Schedule for Week of October 22, 2023

The key reports this week are the advance estimate of Q3 GDP and September New Home sales.

Another key indicator is Personal Income and Outlays and PCE prices for September.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys wi…

Another key indicator is Personal Income and Outlays and PCE prices for September.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 679 thousand SAAR, up from 675 thousand in August.

4:35 PM: Speech, Fed Chair Jerome Powell, Introductory Remarks, At the 2023 Moynihan Lecture in Social Science and Public Policy, Washington, D.C.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 205 thousand initial claims, up from 198 thousand last week.

8:30 AM: Gross Domestic Product, 3rd quarter 2022 (advance estimate). The consensus is that real GDP increased 4.1% annualized in Q3, up from 2.1% in Q2.

8:30 AM ET: Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.6% increase in durable goods orders.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for October.

10:00 AM: Pending Home Sales Index for September. The consensus is 1.0% increase in the index.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 3.4% YoY, and core PCE prices up 3.7% YoY.

10:00 AM: University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 63.2. unemployment consumer sentiment fed home sales gdp unemployment

Government

Looking Back At COVID’s Authoritarian Regimes

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked,…

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked, in March 2020, when President Trump and most US governors imposed heavy restrictions on people’s freedom. The purpose, said Trump and his COVID-19 advisers, was to “flatten the curve”: shut down people’s mobility for two weeks so that hospitals could catch up with the expected demand from COVID patients. In her book Silent Invasion, Dr. Deborah Birx, the coordinator of the White House Coronavirus Task Force, admitted that she was scrambling during those two weeks to come up with a reason to extend the lockdowns for much longer. As she put it, “I didn’t have the numbers in front of me yet to make the case for extending it longer, but I had two weeks to get them.” In short, she chose the goal and then tried to find the data to justify the goal. This, by the way, was from someone who, along with her task force colleague Dr. Anthony Fauci, kept talking about the importance of the scientific method. By the end of April 2020, the term “flatten the curve” had all but disappeared from public discussion.

Now that we are four years past that awful time, it makes sense to look back and see whether those heavy restrictions on the lives of people of all ages made sense. I’ll save you the suspense. They didn’t. The damage to the economy was huge. Remember that “the economy” is not a term used to describe a big machine; it’s a shorthand for the trillions of interactions among hundreds of millions of people. The lockdowns and the subsequent federal spending ballooned the budget deficit and consequent federal debt. The effect on children’s learning, not just in school but outside of school, was huge. These effects will be with us for a long time. It’s not as if there wasn’t another way to go. The people who came up with the idea of lockdowns did so on the basis of abstract models that had not been tested. They ignored a model of human behavior, which I’ll call Hayekian, that is tested every day.

These are the opening two paragraphs of my latest Defining Ideas article, “Looking Back at COVID’s Authoritarian Regimes,” Defining Ideas, March 14, 2024.

Another excerpt:

That wasn’t the only uncertainty. My daughter Karen lived in San Francisco and made her living teaching Pilates. San Francisco mayor London Breed shut down all the gyms, and so there went my daughter’s business. (The good news was that she quickly got online and shifted many of her clients to virtual Pilates. But that’s another story.) We tried to see her every six weeks or so, whether that meant our driving up to San Fran or her driving down to Monterey. But were we allowed to drive to see her? In that first month and a half, we simply didn’t know.

Read the whole thing, which is longer than usual.

(0 COMMENTS) budget deficit coronavirus covid-19 white house fauci trump canadaUncategorized

The hostility Black women face in higher education carries dire consequences

9 Black women who were working on or recently earned their PhDs told a researcher they felt isolated and shut out.

Isolated. Abused. Overworked.

These are the themes that emerged when I invited nine Black women to chronicle their professional experiences and relationships with colleagues as they earned their Ph.D.s at a public university in the Midwest. I featured their writings in the dissertation I wrote to get my Ph.D. in curriculum and instruction.

The women spoke of being silenced.

“It’s not just the beating me down that is hard,” one participant told me about constantly having her intelligence questioned. “It is the fact that it feels like I’m villainized and made out to be the problem for trying to advocate for myself.”

The women told me they did not feel like they belonged. They spoke of routinely being isolated by peers and potential mentors.

One participant told me she felt that peer community, faculty mentorship and cultural affinity spaces were lacking.

Because of the isolation, participants often felt that they were missing out on various opportunities, such as funding and opportunities to get their work published.

Participants also discussed the ways they felt they were duped into taking on more than their fair share of work.

“I realized I had been tricked into handling a two- to four-person job entirely by myself,” one participant said of her paid graduate position. “This happened just about a month before the pandemic occurred so it very quickly got swept under the rug.”

Why it matters

The hostility that Black women face in higher education can be hazardous to their health. The women in my study told me they were struggling with depression, had thought about suicide and felt physically ill when they had to go to campus.

Other studies have found similar outcomes. For instance, a 2020 study of 220 U.S. Black college women ages 18-48 found that even though being seen as a strong Black woman came with its benefits – such as being thought of as resilient, hardworking, independent and nurturing – it also came at a cost to their mental and physical health.

These kinds of experiences can take a toll on women’s bodies and can result in poor maternal health, cancer, shorter life expectancy and other symptoms that impair their ability to be well.

I believe my research takes on greater urgency in light of the recent death of Antoinette “Bonnie” Candia-Bailey, who was vice president of student affairs at Lincoln University. Before she died by suicide, she reportedly wrote that she felt she was suffering abuse and that the university wasn’t taking her mental health concerns seriously.

What other research is being done

Several anthologies examine the negative experiences that Black women experience in academia. They include education scholars Venus Evans-Winters and Bettina Love’s edited volume, “Black Feminism in Education,” which examines how Black women navigate what it means to be a scholar in a “white supremacist patriarchal society.” Gender and sexuality studies scholar Stephanie Evans analyzes the barriers that Black women faced in accessing higher education from 1850 to 1954. In “Black Women, Ivory Tower,” African American studies professor Jasmine Harris recounts her own traumatic experiences in the world of higher education.

What’s next

In addition to publishing the findings of my research study, I plan to continue exploring the depths of Black women’s experiences in academia, expanding my research to include undergraduate students, as well as faculty and staff.

I believe this research will strengthen this field of study and enable people who work in higher education to develop and implement more comprehensive solutions.

The Research Brief is a short take on interesting academic work.

Ebony Aya received funding from the Black Collective Foundation in 2022 to support the work of the Aya Collective.

depression pandemicUncategorized

US Economic Growth Still Expected To Slow In Q1 GDP Report

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised…

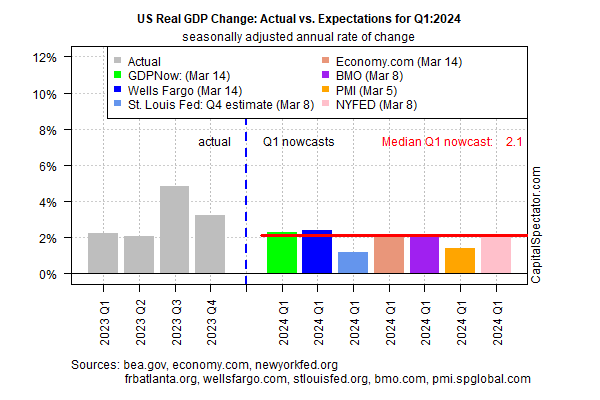

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised estimate is based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Output for the January-through-March period is currently projected to soften to a 2.1% increase (seasonally adjusted annual rate). The estimate reflects a substantially softer rise vs. Q4’s strong 3.2% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to government data.

Today’s revised Q1 estimate was essentially unchanged from the previous Q1 nowcast (published on Mar. 7). At this late date in the current quarter, the odds are relatively high that the current median estimate is a reasonable guesstimate for the actual GDP data that the Bureau of Economic Analysis will publish in late-April.

GDP rising at roughly a 2% pace marks another slowdown from recent quarters, but if the current nowcast is correct it suggests that recession risk remains low. The question is whether the slowdown persists into Q2 and beyond. Given the expected deceleration in growth on tap for Q1, the economy may be flirting with a tipping point for recession later in the year. It’s premature to make such a forecast with high confidence, but it’s a scenario that’s increasingly plausible, albeit speculatively so for now.

Yesterday’s release of retail sales numbers for February aligns with the possibility that even softer growth is coming. Although spending rebounded last month after January’s steep decline, the bounce was lowr than expected.

“The modest rebound in retail sales in February suggests that consumer spending growth slowed in early 2024,” says Michael Pearce, Oxford Economics deputy chief US economist.

Reviewing retail spending on a year-over-year basis provides a clearer view of the softer-growth profile. The pace edged up to 1.5% last month vs. the year-earlier level, but that’s close to the slowest increase in the post-pandemic recovery.

Despite emerging signs of slowing growth, relief for the economy in the form of interest-rate cuts may be further out in time than recently expected, due to the latest round of sticky inflation news this week.

“When the Fed is contemplating a series of rate cuts and is confronted by suddenly slower economic growth and suddenly brisker inflation, they will respond to the new news on the inflation side every time,” says Chris Low, chief economist at FHN Financial. “After all, this is not the first time in the past couple of years consumers have paused spending for a couple of months to catch their breath.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

recession pandemic economic growth fed recession gdp recovery consumer spending

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A