Week Ahead – Let the battles commence

Week Ahead – Let the battles commence

Focus back on fiscal response

It appears we’re moving seemlessly from one major risk to another at the moment in the markets. The election is still technically live, Covid is spreading like wild fire and battles are commencing in Washington and Brussels as households and businesses line up for support to help them navigate through another brutal wave of Covid. A fitting end to a ridiculous 2020.

Fed minutes eyed for December stimulus hints

Brexit talks go virtual at critical point

Oil pushing highs on vaccine results

US

The focus in the US is all about the coronavirus and the release of the FOMC minutes. The White House coronavirus task force is back and that is a sign the Trump administration realizes the current virus spread is expected to continue to rise. Many states are seeing record new cases and their ICU’s are at risk of running out of capacity.

The Fed’s minutes could provide further indications that policy-makers are ready to increase their asset purchases and possibly target purchases at the onger-end of the curve. The virus spread has worsened and given the growing long-term risks to the labor market, investors will expect the December meeting to be a live one.

US Politics

Many states are expected to certify their election results and Republican pressure should build for President Trump to concede the election. President Trump’s refusal to concede the election is creating problems for Biden’s team to hit the ground running when they take over. The peaceful transfer of power was supposed to provide the Biden administration access to federal funding, office space, and all types of stockpile and vaccine information that will allow them to outline their COVID strategy.

EU

The EU 2021-27 budget and pandemic relief talks earlier this year were quite straightforward. Far too straightforward, in fact, if you’ve been following the EU for years. Nothing ever happens that easily. Yes, there was a battle over whether the funds should be given as grants or loans but in the grand scheme of things, that’s nothing and was easily resolved. Nothing is ever that easy when it comes to the EU and now we’re seeing what we’ve become accustomed to. A dispute over the “rule of law” condition for accessing the funds, a stipulation clearly targeted at Hungary and Poland, forcing vetoes from, obviously, Hungary and Poland. Let the battle commence. Although, like with Brexit, time is short.

Brexit

The only thing that’s changed since last week is that one official has been struck down with Covid forcing the negotiations to go virtual at a critical stage. Talks were perhaps heading for the “face-to-face” stage between the two leaders – Boris Johnson and Ursula Von Der Leyen – but unfortunately the British Prime Minister is self-isolating after coming into contact with someone that tested positive so even that may have to be conducted over video link. What a shambles. It should not change the outcome, rather bring a fitting end to a shambolic four years.

UK

The UK remains in lockdown and R has reportedly fallen to between 1 and 1.1, meaning some progress has been made these last two weeks. Whether that will be enough to significantly ease restrictions ahead of the holiday period is yet to be seen. Cases are steadying although fatalities continue to rise. The government and central bank have already undertaken major stimulus measures which means Brexit remains the only other major uncertainty. The pound has been a little sensitive to developments and while we may see a relief rally once a deal is announced, the major risk remains to the downside with an agreement now expected. Rishi Sunak’s spending review next week will be another closely followed event but I don’t expect an enormous amount of currently reaction to it.

Turkey

The lira is more than 12% off its lows, after paring some gains, after the CBRT more than lived up to expectations on Thursday, raising rates by 4.5% and setting itself on a course for a “permanent” fall in inflation. The move was in stark contrast to previous efforts to tighten via the back door and the currency is reaping the rewards. Under the past Governor, the central bank appeared to be crumbling under political pressure but this change suggests a return to a more sustainable approach. Whether that continues is another thing, given President Erdogan’s well-known views on the link between inflation and interest rates.

China

China’s data calendar is quiet with just Industrial Profits on Friday which are expected to improve to minus 0.60% for October. The first week of December’s data releases will give more insight into whether China’s economic expansion is slowing due to slowdowns internationally.

China’s currency and stock markets should continue to remain firm with the Federal Reserve expected to ease in December and US stimulus talks resuming. Investors will be watching for signs of increased stress in the financial system after a number of corporate bond defaults this week. I do not believe though, that it is symptomatic of a deeper problem at this stage.

Hong Kong

No significant data this week. Hong Kong markets may be weighed down by a fresh outbreak of Covid-19 in multiple locations across the territory. That also jeopardises the new Singapore/Hong Kong travel bubble and may see leisure sector equities get marked down along with consumer discretionary.

Markets are ignoring the ongoing erosion of Hong Kong’s democracy.

India

India is in the grip of stagflation as it wrestles with the Covid-19 pandemic/recession. INR gained little benefit from Dollar weakness and remains the regional underperformer. Credit quality concerns and banks persist.The newly installed monetary policy team at the RBI may be seeing light at the end of the tunnel though, with WPI data easing. That may give the RBI room to cut rates in the coming quarter.

Covid-19 continues to torpedo the domestic economy and India is best avoided altogether at the moment from an investor standpoint.

New Zealand

The New Zealand Dollar continues to outperform after the RBNZ left rates unchanged. With a weaker US Dollar in prospect, the Kiwi could move through 0.7000 this week.

Q3 Retail Sales is old news and will be ignored by markets.

Australia

Australia Retail Sales and Employment massively outperformed this week underpinning both the currency and the stock market. The resilience of the Australian data is showing zero effects from China’s export embargo, and suggests that the domestic economy is rapidly recovering to pre-Covid-19 levels. Resource prices continue to be high, strengthening the export sector.

PMI’s on Monday should reinforce the recovery outlook in an otherwise quiet week. Australian stock markets have been content to follow Wall Street slavishly and with US fiscal talks restarting, should remain supported on expectations of a positive outcome.

Australia remains vulnerable to further export boycotts from China, especially if the previously sacrosanct iron ore sector is targeted.

Japan

A quiet week for data releases before the start of December, with Tokyo CPI on Friday expected to show Japan is grappling with deepening deflation. That should be positive for the Yen which could test 103.00 next week.

Japan equities continue to outperform as part of the vaccine rotation recovery play.

Covid-19 cases are spiralling in Japan, but the government is refusing to initiate lockdowns. That could erode and already deeply recessive domestic market, and could see Yen repatriation increase. The government keeps talking (a Japan speciality) about extra budgets and fiscal stimulus. We are yet to see any signs of concrete policy though.

Oil

Oil prices are once again pushing against major resistance but, as yet, failing to gather any momentum at the right time. WTI is sitting around $42 and Brent $44.50, right at the upper end of the range but once again they’ve failed to hold on slightly above here and pulled back. A breakout still looks more likely than not but it’s not giving way easily.

The vaccine news has been a gamechanger for the outlook. No longer is OPEC+ the only major upside risk and, in fact, the group may decide that further modifications are no longer warranted if prices manage to break to the upside ahead of the meeting on 17 December. If WTI could even break $45 before then, it may be hard to get the whole group on board with any significant tweaks unless they see an opportunity to push prices above $50 and provide a buffer.

Gold

Gold continues to languish around its lows, piling pressure on the $1,850-1,860 support region that’s been so reliable over the last few months. It’s looking very vulnerable all of a sudden, with positive vaccine news having become a major downside risk for the yellow metal.

This is despite yields having given up the vaccine gains to trade back around pre-election levels and the dollar slumping around its lows as a result. It should be an interesting few weeks for gold which for much of this year has been driven by the greenback and aligned itself with positive risk appetite. Both of those relationships look fractured suddenly and instead it exists in a perennial state of fear of the vaccine.

Should $1,850 fall, we could see a rapid move back towards $1,800, with any stops below current support likely accelerating any downside initially.

Bitcoin

New highs in bitcoin looks basically inevitable at this point. In fact, I’m a little surprised they haven’t hit them already. It’s been two days since it came close to $1,850. Dragging its feet a little, by its own standards. Given how the last month has gone and the hype that’s back with a bang, you can only imagine where it will go next if new highs are made. $25,000? Maybe $30,000 by year-end? The euphoria is back and while the ride to the top may be fun, the bit that follows has historically shown to be quite the opposite. No doubt it will be an interest end to the year for the crypto community.

Key Economic Events

Saturday, November 21st

– The Group of 20 Leaders’ 2-day Summit begins

– Brexit trade deal negotiations in focus

Sunday, November 22nd

– Hong Kong and Singapore test travel bubble that could allow reciprocal quarantine-free travel for anyone from either side.

Monday, November 23rd

– This week the U.K. and French governments reveal their coronavirus strategies

– San Francisco Fed President Daly speaks on pandemic impact and the future of cities. Chicago Fed President Evans takes part in a moderated Q&A, hosted by the Iowa Bankers Association.

– ECB Executive Board member Schnabel speaks at a money market conference.

– Bank of England chief economist Haldane participates in Charity Finance Week.

– Bank of Canada Deputy Governor Gravelle gives a speech

– The EU’s monthly MARS bulletin on weather and crop conditions is published.

Economic Data

U.S. Nov Markit Manufacturing: 52.5e v 53.4 prior

New Zealand retail sales ex inflation

Australia Markit PMIs

Singapore CPI, GDP

Taiwan unemployment, industrial production

Thailand trade

PMIs: Euro-area, U.K.

Tuesday, November 24th

– St. Louis Fed President Bullard takes part in a Bank of Finland monetary policy webinar hosted by Governor Rehn. ECB Executive Board member Isabel Schnabel also speaks.

– ECB Chief Economist Lane speaks at an IMF event.

– BOE policy maker Haskel speaks on a panel

Economic Data

U.S. FHFA house price index, Conf. Board consumer confidence

Mexico unemployment

Germany GDP components, Ifo business climate Nov 90.9e v 92.7 prior

France manufacturing confidence

Turkey capacity utilization

Hong Kong trade

Macau visitor arrivals

Wednesday, November 25th

– Hong Kong Chief Executive Carrie Lam delivers a long-awaited policy address that she postponed last month to consult China

– U.K. Chancellor of the Exchequer Sunak reveals the government’s spending plans for the next year.

– Austria Central Bank Governor Holzmann presents Austria’s financial stability report.

– The ECB publishes its Financial Stability Review.

– The Federal Reserve releases the minutes from its last meeting. Investors will look to see if they provide any hints to increasing their asset purchases or if they are closer to adopting yield curve control.

– EIA crude oil inventory report

Economic Data

US wholesale inventories, GDP, initial jobless claims, durable goods, personal spending/income, University of Michigan sentiment, FOMC meeting minutes, new home sales

Mexico retail sales, Central Bank inflation report

Brazil current account balance

South Korea business survey

Japan PPI services

Australia construction work done

CPI: Malaysia, South Africa

Thursday, November 26th

– The US stock and bond markets are closed in observance of the Thanksgiving holiday.

– ECB Chief Economist Philip Lane speaks at Trinity College Dublin.

– Bank of Korea Governor Lee Ju-yeol post-rate decision press conference

– The ECB publishes the account of its October monetary policy meeting.

Economic Data

Mexico GDP, Banxico meeting minutes

New Zealand trade

Australia private capital expenditure

Sweden rate decision: Expected to keep repo rate and asset purchases unchanged

Japan machine tool orders, leading index

Singapore industrial production

South Korea rate decision: Expected to keep rates steady at record low level

Friday, November 27th

– SIFMA recommends an early market close at 2 p.m. EST for U.S. dollar-denominated fixed-income securities.

– In the US, Black Friday kickoffs the holiday buying season for many Americans.

– ECB Executive Board member Panetta speaks at a Bundesbank conference.

– ECB Executive Board member Schnabel speaks at the Destatis conference.

– BOE policy maker Silvana Tenreyro speaks at a Bank of France event.

Economic Data

Colombia rate decision: Expected to keep Overnight Lending Rate unchanged at 1.75%

Japan Tokyo CPI

China industrial profits

GDP: Taiwan, India, France, Finland, Sweden

Euro-area economic confidence

France CPI

Italy consumer, manufacturing confidence

Retail sales: Spain, Sweden

Sovereign Rating Updates

– Ireland (S&P),

– Belgium (Moody’s),

– Switzerland (Moody’s)

International

“Extreme Events”: US Cancer Deaths Spiked In 2021 And 2022 In “Large Excess Over Trend”

"Extreme Events": US Cancer Deaths Spiked In 2021 And 2022 In "Large Excess Over Trend"

Cancer deaths in the United States spiked in 2021…

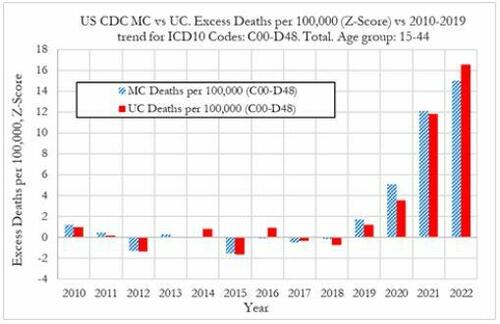

Cancer deaths in the United States spiked in 2021 and 2022 among 15-44 year-olds "in large excess over trend," marking jumps of 5.6% and 7.9% respectively vs. a rise of 1.7% in 2020, according to a new preprint study from deep-dive research firm, Phinance Technologies.

Extreme Events

The report, which relies on data from the CDC, paints a troubling picture.

"We show a rise in excess mortality from neoplasms reported as underlying cause of death, which started in 2020 (1.7%) and accelerated substantially in 2021 (5.6%) and 2022 (7.9%). The increase in excess mortality in both 2021 (Z-score of 11.8) and 2022 (Z-score of 16.5) are highly statistically significant (extreme events)," according to the authors.

That said, co-author, David Wiseman, PhD (who has 86 publications to his name), leaves the cause an open question - suggesting it could either be a "novel phenomenon," Covid-19, or the Covid-19 vaccine.

Cancer deaths in US in 2021 & 2022 in large excess over trend for 15-44 year-olds as extreme events. A novel phenomenon? C19? lockdowns? C19 vaccines? Honored to participate in this work. #CDC where are you? @DowdEdwardhttps://t.co/iUV5oQiWCW pic.twitter.com/uytzaIvvor

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 12, 2024

"The results indicate that from 2021 a novel phenomenon leading to increased neoplasm deaths appears to be present in individuals aged 15 to 44 in the US," reads the report.

The authors suggest that the cause may be the result of "an unexpected rise in the incidence of rapidly growing fatal cancers," and/or "a reduction in survival in existing cancer cases."

They also address the possibility that "access to utilization of cancer screening and treatment" may be a factor - the notion that pandemic-era lockdowns resulted in fewer visits to the doctor. Also noted is that "Cancers tend to be slowly-developing diseases with remarkably stable death rates and only small variations over time," which makes "any temporal association between a possible explanatory factor (such as COVID-19, the novel COVID-19 vaccines, or other factor(s)) difficult to establish."

That said, a ZeroHedge review of the CDC data reveals that it does not provide information on duration of illness prior to death - so while it's not mentioned in the preprint, it can't rule out so-called 'turbo cancers' - reportedly rapidly developing cancers, the existence of which has been largely anecdotal (and widely refuted by the usual suspects).

While the Phinance report is extremely careful not to draw conclusions, researcher "Ethical Skeptic" kicked the barn door open in a Thursday post on X - showing a strong correlation between "cancer incidence & mortality" coinciding with the rollout of the Covid mRNA vaccine.

The argument is over.

— Ethical Skeptic ☀ (@EthicalSkeptic) March 14, 2024

The Covid mRNA Vaxx has cause a sizeable 2021 inflection, and now novel-trend elevation in terms of both cancer incidence & mortality.

Now you know who the liars were all along.

????Incidence = 14.8% excess

????UCoD Mortality = 5.3% excess (lags Incidence) pic.twitter.com/uwN9GMrHl1

Phinance principal Ed Dowd commented on the post, noting that "Cancer is suddenly an accelerating growth industry!"

????Indeed it is…Cancer is suddenly an accelerating growth industry! @EthicalSkeptic provides a chart below showing US Cancer treatment in constant dollars with a current growth rate of 14.8% (6.3% New CAGR) versus long term trend of 1.78% CAGR or $33.8 billion in excess cancer… https://t.co/RIn4R2YZZ7

— Edward Dowd (@DowdEdward) March 14, 2024

Continued:

As a former portfolio manager of of a $14 billion Large Cap Growth Equity portfolio I can definitively say Cancer treatments and the Disabilities have become growth industries that both have inflection points coincidental to the mRNA vaccine rollouts in 2021.

— Edward Dowd (@DowdEdward) March 14, 2024

Chart 1 from… pic.twitter.com/TCt4X1plnM

Bottom line - hard data is showing alarming trends, which the CDC and other agencies have a requirement to explore and answer truthfully - and people are asking #WhereIsTheCDC.

We aren't holding our breath.

Experts are sounding the alarm on a spike in cancer diagnosis worldwide. It is still a mystery. @DowdEdward from Phinance Technologies has also been sounding the alarm for months.

— dr.ir. Carla Peeters (@CarlaPeeters3) March 15, 2024

We are facing a dramatic degradation of the human immune system https://t.co/CPnwP3Oj9G

Wiseman, meanwhile, points out that Pfizer and several other companies are making "significant investments in cancer drugs, post COVID."

Pfizer among several companies making significant investments in cancer drugs, post COVID. @DowdEdward @Kevin_McKernan @JesslovesMJK @niki_kyrylenko https://t.co/nefEZYLW1o https://t.co/r505Sbbcq4

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 15, 2024

Phinance

We've featured several of Phinance's self-funded deep dives into pandemic data that nobody else is doing. If you'd like to support them, click here.

List of our projects following disturbing tends in deaths, disabilities and absences.

— Edward Dowd (@DowdEdward) March 16, 2024

Link to projects at bottom.

✅ V-Damage Project

✅ Excess Mortality Project

✅ US Disabilities Project

✅ US BLS Absence rates Project

✅ US Cause of Death Project

✅ UK Cause of Death…

Government

Gen Z, The Most Pessimistic Generation In History, May Decide The Election

Gen Z, The Most Pessimistic Generation In History, May Decide The Election

Authored by Mike Shedlock via MishTalk.com,

Young adults are more…

Authored by Mike Shedlock via MishTalk.com,

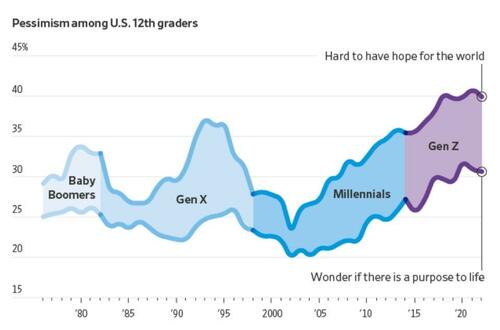

Young adults are more skeptical of government and pessimistic about the future than any living generation before them.

This is with reason, and it’s likely to decide the election.

Rough Years and the Most Pessimism Ever

The Wall Street Journal has an interesting article on The Rough Years That Turned Gen Z Into America’s Most Disillusioned Voters.

Young adults in Generation Z—those born in 1997 or after—have emerged from the pandemic feeling more disillusioned than any living generation before them, according to long-running surveys and interviews with dozens of young people around the country. They worry they’ll never make enough money to attain the security previous generations have achieved, citing their delayed launch into adulthood, an impenetrable housing market and loads of student debt.

And they’re fed up with policymakers from both parties.

Washington is moving closer to passing legislation that would ban or force the sale of TikTok, a platform beloved by millions of young people in the U.S. Several young people interviewed by The Wall Street Journal said they spend hours each day on the app and use it as their main source of news.

“It’s funny how they quickly pass this bill about this TikTok situation. What about schools that are getting shot up? We’re not going to pass a bill about that?” Gaddie asked. “No, we’re going to worry about TikTok and that just shows you where their head is…. I feel like they don’t really care about what’s going on with humanity.”

Gen Z’s widespread gloominess is manifesting in unparalleled skepticism of Washington and a feeling of despair that leaders of either party can help. Young Americans’ entire political memories are subsumed by intense partisanship and warnings about the looming end of everything from U.S. democracy to the planet. When the darkest days of the pandemic started to end, inflation reached 40-year highs. The right to an abortion was overturned. Wars in Ukraine and the Middle East raged.

Dissatisfaction is pushing some young voters to third-party candidates in this year’s presidential race and causing others to consider staying home on Election Day or leaving the top of the ticket blank. While young people typically vote at lower rates, a small number of Gen Z voters could make the difference in the election, which four years ago was decided by tens of thousands of votes in several swing states.

Roughly 41 million Gen Z Americans—ages 18 to 27—will be eligible to vote this year, according to Tufts University.

Gen Z is among the most liberal segments of the electorate, according to surveys, but recent polling shows them favoring Biden by only a slim margin. Some are unmoved by those who warn that a vote against Biden is effectively a vote for Trump, arguing that isn’t enough to earn their support.

Confidence

When asked if they had confidence in a range of public institutions, Gen Z’s faith in them was generally below that of the older cohorts at the same point in their lives.

One-third of Gen Z Americans described themselves as conservative, according to NORC’s 2022 General Social Survey. That is a larger share identifying as conservative than when millennials, Gen X and baby boomers took the survey when they were the same age, though some of the differences were small and within the survey’s margin of error.

More young people now say they find it hard to have hope for the world than at any time since at least 1976, according to a University of Michigan survey that has tracked public sentiment among 12th-graders for nearly five decades. Young people today are less optimistic than any generation in decades that they’ll get a professional job or surpass the success of their parents, the long-running survey has found. They increasingly believe the system is stacked against them and support major changes to the way the country operates.

Gen Z future Outcome

“It’s the starkest difference I’ve documented in 20 years of doing this research,” said Twenge, the author of the book “Generations.” The pandemic, she said, amplified trends among Gen Z that have existed for years: chronic isolation, a lack of social interaction and a propensity to spend large amounts of time online.

A 2020 study found past epidemics have left a lasting impression on young people around the world, creating a lack of confidence in political institutions and their leaders. The study, which analyzed decades of Gallup World polling from dozens of countries, found the decline in trust among young people typically persists for two decades.

Young people are more likely than older voters to have a pessimistic view of the economy and disapprove of Biden’s handling of inflation, according to the recent Journal poll. Among people under 30, Biden leads Trump by 3 percentage points, 35% to 32%, with 14% undecided and the remaining shares going to third-party candidates, including 10% to independent Robert F. Kennedy Jr.

Economic Reality

Gen Z may be the first generation in US history that is not better off than their parents.

Many have given up on the idea they will ever be able to afford a home.

The economy is allegedly booming (I disagree). Regardless, stress over debt is high with younger millennials and zoomers.

This has been a constant theme of mine for many months.

Credit Card and Auto Delinquencies Soar

Credit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90 day or longer delinquencies.

Record High Credit Card Debt

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due.

For nearly all age groups, serious delinquencies are the highest since 2011.

Auto Loan Delinquencies

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29.Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

For further discussion please see Credit Card and Auto Delinquencies Soar, Especially Age Group 18 to 39

Generational Homeownership Rates

Home ownership rates courtesy of Apartment List

The above chart is from the Apartment List’s 2023 Millennial Homeownership Report

Those struggling with rent are more likely to be Millennials and Zoomers than Generation X, Baby Boomers, or members of the Silent Generation.

The same age groups struggling with credit card and auto delinquencies.

On Average Everything is Great

Average it up, and things look pretty good. This is why we have seen countless stories attempting to explain why people should be happy.

Krugman Blames Partisanship

With the recent rise in consumer sentiment, time to revisit this excellent Briefing Book paper. On reflection, I'd do it a bit differently; same basic conclusion, but I think partisan asymmetry explains even more of the remaining low numbers 1/ https://t.co/4lqm7X4472

— Paul Krugman (@paulkrugman) February 17, 2024

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

This allegedly booming economy left behind the renters and everyone under the age of 40 struggling to make ends meet.

Many Are Addicted to “Buy Now, Pay Later” Plans

Buy Now Pay Later, BNPL, plans are increasingly popular. It’s another sign of consumer credit stress.

For discussion, please see Many Are Addicted to “Buy Now, Pay Later” Plans, It’s a Big Trap

The study did not break things down by home owners vs renters, but I strongly suspect most of the BNPL use is by renters.

What About Jobs?

Another seemingly strong jobs headline falls apart on closer scrutiny. The massive divergence between jobs and employment continued into February.

Nonfarm payrolls and employment levels from the BLS, chart by Mish.

Payrolls vs Employment Gains Since March 2023

-

Nonfarm Payrolls: 2,602,000

-

Employment Level: +144,000

-

Full Time Employment: -284,000

For more details of the weakening labor markets, please see Jobs Up 275,000 Employment Down 184,000

CPI Hot Again

CPI Data from the BLS, chart by Mish.

For discussion of the CPI inflation data for February, please see CPI Hot Again, Rent Up at Least 0.4 Percent for 30 Straight Months

Also note the Producer Price Index (PPI) Much Hotter Than Expected in February

Major Economic Cracks

There are economic cracks in spending, cracks in employment, and cracks in delinquencies.

But there are no cracks in the CPI. It’s coming down much slower than expected. And the PPI appears to have bottomed.

Add it up: Inflation + Recession = Stagflation.

Election Impact

In 2020, younger voters turned out in the biggest wave in history. And they voted for Biden.

Younger voters are not as likely to vote in 2024, and they are less likely to vote for Biden.

Millions of voters will not vote for either Trump or Biden. Net, this will impact Biden more. The base will not decide the election, but the Trump base is far more energized than the Biden base.

If Biden signs a TikTok ban, that alone could tip the election.

If No Labels ever gets its act together, I suspect it will siphon more votes from Biden than Trump. But many will just sit it out.

“We’re just kind of over it,” Noemi Peña, 20, a Tucson, Ariz., resident who works in a juice bar, said of her generation’s attitude toward politics. “We don’t even want to hear about it anymore.” Peña said she might not vote because she thinks it won’t change anything and “there’s just gonna be more fighting.” Biden won Arizona in 2020 by just over 10,000 votes.

The Journal noted nearly one-third of voters under 30 have an unfavorable view of both Biden and Trump, a higher number than all older voters. Sixty-three percent of young voters think neither party adequately represents them.

Young voters in 2020 were energized to vote against Trump. Now they have thrown in the towel.

And Biden telling everyone how great the economy is only rubs salt in the wound.

Uncategorized

Women’s basketball is gaining ground, but is March Madness ready to rival the men’s game?

The hype around Caitlin Clark, NCAA Women’s Basketball is unprecedented — but can its March Madness finally rival the Men’s?

In March 2021, the world was struggling to find its legs amid the ongoing Covid-19 pandemic. Sports leagues were trying their best to keep going.

It started with the NBA creating a bubble in Orlando in late 2020, playing a full postseason in the confines of Disney World in arenas that were converted into gyms devoid of fans. Other leagues eventually allowed for limited capacity seating in stadiums, including the NCAA for its Men’s and Women’s Basketball tournaments.

The two tournaments were confined to two cities that year — instead of games normally played in different regions around the country: Indianapolis for the men and San Antonio for the women.

But a glaring difference between the men’s and women’s facilities was exposed by Oregon’s Sedona Prince on social media. The workout and practice area for the men was significantly larger than the women, whose weight room was just a single stack of dumbbells.

Let me put it on Twitter too cause this needs the attention pic.twitter.com/t0DWKL2YHR

— SEDONA (@sedonaprince_) March 19, 2021

The video drew significant attention to the equity gaps between the Men’s and Women’s divisions, leading to a 114-page report by a civil rights law firm that detailed the inequities between the two and suggested ways to improve the NCAA’s efforts for the Women’s side. One of these suggestions was simply to give the Women’s Tournament the same March Madness moniker as the men, which it finally got in 2022.

But underneath the surface of these institutional changes, women’s basketball’s single-biggest success driver was already emerging out of the shadows.

During the same COVID-marred season, a rookie from Iowa led the league in scoring with 26.6 points per game.

Her name: Caitlin Clark.

As it stands today, Clark is the leading scorer in the history of college basketball — Men’s or Women’s. Her jaw-dropping shooting ability has fueled record viewership and ticket sales for Women’s collegiate games, carrying momentum to the March Madness tournament that has NBA legends like Kevin Garnett and Paul Pierce more excited for the Women’s March Madness than the Men’s this year.

Related: Ticket prices for Caitlin Clark's final college home game are insanely high

But as the NCAA tries to bridge the opportunities given to the two sides, can the hype around Clark be enough for the Women’s March Madness to bring in the same fandom as the Men for the 2024 tournaments?

TheStreet spoke with Jon Lewis of Sports Media Watch, who has been following sports viewership trends for the last two decades; Melissa Isaacson, a veteran sports journalist and longtime advocate of women’s basketball; and Pete Giorgio, Deloitte’s leader for Global and US Sports to dissect the rise Caitlin Clark and women’s collegiate hoops ahead of March Madness.

“Nobody is moving the needle like Caitlin Clark,” Lewis told TheStreet. “Nobody else in sports, period, right now, is fueling record numbers on all these different networks, driving viewership beyond what the norm has been for 20 years."

The Caitlin Clark Effect is real — but there are other reasons for the success of women's basketball

The game in which Clark broke the all-time college scoring record against Ohio State on Sunday, Mar. 3 was seen by an average of 3.4 million viewers on Fox, marking the first time a women’s game broke the two million viewership barrier since 2010. Viewership for that game came in just behind the men’s game between Michigan State vs Arizona game on Thanksgiving, which Lewis said was driven by NFL viewership on the same day.

A week later, Iowa’s Big Ten Championship win over Nebraska breached the three million viewers mark as well, and the team has also seen viewership numbers crack over 1.5 million viewers multiple times throughout the regular season.

The success on television has also translated to higher ticket prices, as tickets to watch Clark at home and on the road have breached hundreds of dollars and drawn long lines outside stadiums. Isaacson, who is a professor at Northwestern, said she went to the game between the Hawkeyes and Northwestern Wildcats — which was the first sellout in school history for the team — and witnessed the effect of Clark in person.

“Standing in line interviewing people at the Northwestern game, seeing men who've never been to a women's game with their little girls watching and so excited, and seeing Caitlin and her engaging with little girls, it’s just been really fun,” Isaacson said.

But while Clark is certainly the biggest success driver, her game isn’t the only thing pulling up the women’s side. The three-point revolution, which started in the NBA with the introduction of deeper analytics as well as the rise of stars like Steph Curry, has been a positive for the Women’s game.

“They backed up to the three-point line and it’s opening up the game,” Isaacson said.

One of the major criticisms from a lot of women’s hoops detractors has been how the game does not compare in terms of quality to the men. However, shooting has become a great equalizer, displayed recently during the 2024 NBA All-Star Weekend last month when the WNBA’s Sabrina Ionescu nearly defeated Curry — who is widely considered the greatest shooter ever — in a three-point contest.

Clark has become the embodiment of the three-point revolution for the women. Her shooting displays have demanded the respect of anyone who has doubted women’s basketball in the past because being a man simply doesn’t grant someone the ability to shoot long-distance bombs the way she can.

Basketball pundit Bill Simmons admitted on a Feb. 28 episode of “The Bill Simmons Podcast” that he used to not want to watch women’s basketball because he didn’t enjoy watching the product, but finds himself following the women’s game this year more than the men’s side in large part due to Clark.

“I think she has the chance to be the most fun basketball player, male or female, when she gets to the pros,” Simmons said. “If she’s going to make the same 30-footers, routinely. It’s basically all the same Curry stuff just with a female … I would like watching her play in any format.”

But while Clark is driving up the numbers at the top, she’s not the only one carrying the greatness of the product. Lewis, Isaacson, Giorgio — and even Simmons, on his podcast — agreed that there are several other names and collegiate programs pulling in fans.

“It’s not just Iowa, it’s not just Caitlin Clark, it’s all of these teams,” Giorgio said. “Part of it is Angel Reese … coaches like Dawn Staley in South Carolina … You’ve got great stories left and right.”

The viewership showed that as well because the SEC Championship game between the LSU Tigers and University of South Carolina Gamecocks on Sunday, Mar. 10 averaged two million viewers.

Bridging the gap between the Men’s and Women’s March Madness viewership

The first reason women are catching up to the men is really star power. While the Women’s division has names like Clark and Reese, there just aren’t any names on the Men’s side this year that carry the same weight.

Garnett said on his show that he can’t name any men’s college basketball players, while on the women’s side, he could easily throw out the likes of Clark, Reese, UConn’s Paige Bueckers, and USC’s JuJu Watkins. Lewis felt the same.

Kevin Garnett energy towards WBB is unmatched. Sorry for the language but that’s how he talks. Just watch. pic.twitter.com/0yGBRGaF3O

— The9450 Podcast Network (@The9450) March 8, 2024

“The stars in the men's game, with one and done, I genuinely couldn't give you a single name of a single men’s player,” Lewis said.

A major reason for this is that the Women’s side has the continuity that the Men’s side does not. The rules of the NBA allow for players to play just one year in college — or even play a year professionally elsewhere — before entering the draft, while the WNBA requires players to be 22-years-old during the year of the draft to be eligible.

“You know the stars in the women's game because they stay longer,” Lewis said. “[In the men’s game], the programs are the stars … In the women's game, it's a lot more like the NBA where the players are the stars.”

Parity is also a massive factor on both sides. The women’s game used to be dominated by a few schools like UConn and Notre Dame. Nowadays, between LSU, Iowa, University of South Carolina, Stanford, and UConn, there are a handful of schools that have a shot to win the entire tournament. While this is more exciting for fans, the talent in the women's game isn’t deep enough, so too many upsets are unlikely. Many of the biggest draws are still expected to make deep runs.

But on the men’s side, there is a bigger shot that the smaller programs make it to the end — which is what was seen last year. UConn eventually won the whole thing, but schools without as big of a national fanbase in San Diego State, Florida Atlantic University, and the University Miami rounded out the Final Four.

“People want to see one Cinderella,” Lewis said. “They don't want to see two and three, they want one team that isn't supposed to be there.”

Is Women's March Madness ready to overtake the Men?

Social media might feel like it’s giving more traction to the Women’s game, but experts don’t necessarily expect that to show up in the viewership numbers just yet.

“There’s certainly a lot more buzz than there used to be,” Giorgio said. “It’s been growing every year for not just the past few years but for 10 years, but it’s hard to compare it versus Men’s.”

But the gap continues to get smaller and smaller between the two sides, and this year's tournament could bridge that gap even further.

One indicator is ticket prices. For the NCAA Tournament Final Four in April, “get-in” ticket prices are currently more expensive for the Women’s game than the Men’s game, according to TickPick. The ticketing site also projects that the Women’s Final Four and Championship game ticket prices will smash any previous records for the Women’s side should Clark and the Hawkeyes make a run to the end.

Getty Images/TheStreet

The caveat is that the Women’s Final Four is played in a stadium that has less than a third of the seating capacity of the Men’s Final Four. That’s why the average ticket prices are still more expensive for the men, although the gap is a lot smaller this year than in previous years.

But that caveat pretty much sums up where the women’s game currently stands versus the men’s: There is still a significant gap between the distribution and availability of the former.

While Iowa’s regular season games have garnered millions of viewers, the majority of the most-viewed games are still Men’s contests.

To illustrate the gap between the men’s and women’s game — last year’s Women’s Championship game that saw the LSU Tigers defeat the Hawkeyes was a record-breaking one for the women, drawing an average of 9.9 million viewers, more than double the viewership from the previous year.

One of the main reasons for that increase, as Lewis pointed out, is that last year’s Championship game was on ABC, which was the first time since 1995 that the Women’s Championship game was on broadcast television. The 1995 contest between UConn and Tennessee drew 7.4 million viewers.

The Men’s Championship actually had a record low in viewership last year garnering only 14.7 million viewers, driven in-part due to a lack of hype surrounding the schools that made it to the Final Four and Championship game. Viewership for the Men’s title game has been trending down in recent years — partly due to the effect the pandemic had on collective sports viewership — but the Men’s side had been easily breaching 20 million viewers for the game as recently as 2017.

Iowa's Big Ten Championship win on Sunday actually only averaged 6,000 fewer viewers than the iconic rivalry game between Duke and University of North Carolina Men’s Basketball the day prior. However, there is also the case that the Iowa game was played on broadcast TV (CBS) versus the Duke-UNC game airing on cable channel (ESPN).

So historical precedence makes it unlikely that we’ll see the women’s game match the men’s in terms of viewership as early as this year barring another massive viewership jump for the women and a lack of recovery for the Men’s side.

But ultimately, this shouldn’t be looked at as a down point for Women’s Basketball, according to Lewis. The Men’s side has built its viewership base for years, and the Women’s side is still growing. Even keeping pace with the Men’s viewership is already a great sign.

“The fact that these games have Caitlin Clark are even in the conversation with men's games, in terms of viewership is a huge deal,” Lewis said.

Related: Angel Reese makes bold statement for avoiding late game scuffle in championship game

recovery pandemic covid-19-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

Spread & Containment3 days ago

Spread & Containment3 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex