‘Still early’ for BTC price peak: 5 things to watch in Bitcoin this week

Bitcoin still has plenty of room to run this cycle, data reiterates, while April price gains may "depend on" consumers investing and leaving debts for another day.

Bitcoin (BTC) starts a new week in all-too-familiar territory with…

Bitcoin still has plenty of room to run this cycle, data reiterates, while April price gains may "depend on" consumers investing and leaving debts for another day.

Bitcoin (BTC) starts a new week in all-too-familiar territory with all-time highs just out of reach.

After a positive weekend, the largest cryptocurrency has avoided a deeper price dip than that seen last week, and $50,000 has stuck as support. What next?

Cointelegraph takes a look at five factors which may shape Bitcoin price action in the coming days.

Stocks set for crunch moment

Monday will form an interesting open for U.S. equities as fears mount over the impact of Friday’s $20 billion worth of block trades.

Originating from major players Goldman Sachs and Morgan Stanley, the surprise appearance of the orders targeting mostly tech stocks has caused a headache for traders. This will now play out once the market opens on Wall St. on Monday.

“Traders everywhere know the story and will be glued to their screens,” portfolio manager Sharif Farha told Bloomberg.

Volatility in stocks implies a knock-on effect for Bitcoin, but the ultimate extent of that depends on movements which at the time of writing remain unknown.

“The markets could start trading in a friendly manner at the beginning of the week,” Andreas Lipkow, a strategist at German bank Comdirect added.

“Although there is currently some major profit-taking and unusual block trade activities, these market asymmetries can currently still be processed well.”

Other macro factors include declining oil prices, though this is nevertheless not as pressing for BTC hawks as stocks. An Opec+ meeting later this week, combined with the potential resolution of the crisis in the Suez Canal, are pushing prices down as expectations of a supply increase rise.

BTC price "still consolidating" at $56,000

For Bitcoin spot markets, at least earlier on Monday, it’s a tale of consolidation.

Saturday and Sunday brought some welcome relief for traders who had watched BTC/USD descend to lows, which at one point tapped $50,000 itself.

Deeper dives were avoided, however, and liquidity at $46,000 was left untouched in favor of a return to familiar resistance beginning at around $56,000.

At the time of writing, that was exactly where Bitcoin was, still unable to tackle what has become a broad sea of sellers all the way up to current all-time highs of $61,700.

“Bitcoin scenario is playing out so far, in which the crucial resistance fails to break in one-go. Either way, that's not bad,” Cointelegraph Markets analyst Michaël van de Poppe summarized on Sunday.

“If $54K fails to hold support, I'm assuming we'll see this scenario play out. Still consolidation.”

This wait-and-see attitude has characterized the mood among analysts following the all-time highs. The consequences of a supply shock in the form of draining exchange reserves and a lack of selling from strong hodlers, they argue, have yet to be felt.

April gains "depend on" consumer spending

April’s price performance will “depend” just as much on retail investors as the institutional crowd, according to on-chain analytics service Glassnode.

In its latest research published last week, Glassnode highlighted an unusual disparity between U.S. consumer spending and disposable income generated by coronavirus lockdowns.

While normally tightly bound, the onset of lockdowns saw the two measures of retail investor purchasing power diverge — there was more money, thanks to stimulus checks among other factors, but nowhere to spend it.

Now, with reopening creeping into multiple states, the balance is primed to be redressed as pent-up consumer demand becomes a major narrative.

“Many households now have an extra buffer of income to spend, due to new stimulus checks and decreased spending during lockdowns,” co-founders Yann Allemann Jan Happel tweeted.

“Will they invest this into markets or pay off debt? Bitcoin's April performance will depend on it.”

An accompanying blog post argues that the most recent stimulus checks, worth $1,400, have yet to make their presence felt in the economy.

“The recent stimulus package was much larger than the one in January, yet global markets have felt little effects of it in the global markets so far,” Glassnode said.

“It’s difficult to measure to what extent the checks have arrived in households until today, and more importantly how willingly retail is going to spend or save the money this time considering it may be the last monetary stimulus for a while.”

Unconfirmed reports meanwhile suggest that the next round of checks may come sooner than thought.

RSI says Bitcoin will deliver more gains

Bitcoin technical indicators remain overwhelmingly bullish on longer timeframes.

The latest one to be highlighted is the relative strength index (RSI), which is now entering its “peak” phase which traditionally accompanies price highs.

Quant analyst PlanB, creator of the stock-to-flow series of Bitcoin price models, showed how RSI fluctuates relative to the point in Bitcoin’s halving cycles — four-yearly periods between reductions in the block subsidies paid to miners.

With the year after a halving normally the best in terms of price gains, RSI is indicating that 2021 will be no different to 2013 or 2017.

“Bitcoin monthly RSI is not even 95. In 2011, 2013 and 2017 bull markets we had at least 3 months above 95. Still early,” he summarized over the weekend.

Stock-to-flow meanwhile demands a $100,000 or $288,000 average BTC/USD price this halving cycle, depending on the exact model used.

Fear & Greed stays calm

In terms of investor sentiment, the weekend’s price rise had a welcome muted effect on the chances of an instant sell-off.

That’s according to a classic measure of the market, the Crypto Fear & Greed Index.

A scale between 0 and 100, Fear & Greed charts how the market is feeling about Bitcoin price action, and infers whether recent activity means that it is due for a bounce off lows or a sell-off from highs.

The trip to previous all-time highs of $58,300 in February sparked warning signs from the Index, which circled all-time highs alongside BTC/USD. The comedown saw its score slashed from 94/100 to 38/100 by March 1, only to return to the mid-70s days later.

At the time of writing, the Index measures 72/100, classified as “greed” among investors, but still with much room for leeway before entering sell-off territory, denoted as “extreme greed.”

cryptocurrency bitcoin crypto btc coronavirusUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.

emphasis added

Click on graph for larger image.

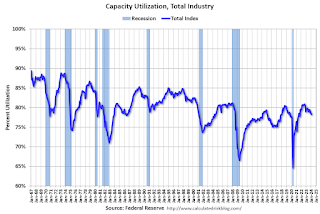

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

International

Fuel poverty in England is probably 2.5 times higher than government statistics show

The top 40% most energy efficient homes aren’t counted as being in fuel poverty, no matter what their bills or income are.

The cap set on how much UK energy suppliers can charge for domestic gas and electricity is set to fall by 15% from April 1 2024. Despite this, prices remain shockingly high. The average household energy bill in 2023 was £2,592 a year, dwarfing the pre-pandemic average of £1,308 in 2019.

The term “fuel poverty” refers to a household’s ability to afford the energy required to maintain adequate warmth and the use of other essential appliances. Quite how it is measured varies from country to country. In England, the government uses what is known as the low income low energy efficiency (Lilee) indicator.

Since energy costs started rising sharply in 2021, UK households’ spending powers have plummeted. It would be reasonable to assume that these increasingly hostile economic conditions have caused fuel poverty rates to rise.

However, according to the Lilee fuel poverty metric, in England there have only been modest changes in fuel poverty incidence year on year. In fact, government statistics show a slight decrease in the nationwide rate, from 13.2% in 2020 to 13.0% in 2023.

Our recent study suggests that these figures are incorrect. We estimate the rate of fuel poverty in England to be around 2.5 times higher than what the government’s statistics show, because the criteria underpinning the Lilee estimation process leaves out a large number of financially vulnerable households which, in reality, are unable to afford and maintain adequate warmth.

Energy security

In 2022, we undertook an in-depth analysis of Lilee fuel poverty in Greater London. First, we combined fuel poverty, housing and employment data to provide an estimate of vulnerable homes which are omitted from Lilee statistics.

We also surveyed 2,886 residents of Greater London about their experiences of fuel poverty during the winter of 2022. We wanted to gauge energy security, which refers to a type of self-reported fuel poverty. Both parts of the study aimed to demonstrate the potential flaws of the Lilee definition.

Introduced in 2019, the Lilee metric considers a household to be “fuel poor” if it meets two criteria. First, after accounting for energy expenses, its income must fall below the poverty line (which is 60% of median income).

Second, the property must have an energy performance certificate (EPC) rating of D–G (the lowest four ratings). The government’s apparent logic for the Lilee metric is to quicken the net-zero transition of the housing sector.

In Sustainable Warmth, the policy paper that defined the Lilee approach, the government says that EPC A–C-rated homes “will not significantly benefit from energy-efficiency measures”. Hence, the focus on fuel poverty in D–G-rated properties.

Generally speaking, EPC A–C-rated homes (those with the highest three ratings) are considered energy efficient, while D–G-rated homes are deemed inefficient. The problem with how Lilee fuel poverty is measured is that the process assumes that EPC A–C-rated homes are too “energy efficient” to be considered fuel poor: the main focus of the fuel poverty assessment is a characteristic of the property, not the occupant’s financial situation.

In other words, by this metric, anyone living in an energy-efficient home cannot be considered to be in fuel poverty, no matter their financial situation. There is an obvious flaw here.

Around 40% of homes in England have an EPC rating of A–C. According to the Lilee definition, none of these homes can or ever will be classed as fuel poor. Even though energy prices are going through the roof, a single-parent household with dependent children whose only income is universal credit (or some other form of benefits) will still not be considered to be living in fuel poverty if their home is rated A-C.

The lack of protection afforded to these households against an extremely volatile energy market is highly concerning.

In our study, we estimate that 4.4% of London’s homes are rated A-C and also financially vulnerable. That is around 171,091 households, which are currently omitted by the Lilee metric but remain highly likely to be unable to afford adequate energy.

In most other European nations, what is known as the 10% indicator is used to gauge fuel poverty. This metric, which was also used in England from the 1990s until the mid 2010s, considers a home to be fuel poor if more than 10% of income is spent on energy. Here, the main focus of the fuel poverty assessment is the occupant’s financial situation, not the property.

Were such alternative fuel poverty metrics to be employed, a significant portion of those 171,091 households in London would almost certainly qualify as fuel poor.

This is confirmed by the findings of our survey. Our data shows that 28.2% of the 2,886 people who responded were “energy insecure”. This includes being unable to afford energy, making involuntary spending trade-offs between food and energy, and falling behind on energy payments.

Worryingly, we found that the rate of energy insecurity in the survey sample is around 2.5 times higher than the official rate of fuel poverty in London (11.5%), as assessed according to the Lilee metric.

It is likely that this figure can be extrapolated for the rest of England. If anything, energy insecurity may be even higher in other regions, given that Londoners tend to have higher-than-average household income.

The UK government is wrongly omitting hundreds of thousands of English households from fuel poverty statistics. Without a more accurate measure, vulnerable households will continue to be overlooked and not get the assistance they desperately need to stay warm.

Torran Semple receives funding from Engineering and Physical Sciences Research Council (EPSRC) grant EP/S023305/1.

John Harvey does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

european uk pandemicUncategorized

Southwest and United Airlines have bad news for passengers

Both airlines are facing the same problem, one that could lead to higher airfares and fewer flight options.

Airlines operate in a market that's dictated by supply and demand: If more people want to fly a specific route than there are available seats, then tickets on those flights cost more.

That makes scheduling and predicting demand a huge part of maximizing revenue for airlines. There are, however, numerous factors that go into how airlines decide which flights to put on the schedule.

Related: Major airline faces Chapter 11 bankruptcy concerns

Every airport has only a certain number of gates, flight slots and runway capacity, limiting carriers' flexibility. That's why during times of high demand — like flights to Las Vegas during Super Bowl week — do not usually translate to airlines sending more planes to and from that destination.

Airlines generally do try to add capacity every year. That's become challenging as Boeing has struggled to keep up with demand for new airplanes. If you can't add airplanes, you can't grow your business. That's caused problems for the entire industry.

Every airline retires planes each year. In general, those get replaced by newer, better models that offer more efficiency and, in most cases, better passenger amenities.

If an airline can't get the planes it had hoped to add to its fleet in a given year, it can face capacity problems. And it's a problem that both Southwest Airlines (LUV) and United Airlines have addressed in a way that's inevitable but bad for passengers.

Image source: Kevin Dietsch/Getty Images

Southwest slows down its pilot hiring

In 2023, Southwest made a huge push to hire pilots. The airline lost thousands of pilots to retirement during the covid pandemic and it needed to replace them in order to build back to its 2019 capacity.

The airline successfully did that but will not continue that trend in 2024.

"Southwest plans to hire approximately 350 pilots this year, and no new-hire classes are scheduled after this month," Travel Weekly reported. "Last year, Southwest hired 1,916 pilots, according to pilot recruitment advisory firm Future & Active Pilot Advisors. The airline hired 1,140 pilots in 2022."

The slowdown in hiring directly relates to the airline expecting to grow capacity only in the low-single-digits percent in 2024.

"Moving into 2024, there is continued uncertainty around the timing of expected Boeing deliveries and the certification of the Max 7 aircraft. Our fleet plans remain nimble and currently differs from our contractual order book with Boeing," Southwest Airlines Chief Financial Officer Tammy Romo said during the airline's fourth-quarter-earnings call.

"We are planning for 79 aircraft deliveries this year and expect to retire roughly 45 700 and 4 800, resulting in a net expected increase of 30 aircraft this year."

That's very modest growth, which should not be enough of an increase in capacity to lower prices in any significant way.

United Airlines pauses pilot hiring

Boeing's (BA) struggles have had wide impact across the industry. United Airlines has also said it was going to pause hiring new pilots through the end of May.

United (UAL) Fight Operations Vice President Marc Champion explained the situation in a memo to the airline's staff.

"As you know, United has hundreds of new planes on order, and while we remain on path to be the fastest-growing airline in the industry, we just won't grow as fast as we thought we would in 2024 due to continued delays at Boeing," he said.

"For example, we had contractual deliveries for 80 Max 10s this year alone, but those aircraft aren't even certified yet, and it's impossible to know when they will arrive."

That's another blow to consumers hoping that multiple major carriers would grow capacity, putting pressure on fares. Until Boeing can get back on track, it's unlikely that competition between the large airlines will lead to lower fares.

In fact, it's possible that consumer demand will grow more than airline capacity which could push prices higher.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic stocks-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex