The past few decades have witnessed the burgeoning development of on-orbit servicing in light of various meaningful space applications such as repair of malfunctioning satellites, debris removal, on-orbit assembly, and so on. As for the orbit-servicing targets, they are usually divided into 2 categories, i.e., cooperative and non-cooperative ones, based on whether the space targets have active cross-link communication and cooperative identifiers with the servicing spacecraft or not. Before executing the orbit-servicing task, close-range rendezvous and proximity is an inevitable process in which precise observation for the orbit-servicing target is implemented to determine the docking ports and time (for the cooperative target) or capture ports and time (for the non-cooperative target). Thus, highly reliable and precise rendezvous and proximity control methods are essential to guarantee the safety and success of the on-orbit servicing task. As for non-cooperative target, a particular quantitative performance bound technique, prescribed performance control (PPC), was proposed and has attracted wide attention in the control system design. By the user’s specific choice for the parameters of the performance function, the finite-time or appointed-time convergence can be achieved for the controlled systems. However, a major defect in the aforementioned PPC control methods should be considered in practical engineering, that is, the actuator saturation induced by high sensitivity to the performance bounds. In a research paper recently published in Space: Science & Technology, scholars from Central South University, Intelligent Science & Technology Academy Limited of CASIC, and University of Strathclyde propose a brand-new anti-saturated appointed-time pose tracking control method for spacecraft rendezvous with a tumbling non-cooperative target, in which a novel appointed-time convergent performance function whose initial derivative is zero and an anti-saturated pose tracking controller with an adaptive saturation compensator are developed.

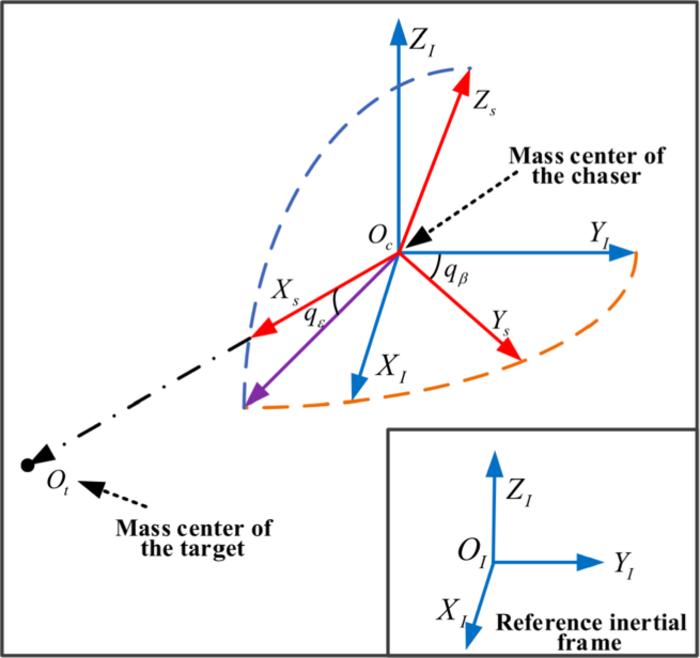

First, authors show the problem statement with description of the relative motion dynamics during the close-range proximity operations. Before moving, it is assumed that 2 spacecrafts are in orbit around the earth. Wherein, one is the servicing spacecraft (chaser for brevity), which has the control ability to approach the target. The other is the target spacecraft (target for brevity), which is tumbling and has no active interaction with the chaser. The relative translational motion between the chaser and target is described in the line of sight (LOS) coordinate frame. Wherein, the distance between the chaser and the target (r), the elevation angle (qε), and azimuth angle (qβ) in the LOS coordinate frame are derived from the accelerated velocity of the tumbling target (at) which is unknown for the chaser, the unknown space perturbations (d), and the accelerated velocity of the chaser (uc) to be designed. The tracking error system for the relative translational motion is obtained. The relative rotational motion dynamics between the chaser and target have been established with the quaternion. Based on the relative rotational motion dynamics, the desired attitude command of the chaser is preplanned, under the consideration that the center axes of the measure sensors should be along with the vector xbcd and the solar panels should be vertical with the solar ray. The coupling relative translational and rotational motion dynamics under the actuator saturation are expressed via newly defined variables χ1 and χ2. Based on the established relative motion dynamic model in Eq. (14), the control objectives of this paper are 2-fold: (a) The orbital and attitude tracking errors χ1 and χ2 can be steered by the designed controller to a small neighborhood around the origin with guaranteed performance within finite time. (b) The negative effects introduced by control saturation can be compensated by devising an adaptive anti-saturation controller.

Then, authors developed an adaptive anti-saturated appointed-time convergent controller for the tracking error system of the close-range proximity operations in Eq. 14. To guarantee the tracking performance and reduce the impact of the actuator saturation problem, a brand-new appointed-time convergent performance function is designed. Suppose that there are n+1 preassigned reference points in the 2-dimensional plane, i.e., P0(t0,y0), P1(t1,y1), …, Pn(tn,yn), the Bézier curve B(α) can be described as B(α) = β0(α)P0 + β1(α)P1 + ⋯ + βn(α)Pn where βi(���) = n!/(i!(n–i)!)·αi(1-α)n–i, i = 0, 1, …, n. The time series t0, t1, t2, …, tn satisfy t0 t1 t2 tn ≤ Ta with Ta is appointed by the users, and the parameter α is chosen as α = t/Ta. According to inherent properties of the introduced Bézier curve, if the first 3 reference points P0(t0,y0), P1(t1,y1), and P2(t2,y2) are selected to satisfy y0 = y1 = y2, then the developed Bézier curve B(α) will go across the first point and derivative of B(α) with respect to t at t0 is zero. Similarly, if the last 3 points Pn−2(tn−2,yn−2), Pn−1(tn−1,yn−1), and Pn(tn,yn) (n ≥ 3) are selected to satisfy yn−2 = yn−1 = yn, then B(α(Ta)) = yn and dB(α)/dt = 0. Based on the aforementioned analysis, a brand-new appointed-time convergent performance function μ(t) is generated by constructing a Bézier curve with 7 points, where y0 = y1 = y2 = μ(0) = μ0, y4 = y5 = y6 = μ(Ta) = μ∞, and y3 is selected to satisfy y3 ∈ (μ0, μ∞) which can be adjusted for different convergent speed. To realize the performance function, an anti-saturated appointed-time pose tracking controller is designed. An auxiliary state variable p ∈ ℝ6 is defined as p = χ1 + λ���(χ2) and the performance inequality is imposed on it to guarantee the pose tracking performance during the close-range proximity operations. The standard tracking error is Λi = pi(t)/μi(t). In PPC structure, the defined performance constraints are then removed using a constraint-free translation function, introducing a newly established state θ. Based on the above derivation, adaptive anti-saturated appointed-time pose tracking controller is devised, constituting of a stable control term and an anti-saturation control term, i.e., u = u0 + uc. Besides, to show the stability, authors prove that under the devised pose controller and adaptive laws, when the control gain ki satisfies ki > (1 + δi)2/8 (i = 1, 2, …, 6), the auxiliary state variable p will be steered to a small neighborhood around origin with guaranteed prescribed performance within appointed time instant Ta,max = max{Ta,i} (i = 1,2,…,6). Both the pose tracking errors χ1 and χ2 are finite-time convergent. Moreover, all the involved close-loop signals for the close-range proximity operations are uniformly ultimately bounded.

Finally, authors present 2 simulation examples of close-range proximity control with a tumbling non-cooperative target to verify the effectiveness of the proposed adaptive finite-time anti-saturated guaranteed control method. In the close-range proximity control with a tumbling target example, the considered target has no active control forces or torques, and is tumbling with a initial angular velocity ωt = [1.5,1.0,1.2]T deg/s. The tracking control system is always stable and the influence of the saturation is reduced by the adaptive projection rule. The chaser can move along with the tumbling target and stay relatively still with the target, thus the proximity and docking mission is well realized. In close-range proximity control with a tumbling and maneuvering target example, the initial system states, parameters, as well as the control parameters are selected the same with close-range proximity control with a tumbling target, except for non-cooperative acceleration caused by the target. The dynamic performance of the tracking system is not influenced by the non-cooperative maneuver, while the steady-state error of r(t) is obviously increased. It is noteworthy that the increased steady-state error is still within the prescribed stable region, and can be reduced by decreasing the prescribed value. These simulation examples show that the constructed auxiliary states are appointed-time stable within the designed performance functions and the proximity and docking mission is well realized even with the maneuvering non-cooperative space target.

DOI

10.34133/space.0045

Article Title

On Finite-Time Anti-Saturated Proximity Control with a Tumbling Non-Cooperative Space Target

Article Publication Date

31-Jul-2023