“This discovery unveils a potential novel molecular target for therapeutic strategies against hepatic steatosis during the aging process […]”

BUFFALO, NY- March 20, 2024 – A new research paper was published in Aging (listed by MEDLINE/PubMed as “Aging (Albany NY)” and “Aging-US” by Web of Science) Volume 16, Issue 5, entitled, “FoxO6-mediated ApoC3 upregulation promotes hepatic steatosis and hyperlipidemia in aged rats fed a high-fat diet.”

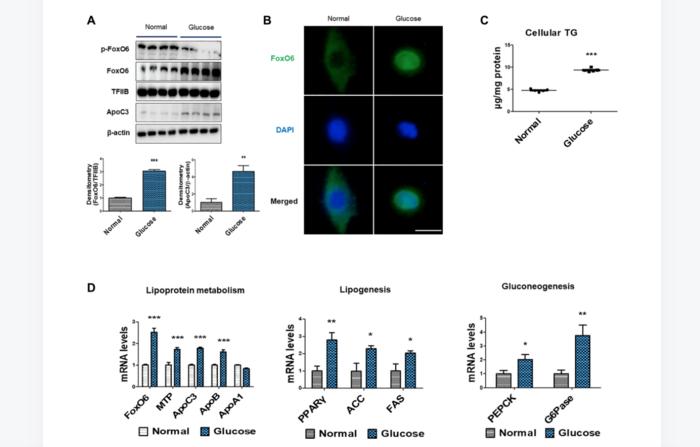

FoxO6, an identified factor, induces hyperlipidemia and hepatic steatosis during aging by activating hepatic lipoprotein secretion and lipogenesis leading to increased ApoC3 concentrations in the bloodstream. However, the intricate mechanisms underlying hepatic steatosis induced by elevated FoxO6 under hyperglycemic conditions remain intricate and require further elucidation.

In this new study, researchers Dae Hyun Kim, Seulah Lee, Sang Gyun Noh, Jaewon Lee, and Hae Young Chung from Pusan National University aimed to delineate the regulatory pathway involving ApoC3 controlled by FoxO6 and its resultant functional impacts.

“[…] we employed a spectrum of models including liver cell cultures, aged rats subjected to HFD, transgenic mice overexpressing FoxO6 (FoxO6-Tg), and FoxO6 knockout mice (FoxO6-KO).”

Their findings indicate that FoxO6 triggered ApoC3-driven lipid accumulation in the livers of aged rats on an HFD and in FoxO6-Tg, consequently leading to hepatic steatosis and hyperglycemia. Conversely, the absence of FoxO6 attenuated the expression of genes involved in lipogenesis, resulting in diminished hepatic lipid accumulation and mitigated hyperlipidemia in murine models. Additionally, the upregulation of FoxO6 due to elevated glucose levels led to increased ApoC3 expression, consequently instigating cellular triglyceride mediated lipid accumulation. The transcriptional activation of FoxO6 induced by both the HFD and high glucose levels resulted in hepatic steatosis by upregulating ApoC3 and genes associated with gluconeogenesis in aged rats and liver cell cultures.

“Our conclusions indicate that the upregulation of ApoC3 by FoxO6 promotes the development of hyperlipidemia, hyperglycemia, and hepatic steatosis in vivo, and in vitro. Taken together, our findings underscore the significance of FoxO6 in driving hyperlipidemia and hepatic steatosis specifically under hyperglycemic states by enhancing the expression of ApoC3 in aged rats.”

Read the full paper: DOI: https://doi.org/10.18632/aging.205610

Corresponding Author: Hae Young Chung

Corresponding Email: hyjung@pusan.ac.kr

Keywords: HFD-feeding, aging, forkhead transcription factor O6, ApoC3, lipid accumulation, hepatic steatosis

Click here to sign up for free Altmetric alerts about this article.

About Aging:

Aging publishes research papers in all fields of aging research including but not limited, aging from yeast to mammals, cellular senescence, age-related diseases such as cancer and Alzheimer’s diseases and their prevention and treatment, anti-aging strategies and drug development and especially the role of signal transduction pathways such as mTOR in aging and potential approaches to modulate these signaling pathways to extend lifespan. The journal aims to promote treatment of age-related diseases by slowing down aging, validation of anti-aging drugs by treating age-related diseases, prevention of cancer by inhibiting aging. Cancer and COVID-19 are age-related diseases.

Aging is indexed by PubMed/Medline (abbreviated as “Aging (Albany NY)”), PubMed Central, Web of Science: Science Citation Index Expanded (abbreviated as “Aging‐US” and listed in the Cell Biology and Geriatrics & Gerontology categories), Scopus (abbreviated as “Aging” and listed in the Cell Biology and Aging categories), Biological Abstracts, BIOSIS Previews, EMBASE, META (Chan Zuckerberg Initiative) (2018-2022), and Dimensions (Digital Science).

Please visit our website at www.Aging-US.com and connect with us:

- X, formerly Twitter

- YouTube

- Spotify, and available wherever you listen to podcasts

Click here to subscribe to Aging publication updates.

For media inquiries, please contact media@impactjournals.com.

Aging (Aging-US) Journal Office

6666 E. Quaker Str., Suite 1B

Orchard Park, NY 14127

Phone: 1-800-922-0957, option 1

###

Journal

Aging-US

DOI

10.18632/aging.205610

Method of Research

Experimental study

Subject of Research

People

Article Title

FoxO6-mediated ApoC3 upregulation promotes hepatic steatosis and hyperlipidemia in aged rats fed a high-fat diet

Article Publication Date

3-Mar-2024