Uncategorized

The Stablecoins Movement — Toward Stability in Crypto Assets

The Stablecoins Movement — Toward Stability in Crypto Assets

Blockchain technology is becoming more and more common in the traditional finance market with stablecoins and CBDCs — could these bring stability for the crypto industry?

Stablecoins have become widely popular in the digital currency industry because they don’t have the volatility associated with other cryptos like Bitcoin (BTC) for instance. Despite their popularity, the first wave of crypto assets — of which Bitcoin is the most popular — is failing as a reliable means of payment or store of value in several ways. They are susceptible to complicated user interfaces, highly volatile prices, issues in governance and regulation, and limits to scalability, among other challenges. Thus, instead of serving as a means of payment, cryptocurrencies in the past have often served as a highly speculative asset.

Related: Stablecoins, Explained

In response, the emerging stablecoins offer the features of conventional crypto assets, while linking the coin’s value to a real-world asset or pool of assets, thereby stabilizing its price. This stabilizing mechanism at the core of this initiative determines whether the units issued can effectively maintain a stable value or not. What is a working stablecoins definition? Per the Bank for International Settlements:

“Stablecoins, which have many of the features of earlier cryptocurrencies but seek to stabilize the price of the ‘coin’ by linking its value to that of a pool of assets, have the potential to contribute to the development of more efficient global payment arrangements.”

Needless to say, since the stablecoin price is more or less stable, it has become increasingly important in the digital currency space. Days before the entire world went into full lockdown, stablecoins and CBDCs, their government-backed sibling, were a hot topic that we have discussed at length.

In this article, I outline some of the crucial aspects of this new promise, beginning with a comprehensive list of stablecoins. Also, I look at how the industry’s giants are competing to make the best of the opportunity.

And, as per my new collaboration series of articles, I reached out to some industry leaders to get their thoughts (consensus), which I included below.

A list of stablecoins

What are the best stablecoins? The most common ones are fiat or asset-backed where the stablecoins serve as a digital representation for a specific asset — say, one coin equals one United States dollar. A second type is known as crypto collateralized stablecoins. Here, several distinct cryptocurrencies, put together in one group, act as a collateral for an issued stablecoin. Then, there are algorithmic stablecoins that eliminate the need for economic markets — a digital authority is created to stabilize the on-chain currency. To simplify, let’s look at an example from each category.

Tether stablecoins (asset-backed)

Endowed with a significant first-mover advantage, stablecoins are among the first crypto assets to surface. Issued by Tether Limited, it operates on the Omni protocol as a token issued on the blockchain. Not only is it backed by the U.S. dollar (USDT) but Tether is also pegged to the euro (EURT) due to the control wielded by the European Union. Additionally, it has launched a Chinese yuan-backed stablecoin (CHNT).

Tether crypto dominates the stablecoin market in terms of market capitalization and trading volume. In February 2019, it accounted for almost 90% of the entire market capitalization of stablecoins. While the market has been witnessing stiff competition, Tether’s quasi-monopoly remains unchallenged with its trading volumes hovering around 95% of the overall stablecoins market and the tether crypto price — which is pretty impressive. It also happens to be the largest tokenized stablecoin, with an average daily volume of $40,337,665,581 and a capitalization of $4,633,935,920, according to stablecoin CoinMarketCap.

Related: Tether Stablecoin: Can the Crypto Market Live Without It?

MakerDAO stablecoins (crypto-collateralized)

Even if a fully trustworthy audit was realized, any kind of regulatory issue is likely to jeopardize the convertibility of Tether. There are plenty of stable digital currencies available, but only one can claim to be widely used, decentralized and trustless — MakerDAO. The MakerDAO CDP portal is responsible for the generation of Dai (DAI), Maker’s in-house stablecoin. It offers an alternative that does not rely on existing models and, as a system, is largely analogous to a pawn shop loan. What is the MakerDAO price? It is backed by on-chain collateral, Ether (ETH), with a floating peg to one U.S. dollar.

Related: Back From the Crypt: MakerDAO Toes the Line Between Life and Death

The MakerDAO model leverages a dual token system comprising primarily of the stablecoins Dai and a secondary unit called Maker (MKR). Here, we’re looking at a Decentralized Autonomous Organization — that is, a decentralized organization represented by cryptographically encrypted “rules” controlled by all MKR holders on the network. They are responsible for carrying out various administrative tasks. As they are in charge of defining the risk parameters, they are also responsible for maintaining a stable Dai exchange rate.

NuBits stablecoins (algorithmic)

Building on Peercoin’s platform, NuBits (USNBT) has been operational since 2014 and is one of the oldest algorithmic stablecoins, with a peak capitalization of $674,584 and a daily volume of $13,176.59, according to CoinMarketCap. Although it recovered remarkably from a major loss of confidence back in 2016 and was additionally able to withstand temporary price fluctuations, the value of NuBits coins failed to recover after a drop in March 2018.

Its stability mechanism largely relies on a dual token design. Share token holders can initiate the creation of new NuBits. However, the share tokens are not pegged to any specific price; they have a fixed supply; and they can be used to validate transactions. The contraction of the NuBits supply is incentivized through dynamic rewards for locking NuBits.

Coinbase vs. Binance — The race for stablecoins

Of all the companies operating in the crypto market, none have grown as significantly in terms of the crypto market cap as these behemoths that have exceeded Morris Katz in painting a new industry. There have also been multiple claims about Binance being the fastest profitable startup to achieve unicorn status — a private company valued over $1 billion. However, Binance is not the undisputed king — Coinbase saw similar explosive growth when the exchange reached a valuation of $8B from $483M in just one year. Coinbase charts are thus looking great.

Binance, though, has a complete monopoly over the market in terms of the trading volume. On Dec. 18, the 24-hour trading volume was $1,448,959,110 (it was approximately $241,458,067 across all trading pairs on the Coinbase Pro exchange although it has significantly increased). Moreover, Binance has a very low fee of just 0.05% per trade for its Binance Coin (BNB). Once you purchase Bitcoin, Litecoin (LTC) or Ether, you can use Binance to convert one of those into nearly any altcoin.

Although Binance has overtaken Coinbase in many ways, it barred American users from its global exchange thanks to regulatory reasons. However, they opened a smaller exchange called Binance.US to continue serving American customers after receiving approval from the New York State Department of Financial Services.

However, days later, Coinbase announced the establishment of the Crypto Rating Council, of which Coinbase and Kraken were two of the founding members, along with other predominantly U.S. firms (Binance was, as you may have guessed, excluded).

Circle’s entry into the stablecoins movement

Although it had emerged as a behemoth of the industry in 2018, Circle, by the end of 2019, had discontinued its payments app and sold Poloniex to an Asia-based consortium. Thereafter, its footprint continued to shrink. The company’s strategic roadmap for the year 2020 involved the sale of its over-the-counter trading desk to Kraken for global expansion.

Kraken, the cryptocurrency exchange based in San Francisco, has been pursuing its expansion spree for a while with the acquisition of product-specific firms. This vital sale will help Circle not just to focus solely on its stablecoins but also to reorganize resources, improve team agility, achieve a specialized product portfolio and lower complexity in operations.

According to Cryptobriefing, it will perhaps soon assume a leading role in the stablecoin project’s infrastructure.

Blockchain consensus with industry leaders

Here’s what other industry leaders feel about this important topic.

Andy Cheung, the founder of ACDX and the former COO of OKEx:

“Stablecoins seem to offer the best of both worlds: utilizing blockchain technology and offering stable value. Personally, I see it merely as a branch of cryptocurrency and is developed to cope with regulations. The most successful model is fiat-backed stablecoin, yet it failed to align with the vision of Bitcoin — to liberate money from banks and giants. That said, it plays a crucial role in the mass adoption of cryptocurrency and bridges the gap between crypto and fiat.”

Paul Veradittakit, partner of Pantera Capital:

“Pantera is an investor in both Maker and Circle. I believe that stablecoins are important for payments, decentralized finance and other applications, and it will be great to see how they evolve and gain adoption. At the end of the day, one way folks can go out to market is having the right relationships and use cases such as payments, Eco and Luna are both great examples of that.”

Vincent Molinari, the founder, CEO and host of Fintech.TV and Digital Asset Report, and the CEO of Molinari Media:

“As the evolution of finance and technology continue to intersect globally, cryptography will continue to deepen its role in global capital flows. The advent of stablecoins, with underlying pooled assets, will continue to be woven into payment systems. This will perhaps see its most significant near-term adoption in the global securities settlement processes. This will create efficiency and scale between global counterparties and meaningful cost savings will be achieved in the cost of carrying capital between transacting syndicates and consortiums as continuous linked settlement and netting will occur via top tier stable coin usage.”

What lies ahead as far as stablecoins are concerned?

The coming years will possibly witness the advent of the second generation of branded stablecoin projects that would include secondary market liquidity, loyalty program integration and branding opportunities. Moreover, now that we have the much-controversial Facebook’s Libra, we might expect stablecoins from other major brands with a large customer network like Delta and Amazon.

Related: Can Blockchain Survive Mass Adoption? Future Perils Disclosed

Further, the Bank of Canada governor mentioned stablecoins in his 2020 vision. It’s true that just like any other invention, stablecoins offer as many conundrums as they do potential benefits. Yet, it’ll be wise on the part of policymakers to envision far-sighted regulatory regimes that will serve to meet the challenge and usher in a less fluctuating future for the stablecoin cryptocurrency.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, you should conduct your own research when making a decision.

J.D. Salbego, is the CEO of Legion Ventures. He is a global leader in blockchain and digital securities with a history of working with industry-leading startups, crypto funds, institutions and governments to drive blockchain innovation, STOs/ICOs, crypto capital markets, international expansion, digital asset fund strategy and go-to-market frameworks. His work has been featured in Forbes, Business Insider and Yahoo. As a market influencer, a speaker, a published author and an internationally recognized subject matter expert, Salbego is frequently invited to speak at leading conferences like the World Economic Forum, BlockShow and Delta Summit.

Uncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

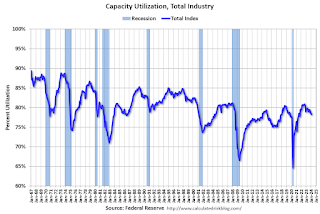

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

Uncategorized

Southwest and United Airlines have bad news for passengers

Both airlines are facing the same problem, one that could lead to higher airfares and fewer flight options.

Airlines operate in a market that's dictated by supply and demand: If more people want to fly a specific route than there are available seats, then tickets on those flights cost more.

That makes scheduling and predicting demand a huge part of maximizing revenue for airlines. There are, however, numerous factors that go into how airlines decide which flights to put on the schedule.

Related: Major airline faces Chapter 11 bankruptcy concerns

Every airport has only a certain number of gates, flight slots and runway capacity, limiting carriers' flexibility. That's why during times of high demand — like flights to Las Vegas during Super Bowl week — do not usually translate to airlines sending more planes to and from that destination.

Airlines generally do try to add capacity every year. That's become challenging as Boeing has struggled to keep up with demand for new airplanes. If you can't add airplanes, you can't grow your business. That's caused problems for the entire industry.

Every airline retires planes each year. In general, those get replaced by newer, better models that offer more efficiency and, in most cases, better passenger amenities.

If an airline can't get the planes it had hoped to add to its fleet in a given year, it can face capacity problems. And it's a problem that both Southwest Airlines (LUV) and United Airlines have addressed in a way that's inevitable but bad for passengers.

Image source: Kevin Dietsch/Getty Images

Southwest slows down its pilot hiring

In 2023, Southwest made a huge push to hire pilots. The airline lost thousands of pilots to retirement during the covid pandemic and it needed to replace them in order to build back to its 2019 capacity.

The airline successfully did that but will not continue that trend in 2024.

"Southwest plans to hire approximately 350 pilots this year, and no new-hire classes are scheduled after this month," Travel Weekly reported. "Last year, Southwest hired 1,916 pilots, according to pilot recruitment advisory firm Future & Active Pilot Advisors. The airline hired 1,140 pilots in 2022."

The slowdown in hiring directly relates to the airline expecting to grow capacity only in the low-single-digits percent in 2024.

"Moving into 2024, there is continued uncertainty around the timing of expected Boeing deliveries and the certification of the Max 7 aircraft. Our fleet plans remain nimble and currently differs from our contractual order book with Boeing," Southwest Airlines Chief Financial Officer Tammy Romo said during the airline's fourth-quarter-earnings call.

"We are planning for 79 aircraft deliveries this year and expect to retire roughly 45 700 and 4 800, resulting in a net expected increase of 30 aircraft this year."

That's very modest growth, which should not be enough of an increase in capacity to lower prices in any significant way.

United Airlines pauses pilot hiring

Boeing's (BA) struggles have had wide impact across the industry. United Airlines has also said it was going to pause hiring new pilots through the end of May.

United (UAL) Fight Operations Vice President Marc Champion explained the situation in a memo to the airline's staff.

"As you know, United has hundreds of new planes on order, and while we remain on path to be the fastest-growing airline in the industry, we just won't grow as fast as we thought we would in 2024 due to continued delays at Boeing," he said.

"For example, we had contractual deliveries for 80 Max 10s this year alone, but those aircraft aren't even certified yet, and it's impossible to know when they will arrive."

That's another blow to consumers hoping that multiple major carriers would grow capacity, putting pressure on fares. Until Boeing can get back on track, it's unlikely that competition between the large airlines will lead to lower fares.

In fact, it's possible that consumer demand will grow more than airline capacity which could push prices higher.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic stocks-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex