The 2020 altcoin Hype-to-Activity index

Tracking the hype and price action of several of your favorite cryptocurrencies.

Crypto fans love to defend their favorite assets. Just look at the XRP army and the LINK Marines. Does the hype expressed on Twitter match up with high…

Tracking the hype and price action of several of your favorite cryptocurrencies.

Crypto fans love to defend their favorite assets. Just look at the XRP army and the LINK Marines. Does the hype expressed on Twitter match up with high trading activity though? A few altcoins throughout 2020 revealed mixed results. Using information from The Tie, a crypto data platform, Cointelegraph looked at assets’ Hype-To-Activity Ratios matched against their prices.

“Hype-To-Activity Ratio measures the number of tweets a particular coin has per each $1M in reported trading volume of that coin,” Joshua Frank, CEO and co-founder of The Tie, told Cointelegraph, adding:

“As of August 15th 2019 the average Hype-To-Activity Ratio in crypto was 1.02. In other words, on average cryptocurrencies see 1.02 tweets per $1M in reported trading volume.”

Twitter often hosts countless discussions on various assets at any given time. Announcements and other events also factor into the equation. Sometimes, trading activity and hype travel in tandem, while other times, the two fall out of balance.

“High Hype-to-Activity Ratios may suggest that a particular cryptocurrency is overhyped in social conversations relative to the amount of trading activity that it has,” Frank explained. “It is a good metric for identifying outliers or for tracking the number of social conversations a particular coin has relative to its trading volume over time.”

The Tie conducted an in-depth study on the scene in 2019. The findings ranged from the relatively obvious — for example, Tether (USDT) is traded much more than it is talked about — to major outliers like Electroneum (ETN), whose off-the-charts reading led The Tie to suspect foul play.

Crypto-asset prices performed well in 2020, with Bitcoin (BTC) leading the charge, breaking its 2017 all-time high price. Ether (ETH), Ripple’s XRP and Chainlink’s LINK also had respectable years, including their share of promotion on Twitter, but did their prices match the hype?

Ether

The crypto industry’s second-largest asset by market cap, ETH, gave the public many talking points in 2020. Progress on Ethereum 2.0, the blockchain’s highly anticipated transition over to a proof-of-stake mining algorithm, took longer than anticipated. On Nov. 24, Eth2 hit the requirements necessary for a Dec. 1 Beacon Chain launch, completing Phase 0. On Dec. 1, Eth2 went live.

Twitter hype for the year noticeably fluctuated against the price of ETH. Its hype converged toward its price near the beginning of 2020.

The COVID-19-caused crash in March provided a powerful external jolt to the markets, with prices plummeting even as hype remained steady. Between late April and early June, hype essentially correlated equally with price action.

Throughout June and July as the “summer of DeFi” unfolded, ETH began increasing in popularity on Twitter. The Hype-to-Activity Ratio went from 0.395 to 1.019 tweets per $1 million in trading volume between June 1 and July 20, all while ETH’s price remained flat, trading approximately between $221 and $247. A powerful rally toward the end of July corrected the discrepancy, with ETH reaching $383 by Aug. 1 while maintaining a hype score of 1.003. On the other hand, its hype flatlined into November and December even as its price began approaching the heights of the 2017 rally.

During that same June and July stretch, ETH’s reported trading volume notably declined while tweets increased. A trading flow of $13.86 billion matched its hype at 0.406 tweets per million in volume on June 2. Volume dropped to $5.59 billion by July 20, but tweets per million in volume more than doubled, hitting 1.019 on the same day.

In recent days, ETH’s price has surged, but its hype has not followed with the same exuberance.

Ripple’s XRP

Crypto’s third-largest asset by market cap, XRP did not have a looming big news event in the same manner as Ethereum did, although the asset’s loyal following, known as the XRP Army, provided a steady stream of hype nevertheless.

In January, comments surfaced from Ripple’s CEO about a potential initial public offering for the company. Headlines throughout the year also included a co-founder’s sale of a portion of his XRP stockpile, developments on a lawsuit claiming XRP was an unregistered security, and the building of a link between the Ethereum and XRP networks, which also involves an upcoming airdrop.

Regarding Twitter hype and prices for the year, XRP tweet flow per volume held at elevated values for most of the year. Similar to ETH, XRP’s price dropped much more than its Twitter activity in March during the COVID-19-induced price drop.

Similar to ETH, between May 11 and July 21, XRP’s hype ratio increased, while its price failed to follow in the same fashion until the start of August when it made up significant ground. XRP, however, generally carried a much higher hype ratio than ETH in that period, during which its hype ranged from 1.414 to 2.754 tweets per $1 million in trading volume.

Its hype began trending downward on Sept. 20, traveling from a ratio of 2.249 down to 0.59 by Dec. 2. Meanwhile, its price traded sideways between $0.22 and $0.25 from Sept. 20 to Nov. 2. Its price rocketed upward through November, however, reaching $0.69 against a declining hype ratio.

The United States Securities and Exchange Commission went after Ripple and XRP on Dec. 22, claiming the company ran an unregistered securities sale and alleging that XRP remains a security even years after launch. XRP fell dramatically in price in the days after the action’s initiation. A number of exchanges have also removed XRP trading. XRP’s price plummeted down to meet its Twitter activity, which was already lagging behind its price before the regulatory news.

Chainlink

LINK has garnered a following similar to that of XRP, known as the Link Marines — the members of which Barstool Sports founder Dave Portnoy called frauds during his brief foray in the crypto space.

The sixth-largest crypto asset in the industry, LINK performed well in price throughout the year, posting a record-high price of approximately $20 in August, based on TradingView data. Between its low in March and its all-time high in August, LINK rose from roughly $1.50 to $20.

Headlines around the asset during the year included multiple partnerships and various Chainlink oracle integrations, as well as some fear, uncertainty and doubt, also known as FUD, thrown in.

LINK showed an exorbitantly high hype ratio early in 2020, tallying a score of 5.128 on Jan. 25 while its price traded far below at $2.46. The hype train crashed after that, falling all the way down to a score of 2.099 by April 11, meeting its price at $3.25 per LINK token.

The asset’s Twitter action did not remain near its price for long though, bouncing right back into a strong uptrend from there and reaching a hype rating of 4.456 by July 6. LINK, however, remained fairly quiet in terms of upward price action during all that Twitter commotion, ranging between $3.17 to $5.30 from April 11 to July 6. Catching up to Twitter’s chatter to a degree, the token then began an uptrend that would eventually bring the asset to $20.

During the stark rally, hype growth actually turned negative much earlier than the record high near $20. Its hype proceeded to plummet down to 1.199 by Oct. 9. Its price fell substantially from $20 after its historic summit, but it still held at an appreciable level compared with the collapse in its hype. LINK recorded significantly more attention than ETH on Twitter in 2020, even noticeably hitting higher than XRP’s levels during the year as well.

Twitter-based hype for ETH, XRP and LINK all trended down or flatlined over the last few months of 2020. Such declines and stagnation might possibly have resulted due to Bitcoin’s dramatic surge during that time. BTC stole the spotlight during the last three months of 2020. Crypto’s largest asset rallied from $10,500 to $19,900 in that time period, dragging certain altcoins up with it in price, but not necessarily in attention.

DeFi

A number of decentralized finance, or DeFi, assets also posted dramatic price action during their first years in existence, riding the 2020 DeFi boom.

Yearn.finance, with its YFI asset, burst onto the crypto scene in the latter half of 2020, soaring from $900 to more than $40,000 per token.

Although earlier months show no available hype ratings, November and December revealed greater hype than price, at a peak score of 0.92 — notably below levels seen in XRP and LINK — amid a price of $25,708.

SushiSwap, a DeFi protocol, and its related SUSHI asset yielded significant drama in September. Sushi’s leader, a pseudonymous individual known as “Chef Nomi,” ran off with some of the project’s development fund, temporarily handing down the protocol to Sam Bankman-Fried, CEO of the exchange FTX. Chef Nomi later returned the funds.

During the latter half of October and the first half of November, SUSHI hype significantly outpaced price, peaking at 1.89 on the hype scale while trading at a price of $0.71 — scoring similar in hype to XRP, but lower than LINK.

Looking back at 2020, and the Hype-To-Activity Ratio in line with asset prices, shows that Twitter activity still remains prevalent in the crypto industry. What will 2021’s data show in the year ahead if Bitcoin’s bull market continues?

cryptocurrency bitcoin ethereum blockchain crypto btc xrp link covid-19International

Illegal Immigrants Leave US Hospitals With Billions In Unpaid Bills

Illegal Immigrants Leave US Hospitals With Billions In Unpaid Bills

By Autumn Spredemann of The Epoch Times

Tens of thousands of illegal…

By Autumn Spredemann of The Epoch Times

Tens of thousands of illegal immigrants are flooding into U.S. hospitals for treatment and leaving billions in uncompensated health care costs in their wake.

The House Committee on Homeland Security recently released a report illustrating that from the estimated $451 billion in annual costs stemming from the U.S. border crisis, a significant portion is going to health care for illegal immigrants.

With the majority of the illegal immigrant population lacking any kind of medical insurance, hospitals and government welfare programs such as Medicaid are feeling the weight of these unanticipated costs.

Apprehensions of illegal immigrants at the U.S. border have jumped 48 percent since the record in fiscal year 2021 and nearly tripled since fiscal year 2019, according to Customs and Border Protection data.

Last year broke a new record high for illegal border crossings, surpassing more than 3.2 million apprehensions.

And with that sea of humanity comes the need for health care and, in most cases, the inability to pay for it.

In January, CEO of Denver Health Donna Lynne told reporters that 8,000 illegal immigrants made roughly 20,000 visits to the city’s health system in 2023.

The total bill for uncompensated care costs last year to the system totaled $140 million, said Dane Roper, public information officer for Denver Health. More than $10 million of it was attributed to “care for new immigrants,” he told The Epoch Times.

Though the amount of debt assigned to illegal immigrants is a fraction of the total, uncompensated care costs in the Denver Health system have risen dramatically over the past few years.

The total uncompensated costs in 2020 came to $60 million, Mr. Roper said. In 2022, the number doubled, hitting $120 million.

He also said their city hospitals are treating issues such as “respiratory illnesses, GI [gastro-intenstinal] illnesses, dental disease, and some common chronic illnesses such as asthma and diabetes.”

“The perspective we’ve been trying to emphasize all along is that providing healthcare services for an influx of new immigrants who are unable to pay for their care is adding additional strain to an already significant uncompensated care burden,” Mr. Roper said.

He added this is why a local, state, and federal response to the needs of the new illegal immigrant population is “so important.”

Colorado is far from the only state struggling with a trail of unpaid hospital bills.

Dr. Robert Trenschel, CEO of the Yuma Regional Medical Center situated on the Arizona–Mexico border, said on average, illegal immigrants cost up to three times more in human resources to resolve their cases and provide a safe discharge.

“Some [illegal] migrants come with minor ailments, but many of them come in with significant disease,” Dr. Trenschel said during a congressional hearing last year.

“We’ve had migrant patients on dialysis, cardiac catheterization, and in need of heart surgery. Many are very sick.”

He said many illegal immigrants who enter the country and need medical assistance end up staying in the ICU ward for 60 days or more.

A large portion of the patients are pregnant women who’ve had little to no prenatal treatment. This has resulted in an increase in babies being born that require neonatal care for 30 days or longer.

Dr. Trenschel told The Epoch Times last year that illegal immigrants were overrunning healthcare services in his town, leaving the hospital with $26 million in unpaid medical bills in just 12 months.

ER Duty to Care

The Emergency Medical Treatment and Labor Act of 1986 requires that public hospitals participating in Medicare “must medically screen all persons seeking emergency care … regardless of payment method or insurance status.”

The numbers are difficult to gauge as the policy position of the Centers for Medicare & Medicaid Services (CMS) is that it “will not require hospital staff to ask patients directly about their citizenship or immigration status.”

In southern California, again close to the border with Mexico, some hospitals are struggling with an influx of illegal immigrants.

American patients are enduring longer wait times for doctor appointments due to a nursing shortage in the state, two health care professionals told The Epoch Times in January.

A health care worker at a hospital in Southern California, who asked not to be named for fear of losing her job, told The Epoch Times that “the entire health care system is just being bombarded” by a steady stream of illegal immigrants.

“Our healthcare system is so overwhelmed, and then add on top of that tuberculosis, COVID-19, and other diseases from all over the world,” she said.

A newly-enacted law in California provides free healthcare for all illegal immigrants residing in the state. The law could cost taxpayers between $3 billion and $6 billion per year, according to recent estimates by state and federal lawmakers.

In New York, where the illegal immigration crisis has manifested most notably beyond the southern border, city and state officials have long been accommodating of illegal immigrants’ healthcare costs.

Since June 2014, when then-mayor Bill de Blasio set up The Task Force on Immigrant Health Care Access, New York City has worked to expand avenues for illegal immigrants to get free health care.

“New York City has a moral duty to ensure that all its residents have meaningful access to needed health care, regardless of their immigration status or ability to pay,” Mr. de Blasio stated in a 2015 report.

The report notes that in 2013, nearly 64 percent of illegal immigrants were uninsured. Since then, tens of thousands of illegal immigrants have settled in the city.

“The uninsured rate for undocumented immigrants is more than three times that of other noncitizens in New York City (20 percent) and more than six times greater than the uninsured rate for the rest of the city (10 percent),” the report states.

The report states that because healthcare providers don’t ask patients about documentation status, the task force lacks “data specific to undocumented patients.”

Some health care providers say a big part of the issue is that without a clear path to insurance or payment for non-emergency services, illegal immigrants are going to the hospital due to a lack of options.

“It’s insane, and it has been for years at this point,” Dana, a Texas emergency room nurse who asked to have her full name omitted, told The Epoch Times.

Working for a major hospital system in the greater Houston area, Dana has seen “a zillion” migrants pass through under her watch with “no end in sight.” She said many who are illegal immigrants arrive with treatable illnesses that require simple antibiotics. “Not a lot of GPs [general practitioners] will see you if you can’t pay and don’t have insurance.”

She said the “undocumented crowd” tends to arrive with a lot of the same conditions. Many find their way to Houston not long after crossing the southern border. Some of the common health issues Dana encounters include dehydration, unhealed fractures, respiratory illnesses, stomach ailments, and pregnancy-related concerns.

“This isn’t a new problem, it’s just worse now,” Dana said.

Medicaid Factor

One of the main government healthcare resources illegal immigrants use is Medicaid.

All those who don’t qualify for regular Medicaid are eligible for Emergency Medicaid, regardless of immigration status. By doing this, the program helps pay for the cost of uncompensated care bills at qualifying hospitals.

However, some loopholes allow access to the regular Medicaid benefits. “Qualified noncitizens” who haven’t been granted legal status within five years still qualify if they’re listed as a refugee, an asylum seeker, or a Cuban or Haitian national.

Yet the lion’s share of Medicaid usage by illegal immigrants still comes through state-level benefits and emergency medical treatment.

A Congressional report highlighted data from the CMS, which showed total Medicaid costs for “emergency services for undocumented aliens” in fiscal year 2021 surpassed $7 billion, and totaled more than $5 billion in fiscal 2022.

Both years represent a significant spike from the $3 billion in fiscal 2020.

An employee working with Medicaid who asked to be referred to only as Jennifer out of concern for her job, told The Epoch Times that at a state level, it’s easy for an illegal immigrant to access the program benefits.

Jennifer said that when exceptions are sent from states to CMS for approval, “denial is actually super rare. It’s usually always approved.”

She also said it comes as no surprise that many of the states with the highest amount of Medicaid spending are sanctuary states, which tend to have policies and laws that shield illegal immigrants from federal immigration authorities.

Moreover, Jennifer said there are ways for states to get around CMS guidelines. “It’s not easy, but it can and has been done.”

The first generation of illegal immigrants who arrive to the United States tend to be healthy enough to pass any pre-screenings, but Jennifer has observed that the subsequent generations tend to be sicker and require more access to care. If a family is illegally present, they tend to use Emergency Medicaid or nothing at all.

The Epoch Times asked Medicaid Services to provide the most recent data for the total uncompensated care that hospitals have reported. The agency didn’t respond.

Continue reading over at The Epoch Times

Uncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

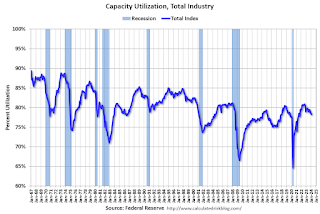

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex