Trending Penny Stocks to Buy Right Now? 8 For Your Watchlist

Are these trending penny stocks worth watching in July 2021?

The post Trending Penny Stocks to Buy Right Now? 8 For Your Watchlist appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

Best Penny Stocks to Watch in July 2021

As we move toward the last week of June, which penny stocks are investors watching for next month? Well, to answer this we have to consider what is going on in the world right now. For starters, we have the end of the Covid pandemic on the horizon. This is resulting in a large amount of bullish sentiment for the future.

That sentiment extends into biotech penny stocks, tech penny stocks, and energy penny stocks among others. The next thing to consider right now is the most recent cryptocurrency dip. This has occurred over the past few days, but the largest drop was witnessed today as Bitcoin price fell below $30,000 for a brief moment.

[Read More] 9 Robinhood Penny Stocks To Watch With Bitcoin Below $30,000

While cryptocurrency and penny stocks are obviously different assets, they can at times trade in parallel with one another. So, considering these two factors and their effects on the stock market, here are five more penny stocks to watch right now. This article is a continuation of ‘Hot Penny Stocks to Buy? 3 For Your Morning Watchlist’.

5 More Penny Stocks to Watch in July 2021

- Uranium Energy Corp. (NYSE: UEC)

- Qudian Inc. (NYSE: QD)

- 9F Inc. (NASDAQ: JFU)

- T2 Biosystems Inc. (NASDAQ: TTOO)

- Kaixin Auto Holdings (NASDAQ: KXIN)

4. Uranium Energy Corp. (NYSE: UEC)

Uranium Energy Corp. is a mining penny stock that explores, extracts, and processes uranium and titanium concentrate. The company operates out of the United States, Canada, and Paraguay. Currently, it has an interest in the Palangana mine, Goliad, Burke Hollow, Longhorn, and Salvo projects. These projects are located in Texas, Arizona, Colorado, Wyoming, Canada, and Paraguay.

On May 20th the company announced that it has increased its physical equity uranium holdings. It has acquired an additional 200,000 pounds of warehoused U.S. uranium. This was fully funded with cash on hand and now totals 2.305 million pounds of U.S. warehoused uranium. The volume-weighted average price for uranium right now is $30 per pound with delivery dates to June 2023.

Plenty of mining penny stocks have been performing very well in the market lately. Uranium is a growing market right now as alternative energy continues to gain momentum. UEC’s stock price sat at around $1.60 per share on average just one month ago. Now as of June 22nd, UEC stock is at $2.80 per share on average. So, will you add UEC stock to your watchlist this week?

5. Qudian Inc. (NYSE: QD)

Financial penny stocks like Qudian Inc. are also witnessing solid performance right now. Qudian is a company that provides online platforms to offer small-company and individual consumer credit products in China. Its products include cash credit products and merchandise offerings to finance borrowers for direct purchase of merchandise off of its marketplace on an installment basis. It also has a platform for loan recommendations and referral services to financial service providers.

One week ago Qudian Inc. reported its first-quarter unaudited financial results for 2021. Its total outstanding loan balance, number of outstanding borrowers, and amount of transactions from loan book business all decreased year over year. Decreasing the number of loans and debt on a company’s books is always good news for investors, and this is no exception.

The Founder, Chairman, and CEO of the company said, “In the first quarter of 2021, we continued to execute a prudent operational strategy related to our cash credit business amid an evolving regulatory environment while making significant strides to advance our early childhood education business initiative.” With all of this in mind, will you add QD stock to your watchlist this month?

6. 9F Inc. (NASDAQ: JFU)

9F Inc. is a tech penny stock that operates a digital financial account platform. This platform integrates and personalizes financial services for those living in China. Some of its products include digital financial accounts, wealth management, and payment facilitation services. Its platforms include Wukong Licai, 9F Wallet, and 9F Puhui. So, what has 9F been doing recently that is causing its stock price to go up?

[Read More] 7 Penny Stocks On Robinhood To Watch In June 2021

On June 3rd the company announced that it will hold an extraordinary general meeting on July 8th. The purpose of the meeting is for shareholders to consider and if thought fit, approve a name change from 9F Inc. to Ether Securities Inc. One month ago, JFU stock was at $1.30 per share on average. Now on June 22nd, the company’s stock price is at $2.35 per share on average. Considering this, is JFU a contender for your list of penny stocks to watch in 2021?

7. T2 Biosystems Inc. (NASDAQ: TTOO)

T2 Biosystems Inc. is a biotech penny stock that focuses on in-vitro diagnostics. The company develops diagnostic products and biotech product candidates in the United States. Its T2 Magnetic Resonance technology allows for the detection of pathogens, biomarkers, and other abnormalities in various unpurified patient sample types. It also offers the T2Dx Instrument, used for detecting pathogens associated with sepsis and Lyme disease.

On June 21st, the company made several key announcements. The first is that it will take part in the American Society for Microbiology and the Federation of European Microbiological Societies’ World Microbe Forum. It will also participate in the Sepsis Tech and Innovation 2021 conference, and a few others as well.

The CEO of T2 John Sperzel said, “We’re looking forward to connecting with like-minded peers in the global medical community to discuss how our rapid diagnostic technology can be more effective than standard blood cultures to reach our common goal of better managing bloodstream infections and sepsis.” With all of these upcoming conferences in mind and TTOO’s forward momentum, will it be on your watchlist?

8. Kaixin Auto Holdings (NASDAQ: KXIN)

Kaixin Auto Holdings is a consumer automobile penny stock-based in China. The company operates 14 used car dealerships throughout the country, allowing it to have quite a broad reach. Additionally, it offers financing channels to its customers through its partnerships with financial institutions. Part of its business model is offering insurance, extended warranties, and after-sales services to its customers. Recently, KXIN stock has driven upward in several trading sessions. And this momentum has many investors asking why.

On June 22nd, Kaixin Auto Holdings announced that it is in discussions surrounding cooperation and a joint venture with a leading RV retailer in China. In the last three years, the RV market in China has increased by 50%. In 2020, more than 69,000 RV vehicles were sold alone. The company intends to collaborate with the RV retailer to sell and rent these vehicles. Additionally, it will explore the opportunity to develop and produce electric RVs.

Companies that enter the electric vehicle space are performing well right now due to the emphasis on renewable energy. With leaders like TSLA stock pushing EV adoption, more companies than ever are working to join this industry. On the day of the announcement, KXIN stock increased by more than 5.6% in the market. So with this in mind, will KXIN stock enter your watchlist for the month?

Which Penny Stocks Are You Watching Right Now?

Finding the best penny stocks to buy in 2021 is all about understanding what makes the market move. Considering the factors mentioned previously, we see that there is a lot going on in the world right now. But, with all of these events comes a high likelihood that we will witness major movement in the stock market.

[Read More] 4 Penny Stocks to Watch That Are Pushing Up in June 2021

To take advantage of this, investors need to understand how to trade penny stocks and what their individual strategy is. Considering this, which penny stocks are you watching right now?

To read about the other four stocks on this list, head to Hot Penny Stocks to Buy? 3 For Your Morning Watchlist

The post Trending Penny Stocks to Buy Right Now? 8 For Your Watchlist appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

nasdaq stocks pandemic cryptocurrency bitcoin pound penny stocksGovernment

Young People Aren’t Nearly Angry Enough About Government Debt

Young People Aren’t Nearly Angry Enough About Government Debt

Authored by The American Institute for Economic Research,

Young people sometimes…

Authored by The American Institute for Economic Research,

Young people sometimes seem to wake up in the morning in search of something to be outraged about. We are among the wealthiest and most educated humans in history. But we’re increasingly convinced that we’re worse off than our parents were, that the planet is in crisis, and that it’s probably not worth having kids.

I’ll generalize here about my own cohort (people born after 1981 but before 2010), commonly referred to as Millennials and Gen Z, as that shorthand corresponds to survey and demographic data. Millennials and Gen Z have valid economic complaints, and the conditions of our young adulthood perceptibly weakened traditional bridges to economic independence. We graduated with record amounts of student debt after President Obama nationalized that lending. Housing prices doubled during our household formation years due to zoning impediments and chronic underbuilding. Young Americans say economic issues are important to us, and candidates are courting our votes by promising student debt relief and cheaper housing (which they will never be able to deliver).

Young people, in our idealism and our rational ignorance of the actual appropriations process, typically support more government intervention, more spending programs, and more of every other burden that has landed us in such untenable economic circumstances to begin with. Perhaps not coincidentally, young people who’ve spent the most years in the increasingly partisan bubble of higher education are also the most likely to favor expanded government programs as a “solution” to those complaints.

It’s Your Debt, Boomer

What most young people don’t yet understand is that we are sacrificing our young adulthood and our financial security to pay for debts run up by Baby Boomers. Part of every Millennial and Gen-Z paycheck is payable to people the same age as the members of Congress currently milking this system and miring us further in debt.

Our government spends more than it can extract from taxpayers. Social Security, which represents 20 percent of government spending, has run an annual deficit for 15 years. Last year Social Security alone overspent by $22.1 billion. To keep sending out checks to retirees, Social Security goes begging to the Treasury Department, and the Treasury borrows from the public by issuing bonds. Bonds allow investors (who are often also taxpayers) to pay for some retirees’ benefits now, and be paid back later. But investors only volunteer to lend Social Security the money it needs to cover its bills because the (younger) taxpayers will eventually repay the debt — with interest.

In other words, both Social Security and Medicare, along with various smaller federal entitlement programs, together comprising almost half of the federal budget, have been operating for a decade on the principle of “give us the money now, and stick the next generation with the check.” We saddle future generations with debt for present-day consumption.

The second largest item in the budget after Social Security is interest on the national debt — largely on Social Security and other entitlements that have already been spent. These mandatory benefits now consume three quarters of the federal budget: even Congress is not answerable for these programs. We never had the chance for our votes to impact that spending (not that older generations were much better represented) and it’s unclear if we ever will.

Young Americans probably don’t think much about the budget deficit (each year’s overspending) or the national debt (many years’ deficits put together, plus interest) much at all. And why should we? For our entire political memory, the federal government, as well as most of our state governments, have been steadily piling “public” debt upon our individual and collective heads. That’s just how it is. We are the frogs trying to make our way in the watery world as the temperature ticks imperceptibly higher. We have been swimming in debt forever, unaware that we’re being economically boiled alive.

Millennials have somewhat modest non-mortgage debt of around $27,000 (some self-reports say twice that much), including car notes, student loans, and credit cards. But we each owe more than $100,000 as a share of the national debt. And we don’t even know it.

When Millennials finally do have babies (and we are!) that infant born in 2024 will enter the world with a newly minted Social Security Number and $78,089 credit card bill for Granddad’s heart surgery and the interest on a benefit check that was mailed when her parents were in middle school.

Headlines and comments sections love to sneer at “snowflakes” who’ve just hit the “real world,” and can’t figure out how to make ends meet, but the kids are onto something. A full 15 percent of our earnings are confiscated to pay into retirement and healthcare programs that will be insolvent by the time we’re old enough to enjoy them. The Federal Reserve and government debt are eating the economy. The same interest rates that are pushing mortgages out of reach are driving up the cost of interest to maintain the debt going forward. As we learn to save and invest, our dollars are slowly devalued. We’re right to feel trapped.

Sure, if we’re alive and own a smartphone, we’re among the one percent of the wealthiest humans who’ve ever lived. Older generations could argue (persuasively!) that we have no idea what “poverty” is anymore. But with the state of government spending and debt…we are likely to find out.

Despite being richer than Rockefeller, Millennials are right to say that the previous ways of building income security have been pushed out of reach. Our earning years are subsidizing not our own economic coming-of-age, but bank bailouts, wars abroad, and retirement and medical benefits for people who navigated a less-challenging wealth-building landscape.

Redistribution goes both ways. Boomers are expected to pass on tens of trillions in unprecedented wealth to their children (if it isn’t eaten up by medical costs, despite heavy federal subsidies) and older generations’ financial support of the younger has had palpable lifting effects. Half of college costs are paid by families, and the trope of young people moving back home is only possible if mom and dad have the spare room and groceries to make that feasible.

Government “help” during COVID-19 resulted in the worst inflation in 40 years, as the federal government spent $42,000 per citizen on “stimulus” efforts, right around a Millennial’s average salary at that time. An absurd amount of fraud was perpetrated in the stimulus to save an economy from the lockdown that nearly ruined it. Trillions in earmarked goodies were rubber stamped, carelessly added to young people’s growing bill. Government lenders deliberately removed fraud controls, fearing they couldn’t hand out $800 billion in young people’s future wages away fast enough. Important lessons were taught by those programs. The importance of self-sufficiency and the dignity of hard work weren’t top of the list.

Boomer Benefits are Stagnating Hiring, Wages, and Investment for Young People

Even if our workplace engagement suffered under government distortions, Millennials continue to work more hours than other generations and invest in side hustles and self employment at higher rates. Working hard and winning higher wages almost doesn’t matter, though, when our purchasing power is eaten from the other side. Buying power has dropped 20 percent in just five years. Life is $11,400/year more expensive than it was two years ago and deficit spending is the reason why.

We’re having trouble getting hired for what we’re worth, because it costs employers 30 percent more than just our wages to employ us. The federal tax code both requires and incentivizes our employers to transfer a bunch of what we earned directly to insurance companies and those same Boomer-busted federal benefits, via tax-deductible benefits and payroll taxes. And the regulatory compliance costs of ravenous bureaucratic state. The price paid by each employer to keep each employee continues to rise — but Congress says your boss has to give most of the increase to someone other than you.

Federal spending programs that many people consider good government, including Social Security, Medicare, Medicaid, and health insurance for children (CHIP) aren’t a small amount of the federal budget. Government spends on these programs because people support and demand them, and because cutting those benefits would be a re-election death sentence. That’s why they call cutting Social Security the “third rail of politics.” If you touch those benefits, you die. Congress is held hostage by Baby Boomers who are running up the bill with no sign of slowing down.

Young people generally support Social Security and the public health insurance programs, even though a 2021 poll by Nationwide Financial found 47 percent of Millennials agree with the statement “I will not get a dime of the Social Security benefits I have earned.”

In the same survey, Millennials were the most likely of any generation to believe that Social Security benefits should be enough to live on as a sole income, and guessed the retirement age was 52 (it’s 67 for anyone born after 1959 — and that’s likely to rise). Young people are the most likely to see government guarantees as a valid way to live — even though we seem to understand that those promises aren’t guarantees at all.

Healthcare costs tied to an aging population and wonderful-but-expensive growth in medical technologies and medications will balloon over the next few years, and so will the deficits in Boomer benefit programs. Newly developed obesity drugs alone are expected to add $13.6 billion to Medicare spending. By 2030, every single Baby Boomer will be 65, eligible for publicly funded healthcare.

The first Millennial will be eligible to claim Medicare (assuming the program exists and the qualifying age is still 65, both of which are improbable) in 2046. As it happens, that’s also the year that the Boomer benefits programs (which will then be bloated with Gen Xers) and the interest payments we’re incurring to provide those benefits now, are projected to consume 100 percent of federal tax revenue.

Government spending is being transferred to bureaucrats and then to the beneficiaries of government spending who are, in some sense, your diabetic grandma who needs a Medicare-paid dialysis treatment, but in a much more immediate sense, are the insurance companies, pharma giants, and hospital corporations who wrote the healthcare legislation. Some percentage of every college graduate’s paycheck buys bullets that get fired at nothing and inflating the private investment portfolios of government contractors, with dubious, wasteful outcomes from the prison-industrial complex to the perpetual war machine.

No bank or nation in the world can lend the kind of money the American government needs to borrow to fulfill its obligations to citizens. Someone will have to bite the bullet. Even some of the co-authors of the current disaster are wrestling with the truth.

Forget avocado toast and streaming subscriptions. We’re already sensing it, but we haven’t yet seen it. Young people are not well-informed, and often actively misled, about what’s rotten in this economic system. But we are seeing the consequences on store shelves and mortgage contracts and we can sense disaster is coming. We’re about to get stuck with the bill.

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

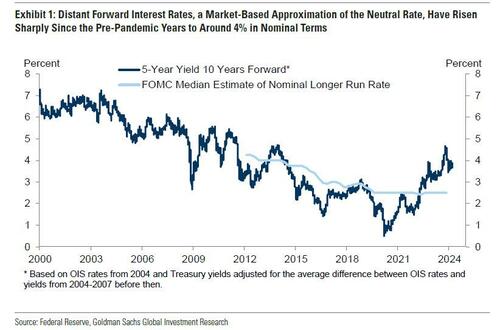

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

Spread & Containment

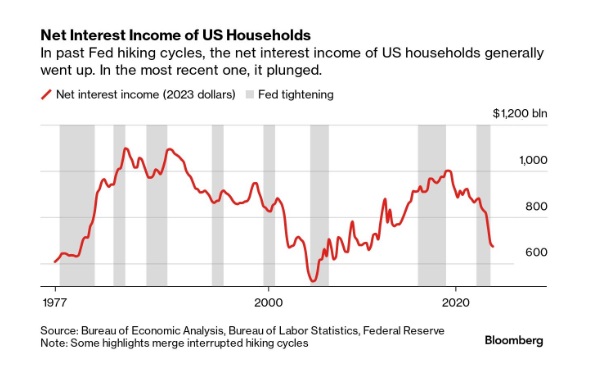

Household Net Interest Income Falls As Rates Spike

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

-

Spread & Containment7 days ago

Spread & Containment7 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex