The women of crypto take over Davos WEF

Talking with outstanding women at Davos, who are shaping the crypto industry — Gender inclusivity as it is: From investors to mentors to entrepreneurs…

Talking with outstanding women at Davos, who are shaping the crypto industry — Gender inclusivity as it is: From investors to mentors to entrepreneurs and technologists.

Many of you closely follow the gathering of the decision-makers at Davos during the annual World Economic Forum. Many of you have very strong opinions about these gatherings, which I share. Right now, however, I would like to discuss what inspired me the most during those five days of the summit. This was my first Davos event, and I could not help noticing how many women decision-makers were present, in stark contrast to similar crypto events happening in Dubai and Lisbon, for example.

Yes, the Promenade at Davos was taken over by crypto companies, exceeding the traditional finance and tech presence, but it was the presence of so many women in senior positions representing every segment of the crypto industry that increased my firm belief that the future of the crypto industry is bright. As operations lead of UpLift DAO, a launchpad for innovative crypto community projects, I interact with our community intensely to keep them engaged, and reach out to as many different sectors as possible.

Having a diverse community brings greater support to new projects, and ensuring that women are well represented is foremost of importance. It’s exciting now to see women having integral roles in major projects and taking the lead in this space to inspire the community.

Many surveys and reports bemoan the low participation rates of women in crypto — estimates say as much as 85% of the crypto community is male — however, a 2019 study by Grayscale challenges that trend and found that 43% of investors interested in Bitcoin are women. This number has surely grown as cryptocurrencies offer easy and open access to investing, unlike traditionally traded assets and commodities.

Related: An open invitation for women to join the Web3 movement

An April 2022 report saw women’s participation increase over 170% in the last fiscal year, while men’s usage was just under 80% higher. Moreover, women on average made larger initial deposits, and although they traded less frequently, their portfolios showed more structured strategies and focused positions.

The evolution and leveling of the financial playing field has come about as information and resources have become more easily accessible to everyone, another result of widespread community-building efforts and transparency built into project designs. While in Davos, I met up with several extraordinary women — from investors to mentors to entrepreneurs and technologists — making waves in the crypto community. These women are impacting the crypto scene right now, dynamic and inspirational pioneers who are paving the way for other women to come to the forefront. I took this opportunity to ask these outstanding women a few questions and am delighted to share their answers with you.

Marieke Frament, the CEO of the NEAR Foundation

a non-profit foundation headquartered in Switzerland that oversees the development of the NEAR protocol. NEAR Protocol is a shared, proof-of-stake, layer-1 blockchain that is simple to use and scalable. NEAR is also a certified carbon-neutral blockchain.

What makes you excited about the crypto industry?

“The most exciting thing for me right now about the crypto industry is the infinite possibilities of using blockchain, specifically the NEAR protocol! The opportunities it presents to transform the way we live and organize our lives are truly incredible. DAOs are super exciting and could allow people and society to work and come together in a more inclusive, fair and democratic way.”

Why were you at WEF in Davos and how do you think women can impact innovation in the global economy these days?

“Crypto was a prominent theme at Davos this year and it was important for NEAR to be there to back the important initiatives that WEF is championing but also to show the world that we are creating a positive impact in the world with the creation of a protocol that is sustainable, accessible and inclusive for everyone. Blockchain's reputation is that it's bad for the environment, and we need world leaders to realize and understand that it's not the case. In this new world of Web3, diversity is even more paramount, and as the rules are being redefined, we need more women and diversity of thought to build an inclusive future around these new tools. Yet right now in the world of crypto, around 85% of the Bitcoin community is male. Men dominate the investor space and women account for only a third of crypto holders worldwide. This is not sustainable and it won't lead to the positive outcomes we want for society as a whole.”

What advice would you give to women who want to start their career in crypto?

“For any women looking to join the world of crypto, I would give the following advice. First off, you don't have to be a developer to get into crypto. Web3, in particular, is about reshaping what we've done on Web2, so pretty much all the skills we require today in Web2 are and will be needed in Web3 and many women are qualified to make their mark in the space. Second, get trained up if you want to become a developer and let us help you! At the moment, Web3 isn't taught yet anywhere, which is why we have launched NEAR University and which is why we are on a path to train millions of developers, both male and female. Finally, my top tips to break into the sector: Start reading and learning as much as you can, and start playing with the tools and DApps that are out there. Also, engage with the companies and projects that resonate most with you and follow influencers on Twitter.”

Kerry Leigh Miller, a founding partner of Overton Venture Capital

an early-stage venture fund investing in next-gen consumer brands and services. Kerry invests in, advises and amplifies best-in-class entrepreneurs and thought leaders across industries and functions.

What makes you excited about the crypto industry?

“The potential to transform every industry by creating incentives and protocols that have the potential to change the world for GOOD.”

Why were you at WEF in Davos and how do you think women can impact innovation in the global economy these days?

“I was there to: (1) share my thought leadership on venture capital, decentralization/Web3, (2) learn from other thought leaders in both business, social impact and politics and (3) create new partnerships. One of the ways where I have already seen women have impact is in DeFi and Web3. I believe women are better communicators. What can be an overwhelming and a complex area to understand, I believe women are stronger than men at educating and distilling Web3 and DeFi into simple use cases and connecting the dots.”

What advice would you give to women who want to start their career in crypto?

“Appoint a digital bodyguard (or several!) — someone who you trust to be your mentor/teacher. Start VERY slow and build from there.”

Thy Diep Ta, co-founder of Unit Network

She designs blockchain & crypto learning, mentoring & coaching programs. She has 15 years of experience in creating peer-to-peer and centralized training programs/curricula as well as transformation programs for self- and organizational development.

What makes you excited about the crypto industry?

“Web3 is an emerging industry with a phenomenal growth rate. As such, there are countless opportunities to come in, shake up and shape the world, and build ventures, products and solutions that drive zero to one farther than nine to 10 innovations. We need every hand to build the economy of tomorrow so everyone is highly welcomed and integrated very fast.”

Why were you at WEF in Davos and how do you think women can impact innovation in the global economy these days?

“When you think of the economy of tomorrow, there’s no way to not think about Web3. The World Economic Forum is the melting pot of ideas, talents and where you have diversity of thoughts. It’s the place where every voice can find its audience, and it’s the most fertile spot to build lasting and strong alliances to move the needle on topics such as women’s participation in the economy of tomorrow.”

What advice would you give to women who want to start their career in crypto?

“Please do not think that you don’t know enough about technology to participate. You can learn all you need within a (relatively) short period of time as our industry is still very young. Getting into it now is not too late; you will have an abnormal return on your time investment to skill up on what may prove to be a more impactful social innovation than the internet, itself. The time to enter is now. With DLT Talents, Unit Masters and H.E.R. DAO, we have created many initiatives that onboard you quickly and connect you with different communities to help you thrive and drive the token economy.”

Sandra Tusin of Mindstream AI and NFT.SOHO

She is the driving force behind Mindstream AI, which is partnering with the U.K. government and the Mayor of London to help underprivileged groups gain access to good education and jobs in technology. Sandra is also the co-founder of NFT.SOHO, which quickly gained prominence by bringing together collectors, artists and innovators at monthly events in London. She also currently works at Outlier Ventures.

What makes you excited about the crypto industry?

“I am thrilled about the number of use cases in blockchain and crypto, and how it can be used to decentralize and make many different industries more efficient and transparent.”

Why were you at WEF in Davos and how do you think women can impact innovation in the global economy these days?

“I was at Davos in order to be around like-minded individuals who care about making an impact that reaches beyond their personal lives. I think the boundaries for women partaking in all types of industries are breaking down more and women can certainly leave a mark on very early industries such as blockchain and [nonfungible tokens or] NFTs to make sure that what is being created and innovated has their input and therefore serves all genders of society well.”

What advice would you give to women who want to start their career in crypto?

“I would advise women to find other like-minded females and mentors, to help each other and learn from each other — it’s always easier to start something or learn something new if you have others pursuing the same journey with you or have already been through those struggles.”

Yuree Hong, founder and advisor of Shechain.co

She is passionate about the United Nations Sustainable Development Goals of Diversity & Inclusion and Education as well as the future of decentralized networks and artificial intelligence. She is a founder & advisor of shechain.co, showcasing women-led blockchain startups with a mission to make the blockchain industry inclusive.

What makes you excited about the crypto industry?

“Crypto enabled by blockchain technology has a hybrid impact involving political, economic and technological advancement. Today, we live in an era of uncertainties such as climate change and geopolitical issues — phenomena the world has experienced in the past when shifting to the new norm. I’m excited about working on the topic right at the beginning when the world is getting prepared for a new kind of transformation.”

Why were you at WEF in Davos, and how do you think women can impact innovation in the global economy these days?

“In Davos, I hosted the “Diversity Redefined: The Future of Women’s Economic Empowerment in Web 3” session. One of the challenges we’ve discovered was that there are not enough financial resources available for women. I believe that women entrepreneurs showing more successful use cases will re-educate the investment market and re-invent the perspectives when it comes to funding. I envision a world where everyone is recognized entirely by their deliverables as humans, regardless of gender. I’m working on shechain.co to achieve that.”

What advice would you give to women who want to start their career in crypto?

“Be curious. Applying a diverse approach will help you advance in the crypto and blockchain industry. If you are technical, try experimenting with app development on multiple protocols like Ethereum (ETH), Polygon (MATIC) or Near (NEAR). If you are more into crypto investing, diversifying your investment portfolio will help hedge against high volatility. If you are a business or marketing person, go to as many conferences or events as possible, yet remember to attend some technical sessions to fill in your technological understanding. I suggest investing your energy and time in understanding the fundamental value of crypto and blockchain.”

Juliet Su, the fund partner and ecosystem lead at NewTribe Capital

a venture capital firm based out of Dubai that invests in early-stage crypto and blockchain projects. Juliet has always been curious about ideas and innovation, which led her to the world of Web3, investing and venture capital.

What makes you thrilled about the crypto industry?

“For me, crypto is similar to the internet back in the 90s. It provides you a definite level of freedom, be it time, location, or work — freedom is the ultimate flex now. You can live where you want, travel around the world and yet be able to pay anyone hassle-free, and all of this thanks to crypto. What really ignites my passion is the rapidly changing market, where one has the opportunity to be constantly updated with the new trends, generate new ideas and explore new opportunities. That gives you room for constant personal growth and brings a real excitement when learning new things daily.”

Why are you at WEF in Davos and how do you think women can impact innovation in the global economy these days?

“I have attended Davos for several years before the pandemic and it’s exciting to come back here again. I simply love the community and its vibe. People here are very open-minded, eager to communicate and super helpful. It’s not only about coming here and doing business but also about building a quality network and having your energies recharged by the ideas from some of the brightest minds in the industry and mixing with like-minded people who are on the same path to change the world.

“My position on women’s impact is slightly different than most others. I don’t support any feminist movements nor champion any women’s leadership programs simply because I believe that their role in the global economy is inevitable. Women are the ones who inspire and back the global leaders, the ones who bring kindness and empathy to any business and often have a broader vision. With specific regard to the crypto space, for sure, I agree that there's a definite lack of women in the industry, which should be addressed to make things more scalable and adaptable.”

What advice would you give to women who want to start their career in crypto?

“I would say that there is no right time to start, you start when it works for you, and find your way. I’d suggest that beginners find their personal strong areas of interest and figure out where they are able to thrive. Start building your network, be bold and honest to yourself and never be afraid to step into the unknown world, exploring is the most exciting part, and the journey never ends.”

Irina Heaver, The Crypto Lawyer

Irina is a cryptocurrency and blockchain lawyer based in Dubai and Switzerland representing clients worldwide. She is highly regarded internationally for her extensive experience and deep technical knowledge of blockchain, smart contracts and cryptocurrency matters.

What makes you excited about the crypto industry?

“The main thing that excites me is Bitcoin and witnessing the full potential being unleashed. Less than 14% of the 570 million population of the Middle East have bank accounts. Some simply do not trust the banking system, some witnessed their country’s currency collapse multiple times just in the last years. Some do not have the required papers to open a bank account. I believe it is one of the basic dignities for each human to be able to participate in commerce and to make a living, and being excluded from financial and banking systems goes against that. Bitcoin fixes this. Each person with a cheap $50 smartphone is now able to participate in international commerce. Let me be clear here, I am not talking about banking the unbanked, I am talking about enabling each person to participate in international trade and commerce, just imagine the potential this will unleash.”

Why were you at WEF in Davos, and how do you think women can impact innovation in the global economy these days?

“I took this chance to come to Davos to participate in side events run by crypto companies, to speak on panels, to meet like-minded Bitcoiners and to speak out on the hypocrisy of the ruling unelected elite. For example, a lot of opposition is happening to Bitcoin mining, as it consumes energy and is allegedly bad for the environment, but here we are in Davos witnessing record helicopter traffic above our heads and the roads are full of petrol-guzzling limousines (with 1 single person being chauffeured around). Is this good for the environment? A lot of talks about banking the unbanked, but in reality, the banking requirements are becoming so ridiculous that we are witnessing the unbanking of the banked. And don’t get me started about digital identity and CBDCs – the perfect instruments of surveillance and quashing dissent.”

What advice would you give to women who want to start their career in crypto?

“The world is progressively moving digital, whether we like it or not, so getting a job in the crypto space makes perfect sense. All finances and financial instruments are already digital, crypto makes it decentralized and cryptographically secured. I would highly recommend attending events in your own city, joining WhatsApp and Telegram groups, finding like-minded people and joining them in the mission to make finance accessible for the many. Clearly, the opportunities ahead are exciting for any women who are looking to diversify and expand their careers in crypto. Learning resources are plentiful and community education is where it’s at — the openness of the community makes it easy to get started and stay active.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

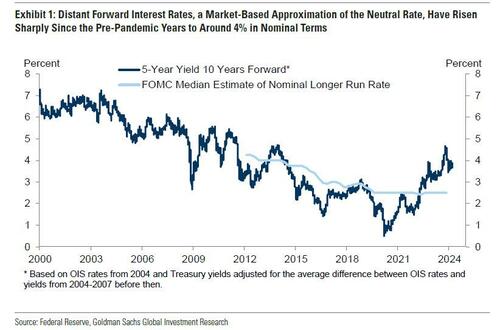

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

Spread & Containment

Household Net Interest Income Falls As Rates Spike

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

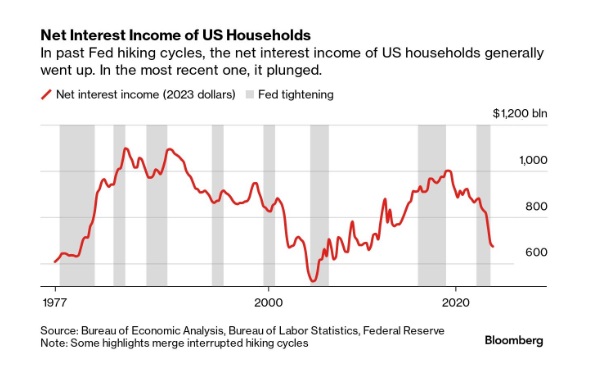

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment7 days ago

Spread & Containment7 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex