Uncategorized

The Conference Board Employment Trends Index™ (ETI) Decreased in March

The Conference Board Employment Trends Index™ (ETI) Decreased in March

PR Newswire

NEW YORK, April 10, 2023

Job Growth Expected to Slow Down Over the Coming Months

NEW YORK, April 10, 2023 /PRNewswire/ — The Conference Board Employment Trends Inde…

The Conference Board Employment Trends Index™ (ETI) Decreased in March

PR Newswire

NEW YORK, April 10, 2023

Job Growth Expected to Slow Down Over the Coming Months

NEW YORK, April 10, 2023 /PRNewswire/ -- The Conference Board Employment Trends Index™ (ETI) declined in March to 116.24, down from a downwardly revised 116.75 in February 2023. The Employment Trends Index is a leading composite index for employment. When the index increases, employment is likely to grow as well, and vice versa. Turning points in the index indicate that a turning point in the number of jobs is about to occur in the coming months.

"The ETI declined slightly in February, but remains quite high, with minimal changes over the past year," said Selcuk Eren, Senior Economist at The Conference Board. "Job losses are concentrated in specific industries. Overall, the economy continues to add jobs in industries where labor shortages remain, and wage growth remains above its prepandemic rate. We expect the Federal Reserve will raise interest rates two more times by 25 basis points each in order to bring wage growth and inflation under control. That will trigger job losses and increased unemployment in the second half of 2023 and early part of 2024."

Eren added: "The labor market remains tight although it has cooled down somewhat from a year ago. On the demand side, the job openings rate is still well above the prepandemic trend but is declining. On the supply side, the labor force continues to grow and reached 166.7 million in March, as a result of rising labor force participation and a rebound in immigration to its long-term trend. The labor-force participation rate for prime-age workers has climbed back to 83.1 percent—the same level as it was in February 2020. We expect the economy will continue adding jobs in industries where employment has yet to fully recover from the pandemic, such as leisure and hospitality and government. Continued job growth is also likely in health care and social assistance, a reflection of our aging society.

"However, labor demand in other industries is cooling. Job growth in goods-producing industries—including manufacturing and construction—has been slowing and turned negative in March. Employment has also been stagnant in transportation and warehousing, as well as in finance and insurance. The information services industry, where most tech companies are listed, shed jobs compared to its highs in November. In the second quarter of 2023, we expect job gains in industries that are still adding jobs to offset losses in industries that have a negative outlook, resulting in continued slow job growth overall. However, in the second half of 2023, we expect job losses to become more widespread as GDP growth turns negative, with the unemployment rate likely to rise to 4.5 percent by early 2024."

March's decrease in the Employment Trends Index was driven by negative contributions from five of eight components: Ratio of Involuntarily Part-time to All Part-time Workers, Number of Employees Hired by the Temporary-Help Industry, Industrial Production, Initial Claims for Unemployment Insurance, and Job Openings.

The Employment Trends Index aggregates eight leading indicators of employment, each of which has proven accurate in its own area. Aggregating individual indicators into a composite index filters out "noise" to show underlying trends more clearly.

The eight leading indicators of employment aggregated into the Employment Trends Index include:

- Percentage of Respondents Who Say They Find "Jobs Hard to Get" (The Conference Board Consumer Confidence Survey®)

- Initial Claims for Unemployment Insurance (U.S. Department of Labor)

- Percentage of Firms With Positions Not Able to Fill Right Now (© National Federation of Independent Business Research Foundation)

- Number of Employees Hired by the Temporary-Help Industry (U.S. Bureau of Labor Statistics)

- Ratio of Involuntarily Part-time to All Part-time Workers (BLS)

- Job Openings (BLS)*

- Industrial Production (Federal Reserve Board)*

- Real Manufacturing and Trade Sales (U.S. Bureau of Economic Analysis)**

*Statistical imputation for the recent month

**Statistical imputation for two most recent months

The Conference Board publishes the Employment Trends Index monthly, at 10 a.m. ET, on the Monday that follows each Friday release of the Bureau of Labor Statistics Employment Situation report. The technical notes to this series are available on The Conference Board website: http://www.conference-board.org/data/eti.cfm.

About The Conference Board

The Conference Board is the member-driven think tank that delivers trusted insights for what's ahead. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org.

Employment Trends Index (ETI)™ 2023 Publication Schedule | |

Index Release Date (10 AM ET) | Data for the Month |

Monday, January 9 2023 | December 2022 |

Monday, February 6 | January 2023 |

Monday, March 13 | February |

Monday, April 10 | March |

Monday, May 8 | April |

Monday, June 5 | May |

Monday, July 10 | June |

Monday, August 7 | July |

Tuesday, September 5* | August |

Monday, October 9 | September |

Monday, November 6 | October |

Monday, December 11 | November |

* Tuesday release due to holiday | |

© The Conference Board 2023. All data contained in this table are protected by United States and international copyright laws. The data displayed are provided for informational purposes only and may only be accessed, reviewed, and/or used in accordance with, and the permission of, The Conference Board consistent with a subscriber or license agreement and the Terms of Use displayed on our website at www.conference-board.org. The data and analysis contained herein may not be used, redistributed, published, or posted by any means without express written permission from The Conference Board. |

COPYRIGHT TERMS OF USE |

All material on Our Sites are protected by United States and international copyright laws. You must abide by all copyright notices and restrictions contained in Our Sites. You may not reproduce, distribute (in any form including over any local area or other network or service), display, perform, create derivative works of, sell, license, extract for use in a database, or otherwise use any materials (including computer programs and other code) on Our Sites ("Site Material"), except that you may download Site Material in the form of one machine readable copy that you will use only for personal, noncommercial purposes, and only if you do not alter Site Material or remove any trademark, copyright or other notice displayed on the Site Material. If you are a subscriber to any of the services offered on Our Sites, you may be permitted to use Site Material, according to the terms of your subscription agreement. |

TRADEMARKS |

"THE CONFERENCE BOARD," the TORCH LOGO, "THE CONFERENCE BOARD EMPLOYMENT TRENDS INDEX," and any other logos, indicia and trademarks featured on Our Sites are trademarks owned by The Conference Board, Inc. in the United States and other countries ("Our Trademarks"). You may not use Our Trademarks in connection with any product or service that does not belong to us nor in any manner that is likely to cause confusion among users about whether we are the source, sponsor, or endorser of the product or service, nor in any manner that disparages or discredits us. |

Violators of these rights will be prosecuted to the full extent of the law. Nothing herein shall restrict the use of the information by news journalists using the information in a legitimate news publication or periodical. |

View original content to download multimedia:https://www.prnewswire.com/news-releases/the-conference-board-employment-trends-index-eti-decreased-in-march-301793243.html

SOURCE The Conference Board

Uncategorized

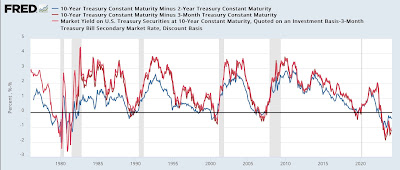

Manufacturing and construction vs. the still-inverted yield curve

– by New Deal democratProf. Menzie Chinn at Econbrowser makes the point that the yield curve is still inverted, and has not yet eclipsed the longest…

- by New Deal democrat

Prof. Menzie Chinn at Econbrowser makes the point that the yield curve is still inverted, and has not yet eclipsed the longest previous time between onset of such an inversion and a recession. So he believes the threat of recession is still on the table.

Uncategorized

Half Of Downtown Pittsburgh Office Space Could Be Empty In 4 Years

Half Of Downtown Pittsburgh Office Space Could Be Empty In 4 Years

Authored by Mike Shedlock via MishTalk.com,

The CRE implosion is picking…

Authored by Mike Shedlock via MishTalk.com,

The CRE implosion is picking up steam.

Check out the grim stats on Pittsburgh.

Unions are also a problem in Pittsburgh as they are in Illinois and California.

Downtown Pittsburgh Implosion

The Post Gazette reports nearly half of Downtown Pittsburgh office space could be empty in 4 years.

Confidential real estate information obtained by the Pittsburgh Post-Gazette estimates that 17 buildings are in “significant distress” and another nine are in “pending distress,” meaning they are either approaching foreclosure or at risk of foreclosure. Those properties represent 63% of the Downtown office stock and account for $30.5 million in real estate taxes, according to the data.

It also calculates the current office vacancy rate at 27% when subleases are factored in — one of the highest in the country.

And with an additional three million square feet of unoccupied leased space becoming available over the next five years, the vacancy rate could soar to 46% by 2028, based on the data.

Property assessments on 10 buildings, including U.S. Steel Tower, PPG Place, and the Tower at PNC Plaza, have been slashed by $364.4 million for the 2023 tax year, as high vacancies drive down their income.

Another factor has been the steep drop — to 63.5% from 87.5% — in the common level ratio, the number used to compute taxable value in county assessment appeal hearings.

The assessment cuts have the potential to cost the city, the county, and the Pittsburgh schools nearly $8.4 million in tax refunds for that year alone. Downtown represents nearly 25% of the city’s overall tax base.

In response Pittsburgh City Councilman Bobby Wilson wants to remove a $250,000 limit on the amount of tax relief available to a building owner or developer as long as a project creates at least 50 full-time equivalent jobs.

It’s unclear if the proposal will be enough. Annual interest costs to borrow $1 million have soared from $32,500 at the start of the pandemic in 2020 to $85,000 on March 1. Local construction costs have increased by about 30% since 2019.

But the city is doomed if it does nothing. Aaron Stauber, president of Rugby Realty said it will probably empty out Gulf Tower and mothball it once all existing leases expire.

“It’s cheaper to just shut the lights off,” he said. “At some point, we would move on to greener pastures.”

Where’s There’s Smoke There’s Unions

In addition to the commercial real estate woes, the city is also wrestling with union contracts.

Please consider Sounding the alarm: Pittsburgh Controller’s letter should kick off fiscal soul-searching

It’s only March, and Pittsburgh’s 2024 house-of-cards operating budget is already falling down. That’s the clear implication of a letter sent by new City Controller Rachael Heisler to Mayor Ed Gainey and members of City Council on Wednesday afternoon.

The letter is a rare and welcome expression of urgency in a city government that has fallen in complacency — and is close to falling into fiscal disaster.

The approaching crisis was thrown into sharp relief this week, when City Council approved amendments to the operating budget accounting for a pricey new contract with the firefighters union. The Post-Gazette Editorial Board had predicted that this contract — plus two others yet to be announced and approved — would demonstrate the dishonesty of Mayor Ed Gainey’s budget, and that’s exactly what’s happening: The new contract is adding $11 million to the administration’s artificially low 5-year spending projections, bringing expected 2028 reserves to just barely the legal limit.

But there’s still two big contracts to go, with the EMS union and the Pittsburgh Joint Collective Bargaining Committee, which covers Public Works workers. Worse, there are tens — possibly hundreds — of millions in unrealistic revenues still on the books. On this, Ms. Heisler’s letter only scratched the surface.

Similarly, as we have observed, the budget’s real estate tax revenue projections are radically inconsistent with reality. Due to high vacancies and a sharp reduction in the common level ratio, a significant drop in revenues was predictable — but not reflected in the budget. Ms. Heisler’s estimate of a 20% drop in revenues from Downtown property, or $5.3 million a year, may even be optimistic: Other estimates peg the loss at twice that, or more.

Left unmentioned in the letter are massive property tax refunds the city will owe, as well as fanciful projections of interest income that are inconsistent with the dwindling reserves, and drawing-down of federal COVID relief funds, predicted in the budget itself. That’s another unrealistic $80 million over five years.

Pittsburgh exited Act 47 state oversight after nearly 15 years on Feb. 12, 2018, with a clean bill of fiscal health.

It has already ruined that bill of health.

Act 47 in Pittsburgh

Flashback February 21, 2018: Act 47 in Pittsburgh: What Was Accomplished?

Pittsburgh’s tax structure was a much-complained-about topic leading up to the Act 47 declaration. The year following Pittsburgh’s designation as financially distressed under Act 47 it levied taxes on real estate, real estate transfers, parking, earned income, business gross receipts (business privilege and mercantile), occupational privilege and amusements. The General Assembly enacted tax reforms in 2004 giving the city authority to levy a payroll preparation tax in exchange for the immediate elimination of the mercantile tax and the phase out of the business privilege tax. The tax reforms increased the amount of the occupational privilege tax from $10 to $52 (this is today known as the local services tax and all municipalities outside of Philadelphia levy it and could raise it thanks to the change for Pittsburgh).

The coordinators recommended an increase in the deed transfer tax, which occurred in late 2004 (it was just increased again by City Council) and in the real estate tax, which increased in 2015.

Legacy costs, principally debt and underfunded pensions, were the primary focus of the 2009 amended recovery plan. The city’s pension funded ratio has increased significantly from where it stood a decade ago, rising from the mid-30 percent range to over 60 percent at last measurement.

The obvious question? Will the city stick to the steps taken to improve financially and avoid slipping back into distressed status? If Pittsburgh once stood “on the precipice of full-blown crisis,” as described in the first recovery plan, hopefully it won’t return to that position.

The Obvious Question

I could have answered the 2018 obvious question with the obvious answer. Hell no.

No matter how much you raise taxes, it will never be enough because public unions will suck every penny and want more.

On top of union graft, and insanely woke policies in California, we have an additional huge problem.

Hybrid Work Leaves Offices Empty and Building Owners Reeling

Hybrid work has put office building owners in a bind and could pose a risk to banks. Landlords are now confronting the fact that some of their office buildings have become obsolete, if not worthless.

Meanwhile, in Illinois …

Chicago Teachers’ Union Seeks $50 Billion Despite $700 Million City Deficit

Please note the Chicago Teachers’ Union Seeks $50 Billion Despite $700 Million City Deficit

The CTU wants to raise taxes across the board, especially targeting real estate.

My suggestion, get the hell out...

Uncategorized

Profits over patients: For-profit nursing home chains are draining resources from care while shifting huge sums to owners’ pockets

Owners of midsize nursing home chains harm the elderly and drain huge sums of money from facilities using opaque accounting practices while government…

The care at Landmark of Louisville Rehabilitation and Nursing was abysmal when state inspectors filed their survey report of the Kentucky facility on July 3, 2021.

Residents wandered the halls in a facility that can house up to 250 people, yelling at each other and stealing blankets. One resident beat a roommate with a stick, causing bruising and skin tears. Another was found in bed with a broken finger and a bloody forehead gash. That person was allowed to roam and enter the beds of other residents. In another case, there was sexual touching in the dayroom between residents, according to the report.

Meals were served from filthy meal carts on plastic foam trays, and residents struggled to cut their food with dull plastic cutlery. Broken tiles lined showers, and a mysterious black gunk marred the floors. The director of housekeeping reported that the dining room was unsanitary. Overall, there was a critical lack of training, staff and supervision.

The inspectors tagged Landmark as deficient in 29 areas, including six that put residents in immediate jeopardy of serious harm and three where actual harm was found. The issues were so severe that the government slapped Landmark with a fine of over US$319,000 − more than 29 times the average for a nursing home in 2021 − and suspended payments to the home from federal Medicaid and Medicare funds.

But problems persisted. Five months later, inspectors levied six additional deficiencies of immediate jeopardy − the highest level.

Landmark is just one of the 58 facilities run by parent company Infinity Healthcare Management across five states. The government issued penalties to the company almost 4½ times the national average, according to bimonthly data that the Centers for Medicare & Medicaid Services first started to make available in late 2022. All told, Infinity paid nearly $10 million in fines since 2021, the highest among nursing home chains with fewer than 100 facilities.

Infinity Healthcare Management and its executives did not respond to multiple requests for comment.

Race to the bottom

Such sanctions are nothing new for Infinity or other for-profit nursing home chains that have dominated an industry long known for cutting corners in pursuit of profits for private owners. But this race to the bottom to extract profits is accelerating, despite demands by government officials, health care experts and advocacy groups to protect the nation’s most vulnerable citizens.

To uncover the reasons why, The Conversation delved into the nursing home industry, where for-profit facilities make up more than 72% of the nation’s nearly 14,900 facilities. The probe, which paired an academic expert with an investigative reporter, used the most recent government data on ownership, facility information and penalties, combined with CMS data on affiliated entities for nursing homes.

The investigation revealed an industry that places a premium on cost cutting and big profits, with low staffing and poor quality, often to the detriment of patient well-being. Operating under weak and poorly enforced regulations with financially insignificant penalties, the for-profit sector fosters an environment where corners are frequently cut, compromising the quality of care and endangering patient health.

Meanwhile, owners make the facilities look less profitable by siphoning money from the homes through byzantine networks of interconnected corporations. Federal regulators have neglected the problem as each year likely billions of dollars are funneled out of nursing homes through related parties and into owners’ pockets.

More trouble at midsize

Analyzing newly released government data, our investigation found that these problems are most pronounced in nursing homes like Infinity − midsize chains that operate between 11 and 100 facilities. This subsection of the industry has higher average fines per home, lower overall quality ratings, and are more likely to be tagged with resident abuse compared with both the larger and smaller networks. Indeed, while such chains account for about 39% of all facilities, they operate 11 of the 15 most-fined facilities.

With few impediments, private investors who own the midsize chains have swooped in to purchase underperforming homes, expanding their holdings even as larger chains divest and close facilities.

“They are really bad, but the names − we don’t know these names,” said Toby Edelman, senior policy attorney with the Center for Medicare Advocacy, a nonprofit law organization.

In response to The Conversation’s findings on nursing homes and request for an interview, a CMS spokesperson emailed a statement that said the CMS is “unwavering in its commitment to improve safety and quality of care for the more than 1.2 million residents receiving care in Medicare- and Medicaid-certified nursing homes.”

“We support transparency and accountability,” the American Health Care Association/National Center for Assisted Living, a trade organization representing the nursing home industry, wrote in response to The Conversation‘s request for comment. “But neither ownership nor line items on a budget sheet prove whether a nursing home is committed to its residents.”

Ripe for abuse

It often takes years to improve a poor nursing home − or run one into the ground. The analysis of midsize chains shows that most owners have been associated with their current facilities for less than eight years, making it difficult to separate operators who have taken long-term investments in resident care from those who are looking to quickly extract money and resources before closing them down or moving on. These chains control roughly 41% of nursing home beds in the U.S., according to CMS’s provider data, making the lack of transparency especially ripe for abuse.

A churn of nursing home purchases even during the pandemic shows that investors view the sector as highly profitable, especially when staffing costs are kept low and fines for poor care can easily be covered by the money extracted from residents, their families and taxpayers.

A March 2024 study from Lehigh University and the University of California, Los Angeles also shows that costs were inflated when nursing home owners switched to contractors they controlled directly or indirectly. Overall, spending on real estate increased 20.4% and spending on management increased 24.6% when the businesses were affiliated, the research showed.

“This is the model of their care: They come in, they understaff and they make their money,” said Sam Brooks, director of public policy at the Consumer Voice, a national resident advocacy organization. “Then they multiply it over a series of different facilities.”

This is a condensed version of an article from The Conversation’s investigative unit. To find out more about the rise of for-profit nursing homes, financial trickery and what could make the nation’s most vulnerable citizens safer, read the complete version.

Campbell is an adjunct assistant professor at Columbia University and a contributing writer at the Garrison Project, an independent news organization that focuses on mass incarceration and criminal justice.

Harrington is an advisory board member of the nonprofit Veteran's Health Policy Institute and a board member of the nonprofit Center for Health Information and Policy. Harrington served as an expert witness on nursing home litigation cases by residents against facilities owned or operated by Brius and Shlomo Rechnitz in the past and in 2022. She also served as an expert witness in a case against The Citadel Salisbury in North Carolina in 2021.

real estate pandemic-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex