Uncategorized

The Reasons Behind The Unexplained Departure Of Tesla CFO – Shortseller

Stanphyl Capital’s commentary for the month ended August 31, 2023, discussing their short position in Tesla Inc (NASDAQ:TSLA). Tesla’s CFO … Read…

Stanphyl Capital’s commentary for the month ended August 31, 2023, discussing their short position in Tesla Inc (NASDAQ:TSLA).

Tesla's CFO Departs

The big August news from Tesla was the sudden and unexplained departure of its CFO, the latest in a series of sudden and unexplained Tesla CFO departures. One possible explanation is obvious: Elon Musk is a pathological liar and securities fraudster “in plain sight.”

Why would he let his CFOs run the books honestly when they’re not “in plain sight” and hundreds of billions of dollars of his personal compensation depends on their results? Perhaps at some point the latest CFO decided he had pulled enough money out of the company (an incredible $590 million!) and wanted to be free to spend it, rather than behind bars dreaming about it!

Or perhaps the CFO’s resignation was tied into July’s Reuters revelation of a massive & systemic Elon Musk-directed consumer fraud regarding the range of Tesla’s cars, or Musk’s alleged theft of company assets to build himself a house, both of which it was revealed in August are being investigated by the DOJ.

Or perhaps the CFO quit because in May Handelsblatt revealed a massive & systemic Tesla safety cover-up while people continue to die in (or because of) Teslas at an astounding pace. Regardless, whether from these transgressions or something else, Musk will go down because people like him always do.

Q2 Earnings

Meanwhile, in July Tesla reported Q2 earnings that proved once again it’s now just a low-margin car company forced to continually slash prices to maintain delivery volume, and on the conference call Musk insinuated that the price-slashing will continue (as it did yet again in China in August). Rather than discuss the report here with my usual verbiage, I shall instead post a few of my Tweets from the night it was released:

And one from Jim Chanos:

Yes, please don’t lecture me about Tesla’s “energy business,” which in Q2 accounted for just 6% of revenue (declining from 6.5% in Q1) and likely has a net margin in the mid-single digits as it’s in an extremely competitive, low-margin industry.

Also, Tesla recently announced that it will open its U.S. charging stations to cars from multiple other manufacturers which, in turn, will adopt Tesla’s connector and charging protocol. (Those competitors are building their own network, too.)

Seeing as many people only buy a Tesla instead of a competing EV in order to access those chargers, and seeing as all the competing charging networks will also adopt this protocol while paying Tesla nothing (Tesla open-sourced it), this will cost Tesla far more in lost auto sale profits than the pennies per share it may gain from charging profits. Thus, any increase in Tesla’s stock price that can be attributed to this is as ridiculous as the increase attributed to its “AI” that regularly sends Teslas crashing into other vehicles, people, trees and buildings.

Tesla has objectively lost its “product edge,” with many competing cars now offering comparable or better real-world range, better interiors, similar or faster charging speeds and much better quality. Tesla ranks near the bottom of both Consumer Reports’ reliability survey and the 2023 JD Power survey:

In fact, Tesla is likely now the second, third or fourth choice for many EV buyers, and only maintains its volume lead though a short-lived edge in production capacity that will disappear over the next 12 to 36 months as competitors rapidly increase the ability to produce their superior EVs.

Tesla’s poorly-built Model Y faces competition from the much better made (and often just better) electric Hyundai Ioniq 5, Kia EV6, Ford Mustang Mach E, Cadillac Lyriq, Nissan Ariya, Audi Q4 e-tron, BMW iX3, Mercedes EQB, Chevrolet Blazer EV & Equinox EV, Volvo XC-40 Recharge and Polestar 3. And Tesla’s Model 3 now has terrific direct “sedan competition” from Volvo’s beautiful Polestar 2, BMW’s i4, Hyundai’s Ioniq 6 and Volkswagen’s ID.7, as well as multiple local competitors in China.

And in the high-end electric car segment worldwide the Porsche Taycan outsells the Model S, while the spectacular new BMW i7, Mercedes EQS and EQE, Audi e-Tron GT and Lucid Air make the Tesla look like a fast Yugo, while the extremely well reviewed new BMW iX, Mercedes EQS SUV and Audi Q8 eTron (as well as multiple new Chinese models) do the same to the Model X.

And oh, the joke of a “pickup truck” Tesla first previewed in 2019 (and still hasn’t shown in production-ready form) won’t be much of “growth engine” either, as by the time it’s in meaningful mass-production in 2024 that grotesque-looking kluge will enter a dogfight of a market vs. Ford’s F-150 Lightning, GM’s electric Silverado, the Dodge Ram REV and Rivian’s R1T.

Tesla Is Blackberry

Indeed, for years I’ve said “Tesla is Blackberry”—the maker of a first-generation version of a product that—once the market was proven—would be supplanted into niche obscurity by newer, better versions, and now it’s finally happening. I believe Musk knows this (hence his recent “Twitter buying distraction”), with VW Group, Hyundai/Kia, Ford, GM, Stellantis, BMW, Mercedes, BYD & other Chinese competitors and, in a few years, Toyota, Nissan & Honda, stealing Tesla’s share and pounding its stock price into the low double-digits, where it will be valued as “just another car company.”

Meanwhile, the NHTSA has initiated the first of what will likely be multiple recalls of Tesla’s fraudulently named “Full Self Driving” (even before the aforementioned safety cover-up revealed by Handelsblatt), and in January it was revealed that Elon Musk personally directed its fake, fraudulent promotional video (something extremely similar to what Theranos did with its blood machines and Nikola with its truck), and that the DOJ is investigating him for it and so is the SEC.

The refund liability potential for Tesla for this is in the billions of dollars, and possibly even the tens of billions if a class action lawsuit proves that the cars involved were purchased solely due to the (fallacious) promise of “full self-driving.” And, of course, there will be a massive “valuation reappraisal” for Tesla’s stock as the world wakes up to the fact that its so-called “autonomy technology” is deadly, trailing-edge garbage that Consumer Reports now ranks just seventh vs. competitors’ systems (behind Ford, GM, Mercedes, BMW, Toyota and Volkswagen) and Guidehouse Insights now rates dead last:

Yet Tesla has sold this trashy software for almost seven years now…

…and still promotes it on its website via the aforementioned completely fraudulent video! (For all Tesla-related deaths cited in the media—which is likely only a small fraction of those that have occurred—please see this spreadsheet.)

Another favorite Tesla hype story has been built around so-called “proprietary battery technology.” In fact though, Tesla has nothing proprietary there—it doesn’t make them, it buys them from Panasonic, CATL and LG, and it’s the biggest liar in the industry regarding the real-world range of its cars. And if new-format 4680 cells enter the market, even if Tesla makes some of its own, other manufacturers will gladly sell them to anyone, and BMW has already announced it will buy them from CATL and EVE.

So Here Is Tesla's Competition In Cars...

(note: these links are regularly updated)

- Porsche Taycan

- Porsche Macan Electric Coming in 2024

- Volkswagen ID.3

- Volkswagen ID.4 Electric SUV

- Volkswagen ID.6 SUV EV in China

- Volkswagen ID.Buzz Electric Van

- Volkswagen ID.7

- VW's ID.2all compact EV will cost under €25,000 when it arrives in 2025

- VW’s Cupra Born

- Volkswagen Group Will Spend $200 Billion To Boost Its EV Business

- Audi Q8 e-tron electric SUV

- Audi e-tron GT

- Audi Q4 e-tron

- Audi Q6 e-tron electric SUV

- Audi A6 E-tron due in early 2024 with saloon, estate and hot RS6

- Hyundai Ioniq 5

- Hyundai Ioniq 6

- Hyundai Kona Electric

- Genesis GV60

- Genesis GV70

- Kia Niro

- Kia EV6

- Kia EV9

- Kia EV5

- Kia EV4

- Jaguar’s All-Electric i-Pace

- Mercedes EQS

- Mercedes EQS SUV

- Mercedes EQE

- Mercedes EQE SUV

- Mercedes EQC electric SUV available in Europe & China

- Mercedes EQV Electric Passenger Van

- Mercedes EQB

- Mercedes EQA SUV

- Ford Mustang Mach-E

- Ford F-150 Lightning

- Ford to launch 7 EVs in Europe in big electric push

- Ford unveils Lincoln Star electric SUV concept as it readies to add four new EVs by 2026

- Chevrolet Blazer EV

- Chevrolet Equinox EV

- Chevrolet Bolt

- Chevrolet Bolt EUV electric crossover

- Cadillac All-Electric Lyriq

- Cadillac to start making 3 more EVs in 2024

- GMC Electric Hummer Pick-Up and SUV

- GM electric Silverado pickup truck

- GMC Sierra EV Denali

- GM Launches BrightDrop to Electrify the Delivery of Goods and Services

- GM & Honda Will Codevelop Affordable EVs Targeting Most Popular Vehicle Segments

- Two Jeep EVs to make U.S. debuts in 2024

- BMW iX2

- BMW iX3

- BMW iX

- BMW i4 sedan

- BMW i7

- BMW iX1

- Nissan Ariya: All-Electric Crossover SUV

- Nissan LEAF e+

- Polestar 2 sedan

- Polestar 3 electric SUV

- Volvo EX30

- Volvo XC40 Recharge electric SUV

- Volvo C40 Recharge electric crossover

- Volvo EX90 electric SUV

- Acura ZDX

- Renault Zoe electric

- Renault to boost low-volume Alpine brand with 3 EVs

- Renault's Megane E-Tech

- Dodge Ram 1500 REV

- Honda, Sony to start premium EV deliveries in 2026

- Honda pours $40 billion into electrification, targets 2 million EV production by 2030

- Peugeot e-208

- Peugeot E-2008

- Peugeot E-308

- Peugeot's full-electric 3008 and 5008 SUVs will have up to 700 km range

- Subaru Solterra

- Subaru accelerates U.S. electric plans with local production and 8-model EV lineup

- Citroen e-C3

- Rivian electric pickup trucks & SUVs

- Maserati Grecale Folgore

- Mini Cooper SE Electric

- Toyota bZ4X

- Toyota and Lexus Will Launch 10 New EVs By 2026

- Opel Corsa-e

- Opel Astra electric

- Vauxhall Mokka electric

- Skoda Enyaq iV electric SUV

- Skoda Enyaq electric coupe

- BYD presents three BEVs for European market

- Nio expands into Europe and beyond

- Lucid Motors: Electric Luxury Cars

- Fisker Ocean

- Rolls-Royce Electric Spectre

- Bentley will start output of first full EV in 2025

- Aston Martin will build electric vehicles in UK from 2025

And in China...

- BYD is #1 in Chinese EVs, selling FAR more than Tesla

- Volkswagen Group Accelerates Electrification Drive to Boost Presence in Chinese Market

- Audi, SAIC EV Tie-Up a ‘Coming of Age’ for Chinese Automaking

- Audi-FAW's $3.3 billion electric vehicle venture

- Nio

- Xpeng Motors

- Hozon/Neta

- Li Auto

- GAC Aion

- Leap Motors

- GM plans to launch over 15 EV models in China by 2025

- Ford Mustang Mach-E Rolls Off Assembly Line in China

- Cheaper than Tesla: Honda takes aim at China's middle class

- BMW i3 Debuts As All-Electric 3 Series Only For China

- Hongqi

- Geely

- Zeekr Premium EVs by Geely

- Baidu and Geely put nearly $400 million more into their electric car venture

- China-made Mercedes-Benz EQE hits market

- BAIC

- Hyundai, BAIC Motor to inject $942 mn in China JV for EVs

- Toyota partners with BYD to build affordable $30,000 electric car

- Lexus RZ 450e Steers For China

- Dongfeng

- SAIC

- Renault launches sales of first EV in China

- Nissan expects 40% of sales in China to be electrified by 2026

- Changan forms subsidiary Avatar Technology to develop smart EVs with Huawei, CATL

- WM Motors/Weimar

- Chery

- Seres

- Enovate

- Singulato

- JAC Motors

- Iconiq Motors

- Aiways

- Skyworth Auto

- Youxia

- Human Horizons

- Xiaomi announces plans for four electric vehicle models

Here's Tesla's Competition In Autonomous Driving; The Independents All Have Deals With Major Oems...

- Waymo ranked top & Tesla last in Guidehouse leaderboard on automated driving systems

- Tesla has a self-driving strategy other companies abandoned years ago

- Waymo operates robotaxis NOW

- GM’s Cruise operates robotaxis NOW

- Mobileye operates driverless test fleets in Europe and the U.S.

- Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

- Ford’s hands-free “Blue Cruise”

- Mercedes Launches SAE Level 3 Drive Pilot System

- Honda Legend Sedan with Level 3 Autonomy Now Available in Japan

- Motional (Hyundai) & Uber Announce Autonomous Ride-hail and Delivery Services

- Stellantis Completes Acquisition of aiMotive to Accelerate Autonomous Driving Journey

- Amazon’s Zoox will test its autonomous vehicles on Seattle’s rainy streets

- Baidu to further deploy 200 driverless vehicles in China in 2023

- Baidu Apollo City Driving Max

- Alibaba-backed AutoX unveils first driverless RoboTaxi production line in China

- Pony.ai approved for public driverless robotaxi service in Beijing

- SAIC-backed Xiangdao Chuxing kicks off Robotaxi pilot operation in Shenzhen

- WeRide greenlighted for autonomous road test with empty driver’s seat in Beijing

- GAC-backed Ontime greenlighted for pilot operation of Robotaxi service in Guangzhou

- Xpeng debuts most advanced semi-autonomous driving system to rival Tesla

Here's Where Tesla's Competition Will Get Its Battery Cells...

- Panasonic (making deals with multiple automakers)

- LG

- Samsung

- SK Innovation

- Toshiba

- CATL

- BYD

- Northvolt

- Volkswagen to Build Six Electric-Vehicle Battery Factories in Europe

- GM’s Ultium

- GM to develop lithium-metal batteries with SolidEnergy Systems

- SK On and Ford form BlueOval SK, an EV battery joint venture

- Hyundai teams with SK to make batteries for U.S.-built EVs

- Hyundai Motor developing solid-state EV batteries

- BMW & Ford Invest in Solid Power to Secure All Solid-State Batteries for Future Electric Vehicles

- Stellantis affirms commitment to build battery factory in Italy with Mercedes, TotalEnergies

- Stellantis and Samsung SDI to Invest Over $2.5B in Battery Production Plant in United States

- Stellantis and LG to Invest Over $5 Billion CAD in Joint Venture for Li-Ion Battery Plant in Canada

- Stellantis and Factorial Energy to Jointly Develop Solid-State Batteries for Electric Vehicles

- Mercedes-Benz to build 8 battery factories in push to become electric-only automaker

- Mercedes-Benz and Sila achieve breakthrough with high silicon automotive battery

- Toyota pledges $2.1bn more for U.S. EV battery plant

- Toyota to roll out solid-state-battery EVs as soon as 2027

- Nissan preps an old engine plant to make solid-state EV batteries

- Honda and LG Energy Formally Establish Battery Production Joint Venture

- Honda, GS Yuasa agree to collaborate in lithium-ion batteries

- Daimler joins Stellantis as partner in European battery cell venture ACC

- Renault signs EV battery deals with Envision, Verkor for French plants

- Nissan to build $1.4bn EV battery plant in UK with Chinese partner

- Nissan Announces Proprietary Solid-State Batteries

- Foxconn breaks ground on first EV battery plant

- Envision-AESC

- ONE

- EVE

- Freyr

- Verkor

- Farasis

- Microvast

- Akasol

- Cenat

- Wanxiang

- Eve Energy

- Svolt

- Romeo Power

- ProLogium

- Morrow

- Amprius

- CALB

And Here's Tesla's Competition In Storage Batteries...

- Panasonic

- Samsung

- LG Energy Solutions

- CATL

- BYD

- AES + Siemens (Fluence)

- GE

- Hitachi ABB

- Toshiba

- Saft

- Johnson Contols

- EnerSys

- SOLARWATT

- Sonnen

- Generac

- GM Energy

- Canadian Solar

- Kokam

- Eaton

- Tesvolt

- Leclanche

- Lockheed Martin

- Honeywell

- EOS Energy Storage

- ESS

- Electriq Power

- Redflow

- Primus Power

- Simpliphi Power

- Invinity

- Murata

- Bollore

- Adara

- Blue Planet

- Aggreko

- Orison

- Powin Energy

- Nidec

- Powervault

- Kore Power

- Shanghai Electric

- LithiumWerks

- Natron Energy

- Energy Vault

- Ambri

- Voltstorage

- Cadenza Innovation

- Morrow

- Gridtential

- Villara

- Elestor

- SolarEdge

- Q-Cells

- Huawei

- Toyota

- ADS-TEC

- Form Energy

- Enphase

- Sumitomo Electric

- Stryten Energy

- Freyr

- Growatt

- Polarium

- Alfen

- Quino Energy

- Gotion

- ZincFive

- Dragonfly Energy

- Salgenx

- Lunar Energy

Thanks,

Mark Spiegel

Stanphyl Capital

nasdaq eosUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

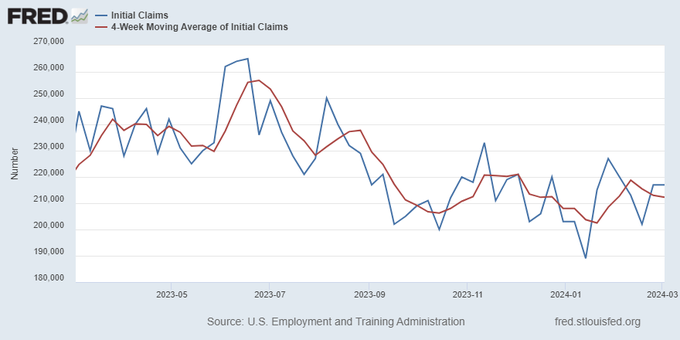

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

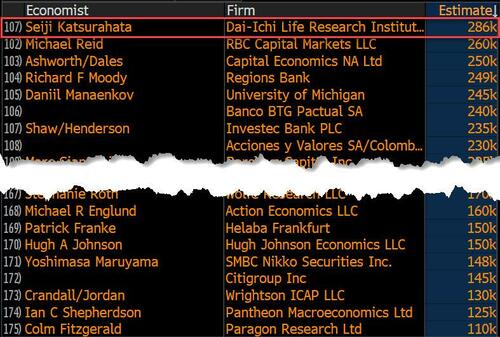

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex