Uncategorized

The Time To Leave X(Twitter) Is Now

Bitcoiners understand that the centralization of money is bad for society, yet they use centralized social media platforms.

Bitcoin Twitter has been an exciting place over the last year as the Nostr and Ordinals protocols became the new up-and-coming protocols on the scene.

Ordinals exposed a fault line starting to form within the Bitcoin community. The ossifiers class that wants to keep Bitcoin the way it is versus the builders that want to explore and create new use cases for Bitcoin has turned into two distinct camps that will never reconcile their differences.

This has yet to happen with the NOSTR protocol. Capital has been pouring into development from some of the most well-known entities in Bitcoin. Primal, a nostr-focused client, recently secured $1 million in funding from Ten31 and Hivemind. Jack Dorsey, the former CEO of Twitter, has pledged $10 million to spur the development of the nostr protocol. Despite these positive developments, there hasn't been a mass exodus of Bitcoiners from X, formerly known as Twitter, to the freedom protocol. Why is that?

I'm shocked that most Bitcoiners have decided to stay behind the barbed wire fence of mass surveillance and have their data continually harvested for the benefit of Elon Musk.

The door to freedom is right before us, yet many decide to stay, but why?

For all the talk about incentives matter, the average Bitcoiner has fallen into the same social media trap that every other nocoiner has found themselves in. Here are a few reasons I believe Bitcoiners on X resist leaving the platform.

Network Effects Are A Hell Of A Drug

This is one of the main reasons why the most prominent voices on Twitter have yet to make the jump to being nostr only. X has been around much longer than the nostr protocol and is used by millions of people around the globe. If you are a Bitcoiner who has spent years building a massive Twitter following, it must be tough to migrate to a new platform with a much smaller user base and requires some technical knowledge to set up. It is easy to understand the rationale for staying on Twitter. There is too much to lose from a business perspective to make the jump.

By making this decision, they are missing an opportunity to introduce their audience to nostr and the idea of freedom tech in general. Staying on Twitter doesn't advance the mission of hyperbitcoinization because it perpetuates the usage of centralized communications platforms and undermines the message of freedom. Twitter might have a more extensive user base than Nostr, but when you look deeper at the numbers, it doesn't mean anything.

In the same survey, 25 percent of users said they would not be on the platform a year from now. That's a lot of people who will not learn about Bitcoin from X.

Usage of the app continues to decline year over year with no end in sight. Worldwide visits to Twitter.com dropped 7.3 percent year over year. Monthly active users on Android and iOS are down 15 percent for Android and 14 percent for iOS. X is on a slow-motion decline, so the argument that Bitcoiners should stay on X because it's more effective for orange pilling nocoiners doesn't hold water. Nocoiners are fleeing X in droves.

We also know social media companies are used to control and influence society worldwide. How can we advocate for separating money and state when we can’t even leave our Twitter accounts behind? Here are a few examples of the state using centralized social media platforms to its advantage:

- https://therecord.media/ukraine-police-raid-social-media-bot-farm

- https://reutersinstitute.politics.ox.ac.uk/news/despite-western-bans-putins-propaganda-flourishes-spanish-tv-and-social-media

- https://www.nbcnews.com/tech/tech-news/more-governments-ever-are-using-social-media-push-propaganda-report-n1076301

X certainly doesn't free humanity from the clutches of the surveillance state in any way; it traps us in a digital panopticon with no escape. If the goal is hyperbitcoinization, we should do everything possible to erode the state's power. Staying on X empowers the government by giving them unlimited access to our data. You might lose followers and money in the short term, but it's worth it. Short-term pain for long-term gain should be the priority. We are doing this for the kids, right?

Dopamine Hits Feelz Good

Who doesn't like posting a tweet and watching it go viral on Bitcoin Twitter? It gives you the massive dopamine rush that social media was designed for. This is why most of us keep coming back to Twitter in the first place. We want that dopamine mang! Think of Twitter as the drug dealer on the corner giving you all the dopamine you want. It's available on your phone 24 hours a day, seven days a week.

It has been clinically proven that when you receive a notification or retweet, your brain experiences an increased level of dopamine, further positively reinforcing the need to use social media. Did you know nearly 40 percent of those aged 18-22 reported feeling addicted to social media?

The engineers at X clearly understand this issue and have designed their platform to encourage people to stay there as long as possible. They are no fools. This is how they make money. I am guilty of scrolling away on X, but we all should be conscious of what they are trying to do.

Not saying nostr is the panacea to this problem, but the protocol doesn't have the mind-altering algos that are trying to keep you addicted to the protocol. Is it fair to say that nostr is better for your mental health? Just throwing that out there.

We Need To Live Our Values

This picture is the one that hit me the most and inspired me to write this article. As Bitcoiners, how can we rail against big tech and the surveillance state if we continue to use the tools the state uses to suppress free speech? How will we rally people to the cause of Bitcoin if we don't live by the very ideas we espouse to the world?

Using Twitter is, but one compromise, but one leads to another and another. We all live in a world of trade-offs. We should all strive for a world where freedom tech is the norm and not an exception. In general, Bitcoin and freedom tech have allowed us to remake the world and orient it towards peace and cooperation and away from the war, death, and destruction that the psychopaths in political office want to inflict on the common man.

Remember that the rich and powerful are not on our side. I urge all Bitcoiners to use nostr and slowly transition away from big tech because you never know when you will lose access to your data and all your hard work.

Here is my pubkey if you want to chat using freedom tech! I look forward to seeing you over there! Escape to freedom.

npub1cl4deuxsxk2ldqgq85q9xfn898253qjyfcrcnkqd2wdks7ppu43qn0gu8k

bitcoinUncategorized

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

One month after the inflation outlook tracked…

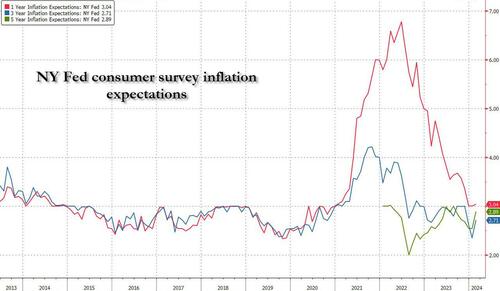

One month after the inflation outlook tracked by the NY Fed Consumer Survey extended their late 2023 slide, with 3Y inflation expectations in January sliding to a record low 2.4% (from 2.6% in December), even as 1 and 5Y inflation forecasts remained flat, moments ago the NY Fed reported that in February there was a sharp rebound in longer-term inflation expectations, rising to 2.7% from 2.4% at the three-year ahead horizon, and jumping to 2.9% from 2.5% at the five-year ahead horizon, while the 1Y inflation outlook was flat for the 3rd month in a row, stuck at 3.0%.

The increases in both the three-year ahead and five-year ahead measures were most pronounced for respondents with at most high school degrees (in other words, the "really smart folks" are expecting deflation soon). The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at all horizons, while the median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined at the one- and three-year ahead horizons and remained unchanged at the five-year ahead horizon.

Going down the survey, we find that the median year-ahead expected price changes increased by 0.1 percentage point to 4.3% for gas; decreased by 1.8 percentage points to 6.8% for the cost of medical care (its lowest reading since September 2020); decreased by 0.1 percentage point to 5.8% for the cost of a college education; and surprisingly decreased by 0.3 percentage point for rent to 6.1% (its lowest reading since December 2020), and remained flat for food at 4.9%.

We find the rent expectations surprising because it is happening just asking rents are rising across the country.

At the same time as consumers erroneously saw sharply lower rents, median home price growth expectations remained unchanged for the fifth consecutive month at 3.0%.

Turning to the labor market, the survey found that the average perceived likelihood of voluntary and involuntary job separations increased, while the perceived likelihood of finding a job (in the event of a job loss) declined. "The mean probability of leaving one’s job voluntarily in the next 12 months also increased, by 1.8 percentage points to 19.5%."

Mean unemployment expectations - or the mean probability that the U.S. unemployment rate will be higher one year from now - decreased by 1.1 percentage points to 36.1%, the lowest reading since February 2022. Additionally, the median one-year-ahead expected earnings growth was unchanged at 2.8%, remaining slightly below its 12-month trailing average of 2.9%.

Turning to household finance, we find the following:

- The median expected growth in household income remained unchanged at 3.1%. The series has been moving within a narrow range of 2.9% to 3.3% since January 2023, and remains above the February 2020 pre-pandemic level of 2.7%.

- Median household spending growth expectations increased by 0.2 percentage point to 5.2%. The increase was driven by respondents with a high school degree or less.

- Median year-ahead expected growth in government debt increased to 9.3% from 8.9%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.6 percentage point to 26.1%, remaining below its 12-month trailing average of 30%.

- Perceptions about households’ current financial situations deteriorated somewhat with fewer respondents reporting being better off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off and a slightly larger share of respondents expecting to be worse off a year from now.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 1.4 percentage point to 38.9%.

- At the same time, perceptions and expectations about credit access turned less optimistic: "Perceptions of credit access compared to a year ago deteriorated with a larger share of respondents reporting tighter conditions and a smaller share reporting looser conditions compared to a year ago."

Also, a smaller percentage of consumers, 11.45% vs 12.14% in prior month, expect to not be able to make minimum debt payment over the next three months

Last, and perhaps most humorous, is the now traditional cognitive dissonance one observes with these polls, because at a time when long-term inflation expectations jumped, which clearly suggests that financial conditions will need to be tightened, the number of respondents expecting higher stock prices one year from today jumped to the highest since November 2021... which incidentally is just when the market topped out during the last cycle before suffering a painful bear market.

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemployment-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex