Spread & Containment

The Right To Bodily Integrity: Nobody Wins And We All Lose In The COVID-19 Showdown

The Right To Bodily Integrity: Nobody Wins And We All Lose In The COVID-19 Showdown

Authored by John W. Whitehead & Nisha Whitehead via The Rutherford Institute,

“We’ve reached the point where state actors can penetrate rectums…

Authored by John W. Whitehead & Nisha Whitehead via The Rutherford Institute,

“We’ve reached the point where state actors can penetrate rectums and vaginas, where judges can order forced catheterizations, and where police and medical personnel can perform scans, enemas and colonoscopies without the suspect’s consent. And these procedures aren’t to nab kingpins or cartels, but people who at worst are hiding an amount of drugs that can fit into a body cavity. In most of these cases, they were suspected only of possession or ingestion. Many of them were innocent... But these tactics aren’t about getting drugs off the street... These tactics are instead about degrading and humiliating a class of people that politicians and law enforcement have deemed the enemy.”

- Radley Balko, The Washington Post

Freedom is never free.

There is always a price—always a sacrifice—that must be made in order to safeguard one’s freedoms.

Where that transaction becomes more complicated is when one has to balance the rights of the individual with the needs of the community.

Philosophers such as Thomas Hobbes, John Locke and Jean-Jacques Rousseau envisioned the social contract between the individual and a nation’s rulers as a means of finding that balance. Invariably, however, those in power grow greedy, and what was intended to be a symbiotic relationship with both sides benefitting inevitably turns into a parasitic one, with a clear winner and a clear loser.

We have seen this vicious cycle play out over and over again throughout the nation’s history.

Just look at this COVID-19 pandemic: the whole sorry mess has been so overtly politicized, propagandized, and used to expand the government’s powers (and Corporate America’s bank balance) that it’s difficult at times to distinguish between what may be legitimate health concerns and government power grabs.

After all, the government has a history of shamelessly exploiting national emergencies for its own nefarious purposes. Terrorist attacks, mass shootings, civil unrest, economic instability, pandemics, natural disasters: the government has been taking advantage of such crises for years now in order to gain greater power over an unsuspecting and largely gullible populace.

This COVID-19 pandemic is no different.

Yet be warned: we will all lose if this pandemic becomes a showdown between COVID-19 vaccine mandates and the right to bodily integrity.

It doesn’t matter what your trigger issue is—whether it’s vaccines, abortion, crime, religion, immigration, terrorism or some other overtly politicized touchstone used by politicians as a rallying cry for votes—we should all be concerned when governments and businesses (i.e., the Corporate State) join forces to compel individuals to sacrifice their right to bodily integrity (which goes hand in hand with the right to conscience and religious freedom) on the altar of so-called safety and national security.

That’s exactly what’s unfolding right now, with public and private employers using the threat of termination to force employees to be vaccinated against COVID-19.

Unfortunately, legal protections in this area are limited.

While the Americans with Disabilities Act protects those who can prove they have medical conditions that make receiving a vaccination dangerous, employees must be able to prove they have a sensitivity to vaccines.

Beyond that, employees with a religious objection to the vaccine mandate can try to request an exemption, but even those who succeed in gaining an exemption to a vaccine mandate may have to submit to routine COVID testing and mask requirements, especially if their job involves contact with other individuals.

Under the First Amendment and Title VII of the Civil Rights Act of 1964, individuals have a right of conscience and/or religious freedom to ask that their sincere religious beliefs against receiving vaccinations be accommodated. To this end, The Rutherford Institute has issued guidance and an in-depth fact sheet and model letter for those seeking a religious exemption to a COVID-19 vaccine mandate in the workplace. The Rutherford Institute’s policy paper, “Know Your Rights: How To Request a Religious Accommodation for COVID-19 Vaccine Mandates in the Workplace,” goes into the details of how and why and in which forums one can request such accommodation, but there is no win-win scenario.

As with all power plays of this kind, the ramifications of empowering the government and its corporate partners to force individuals to choose between individual liberty and economic survival during a so-called state of “emergency” can lead to terrifying results.

At a minimum, it’s a slippery slope that justifies all manner of violations in the name of national security, the interest of the state and the so-called greater good.

If the government—be it the President, Congress, the courts or any federal, state or local agent or agency—can willfully disregard the rights of any particular person or group of persons, then that person becomes less than a citizen, less than human, less than deserving of respect, dignity, civility and bodily integrity. He or she becomes an “it,” a faceless number that can be tallied and tracked, a quantifiable mass of cells that can be discarded without conscience, an expendable cost that can be written off without a second thought, or an animal that can be bought, sold, branded, chained, caged, bred, neutered and euthanized at will.

That’s exactly where we find ourselves now: caught in the crosshairs of a showdown between the rights of the individual and the so-called “emergency” state.

All of those freedoms we cherish—the ones enshrined in the Constitution, the ones that affirm our right to free speech and assembly, due process, privacy, bodily integrity, the right to not have police seize our property without a warrant, or search and detain us without probable cause—amount to nothing when the government and its agents are allowed to disregard those prohibitions on government overreach at will.

This is the grim reality of life in the American police state.

Our so-called rights have been reduced to technicalities in the face of the government’s ongoing power grabs.

Yet those who founded this country believed that what we conceive of as our rights were given to us by God—we are created equal, according to the nation’s founding document, the Declaration of Independence—and that government cannot create nor can it extinguish our God-given rights. To do so would be to anoint the government with god-like powers and elevate it above the citizenry.

And that, in a nutshell, is what happens when government officials are allowed to determine who is deserving of constitutional rights and who should be stripped of those rights for whatever reason may be justified by the courts and the legislatures.

In this way, concerns about COVID-19 mandates and bodily integrity are part of a much larger debate over the ongoing power struggle between the citizenry and the government over our property “interest” in our bodies. For instance, who should get to decide how “we the people” care for our bodies? Are we masters over our most private of domains, our bodies? Or are we merely serfs who must answer to an overlord that gets the final say over whether and how we live or die?

This debate over bodily integrity covers broad territory, ranging from abortion and euthanasia to forced blood draws, biometric surveillance and basic healthcare.

Forced vaccinations are just the tip of the iceberg.

Forced vaccinations, forced cavity searches, forced colonoscopies, forced blood draws, forced breath-alcohol tests, forced DNA extractions, forced eye scans, forced inclusion in biometric databases: these are just a few ways in which Americans continue to be reminded that we have no control over what happens to our bodies during an encounter with government officials.

Consider the case of Mitchell vs. Wisconsin in which the U.S. Supreme Court in a 5-4 decision found nothing wrong when police officers read an unconscious man his rights and then proceeded to forcibly and warrantlessly draw his blood while he was still unconscious in order to determine if he could be charged with a DUI.

To sanction this forced blood draw, the cops and the courts hitched their wagon to state “implied consent” laws (all of the states have them), which suggest that merely driving on a state-owned road implies that a person has consented to police sobriety tests, breathalyzers and blood draws.

More than half of the states (29 states) allow police to do warrantless, forced blood draws on unconscious individuals whom they suspect of driving while intoxicated.

Seven state appeals courts have declared these warrantless blood draws when carried out on unconscious suspects are unconstitutional. Courts in seven other states have found that implied consent laws run afoul of the Fourth Amendment. And yet seven other states (including Wisconsin) have ruled that implied consent laws provide police with a free pass when it comes to the Fourth Amendment and forced blood draws.

Read the writing on the wall, and you’ll see how little remains of our right to bodily integrity in the face of the government’s steady assaults on the Fourth Amendment.

Our freedoms—especially the Fourth Amendment—continue to be strangulated by a prevailing view among government bureaucrats that they have the right to search, seize, strip, scan, spy on, probe, pat down, taser, and arrest any individual at any time and for the slightest provocation.

Worse, on a daily basis, Americans are being made to relinquish the most intimate details of who we are—our biological makeup, our genetic blueprints, and our biometrics (facial characteristics and structure, fingerprints, iris scans, etc.)—in order to clear the nearly insurmountable hurdle that increasingly defines life in the United States: we are now guilty until proven innocent.

Such is life in America today that individuals are being threatened with arrest and carted off to jail for the least hint of noncompliance, homes are being raided by militarized SWAT teams under the slightest pretext, property is being seized on the slightest hint of suspicious activity, and roadside police stops have devolved into government-sanctioned exercises in humiliation and degradation with a complete disregard for privacy and human dignity.

While forced searches—of one’s person and property—may span a broad spectrum of methods and scenarios, the common denominator remains the same: a complete disregard for the dignity and rights of the citizenry.

Unfortunately, the indignities being heaped upon us by the architects and agents of the American police state—whether or not we’ve done anything wrong—are just a foretaste of what is to come.

The government doesn’t need to tie you to a gurney and forcibly take your blood or strip you naked by the side of the road in order to render you helpless. As this showdown over COVID-19 vaccine mandates makes clear, the government has other methods—less subtle perhaps but equally devastating—of stripping you of your independence, robbing you of your dignity, and undermining your rights.

With every court ruling that allows the government to operate above the rule of law, every piece of legislation that limits our freedoms, and every act of government wrongdoing that goes unpunished, we’re slowly being conditioned to a society in which we have little real control over our bodies or our lives.

You may not realize it yet, but you are not free.

If you believe otherwise, it is only because you have made no real attempt to exercise your freedoms.

Had you attempted to exercise your freedoms before now by questioning a police officer’s authority, challenging an unjust tax or fine, protesting the government’s endless wars, defending your right to privacy against the intrusion of surveillance cameras, or any other effort that challenges the government’s power grabs and the generally lopsided status quo, you would have already learned the hard way that the American Police State has no appetite for freedom and it does not tolerate resistance.

This is called authoritarianism, a.k.a. totalitarianism, a.k.a. oppression.

As Glenn Greenwald notes for the Guardian:

Oppression is designed to compel obedience and submission to authority. Those who voluntarily put themselves in that state – by believing that their institutions of authority are just and good and should be followed rather than subverted – render oppression redundant, unnecessary. Of course people who think and behave this way encounter no oppression. That's their reward for good, submissive behavior. They are left alone by institutions of power because they comport with the desired behavior of complacency and obedience without further compulsion. But the fact that good, obedient citizens do not themselves perceive oppression does not mean that oppression does not exist.

Get ready to stand your ground or run for your life.

As I make clear in my book Battlefield America: The War on the American People, our government “of the people, by the people and for the people” has been transformed into a greedy pack of wolves that is on the hunt.

“We the people” are the prey.

Spread & Containment

AI can help predict whether a patient will respond to specific tuberculosis treatments, paving way for personalized care

People have been battling tuberculosis for thousands of years, and drug-resistant strains are on the rise. Analyzing large datasets with AI can help humanity…

Tuberculosis is the world’s deadliest bacterial infection. It afflicted over 10 million people and took 1.3 million lives in 2022. These numbers are predicted to increase dramatically because of the spread of multidrug-resistant TB.

Why does one TB patient recover from the infection while another succumbs? And why does one drug work in one patient but not another, even if they have the same disease?

People have been battling TB for millennia. For example, researchers have found Egyptian mummies from 2400 BCE that show signs of TB. While TB infections occur worldwide, the countries with the highest number of multidrug-resistant TB cases are Ukraine, Moldova, Belarus and Russia.

Researchers predict that the ongoing war in Ukraine will result in an increase in multidrug-resistant TB cases because of health care disruptions. Additionally, the COVID-19 pandemic reduced access to TB diagnosis and treatment, reversing decades of progress worldwide.

Rapidly and holistically analyzing available medical data can help optimize treatments for each patient and reduce drug resistance. In our recently published research, my team and I describe a new AI tool we developed that uses worldwide patient data to guide more personalized and effective treatment of TB.

Predicting success or failure

My team and I wanted to identify what variables can predict how a patient responds to TB treatment. So we analyzed more than 200 types of clinical test results, medical imaging and drug prescriptions from over 5,000 TB patients in 10 countries. We examined demographic information such as age and gender, prior treatment history and whether patients had other conditions. Finally, we also analyzed data on various TB strains, such as what drugs the pathogen is resistant to and what genetic mutations the pathogen had.

Looking at enormous datasets like these can be overwhelming. Even most existing AI tools have had difficulty analyzing large datasets. Prior studies using AI have focused on a single data type – such as imaging or age alone – and had limited success predicting TB treatment outcomes.

We used an approach to AI that allowed us to analyze a large and diverse number of variables simultaneously and identify their relationship to TB outcomes. Our AI model was transparent, meaning we can see through its inner workings to identify the most meaningful clinical features. It was also multimodal, meaning it could interpret different types of data at the same time.

Once we trained our AI model on the dataset, we found that it could predict treatment prognosis with 83% accuracy on newer, unseen patient data and outperform existing AI models. In other words, we could feed a new patient’s information into the model and the AI would determine whether a specific type of treatment will either succeed or fail.

We observed that clinical features related to nutrition, particularly lower BMI, are associated with treatment failure. This supports the use of interventions to improve nourishment, as TB is typically more prevalent in undernourished populations.

We also found that certain drug combinations worked better in patients with certain types of drug-resistant infections but not others, leading to treatment failure. Combining drugs that are synergistic, meaning they enhance each other’s potency in the lab, could result in better outcomes. Given the complex environment in the body compared with conditions in the lab, it has so far been unclear whether synergistic relationships between drugs in the lab hold up in the clinic. Our results suggest that using AI to weed out antagonistic drugs, or drugs that inhibit or counteract each other, early in the drug discovery process can avoid treatment failures down the line.

Ending TB with the help of AI

Our findings may help researchers and clinicians meet the World Health Organization’s goal to end TB by 2035, by highlighting the relative importance of different types of clinical data. This can help prioritize public health efforts to mitigate TB.

While the performance of our AI tool is promising, it isn’t perfect in every case, and more training is needed before it can be used in the clinic. Demographic diversity can be high within a country and may even vary between hospitals. We are working to make this tool more generalizable across regions.

Our goal is to eventually tailor our AI model to identify drug regimens suitable for individuals with certain conditions. Instead of a one-size-fits-all treatment approach, we hope that studying multiple types of data can help physicians personalize treatments for each patient to provide the best outcomes.

Sriram Chandrasekaran receives funding from the US National Institutes of Health.

treatment genetic pandemic covid-19 spread russia ukraine world health organizationGovernment

Young People Aren’t Nearly Angry Enough About Government Debt

Young People Aren’t Nearly Angry Enough About Government Debt

Authored by The American Institute for Economic Research,

Young people sometimes…

Authored by The American Institute for Economic Research,

Young people sometimes seem to wake up in the morning in search of something to be outraged about. We are among the wealthiest and most educated humans in history. But we’re increasingly convinced that we’re worse off than our parents were, that the planet is in crisis, and that it’s probably not worth having kids.

I’ll generalize here about my own cohort (people born after 1981 but before 2010), commonly referred to as Millennials and Gen Z, as that shorthand corresponds to survey and demographic data. Millennials and Gen Z have valid economic complaints, and the conditions of our young adulthood perceptibly weakened traditional bridges to economic independence. We graduated with record amounts of student debt after President Obama nationalized that lending. Housing prices doubled during our household formation years due to zoning impediments and chronic underbuilding. Young Americans say economic issues are important to us, and candidates are courting our votes by promising student debt relief and cheaper housing (which they will never be able to deliver).

Young people, in our idealism and our rational ignorance of the actual appropriations process, typically support more government intervention, more spending programs, and more of every other burden that has landed us in such untenable economic circumstances to begin with. Perhaps not coincidentally, young people who’ve spent the most years in the increasingly partisan bubble of higher education are also the most likely to favor expanded government programs as a “solution” to those complaints.

It’s Your Debt, Boomer

What most young people don’t yet understand is that we are sacrificing our young adulthood and our financial security to pay for debts run up by Baby Boomers. Part of every Millennial and Gen-Z paycheck is payable to people the same age as the members of Congress currently milking this system and miring us further in debt.

Our government spends more than it can extract from taxpayers. Social Security, which represents 20 percent of government spending, has run an annual deficit for 15 years. Last year Social Security alone overspent by $22.1 billion. To keep sending out checks to retirees, Social Security goes begging to the Treasury Department, and the Treasury borrows from the public by issuing bonds. Bonds allow investors (who are often also taxpayers) to pay for some retirees’ benefits now, and be paid back later. But investors only volunteer to lend Social Security the money it needs to cover its bills because the (younger) taxpayers will eventually repay the debt — with interest.

In other words, both Social Security and Medicare, along with various smaller federal entitlement programs, together comprising almost half of the federal budget, have been operating for a decade on the principle of “give us the money now, and stick the next generation with the check.” We saddle future generations with debt for present-day consumption.

The second largest item in the budget after Social Security is interest on the national debt — largely on Social Security and other entitlements that have already been spent. These mandatory benefits now consume three quarters of the federal budget: even Congress is not answerable for these programs. We never had the chance for our votes to impact that spending (not that older generations were much better represented) and it’s unclear if we ever will.

Young Americans probably don’t think much about the budget deficit (each year’s overspending) or the national debt (many years’ deficits put together, plus interest) much at all. And why should we? For our entire political memory, the federal government, as well as most of our state governments, have been steadily piling “public” debt upon our individual and collective heads. That’s just how it is. We are the frogs trying to make our way in the watery world as the temperature ticks imperceptibly higher. We have been swimming in debt forever, unaware that we’re being economically boiled alive.

Millennials have somewhat modest non-mortgage debt of around $27,000 (some self-reports say twice that much), including car notes, student loans, and credit cards. But we each owe more than $100,000 as a share of the national debt. And we don’t even know it.

When Millennials finally do have babies (and we are!) that infant born in 2024 will enter the world with a newly minted Social Security Number and $78,089 credit card bill for Granddad’s heart surgery and the interest on a benefit check that was mailed when her parents were in middle school.

Headlines and comments sections love to sneer at “snowflakes” who’ve just hit the “real world,” and can’t figure out how to make ends meet, but the kids are onto something. A full 15 percent of our earnings are confiscated to pay into retirement and healthcare programs that will be insolvent by the time we’re old enough to enjoy them. The Federal Reserve and government debt are eating the economy. The same interest rates that are pushing mortgages out of reach are driving up the cost of interest to maintain the debt going forward. As we learn to save and invest, our dollars are slowly devalued. We’re right to feel trapped.

Sure, if we’re alive and own a smartphone, we’re among the one percent of the wealthiest humans who’ve ever lived. Older generations could argue (persuasively!) that we have no idea what “poverty” is anymore. But with the state of government spending and debt…we are likely to find out.

Despite being richer than Rockefeller, Millennials are right to say that the previous ways of building income security have been pushed out of reach. Our earning years are subsidizing not our own economic coming-of-age, but bank bailouts, wars abroad, and retirement and medical benefits for people who navigated a less-challenging wealth-building landscape.

Redistribution goes both ways. Boomers are expected to pass on tens of trillions in unprecedented wealth to their children (if it isn’t eaten up by medical costs, despite heavy federal subsidies) and older generations’ financial support of the younger has had palpable lifting effects. Half of college costs are paid by families, and the trope of young people moving back home is only possible if mom and dad have the spare room and groceries to make that feasible.

Government “help” during COVID-19 resulted in the worst inflation in 40 years, as the federal government spent $42,000 per citizen on “stimulus” efforts, right around a Millennial’s average salary at that time. An absurd amount of fraud was perpetrated in the stimulus to save an economy from the lockdown that nearly ruined it. Trillions in earmarked goodies were rubber stamped, carelessly added to young people’s growing bill. Government lenders deliberately removed fraud controls, fearing they couldn’t hand out $800 billion in young people’s future wages away fast enough. Important lessons were taught by those programs. The importance of self-sufficiency and the dignity of hard work weren’t top of the list.

Boomer Benefits are Stagnating Hiring, Wages, and Investment for Young People

Even if our workplace engagement suffered under government distortions, Millennials continue to work more hours than other generations and invest in side hustles and self employment at higher rates. Working hard and winning higher wages almost doesn’t matter, though, when our purchasing power is eaten from the other side. Buying power has dropped 20 percent in just five years. Life is $11,400/year more expensive than it was two years ago and deficit spending is the reason why.

We’re having trouble getting hired for what we’re worth, because it costs employers 30 percent more than just our wages to employ us. The federal tax code both requires and incentivizes our employers to transfer a bunch of what we earned directly to insurance companies and those same Boomer-busted federal benefits, via tax-deductible benefits and payroll taxes. And the regulatory compliance costs of ravenous bureaucratic state. The price paid by each employer to keep each employee continues to rise — but Congress says your boss has to give most of the increase to someone other than you.

Federal spending programs that many people consider good government, including Social Security, Medicare, Medicaid, and health insurance for children (CHIP) aren’t a small amount of the federal budget. Government spends on these programs because people support and demand them, and because cutting those benefits would be a re-election death sentence. That’s why they call cutting Social Security the “third rail of politics.” If you touch those benefits, you die. Congress is held hostage by Baby Boomers who are running up the bill with no sign of slowing down.

Young people generally support Social Security and the public health insurance programs, even though a 2021 poll by Nationwide Financial found 47 percent of Millennials agree with the statement “I will not get a dime of the Social Security benefits I have earned.”

In the same survey, Millennials were the most likely of any generation to believe that Social Security benefits should be enough to live on as a sole income, and guessed the retirement age was 52 (it’s 67 for anyone born after 1959 — and that’s likely to rise). Young people are the most likely to see government guarantees as a valid way to live — even though we seem to understand that those promises aren’t guarantees at all.

Healthcare costs tied to an aging population and wonderful-but-expensive growth in medical technologies and medications will balloon over the next few years, and so will the deficits in Boomer benefit programs. Newly developed obesity drugs alone are expected to add $13.6 billion to Medicare spending. By 2030, every single Baby Boomer will be 65, eligible for publicly funded healthcare.

The first Millennial will be eligible to claim Medicare (assuming the program exists and the qualifying age is still 65, both of which are improbable) in 2046. As it happens, that’s also the year that the Boomer benefits programs (which will then be bloated with Gen Xers) and the interest payments we’re incurring to provide those benefits now, are projected to consume 100 percent of federal tax revenue.

Government spending is being transferred to bureaucrats and then to the beneficiaries of government spending who are, in some sense, your diabetic grandma who needs a Medicare-paid dialysis treatment, but in a much more immediate sense, are the insurance companies, pharma giants, and hospital corporations who wrote the healthcare legislation. Some percentage of every college graduate’s paycheck buys bullets that get fired at nothing and inflating the private investment portfolios of government contractors, with dubious, wasteful outcomes from the prison-industrial complex to the perpetual war machine.

No bank or nation in the world can lend the kind of money the American government needs to borrow to fulfill its obligations to citizens. Someone will have to bite the bullet. Even some of the co-authors of the current disaster are wrestling with the truth.

Forget avocado toast and streaming subscriptions. We’re already sensing it, but we haven’t yet seen it. Young people are not well-informed, and often actively misled, about what’s rotten in this economic system. But we are seeing the consequences on store shelves and mortgage contracts and we can sense disaster is coming. We’re about to get stuck with the bill.

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

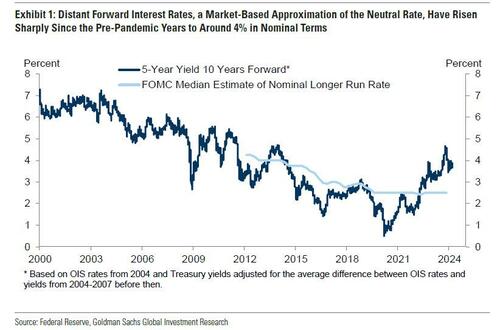

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex