASIC dominance and advanced a system where GPUs and CPUs could retain their competitive edge in mining.

Scalability and high efficiency are also at the core of CryptoNight, which has its computation increased exponentially, guaranteeing greater scaling through faster transactions.

Which cryptocurrencies use the CryptoNight mining algorithm?

Bytecoin was the first cryptocurrency to apply the CryptoNote protocol to its blockchain, but its application on Monero helped the project gain more reputation and notoriety.

A number of cryptocurrencies have integrated the CryptoNight algorithm, with the first-ever example being CryptoNoteCoin, a clear reference to the CryptoNight project.

Bytecoin

Though initially committed to resisting ASIC dominance, the first CryptoNight coin that supported the project’s development announced in 2018 that it would integrate ASIC mining while keeping the algorithm to prevent security and anonymity issues.

Monero

Despite Monero no longer using CryptoNight, it was one of its strongest supporters for its stance against ASIC power. Monero inherited CryptoNight as its proof-of-work in 2014, and since then, it has slightly evolved the algorithm, creating CryptoNight-R to intentionally break compatibility with the existing ASICs.

However, an efficient ASIC-compatible CryptoNight was developed in 2017 by Bitmain, and by 2018, ASICs had rejoined the Monero network. In 2019, Monero changed its mining algorithm to RandomX, which focused on CPU mining.

Electroneum (ETN)

Electroneum utilizes the CryptoNight mining algorithm, with a notable innovation in its mobile version, allowing users to mine the cryptocurrency not only through the conventional method but also by utilizing their smartphones via a mobile miner.

Other lesser-known projects that implement the CryptoNight algorithm include Boolberry, Dashcoin, DigitalNote, DarkNetCoin and Pebblecoin. However, these projects have been exposed to malicious attacks in 2017, raising concerns around the security of their networks and the reliability of the CryptoNight algorithm.

Different variants were created for the CryptoNight algorithm, and CryptoNight Heavy is one version of the hashing algorithm. It is implemented in various cryptocurrency projects, including Ryo Currency, Sumokoin and Loki.

However, since CryptoNight Heavy relies on a trustless peer-to-peer network, it may lead to serious vulnerabilities. Since nodes must check every new block’s PoW and spend a significant amount of time evaluating every hash, they may become more vulnerable to distributed denial-of-service (DDoS) attacks, coordinated botnet-targeted activities that overwhelm a network with fake traffic.

What’s ahead for CryptoNight algorithm?

Since its inception in 2012, the CryptoNight algorithm has undergone significant changes, upgrades and slight modifications to accommodate the different cryptocurrency projects until the ultimate version created by Monero, CryptoNight-R, was introduced.

Is CryptoNight still a valid mining algorithm, or has it failed its mission to become an egalitarian tool? All the different versions had one common goal: ASIC resistance and preventing its further dominance in crypto mining.

Many believe this did not happen, and the project failed to deliver on its original stance. The Monero team stated that the failure was due to security reasons. Since the CryptoNight hash is rather expensive and time consuming to verify, it may represent a DoS risk to nodes as previously highlighted for some of CryptoNight-based cryptocurrencies.

Others think it did its best to prevent further expansion of ASIC corporate power. It was born as an egalitarian type of algorithm that could guarantee equal rights for people to mine, not only to the corporate world.

It still works as a mining tool open to everyone, even though the ASIC resistance capability is no longer feasible since the ASICs were able to adapt to successfully mine for this algorithm. Nevertheless, it can still be a good starting point for developing future cryptocurrency projects, especially for users who value privacy and fair mining.

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

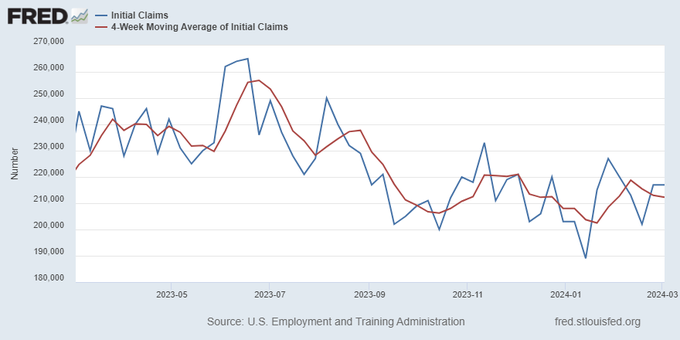

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemployment-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex