Uncategorized

The #1 Warning Sign Capital Controls Are Coming Soon And 4 Ways To Beat Them

The #1 Warning Sign Capital Controls Are Coming Soon And 4 Ways To Beat Them

Authored by Nick Giambruno via InternationalMan.com,

Weekends…

Authored by Nick Giambruno via InternationalMan.com,

Weekends and holidays are the perfect time to catch people off guard…

Like a street thug committing a mugging, capital controls blindside most people - otherwise, they wouldn’t be effective.

The government declares a surprise bank holiday and shuts all the banks - mere hours after they denied they were even thinking about such actions.

They impose capital controls to stop citizens from taking their money out of the country.

Cash-sniffing dogs, which make drug-sniffing dogs look friendly, show up at airports and border crossings.

At this point, your savings are like a lobster in a trap. It’s not hard to see what comes next…

Once a desperate government has your money within its reach, it’ll find a way to take as much of it as possible.

Don’t be surprised if your local currency suffers a massive devaluation, bank deposits are suddenly worth a fraction of what they were just yesterday, or the government imposes an emergency tax.

Whatever the method or pretext, the outcome is always the same: a wealth transfer from you to the government.

This familiar story has played out in many countries in recent years. The pattern is clear and should surprise no one the next time it happens.

It’s all but certain governments in financial trouble will turn to capital controls as a desperate, misguided solution—with devastating consequences for ordinary people.

Argentina, Lebanon, Venezuela, Iceland, Greece, Cyprus, Turkey, Russia, Ukraine, China, India, South Korea, and governments in countless other countries have recently imposed capital.

The lesson from these examples is capital controls can happen anywhere and anytime.

Although it seems unthinkable to most, there is an excellent chance capital controls are coming to the US—they’ve happened before and could happen again soon.

Remember, in 1933, through Executive Order 6102, President Roosevelt forced Americans to exchange their gold for US dollars under penalty of 10 years in prison and a $10,000 fine (or more than $242,000 in today’s debased confetti).

Of course, the official government gold exchange rate was unfavorable. It amounted to around a 41% confiscation of purchasing power.

The US government continued prohibiting private ownership of gold bullion for 41 years until they reluctantly allowed the plebs to own it again in 1974.

So, there is a clear historical precedent for implementing capital controls in the US, especially during a crisis.

Today, it’s self-evident the fiat currency system centered on the US dollar is self-destructing at an alarming rate.

After more than 52 years, it’s long past the end of its shelf-life, like a carton of spoiled milk.

Even the global elites running the system can see that and openly talk about what they want to come next.

That’s why there’s all this talk about a Great Reset… and without a doubt, capital controls will be part of it.

All it would take is a crisis—real or contrived—or some other pretext and the stroke of the president’s pen on a new executive order.

Expect it to happen.

Why and How Governments Impose Capital Controls

Capital controls are government restrictions on how people can use their money—something that should be abhorrent to anyone who believes in property rights and a free society.

Here’s how capital controls work…

Governments might allow people to buy foreign currency (or gold) only at an “official” rate that they set, which is always less favorable than the free-market rate. The difference between the fake official rate and the real free-market rate amounts to a wealth transfer to the government.

Another form of capital controls is steep taxes on international money transfers or purchasing foreign assets.

Governments could also flat-out prohibit ownership of foreign assets or moving any form of wealth outside the country.

No matter what flavor they come in, capital controls always help a government trap money within its borders so it’s easier for them to take.

A propaganda campaign is also necessary to gaslight people into believing such actions are required to protect the average person.

Expect politicians to make disingenuous claims to make them appear as saviors instead of aggressors.

The mainstream media will amplify this false narrative and demonize those opposed to capital controls as disloyal citizens or worse.

What Happens After Capital Controls

Capital controls are always a prelude to something worse.

That’s because once governments trap money inside a country, it’s probably only a matter of hours before there is wealth confiscation. Anything they don’t steal immediately, they box in for future thefts.

That’s why you must act before they impose capital controls.

How much time do you have?

While it’s impossible to know, acting well in advance is advisable. It’s better to be a year early than even a minute late.

However, there is one common feature I’ve noticed when countries impose capital controls that indicates the situation is imminent. It’s like someone waving a big fat red flag.

That warning sign is a government official denying that they are considering imposing capital controls.

Whenever you hear a central banker or politician say something won’t happen, you can almost be sure it will happen. And probably soon.

Coming from a bureaucrat, the real meaning of “no, of course not” is “it could happen tomorrow.”

It’s like the old saying: “Believe nothing until it has been officially denied.”

These deceptions have a purpose: Politicians and central bankers must surprise the public to get the desired results.

When you hear the official denial, you probably have only a matter of hours before they impose capital controls. Urgent action is required.

Four Ways To Beat Capital Controls

The solution is simple.

Place some of your savings outside your home country so it’s not trapped when the government imposes capital controls. It will be waiting for you safely on the other side.

Below are four ways you can do that.

First, obtain a foreign bank account. Capital controls imposed in your home country are unlikely to affect a bank account in another country.

Second, real estate in a foreign country is an excellent way to store significant capital abroad. Your home government won’t be able to seize it without a literal act of war.

Third, another solution is physical gold bullion coins held in a non-bank vault in a friendly foreign jurisdiction.

Last, there is Bitcoin, which is like kryptonite to capital controls.

Bitcoin is the most portable asset in the world. It’s a digital bearer asset that can achieve final international settlement in 10 minutes for pennies.

Anyone with a smartphone can use Bitcoin to send and receive value anywhere in the world—capital controls be damned.

Going through airports and crossing borders with Bitcoin is much more practical than other forms of wealth.

If you hold Bitcoin on your phone, laptop, or flash drive, it can be accessible to border agents if they search you and you reveal your password. However, those things are much less conspicuous than gold or stacks of cash.

Further, many popular Bitcoin wallets use a 12-word phrase to recover your funds. If you memorize the 12-word phrase, you can potentially store billions of dollars worth of value just in your head with nothing else.

That’s why Bitcoin skyrockets in popularity in countries with capital controls.

Conclusion

The current dollar-based monetary system is on its way out. Even the central bankers running the system can see that.

They are preparing for what comes next as they attempt to “reset” the system. It’s a virtual certainty they will impose capital controls.

I suspect it could all go down soon… and it won’t be pretty for most people.

We are likely on the cusp of a historic financial earthquake…

One that could alter the direction of the US forever and mark the biggest economic event of our lifetimes.

Yet few people are aware of what is happening.

And even fewer know how to prepare.

That’s exactly why I just released an urgent new report with all the details, including what you must do to prepare. It’s called, The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now. Click here to download the PDF now.

Uncategorized

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

One month after the inflation outlook tracked…

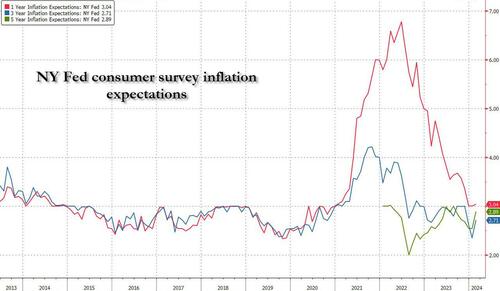

One month after the inflation outlook tracked by the NY Fed Consumer Survey extended their late 2023 slide, with 3Y inflation expectations in January sliding to a record low 2.4% (from 2.6% in December), even as 1 and 5Y inflation forecasts remained flat, moments ago the NY Fed reported that in February there was a sharp rebound in longer-term inflation expectations, rising to 2.7% from 2.4% at the three-year ahead horizon, and jumping to 2.9% from 2.5% at the five-year ahead horizon, while the 1Y inflation outlook was flat for the 3rd month in a row, stuck at 3.0%.

The increases in both the three-year ahead and five-year ahead measures were most pronounced for respondents with at most high school degrees (in other words, the "really smart folks" are expecting deflation soon). The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at all horizons, while the median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined at the one- and three-year ahead horizons and remained unchanged at the five-year ahead horizon.

Going down the survey, we find that the median year-ahead expected price changes increased by 0.1 percentage point to 4.3% for gas; decreased by 1.8 percentage points to 6.8% for the cost of medical care (its lowest reading since September 2020); decreased by 0.1 percentage point to 5.8% for the cost of a college education; and surprisingly decreased by 0.3 percentage point for rent to 6.1% (its lowest reading since December 2020), and remained flat for food at 4.9%.

We find the rent expectations surprising because it is happening just asking rents are rising across the country.

At the same time as consumers erroneously saw sharply lower rents, median home price growth expectations remained unchanged for the fifth consecutive month at 3.0%.

Turning to the labor market, the survey found that the average perceived likelihood of voluntary and involuntary job separations increased, while the perceived likelihood of finding a job (in the event of a job loss) declined. "The mean probability of leaving one’s job voluntarily in the next 12 months also increased, by 1.8 percentage points to 19.5%."

Mean unemployment expectations - or the mean probability that the U.S. unemployment rate will be higher one year from now - decreased by 1.1 percentage points to 36.1%, the lowest reading since February 2022. Additionally, the median one-year-ahead expected earnings growth was unchanged at 2.8%, remaining slightly below its 12-month trailing average of 2.9%.

Turning to household finance, we find the following:

- The median expected growth in household income remained unchanged at 3.1%. The series has been moving within a narrow range of 2.9% to 3.3% since January 2023, and remains above the February 2020 pre-pandemic level of 2.7%.

- Median household spending growth expectations increased by 0.2 percentage point to 5.2%. The increase was driven by respondents with a high school degree or less.

- Median year-ahead expected growth in government debt increased to 9.3% from 8.9%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.6 percentage point to 26.1%, remaining below its 12-month trailing average of 30%.

- Perceptions about households’ current financial situations deteriorated somewhat with fewer respondents reporting being better off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off and a slightly larger share of respondents expecting to be worse off a year from now.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 1.4 percentage point to 38.9%.

- At the same time, perceptions and expectations about credit access turned less optimistic: "Perceptions of credit access compared to a year ago deteriorated with a larger share of respondents reporting tighter conditions and a smaller share reporting looser conditions compared to a year ago."

Also, a smaller percentage of consumers, 11.45% vs 12.14% in prior month, expect to not be able to make minimum debt payment over the next three months

Last, and perhaps most humorous, is the now traditional cognitive dissonance one observes with these polls, because at a time when long-term inflation expectations jumped, which clearly suggests that financial conditions will need to be tightened, the number of respondents expecting higher stock prices one year from today jumped to the highest since November 2021... which incidentally is just when the market topped out during the last cycle before suffering a painful bear market.

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemployment-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex