The Macro Case For Investing In Bitcoin

Key drivers like price, current macro trends and risks indicate that bitcoin is a great investment and possibly the best one available now.

Key drivers like price, current macro trends and risks indicate that bitcoin is a great investment and possibly the best one available now.

Note: This article does not constitute financial advice.

Like many, when I first heard of bitcoin, my reaction was “Why would anyone invest real cash in magic internet money?” It was worth zero — backed by nothing. And, like a fool, I was keen to point this out to anyone who would listen. But still, I was curious what the buzz was about, so I continued to keep an eye on it until, in 2015, I had a mental breakthrough. I was listening to a podcast when Wences Casares made a statement that went something like this:

Bitten by the bug, I spent months reading anything bitcoin-related, talking with friends, developing an investment thesis and assessing probabilities that bitcoin could actually achieve these outcomes. Like any good MBA graduate, I quickly worked up a SWOT analysis (strengths, weaknesses, opportunities and threats) and a simple pricing model that compared the number of network wallets to price. At the end of this exercise, there was only one answer: It was prudent to invest a small percentage of my portfolio in bitcoin. For me, I chose 1 percent of investable assets. And now, like all other bitcoiners, I wish I had invested far more.

Below is my hopefully simple and concise explanation as to why I still believe bitcoin is a great investment, and quite possibly, the best investment opportunity there is right now. Let’s look at some key drivers of price, current macro trends and risks.

Money Supply/Stimulus

In my opinion, “printer go brrrr” is not exactly accurate as some of this is a swap of similar assets, but the Federal Reserve did effectively prevent wide-scale deleveraging during the COVID-19 pandemic by aggressively opening lines of credit, lowering rates and embarking on the most aggressive quantitative easing (QE) program we have ever seen.

Meanwhile, politicians are dropping cash on their constituents. Some of that stimulus will chase asset prices, and these actions have moved all markets to “risk on,” given that widespread deleveraging risk is off the table. In simple terms, deleveraging is the selling of assets by institutions or individuals to repair balance sheets and/or pay debt. This was a primary cause of the Great Financial Crisis. In my opinion, the risks today appear more tilted toward higher inflation, not deleveraging, and what better way to hedge inflation than with digital gold?

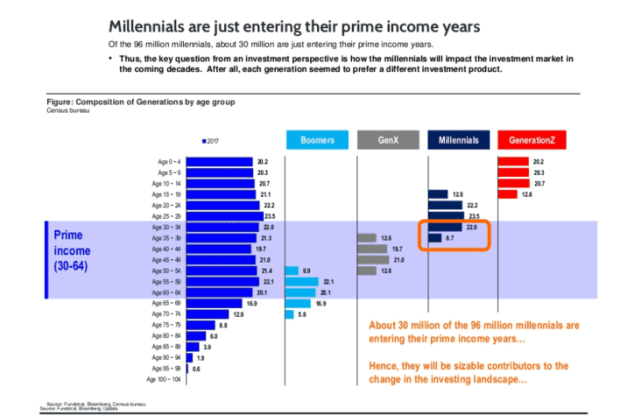

Demographics

Millennials are the largest generation in the United States and are now entering their prime earning years (see the Fundstrat chart below). This generation watched during the Great Financial Crisis as their parents lost their jobs and homes. A Facebook survey showed that 92 percent of them mistrust banks, but that they love bitcoin. A survey has shown that 20 percent of them own bitcoin now, and more are likely to buy bitcoin in the future. I believe it. Anyone with kids today can see that youth value digital property as much, or more, than they do real property. I say, don’t fight youth.

Retail Adoption

The value of a network is related to its number of users, says Metcalfe’s law. Back in 2015, I modeled bitcoin’s price based on the number of network wallets (as a proxy for users). The statistical correlation was very good and the relationship very clear — more users equals higher price. What is particularly interesting about bitcoin is every FOMO event raises price, peaks interest and creates more HODLers.

I have watched this play out for two bitcoin Halving cycles. Now, as I watch a third cycle, I do not see that trend reversing. The bitcoin community is stronger than ever, and once someone falls down the bitcoin rabbit hole, they rarely climb back out. Bitcoin’s fixed supply, portability and auditability make an ideal potential global savings vehicle. I foresee adoption continuing until each country effectively has a currency duopoly — local currency for spending and bitcoin for long-term savings.

Institutional Adoption

Not all adoption is created equal. The small amounts retail has invested in bitcoin will pale in comparison to when institutional investors become heavily involved. MassMutual and Tesla are just the start. Bitcoin is an ideal institutional investment for several reasons.

First, it is a potential store of value as gold 2.0. Second, it is a tech adoption play with asymmetrical returns — massive upside and limited downside. Third, and most importantly, there is a game theory behind these high-profile investments. Every one of these big players that gets in creates a media splash, legitimizing the network and increasing the price, until bitcoin becomes a boring, safe-haven asset.

Stock-To-Flow Modeling

Some call it voodoo, others call it genius. Stock-to-flow is the idea that the relative market capitalization of assets is related to the supply of an asset (stock) and the rate at which that asset can be produced (flow).

Plan B, an anonymous Twitter account, created this model by comparing bitcoin prices through various halving cycles, and then expanded the model to include other assets such as gold and silver. Is it accurate? So far, it has been, but I argue that doesn’t matter. What is important is that Plan B created a legitimate way for people to wrap their brains around how bitcoin scarcity could be valued.It is useful, many believe it, and the prices it predicts: MOON!

So, given that backdrop, let’s look at how bitcoin would perform as an asset under different economic scenarios.

Return To Tend Growth

If we assume the global economy returns to trend growth, then all of the tail winds described above continue and bitcoin goes higher, year after year. This is the most likely case in my opinion — years ahead of steady price appreciation until bitcoin takes its place among other safe global assets.

Deflationary Environment

Bitcoiners won’t like this, but if the financial system falls apart, bitcoin will get crushed. One only needs to look at the price of gold during the financial crisis to see why. It fell 25 percent from peak to trough in 2008, which, given the current volatility of bitcoin in this early stage, could be more like 80 percent.

The reality is that debt and spending are denominated in fiat, so if a steep deflationary downturn hits, bitcoin will be sold by individuals to pay for basic needs, such as food and housing. Wall Street will also be selling to raise funds to settle margin calls and strengthen balance sheets.

Inflationary Environment

This is where bitcoin would really shine. A period of 1970s-like inflation (high single digits) would completely validate bitcoin, the hardest asset on the planet, as a global store of value. As fiat is printed and spent, the supply of bitcoin released to the network marches on in accordance with its issuance schedule, the price moons and bitcoin adoption moves to warp speed. I have often found it curious that some bitcoiners criticize central banks and governments for inflating the currency when this is precisely what would accelerate bitcoin adoption as a global savings vehicle.

But what about the risks? Well, there are a few of them I get asked about frequently. While these risks should always be taken seriously, none of them discourage me from HODling in bitcoin.

Government Bans

If the U.S. government decided to outlaw bitcoin as an asset, the price would crater. This would not stop the Bitcoin network, as it would continue to operate underground, but pulling away funding from Wall Street and Main Street under no circumstances would be good for price.

Yet, I find this highly unlikely for many reasons. First, bitcoin as a safe-haven asset is not a threat to governments. As I laid out in my previous article, production of a global safe asset could make monetary policy more effective and does nothing to prevent governments from issuing currency or borrowing.

Second, a ban would chase away innovation. This financial revolution is happening no matter what. A country can either participate and benefit or get left behind.

Third, by the time a government could view it as a threat, in a free society, there is no incentive to ban. If the citizens in your county hold a lot of bitcoin, what is gained by making them poorer? Indeed, we saw this in South Korea a few years ago, when the government contemplated a cryptocurrency ban and quickly reversed course after public outcry.

Fourth, most regulation has been in the opposite direction. In the U.S., banks are now allowed to custody bitcoin and it already has a robust futures market.

But what about illicit activity and terrorism? Honestly, you need to be dumber than a box of rocks to use bitcoin for such purposes. It is an open network, which means that payments are easily traceable. If anything, it is far more likely that privacy coins get banned than bitcoin.

Hacks

Clearly this would reduce confidence in bitcoin and send the price plunging.

I think exchanges getting hacked would create a temporary pull back, and this is probably likely at some point in the future. Miner centralization is also a related risk. But so far, the network itself has not been hacked and it is securing over $1 trillion of value. I don’t think a 51 percent attack is remotely likely, but let’s assume one did occur — how would the network respond?

The most likely outcome in my opinion is that Bitcoin Core identifies the cause and issues new code, which is re-released with all network participants maintaining their prior bitcoin balances. Bitcoin is more than just computer code, it is the community of users that give it value. To illustrate, what would happen if someone hacked the U.S. Federal Reserve, would dollars cease to exist? Not at all, central bankers would strengthen security, return the digits on their spreadsheet and everyone would keep spending dollars.

Rising Bond Yields

The price of bitcoin, or any asset for that matter, must be considered relative to risk and return. So, let’s assume that 10-year U.S. bond yields increase to say 15 percent — what would happen to bitcoin?

The answer here is, it depends why yields are rising. Say we enter a period of high inflation, and central banks decide to take a Paul Volker-style approach. They raise rates far higher than what the economy can sustain and choke the money supply, creating unemployment. Under these circumstances, dollars become scarcer relative to bitcoin and the price of bitcoin will fall.

However, if bond prices are rising because of higher inflation, or even just inflation expectations, this would be bullish for bitcoin as it would validate its use as an inflation hedge.

Sustainable Investing

Some claim that bitcoin is bad for the environment due to the network’s power consumption. This may discourage them from investing. In my opinion, it is unclear whether bitcoin is in fact dirty.

While it uses a lot of power, much of it is “stranded” and, in terms of energy mix, bitcoin is heavily skewed towards renewables relative to most other industries. Regardless, does it even make sense to blame bitcoin for a dirty energy grid? Think about how much power is consumed by activities like watching TV or gaming, or how much environmental damage is created by gold mining. Bitcoin sits on top of whatever energy grid we have, so if the issue is dirty power, then governments need to encourage clean power generation. This is not the responsibility of bitcoin.

Competing Coins

You’ve heard it before, a better cryptocurrency will come along and replace bitcoin. Yes, if such a mythical coin popped into existence, and it was able to duplicate Bitcoin’s network effects, it would impact bitcoin’s price. However, this is not likely in the near term.

Bitcoin has a huge lead in terms of installed user base, wallet and storage infrastructure, trading pairs, futures markets and brand. For another coin to replace those, it would need to be an order of magnitude better, and as a pure store of value, I’m not even sure that’s possible.

With EIP 1559, perhaps ETH could compete as hard money, but we see few taking that seriously today. The Ethereum network remains a couple of years away from completion of its stated roadmap. In the meantime, every day that goes by means that Bitcoin’s network effects grow stronger.

To be sure, there are other risks I haven’t mentioned here, including potential community dysfunction leading to forks, but in my opinion these are even less likely to prevent price appreciation than those I have highlighted.

In closing, many macro factors appear to be aligned for explosive bitcoin price growth over the next several years, and the risks are unlikely to prevent the bull case from unfolding.

So, where is the bitcoin price headed? In a word, higher. I do not see a global downturn ahead with so much stimulus and pent-up, post-pandemic consumer demand. If anything, with millennials entering prime earning years and with institutions incentivized through game theory, I think this is probably the best risk/return period for bitcoin that has ever existed.

I don’t do splashy price predictions because, honestly, they are unnecessary. Assuming bitcoin only becomes gold 2.0 results in a price per coin of near $500,000 and that is just one use case, ignoring all other ways we store value (currency, stocks, bonds, real estate, collectables, etc.). The only real questions in my mind are how much higher than gold’s market cap it will go and how quickly we will get there.

This is a guest post by Monetary Wonk. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

cryptocurrency bitcoin ethereum btc pandemic covid-19Government

Moderna turns the spotlight on long Covid with new initiatives

Moderna’s latest Covid effort addresses the often-overlooked chronic condition of long Covid — and encourages vaccination to reduce risks. A digital…

Moderna’s latest Covid effort addresses the often-overlooked chronic condition of long Covid — and encourages vaccination to reduce risks. A digital campaign debuted Friday along with a co-sponsored event in Detroit offering free CT scans, which will also be used in ongoing long Covid research.

In a new video, a young woman describes her three-year battle with long Covid, which includes losing her job, coping with multiple debilitating symptoms and dealing with the negative effects on her family. She ends by saying, “The only way to prevent long Covid is to not get Covid” along with an on-screen message about where to find Covid-19 vaccines through the vaccines.gov website.

“Last season we saw people would get a flu shot, but they didn’t always get a Covid shot,” said Moderna’s Chief Brand Officer Kate Cronin. “People should get their flu shot, but they should also get their Covid shot. There’s no risk of long flu, but there is the risk of long-term effects of Covid.”

It’s Moderna’s “first effort to really sound the alarm,” she said, and the debut coincides with the second annual Long Covid Awareness Day.

An estimated 17.6 million Americans are living with long Covid, according to the latest CDC data. About four million of them are out of work because of the condition, resulting in an estimated $170 billion in lost wages.

While HHS anted up $45 million in grants last year to expand long Covid support initiatives along with public health campaigns, the condition is still often ignored and underfunded.

“It’s not just about the initial infection of Covid, but also if you get it multiple times, your risks goes up significantly,” Cronin said. “It’s important that people understand that.”

grants covid-19 cdc hhsGovernment

Consequences Minus Truth

Consequences Minus Truth

Authored by James Howard Kunstler via Kunstler.com,

“People crave trust in others, because God is found there.”

-…

Authored by James Howard Kunstler via Kunstler.com,

“People crave trust in others, because God is found there.”

- Dom de Bailleul

The rewards of civilization have come to seem rather trashy in these bleak days of late empire; so, why even bother pretending to be civilized? This appears to be the ethos driving our politics and culture now. But driving us where? Why, to a spectacular sort of crack-up, and at warp speed, compared to the more leisurely breakdown of past societies that arrived at a similar inflection point where Murphy’s Law replaced the rule of law.

The US Military Academy at West point decided to “upgrade” its mission statement this week by deleting the phrase Duty, Honor, Country that summarized its essential moral orientation. They replaced it with an oblique reference to “Army Values,” without spelling out what these values are, exactly, which could range from “embrace the suck” to “charlie foxtrot” to “FUBAR” — all neatly applicable to our country’s current state of perplexity and dread.

Are you feeling more confident that the US military can competently defend our country? Probably more like the opposite, because the manipulation of language is being used deliberately to turn our country inside-out and upside-down. At this point we probably could not successfully pacify a Caribbean island if we had to, and you’ve got to wonder what might happen if we have to contend with countless hostile subversive cadres who have slipped across the border with the estimated nine-million others ushered in by the government’s welcome wagon.

Momentous events await. This Monday, the Supreme Court will entertain oral arguments on the case Missouri, et al. v. Joseph R. Biden, Jr., et al. The integrity of the First Amendment hinges on the decision. Do we have freedom of speech as set forth in the Constitution? Or is it conditional on how government officials feel about some set of circumstances? At issue specifically is the government’s conduct in coercing social media companies to censor opinion in order to suppress so-called “vaccine hesitancy” and to manipulate public debate in the 2020 election. Government lawyers have argued that they were merely “communicating” with Twitter, Facebook, Google, and others about “public health disinformation and election conspiracies.”

You can reasonably suppose that this was our government’s effort to disable the truth, especially as it conflicted with its own policy and activities — from supporting BLM riots to enabling election fraud to mandating dubious vaccines. Former employees of the FBI and the CIA were directly implanted in social media companies to oversee the carrying-out of censorship orders from their old headquarters. The former general counsel (top lawyer) for the FBI, James Baker, slid unnoticed into the general counsel seat at Twitter until Elon Musk bought the company late in 2022 and flushed him out. The so-called Twitter Files uncovered by indy reporters Matt Taibbi, Michael Shellenberger, and others, produced reams of emails from FBI officials nagging Twitter execs to de-platform people and bury their dissent. You can be sure these were threats, not mere suggestions.

One of the plaintiffs joined to Missouri v. Biden is Dr. Martin Kulldorff, a biostatistician and professor at the Harvard Medical School, who opposed Covid-19 lockdowns and vaccine mandates. He was one of the authors of the open letter called The Great Barrington Declaration (October, 2020) that articulated informed medical dissent for a bamboozled public. He was fired from his job at Harvard just this past week for continuing his refusal to take the vaccine. Harvard remains among a handful of institutions that still require it, despite massive evidence that it is ineffective and hazardous. Like West Point, maybe Harvard should ditch its motto, Veritas, Latin for “truth.”

A society hostile to truth can’t possibly remain civilized, because it will also be hostile to reality. That appears to be the disposition of the people running things in the USA these days. The problem, of course, is that this is not a reality-optional world, despite the wishes of many Americans (and other peoples of Western Civ) who wish it would be.

Next up for us will be “Joe Biden’s” attempt to complete the bankruptcy of our country with $7.3-trillion proposed budget, 20 percent over the previous years spending, based on a $5-billion tax increase. Good luck making that work. New York City alone is faced with paying $387 a day for food and shelter for each of an estimated 64,800 illegal immigrants, which amounts to $9.15-billion a year. The money doesn’t exist, of course. New York can thank “Joe Biden’s” executive agencies for sticking them with this unbearable burden. It will be the end of New York City. There will be no money left for public services or cultural institutions. That’s the reality and that’s the truth.

A financial crack-up is probably the only thing short of all-out war that will get the public’s attention at this point. I wouldn’t be at all surprised if it happened next week. Historians of the future, stir-frying crickets and fiddleheads over their campfires will marvel at America’s terminal act of gluttony: managing to eat itself alive.

* * *

Support his blog by visiting Jim’s Patreon Page or Substack

Uncategorized

One city held a mass passport-getting event

A New Orleans congressman organized a way for people to apply for their passports en masse.

While the number of Americans who do not have a passport has dropped steadily from more than 80% in 1990 to just over 50% now, a lack of knowledge around passport requirements still keeps a significant portion of the population away from international travel.

Over the four years that passed since the start of covid-19, passport offices have also been dealing with significant backlog due to the high numbers of people who were looking to get a passport post-pandemic.

Related: Here is why it is (still) taking forever to get a passport

To deal with these concurrent issues, the U.S. State Department recently held a mass passport-getting event in the city of New Orleans. Called the "Passport Acceptance Event," the gathering was held at a local auditorium and invited residents of Louisiana’s 2nd Congressional District to complete a passport application on-site with the help of staff and government workers.

'Come apply for your passport, no appointment is required'

"Hey #LA02," Rep. Troy A. Carter Sr. (D-LA), whose office co-hosted the event alongside the city of New Orleans, wrote to his followers on Instagram (META) . "My office is providing passport services at our #PassportAcceptance event. Come apply for your passport, no appointment is required."

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The event was held on March 14 from 10 a.m. to 1 p.m. While it was designed for those who are already eligible for U.S. citizenship rather than as a way to help non-citizens with immigration questions, it helped those completing the application for the first time fill out forms and make sure they have the photographs and identity documents they need. The passport offices in New Orleans where one would normally have to bring already-completed forms have also been dealing with lines and would require one to book spots weeks in advance.

These are the countries with the highest-ranking passports in 2024

According to Carter Sr.'s communications team, those who submitted their passport application at the event also received expedited processing of two to three weeks (according to the State Department's website, times for regular processing are currently six to eight weeks).

While Carter Sr.'s office has not released the numbers of people who applied for a passport on March 14, photos from the event show that many took advantage of the opportunity to apply for a passport in a group setting and get expedited processing.

Every couple of months, a new ranking agency puts together a list of the most and least powerful passports in the world based on factors such as visa-free travel and opportunities for cross-border business.

In January, global citizenship and financial advisory firm Arton Capital identified United Arab Emirates as having the most powerful passport in 2024. While the United States topped the list of one such ranking in 2014, worsening relations with a number of countries as well as stricter immigration rules even as other countries have taken strides to create opportunities for investors and digital nomads caused the American passport to slip in recent years.

A UAE passport grants holders visa-free or visa-on-arrival access to 180 of the world’s 198 countries (this calculation includes disputed territories such as Kosovo and Western Sahara) while Americans currently have the same access to 151 countries.

stocks pandemic covid-19 grants-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex