Uncategorized

Solar PV backsheet market size to increase by USD 1,503.88 million: Market research insights highlight increasing use of thin-film solar PV modules as a key driver – Technavio

Solar PV backsheet market size to increase by USD 1,503.88 million: Market research insights highlight increasing use of thin-film solar PV modules as a key driver – Technavio

PR Newswire

NEW YORK, Jan. 18, 2023

NEW YORK, Jan. 18, 2023 /PRNewswire/…

Solar PV backsheet market size to increase by USD 1,503.88 million: Market research insights highlight increasing use of thin-film solar PV modules as a key driver - Technavio

PR Newswire

NEW YORK, Jan. 18, 2023

NEW YORK, Jan. 18, 2023 /PRNewswire/ -- According to Technavio, the solar PV backsheet market will witness a YOY growth of 9.78% in 2023. The market is segmented by product (fluoropolymer and non-fluoropolymer), end-user (utility, commercial, and residential), and geography (APAC, Europe, North America, South America, and Middle East and Africa). The solar PV backsheet market size is estimated to increase by USD 1,503.88 million at a CAGR of 10.75% from 2022 to 2027. - Request a Sample Report

Solar PV backsheet Market - Vendor Insights

The global solar PV backsheet market is highly fragmented, with the presence of several global and regional vendors. Global vendors have a strong foothold in the market. They are investing in various technologies to develop high-quality solar PV backsheets. Other prominent vendors are trying to remain competitive and garner major market revenue by establishing a strong customer base.

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

- Agfa Gevaert NV

- Arkema Group

- COVEME Spa

- Cybrid Technologies Inc.

- DUNMORE Corp.

- DuPont de Nemours Inc.

- FLEXcon Co. Inc.

- Honeywell International Inc.

- Jiangsu Zhongtian Technology Co Ltd

- Jolywood (Suzhou) Sunwatt Co Ltd

- Koninklijke DSM NV

- KREMPEL GmbH

- Mitsubishi Corp.

- Nippon Light Metal Holdings Co. Ltd.

- Targray Technology International Inc.

- For details on vendor and its offerings – Buy the report!

Solar PV backsheet Market - Geographical Analysis

APAC will provide maximum growth opportunities in solar PV backsheet market during the forecast period. According to our research report, the region will account for 66% of the global market growth during the forecast period.

The market in APAC is majorly driven by increased investments in renewable energy in China, India, South Korea, and Australia. Governments in these countries have set targets to install solar-based powered plants to reduce dependency on fossil fuel powered electricity generation. According to IEA, in 2021, India accounted for more than 11% of the global cumulative installed capacity of solar PV. This is expected to further grow with increasing demand for electricity due to rapid economic growth. Such developments are fostering the growth of the solar PV backsheet market in APAC.

Solar PV backsheet Market - Key Segment Analysis

The market share growth by the fluoropolymer segment will be significant during the forecast period. Fluoropolymer solar PV backsheets exhibit long-term performance and reliability in diverse climatic conditions. They also have low module power loss and almost no backsheet degradation. Such benefits are driving the demand for fluoropolymer solar PV backsheets.

Download a Sample to obtain additional highlights and key points on various market segments and their impact in coming years.

Solar PV backsheet Market - Key Market Drivers and Challenges:

The solar PV backsheet market is primarily driven by the increasing use of thin-film solar PV modules. The demand for thin-film solar PV modules is increasing among end-users. They cost less than other solar PV modules and offer better flexibility which makes them ideal for use on curved surfaces. These properties have increased their use in building-integrated photovoltaics (BIPVs). The growing use of thin-film solar PV modlues in many applications has increased the demand for backsheets to conform to uneven structures to promote the flexibility of the module and provide a high vapor barrier to enable the efficient performance of thin-film solar PV modules. This, in turn, is driving the growth of the market.

The risk of backsheet-associated PV module failure is a major challenge in the market. Backsheets of solar PV modules have various drawbacks, including chalking and cracking. These issues are often observed in conjunction with the formation of a matte and rough surface on the backsheet, which leads to the formation of mold. The formation of mold further leads to insulation failure of the backsheet or cracking of the backsheet along the busbars and the cells of modules. Such failures lead to the loss of ultraviolet (UV) protection to the modules and affect the productivity of solar modules. These challenges are hindering the growth of the market.

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the solar PV backsheet market between 2023 and 2027

- Precise estimation of the size of the solar PV backsheet market and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market industry across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of solar PV backsheet market vendors

Register for a free trial today and gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Related Reports:

- The solar photovoltaic services (PV) market is estimated to grow at a CAGR of 15.38% between 2022 and 2027. The size of the market is forecast to increase by USD 16,359.62 million. The increasing new installations and aging asset base of solar PV modules are notably driving the market growth, although factors such as challenges associated with recycling of scrap from solar PV systems may impede the market growth.

- The clean energy technologies market is estimated to grow at a CAGR of 5.94% between 2022 and 2027. The size of the market is forecast to increase by USD 94,999.86 million. The rising demand for clean energy sources is notably driving the market growth, although factors such as challenges associated with the availability of renewable sources of energy may impede the market growth.

Solar PV Backsheet Market Scope | |

Report Coverage | Details |

Page number | 168 |

Base year | 2022 |

Historic period | 2017-2021 |

Forecast period | 2023-2027 |

Growth momentum & CAGR | Accelerate at a CAGR of 10.75% |

Market growth 2023-2027 | USD 1503.88 million |

Market structure | Fragmented |

YoY growth 2022-2023(%) | 9.78 |

Regional analysis | APAC, Europe, North America, South America, and Middle East and Africa |

Performing market contribution | APAC at 66% |

Key countries | US, China, Japan, Australia, and Germany |

Competitive landscape | Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

Key companies profiled | 3M Co., Agfa Gevaert NV, Arkema Group, COVEME Spa, Cybrid Technologies Inc., DUNMORE Corp., DuPont de Nemours Inc., FLEXcon Co. Inc., Honeywell International Inc., Jiangsu Zhongtian Technology Co Ltd, Jolywood (Suzhou) Sunwatt Co Ltd, Koninklijke DSM NV, KREMPEL GmbH, Mitsubishi Corp., Nippon Light Metal Holdings Co. Ltd., Targray Technology International Inc., Tomark Worthen LLC, Toppan Printing Co Ltd, Toray Industries Inc., and Toyobo Co. Ltd. |

Market dynamics | Parent market analysis, market growth inducers and obstacles, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and market condition analysis for the forecast period. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Product

- Exhibit 06: Executive Summary – Chart on Market Segmentation by End-user

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global - Market size and forecast 2022-2027 ($ million)

- Exhibit 15: Data Table on Global - Market size and forecast 2022-2027 ($ million)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global solar PV backsheet Market 2017 - 2021

- Exhibit 18: Historic Market Size – Data Table on Global solar PV backsheet Market 2017 - 2021 ($ million)

- 4.2 Product Segment Analysis 2017 - 2021

- Exhibit 19: Historic Market Size – Product Segment 2017 - 2021 ($ million)

- 4.3 End-user Segment Analysis 2017 - 2021

- Exhibit 20: Historic Market Size – End-user Segment 2017 - 2021 ($ million)

- 4.4 Geography Segment Analysis 2017 - 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 - 2021 ($ million)

- 4.5 Country Segment Analysis 2017 - 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 - 2021 ($ million)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis - Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition - Five forces 2022 and 2027

6 Market Segmentation by Product

- 6.1 Market segments

- Exhibit 30: Chart on Product - Market share 2022-2027 (%)

- Exhibit 31: Data Table on Product - Market share 2022-2027 (%)

- 6.2 Comparison by Product

- Exhibit 32: Chart on Comparison by Product

- Exhibit 33: Data Table on Comparison by Product

- 6.3 Fluoropolymer - Market size and forecast 2022-2027

- Exhibit 34: Chart on Fluoropolymer - Market size and forecast 2022-2027 ($ million)

- Exhibit 35: Data Table on Fluoropolymer - Market size and forecast 2022-2027 ($ million)

- Exhibit 36: Chart on Fluoropolymer - Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Fluoropolymer - Year-over-year growth 2022-2027 (%)

- 6.4 Non-fluoropolymer - Market size and forecast 2022-2027

- Exhibit 38: Chart on Non-fluoropolymer - Market size and forecast 2022-2027 ($ million)

- Exhibit 39: Data Table on Non-fluoropolymer - Market size and forecast 2022-2027 ($ million)

- Exhibit 40: Chart on Non-fluoropolymer - Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Non-fluoropolymer - Year-over-year growth 2022-2027 (%)

- 6.5 Market opportunity by Product

- Exhibit 42: Market opportunity by Product ($ million)

7 Market Segmentation by End-user

- 7.1 Market segments

- Exhibit 43: Chart on End-user - Market share 2022-2027 (%)

- Exhibit 44: Data Table on End-user - Market share 2022-2027 (%)

- 7.2 Comparison by End-user

- Exhibit 45: Chart on Comparison by End-user

- Exhibit 46: Data Table on Comparison by End-user

- 7.3 Utility - Market size and forecast 2022-2027

- Exhibit 47: Chart on Utility - Market size and forecast 2022-2027 ($ million)

- Exhibit 48: Data Table on Utility - Market size and forecast 2022-2027 ($ million)

- Exhibit 49: Chart on Utility - Year-over-year growth 2022-2027 (%)

- Exhibit 50: Data Table on Utility - Year-over-year growth 2022-2027 (%)

- 7.4 Commercial - Market size and forecast 2022-2027

- Exhibit 51: Chart on Commercial - Market size and forecast 2022-2027 ($ million)

- Exhibit 52: Data Table on Commercial - Market size and forecast 2022-2027 ($ million)

- Exhibit 53: Chart on Commercial - Year-over-year growth 2022-2027 (%)

- Exhibit 54: Data Table on Commercial - Year-over-year growth 2022-2027 (%)

- 7.5 Residential - Market size and forecast 2022-2027

- Exhibit 55: Chart on Residential - Market size and forecast 2022-2027 ($ million)

- Exhibit 56: Data Table on Residential - Market size and forecast 2022-2027 ($ million)

- Exhibit 57: Chart on Residential - Year-over-year growth 2022-2027 (%)

- Exhibit 58: Data Table on Residential - Year-over-year growth 2022-2027 (%)

- 7.6 Market opportunity by End-user

- Exhibit 59: Market opportunity by End-user ($ million)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 60: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 61: Chart on Market share by geography 2022-2027 (%)

- Exhibit 62: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 63: Chart on Geographic comparison

- Exhibit 64: Data Table on Geographic comparison

- 9.3 APAC - Market size and forecast 2022-2027

- Exhibit 65: Chart on APAC - Market size and forecast 2022-2027 ($ million)

- Exhibit 66: Data Table on APAC - Market size and forecast 2022-2027 ($ million)

- Exhibit 67: Chart on APAC - Year-over-year growth 2022-2027 (%)

- Exhibit 68: Data Table on APAC - Year-over-year growth 2022-2027 (%)

- 9.4 Europe - Market size and forecast 2022-2027

- Exhibit 69: Chart on Europe - Market size and forecast 2022-2027 ($ million)

- Exhibit 70: Data Table on Europe - Market size and forecast 2022-2027 ($ million)

- Exhibit 71: Chart on Europe - Year-over-year growth 2022-2027 (%)

- Exhibit 72: Data Table on Europe - Year-over-year growth 2022-2027 (%)

- 9.5 North America - Market size and forecast 2022-2027

- Exhibit 73: Chart on North America - Market size and forecast 2022-2027 ($ million)

- Exhibit 74: Data Table on North America - Market size and forecast 2022-2027 ($ million)

- Exhibit 75: Chart on North America - Year-over-year growth 2022-2027 (%)

- Exhibit 76: Data Table on North America - Year-over-year growth 2022-2027 (%)

- 9.6 South America - Market size and forecast 2022-2027

- Exhibit 77: Chart on South America - Market size and forecast 2022-2027 ($ million)

- Exhibit 78: Data Table on South America - Market size and forecast 2022-2027 ($ million)

- Exhibit 79: Chart on South America - Year-over-year growth 2022-2027 (%)

- Exhibit 80: Data Table on South America - Year-over-year growth 2022-2027 (%)

- 9.7 Middle East and Africa - Market size and forecast 2022-2027

- Exhibit 81: Chart on Middle East and Africa - Market size and forecast 2022-2027 ($ million)

- Exhibit 82: Data Table on Middle East and Africa - Market size and forecast 2022-2027 ($ million)

- Exhibit 83: Chart on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- Exhibit 84: Data Table on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- 9.8 China - Market size and forecast 2022-2027

- Exhibit 85: Chart on China - Market size and forecast 2022-2027 ($ million)

- Exhibit 86: Data Table on China - Market size and forecast 2022-2027 ($ million)

- Exhibit 87: Chart on China - Year-over-year growth 2022-2027 (%)

- Exhibit 88: Data Table on China - Year-over-year growth 2022-2027 (%)

- 9.9 Japan - Market size and forecast 2022-2027

- Exhibit 89: Chart on Japan - Market size and forecast 2022-2027 ($ million)

- Exhibit 90: Data Table on Japan - Market size and forecast 2022-2027 ($ million)

- Exhibit 91: Chart on Japan - Year-over-year growth 2022-2027 (%)

- Exhibit 92: Data Table on Japan - Year-over-year growth 2022-2027 (%)

- 9.10 US - Market size and forecast 2022-2027

- Exhibit 93: Chart on US - Market size and forecast 2022-2027 ($ million)

- Exhibit 94: Data Table on US - Market size and forecast 2022-2027 ($ million)

- Exhibit 95: Chart on US - Year-over-year growth 2022-2027 (%)

- Exhibit 96: Data Table on US - Year-over-year growth 2022-2027 (%)

- 9.11 Germany - Market size and forecast 2022-2027

- Exhibit 97: Chart on Germany - Market size and forecast 2022-2027 ($ million)

- Exhibit 98: Data Table on Germany - Market size and forecast 2022-2027 ($ million)

- Exhibit 99: Chart on Germany - Year-over-year growth 2022-2027 (%)

- Exhibit 100: Data Table on Germany - Year-over-year growth 2022-2027 (%)

- 9.12 Australia - Market size and forecast 2022-2027

- Exhibit 101: Chart on Australia - Market size and forecast 2022-2027 ($ million)

- Exhibit 102: Data Table on Australia - Market size and forecast 2022-2027 ($ million)

- Exhibit 103: Chart on Australia - Year-over-year growth 2022-2027 (%)

- Exhibit 104: Data Table on Australia - Year-over-year growth 2022-2027 (%)

- 9.13 Market opportunity by geography

- Exhibit 105: Market opportunity by geography ($ million)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 106: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 107: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 108: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 109: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 110: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 111: Matrix on vendor position and classification

- 12.3 3M Co.

- Exhibit 112: 3M Co. - Overview

- Exhibit 113: 3M Co. - Business segments

- Exhibit 114: 3M Co. - Key news

- Exhibit 115: 3M Co. - Key offerings

- Exhibit 116: 3M Co. - Segment focus

- 12.4 Agfa Gevaert NV

- Exhibit 117: Agfa Gevaert NV - Overview

- Exhibit 118: Agfa Gevaert NV - Business segments

- Exhibit 119: Agfa Gevaert NV - Key offerings

- Exhibit 120: Agfa Gevaert NV - Segment focus

- 12.5 Arkema Group

- Exhibit 121: Arkema Group - Overview

- Exhibit 122: Arkema Group - Business segments

- Exhibit 123: Arkema Group - Key news

- Exhibit 124: Arkema Group - Key offerings

- Exhibit 125: Arkema Group - Segment focus

- 12.6 COVEME Spa

- Exhibit 126: COVEME Spa - Overview

- Exhibit 127: COVEME Spa - Product / Service

- Exhibit 128: COVEME Spa - Key offerings

- 12.7 Cybrid Technologies Inc.

- Exhibit 129: Cybrid Technologies Inc. - Overview

- Exhibit 130: Cybrid Technologies Inc. - Product / Service

- Exhibit 131: Cybrid Technologies Inc. - Key offerings

- 12.8 DUNMORE Corp.

- Exhibit 132: DUNMORE Corp. - Overview

- Exhibit 133: DUNMORE Corp. - Product / Service

- Exhibit 134: DUNMORE Corp. - Key offerings

- 12.9 DuPont de Nemours Inc.

- Exhibit 135: DuPont de Nemours Inc. - Overview

- Exhibit 136: DuPont de Nemours Inc. - Business segments

- Exhibit 137: DuPont de Nemours Inc. - Key news

- Exhibit 138: DuPont de Nemours Inc. - Key offerings

- Exhibit 139: DuPont de Nemours Inc. - Segment focus

- 12.10 FLEXcon Co. Inc.

- Exhibit 140: FLEXcon Co. Inc. - Overview

- Exhibit 141: FLEXcon Co. Inc. - Product / Service

- Exhibit 142: FLEXcon Co. Inc. - Key offerings

- 12.11 Honeywell International Inc.

- Exhibit 143: Honeywell International Inc. - Overview

- Exhibit 144: Honeywell International Inc. - Business segments

- Exhibit 145: Honeywell International Inc. - Key news

- Exhibit 146: Honeywell International Inc. - Key offerings

- Exhibit 147: Honeywell International Inc. - Segment focus

- 12.12 Jiangsu Zhongtian Technology Co Ltd

- Exhibit 148: Jiangsu Zhongtian Technology Co Ltd - Overview

- Exhibit 149: Jiangsu Zhongtian Technology Co Ltd - Product / Service

- Exhibit 150: Jiangsu Zhongtian Technology Co Ltd - Key offerings

- 12.13 Jolywood (Suzhou) Sunwatt Co Ltd

- Exhibit 151: Jolywood (Suzhou) Sunwatt Co Ltd - Overview

- Exhibit 152: Jolywood (Suzhou) Sunwatt Co Ltd - Product / Service

- Exhibit 153: Jolywood (Suzhou) Sunwatt Co Ltd - Key offerings

- 12.14 Koninklijke DSM NV

- Exhibit 154: Koninklijke DSM NV - Overview

- Exhibit 155: Koninklijke DSM NV - Business segments

- Exhibit 156: Koninklijke DSM NV - Key news

- Exhibit 157: Koninklijke DSM NV - Key offerings

- Exhibit 158: Koninklijke DSM NV - Segment focus

- 12.15 KREMPEL GmbH

- Exhibit 159: KREMPEL GmbH - Overview

- Exhibit 160: KREMPEL GmbH - Product / Service

- Exhibit 161: KREMPEL GmbH - Key offerings

- 12.16 Nippon Light Metal Holdings Co. Ltd.

- Exhibit 162: Nippon Light Metal Holdings Co. Ltd. - Overview

- Exhibit 163: Nippon Light Metal Holdings Co. Ltd. - Business segments

- Exhibit 164: Nippon Light Metal Holdings Co. Ltd. - Key offerings

- Exhibit 165: Nippon Light Metal Holdings Co. Ltd. - Segment focus

- 12.17 Toray Industries Inc.

- Exhibit 166: Toray Industries Inc. - Overview

- Exhibit 167: Toray Industries Inc. - Business segments

- Exhibit 168: Toray Industries Inc. - Key news

- Exhibit 169: Toray Industries Inc. - Key offerings

- Exhibit 170: Toray Industries Inc. - Segment focus

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 171: Inclusions checklist

- Exhibit 172: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 173: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 174: Research methodology

- Exhibit 175: Validation techniques employed for market sizing

- Exhibit 176: Information sources

- 13.5 List of abbreviations

- Exhibit 177: List of abbreviations

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/solar-pv-backsheet-market-size-to-increase-by-usd-1-503-88-million-market-research-insights-highlight-increasing-use-of-thin-film-solar-pv-modules-as-a-key-driver---technavio-301723128.html

SOURCE Technavio

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

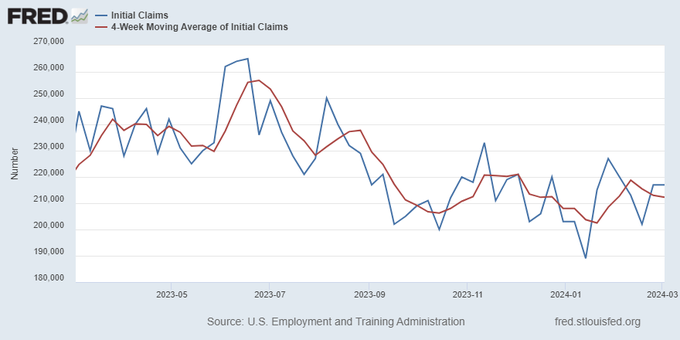

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemployment-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex